Abstract

This study examines whether banking transparency and competition affect financial stability of banks and transparency acts as a conduit in effecting the competition among banks to increase or decrease their financial stability. This study uses multiple variations of a two-step system generalized method of moments approach on annual data from 164 Chinese commercial banks from 2000 to 2014. The results of this study showed that transparency with market power lessens the insolvency risk of banks as well as credit market risk; one could infer that market discipline works more robustly in the presence of disclosure requirements. This study supports existing market literature that China’s banking transparency is a significant determinant of changes in financial stability given the market structure of its banking system while controlling for several exogenous and endogenous variables. The results are robust by using alternate proxies for market structure, banking transparency and financial stability.

Similar content being viewed by others

Notes

Keeley (1990) claimed that deregulation of the US banking sector in the 1970s and 1980s increased competition and, through the accompanying decrease in monopoly rents, directed to an intensified equilibrium risk of failure.

The details regarding implementation of the BASEL framework in the Chinese economy can be viewed at the following link given on the bank for international settlement website. https://www.bis.org/press/p130927.htm.

For details on the subcategories of the index see the study of Nier (2005).

Cordella and Yeyati (1998) and Furman et al. (1998) suggested that greater transparency practices could worsen the situation of banks when they are hit by an exogenous shock resulting in banks to shut down. This claim points toward lowering of competition and increasing of market power of certain banks, which might be because mergers, acquisitions and bankruptcies reduce competitors in market. Gorton and Huang (2002) pointed out that the banks are hit by systematic or idiosyncratic shocks. Investors cannot observe the idiosyncratic risk of information-opaque banks. Chen and Hasan (2006) claimed that strong market discipline mechanism due to greater transparency could lead to stimulating competition. However, in case of large number of banks being risky would lead to accumulation of market power by small number of highly stable banks.

References

Agoraki M-EK, Delis MD, Pasiouras F (2011) Regulations, competition and bank risk-taking in transition countries. J Financ Stab 7:38–48

Alhassan AL, Tetteh ML, Brobbey FO (2016) Market power, efficiency and bank profitability: evidence from Ghana. Econ Change Restruct 49:71–93

Alqahtani F, Mayes DG, Brown K (2016) Economic turmoil and Islamic banking: evidence from the Gulf cooperation council. Pac Basin Financ J 39:44–56

Anand BN, Galetovic A (2000) Information, nonexcludability, and financial market structure. J Bus 73:357–402

Andrievskaya I, Semenova M (2016) Does banking system transparency enhance bank competition? Cross-country evidence. J Financ Stab 23:33–50

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68:29–51

Ariss RT (2010) On the implications of market power in banking: evidence from developing countries. J Bank Financ 34:765–775

Barth JR, Caprio G Jr, Levine R (2013) Bank regulation and supervision in 180 countries from 1999 to 2011. J Financ Econ Policy 5:111–219

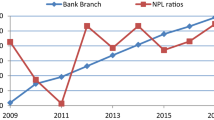

Bashir U, Yu Y, Hussain M, Wang X, Ali A (2017) Do banking system transparency and competition affect nonperforming loans in the Chinese banking sector? Appl Econ Lett 24:1519–1525

Bashir U, Yugang Y, Hussain M (2020) Role of bank heterogeneity and market structure in transmitting monetary policy via bank lending channel: empirical evidence from Chinese banking sector. Post Commun Econ. https://doi.org/10.1080/14631377.2019.1705082

Beck T, Demirgüç-kunt A, Maksimovic V (2004) Bank competition and access to finance: international evidence. J Money Credit Bank 36(3):627–648

Berger AN, Deyoung R (1997) Problem loans and cost efficiency in commercial banks. J Bank Financ 21:849–870

Berger AN, Klapper LF, Turk-Ariss R (2009) Bank competition and financial stability. J Financ Serv Res 35:99–118

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Boone J (2008) A new way to measure competition. Econ J 118:1245–1261

Boot AW, Schmeits A (2000) Market discipline and incentive problems in conglomerate firms with applications to banking. J Financ Intermed 9:240–273

