Abstract

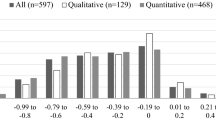

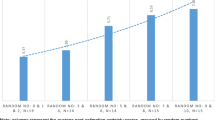

Correction for hypothetical bias using follow up certainty questions often takes one of two forms: (1) two options, “definitely sure” and “probably sure”, or (2) a 10-point scale with 10 very certain. While both have been successful in eliminating hypothetical bias from estimates of WTP by calibrating based on the certainty of yes responses, little is known about the relationship between the two. The purpose of this paper is to compare the two using data from three field experiments in a private good, dichotomous choice format. We compare four types of yes responses that differ in the criterion used to determine if there is sufficient certainty for a hypothetical yes response to be considered a true yes response. We make several comparisons, but focus on determining which values on the 10-point scale give the same estimates of WTP as “definitely sure” hypothetical yeses and real yeses (actual purchases). Values that produce equivalence are near 10 on the certainty scale.

Similar content being viewed by others

References

Arrow K, Solow R, Leamer E, Portney P, Radner R, Schuman H (1993) Report of the NOAA panel on contingent valuation. Fed Regist 58: 4602–4614

Berrens RP, Jenkins-Smith H, Bohara AK, Silva CL (2002) Further investigation of voluntary contribution contingent valuation: fair share, time of contribution, and respondent uncertainty. J Environ Econ Manag 44(1): 144–168

Blumenschein K, Johannesson M (2001) Patient willingness to pay for lipid management services provided by pharmacists: an application of the contingent valuation method. University of Kentucky, College of Pharmacy, Unpublished Report

Blumenschein K, Johannesson M, Blomquist GC, Liljas B, O’Conor RM (1998) Experimental results on expressed certainty and hypothetical bias in contingent valuation. South Econ J 65(1): 169–177

Blumenschein K, Johannesson M, Yokoyama KK, Freeman PR (2001) Hypothetical versus real willingness to pay in the health care sector: results from a field experiment. J Health Econ 20(3): 441–457

Blumenschein K, Blomquist GC, Johannesson M, Horn N, Freeman P (2008) Eliciting willingness to pay without bias: evidence from a field experiment. Econ J 118(525): 114–137

Carson RT, Groves T (2007) Incentive and informational properties of preference questions. Environ Resour Econ 37(1): 181–210

Champ PA, Bishop RC (2001) Donation payment mechanisms and contingent valuation: an empirical study of hypothetical bias. Environ Resour Econ 19(4): 383–402

Champ PA, Bishop RC, Brown TC, McCollum DW (1997) Using donation mechanisms to value nonuse benefits from public goods. J Environ Econ Manag 33(2): 151–162

Cummings RG, Taylor LO (1999) Unbiased value estimates for environmental goods: a cheap talk design for the contingent valuation method. Am Econ Rev 89(3): 649–665

Dubourg WR, Jones-Lee MW, Loomes G (1994) Imprecise preferences and the WTP-WTA disparity. J Risk Uncertain 9: 115–133

Evans MF, Flores NE, Boyle KJ (2003) Multiple-bounded uncertainty choice data as probabilistic intentions. Land Econ 79: 549–560

Farmer MC, Lipscomb CA (2008) Conservative dichotomous choice responses in the active policy setting: DC rejections below WTP. Environ Resour Econ 39: 223–246

Flachaire E, Hollard G (2007) Starting point bias and respondent uncertainty in dichotomous choice contingent valuation surveys. Resour Energy Econ 29(3): 183–194

Håkansson C (2008) A new valuation question: analysis and insights from interval open-ended data in contingent valuation. Environ Resour Econ 39: 175–188

Harrison GW (2006) Experimental evidence on alternative environmental valuation methods. Environ Resour Econ 34(1): 125–162

Harrison GW, Rutström E (2008) Experimental evidence on the existence of hypothetical bias in value elicitation methods. In: Plott C, Smith VL(eds) Handbook of experimental economics results.. Elsevier Science, New York

Johannesson M, Johansson P-O, Kriström B, Gerdtham U-G (1993) Willingness to pay for antihypertensive therapy: further results. J Health Econ 12(1): 95–108

