Abstract

According to the World Bank, energy efficiency is a critical facilitator of most Sustainable Development Goals. Its contribution to CO2 emission reduction is astounding. Environmentalists have recently emphasized the essential need to determine energy efficiency causes. This research broadens the debate's horizons by proposing additional possible energy efficiency factors using data from the Chinese economy. From 1990 to 2020, we examined the influence of investment in renewable energy resources, financial inclusion, industrial production, and trade openness on China's energy efficiency and climate risk. Additionally, this study is added to the literature by examining the causal relationships between variables while considering the temporal dimension. The findings indicate that industrial production, financial inclusion, public R&D on renewable energy, and trade openness contribute significantly to China's energy efficiency and climate risk. All other factors, except industrial production, are positively associated with energy efficiency. The path of causality is established from energy efficiency and climate risk to financial inclusion, industrial production, renewable energy, public research and development budgets, and trade openness. According to the findings, changes in energy performance have frequency-changing impacts on all variables. Policymakers believe that the financial system must be strengthened since this will significantly influence renewable energy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Energy efficiency is critical given the complex economic model of low-carbon emissions and sustainable development. Global production has increased tenfold over the last century, dramatically increasing global warming. During the urbanization, carbon dioxide concentrations increased by 47%, global temperatures rose by 1.8 °C, and sea levels rose by 5 inches (Mohsin et al. 2021a, b, c). These greenhouse gas emissions adversely affect human life (Mikhaylov et al. 2020). Worldwide greenhouse gas emissions have reached unprecedented levels. Regardless of being stopped immediately, the accumulated emission levels will harm future generations (Li et al. 2021a, b) In light of these sobering statistics, governments have prioritized economic growth while addressing ecological consequences. As a result, they are creating various technologies to deliver energy services that are economical, ecologically friendly, and dependable—organized global discussions such as the 1997 Kyoto Protocol and the 2015 Paris Agreement on Climate Change (PCA) to address growing global environmental challenges. These rules have been implemented to ensure that subsequent generations inherit a green and clean environment (Inguscio 2022). Under the accord, nations must adopt severe steps to limit carbon dioxide emissions. The transition from industrial to renewable energy systems is the most critical step today (Kumar et al. 2022; Sahebi et al. 2022). It necessitates investment in renewable energy research and development. It is because it increases energy efficiency.

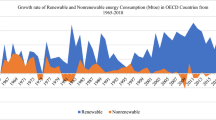

Energy demand increases as the world's population grows and the industry develops quickly. As a result of the finite supply of fossil fuels like coal and oil, the world probably needs an endless supply of substitute clean energy sources, such as hydroelectric power, wind and solar energy, renewable sources, biofuel power, and hydroelectric energy. Renewable energy's percentage of the main energy supply is rising, including the most recent data from the China Energy Information Administration, issued in 2019. As of 2019, the USA generated 8.9 trillion British thermal units (BTU) of renewable energy, over six times as much as in 2015. The spike in new wind and solar power facilities fuelled the increase in production. According to an OECD poll, renewable energy has grown from 16.7 percent in 2009 to 21.48 percent in the ten years after that. It is estimated to be responsible for more than half of global energy infrastructure by 2050, according to the report's authors (Mohsin et al. 2021a).

The 2015 Paris Agreement, which set a limit of 2 °C over preindustrial levels for world average temperature increase, was accepted in recent years. For example (Yoshino et al. 2021). Because of the shift in climate policy, the energy mix will change, with a greater reliance on renewable sources of power. Researchers (Pofoura et al. 2021) contend that implementing policy to combat global warming leads to significant increases in the usage of renewable energy and decreases in greenhouse gas emissions. Stock markets are affected by various variables, including the company's exposure to climate risk (Kaakeh et al. 2021) is a price element in a cross section of stock returns. Major climate policy shifts sparked a spike in energy business pricing.

Climate change is therefore influencing expenditures in transportation infrastructure as the worldwide route to net-zero emissions accelerates rapidly. In many regions of the globe, coal-fired energy production is progressively phased out, putting fossil deposits, enterprises, and assets in danger of becoming stranded assets. When fossil-fuel projects fail to meet their expected returns, they risk shutting down and defaulting on the financial responsibilities originally incurred in their construction. According to the Carbon Tracker Organization, nearly a third of the projected fossil-fuel investments through 2040 might fail to reach the targets of the Climate Change Act if the policy and market transitions are not implemented. An approximately €1–4 trillion loss in global wealth may be caused by the trapping worth of carbon fuels investments, which is equal to the economic crisis of 2008, according to (Melanidis and Hagerman 2022). Natural gas has developed as a transitory "bridge" fuel that provides charge and variable power production in tandem with the fast phase-out of natural gas. RPS and carbon neutrality or net-zero goals are driving national economic development in a big way right now.

This research needs to be done on several fronts. First, governments need to link their renewable energy investments with renewable energy to achieve the United Nations Sustainable Development Goals (SDGs) set out in the 2030 Agenda for Sustainable Development. Energy efficiency and productivity are inseparable from the achievements of most UN SDGs. Linking energy efficiency and productivity is critical. Third, industrial production was necessary to reduce poverty, develop the economy, and free people from the pain of the Industrial Revolution. The global environment, on the other hand, continues to worsen.

Furthermore, China's economy is transitioning away from energy-intensive industries. As a result, there is a critical relationship between industrial output and renewable energy. Fourth, consumers want solutions that balance economic development, climate change, and energy efficiency. Policymakers and academia need to understand many factors that improve energy efficiency in these environments (Xin et al. 2022). The country's CO2 emissions have declined due to a range of environmental regulations and market factors. However, carbon dioxide emissions per capita continue to exceed the country's GWP target. Over the past decade, the increase in CO2 emissions is estimated to have resulted in hidden costs of $240 billion (Tian et al. 2022). To that end, the Joe Biden administration has several plans. To achieve carbon reduction targets, the government plans to increase the amount of renewable energy in the overall energy mix. Therefore, identifying the variables that affect China's energy efficiency is the key to accelerating the energy transition and improving environmental efficiency through energy efficiency by 2050. This relationship is critical to the energy transition of the China economy and carbon reduction strategy (Dai et al. 2021).