Boot AW, Thakor AV (2000) Can relationship banking survive competition? J Financ 55:679–713

Boyd JH, De Nicolo G (2005) The theory of bank risk taking and competition revisited. J Financ 60:1329–1343

Chen Y (1999) Banking panics: the role of the first-come, first-served rule and information externalities. J Polit Econ 107:946–968

Chen Q-A, Du F (2016) Financial innovation, systematic risk and commercial banks’ stability in China: theory and evidence. Appl Econ 48:3887–3898

Chen Y, Hasan I (2006) The transparency of the banking system and the efficiency of information-based bank runs. J Financ Intermed 15:307–331

Claessens S, Klingebiel D (2001) Competition and scope of activities in financial services. World Bank Res Observer 16(1):19–40

Claessens S, Laeven L (2004) What drives bank competition? Some international evidence. J Money Credit Bank 36:563–583

Committee B (2001) The new Basel capital accord. Consultative Document, Basle

Cordella T, Yeyati EL (1998) Public disclosure and bank failures. Staff Pap 45:110–131

Cordella T, Yeyati EL (2002) Financial opening, deposit insurance, and risk in a model of banking competition. Eur Econ Rev 46:471–485

Darrough MN (1993) Disclosure policy and competition: Cournot vs. Bertrand. Account Rev 68:534–561

De Guevara JF, Maudos J, Pérez F (2005) Market power in European banking sectors. J Financ Serv Res 27:109–137

Demirgüç-Kunt A, Levine R (1996) Stock markets, corporate finance, and economic growth: an overview. World Bank Econ Rev 10(2):223–239

Demirgüç-Kunt A, Martínez Pería MS (2010) A framework for analyzing competition in the banking sector: an application to the case of Jordan. In: World bank policy research working paper series

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91:401–419

Dutta N, Mukherjee D (2018) Can financial development enhance transparency? Econ Change Restruct 51:279–302

Elliott M, Golub B, Jackson MO (2014) Financial networks and contagion. Am Econ Rev 104:3115–3153

Feltham GA, Gigler FB, Hughes JS (1992) The effects of line-of-business reporting on competition in oligopoly settings. Contemp Account Res 9:1–23

Ferrell A (2007) The case for mandatory disclosure in securities regulation around the world. Brook J Corp Fin Com L 2:81

Fu XM, Lin YR, Molyneux P (2014) Bank competition and financial stability in Asia Pacific. J Bank Financ 38:64–77

Furman J, Stiglitz JE, Bosworth BP, Radelet S (1998) Economic crises: evidence and insights from East Asia. Brook Pap Econ Act 1998:1–135

Gertner R, Gibbons R, Scharfstein D (1988) Simultaneous signalling to the capital and product markets. RAND J Econ 19:173–190

Ghosh A (2015) Banking-industry specific and regional economic determinants of non-performing loans: evidence from US states. J Financ Stab 20:93–104

Giannetti M (2003) Bank-firm relationships and contagious banking crises. J Money Credit Bank 35:239–261

Gorton G, Huang L (2002) Banking panics and the origin of central banking. National Bureau of Economic Research, Cambridge

Hayes RM, Lundholm R (1996) Segment reporting to the capital market in the presence of a competitor. J Account Res 34:261–279

Hellmann TF, Murdock KC, Stiglitz JE (2000) Liberalization, moral hazard in banking, and prudential regulation: are capital requirements enough? Am Econ Rev 90(1):147–165

Herd R (2013) The evolution of China’s social policies. Econ Change Restruct 46:109–141

Houston JF, Lin C, Lin P, Ma Y (2010) Creditor rights, information sharing, and bank risk taking. J Financ Econ 96:485–512

Hu JL, Li Y, Chiu YH (2004) Ownership and nonperforming loans: evidence from Taiwan’s banks. Dev Econ 42:405–420

Hyytinen A, Takalo T (2004) Preventing systemic crises through bank transparency. Econ Notes 33:257–273

Jiang C, Yao S, Feng G (2013) Bank ownership, privatization, and performance: evidence from a transition country. J Bank Financ 37:3364–3372

