Abstract

This paper considers the assignment of tradable permits—representing property rights of an environmental good—to community members who are harmed by pollution generated by firms. These community members can in turn sell permits to polluters according to their personal preferences. For a special case with a sole household, market transactions between the household and polluters achieve an efficient pollution level. However, for a group of households, the decentralized market solution fails to yield social efficiency because of competitive consumption of the environmental goods. We design a revenue-sharing mechanism akin to unitization, under which market transactions also achieve efficient resource allocation. Importantly, in some cases, efficiency can be achieved even when regulators are ignorant of the private valuation of the environmental good.

Similar content being viewed by others

Notes

While a vast literature has arisen to consider mechanisms such as a Pigovian tax, grandfathering permits, permit auctions, abatement subsidies, etc., simply assigning property rights in the form of tradable permits to the victims has been considered less frequently. This is surprising in some sense, as the absence of a market generated by the lack of property rights is the key source of inefficiency (Baumol and Oates 1988). On the other hand, as discussed in more detail below, this may simply reflect the fact that distributing permits to multiple victims of pollution raises obvious free-rider issues, as discussed by Proost (1995). For examples of literature considering the myriad of environmental policy instruments, see Montgomery (1972), Hahn and Hester (1989), Goulder (2013), Fisher-Vanden and Olmstead (2013), Schmalensee and Stavins (2013), Newell et al. (2013) , Baumol (1972), Buchanan and Tullock (1975), Polinsky (1979), Tietenberg (1990), and Hahn (2000).

As Coase (1960) notes, economic efficiency is independent of the assignment of property rights if there are no transaction costs.

Some may argue that the free rider problem can be solved through thorough negotiation among the parties and thus is a transaction cost problem. For the purpose of this paper, it is assumed that these transaction costs exist and the free rider problem is not negotiated away.

This inefficiency arising from the free rider problem is also seen in the failure of Lindahl pricing if individuals underreport their preferences for public goods. The Groves-Ledyard mechanism provides a possible solution by formulating an ingenious allocation-taxation scheme, which requires the assumption of Nash behavior by all households (Groves and Ledyard 1977). This poses significant difficulties for practical implementation of the mechanism because of the information required by households.

Other related papers on household participation in permit markets include Smith and Yates (2003a, b), and English and Yates (2007), who note the problem of free-riding and consider the optimal policy response to it, Shrestha (1998) and Malueg and Yates (2006) who essentially take the existence of environmental groups as a given and ignore the underlying collective action problem, and Boyd and Conley (1997) and Conley and Smith (2005) who consider personalized prices.

Note that this is in sharp contrast to “traditional” tradeable permit systems, where the determination of the quantity of permits to be allocated (the “cap”) is a key component of optimal policy design. Note also that this result regarding tradable permits in fisheries is analogous to the point made by Shrestha (1998), Ahlheim and Schneider (2002), Rousse (2008), and others that household participation in emissions trading can lead to an efficient, endogenous emissions cap.

This mechanism is similar to unitization, which has been used to resolve the externalities in common pool resources, for example, an oil or gas field shared by multiple landowners (Libecap and Wiggins 1984). For renewable common pool resources, Kaffine and Costello (2011) develop a comprehensive theory for internalizing externalities across spatial owners in a fishery example. They generalize the notion of unitization and find that a profit-sharing mechanism can yield first-best outcomes, even when the self-interested agents voluntarily participate in the unitization scheme. This paper extends the concept of unitization to environmental protection issues. While Kaffine and Costello (2011) find that full unitization with an arbitrary return-share from the profit pool is both necessary and sufficient for an efficient outcome, we find that such a design is neither necessary nor sufficient for an efficient household tradable permit system.

Due to the lack of markets, methods such as contingent valuation and travel cost analysis have been developed to determine how people value environmental goods. However, the costs of obtaining this information may be prohibitively high due to the costly nature of employing these methods, and as such regulators may lack the information required for efficient regulation.

The relationship between the environmental good e and pollution z is defined below.

