Abstract

It attempts to empirically understand the role of Information and Communication Technology infrastructure and governance quality in direct and indirect tax revenues mobilisation for the combined governments of Centre, States and Union Territories of India during the post-liberalisation period of 1990–1991 to 2017–2018. Considering that the recently implemented Goods and Services Tax (GST) is not entirely different from the previous value added tax (VAT) regime in terms of revenue collections at each stages on the value added of manufacturing and sales but an extension of VAT (which existed since 2005 by most of the states and Union Territories until 1st July 2017) by bringing the services into tax net, it tries to assess on the role of institutions/governance and use of modern ICT infrastructures in realisation of greater tax revenues for the combined government. The findings surprisingly reveal that ICT infrastructures and governance quality have no significant positive effect on the overall tax revenue collections. This contrary outcome could be possible when there is greater scope for tax payers to easily escape out of the tax net by carrying out the transactions outside the ICT system or without relying on to the use of ICT infrastructure and leaving no trace behind.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Despite India’s consistent ascendancy as one of the fastest growing developing economies in the world for quite a long period of time (for almost one and half decades except the present recessionary milieu since 2019–2020 which is characterised by sluggish pace of domestic demand and recession in major economies in the world and again outbreak of Covid-19 exposing the world economy into serious economic perils),Footnote 1 it is believed that the quality of governance and provisioning of public goods and services in India continue to be the modest. There exists a greater complementarity relation between the two. Effective governance can go a long way to ensure the efficiency in the delivery of public services and similarly, optimal availability of public infrastructure especially in terms of the wide-accessibility of modern technologies (such as ICT or digital facilities) can also to a large extent ensure the efficiency in delivery of public services through greater accountability and transparency in information between the service providers, government agencies and the intended beneficiaries of those public services.Footnote 2

Most of the studies while examining the factors influencing the tax compliances by the tax payers for greater tax revenues although admit to face practical difficulties in measuring the compliance gap (tax evasion) and obtaining the statistical information relating to the factors influencing the compliances for all the economies in general, but they observe lesser degree of compliances or higher levels of tax evasion in developing economies (Andreoni et al. 1998). This along with the economic structure (lower income base/low level of economic development), fragmented politics, weak institutional structure and low transparency drive for a low proportion of tax revenue to GDP environment for the developing economies comparing the rich economies (Besley and Persson 2014).Footnote 3 Studies consider effective enforcement by tax authorities (tax administration) and availability of information about the potential tax payers, as critical factors in influencing the compliance behaviour of tax payers. In view of the absence information about the extent of improvement in effectiveness in tax administration (or efficiency in tax collection by tax authorities) and degree of tax compliances by the tax payers for a developing economy like India, this study focuses on examining the quality of governance and access to modern ICT facilities as proximate measures of the extent of efficiency in tax administration and degree of tax compliances and their role, to what extent they are responsible for improvement in the realisation of tax revenues for India.

Although over the last two–three decades there has been an acceleration in the availability and use of physical infrastructures and modern information services by all economies including India, however, India has been still facing economy-wide physical infrastructure constraints in many spheres of economic activities including the ICT infrastructure facilities. This restrains in the realisation of full benefits of digitalisation not only for the government but also for the public. These constraints can clearly be visible when it involves the synergy between the delivery of services by various public agencies and private sector’s access to those services through the modern technologies. The deficiencies can be observed in accomplishing the relevant works being ultimately and successfully done by the public.

Similarly, when it comes to measuring the quality of governance for developing economies including India, there is either modest improvement or no improvement over the years. In the global corruption perception index ranking by the Transparency International, India, was ranked 79th position in 2016 among 176 countries. With its rank being slipped to 81st in 2017 in the list of 180 countries, the Transparency International (2019) on the basis of perception of public sector corruption put it among the worst offenders in graft and press freedom in Asia Pacific Region.Footnote 4 In 2018, although it could improve its position marginally to 78th most corrupt country in the world along with Burkina Faso, Ghana, Kuwait, Lesotho, Trinidad and Tobago, and Turkey, all scoring the same on the corruption metre, however, in 2019, it again slipped to 80th among 180 nations. Footnote 5It is claimed that on account of absence of clear mechanism to establish accountability, the corrupt officials in the name of public welfare improvement, channel public funds to wasteful projects which generate bribes, depleting public funds that could otherwise have been spent productively on heads such as health, education and other services. This could have potentially benefitted the poor in most significant ways.Footnote 6 Poor quality of governance and lack of progressive modern infrastructure and digitalisation facilities are likely to have important bearings on the fiscal performance of national governments of developing economies. Weakness in both the factors not only leads to low levels of revenue realisation but also increases their fiscal deficits. The developing economies’ governments fail to control their fiscal deficits more especially when they fail to achieve efficiency in government expenditure allocations and not being able to restrain total expenditures in response to increasing population and cost of provisioning of public goods and services on account of escalation in inflation.

Since a developing economy like India with vast geographical size has been experiencing a rapid population boom (although the population is growing at a lesser rate in the recent decades comparing prior years of 1990s), it requires provision of various basic public services and facilities by various concerned governments over which they retain their authority in terms of their jurisdictional setting. Footnote 7 Facilitating the public with provisioning of access to modern information and communication technologies (ICT) assumes critical importance in enabling the public to comply with various governmental laws as per various official/departmental bureaucratic rules along with provisioning of most convenient public transportation facilities with proper carrier/container capacity for smooth movement of goods and people across locations and equipping the nation with necessary roads and infrastructures. However, the provisioning of these basic facilities is still far away from meeting the realistic demand in terms of both quantity and quality of public services for a developing economy like India. This can be assessed considering the per capita availability of various infrastructure indices made available with the World Bank and other national statistical official agencies suggesting congestion in accession to most of the public services. As a case in point, this problem is being more severely pronounced when the tax payers while trying to comply with implementation of new taxation policies at the initiation of every round of new major indirect taxation reforms carried by the government in India like introduction of VAT and GST, the tax payers have to struggle very hard besides overcoming other constraints in meeting the desired compliances. In recent times, on several occasions, it is reported that even after several months of implementation of GST in India, the situation has remained so precarious that the tax payers are not able to have proper access to the government’s e-filing tax network system either to e-file their taxes or even timely claim the input tax credits on their input purchases while filing the taxes on the sale of their final goods. This clearly reflects the capacity constraints facing the government and tax administration authorities in equipping with adoption of suitable ICT infrastructure facilities to the public on the one hand, and more particularly, when the authorities are trying very hard to enforce new tax policy changes to be complied by the tax payers (manufacturers and sellers) on the other. Given the prevailing uneasy and disruptive environment, this could reflect severe financial resource constraint and skilled personnel crunch facing the governments to meet and improve the physical and administrative capacity necessary for a growing and populous economy. This in effect is failing to pass the test of economic efficiency, when the government radically aims at amending the economy’s tax policies before the system is ready to accommodate the change. Moreover, this has also resulted in less realisation of revenues than its potential levels for both the central and state governments what the authorities had expected prior to the implementation of indirect tax policy changes, i.e. GST.