From 1990 to 2020 the study aims to China’s economy has opened up to industrial production and trade in recent years; China has implemented a series of policies to improve energy efficiency, critical to environmental sustainability. Due to the improvement in energy efficiency, studying the factors that affect my country's energy efficiency is necessary. In the literature, the issue of energy efficiency has gotten a lot of attention. However, current research focuses on only one aspect of the problem: the impact of renewable energy on development. This study looked at factors that affect energy efficiency, another factor that determines energy efficiency. This study aimed to assess the impact of RE investments on EE. Therefore, this study enriches current knowledge by examining new EE factors such as energy resource investment, financial integration, and trade openness.

Examining the rest of the content is organized. The next part summarizes the data on energy efficiency concerns. This section also illustrates how economic growth and energy efficiency are linked. Part 3 contains data on energy efficiency as well as other aspects such as financial intermediation, industrial production, research and development, and trade openness. In addition, this part covers potential models, data sources, and model estimation methods. The last portion of the report highlights the concerns and makes policy recommendations.

2 Literature review

Renewable energy's critical role in reaching carbon neutrality has been thoroughly researched in the literature. Energy efficiency (Attia et al. 2022; Kang et al. 2022; Paramati et al. 2022; Zakari et al. 2022) and environmental efficiency (Tang and Tan 2015; Tawiah et al. 2021; Wang et al. 2022; Wei et al. 2021) guide on using RCTs in future data analysis to identify factors that impact energy efficiency (Alvarado et al. 2022; Huang et al. 2022; Nuryartono and Pasaribu 2022) human capital and economic complexity energy costs (Li and Ho, 2022; Peter et al. 2022).

Many researchers think there has been a causal link between financial inclusion and economic growth in recent years (Gyimah et al. 2022; Razak and Asutay 2022; Ullah et al. 2022) and that the relationship between financial inclusion and economic growth is economic growth. It is a motivating factor. Experts have recently expanded the financial sector's external capacities to include natural resources and the environment, and arguments on the relationship between economic integration and the environment have heated up (Mughal et al. 2022). Some academics claim that economic integration does not promote environmental improvement by lowering carbon dioxide emissions. For example, (Chopra et al. 2022) studied the influence of economic integration on global warming in Asia from 2004 to 2014. They concluded that more significant fiscal consolidation would increase carbon emissions because of the tremendous rise of energy-intensive items like autos, refrigerators, and air conditioners. Also, see Chaudhry et al. We use data from the Organization of Islamic Cooperation (OIC) nations from 2004 to 2018 to undertake an empirical assessment of the influence of inclusive economic development on environmental deterioration. They suggest that the greenhouse effect has a favourable relationship with the growth of financial integration (Cao et al. 2022; Chien et al. 2022a, b; Mahmood 2022; Mesagan 2021; Miśkiewicz 2021; Razak and Asutay 2022; Usman et al. 2022; Wang et al. 2022).

It is vital that "green finance" does not only refer to funding for fighting climate change. This would include environmental legislation in the industry, water purification, and the protection of biological variety. Financing for mitigation and management measures is readily available (Ghinoi and Steiner 2020). Greenhouse gas emission reductions and avoidance are termed financial mitigation flows. Operating costs that lessen the vulnerability of goods and people to the repercussions of environmental issues are referred to as adaptation financial flows. In N11 countries, the stochastic volatility metric causation technique discovered a relationship between economic growth and energy use. They found that Bhutan, Ethiopia, France, Greece, Japan, Mexico, Uruguay, and the Netherland had all implemented energy conservation measures. Several researchers have discovered that regions in the Eurozone and around the world have become more aware of the importance of international trade in promoting structural reforms and the implementation of sustainable power (Kuo et al. 2022), and this has led to a rise in the use of renewable sources in the Asia and around the world. Developing finance sources from an economic viewpoint has yielded several resource efficiency advantages. When combating climate change and promoting new green resources like wind resources, monetary authorities will play a significant role. To reduce the effect of global warming and pollution, entrepreneurs should include green investments in their portfolios. Climate risk may influence investment decisions in various ways. Investing in renewable energy facilities (e.g. through project finance), renewable technology venture funding, and alternative solution consumer lending are all green trading techniques that include synergistic and antagonistic screening (Yasmeen et al. 2022).

On the other hand, the categories for certain financial businesses and the conditions for green investments are still unclear. Exaggerating the genuine influence on the environment of their firm by using the phrase "Climate policy" is a word that is misused to characterize collateralized debt obligations. In most cases, financial institutions and issuers are mostly responsible for an organization's environmental monitoring and reporting (Talebizadeh et al. 2021). Various government borrowers' environmental effects are unreliable because of inherent possible conflicts of interest between lenders, purchasers, and certain aim providers. For investors and rating agencies, transparency and consistency of indications are essential for guiding investment opportunities towards debtors capable of executing the transition forward towards a low-carbon economy.

On the other hand, other scholars think that economic integration aids in achieving carbon neutrality to the greatest extent possible. Financial integration, they feel, is a good instrument for businesses to implement sophisticated low-carbon technology and environmental management (Li et al. 2021a, b; Moshood et al. 2021); consider how economic development impacts the top 15 polluters' ecological degradation as a proxy for inclusive funding. This shows that economic development and carbon dioxide emissions have a negative relationship. By easing energy poverty and reducing carbon dioxide emissions through technical innovation, economic integration can reduce carbon emissions. (Koomson and Danquah 2021) researched the influence of economic integration on the alleviation of energy poverty in Ghana and discovered that improving the country's financial integration has the potential to eliminate energy poverty. The observed association between energy poverty and the greenhouse effect was proven by Chien et al. (2022a, b), John and Deinde (2021), Zhao et al. (2022a, b, c) both got the same results as us. Economic integration can help countries reduce their carbon impact by removing energy poverty.

There may be a nonlinear link between financial inclusion and the greenhouse effect in addition to the linear one described above. Weimin et al. (2022), investigated if there is an inverted U-shaped link between economic integration and global carbon emissions using the environmental Kuznets curve (EKC). In other words, China's carbon dioxide emissions are inversely proportional to its economic integration. Further investigations (Yin et al. 2022) have backed this conclusion. However, studies frequently underestimate the influence of economic integration on carbon emission reductions in space, particularly in China.

