Abstract

Payment-for-ecosystem services programs may use auctions to procure ecosystem services for cost-effective conservation. Conservation practices that generate private benefits (e.g., on-site benefits of erosion prevention) can reduce the effective cost of participation for landowners, and the inclusion of these services in the auction scoring criteria could increase overall cost-effectiveness for the buyer. However, the potential cost-effectiveness gain of including these private-benefit conservation practices may not be fully realized, as increased heterogeneity in the net cost of participation may reduce competition. Our induced-value laboratory experiment explores the impact of heterogeneous private benefits of conservation on auction cost-effectiveness when conservation practice choice is endogenous to offer formation. Heterogeneity in the private benefits of conservation across the landscape generates variation in competition levels across bidders that can lead to increased rent-seeking by bidders with substantial private benefits.

Similar content being viewed by others

Notes

Increased on-site soil retention can lead to increased yields and the reduced use of inputs for farmers (Sullivan et al. 2004).

See Claassen et al. (2014) for a review of conservation practices in agricultural systems and their potential for additionality concerns.

The EBI allows for the following maximum weights to be assigned to each of the above ecosystem-service categories when evaluating an offer: 100, 100, 100, 50, and 45, respectively. The maximum points awarded to the cost component are determined by the offer’s price and how it compares to the maximum payment rate (FSA 2015).

In an experimental setting, Corns and Schotter (1999) find that price-preference rules can be designed to increase both cost-effectiveness and the number of minority-owned contract winners. In the context of California auctions for road construction contracts, which feature a 5% price preference for small firms on projects using only state funds, Marion (2007) finds that small firms bid less aggressively and large firms bid more aggressively in the presence of bid preferences; however, the potential benefits of this strategic behavior are overwhelmed by the impacts of bid preferences on large-firm participation rates. Krasnokutskaya and Seim (2011) also uses data from Caltrans highway auctions to estimate a structural model of bidder participation in bid preference auctions and emphasize the importance of bidder participation in determining the effect of bid preferences on procurement cost.

The within-subject design increases the sample size and minimizes the error variance associated with participant heterogeneity, although it raises the possibility of carryover effects between treatments (Charness et al. 2012). Appendix Tables 10, 11, and 12 display results for our regression analyses using a subset of sessions that provide a counterbalanced treatment order [including the treatments described in Conte and Griffin (2017)] for evidence that our findings are robust to the presence of potential order effects. We utilized random treatment ordering across four treatments in our 12 sessions due to recruitment uncertainty at the outset of the experiment.

The Conservation Reserve Program utilizes a target-constrained auction, in which bids are accepted until the target acreage is achieved, as an enrollment mechanism. Evidence from the lab (e.g., Schilizzi and Latacz-Lohmann 2007b) and the field (Hellerstein 2017) suggests that the cost-effectiveness advantage that the target-constrained auction offers relative to a budget-constrained auction diminishes with repeated bidding. The conditions of our auction (e.g., endogenous quality choice and heterogeneous bidders) are sufficiently different from those under which existing studies have compared these two types of conservation procurement auctions that revisiting these comparisons under more field-representative seller conditions would seem to be a fruitful area of future research.

Messer et al. (2014) suggest that seller rents are sensitive to access to information about the budget level in an experimental discriminatory land procurement auction; however, the treatments considered in that study do not lead to a clear directional conclusion about the optimal information-revelation strategy for our study. So, we chose to utilize the hidden budget information setting applied by Cason et al. (2003) to maintain consistency with related research.

Participants rotated roles so that they each spent an equal number of periods as each unknown type, equalizing earning potential under our constant exchange rate.

Immediately prior to data collection, instructions were read aloud to participants and unpaid practice periods employing the format, but not the parameters, of the Public treatment were conducted to familiarize participants with the auction format and software.

Participants were not given a choice about whether to enter the auction in each period. In practice, producers face a decision about whether or not to participate in conservation procurement auctions, and the literature on bid preferences and procurement auction outcomes has shown that bidder behavior’s impact on auction performance in the presence of bid preferences is substantial on the extensive margin, namely the participation decision, with non-preferred bidders less willing to participate in auctions, further decreasing the competition faced by preferred bidders—those with substantial private benefits from conservation in our context (e.g., Marion 2007). Further work exploring these issues in the context of endogenous auction entry would be a substantial contribution to the literature in the context of conservation procurement auctions.