The financial resource constraint being faced by the governments over the years including the recent period gets reflected from the higher level of fiscal deficits and increasing debt of the central government relative to the states and the Union Territories (UTs). This weak fiscal situation has arisen despite the continuous efforts by both the governments to maintain fiscal discipline by putting ceilings on their respective fiscal deficits and debt levels and increasing efforts for greater tax revenue collections as per their changing fiscal rules from time to time. Therefore, to make appropriate provisioning of public infrastructures for common access, both the centre and states governments (including UTs) need to have more financial resources. The mobilisation of financial resources among other things hinges on methods and mechanism of collecting tax revenues with proper deployment of quantity and quality of modern physical infrastructures, efficient tax collectors, transparency and accountability in the system (transparency in methods of collecting tax revenues by public officials and honesty and morality of the tax payers in complying with the changed tax laws), tracking of information on portion of income generated in the private sector but legally falling outside the purview of untaxed sector (which again hinges on changing structural features of the economy), simplification of the tax laws, knowledge and awareness of the citizens to comply with tax laws and financial and real punishments associated with defaults in tax payments among others.

With revolution of ICT infrastructure which seems to be the sine qua non for the global economy, this study looks at whether the use of modern ICT infrastructures has resulted in greater collection of tax revenues in view of potential contributory power of ICT infrastructures to confer towards transparency and accountability in the taxation system. When one refers to the use of modern infrastructure, it does not only include the use of modern infrastructures from government side but also constraints on the availability and accessibility of those infrastructures for the common public use (private sector). Otherwise, infrastructure capacity creation by either party without ensuring accessibility of the same by the other party on a mutual basis may put constraints on achieving the desired outcomes in an economy. The use of ICT infrastructure (digitalisation) is not only gaining importance in realisation of revenues for the governments, but also for improvement of governance quality, and services delivery by the public agencies. The ICTs are not only accounting for the rapid improvement in general service delivery, but within the context of public sector performance, they are increasingly seen as panacea to many problems that the governments are facing while trying to serve the citizens in most efficient ways in their respective jurisprudence. E-governance has been publicised as a means to cut costs, while at the same time it improves the quality, timeliness and access to service delivery by public agencies.Footnote 8

On the other side, it is also possible for one to argue that when governments can realise greater revenues that itself could enable the government to enhance its capacity to deploy more quality physical infrastructures including modern ICT infrastructures and thereby enhancing the levels of general welfare in the economy. Apart from efficient deployment and use of ICT infrastructures, unless tax administration is efficiently complemented with the quality of governance machinery and proper institutional structure, ICT infrastructure alone may not be of adequate help to realise desired revenue productivity gains for the governments. Therefore, it is important to examine role of ICT infrastructure along with governance quality (or institutional mechanism) in realisation of greater tax revenue productivity or revenue augmentation for a developing economy like India. Placing the emphasis on quality of governance is quite significant for realisation of potential revenues, without which there will be greater leakages/wastages of public resources and tax evasion, ultimately compromising with the aggregate welfare through its distortionary consequences.

A study conducted by IMF (2016) on “Corruption: Costs and Mitigating Strategies” points out corruption imposes a greater social cost on nations as it weakens state’s capacity to perform its core functions. It affects macro-financial stability, public and private investment, human capital formation, curbs on economic growth and thereby undermining the potential drivers of inclusive growth. Countries with higher corruption tend to have poor access and low quality infrastructure for a given level of public capital stock, thereby undermining the efforts to improve over the infrastructure gap and productivity of existing capital. The worldwide, bribery alone which constitutes around 1% of total corruption is estimated to cost around $2 trillion a year, equivalent to the size of the GDP of many smaller wealthy countries like Italy and many times of $149.3 billion received as global development aid to developing and least developing countries (2018).Footnote 9 Several studies (Mauro 2004; Dreher and Herzfeld 2005; Blackburn et al. 2006; Arnone and Iliopulos 2007; Muralidharan et al. 2014) also point out that the countries that are less corrupt and maintain good transparency record achieve greater economic success in terms of higher growth, GDP levels and Human Development Index (of United Nations) based on measures such as life expectancy and years of schooling. On the contrary, studies have also evidenced positive contribution of corruption on economic growth for the developing economies (Ugur and Dasgupta 2011; Campos et al. 1999; Ugur 2014). Based on the theory of bureaucracy, experts are of the opinion that enhancing the salaries of the government employees can be thought of as a way to mitigate the problem of corruption and improving the productivity in public sector and that in turn can contribute to higher growth. Otherwise, if the officials cannot earn certain wage levels sufficient enough to take care of their cost of living, they are likely to recourse to corrupt practices. This view is based on the proposition that higher are the wages and salaries for the government employees, this would act as a deterrent for employees to engage in corrupt practices as this can serve as a risk of losing their jobs at the enhanced salaries (Van Rijckeghem and Weder 2002). Therefore, higher wages may contribute to productivity of public capital. In contrast, based on institution-building theories, some others advocate strong institutional measures to be in place which can check corrupt tendencies of officials (through establishment of proper legal framework as to protect the government institutions with measures such as liability of actions for officials omitting the rule of law while discharging their duties in good faith of the institution).Footnote 10 However, the governments have also their own capacities to which they can raise the salaries of their employees given their hard budget constraints which they face similar to the private sector.

In contrast, the international financial institutions, such as IMF and World Bank, are also helping the governments around the world to fight against corruption, and poverty by improving transparency, accountability and suggesting timely institutional changes for better institutional and fiscal outcomes and achieve higher growth and development targets. The anti-corruption measures by various governments around the world are also providing opportunities for private technology corporate agents to innovate alternative strategies like blockchain technology. In India, it has resulted in introduction of Aadhaar card and by linking it with all other bank accounts, enabling to trace the transactions for each individual’s accounts including various beneficiaries of different government cash transfer benefit programs. The technology enables to aggregate the data from various sources of government spending and contracting of public services and analyse this information for gauging the wastage, fraud, and corruption in government and also helping the governments to collect information on private properties (income and wealth) generated and tax payables. Although digital information in general is easy to modify, blockchain is thought to provide a robust immutability of not engaging in dishonest and illegal activities. This has recently come into vogue by many social welfare agencies responsible for implementation of various governmental schemes around the globe. However, despite recognition of greater effectiveness of digital technologies, it has been facing resistance and prohibition in its use by many governments on account of cyber security concerns. Therefore, its large-scale adoption needs governments’ support which is necessary to fight against official corruption. Thus, the institution of government plays a critical role for efficiency in the uses of available technologies.

Technology has dramatic influence over our day today lives and almost all the activities in various sectors of different capacities. Public finance, which involves an art of efficiently raising and allocating financial resources to deliver optimal public services and benefits, redistributing income and smoothing of ups and downs of the business cycle, has been undergoing dramatic digital revolution. Digital revolution has been influencing and reshaping governments’ activities and programs. How governments need to effectively manage these activities crucially hinges on their ability to collect, process and act on an array of information on how much enterprises/firms and workers earn, how many people are unemployed, who qualifies for the benefit of government’s program. Digitalisation has been aiding governments and the people to collect enormous amounts of required information on a mutual exchangeable basis. It benefits governments to design their revenues and expenditures policies. Similar to many other developing emerging economies, people in India are able to realise subsidies and welfare payment benefits directly in their bank accounts, by uniquely linking it with their biometric identifiers. When the tax authorities collect information on sales and wages on a real-time basis in several advanced and emerging economies, this not only gives an immediate insight into the state of the economy, but also government’s fiscal position, enabling them to chart out immediate and long term future policy strategies.