Only a few studies, particularly in China, have looked at the carbon impact of financial integration. Furthermore, many experts in the area overlook this specific CO2 collection procedure. The China Comprehensive Financial Consolidation Index utilizes gender tabular data from 2004 to 2018 to see how financial consolidation affects carbon emissions in different parts of the country. Future research will also focus on how energy efficiency changes and how it affects the relationship between economic inclusion and carbon emissions.

2.1 Industrial power production

In the evidence, industrial productivity best indicates energy efficiency. Several studies have examined how energy efficiency affects industrial production (Ouyang et al. 2021; Zhao et al. 2022a, b, c). Academics haven't studied how industrial output affects energy efficiency. Industrial production and energy efficiency are incompatible (Dalla Longa et al. 2022). Moreover (Hassan et al. 2022a, b), industrial output affects renewable energy because it is the biggest energy user (Mahi et al. 2021).

2.2 Finance and energy

Financial integration is a topic that has received much attention in the literature. Several academics have explored the influence of financial consolidation on critical macroeconomic indicators. The result of economic integration on energy and environmental efficiency has lately been addressed by researchers (Mesagan 2021). The influence of economic integration on energy efficiency, on the other hand, has received little attention. Previous research (Hassan et al. 2022a, b; Wang and Li 2019) has primarily focused on the effect of economic growth on energy use. Economic expansion is predicted to boost energy consumption by promoting banking activity by increasing efficiency and lowering bank risk and the cost of bank lending (Islam et al. 2022). As a result, economic development and energy use are inextricably linked. The influence of economic growth on renewable energy, on the other hand, has received little attention. The problem of increasing energy efficiency due to economic development has received very little attention (CI et al. 2022; Gyimah et al. 2022; Olayungbo et al. 2022; Tong et al. 2020). CI et al. (2022) look at ways to enhance energy efficiency in response to Russian economic development, whereas Gyimah et al. (2022) is the situation in 28 EU nations. The demand for complicated financial systems has grown over time (2020), owing to a scarcity of public investment funding. Through a solid financial plan, investors may stimulate demand for renewable energy by financing sustainable and energy-efficient technology. By transferring funds from wasteful to efficient funds, a healthy financial system may also enhance the need for renewable energy.

To summarize, growing renewable energy is essential for establishing a clean and green environment. As a result, the most intriguing component of our research is our knowledge of the features that contribute to energy efficiency while switching to a low-carbon energy system. To expand the proportion of renewable energy in China's global energy mix, investments in renewable energy, economic integration, industrial output, and free trade are required. In China, there is a lot of research on energy efficiency (Li and Ho 2022; Liu et al. 2022a, b; Mesagan, 2021; Xin et al. 2022). On the other hand, these studies exclusively look at the influence of renewable energy on growth as one source of worry. This white paper adds to the current body of knowledge in the following ways: A new research was done as a starting step to look at the influence of renewable energy investments on energy efficiency. Other characteristics explored as predictors of energy efficiency include financial inclusion and trade openness.

Many academics think there is a causal association between financial inclusion and economic development in recent years and that this correlation is a positive stimulus. It is OK to be impacted. Experts have recently expanded the financial sector's external capacities to include natural resources and the environment, and arguments on the relationship between economic integration and the environment have heated (Paramati et al. 2022). Some academics claim that economic integration does not promote environmental improvement by lowering carbon dioxide emissions. For example, (Hassan et al. 2022a, b) studied the influence of economic integration on global warming in Asia from 2004 to 2014. They concluded that more significant fiscal consolidation would increase carbon emissions because of the tremendous rise of energy-intensive items like autos, refrigerators, and air conditioners. They suggest that the greenhouse effect has a favourable relationship with the growth of financial integration (CI et al. 2022; Koomson and Danquah, 2021; Mikhaylov et al. 2020; Nasir et al. 2021; Wang et al. 2021).

Moreover, there is currently a shortage of research on the impact of Brazil's foreign commerce on the energy-emissions climate nexus. Few studies have examined the carbon footprint of the trade from emerging nations such as Russia. We searched the scientific literature and only identified three studies examining Chinese exports and imports' energy and carbon content. From 1972 through 1995 (Berner et al. 2022) examined the Chinese trade (Sanaye et al. 2022). These studies look at energy transfers and pollutants rather than an ecological footprint. Still, they also utilize the total amount of energy instead of sustainable and non-renewable portions to compare, which is more important for reducing greenhouse gas emissions. There are now studies that concentrate on the radioactive decay of materials of a single sector, area, or economic block rather than examining the impacts of the energy matrix on business as a whole instead of on parts of the economy through economic cooperation and development (Walter and Brüggemann 2020). Studies conducted in the USA and abroad ignore renewable and non-renewable energy sources’ role in climate change. Filling up these holes is the purpose of the present research, which is helpful.

There may be a nonlinear link between financial inclusion and the greenhouse effect in addition to the linear one described above and investigated if there is an inverted U-shaped link between economic integration and global carbon emissions using the environmental Kuznets curve (EKC). In other words, China's carbon dioxide emissions are inversely proportional to its economic integration. Further investigations have backed up this conclusion. However, studies frequently underestimate the influence of economic integration on carbon emission reductions in space, particularly in China.

Green finance's primary significance in the link between economic growth and energy efficiency has been studied by several academics. Green finance, make out, is a powerful tool for resolving the conflict between economic growth and environmental sustainability. According to the researchers, green finance proved to be an effective instrument for increasing energy efficiency through green technology innovation. Green finance and energy efficiency have a good link, according to Liu et al. (2022a, b) and Zhao and Taghizadeh-Hesary (2022).

According to an empirical study, green finance is a long-term approach for improving energy efficiency, although FinTech and economic integration are adversely associated with energy efficiency in E7 nations. It is a good idea to increase financial inclusion to boost the green economy's performance.

CO2 emissions may be significantly reduced when energy efficiency and economic integration are coupled, (Wang et al. 2022) and his colleagues. In terms of energy and environmental policy, energy efficiency has long been a top focus.