Babcock et al. (1997) shows that this format produces cost-effective outcomes under various degrees of correlation between cost and quality.

This discriminatory-price design has been shown to perform better than alternative fixed-price payment mechanisms (Cason and Gangadharan 2004; Messer and Allen 2010; Horowitz et al. 2009), although this advantage has been shown to diminish with bidder experience (Schilizzi and Latacz-Lohmann 2007a).

The present experiment was conducted within the same sessions as an experiment studying the impact of access to information about conservation practice quality on auction performance and bidder behavior, as described in Conte and Griffin (2017). See the appendix for the experiment instructions.

The minimum payment was \(\$14\) and the maximum was \(\$69\), with \(\$22.50{-}\$45\) representing the 10th–90th% range of earnings.

Walker (1980) shows that the truth-revealing outcome in an auction will not be realized if the budget constraint is binding.

Each treatment has the same number of auction periods across sessions, and our focal research question does not concern session-level effects. So, standard errors are clustered at the session level as opposed to the use of a multilevel model (Gelman 2006).

We also ran these models using cumulative session experience rather than treatment experience as our experience measure. The results in models 2 and 3 are largely unchanged using this alternative measure of participant experience, with the coefficient on the Private treatment indicator in model 2 estimated as \(-\,0.0195\) (\(p=0.000\)) in the cumulative experience specification (vs. \(-\,0.0201\) in the treatment experience specification). When cumulative, rather than treatment, experience is used, the coefficient on the Private treatment indicator in model 3 is negative and significant at the 5% level (coefficient estimate = \(-\,0.0184\) and \(p=0.036\)). The sum of this coefficient and the coefficient on the interaction term between the Private treatment indicator and cumulative experience is negative (\(-\,0.0185\)) and statistically significant (\(p=0.029\)). The somewhat stronger results using session experience seem supportive of the role of experience in helping bidders realized when they have access to actions with substantial private benefits, which convey advantages in terms of expected profit. This outcome emphasizes the challenge of successful bid formation in these auctions (Banerjee and Conte 2018).

The linear probability model is used as opposed to a conditional logit model, as maximum likelihood estimation of fixed-effects models can lead to inconsistent estimates of structural parameters (Neyman and Scott 1948).

See Table 9 in the appendix for the results of similar models in which the offered price is the dependent variable.

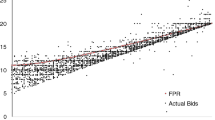

Plots of the mean of the residuals from a regression of POScore on selected practice quality, indicators for minimum cost and maximum quality, treatment experience, and bidder type conditional on selected-practice score similarly reveal a lack of evidence for a differential effect of selected-practice quality near this threshold.

We use a change in net costs versus explicitly breaking out gross costs and private benefits to simplify an already complicated decision process over quality, cost, and price on three conservation practices. Given that we observe significant differences in behavior by cost type, a useful potential addition to this work would explicitly separate out these private benefits from their net effect on cost. We would expect a rational profit maximizing seller to simply calculate the net effect on cost as we have done here, but idiosyncratic behavioral responses to different conservation actions may exist especially as these practices are more contextualized.

In the Private treatment, the Large Private bidders, those with the most private benefit from one of their conservation practices, chose that practice 53% of the time, versus the background 33% rate for those of the Public type.

References

Arnold MA, Duke JM, Messer KD (2013) Adverse selection in reverse auctions for environmental services. Land Econ 89(3):387–412

Babcock BA, Lakshminarayan PG, Wu J, Zilberman D (1996) The economics of a public fund for environmental amenities: a case study of crp contracts. Am J Agric Econ 78(4):961–971

Babcock B, Lakshminarayan P, Wu J, Zilberman D (1997) Targeting tools for the purchase of environmental amenities. Land Econ 73(3):325–339

Bajari P (2001) Comparing competition and collusion: a numerical approach. Econ Theory 18(1):187–205

Bajari P, Ye L (2003) Deciding between competition and collusion. Rev Econ Stat 85(4):971–989