While there may exist a jerky side of digitalisation due to the concerns of privacy, confidentiality and cyber security, at the same time, it raises broader debate over inequality of its access and redistribution of its real benefits. With the help of a standardised simple structured personal information reporting format, through wide use of digitisation and electronic interface, tax authorities can be able to access vital and accurate sources of information collected by other private and government agencies on areas like personal bank-based transactions and interest incomes accrued. This is possible when governments take efforts in encouraging and compelling the people to carry out transactions only through banks.Footnote 11 A study by Hondroyiannis and Papaoikonomou (2017) reported that an imposition of restriction on cash withdrawals in July 2015 in Greece triggered a surge in card payments by consumers resulting in an unprecedented realisation of VAT revenues. Based on quarterly time series data, they empirically established that a 1% increase in the share of card payments in private consumption resulted in almost 1% higher VAT revenues through greater compliances, and, lowering the VAT rate and promotion of card-based transactions can lead to greater tax buoyancy. When Hondroyiannis and Papaoikonomou (2018) extended their analyses to cover 19 Euro Area economies for the same period 2003q1–2016q4, the analysis corroborated with similar evidence for individual economies that an increasing share of card payments in private consumption expenditure improves the VAT tax compliance. A higher share of card payments in consumption expenditure may therefore be expected to improve the efficiency of consumption taxes like VAT.

Just like the authorities receive real-time data on wages paid by employers and determine tax liabilities of workers and companies, similarly electronic invoicing system can allow immediate access to data on firm sales and purchases. Many countries’ governments are also using invoice-matching software programs to verify value added tax (VAT) refund claims of merchants associated with tax amounts filed by them. Based upon usual tax input credit method of computing the tax liabilities for sellers under GST, the GST collection in India also follows a similar tax invoice information matching method of collecting taxes from tax payers. These are significant measures towards resolving the problem that has long thwarted the tax collectors around the world. These technological solutions have also promising benefits for fragile economies, where conflict and corruption hamper the tax collections and receipts of benefit payments. Mobile technologies are also relied upon as direct and effective mediums to deliver public services, carrying transactions, track medical records when admitted as patients and disseminate other vital information. With better data collection, access and increased data processing power, technological improvement and their adoptions can allow the governments to improve ways of collecting taxes. Electronic filing makes it easier and cheaper for taxpayers to fill out tax returns and also for governments to speedily process those. It saves people’s time in running to revenue offices, relies on officials and pays bribes to lower their tax payments.

The introduction of new taxes on goods and services in India had its effects in increasing the number of registered taxpayers by around 38% over the existing numbers in less than 1 year since its introduction.Footnote 12 The greater merit in using this modernised infrastructure is that data on each individual taxpayer can be aggregated from a wide range of government and corporate sources in powerful ways, as well as individual digital footprints which can be established to build up a profile of taxpayers’ total income. This information can later be used to assess the accuracy of information reported by individuals. Such improved data processing capabilities can be utilised on a massive scale to improve revenue mobilisation potentials and its accrual forecasts. Digital technologies, including electronic payment systems, not only lower the cost of tax collection but also create the potential for expanding the tax bases.

The introduction and use of biometric technology in India has immensely helped various welfare agencies in government to extend social benefits to intended beneficiaries on a massive scale in a more transparent way. Since this technology enables to properly monitor and record biometric characteristics, such as fingerprints, it allows more accurate authentication of individuals’ identity at lesser expense from a wide range of databases. The same technology if can be deployed to assess the risks of non-compliance and predict the behavioural impact of new tax and spending policies, it can go a long way to enhance the tax compliances. The use of biometric authentication and digital payment systems for paying government subsidies to intended recipients can reduce the reliance on blunt redistributive instruments.Footnote 13 The theory and evidences suggest that a low and reduced rate of VAT on necessities, while aiming at benefiting the poor, it largely benefits the wealthy even more. Therefore, a better targeted tax payment mechanism may surmount the redistributive goals in a more efficient way, providing the reliable necessary benefits to the poorest. This implies that there exists greater scope of making sales taxation, land taxes and other taxes more progressive in India by restricting the applicable concessional taxes for individuals to some minimum size of land holdings and increasing the tax rates for people crossing those thresholds. This may serve as an enabling measure for the poor to afford for purchasing land for shelter and entrepreneurship and other productive purpose like agriculture.

2 Broad structure of taxation system in India

Indian fiscal federalism based on constitutional principle follows separation of tax powers between the centre and state governments.Footnote 14 The central government has the power to levy major broad-based and mobile tax bases. The major direct taxes by centre include taxes on non-agricultural personal incomes and wealth, and corporate income, while major indirect tax sources are excise duties on manufactured products, customs duties and services taxes without a proper coordination mechanism with the states in collection of indirect tax revenues. The excise duties on manufactured products have evolved as VAT on manufactured goods. The major tax powers assigned to states include taxes on agricultural incomes and wealth, sales taxes, excises on alcoholic products, taxes on motor vehicles and on transport of passengers and goods, stamp duties and registration fees on transfer of property and taxes and duties on electricity. States also have powers to levy taxes on entertainment and incomes earned from professions, trade or employment. Some states have retained these powers with themselves, while others have assigned some of these revenue bases to their local bodies. The state’s list also includes property taxes and taxes on entry of goods into a local area for consumption and use or sale. The states, however, mostly assign these revenue sources to local bodies. Except few specified services, taxes on which were assigned to states such as entertainment tax, passengers and goods tax, and electricity duty, the constitution of India did not explicitly recognise and assign the power to tax the services to any lower governments till as late as 2003. However, since all residuary tax powers were assigned to the central government, this authority became the basis for the centre to levy taxes on selected services from 1st July, 1994. In 2003, with 88th amendment to constitution, the central government was specifically assigned the power to tax on services. The following description would give a broad understanding of trends of direct and indirect taxes levied by the combined government.

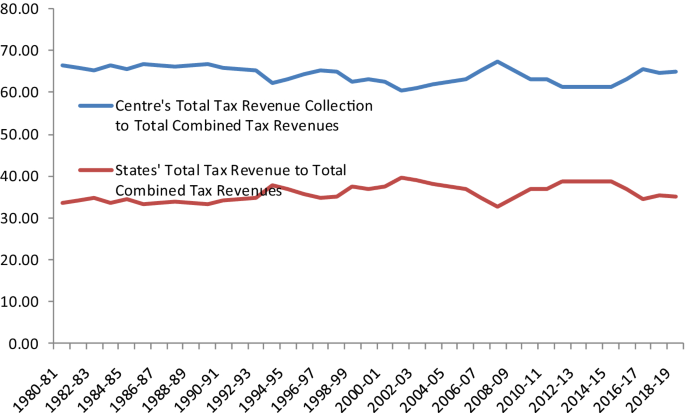

Figure 1 reflects that the central government consistently collects a greater percentage of total combined tax revenues of around 65% and the rest, 35% of total revenues is collected by states. This reflects asymmetry in revenue raising power between the two governments in India. Out of the total tax revenues collected by the centre, as per the recommendation of 14th Finance Commission of India, central government shared almost 40% of total tax revenues with states. This was a substantial jump in states’ share from 32% as recommended by 13th Finance commission. This is an effort by the central government to ensure greater financial empowerment of states under a framework of cooperative fiscal federalism.