On the other hand, energy efficiency is defined as a reduction in energy input per unit of economic output, as specified in energy efficiency. As a result, increasing energy efficiency can reduce energy use while also saving money (Chien et al. 2022a, b). In other words, companies and people may cut energy consumption and consequently CO2 emissions by maintaining the same level of economic activity while increasing energy efficiency (Dalla Longa et al. 2022; Truby et al. 2022) High energy efficiency, on the other hand, denotes a high level of low-carbon technology and is the foundation for the discovery and development of renewable energy. Many experts believe that using renewable energy can help reduce CO2 emissions. Their findings imply that energy efficiency is the most effective and efficient solution for lowering CO2 emissions. Much additional research has shown a negative relationship between energy efficiency and CO2 (Akram et al. 2022; Lei et al. 2022).

2.3 The specific index system China Financial Inclusion

To properly grasp China's expanding financial integration and the carbon emissions resulting from its economic integration, a thorough and accurate evaluation of China’s financial integration has become a must. To estimate total financial sector growth, several researchers increasingly use complex methods. To investigate economic integration, (Mesagan et al. 2022) employ three variables: official accounts, savings, and credit. The Mesagan (2021) study also supports this method of financial integration. Parihar et al. (2022) presented an index system based on permeability, availability, and durability, while (Mohsin et al. 2021c, a, b) proposed an index system based on three dimensions of permeability, accessibility, and usefulness. Some researchers have devised and deployed indicator systems that consider a variety of characteristics, including consumption, effectiveness, availability, and cost.

3 Theoretical justification and methods of analysis

3.1 Model

In public R&D funding for renewable energy, the following empirical model is used to investigate the influence of financial integration and industrial output on energy efficiency and trade openness.

The EU represents energy efficiency, which is calculated as the proportion of energy output to energy consumption. Energy efficiency improvements throughout time contribute to economic and sectoral energy efficiency gains and the total energy consumption includes renewable and waste energy. On-point IEA data (IEA). World Bank calculates GDP (2021).

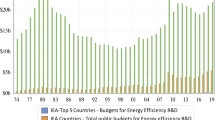

This study uses the public budget for renewable energy R&D as a gauge of renewable energy investment (RER&D). OECD tracks RER&D (2021). FIN (finance) combines statistics from commercial banks, branches, contract deposits (% of GDP), and ATMs (percent of GDP). IMF statistics (2021). World Bank measures trade openness in 1 TB. China's data spans 1990–2021.

3.2 Theory

The increase in productivity per unit of energy consumption is called energy efficiency. This measure takes into account both productivity and energy consumption. It is generally accepted that investment in renewable energy contributes to energy efficiency. Based on previous research, the analysis predicts that public research and development of renewable energy will have a beneficial impact on the EU, i.e. \(\left({\pi }^{2}=\frac{\partial \mathrm{EE}}{\partial \mathrm{RER}\&D}>0\right)\). One possible explanation for the negative impact on EU industrial production is that significant investments in renewable energy research and development have expanded options for switching to more efficient renewable energy sources. R&D investments also improve energy efficiency by helping governments explore environmentally friendly renewable energy technologies. The study predicts that industrial production will have a negative impact on the EU, i.e. \(\left({\pi }^{4}=\frac{\partial \mathrm{EE}}{\partial \mathrm{INDP}}<0\right)\). The China budget is shifting away from energy production, which might explain why industrial output negatively influences growth. The country is heavily reliant on energy imports. China's contribution to energy, particularly renewable energy, has dwindled over time. As a result, it can be stated that China's industrial output has a negative influence and that economic restructuring will also enhance China's energy performance. One explanation for this assertion is that financial integration, a crucial part of economic growth, stimulates demand for renewable energy by boosting investors' capacity to fund energy-efficient technology at reasonable rates. Switching from RE sources to less expensive non-renewable energy sources can also help households save money, i.e. \(\left({\pi }^{3}=\frac{\partial \mathrm{EE}}{\partial \mathrm{FIN}}>0\right)\). In addition, the economy is likely to benefit from the opening of trade, EE, i.e. \(\left({\pi }^{5}=\frac{\partial \mathrm{EE}}{\partial \mathrm{TO}}>0\right)\). This is because international commerce allows countries to learn from each other's experiences moving from less efficient to more efficient energy technology. The international exchange also makes it easier for filthy industries to be transferred from developed to developing countries. As a result, China will profit from trade liberalization.

3.3 Econometric methods

From 1990 to 2020, control variables look at the influence of China’s economic integration and industrial production on energy efficiency. This study tested an empirical model using time series econometric approaches, which can handle data with structural perturbations and validate the established sequences. Regional and global economic shocks, the 2009 recession, and, most recently, the new coronavirus pandemic in 2019 are all wreaking havoc on the Chinese economy. As a result, cells should be characterized in light of these outcomes (Table 1).

The Bayer and Hank (B&H) real test is used. This study looks at the long-term relationships between energy efficiency and features like development, financial inclusion, government support of energy research, financial inclusion, and industrial production. The BH test equation is as follows.

The essential values are shown as symbols EG-J and EG-J-Bo-Ba.

The influence of financial consolidation and industrial output on energy efficiency in China from 1990 to 2020 is studied using control variables. We use econometric time series approaches to estimate empirical models in this work. To assess established series that can manage data with structural perturbations. The China economy has been decimated by the regional and global economic crisis, the 2009 recession, and the 2019 new coronavirus pandemic. As a result, while characterizing cells, these results must be considered (Table 2).

The researchers utilized Johansen's completeness test to establish robustness, which is analogous to the B&H test. For initial differences, these parameters must stay constant. The models in this study were evaluated using FMOLS, DOLS, and CCR methods. We employ the FMOLS approach, a semi-parametric method to handle the potential of correlation. When dealing with the link between random explanatory variables and integral equations, the test's key benefit is asymptotically correct and efficient. The FMOLS architecture successfully tackles this issue by allowing team members to connect failed process sequences across many team members. This study also employed DOLS and CCR methodologies in addition to FMOLS. The DOLS approach minimizes minimum sampling time and distortion in test equations, such as lead and bass. We employ the DOLS estimator to check endogeneity and diminish intrinsic feedback by raising both frontal and lateral inequalities. DOLS takes bias, endogenous correlation, and serial correlation into consideration. This study also evaluated the model using Park's (1992) CCR test.