While these simplifications may seem extreme, they serve the purpose of focusing on the tradeoff faced by the household in terms of selling or retaining pollution permits z. A number of extensions of this basic setup are certainly possible, however the underlying insight of the model developed below is likely to continue to hold.

Indeed, the optimal pollution level could also be achieved if permits are issued to polluters. In that case, the household would buy some amount of permits from the polluters to achieve social efficiency. While the distribution of benefits may differ, in the absence of transaction costs, efficiency will be achieved.

The total amount of pollution suffered by all households in the absence is again \(\bar{z}\), as \({\textstyle }\sum _{i=1}^{N}k_{i}\bar{z}=\bar{z}\).

This idea is similar to the fishery with spatial connectivity example in Kaffine and Costello (2011), where patch owner i has fish dispersal to other patches while also receiving dispersal from other patches.

Again, in a special situation where all the permits are sold out, we would have \(z=\bar{z}\). In this case all the environmental good e would be destroyed, \(e=\sum _{i=1}^{N}e_{i}=0\).

Note that from the first order conditions, \(U_{x_i} = U_{x_j} \forall i,j\).

As Arnason (2009) notes “...it doesn’t matter for the eventual harvesting outcome to which party the initial allocation of quota shares, or more generally fishing rights, is made,” and that “...it doesn’t matter what TAC [the cap] the authorities set (as long as it exceeds the efficient one).”

Note that this does not imply that allocating the permits in such a fashion has no impact on welfare. Each household has some incentive to withhold permits according to the damage they personally receive; however, this incentive to withhold permits is too small relative to the efficient case. Of course, this private incentive is diminishing as N increases and \(k_i\) falls.

The fact that revenue-sharing in a tradable permit system amongst households can achieve efficiency shares some similarities with the literature on free-riding and International Environmental Agreements (Barrett 1994). For example, Barrett (2001) shows that side payments can, in some circumstances, overcome the free rider problem to increase participation in cooperative agreements.

In brief, full unitization in Kaffine and Costello (2011) leads each fisherman to maximize total fishery profits, equivalent to the objective of the sole owner, regardless if they receive a 1 or 10 % share of the total profits. Here, the efficient unitization scheme plays a more nuanced role, as it balances the marginal benefits that a household receives from selling a permit (via \(\gamma _i)\) against the marginal cost they incur (via \(k_i)\) from the sale of that permit.

Households with a relatively high (low) valuation for the environmental good will receive a larger (smaller) modifier. This is most clear when \(k_i=1/N\), in which case the modifier is simply the ratio of the household’s marginal utility divided by the average marginal utility, and the average modifier is simply equal to 1.

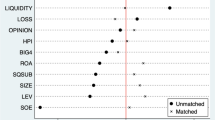

While the previous sections have analytically determined what the efficient share rule \(\gamma _i\) should be, here we are more concerned with how the “simple” rule of \(\gamma _i=k_i\) performs under a variety of scenarios. Because this rule requires no knowledge of individual preferences, we consider it the most relevant case to analyze.

We also considered the case of homogeneous damages, simply \(k_i=1/N\), as well as various permutations of k. Results were extremely similar to those presented below (both qualitatively and quantitatively) and we thus do not report them.

Of course, increasing the number of agents N harmed will decrease the welfare gain from simply allocating permits without revenue-sharing.

A larger elasticity of substitution increases the non-linearity of the household permit supply function with respect to the share rule \(\gamma _i\), such that the sales from the households who sell too many permits relative to the efficient level are offset less by the households who sell too few.

Even in the extreme case where \(\beta =\{0.9,0.7,0.5,0.3,0.1\}\) and \(\sigma =2\), total utility was 0.919 relative to the efficient solution.

With the caveat that the degree of “near-efficiency” will be eroded in the case of substantial heterogeneity of preferences.

Nor does efficiency require impure altruism, as in Ahlheim and Schneider (2002).