The combined tax revenue as a percentage to GDP over the years shows an increasing trend along with combined direct tax revenues to GDP% (as shown in Fig. 2). It reveals that the direct tax revenue to GDP% has been leading the overall trends of total combined tax revenue to GDP% since the period, 2002–2003 than the prior years. In 2018–2019, out of 18% of total combined revenue to GDP%, the centre’s collection of revenues as a percentage of GDP constituted around 12%, while states’ tax revenue constituted the rest of 6% of GDP. Similarly, indirect tax revenue as a principal revenue source of combined government which constituted a little less than 12% of GDP, the rest is accounted by direct tax revenue out of a little over 18% of total revenues of both the governments to GDP. The figure also indicates there is a change in the composition revenues collected for the combined government. In earlier period, relatively a greater percentage of revenues was being mobilised from indirect sources, but now source has shifted from indirect to direct sources.Footnote 15

Further, as can be seen in Fig. 3, it is the central government which is found to enjoy the maximum share of revenues in combined direct tax revenue collections, while both the states and UTs are converging to almost to have an equal amounts of tax revenues shares in respect of indirect tax revenues comparing centre’s share.

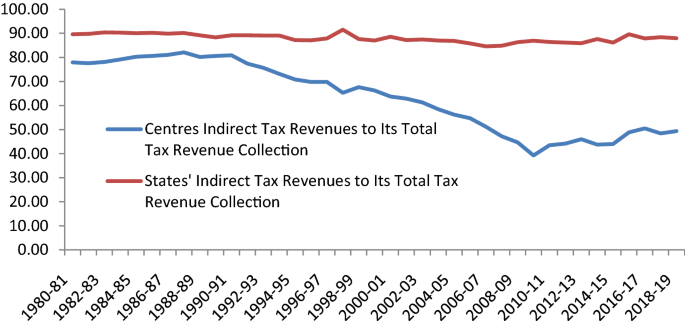

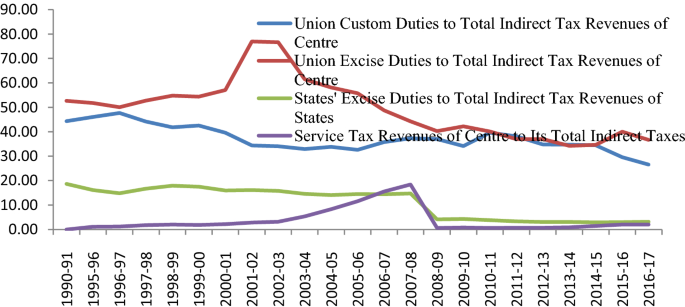

Figure 4 reflects that centre’s indirect tax revenue collection suffered its share in relation to its own total revenue collection as direct tax revenue has witnessed a relative increase comparing its indirect tax revenue collections. For states, it is the indirect tax revenue shares which are maintained almost at a stable proportion. For centre, indirect tax revenue to its total revenues which was at 78% in 1980–1981 has gone down to 49% in 2018–2019, while for states, it was 89% in 1980–1981 and has marginally decreased to 88% in 2018–2019. The falling trend on indirect revenue share is majorly on account of reduction of import and export duties on account of the liberalisation policies pursued at the insistence of IMF, World Bank and WTO and competitiveness strategies adopted by other countries globally in a globalised era. This also gets reflected from relative share of custom duties in proportion to total indirect taxes collected by the centre (shown in Fig. 5).

3 Contrasting the present indirect tax regime of GST with the previous regime of VAT

VAT, a dual tax regime, featuring with plethora of tax rates on various ranges of goods, with a very limited degree of harmonisation in rates across different states in India on their value additions at different stages of their sales in the chain, beside central government imposing excise duties at the manufacturing level on both goods and services.Footnote 16 The states did not enjoy any power to tax on services and thereby breaking the chain in production in their value additions. This problem was common and obvious when many services go as inputs into the production and sales of many other goods and thereby breaking the value addition in the chain of sales before it is ultimately consumed. Further, since central tax authority imposes taxes on manufacturing and state authorities impose taxes on sales at different stages sales and production, therefore, there is greater likelihood that it can result in tax on taxes on value of goods by different taxing authorities and at different stages before the good is being sold by the retailer to the ultimate consumer.Footnote 17 Such cascading effect of taxes leads to distortion of productive activities and unlawful reporting or even non-reporting of tax liabilities, sometimes resulting in low output and low tax revenues for both central and state governments, ultimately straining the government finances and thereby, compromising with economic growth. These scenarios were also intensely observed under the sales tax regime, prior to the implementation of VAT at the state levels. Therefore, to have a comprehensive indirect consumption tax regime, it required a coordinated reform effort of both the states and centre in reforming the state sales taxes along with reforms in the central excise duty.

The states were persuaded by the central government to rationalise their tax systems along the lines recommended by a study group from NIPFP led by Bagchi (1994). The government of India had appointed a State Finance Ministers’ Committee to make the recommendations to phase in VAT regime in a time bound frame. The committee, which was subsequently transformed into the Empowered Committee of State Finance Ministers, recommended that the states adopt floor rates to minimise the “race to the bottom”. However, the committee recommended VAT implementation in 2003 but continued to be postponed until April 2005. The delay in its implementation by states was largely attributed to the perceived revenue losses by states on account of input tax credits under VAT regime. However, implementation of VAT in April 2005 extended the sales tax only up to retail level with credit allowed for the taxes paid on intrastate purchases used for all intrastate and interstate sales. The interstate sales tax, that is, the central sales tax (CST), continued in the same form, pending a proposal for its phase out within 2 years of VAT introduction. Thus, many characteristics of sales taxation regime continued to prevail in VAT regime such as non-uniform tax rates, tax bases falling outside the scope of VAT including services taxes and customs duty. Gasoline and diesel fuel (which contribute around 40% of the sales tax) were kept outside the purview of VAT.

Given the sequence of indirect tax reforms, GST is conceived to be a game changer. It tried to legislate the laws to bring the services under the tax net of the states and eliminate the cascading effects of taxes by engaging two tax authorities to impose taxes concurrently than sequentially at different stages of production and value additions in the supply chain under a dual control mechanism of indirect tax collection.Footnote 18 Both the central, states and UTs tax authorities are levying the taxes together at a uniform rate for both the goods and services (with 5–6 differential rates on a range of goods on the basis of their necessity and luxury). It provides an opportunity to the tax payers to file their tax returns on a single interface (single server connected to the web) to both the taxing authorities and thereby breaking the barriers in trade and commerce across the state borders (aiding to create a single common market). This is intended to help unleash the productive potential of economic activities with an aim to achieve higher growth and realise the true tax revenue potential for all the governments. Since the inception of the discussion on GST by the Government of India (2000) in its budget (2000-01) for its introduction, its implementation procedures had undergone several rounds of revisions along with debates about rate setting which consumed significant amount of time before it finally got implemented on 1st July 2017. It being purely a destination based tax, tax revenues collected at the state borders by the central government agencies through the IGST mode on commodity imports/exports, the revenues are being shared with state governments & UTs where the goods are being finally consumed. It is claimed as the largest indirect tax reform in the history of India. The reform mandated integration of entire nation’s diverse tax portfolio into a single taxation system. However, its introduction has given rise to massive complexities in developing an IT platform, to handle not only the diverse tax systems of 36 States/Union Territories & Union Government, but also needed providing a single interface for more than one crore taxpayers for their GST compliances. The major difference of the present GST regime over earlier indirect tax regime is that the states and the Centre both collect revenues concurrently with almost at same rate under GST sacrificing their respective flexibilities in levying the taxes.Footnote 19 The proponents of GST claim that “one of the fundamental features of GST is to achieve seamless flow of input credit across the chain (from the manufacture of goods till it is consumed) and across the country. The money in the economy is circulating as a network of pipes through which water is flowing. The banking system manages this network, and the efficiency of this system is known as liquidity”.