To guarantee dependability, robust regression analysis was used. A frequency-domain causality test was utilized to assess energy efficiency and causation between FINANCE, INDP, RER&D, and TO (series). Long-term, short-term, mid-term, and test frequencies are I = 0.05, 1.50, and 2.50. This method has the benefit of quickly eliminating seasonal variance from a dataset.

4 Results and discussion

The (Narayan and Popp 2010) test integrates the features of time series variables in this study. Table 3 shows that the first-order difference has no effect on sustainable energy, economic flows, industrial production, public R&D, or renewable energy trade openness. All variable-level means are not equal, even though the variables are same.

Energy efficiency, wealth creation, industrial production, public renewable power R&D, and full-scale firms were identified using Bayer–Hanke integration tests, integrating model variables with B&H. Integration of variables is the main statistical test for EG, JJ, Ba, Bo, EG-J, and EG-J-Ba-Bo. Included are energy efficiency, financial integration, industrial production, renewable energy R&D, and trade liberalization. JJ integration can discover four vectors. Thus, model variables are synthetic. The results of the JJ test and B&H test are reported in Table 3.

The findings of the FMOLS, DOLS, and CCR techniques are shown in Table 4. The apparent elements impacting China's energy efficiency include financial integration, industrial output, public R&D in renewable energy, and trade openness. Table 5 displays some intriguing findings. The results of the robust regression analysis are shown in Table 6.

China's energy efficiency gains from early investments in energy resources (based on public R&D assessments of renewable energy). Shifting the economy away from non-renewable energy and towards efficient renewable energy would necessitate a significant investment in R&D. Governments can invest in R&D to create ecologically friendly renewable energy technology that reduces carbon dioxide emissions. Under the PCA, countries will also be required to transition to renewable energy-based industrial structures. Investing billions in R&D, as many are now pointing out, is a critical step. To contribute to the Sustainable Development Initiative by pursuing energy efficiency targets. Energy efficiency (SDGs) is crucial in the seven United Nations Sustainable Development Goals. The argument is centred on renewable energy. SDGS's primary objective is to increase energy efficiency and deliver contemporary power. Investing in energy resources is vital to accomplish one of the SDGs: clean and cheap energy (Table 7).

REC also affects industrial production negatively. CCR enhances INDP size over FMOLS and DOLS. For every 1 percent increase in INDP, energy efficiency declined 0.985 percent. High-energy-consuming sectors increased at a rate of 1.1 per year during the last decade, whereas low-energy-consuming industries grew at 3.2. This suggests energy intensity has risen slower than industrial production. This is because China's industrial sector uses oil, coal, electricity, natural gas, and renewable energy (mainly biomass) (primarily biomass). The industrial sector's overall energy mix has less renewable energy. China's renewable energy consumption climbed from 62 million QBTU in 1950 to 1854 in 2000. China's industrial sector will use 2356RE by 2020. China's industrial sector utilized 0.858, 4.326, 7.625, and 11.36 QBTU of coal, electricity, oil, and natural gas during this time. As China's economy swings away from energy-intensive industries, renewable energy in its industrial sector has decreased. Renewable energy utilization has been increasing in all other areas. China's industrial production is losing its renewable/non-renewable energy balance.

Second, China's economic integration depends on energy efficiency. The China financial system allows consumers to get low-cost financing for durable products and investors to develop or expand renewable energy installations, according to the study. Increased financial inclusion will allow investors to reinvest in energy-efficient firms. Customers switch to renewable energy as financial services become more accessible and equal. Anton and his colleagues are promoting green energy (2020). Economic growth boosts energy efficiency, says one study. Seven SDGs depend on fiscal integration (SDGs). "Everyone should have inexpensive, reliable, sustainable, modern energy." Enhanced financial integration makes investors more inclined to support low-cost, energy-efficient technologies, which boosts renewable energy demand. SDG 7 is attainable. We believe financial inclusion is needed to achieve one of the Sustainable Development Goals, such as clean and affordable energy. 17% of global energy usage is renewable.

The statistics suggest that trade openness improves energy efficiency. International trade's involvement in knowledge transmission between countries may affect energy efficiency through knowledge transfer. Countries often study their counterparts' experiences to enhance their use of renewable energy. As international trade grows, so are energy-efficient home appliances, per capita, the number of financial and banking sector personnel. Non-renewable energy accounts for 93 Mtoe (nearly 92 percent), whereas renewable energy accounts for 7.8Mtoe (5.6 percent). In contrast, 29.6 Mtoe (62 percent) came from non-renewable sources of energy, and 34 Mtoe (50 percent) availability from renewable. Interactive Greenhouse gas emissions inherent in commodities and services are exported and imported due to international commerce in virtual energy. The Chinese economy imported 258.36 Mt CO2-Eq. (93 percent) from the rest of the world, while the country's renewable energy sector imported only 8.5 Mt CO2-Eq. (3.8 percent). Instead of exporting 66.3 Mt CO2-Eq. (37 percent) from renewable energy sources, China sent out 95.83 Mt CO2-Eq. (56.1 percent) from commodities and services derived from non-renewable renewable technologies.

5 Conclusion

5.1 Policy implications

Financial integration, industrialized production, public renewable energy R&D, and trade liberalization influence China's energy performance. This study, like the majority of others, adds to our understanding by focusing on financial integration rather than economic growth. Furthermore, unlike previous studies, our conclusions are based on industrial production rather than GDP. China’s economy has benefited greatly from industrial output. Furthermore, this study adds to the corpus of knowledge by examining causal linkages between variables in the context of time. It shows how the nature of the link between energy efficiency and the factors that influence it evolves through time. This approach (series) looks into cause-and-effect relationships between variables at different frequencies (string). Industrial output, economic integration, public renewable energy R&D, and trade openness are all important factors in China's energy efficiency, according to studies. Except for industrial production, all other variables are positively related to REC. The results were consistent with the approaches used, which included FMOLS, DOLS, and CCR.

FMOLS estimates of industrial production and trade openness, on the other hand, are higher than DOLS and CCR estimates. Energy efficiency is causally linked to industrial output, financial integration, public R&D, and exposure to the renewable energy trade. Energy Vibration Efficiency has varied degrees of influence on all variables.

