Abstract

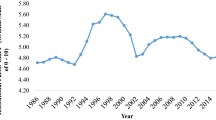

This study examines the moderating effect of institutional quality on the finance–growth nexus in the West African region via dynamic panel generalized method of moments. The findings reveal that the linear financial development has a separate positive influence on growth, while the interaction between financial development and institutional quality has a negative effect on growth. It implies that institutional quality constitutes a drag that diminishes and leaks out the growth benefits of financial development in West Africa. The threshold level of institutional quality beyond which financial development accelerates economic growth in the region is found to be 4.77 on the ordinal scale of 10 points. It is, however, evident that most of the countries in West Africa operate below the threshold. Hence, it is concluded that the institutional framework weakens the impact of finance on growth in the subregion of sub-Saharan Africa.

Similar content being viewed by others

References

Abekah-Koomson I, Loon PW, Premaratne G, Yean TS (2019) Total factor productivity growth: evidence from West African economies. Glob Bus Rev. https://doi.org/10.1177/0972150919856194

Acemoglu D, Johnson S (2005) Unbundling institutions. J Polit Econ 113(5):949–995

Acemoglu D, Johnson S, Robinson JA (2005) Institutions as a fundamental cause of long-run growth. Handb Econ Growth 1:385–472

Adusei M (2012) Financial development and economic growth: is Schumpeter right. Br J Econ Manag Trade 2(3):265–278

Adusei M (2018) The finance–growth nexus: does risk premium matter? Int J Finance Econ. https://doi.org/10.1002/ijfe.1681

African Economic Outlook (2013) Structural transformation and natural resources. African Development Bank, Abidjan

Aghion P, Howitt P, Howitt PW, Brant-Collett M, García-Peñalosa C (1998) Endogenous growth theory. MIT Press, Cambridge

Ahlin C, Pang J (2008) Are financial development and corruption control substitutes in promoting growth? J Dev Econ 86(2):414–433

Akinlo AE, Egbetunde T (2010) Financial development and economic growth: the experience of 10 sub-Saharan African countries revisited. Rev Finance Bank 2(1):17–28

Alexiou C, Vogiazas S, Nellis JG (2018) Reassessing the relationship between the financial sector and economic growth: Dynamic panel evidence. Int J Finance Econ 23(2):155–173

Allen F, Otchere I, Senbet LW (2011) African financial systems: a review. Rev Dev Finance 1(2):79–113

Allen F, Carletti E, Cull R, Qian JQ, Senbet L, Valenzuela P (2014) The African financial development and financial inclusion gaps. J Afr Econ 23(5):614–642

Aluko OA, Ibrahim M (2020a) Institutions and the financial development–economic growth nexus in sub-Saharan Africa. Econ Notes. https://doi.org/10.1111/ecno.12163

Aluko OA, Ibrahim M (2020b) Institutions and financial development in ECOWAS. J Sustain Finance Invest. https://doi.org/10.1080/20430795.2020.1717240

Andrianaivo M, Yartey CA (2010) Understanding the growth of African financial markets. Afr Dev Revew 22(3):394–418

Ang JB (2008) A survey of recent developments in the literature of finance and growth. J Econ Surv 22(3):536–576

Anwar S, Cooray A (2012) Financial development, political rights, civil liberties and economic growth: evidence from South Asia. Econ Model 29(3):974–981

Arcand JL, Berkes E, Panizza U (2015) Too much finance? J Econ Growth 20(2):105–148

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arminen H, Menegaki AN (2019) Corruption, climate and the energy-environment-growth nexus. Energy Econ 80:621–634

Bagehot W (1873) Lombard street: a description of the money market. Scribner, Armstrong & Company, New York

Balach R, Law SH (2015) Effects of financial development, institutional quality, and human capital on economic performance in SAARC countries. Emp Econ Lett 14(2):131–141

Baltagi B, Demetriades P, Law SH (2007) Financial development, openness and institutions. University of Leicester discussion paper in economics, p 5

Bandura WN, Dzingirai C (2019) Financial development and economic growth in Sub-Saharan Africa: the role of institutions. PSL Q Rev 72(291):315–334