However, it needs to be assessed and validated to what extent the present GST regime has accomplished the intended objectives of introducing a robust indirect taxation system of the country. In its initial implementation stages, it has given rise to several infirmities with regard to settlement/fixation of tax rates on various products and uncertainties in its procedural implementation. The government has been trying to settle the rates on different products and other issues on a step by step basis by frequently adjusting and readjusting with tax rates depending on the demand of various interest groups and sectors. As a result, there appears an unreasonable biasness towards some sectors by imposing a higher tax rates and lack of attention on sectors or products that deserves equal treatment. For instance, there was no rationality for a product like cement to be differentiated from any other goods of basic importance or necessities, while luxury goods like jewellery attracted a tax rate of only 3%. Thus, if cement attracted a maximum GST rate of 28%, how it can make the home construction affordable for the homeless, more especially in a context, when the Central Government is trying to ensure shelter for the poor under various central government schemes. The people who are just at the margin of above the poverty line but wished to construct their own shelter, high tax rate should not stand as a burden or barrier for construction of new home projects. After all, the use of products like cement is associated with creation of more new jobs and welfare of mass through their forward linkage and therefore should have received due consideration. It was pronounced that GST would prove to be revenue productive and it would greatly benefit the consumers and consumer states by making them realise higher revenues. This issue, however, calls for greater scrutiny as cascading effects of taxes on prices seem to be mostly absorbed by the manufacturers and the vendors without passing same benefits of price reductions to the consumers. This gets reflected from increasing trend of general price levels after GST implementation. There are many countries in the world which have also shown similar experiences. This may imply that GST has not made any greater contributions of keeping down the overall inflation rates in the economy since its implementation.

Under GST regime, all tax transactions are digitised and stored on a central database, easily amenable to better collation on an accrual basis. However, in spite of entrusting a special agency to provide responsible services to tax payers, businesses are facing challenges in filing their tax return. There were instances when returns could not be filed, and refunds to exporters could not be processed and anomalies in the rate structure resurfaced. In addition, business are also complaining of several hurdles in tax payments as they have to file monthly returns along with a final annual returns which comes to filing of around 37 returns in a year and allowance is made for business below certain threshold level of turnovers to adopt for the composition scheme. Many contentious issues like invoice matching, single return, etc., are yet to be addressed properly. Having rushed into GST implementation without adequate preparation, the government had initially suspended many provisions relating to tax collection at source, tax deduction at source and many other new provisions were rushed in. These inefficiencies annoyed the taxpayers when the government tried to be strong on enforcement. Small taxpayers continue to complain of complexities in laws. The petroleum products, alcohol, tobacco and real estate are still to be brought into the ambit of GST which is a real challenge. The enforcement machinery is yet to come to the grips of complexities and ground realties. There are greater volatilities in the monthly realisation of GST revenues. The states are falling short of their revenue targets under GST, and they are complaining off non-receipt of compensation receipts from the centre. There are also problems with the formulae for refund of unutilised input tax credit for the manufacturers/sellers on account of zero-rated exports. It seems that, the government needs to do a lot more on legislation, interpretation, rationalisation of tax rates, streamlining refund procedures and exemptions for exporters, and so on. The GST Council has been meeting up frequently to take decisions for easing of the compliance burden, grant upfront exemptions to the exporters and streamline the rate structure. Despite several shortcomings, the e-tax system by offering an electronic registration, filing of returns, return computations and payment, as well as education and information to the taxpayers, it is likely to considerably reduce the cost of compliances. Therefore, the present study focuses in evaluating the influence of modern electronic system on tax revenue generations in India as electronic system is likely to contribute to the efficiency, transparency and accountability in tax collection and administration by the government officials and improve the compliances by the tax payers and thereby enhancing the tax productivity.

4 Reflections from theory

Governance in relation to taxation is usually defined as a mechanism in which tax evasion and tax avoidance can be minimised (Morrell and Tuck 2014). It establishes a relationship between the enforcement pressure (legal framework) and compliance by the tax payers. Effectiveness in the enforcement of taxation laws is made possible by mutually linking up with other government agencies and regulatory agencies (third parties). Equipped with better information, one can expect better enforcement of taxation laws and less tax evasion (more transparency) and hence greater revenue realisations. This may require a greater deployment of ICT infrastructure. However, without good governance, ICT may play a trivial role in tax administration. The good quality governance can predominantly shape taxation system of a country and provide better revenue realisations. Good governance is an outcome of an efficient administration, trust in government and political stability. Lack of three things may undermine the emergence and development of an efficient taxation system.

While emphasising on a comprehensive survey of theoretical literature on linking the reliance on modern ICT infrastructure and the extent it induces greater tax compliances and therefore contributed to raising tax revenues, the theoretical contribution is undoubtedly absent. Even public finance literature emphasises on a strong tax administration which by inducing greater tax compliances can raise revenues for the government, however, the literature is largely silent on how to lay a strong enforcement mechanism for developing countries when the overall governance or institutional quality is weaker for their macro economy. Authors have pointed out that intensity of desk and field audits and, quality and availability of customer services, etc., can substantially reduce the compliance gap (taxes legally due minus actual payments or illegal non-payments), but this may be relevant for the developed economies. Even the same can be envisaged for the developing economies, but it may be difficult in practice as it requires deployment of massive resources for hiring manpower and reasonable technological diffusion.

Accountability plays a crucial role more especially when citizens are concerned about the visible link to be established between the flows of tax collection and distribution and allocation of those tax revenues. This link would justify tax collection from the public and which may help in increasing the rate of compliances. Tax compliance is usually low among the developing countries, where people neither trust that the government is concerned about their interest nor do they have the trust for a wise utilisation of mobilised revenues. Thus, when voluntary compliances are hard to come forth from majority of the tax payers, tax morale could take some role with government propagation. Many Latin American and Caribbean and South and Southeast Asian countries (Bangladesh, Pakistan, Nepal, Malaysia, Cambodia, Indonesia, Laos, Sri Lanka and Philippines) are low performers in regard to raising government revenues comparing the advanced countries. A better tax administration/governance would of help to build up the confidence of the taxpayers leading to improvement in tax compliances and mutual cooperation among both parties.

In examining the determinants of compliance cost, Slemrod (1989) observed that taxpayers’ hours part of the compliance cost (including dollars spent for hiring professional assistance) goes up with taxpayer’s marginal tax rate. Therefore, the optimum enforcement can be reached where the enforcement elasticity of tax revenues is equal to marginal resource cost (compliance and tax administration costs) to the incremental revenue raised. Thus, the design of an efficient taxation requires taking into account the information on marginal cost of compliance and administration and the marginal social value of public spending.