In response to rising environmental and economic issues, the United Nations developed many Sustainable Development Goals (SDGs) in 2015. Environmental sustainability, as well as poverty, inequality, and injustice alleviation, are the primary goals of these SDGs. A major focus is on the usage of renewable energy. The main purpose of SDGS is to improve energy efficiency and gain access to new energy sources (UN DESA 2017). 2017 is the year (DESA). Energy efficiency is a cornerstone of most SDGs, according to the World Bank.

Based on these findings:

-

I.

This study offers relevant laws to increase energy efficiency, a crucial component of most SDGs, including sustainable energy and the environment. SDGS's primary goal is to boost energy efficiency and supply creative energy.

-

II.

Consequently, China should spend more on green sources and emphasize energy efficiency. Improved energy efficiency helps poor groups to contribute to the transition to a low-carbon future by boosting productive potential. It also improves energy efficiency, cutting costs, and offering fewer environmental dangers. Furthermore, improving energy efficiency necessitates strengthening the world's economy, which has substantial implications for energy efficiency.

-

III.

Further, according to the financial system, enough money must be available to support energy efficiency measures. Economic integration can help renewables gain a more significant part of the energy pie. According to the World Bank, one of the SDGs is budgetary consolidation. A solid financial system may make more investments in renewable energy through research and development, increasing energy efficiency. To expand the usage of renewable energy in manufacturing, energy measures are also required. Households' access to economic resources must also be improved. The public and commercial sectors will be unable to expand the energy industry without the cooperation of family members.

-

IV.

Energy investment, financial integration, industrial production, and trade liberalization influence China's energy efficiency. Examine how energy investment and other variables affect China's energy efficiency. South Asia, Europe, the OECD, the G8, and the BRICS may benefit. Most studies are needed to confirm the causal relationship between energy expenditure and energy efficiency.

References

Akram R, Umar M, Xiaoli G, Chen F (2022) Dynamic linkages between energy efficiency, renewable energy along with economic growth and carbon emission. A case of MINT countries an asymmetric analysis. Energy Rep 8:2119–2130

Alvarado R, Ortiz C, Ponce P, Toledo E (2022) Renewable energy consumption, human capital index, and economic complexity in 16 Latin American countries: evidence using threshold regressions. In: Energy-Growth Nexus in an Era of Globalization, pp. 287–310. Elsevier, Amsterdam

Attia S, Kosiński P, Wójcik R, Węglarz A, Koc D, Laurent O (2022) Energy efficiency in the polish residential building stock: a literature review. J Build Eng 45:103461

Berner A, Lange S, Silbersdorff A (2022) Firm-level energy rebound effects and relative efficiency in the German manufacturing sector. Energy Econ 109. https://doi.org/10.1016/j.eneco.2022.105903

Cao X, Kannaiah D, Ye L, Khan J, Shabbir MS, Bilal K, Tabash MI (2022) Does sustainable environmental agenda matter in the era of globalization? The relationship among financial development, energy consumption, and sustainable environmental-economic growth. Environ Sci Pollut Res, 1–11.

Chien F, Hsu C-C, Ozturk I, Sharif A, Sadiq M (2022a) The role of renewable energy and urbanization towards greenhouse gas emission in top Asian countries: evidence from advance panel estimations. Renew Energy 186:207–216

Chien F, Hsu C-C, Zhang Y, Tran TD, Li L (2022b) Assessing the impact of green fiscal policies and energy poverty on energy efficiency. Environ Sci Pollut Res 29(3):4363–4374

Chopra R, Magazzino C, Shah MI, Sharma GD, Rao A, Shahzad U (2022) The role of renewable energy and natural resources for sustainable agriculture in ASEAN countries: Do carbon emissions and deforestation affect agriculture productivity? Resour Policy 76:102578

Ci W, Okereke EJ, Nnamdi IS (2022) Financial development and economic growth: a causal analysis. GPH-Int J Bus Manag (IJBM) 5(01):1–18

Dai L, Mu X, Lee CC, Liu W (2021) The impact of outward foreign direct investment on green innovation: the threshold effect of environmental regulation. Environ Sci Pollut Res 28(26):34868–34884. https://doi.org/10.1007/S11356-021-12930-W

Dalla Longa F, Fragkos P, Nogueira LP, van der Zwaan B (2022) System-level effects of increased energy efficiency in global low-carbon scenarios: amodel comparison. Comput Ind Eng 167:108029

Fragkos P (2022) Analysing the systemic implications of energy efficiency and circular economy strategies in the decarbonisation context. AIMS Energy 10(2):191–218

Ghinoi S, Steiner B (2020) The political debate on climate change in Italy: a discourse network analysis. Politics Governance. https://doi.org/10.17645/pag.v8i2.2577

Gyimah J, Yao X, Tachega MA, Hayford IS, Opoku-Mensah E (2022) Renewable energy consumption and economic growth: new evidence from Ghana. Energy 248:123559

Hassan ST, Batool B, Zhu B, Khan I (2022a).Environmental complexity of globalization, education, and income inequalities: New insights of energy poverty. J Clean Production, 130735.

Hassan T, Song H, Khan Y, Kirikkaleli D (2022b) Energy efficiency a source of low carbon energy sources? Evidence from 16 high-income OECD economies. Energy, 123063.

Huang Y, Haseeb M, Usman M, Ozturk I (2022) Dynamic association between ICT, renewable energy, economic complexity and ecological footprint: Is there any difference between E-7 (developing) and G-7 (developed) countries? Technol Soc 68:101853

Inguscio A (2022) The EU Perspective from Setbacks to Success: Tackling Climate Change from Copenhagen to the Green Deal and the Next-Generation EU. In Interdisciplinary Approaches to Climate Change for Sustainable Growth (pp. 127–139). Springer, Cham.

Islam M, Alam M, Ahmed F, Al-Amin AQ (2022) Economic growth and environmental pollution nexus in Bangladesh: revisiting the environmental Kuznets curve hypothesis. Int J Environ Stud, 1–25.