Banerjee S, Conte MN (2018) Information access, conservation practice choice, and rent seeking in conservation procurement auctions: evidence from a laboratory experiment. Am J Agric Econ 100(5):212–230

Banerjee S, Kwasnica AM, Shortle JS (2015) Information and auction performance: a laboratory study of conservation auctions for spatially contiguous land management. Environ Resour Econ 61(3):409–431

Cameron AC, Gelbach JB, Miller DL (2008) Bootstrap-based improvements for inference with clustered errors. Rev Econ Stat 90(3):414–427

Cason TN, Gangadharan L (2004) Auction design for voluntary conservation programs. Am J Agric Econ 86(5):1211–1217

Cason TN, Gangadharan L, Duke C (2003) A laboratory study of auctions for reducing non-point source pollution. J Environ Econ Manag 46(3):446–471

Charness G, Gneezy U, Kuhn MA (2012) Experimental methods: between-subject and within-subject design. J Econ Behav 81(1):1–8

Claassen R, Cattaneo A, Johansson R (2008) Cost-effective design of agri-environmental payment programs: us experience in theory and practice. Ecol Econ 65(4):737–752

Claassen R, Horowitz J, Duquette E, Ueda K (2014) Additionality in U.S. agricultural conservation and regulatory offset programs. Economic Research Service, United States Department of Agriculture. Research Report #170. Retrieved from https://www.ers.usda.gov/webdocs/publications/45244/48525_err170.pdf

Conte MN (2013) Valuing ecosystem services. In: Levin S (ed) Encyclopedia of biodiversity. Princeton University Press, Princeton

Conte MN, Griffin RM (2017) Quality information and procurement auction outcomes: evidence from a payment for ecosystem services laboratory experiment. Am J Agric Econ 99(3):571–591

Corns A, Schotter A (1999) Can affirmative action be cost effective? an experimental examination of price-preference auctions. Am Econ Rev 89(1):291–305

Drum RG, Ribic CA, Koch K, Lonsdorf E, Grant E, Ahlering M et al (2016) Strategic grassland bird conservation throughout the annual cycle: linking policy alternatives, landowner decisions, and biological population outcomes. PLoS ONE 10(11):e0142525

Duke JM, Dundas SJ, Messer KD (2013) Cost-effective conservation planning: lessons from economics. J Environ Manag 125:126–133

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Flambard V, Perrigne I (2006) Asymmetry in procurement auctions: evidence from snow removal contracts. Econ J 116(514):1014–1036

Fréchette G (2012) Session-effects in the laboratory. Exp Econ 15(3):485–498

Fryirs KA, Brierley GJ, Preston NJ, Kasai M (2007) Buffers, barriers and blankets: the (dis) connectivity of catchment-scale sediment cascades. Catena 70:49–67

FSA (2015) Conservation fact sheet: conservation reserve program 49th general enrollment period environmental benefits index. Farm Service Agency, United States Department of Agriculture. Retrieved from https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/archived-fact-sheets/crp_49th_GEP_EBI.pdf

Garcia-Estringana P, Alonso-Blázquez N, Marques MJ, Bienes R, González-Andrés F, Alegre J (2013) Use of mediterranean legume shrubs to control soil erosion and runoff in central spain. A large-plot assessment under natural rainfall conducted during the stages of shrub establishment and subsequent colonisation. Catena 102:3–12

Gelfand I, Zenone T, Poonam J, Chen J, Hamilton SK, Robertson GP (2011) Carbon debt of conservation reserve program (crp) grasslands converted to bioenergy production. Proc Natl Acad Sci 108(33):13864–13869

Gelman A (2006) Multilevel (hierarchical) modeling: what it can and cannot do. Technometrics 48(3):432–435

Heimlich R (1989) Productivity and erodibility of U.S. cropland. In: Agricultural economics report, vol 604

Hellerstein DM (2017) The us conservation reserve program: the evolution of an enrollment mechanism. Land Use Policy 63:601–610

Hellerstein D, Higgins N (2010) The effective use of limited information: Do bid maximums reduce procurement cost in asymmetric auctions? Agric Resour Econ Rev 39(2):288–304