Jiménez G, Lopez JA, Saurina J (2013) How does competition affect bank risk-taking? J Financ Stab 9:185–195

Jordan JS, Peek J, Rosengren ES (2000) The market reaction to the disclosure of supervisory actions: implications for bank transparency. J Financ Intermed 9:298–319

Keeley MC (1990) Deposit insurance, risk, and market power in banking. Am Econ Rev 80:1183–1200

Leon F (2015) Measuring competition in banking: a critical review of methods. Series Etudes et documents du CERDI

Lerner AP (1934) Economic theory and socialist economy. Rev Econ Stud 2:51–61

Marcus AJ (1984) Deregulation and bank financial policy. J Bank Financ 8:557–565

Matutes C, Vives X (1996) Competition for deposits, fragility, and insurance. J Financ Intermed 5:184–216

Morgan DP (1999) Whether and why banks are opaque. In: Federal reserve bank of Chicago proceedings, 1999

Nier EW (2004) Banking crises and transparency

Nier EW (2005) Bank stability and transparency. J Financ Stab 1:342–354

Nier E, Baumann U (2006) Market discipline, disclosure and moral hazard in banking. J Financ Intermed 15:332–361

Niinimäki JP (2004) The effects of competition on banks’ risk taking. J Econ 81(3):199–222

Noman AHM, Gee CS, Isa CR (2017) Does competition improve financial stability of the banking sector in ASEAN countries? An empirical analysis. PloS One 12:e0176546

Repullo R (2004) Capital requirements, market power, and risk-taking in banking. J Fin Intermed 13(2):156–182

Roodman D (2009) A note on the theme of too many instruments. Oxf Bull Econ Stat 71:135–158

Salas V, Saurina J (2002) Credit risk in two institutional regimes: Spanish commercial and savings banks. J Financ Serv Res 22:203–224

Schaeck K, Cihak M (2012) Banking competition and capital ratios. Eur Financ Manag 18:836–866

Schaeck K, Cihák M (2014) Competition, efficiency, and stability in banking. Financ Manag 43:215–241

Semenova M (2012) Market discipline and banking system transparency: do we need more information? J Bank Regul 13:241–248

Stern GH, Feldman RJ (2004) Too big to fail: the hazards of bank bailouts. Brookings Institution Press, Washington, DC

Us V (2016) A dynamic approach to analysing the effect of the global crisis on nonperforming loans: evidence from the Turkish banking sector. Appl Econ Lett 24:186–192

Us V (2017) Dynamics of non-performing loans in the Turkish banking sector by an ownership breakdown: the impact of the global crisis. Financ Res Lett 20:109–117

Verrecchia RE (1983) Discretionary disclosure. J Account Econ 5:179–194

Vishwanath T, Kaufmann D (2001) Toward transparency: new approaches and their application to financial markets. World Bank Res Observer 16:41–57

Vives X (2010) Competition and stability in banking

Walter I, Gray HP (1983) Protectionism and international banking: sectorial efficiency, competitive structure and National policy. J Bank Financ 7(4):597–609

Ye Q, Xu Z, Fang D (2012) Market structure, performance, and efficiency of the Chinese banking sector. Econ Change Restruct 45:337–358

Zhang D, Cai J, Dickinson DG, Kutan AM (2016) Non-performing loans, moral hazard and regulation of the Chinese commercial banking system. J Bank Financ 63:48–60

Acknowledgements

This paper was written while Usman Bashir was a research fellow at the School of Management, University of Science and Technology of China (SOM, USTC). He would like to thank USTC for its hospitality and financial support. We thank the Editor, George Hondroyiannis, and the anonymous referee for their comments. We also thank Xiao Wang, Dimitrios Tsomocos, and Shen Rui for their useful suggestions. The views expressed in this paper are those of the authors. Any remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bashir, U., Khan, S., Jones, A. et al. Do banking system transparency and market structure affect financial stability of Chinese banks?. Econ Change Restruct 54, 1–41 (2021). https://doi.org/10.1007/s10644-020-09272-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-020-09272-x