John AS, Deinde IG (2021) Energy poverty, climate change and economic growth. Energy 4(3):98–115

Kaakeh M, Shirazi SS, Gokmenoglu KK (2021) The extended GREEN-A framework: a gender comparison in consumer support for sustainable businesses practices. J Environ Assessment Policy Manage 23(01n02):2250011. https://doi.org/10.1142/S1464333222500119

Kang J, Yu C, Xue R, Yang D, Shan Y (2022) Can regional integration narrow city-level energy efficiency gap in China? Energy Policy 163:112820

Koomson I, Danquah M (2021) Financial inclusion and energy poverty: empirical evidence from Ghana. Energy Economics 94:105085

Kumar A, Pal D, Kar SK, Mishra SK, Bansal R (2022) An overview of wind energy development and policy initiatives in India. Clean Technol Environ Policy, 1–22.

Kuo Y, Maneengam A, Phan The C, Binh An N, Nassani AA, Haffar M, Qadus A (2022) Fresh evidence on environmental quality measures using natural resources, renewable energy, non-renewable energy and economic growth for 10 Asian nations from CS-ARDL technique. Fuel 320:123914. https://doi.org/10.1016/J.FUEL.2022.123914

Lei W, Xie Y, Hafeez M, Ullah S (2022) Assessing the dynamic linkage between energy efficiency, renewable energy consumption, and CO2 emissions in China. Environ Sci Pollut Res 29(13):19540–19552

Li J, Ho MS (2022) Indirect cost of renewable energy: insights from dispatching. Energy Economics 105:105778

Li W, Chien F, Hsu CC, Zhang YQ, Nawaz MA, Iqbal S, Mohsin M (2021a) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102063

Li H-S, Geng Y-C, Shinwari R, Yangjie W, Rjoub H (2021b) Does renewable energy electricity and economic complexity index help to achieve carbon neutrality target of top exporting countries? J Environ Manage 299:113386

Liu H, Yao P, Latif S, Aslam S, Iqbal N (2022b) Impact of Green financing, FinTech, and financial inclusion on energy efficiency. Environ Sci Pollut Res 29(13):18955–18966

Liu D, Xie Y, Hafeez M, Usman A (2022a) The trade-off between economic performance and environmental quality: does financial inclusion matter for emerging Asian economies? Environ Sci Pollut Res, 1–10.

Mahi M, Ismail I, Phoong SW, Isa CR (2021) Mapping trends and knowledge structure of energy efficiency research: what we know and where we are going. Environ Sci Pollut Res 28(27):35327–35345

Mahmood H (2022) The effects of natural gas and oil consumption on CO2 emissions in GCC countries: asymmetry analysis. Environ Sci Pollut Res, 1–17.

Melanidis MS, Hagerman S (2022) Competing narratives of nature-based solutions: leveraging the power of nature or dangerous distraction? Environ Sci Policy. https://doi.org/10.1016/j.envsci.2022.02.028

Mesagan EP (2021) Efficiency of financial integration, foreign direct investment and output growth: policy options for pollution abatement in Africa. Economic Issues 26(1):1–19

Mesagan EP, Akinsola F, Akinsola M, Emmanuel PM (2022) Pollution control in Africa: the interplay between financial integration and industrialization. Environ Sci Pollution Res, 1–11.

Mikhaylov A, Moiseev N, Aleshin K, Burkhardt T (2020) Global climate change and greenhouse effect. Entrepreneurship Sustain Issues 7(4):2897

Miśkiewicz R (2021) The impact of innovation and information technology on greenhouse gas emissions: a case of the Visegrád countries. J Risk Financial Manage 14(2):59

Mohsin M, Ullah H, Iqbal N, Iqbal W, Taghizadeh-Hesary F (2021b) How external debt led to economic growth in South Asia: a policy perspective analysis from quantile regression. Econ Anal Policy 72:423–437. https://doi.org/10.1016/J.EAP.2021.09.012

Mohsin M, Taghizadeh-Hesary F, Panthamit N, Anwar S, Abbas Q, Vo XV (2021c) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett 43:101520

Mohsin M, Phoumin H, Youn IJ, Taghizadeh-Hesary F (2021) Enhancing energy and environmental efficiency in the power sectors: a case study of Singapore and China. J Environ Assessment Policy Manage 23(03n04):2250018. https://doi.org/10.1142/S1464333222500181

Moshood TD, Nawanir G, Mahmud F, Sorooshian S, Adeleke AQ (2021) Green and low carbon matters: A systematic review of the past, today, and future on sustainability supply chain management practices among manufacturing industry. Clean Eng Technol 4:100144

Mughal N, Arif A, Jain V, Chupradit S, Shabbir MS, Ramos-Meza CS, Zhanbayev R (2022) The role of technological innovation in environmental pollution, energy consumption and sustainable economic growth: evidence from South Asian economies. Energ Strat Rev 39:100745

Narayan PK, Popp S (2010) A new unit root test with two structural breaks in level and slope at unknown time. J Appl Stat 37(9):1425–1438

Nasir MA, Canh NP, Le TNL (2021) Environmental degradation & role of financialisation, economic development, industrialisation and trade liberalisation. J Environ Manage 277:111471

Nuryartono N, Pasaribu SH (2022) Economic complexity and sustainable growth in developing countries. Econ Dev Anal J 11(1):23–33

Olayungbo DO, Faiyetole AA, Olayungbo AA (2022) Economic growth, energy consumption, and carbon emissions: the case of Nigeria. In: Handbook of research on energy and environmental finance 4.0 (pp. 259–276). IGI Global, Hershey.