Horan RD, Shortle JS, Abler DG (2004) The coordination and design of point-nonpoint trading programs and agri-environmental policies. Agric Resour Econ Rev 33(1):61–78

Horowitz JK, Lynch L, Stocking A (2009) Competition-based environmental policy: an analysis of farmland preservation in Maryland. Land Econ 85(4):555–575

Johnson KA, Dalzell BJ, Donahue M, Gourevitch J, Johnson DL, Karlovits GS, Keeler B, Smith JT (2016) Conservation reserve program (crp) lands provide ecosystem service benefits that exceed land rental payment costs. Ecosyst Serv 18:175–185

Karakostas A, Zizzo DJ (2016) Compliance and the power of authority. J Econ Behav Organ 124:67–80

Kirwan B, Lubowski RN, Roberts MJ (2005) How cost-effective are land retirement auctions? Estimating the difference between payments and willingness to accept in the conservation reserve program. Am J Agric Econ 87(5):1239–1247

Krasnokutskaya E, Seim K (2011) Bid preference programs and participation in highway procurement auctions. Am Econ Rev 101(6):2653–2686

Latacz-Lohmann U, Van der Hamsvoort CP (1997) Auctioning conservation contracts: a theoretical analysis and application. Am J Agric Econ 79(2):407–418

Lebrun B (1996) Existence of an equilibrium in first price auctions. Econ Theory 7(3):421–443

Lonsdorf E, Ricketts T, Kremen C, Winfree R, Greenleaf S, Williams N (2011) Crop pollination services. In: Kareiva P, Tallis H, Ricketts T, Daily G, Polasky S (eds) Natural capital: theory and practice of mapping ecosystem services. Oxford University Press, Oxford

Marion J (2007) Are bid preferences benign? The effect of small business subsidies in highway procurement auctions. J Pub Econ 91(7):1591–1624

Maskin E, Riley J (2000) Equilibrium in sealed high bid auctions. Rev Econ Stud 67(3):439–454

McAfee RP, McMillan J (1987) Auctions and bidding. J Econ Lit 25(2):699–738

McCarthy DP, Donald PF, Scharlemann JPW, Buchanan GM, Balmford A, Green JMH, Bennun LA, Burgess ND, Fishpool LDC, Garnett ST et al (2012) Financial costs of meeting global biodiversity conservation targets: current spending and unmet needs. Science 338(6109):946–949

Messer KD, Allen W (2010) Applying optimization and the analytic hierarchy process to enhance agricultural preservation strategies in the state of delaware. Agric Resour Econ Rev 39(3):442–456

Messer K, Duke J, Lynch L (2014) Applying experiments to land economics: public information and auction efficiency in ecosystem service markets. In: Duke J, Wu J (eds) Oxford handbook of land economics. Oxford University Press, Oxford

Miranda ML (1992) Landowner incorporation of onsite soil erosion costs: an application to the conservation reserve program. Am J Agric Econ 74(2):434–443

Neyman J, Scott EL (1948) Consistent estimation from partially consistent observations. Econometrica 16(1):1–32

Nordstrom KF, Hotta S (2004) Wind erosion from cropland in the usa: a review of problems, solutions and prospects. Geoderma 121(3–4):157–167

Pattanayak SK, Wunder S, Ferraro PJ (2010) Show me the money: Do payments supply environmental services in developing countries? Rev Environ Econ Policy 4(2):254–274

Rao MN, Yang Z (2010) Groundwater impacts due to conservation reserve program in texas county, oklahoma. Appl Geogr 30(3):317–328

Reddy SMW, Guannel G, Griffin R, Faries J, Boucher T, Thompson M, Brenner J, Bernhardt J, Verutes G, Wood SA et al (2016) Evaluating the role of coastal habitats and sea-level rise in hurricane risk mitigation: an ecological economic assessment method and application to a business decision. Integr Environ Assess Manag 12(2):328–344

Ribaudo MO, Hoag DL, Smith ME, Heimlich R (2001) Environmental indices and the politics of the conservation reserve program. Ecol Ind 1(1):11–20

Schilizzi S, Latacz-Lohmann U (2007a) Quantifying the benefits of conservation auctions. Eurochoices 6(3):32–39