According to some, the enforcement of tax laws strategically interact with statutory tax rates (Keen and Slemrod 2017). A higher marginal tax rate which has the tendency to induce evasion can be dampened by undertaking more effective administration. On the contrary, Keen and Slemrod suggest that the best response to weaker administration is to set the tax rate at a lower level and best response to a higher tax rate requires greater administrative efforts.Footnote 20 Thus, the elasticity of taxable income with respect to tax rate is endogenous to enforcement activities. Higher is the elasticity of taxable income to tax rates (because of higher welfare cost) and higher is the enforcement elasticity of raising tax revenues, there is a strong case for raising additional revenues by spending additional resources on enforcement rather than raising tax rates. And when this is supplemented with lower enforcement cost, it would naturally favour enforcement actions. In a similar line, Gemmell and Hasseldine (2014) viewed that additional enforcement is undesirable to the extent that it leads to tax induced reduction in true income resulting in distortion in production and shifting the taxpayers from evasion to resort to avoidance. In this context, in order to evaluate the response of VAT compliance gap to administrative expenditures, a study by IMF (2015) estimated the enforcement elasticity for (27 EU member and Japan) during 2000–2011. Finding the response of compliance gap with respect to the enforcement cost is negative and significant; they provided the elasticity estimate to be about .17. Based on a theoretical model, Bruno (2019) concluded that good quality political institutions are not a sufficient condition for tax enforcement or tax compliance. On account of endogenous role of tax morale, government could be pushed ex-post towards poor or no tax enforcement. Contrastingly, when good political institutions are not accompanied with better information about the enforcement of tax collection, there is scope for co-existence of poor tax enforcement, low tax compliance and weak tax morale. Bruno (2019) model predicted that whenever there is high uncertainty over the proportion of agents evading taxes (which occurs in institutionally weak societies) and the sunk costs the government must sustain for tax enforcement are high. Wherever there is low morale, there is low tax compliance.Footnote 21 Thus, it happens that where institutions are sound and tax evasion is costly (with an efficient judiciary system), then tax morale rises spontaneously. So it is the institutional system desired by the society (as a part of social custom) which determines the individual human behaviour and their morale. In a society with full tax compliance, which is extreme and an ideal system, the role of tax administration would be restricted to the provision of facilities for citizens to discharge its responsibilities. In case of non-compliance, the tax administration will have to play the role of policeman. However, on account of lack of resources where it cannot play the role of a policeman to all taxpayers, tax administration has to work out for a voluntary compliance strategy and fight against the tax evasion (Savica et al. 2015).

Concerning indirect taxation, Yitzhaki (1979) observed that tax causes substitution effect unless demand for the taxed commodity is inelastic. Optimal taxation theory enables to fix the tax rates for commodities which minimises the substitution effects (Ramsey 1927). Obviously, the minimum deadweight loss is a non-increasing function of size of set of taxed commodities. At the extreme, when all the commodities are taxed at the same rate, un-altering the relative prices, one ends up with zero deadweight losses. However, major factor which prevents an increase in number of commodities is the administrative cost of taxation, which is a decision variable. The government by changing the size of the tax bases, can trade off the losses on account of administrative costs against the excess burden. The optimum level of administration is also an increasing function of tax revenues. The optimality is reached when marginal cost of raising revenues through administrative cost equals marginal excess burden (marginal cost of raising revenues) on account of change in tax rates. Evans (2003) in reviewing the literature observed that the compliance cost varies across countries, although comparability of the estimates is quite difficult on account of differences in methodology and conceptualisation (like computation of whether to resort to social or private cost of taxation).

5 Empirical literature survey

In the absence of literature taking into account of the role of both ICT infrastructures and quality of governance in contributing to tax revenue realisation of countries, the following discussion tries to provide an indication about the state and degree of institutional transparency achieved in developing countries in general and India in particular and their implications for greater revenue realisations. This would provide the insight about the contributions of various factors as well as required strategies for effective tax revenue realisation for the governments in a country. A host of studies relate to transparency in general and effective governance in particular, how do they contribute to better economic performance of countries. Alon et al.(2018) in their study they demonstrated that although the prevailing wisdom suggests that less corrupt and more democratic countries do economically perform better, however, they observed the studies are at best inconsistent. They build up a theory linking corruption and regime type to economic growth. Using multiple databases including Polity IV, transparency international and World Bank, for 158 countries, they showed that under autocracy (dictatorship or totalitarian regimes), corruption was less harmful to economic growth than under anocracy (including emerging and infant democracies). This to some extent helped to resolve some inconsistencies and contradictory results observed from existing studies on corruption and economic growth. They demonstrated that democracies had the lowest level of corruption, while autocracies outperformed anocracies economically because they embed corruption more efficiently. Therefore, the policies should minimise the disruptions and efficiency losses due to corruption during the transition from autocracy to democracy.

Considering 149 panel of VAT implemented countries both from developed and developing economies or alternatively Sub-Saharan Africa (SSA) and non-Sub-Saharan African (non-SSA) countries over 1970–2013, Houssa and Megersa (2017) estimated a tax effort model accounting institutional and geographical characteristics of countries. They observed although VAT adoption had resulted in significant revenue gains for all the countries, but marginal contribution of VAT was significant for SSA countries comparing other developing and developed economies. Their investigation demonstrated that tax revenue collection was found to be higher for countries with a better institutional quality—even prior to adoption of VAT. Adoption of VAT only helped to maximise the revenues for those countries. They concluded that since VAT is now adopted in almost all countries across the world, all the developing countries should focus greater attention on promoting the reforms to improve the quality of institutions that can facilitate their tax collection.

He envisaged that ICT penetration can directly and indirectly contribute to raising tax revenues: directly through greater compliances and reducing collection and monitoring cost, and indirectly through improving efficiency in resource allocation raises productivity and income. Examining an unbalanced panel data set for 157 countries for the period 1990 to 2013, Koyuncu et al. (2016) explored the impact of ICT penetration (using both the univariate and multivariate time effect models (penetration of internet, fixed broadband, personal computers and mobile phones) on tax revenue. Using both the univariate and multivariate time effect models, they observed a highly statistically significant positive correlation between ICT penetration and tax revenue. This statistical relationship was found to be valid for four ICT penetration indicators and three tax revenue indicators.

The political coups in Fiji in 2000 led a scenario of mediocre economic performance, leading to deterioration of government finances and stagnant investment levels in Fiji in September 2002. As a remedy to this, the policy makers at the IMF recommended an increase in VAT. The national government, without carrying an in-depth economy-wide impact evaluation exercise of such a policy, announced a 25% increase in VAT in its 2003 budget. Beginning 1 January 2003, all goods and services were levied a VAT rate of 12.5%. Given the setting, Narayan (2003) used a computable general equilibrium model to examine the economy-wide effects of VAT policy. He observed that while VAT improved government revenue and brought 0.6% increase in real GDP, however, it failed to address to raise investment levels. VAT actually led to a decline in investments and a reduction in real consumption and national welfare. From this, he deduced that the IMF policy was misdirected.

In view of increasing challenges being faced by the OECD countries on account of ageing population, increasing fiscal deficits and indebtedness, Belinga et al. (2014) investigated how faster economic growth can boost the government revenues from estimation of short- and long-run tax buoyancies during 1965–2012. They observed that the short-run tax buoyancy of aggregate tax revenues did not significantly differ from one for majority of the countries, in spite of increased tax buoyancy achieved since late 1980s and making the tax systems to better serve as an automatic stabilizer. However, they observed the long-run buoyancy to exceed one in about half of the OECD countries, implying that GDP growth had helped to improve structural fiscal deficit ratios. Corporate taxes were by far the most buoyant, while excises and property taxes were least buoyant. For personal income taxes and social contributions, short- and long-run buoyancies had declined since late 1980s and had, on average, become lower than one.