Bardhan P (2001) Distributive conflicts, collective action, and institutional economics’. In: Meir G, Stiglitz J (eds) Frontiers of development economics. Oxford University Press, New York

Beck T, Levine R, Loayza N (2000) Finance and the Sources of Growth. J Financ Econ 58(1–2):261–300

Beck R, Georgiadis G, Straub R (2014) The finance and growth nexus revisited. Econ Lett 124(3):382–385

Berhane K (2018) The role of financial development and institutional quality in economic growth in Africa in the era of globalization. In: Heshmati A (ed) Determinants of Economic Growth in Africa. Palgrave Macmillan, Cham, pp 149–196. https://doi.org/10.1007/978-3-319-76493-1_6

Best A, Francis BM, Robinson CJ (2017) Financial deepening and economic growth in Jamaica. Glob Bus Rev 18(1):1–18

Bist JP (2018) Financial development and economic growth: evidence from a panel of 16 African and non-African low-income countries. Cogent Econ Finance 6(1):1449780

Blackburn K, Hung VT (1998) A theory of growth, financial development and trade. Economica 65(257):107–124

Breitung J (2002) Nonparametric tests for unit roots and cointegration. J Econom 108(2):343–363

Buck T, Liu X, Skovoroda R (2008) Top executive pay and firm performance in China. J Int Bus Stud 39(5):833–850

Caner M, Hansen BE (2004) Instrumental variable estimation of a threshold model. Econom Theory 20(5):813–843

Capasso S (2004) Financial markets, development and economic growth: tales of informational asymmetries. J Econ Surv 18(3):267–292

Chang HC, Huang BN, Yang CW (2011) Military expenditure and economic growth across different groups: a dynamic panel Granger-causality approach. Econ Model 28(6):2416–2423

Chen PF, Lee CC, Chiu YB (2014) The nexus between defense expenditure and economic growth: new global evidence. Econ Model 36:474–483

Chinn MD, Ito H (2006) What matters for financial development? Capital controls, institutions, and interactions. J Dev Econ 81(1):163–192

Claessens S, Laeven L (2003) Financial development, property rights, and growth. J Financ 58(6):2401–2436

Compton RA, Giedeman DC (2011) Panel evidence on finance, institutions and economic growth. Appl Econ 43(25):3523–3547

Das K, Quirk T (2016) Which institutions promote growth? Revisiting the evidence. Econ Pap J Appl Econ Policy 35(1):37–58

Demetriades P, Fielding D (2012) Information, institutions, and banking sector development in West Africa. Econ Inq 50(3):739–753

Demetriades P, Law HS (2006) Finance, institutions and economic development. Int J Finance Econ 11(3):245–260

Durusu-Ciftci D, Ispir MS, Yetkiner H (2017) Financial development and economic growth: some theory and more evidence. J Policy Model 39(2):290–306

Effiong E (2015) Financial development, institutions and economic growth: evidence from sub-Saharan Africa. MPRA paper no. 66085. http://mpra.ub.uni-muenchen.de/66085/

Ehigiamusoe KU, Lean HH (2019) Influence of real exchange rate on the finance-growth nexus in the West African Region. Economies 7(1):23

Ehigiamusoe KU, Lean HH, Lee CC (2019) Moderating effect of inflation on the finance–growth nexus: insights from West African countries. Empir Econ 57(2):399–422

Ehigiamusoe KU, Lean HH, Smyth R (2020) The moderating role of energy consumption in the carbon emissions-income nexus in middle-income countries. Appl Energy 261:114215. https://doi.org/10.1016/j.apenergy.2019.114215

Fernández A, Tamayo CE (2017) From institutions to financial development and growth: what are the links? J Econ Surv 31(1):17–57

Gapy NKG, Sobhanian SMH, Soretz S, Sahabi B (2015) Nonlinear effects of financial sector development on iran economic growth: with an emphasis on the role of interest rate. Development 5(2):75–96

Gazdar K, Cherif M (2015) Institutions and the finance–growth nexus: empirical evidence from MENA countries. Borsa Istanb Rev 15(3):137–160