References

Ahlheim M, Schneider F (2002) Allowing for household preferences in emission trading-a contribution to the climate policy debate. Environ Resour Econ 21(4):317–342

Arnason R (2009) Conflicting uses of marine resources: can ITQs promote an efficient solution? Aust J Agric Resour Econ 53:145–174

Barrett S (1994) Self-enforcing international environmental agreements. Oxford Economic Papers, Oxford, pp 878–894

Barrett S (2001) International cooperation for sale. Eur Econo Rev 45(10):1835–1850

Baumol WJ (1972) On taxation and the control of externalities. Am Econ Rev 62(3):307–322

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, New York

Boyd JH, Conley JP (1997) Fundamental nonconvexities in arrovian markets and a coasian solution to the problem of externalities. J Econ Theory 72(2):388–407

Buchanan JM, Tullock G (1975) Polluters’ profits and political response: direct controls versus taxes. Am Econ Rev 65(1):139–147

Coase RH (1960) The problem of social cost. J Law Econ 3:1–44

Conley JP, Smith SC (2005) Coasian equilibrium. J Math Econ 41(6):687–704

English D, Yates A (2007) Citizens’ demand for permits and kwerel’s incentive compatible mechanism for pollution control. Econ Bull 17(4):1–9

Fisher-Vanden K, Olmstead S (2013) Moving pollution trading from air to water: potential, problems, and prognosis. J Econ Perspect 27(1):147–172

Goulder LH (2013) Markets for pollution allowances: what are the (new) lessons? J Econ Perspect 27(1):87–102

Groves T, Ledyard J (1977) Optimal allocation of public goods: a solution to the “free rider” problem. Econometrica 45(4):783–809

Hahn RW (2000) The impact of economics on environmental policy. J Environ Econ Manag 39:375–399

Hahn RW, Hester G (1989) Where did all the markets go? An analysis of EPA’s emissions trading program. Yale J Regul 6(1):109–153

Kaffine D, Costello C (2011) Unitization of spatially connected renewable resources. B E J Econ Anal Policy 11(1). doi:10.2202/1935-1682.2714

Libecap GD, Wiggins SN (1984) Contractual responses to the common pool: prorationing of crude oil production. Am Econ Rev 74(1):87–97

Malueg DA, Yates AJ (2006) Citizen participation in pollution permit markets. J Environ Econ Manag 51(2):205–217

Montgomery W (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5(3):395–418

Newell RG, Pizer WA, Raimi D (2013) Carbon markets 15 years after Kyoto: lessons learned, new challenges. J Econ Perspect 27(1):123–146

Polinsky AM (1979) Notes on the symmetry of taxes and subsidies in pollution control. Can J Econ 12(1):75–83

Proost S (1995) Public policies and externalities. In: Folmer H, Gabel HL, Opschoor H (eds) Principles of environmental and resource economics: a guide for students and decision-makers. Edward Elgar Publishing Ltd, Cheltenham, pp 47–66

Rousse O (2008) Environmental and economic benefits resulting from citizens’ participation in \(\text{ CO }_2\) emissions trading: an efficient alternative solution to the voluntary compensation of CO\(_2\) emissions. Energy Policy 36(1):388–397

Schmalensee R, Stavins RN (2013) The \(\text{ SO }_2\) allowance trading system: the ironic history of a grand policy experiment. J Econ Perspect 27(1):103–122

Shrestha RK (1998) Uncertainty and the choice of policy instruments: a note on Baumol and Oates propositions. Environ Resour Econ 12(4):497–505

Smith SC, Yates AJ (2003a) Optimal pollution permit endowments in markets with endogenous emissions. J Environ Econ Manag 46(3):425–445

Smith SC, Yates AJ (2003b) Should consumers be priced out of pollution-permit markets? J Econ Educ 34(2):181–189

Tietenberg T (1990) Economic instruments for environmental regulation. Oxford Review of Economic Policy 6(1)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, P., Kaffine, D.T. Community-Based Tradable Permits for Localized Pollution. Environ Resource Econ 65, 773–788 (2016). https://doi.org/10.1007/s10640-015-9925-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9925-x