Ouyang X, Chen J, Du K (2021) Energy efficiency performance of the industrial sector: from the perspective of technological gap in different regions in China. Energy 214:118865

Paramati SR, Shahzad U, Doğan B (2022) The role of environmental technology for energy demand and energy efficiency: Evidence from OECD countries. Renew Sustain Energy Rev 153:111735

Parihar M, Bhagwat K, Dasari N (2022) Economic analysis of energy efficient transportation in India with special reference to the passenger movement. In: Smart systems: innovations in computing (pp. 31–40). Springer, Cham

Peter AP, Koyande AK, Chew KW, Ho S-H, Chen W-H, Chang J-S, Krishnamoorthy R, Banat F, Show PL (2022) Continuous cultivation of microalgae in photobioreactors as a source of renewable energy: Current status and future challenges. Renew Sustain Energy Rev 154:111852

Pofoura AK, Sun H, Mensah IA, Liu F (2021) How does eco-innovation affect CO2 emissions? Evidence from Sub-Saharan Africa. J Environ Assessment Policy Manage 23(03n04):2250017. https://doi.org/10.1142/S146433322250017X

Razak AA, Asutay M (2022) Financial inclusion and economic well-being: evidence from Islamic Pawnbroking (Ar-Rahn) in Malaysia. Res Int Bus Financ 59:101557

Sahebi IG, Mosayebi A, Masoomi B, Marandi F (2022) Modeling the enablers for blockchain technology adoption in renewable energy supply chain. Technol Soc, 101871.

Sanaye S, Alizadeh P, Yazdani M (2022) Thermo-economic analysis of syngas production from wet digested sewage sludge by gasification process. Renew Energy 190:524–539. https://doi.org/10.1016/j.renene.2022.03.086

Talebizadeh SM, Hosseingholizadeh R, Bellibaş MŞ (2021) Analyzing the relationship between principals’ learning-centered leadership and teacher professional learning: The mediation role of trust and knowledge sharing behavior. Stud Educ Eval 68:100970. https://doi.org/10.1016/J.STUEDUC.2020.100970

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454

Tawiah VK, Zakari A, Khan I (2021) The environmental footprint of China-Africa engagement: an analysis of the effect of China-Africa partnership on carbon emissions. Sci Total Environ 756:143603

Tian J, Yu L, Xue R, Zhuang S, Shan Y (2022) Global low-carbon energy transition in the post-COVID-19 era. Appl Energy 307:118205

Tong T, Ortiz J, Xu C, Li F (2020) Economic growth, energy consumption, and carbon dioxide emissions in the E7 countries: a bootstrap ARDL bound test. Energy Sustain Soc 10(1):1–17

Truby J, Brown RD, Dahdal A, Ibrahim I (2022) Blockchain, climate damage, and death: Policy interventions to reduce the carbon emissions, mortality, and net-zero implications of non-fungible tokens and Bitcoin. Energy Res Soc Sci 88:102499

Ullah S, Ali K, Shah SA, Ehsan M (2022) Environmental concerns of financial inclusion and economic policy uncertainty in the era of globalization: evidence from low & high globalized OECD economies. Environ Sci Pollut Res, 1–15.

Usman M, Jahanger A, Makhdum MSA, Balsalobre-Lorente D, Bashir A (2022) How do financial development, energy consumption, natural resources, and globalization affect Arctic countries’ economic growth and environmental quality? An Advanced Panel Data Simulation. Energy 241:122515

Walter S, Brüggemann M (2020) Opportunity makes opinion leaders: analyzing the role of first-hand information in opinion leadership in social media networks. Inf Commun Soc. https://doi.org/10.1080/1369118X.2018.1500622

Wang Y, Li J (2019) Spatial spillover effect of non-fossil fuel power generation on carbon dioxide emissions across China’s provinces. Renew Energy 136:317–330

Wang C, Miao Z, Chen X, Cheng Y (2021) Factors affecting changes of greenhouse gas emissions in Belt and Road countries. Renew Sustain Energy Rev 147:111220

Wang Y, Deng X, Zhang H, Liu Y, Yue T, Liu G (2022) Energy endowment, environmental regulation, and energy efficiency: evidence from China. Technol Forecast Soc Chang 177:121528

Wei F, Zhang X, Chu J, Yang F, Yuan Z (2021) Energy and environmental efficiency of China’s transportation sectors considering CO2 emission uncertainty. Transp Res Part D Transp Environ 97:102955

Weimin Z, Sibt-e-Ali M, Tariq M, Dagar V, Khan MK (2022) Globalization toward environmental sustainability and electricity consumption to environmental degradation: does EKC inverted U-shaped hypothesis exist between squared economic growth and CO2 emissions in top globalized economies. Environ Sci Pollut Res, 1–11.

Xin L, Sun H, Xia X, Wang H, Xiao H, Yan X (2022) How does renewable energy technology innovation affect manufacturing carbon intensity in China? Environ Sci Pollut Res, 1–18.

Yasmeen R, Tao R, Jie W, Padda IUH, Shah WUH (2022) The repercussions of business cycles on renewable & non-renewable energy consumption structure: evidence from OECD countries. Renew Energy 190:572–583. https://doi.org/10.1016/J.RENENE.2022.03.138

Yin R, Wang Z, Chai J, Gao Y, Xu F (2022) The evolution and response of space utilization efficiency and carbon emissions: a comparative analysis of spaces and regions. Land 11(3):438

Yoshino N, Rasoulinezhad E, Taghizadeh-Hesary F (2021) Economic Impacts of Carbon Tax in a General Equilibrium Framework: empirical study of Japan. J Environ Assessment Policy Manage 23(01n02):2250014. https://doi.org/10.1142/S1464333222500144

Zakari A, Khan I, Tan D, Alvarado R, Dagar V (2022) Energy efficiency and sustainable development goals (SDGs). Energy 239:122365

Zhao L, Taghizadeh-Hesary F (2022) Role of R&D investments and air quality in green governance efficiency. Econ Res-Ekonomska Istraživanja, 1–12.

Zhao J, Shahbaz M, Dong K (2022a) How does energy poverty eradication promote green growth in China? The role of technological innovation. Technol Forecast Soc Chang 175:121384

Zhao X, Mahendru M, Ma X, Rao A, Shang Y (2022b) Impacts of environmental regulations on green economic growth in China: new guidelines regarding renewable energy and energy efficiency. Renew Energy 187:728–742

Zhao X, Ramzan M, Sengupta T, Sharma GD, Shahzad U, Cui L (2022c) Impacts of bilateral trade on energy affordability and accessibility across Europe: does economic globalization reduce energy poverty? Energy Build, 112023.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Guo, L., Kuang, H. & Ni, Z. A step towards green economic policy framework: role of renewable energy and climate risk for green economic recovery. Econ Change Restruct 56, 3095–3115 (2023). https://doi.org/10.1007/s10644-022-09437-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09437-w