Johannesson M, Blomquist GC, Blumenschein K, Johansson P-O, Liljas B, O’Conor RM (1999) Calibrating hypothetical willingness to pay responses. J Risk Uncertain 18(1): 21–32

Johansson P-O (1995) Evaluating health risks: an economic approach. Cambridge University Press, Cambridge

Kriström B (1990) A non-parametric approach to the estimation of welfare measures in discrete response valuation studies. Land Econ 66(2): 135–139

Li C-Z, Mattsson L (1995) Discrete choice under preference uncertainty: an improved structural model for contingent valuation. J Environ Econ Manag 28: 256–269

List JA, Gallet CA (2001) What experimental protocol influence disparities between actual and hypothetical stated values. Environ Resour Econ 20(3): 241–254

Little J, Berrens R (2004) Explaining disparities between actual and hypothetical stated values: further investigation using meta-analysis. Econ Bull 3(6): 1–13

Loomis J, Ekstrand E (1998) Alternative approaches for incorporating respondent uncertainty when estimating willingness to pay: the case of the Mexican spotted owl. Ecol Econ 27(1): 29–41

Loomis J, Brown T, Lucero B, Peterson G (1996) Improving validity of experiments of contingent valuation methods: results of efforts to reduce the disparity of hypothetical and actual willingness to pay. Land Econ 72(4): 450–461

Murphy JJ, Allen PG, Stevens TH, Weatherhead D (2005) Meta-analysis of hypothetical bias in stated preference valuation. Environ Resour Econ 30(3): 313–325

Poe GL, Clark JE, Rondeau D, Schulze WD (2002) Provision point mechanisms and field validity tests of contingent valuation. Environ Resour Econ 23(1): 105–131

Ready RC, Whitehead JC, Blomquist GC (1995) Contingent valuation when respondents are ambivalent. J~Environ Econ Manag 29(2): 181–196

Ready RC, Navrud S, Dubourg WR (2001) How do respondents with uncertain willingness to pay answer contingent valuation questions. Land Econ 77(3): 315–326

Svensson E (2000) Comparison of the quality of assessments using continuous and discrete ordinal rating scales. Biometr J 42(4): 417–434

Vossler CA, Ethier RG, Poe GL, Welsh MP (2003) Payment certainty in discrete choice contingent valuation responses: results from a field validity test. South Econ J 69(4): 886–902

Vossler CA, McKee M, McKee M (2006) Induced-value tests of contingent valuation elicitation mechanisms. Environ Resour Econ 35: 137–168

Wang H (1997) Treatment of don’t-know responses in contingent valuation surveys: a random valuation model. J Environ Econ Manag 32(2): 219–232

Watson V, Ryan M (2007) Exploring preference anomalies in double-bounded contingent valuation. J Health Econ 26(3): 463–482

Whitehead JC, Cherry T (2007) Willingness to pay for a green energy program: a comparison of ex-ante and ex-post hypothetical bias mitigation approaches. Resour Energy Econ 29(4): 247–326

Author information

Authors and Affiliations

Corresponding author

Additional information

Prepared for the 6th iHEA World Congress held July 8–11, 2007 in Copenhagen, Denmark and the Conference “Validating Values of Safety and Travel Time” held August 16–17, 2007 at Örebro University in Örebro, Sweden. For comments we thank conference participants, participants in a seminar at the Baltic International Centre for Policy Studies in Riga, Latvia, as well as John Horowitz, John Whitehead, and two anonymous referees. Work on this paper was done while Glenn Blomquist was a Visiting Fulbright Scholar at the Stockholm School of Economics in Riga. He gratefully acknowledges this support. Brandon Koford provided exemplary research assistance.

Rights and permissions

About this article

Cite this article

Blomquist, G.C., Blumenschein, K. & Johannesson, M. Eliciting Willingness to Pay without Bias using Follow-up Certainty Statements: Comparisons between Probably/Definitely and a 10-point Certainty Scale. Environ Resource Econ 43, 473–502 (2009). https://doi.org/10.1007/s10640-008-9242-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-008-9242-8