Ghirmay T (2004) Financial development and economic growth in sub-Saharan African countries: evidence from time series analysis. Afr Dev Rev 16(3):415–432

Haini H (2019) Examining the relationship between finance, institutions and economic growth: evidence from the ASEAN economies. Econ Change Restruct. https://doi.org/10.1007/s10644-019-09257-5

Hall RE, Jones CI (1997) Levels of economic activity across countries. Am Econ Rev 87(2):173–177

Hassan MK, Sanchez B, Yu JS (2011) Financial development and economic growth: new evidence from panel data. Q Rev Econ Finance 51(1):88–104. https://doi.org/10.1016/j.qref.2010.09.001

Hechmy B (2016) Governance and financial development: evidence from the Middle East and North Africa region. Econom Res Finance 1(2):115–127

Herger N, Hodler R, Lobsiger M (2008) What determines financial development? Culture, institutions or trade. Rev World Econ 144(3):558–587

Hermes N, Lensink R (2003) Foreign direct investment, financial development and economic growth. J Dev Stud 40(1):142–163

Hondroyiannis G, Lolos S, Papapetrou E (2005) Financial markets and economic growth in Greece, 1986–1999. J Int Financ Mark Inst Money 15(2):173–188

Hsiao C (2003) Analysis of panel data, 2nd edn. Cambridge University Press, Cambridge

Huang Y (2010) Political institutions and financial development: an empirical study. World Dev 38(12):1667–1677

Ibrahim M, Alagidede P (2017a) Financial sector development, economic volatility and shocks in sub-Saharan Africa. Phys A 484:66–81

Ibrahim M, Alagidede P (2017b) Financial development, growth volatility and information asymmetry in sub-Saharan Africa: does law matter? S Afr J Econ 85(4):570–588

Iheanacho E (2016) The impact of financial development on economic growth in Nigeria: An ARDL analysis. Economies 4(4):26

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74

IMF (2016) Sub-Saharan Africa time for a policy reset. regional economic outlook. Sub-Saharan Africa. International Monetary Fund, Washington. World economic and financial surveys

Jelmin K (2012) Democratic accountability in service delivery: a synthesis of case studies. International Institute for Democracy and Electoral Assistance, IDEA, Stockholm

Khan A, Ahmed M, Bibi S (2019) Financial development and economic growth nexus for Pakistan: a revisit using maximum entropy bootstrap approach. Empir Econ 57(4):1157–1169. https://doi.org/10.1007/s00181-018-1501-0

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108(3):717–737

Kratou H, Gazdar K (2016) Addressing the effect of workers’ remittance on economic growth: evidence from MENA countries. Int J Soc Econ 43(1):51–70

Kuada J (2016) Financial market performance and growth in Africa. Afr J Econ Manag Stud 7(2):1–7

Kutan AM, Samargandi N, Sohag K (2017) Does institutional quality matter for financial development and growth? Further evidence from MENA countries. Aust Econ Pap 56(3):228–248

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1997) Legal determinants of external capital. J Finance 52(3):1131–1150

Law SH, Azman-Saini WNW (2012) Institutional quality, governance, and financial development. Econ Gov 13(3):217–236

Law SH, Habibullah MS (2006) Financial development, institutional quality and economic performance in East Asian economies. Rev Appl Econ 2(2):201–216

Law SH, Azman-Saini WNW, Ibrahim MH (2013a) Institutional quality thresholds and the finance–growth nexus. J Bank Finance 37(12):5373–5381

Law SH, Lim TC, Ismail NW (2013b) Institutions and economic development: a Granger causality analysis of panel data evidence. Econ Syst 37(4):610–624

Law SH, Tan HB, Azman-Saini WNW (2014) Financial development and income inequality at different levels of institutional quality. Emerg Mark Finance Trade 50(sup1):21–33. https://doi.org/10.2753/REE1540-496X5001S102

Law SH, Kutan AM, Naseem NAM (2018a) The role of institutions in finance curse: evidence from international data. J Comp Econ 46(1):174–191. https://doi.org/10.1016/j.jce.2017.04.001