Few studies have also investigated the relationship between the use of IT and government budget performance in terms of increases in tax revenues and efficiency or targeted delivery of government services. Dzidonu (2012) while analysing the benefit of using IT to manage the operations and delivery of public sector institutions, he observed the use of IT has led to the improvement in administrative efficiency, effectiveness and productivity in service delivery, reduction in administrative, operational and transaction costs to the public including reduced cost to access information. The benefits in the use of IT in taxation were infinite as it facilitated reducing the overhead cost of managing the agencies of government responsible for tax administration, instant computation of tax liability from the use of online tax calculator, reduced cost of registering tax payers and instant generation of tax identification number. It had also significantly resulted in reduction of collusion between the tax officials and the taxpayers in regard to tax liability, fraudulent activities of tax collectors in the event of non-remittance of taxes by the tax payers and ultimately helping to boost the revenue generation by the government and reducing the cost of administration (administrative, overhead and transactional) and corrupt practices.

Dowe (2008) observed that the tax authorities around the world are using electronic tax administration systems (like e-government led solutions like electronic tax filing (e-filing) to interact with taxpaying public in tax collection, administration and compliance settings, so as to improve effectiveness and efficiency in tax administration. Given that the bureaucratic structure is very expensive for public, the use of automated systems has proven to be capable of introducing massive efficiencies for the business to process the information and file the taxes at minimal cost. Although it is recognised that the use of IT technologies is expected to yield greater tax productivity, however, it is not without its pitfalls in harnessing its benefits. It depends on quality of internet facility, availability of electricity to power the host server, cost of maintenance of ICT facilities, technical know-how by tax administering agencies and literacy among tax-paying populations (especially the lower income tax payers) and incidence of internet hackings. In Nigeria context, Oseni (2015) concluded that the use of this modern technology had considerably reduced tax evasion activities as all potential taxpayers were captured by the system. However, he was of the opinion that the use of ICT can be catastrophic if carelessly employed by both the tax payers and the tax administrators as scammers and hackers of the internet facilities can utilise the ignorance opportunities or the lax security of the system.

By conducting a comprehensive survey of literature from various empirical studies based on the individual and cross countries, Koyuncu et al. (2016) noted GDP per capita, the sectoral composition of GDP, the level of foreign direct investment (FDI), trade openness and the level of public debt were the major determinants of tax revenues. Macroeconomic variables such as exchange rate, inflation rate; institutional factors like corruption, law and order, voice and accountability, civil and political rights, the level of democracy, government stability, political stability and economic stability; social variables such as the educational levels, and population growth were also considered to influence the tax revenues of the governments. Considering an unbalanced panel data set for 157 countries for 1990 to 2013 and using four ICT penetration indicators and three tax revenue indicators, they verified the hypothesis that whether ICT penetration had contributed to increased tax revenues. They evidenced highly statistically significant positive correlation between ICT penetration and tax revenues by accounting other determinants of tax revenues including the time effects in the model. Keen and Lockwood (2010) considering 143 countries for a period of 25 years observed that income per capita is not determinant for VAT adoption implying this is not preserved for the rich countries. However, a country is likely to adopt VAT if it is rich in terms of agriculture sector and lower in tax/GDP ratio. IMF also played a significant independent role in adoption of VAT. Although a VAT dummy had a positive impact on revenue to GDP ratio in few equations, it had also negative impacts. However, by allowing the impact of VAT to vary with country circumstances, a more complex result emerged. The shift effect of VAT on revenue ratio was negative. The revenue gains were clearly with the rich and more opened economies.

In the Indian context, considering the period from 1980 to 1981, Rajaraman et al. (2006) attempted to estimate the tax buoyancy for most of the Indian states where VAT was implemented in all but except 8 states in 2005. Since they traced the structural breaks occurring in 1990s for all the states, therefore, to overcome this problem they incorporated the share of industry in total output to estimate the tax buoyancy equation. They observed that the sign of the change in tax buoyancy coefficient at the break is positive in all but six states. The set of six where there was a negative change at the break included three states with (post-break) buoyancy coefficients below one: Gujarat, Meghalaya and West Bengal. In all the rest, the post-break coefficients were comfortably above one. In states which experienced a buoyancy-enhancing structural break in late 1990s, the spurt in tax effort might have been an endogenous response to implementation of higher salary scales as recommended by Fifth Pay Commission, starting in 1996–1997 (with a post-break period of only 5 or 6 years going up to 2002–2003). The median tax buoyancy they estimated was 1.30 against 1.20 which was the median buoyancy assigned to the states for the period 2005–2010 as per the report of the Twelfth Finance Commission (TFC). The study pointed out that the TFC projected buoyancies underlie the deficit grants awarded to the states and therefore carry a normative component. While referring to Shome Committee’s report (Government of India 2001), they observed that the fall in aggregate buoyancy across the states from 1.12 in the 1980s to 1.04 over the period 1990–1999 can be attributed to the sectoral shift towards services.

In the Indian context, Das-Gupta (2012) had also analysed the revenue effect of VAT over sales tax regime for 29 states during 1993–1994 to 2008–2009 along with assessing the administrative efficiency and evasion proneness. He observed a positive impact of VAT dummy variable implying a higher secular revenue productivity of VAT compared to sales tax regime. Analysing the same issue for individual states, he observed that VAT revenue performance was positive in 15 out of 23 jurisdictions including 6 of the 10 major states (excluding AP). The revenue gains were smaller for Karnataka, Kerala and UP. In overall, even if VAT performance was positive in 2/3rd of the states, improved own revenue performance after VAT introduction occurred in less than 40% including only two major states. Using a VAT dummy and finding its consistently insignificant for individual states, he concluded that VAT did not lead to base expansion. Analysing the assessment report of CAG (2010), he attributed the loss of revenues by the states to large tax evasion by dealers on account of ineffective procedures for verifying ITC claims and detection of fake ITC claims, incomplete automation, limited electronic return filing and lack of cross verification of information in VAT returns across dealers within and across the states.

Reviewing the existing literature, it suggests that studies have mostly focussed on factors determining the compliance behaviour of tax payers, designing optimal taxation policies, distributional and welfare consequences, effects of major changes in tax policies in terms of access to new tax instrument (like VAT) and their implications for government revenues. However, it is very scarce to trace any study attempting to relate the use of ICT technology in combination with the quality of governance which can influence the flow of information between the revenue collecting authority and the tax payers and thereby influencing the tax revenues and tax efforts of the authorities through tax enforcement more especially in a developing country like India. Therefore, this study makes an effort towards this understanding by relating both the above indicators (information technology and governance quality) with the realised tax revenues at the both levels of government in India. The empirical literature is also very infrequent in both international and Indian contexts in examining the effects of revenue compliance reduction costs on account of the use of modern ICT. It is of greater relevance to understand how the revolution in ICT has got a bearing on the revenue mobilisation efforts of governments, along with controlling the role of governance or institutional factors, while trying to relate the tax revenues with the tax base of an economy, which is the subject of investigation in this analysis.

6 Model specification

Following the extant literature, the tax revenue function (whether indirect tax revenue on commodities consumed or direct tax revenues on incomes, wealth/capital gains and returns) can be broadly specified to depend on the institutional quality (governance/bureaucratic quality), spread of ICT, real GDP per capita income and trade openness. Strict intervention by enforcing agencies may produce better compliance outcomes, however, excess government intervention or tax authority being hard on honest tax payers is likely to produce dampening effect by distorting labour force participation and macroeconomic activities.