Schilizzi S, Latacz-Lohmann U (2007b) Assessing the performance of conservation auctions: an experimental study. Land Econ 83(4):497–515

Smith RBW (1995) The conservation reserve program as a least-cost land retirement mechanism. Am J Agric Econ 77(1):93–105

Sullivan P, Hellerstein D, Hansen L, Johansson R, Koenig S, Lubowski R, McBride W, McGranahan D, Roberts M, Vogel S, Bucholtz S (2004) The conservation reserve program: Economic implications for rural America. Economic research service, united states department of agriculture. Research report #834. https://doi.org/10.2139/ssrn.614511

USDA (2015) Conservation reserve program 49th general enrollment period environmental benefit index: fact sheet. Farm Service Agency, United States Department of Agriculture. Retrieved from https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/archived-factsheets/crp_49th_GEP_EBI.pdf

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Finance 16(1):8–37

Vukina T, Zheng X, Marra M, Levy A (2008) Do farmers value the environment? Evidence from a conservation reserve program auction. Int J Ind Organ 26(6):1323–1332

Walker M (1980) On the nonexistence of a dominant strategy mechanism for making optimal public decisions. Econometrica 48(6):1521–1540

Woodward RT (2011) Double-dipping in environmental markets. J Environ Econ Manag 61(2):153–169

Wu JJ, Babcock BA (1996) Contract design for the purchase of environmental goods from agriculture. Am J Agric Econ 78(4):935–945

Wunder S, Engel S, Pagiola S (2008) Taking stock: a comparative analysis of payments for environmental services programs in developed and developing countries. Ecol Econ 65(4):834–852

Xu J, Tao R, Xu Z, Bennett MT (2010) China’s sloping land conversion program: Does expansion equal success? Land Econ 86(2):219–244

Zizzo DJ (2010) Experimenter demand effects in economic experiments. Exp Econ 13(1):75–98

Acknowledgements

Funding was provided by Fordham University (Faculty Research Grant).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

1: Appendix

1.1 1.1: Experiment Instructions

2: Instructions

Lottery Period

Welcome to the experiment. This is an experiment in market decision making. If you follow the instructions carefully and make good decisions you will be well-prepared to succeed in today’s experiment. In today’s session you will participate in a lottery and a series of auctions. Your cash earnings today will consist of a $10 show-up payment, and payments based on your performance in the lottery and auctions.

We will first start with the lottery experiment. We will read through the instructions for the lottery together, and then proceed to the software interface.

In this part of today’s session you are asked to make a choice in 11 different paired lotteries. Each lottery has different possible combinations of payoffs. Your task will be to consider each lottery and select A or B using the scroll bar to indicate a preference for taking part in sub-lottery A or sub-lottery B. Consider the payoffs associated with selecting A or B for each of the 10 choices and pick accordingly, as your selection will affect your payoff for completing this task.

After you are finished selecting A or B for the 11 choices, please press “click here to continue.” At the end of the experiment when you come to collect your earnings, one of the lotteries will be selected at random to determine your payoff. These payoffs are in $, not experimental dollars like the rest of today’s session.

To determine your payoff, when you come to collect your earnings for the experiment at the conclusion of the session, you will:

-

1.

Select a card from shuffled cards numbered 1–11 to select the lottery that you will receive your payoff from

-

2.

Select another card from shuffled cards numbered 1–10 to determine which of the two payoffs you receive from the chosen sub-lottery.

The payoff from the lottery will be added to your show-up payment and your earnings from the rest of the experiment.

Auction Instructions

We will now proceed into the next phase of today’s session, where you will make decisions in an auction environment. During this part of the experiment, you will earn money in experimental dollars. At the end of the experiment, these will be converted to real dollars at a rate of 120 experimental dollars per $1 and you will be paid as you leave. This is in addition to the $10 show-up payment and your lottery earnings.

How You Make Money

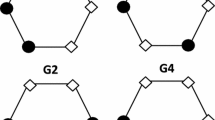

In today’s experiment, you will participate in a series of auctions. In each auction period, you will have three types of items to sell: Red, Green, and Blue items. Each item has a cost and quality, which will vary from period to period and across participants. Your values in one period are in no way linked to values in other periods. Your cost and quality values are also not linked. As we move through the instructions, you can refer to the supplemental handout for an example screenshot of the auction software interface.