Law SH, Lee WC, Singh N (2018b) Revisiting the finance-innovation nexus: evidence from a non-linear approach. J Innov Knowl 3(3):143–153. https://doi.org/10.1016/j.jik.2017.02.001

Le TH, Kim J, Lee M (2016) Institutional quality, trade openness, and financial sector development in Asia: an empirical investigation. Emerg Mark Finance Trade 52(5):1047–1059

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108(1):1–24

Levine R (1991) Stock markets, growth, and tax policy. J Finance 46(4):1445–1465

Levine R (1997) Financial development and economic growth: views and agenda. J Econ Lit 35(2):688–726

Levine R (1999) Law, finance, and economic growth. J Financ Intermed 8(1–2):8–35

Levine R (2003) More on finance and growth: more finance, more growth? Rev Fed Reserv Bank St Louis 85(4):31–46

Levine R (2005) Finance and growth: theory and evidence. In: Handbook of economic growth, vol 1 (Part A), pp 865–934

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77

Loayza N, Ranciere R (2006) Financial development, financial fragility, and growth. J Money Credit Bank 38(4):1051–1076

Lucas RE (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437

Menegaki AN, Ozturk I (2013) Growth and energy nexus in Europe revisited: evidence from a fixed effects political economy model. Energy Policy 61:881–887

Menegaki AN, Tugcu CT (2016) Rethinking the energy-growth nexus: proposing an index of sustainable economic welfare for Sub-Saharan Africa. Energy Res Soc Sci 17:147–159

Meo MS, Chowdhury MAF, Shaikh GM, Ali M, Masood Sheikh S (2018) Asymmetric impact of oil prices, exchange rate, and inflation on tourism demand in Pakistan: new evidence from nonlinear ARDL. Asia Pac J Tour Res 23(4):408–422

Miletkov M, Wintoki MB (2009) Legal institutions, democracy and financial sector development. Adv Financ Econ 13:171–196

Miller MH (1998) Financial markets and economic growth. J Appl Corp Finance 11(3):8–15

Mishkin FS (2009) Globalization and financial development. J Dev Econ 89(2):164–169

Mlachila M, Cui L, Jidoud A, Newiak M, Radzewicz-Bak B, Takebe M, Zhang J (2016) Financial development in Sub-Saharan Africa: promoting inclusive and sustainable growth (no. 16/11). International Monetary Fund

Moradbeigi M, Law SH (2017) The role of financial development in the oil-growth nexus. Resour policy 53:164–172

muye im, muye iy (2017) Testing for causality among globalization, institution and financial development: further evidence from three economic blocs. Borsa Istanb Rev 17(2):117–132

Naceur MSB, Blotevogel MR, Fischer MM, Shi H (2017) Financial development and source of growth: new evidence. International Monetary Fund

Narayan PK, Narayan S (2013) The short-run relationship between the financial system and economic growth: new evidence from regional panels. Int Rev Financ Anal 29:70–78

Nelson RR, Sampat BN (2001) Making sense of institutions as a factor shaping economic performance. Revista de Economía Institucional 3(5):17–51

Ng A, Dewandaru G, Ibrahim MH (2015) Property rights and the stock market-growth nexus. N Am J Econ Finance 32:48–63

North DC (1990) A transaction cost theory of politics. J Theor Polit 2(4):355–367

Nyasha S, Odhiambo NM (2018) Financial development and economic growth nexus: a revisionist approach. Econ Notes Rev Bank Finance Monet Econ 47(1):223–229

Olagbaju IO, Akinlo AE (2018) FDI and economic growth relationship in sub-saharan africa: is the domestic financial system a significant intermediator? Arch Bus Res 6(5):90–112

Olaniyi CO (2019) Asymmetric information phenomenon in the link between CEO pay and firm performance: an innovative approach. J Econ Stud 46(2):1–2

Olaniyi CO, Obembe OB, Oni EO (2017a) Analysis of the nexus between CEO pay and performance of non-financial listed firms in Nigeria. Afr Dev Rev 29(3):429–445

Olaniyi CO, Simon-Oke OO, Obembe OB, Bolarinwa ST (2017b) Re-examining firm size-profitability nexus: empirical evidence from non-financial listed firms in Nigeria. Glob Bus Rev 18(3):543–558