There can be a strategic complementarity between statutory tax rate and law enforcements. When there is weak governance, the best response to weaker administration is to set a lower tax rate to achieve better compliances which may to some extent complement with augmenting the revenues. Conversely, the best response to a higher tax rate requires to be complimented with greater administrative efforts. With low marginal tax rates and weak administration, tax evasion can lead to smaller revenue reliefs(gains) for tax payers and thereby incentivising the tax payers to reduce their compliance gapsFootnote 22 as this may come with financial and real penalty risk (loss of reputation) of being getting caught as a tax defaulter. However, strict governance, with low tax rate may broaden the tax base by reducing the compliance gap, while the total revenue may be relatively lower than with full compliance with higher tax rates. Otherwise, strict governance with higher marginal taxes may yield big financial gains for the evader with greater losses when caught as a defaulter.

Greater intensity in the use of digitalisation and ICT technology is changing the traditional ways of carrying out modes of businesses operations. The creation of values is fundamental to ensuring that the tax system responds to these challenges. The complexities involved in certain highly digitalised business models and value creation in digitalised age have potential implication for existing international tax framework. The value addition with the use of these modernised services has given rise to the loopholes in generation of tax revenues.Footnote 23 As has been emphasised in literature, digitalisation of the economy could be one of the key factors to base erosion and profit shifting (BEPS). With increasing intensity in the use of digitalisation in coordination and collection of information from third party agencies (banks and employers, etc.), it is likely to enhance greater compliances.

E-commerce can greatly encourage and support cashless transactions dramatically helping the governments to curb the black money transactions. Digitalisation provides new opportunities as well as some new challenges to tax policy and administration beyond the international tax system. As a result, the rise of non-standard work includes the growth of gig and sharing economy and this can greatly affect the tax compliance and revenues mobilisations. While technologies like blockchain give rise to both new, secure methods of record keeping, at the same time, it also facilitates use of the crypto-currencies which pose risks to the gains made on tax transparency. This is a grey area of research in taxation which needs investigation for policy to ensure that authorities harness the opportunities that these changes would bring in while ensuring the ongoing effectiveness of the tax system. It will be important to give specific consideration on how policy changes can be implemented in developing countries to take into account their particular circumstances.

It is not only that tax revenues respond to the tax base, tax revenue as a development policy strategy may also respond to economic growth and the size of the informal sector in the economy and dependency ratio.Footnote 24 Tax rates as part of fiscal policy instrument are likely to affect productive efficiency and thereby the economic growth and growth rate in turn are also likely to affect tax revenue potential of an economy. There can be a simultaneity relationship between tax revenue and growth rate. With increase in trade openness, nations are competing with each other to attract more investment and trade which result in reduction of corporate taxes and taxes on import of raw materials. The globalisation emphasises on the need to minimise both efficiency cost and compliance cost of the tax system. This has been resulting in decline in overall revenues for governments as a result of cuts in tariffs and duty on imports and exports, and it is also true that with reductions in export duties, it is likely to reduce the export prices in international markets and thereby promoting international trade and economic growth and hence increased tax revenues.

We specify the tax revenue models in three common ways. Equation 1 is expressed in terms of per capita tax revenues, and Eq. 2 is expressed in terms of tax revenues as percentage of GDP. In order to examine whether structural features of the economy matter in collection of tax revenues for the governments, the model to incorporate the structural features of the economy, it considers non-taxed sector (share of agriculture in total output), where both the states and central governments do not levy any taxes. In respect of services, it is the central government which had been enjoying the privilege of imposing taxes on services sales and with recent introduction of GST, services sales have been incorporated as a tax base for the states also. Therefore, it considers combining services output with industrial output by treating them as similar activities for tax treatment and treated share of agricultural output as a separate independent variable which is not subject to imposition of direct taxes or indirect taxes unless it happens to be capital input purchases for agriculture sector, which are subject to some indirect tax levies. Further, two types of models are specified to be estimated for each kind of revenues such as aggregate combined tax revenues of both centre and states and UT governments, for combined direct tax revenues and combined indirect tax revenues of centre and states and UT governments and total state indirect tax revenues. It is to be noted that it is the centre which collects a maximum chunk of revenues through direct taxes on private income and wealth; it also collects a major share of indirect tax revenues from total indirect tax sources, while it is the states and UTs which collect major percentages of their total tax revenues mainly from indirect sources on sales. It is the centre which collects the custom duties, excise duties, service taxes on indirect ways and the maximum contribution of tax revenues comes from indirect sources than direct sources, which is almost a characteristic feature of taxation for most of the developing countries around the world. Our objective is to examine whether the use of modern ICT has resulted in greater tax revenue collection for the combined governments, controlling the tax base and quality of institutional factors. Now, the study specifies both the considered models Model A and Model B on total combined tax revenues of centre and state governments. Model A is in per capita terms attempts to understand the factors in the flow of revenues to the government on a per capita basis, while model B is in terms of tax efforts to assess how tax effort responds with different macroeconomic factors in the economy. The first one can be treated as a supply side equation, and the second one can be treated as a demand side equation for determination of government revenues.

Model A

Model B

whereas, governance quality may affect the tax revenues positively or negatively, ICT and per capita income are supposed to have positive influence on revenue collection, trade openness is supposed to have negatively affect the tax revenues due to competition among nations to reduce both export and import duties, growth rate is supposed to have positive influence on tax revenues, and dependency ratio and agricultural share are likely to adversely affect the tax revenue realisations.

7 Data sources and descriptions of variables used

The coverage of the analysis spans from the period from 1990–1991 to 2017–2018, where there are lot of reform measures undertaken in areas of fiscal policy specifically in respect of taxation and external sector, and monetary policy measures. With recommendation of Tax Reform Committee (TRC 1991), a number of systematic and comprehensive tax reform measures were initiated at the central level from December 1991 along with initiation of other market-based economic reforms. Since then, there are significant tax reform measures being initiated over different periods. With an aim to relate the use of ICT infrastructure and governance quality with tax revenue mobilisation, the key reason of starting the period of the analysis from 1990 to 1991 is that the statistics on many of the modern infrastructure indicators were not available prior to 1990–1991, which may be due to their recent introduction and thin intensity in their use in the Indian economy prior to this period. The data on tax revenues of centre and states, GDP, are collected from the Handbook of Statistics on the Indian Economy of Reserve Bank of India (RBI). The statistics on population to convert GDP and revenue variables into their per capita terms along with the data on 6 other types of ICT-related infrastructure variables such as internet users per million, mobile cellular phones per million, fixed telephone subscriptions per million, fixed broadband subscriptions per million, access to electricity consumption per million are collected from the World Bank Development Indicators of the World Bank to form a composite of an ICT infrastructure variable through the use of principal component analysis (PCA). The statistics to capture the quality of governance, political, social and judicial system (overall average measure of institutional quality based on 5 major parameters and by replacing it with an aggregative overall 12 indicators) are drawn from Political Risk Services International Country Risk Guide (PRS) published by the PRS Group.Footnote 25 An overall average high score on sum of all these parameters would imply lower risk or a favourable institutional, socioeconomic conditions and governance settings for an economy; while on the contrary, a lower score implies greater political risk. As an alternative to this, we had also substituted with the rule of law variables drawn from the World Bank Development Indicators. The study also consistently used VAT adoption dummy at the state level from the period 2005 for state indirect tax revenue and combined total tax revenue equations.

8 Econometric results

The two revenue models specified in the above Eqs. 1 and 2 relate to (1) being the per capita revenue function which is estimated in logarithmic term for easy of interpretation of its estimated parameters and (2) relates to the estimation of revenue effort. In the latter, tax revenue is normalised w.r.t. GDP and is directly estimated in ratio form without converting the variables in logarithmic form. This is done as a standard practice in many other studies, with the intent that it does not pose any interpretational problem.