In each auction period, you must choose one item that you would like to sell and the price (your “offer”) that you would like to sell the item at. Your choice of item and your offer are collected via the software interface and are not known to other participants. Do not use a dollar sign when entering your offer through the software interface.

The experimenter (who is the buyer) has a limited budget and likely cannot purchase all items offered by all participants in each auction period. You can sell only one item per period, and if you sell that item, then you must pay that item’s cost. If you are able to successfully sell an item in a given period, your earnings in that auction period are equal to the value of your offer minus the cost of the item sold.

Consider the following illustrative example: if your offer of 220 for your Red item is accepted in a given period, and it has a cost of 200, your earnings that period would be 220 200 = 20. These period earnings are recorded and added to your “session earnings” before you move on to the next auction period. If you do not sell an item in a period, your earnings are zero for that period; you only pay an item’s cost if you are able to sell that item.

Quality

The experimenter, who is the buyer, values higher quality items and uses a scoring rule to help ensure the budget is spent on high quality items. The probability your offer will be accepted is based on both the offer and the quality of the item, in addition to the quality and offers of other auction participants. To rank offers for acceptance, the experimenter turns your offer and quality information into a score using the following rule:

Consider the following illustrative example in the box below. If your offer is 50 and the quality of the item is 10, then your score is 10/50 = 0.2. Others’ items are scored similarly and then they are ranked by their score. Offers are accepted at their offer value until the budget is exhausted.

In the below example table, you will see that offers are ranked not on quality or offer, but instead on their score. Items are accepted in order starting from the highest score to the lowest score, until the budget of 100 experimental dollars is exhausted. In the experiment you will not know the budget level or anything about the quality, offers, scores, and acceptance decisions of other participants.

Example

Participant ID | Score | Quality | Offer | Accepted | Remaining budget (100 to start) |

|---|---|---|---|---|---|

1 | 0.49 | 27 | 55 | Y | 45 |

2 | 0.43 | 9 | 21 | Y | 24 |

3 | 0.29 | 20 | 70 | N | − 54 |

4 | 0.21 | 8 | 38 | N | − 92 |

A key thing to understand is that the numbers used in the example are for illustration only and the values and your offer choice may be completely different in the actual experiment.

In this example, Red has the highest quality of your three items, so it is ranked first. Blue is second highest, so it gets a rank of two. Green is the lowest quality, so it is ranked third. Again, these numbers are for example only and the values in the experiment may be different.

Changes from the Basic Setup

You are now familiar with the basic design of an auction period. During the course of the experiment, some of the information on your screen may change.

The change relates to your knowledge of the quality of each of your items. In every auction period, each of your items has a quality assigned to it; however, in some periods the quality value may not be displayed even though it is known to the experimenter. In these periods, the experimenter still assigns a score based on your offer and quality and uses the score to rank bids. However, you will have to make your item choice and offer without this information.

In other periods, each items quality will be displayed as a rank. As before, the exact number is known to the experimenter and scoring is based on the exact number. However, you will only see the quality rank of the three items.

Summary

A period has the following order

-

1.

Period begins

-

2.

You select an item to sell and enter an offer price to sell that item for

-

3.

All offers are submitted and ranked according to the scoring rule

-

4.

Offers are accepted according to their ranked score until the budget is exhausted

-

5.

You are notified if your offer was accepted and your earnings are calculated automatically and added to your session total

-

6.

Period ends

Questions

How well you understand these rules and procedures are an important determinant of how much you earn in today’s session. Think back over the instructions, and if you have any questions, please raise your hand now. We will conduct a practice auction next to give you an opportunity to familiarize yourself with the auction interface. None of the earnings in the practice auction will influence your cash payment today. Once the auctions begin, no talking among participants will be permitted.

1.1 2.1: Additional Analysis

See Table 9.

1.2 2.2: Order effects

Rights and permissions

About this article

Cite this article

Conte, M.N., Griffin, R. Private Benefits of Conservation and Procurement Auction Performance. Environ Resource Econ 73, 759–790 (2019). https://doi.org/10.1007/s10640-019-00333-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-019-00333-y