Pagano M (1993) Financial markets and growth: an overview. Eur Econ Rev 37(2–3):613–622

Pan L, Mishra V (2018) Stock market development and economic growth: empirical evidence from China. Econ Model 68(1):661–673

Pan F, Yang B (2018) Financial development and the geographies of startup cities: evidence from China. Small Bus Econ. https://doi.org/10.1007/s11187-017-9983-2

Patrick HT (1966) Financial development and economic growth in underdeveloped countries. Econ Dev Cult Change 14(2):174–189

Phiri A (2015) Asymmetric cointegration and causality effects between financial development and economic growth in South Africa. Stud Econ Finance 32(4):464–484

Puatwoe JT, Piabuo SM (2017) Financial sector development and economic growth: evidence from Cameroon. Financ Innov 3(1):25

Rachdi H, Mensi S (2012) Does institutions quality matter for financial development and economic growth nexus? Another look at the evidence from MENA countries. In: Economic research forum, working paper no. 705

Raheem ID (2017) More finance or better finance in Feldstein–Horioka puzzle: Evidence from SSA countries. Glob Bus Rev 18(1):1–12. https://doi.org/10.1177/0972150916666912

Raheem ID, Ajide KB, Adeniyi O (2016) The role of institutions in output growth volatility-financial development nexus: a worldwide study. J Econ Stud 43(6):910–927

Rahman A, Khan MA, Charfeddine L (2020) Financial development-economic growth nexus in Pakistan: New evidence from the markov switching model. Cogent Econ Finance. https://doi.org/10.1080/23322039.2020.1716446

Robinson J (1952) The generalization of the general theory. In: Robinson J (ed) The rate of interest and other essays. MacMillan, London

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romer PM (1989) Human capital and growth: theory and evidence (no. w3173). National Bureau of Economic Research

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5, Part 2):S71–S102

Roodman D (2009) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158

Schumpeter JA (1911) The theory of development. Harvard University Press, Cambridge

Sghaier IM (2018) Financial development, institutions and economic growth in North African countries. Roman Econ J 20(69):53–72

Shahbaz M, Van Hoang TH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212

Thiel M (2001) Finance and economic growth-a review of theory and the available evidence (no. 158). Directorate General Economic and Financial Affairs (DG ECFIN), European Commission

Türsoy T, Faisal F (2018) Does financial depth impact economic growth in North Cyprus? Financ Innov 4(1):12. https://doi.org/10.1186/s40854-018-0096-y

Tyson JE (2016) Sub-Saharan Africa’s economic downturn and its impact on financial development. Working paper 440, Shockwatch Bulletin, Overseas Development Institute, London. https://www.odi.org/sites/odi.org.uk/files/resource-documents/10724.pdf

Wintoki MB, Linck JS, Netter JM (2012) Endogeneity and the dynamics of internal corporate governance. J Financ Econ 105(3):581–606

Wooldridge JM (2002) Econometric analysis of cross section and panel data. MIT Press, Cambridge

Wu CF, Huang SC, Chang T, Chiou CC, Hsueh HP (2020) The nexus of financial development and economic growth across major Asian economies: evidence from bootstrap ARDL testing and machine learning approach. J Comput Appl Math. https://doi.org/10.1016/j.cam.2019.112660

Yahyaoui A, Rahmani A (2009) Financial development and economic growth: role of institutional quality. Panoeconomicus 56(3):327–357

Zang H, Kim YC (2007) Does financial development precede growth? Robinson and Lucas might be right. Appl Econ Lett 14(1):15–19

Acknowledgements

The authors acknowledge the direction of the handling director and the suggestions provided by the anonymous referees. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential conflict of interest was reported by the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Table 7.

Rights and permissions

About this article

Cite this article

Olaniyi, C.O., Oladeji, S.I. Moderating the effect of institutional quality on the finance–growth nexus: insights from West African countries. Econ Change Restruct 54, 43–74 (2021). https://doi.org/10.1007/s10644-020-09275-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-020-09275-8