Abstract

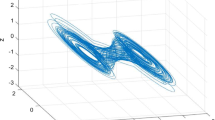

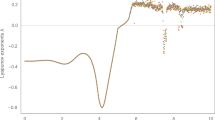

The article proposes a new nonlinear optimal control method for the stabilization of the business cycles of interconnected finance agents. First, the dynamics of the interacting finance agents and of the associated business cycles is described by a model of coupled nonlinear oscillators. Next, this dynamic model undergoes approximate linearization round a temporary operating point which is defined by the present value of the system’s state vector and the last value of the control inputs vector that was exerted on it. The linearization procedure is based on Taylor series expansion of the dynamic model and on the computation of Jacobian matrices. Next, for the linearized model of the interacting finance agents, an H-infinity feedback controller is designed. The computation of the feedback control gain requires the solution of an algebraic Riccati equation at each iteration of the control algorithm. Through Lyapunov stability analysis it is proven that the control scheme is globally asymptotically stable.

Similar content being viewed by others

References

Anderson, H., & Ramsey, J. (2002). U.S. and Canadian industrial production indices as coupled oscillators. Journal of Economic Dynamics and Control, 26, 33–67.

Andrievsky, B., Dymkin, E., & Fradkov, A. (1997) Adaptive control of nonlinear business cycle models. In Proceedings of IC&C’97, International Conference on Informatics and Control, St. Petersburg, Russia.

Ashada, T., & Yoshida, H. (2003). Coefficient criterion for four-dimensional Hopf bifurcations: A complete mathematical characterisation and applications to economic dynamics. Chaos, Solitons and Fractals, 18, 525–536.

Barnett, W., & He, Y. (1999). Stability analysis of continuous-time macroeconometric systems. Studies in nonlinear dynamics and econometrics (Vol. 3, pp. 169–188). Berlin: De Gruyter.

Basseville, M., & Nikiforov, I. (1993). Detection of abrupt changes: Theory and applications. Upper Saddle River: Prentice-Hall.

Bashkirtsev, I., Ryashka, L., & Ryazanova, T. (2018). Stochastic sensirivity analysis of the variability of dynamics and transition to chaos in the business cycle model. Communications in Nonlinear Science and Numerical Simulation, 54, 174–184.

Chian, A. C. (2000). Nonlinear dynamics and chaos in macroeconomics. International Journal of Theoretical Applied Finance, 3, 601–613.

Doyle, J. C., Glover, K., Khargonekar, P. P., & Francis, B. A. (1989). State-space solutions to standard \(H_2\) and \(H_{\infty }\) control problems. IEEE Transactions on Automatic Control, 34, 831–847.

Esashi, K., Onazaki, T., & Saiki, Y. (2014). Chaotic itinerrancy on regional business cycle synchronization, discussion paper no 237. Institute of Economic Research, Chuo University, Tokyo, Japan.

Fanti, L., & Manfredi, P. (2007). Chaotic business cylces and fiscal policy: An IS-LM model with distributed tax collection lags. Chaos Solitons Fractals, 32, 736–744.

Filler, L., & Selover, D. (2014). Why can weak linkages cause international stock-market synchronization? The mode-locking effect. International Journal of Financial Research, 5(3), 20–42.

Gibbs, B. P. (2011). Advanced Kalman filtering, least squares and modelling: A practical handbook. Hoboken: Wiley.

Guegan, D. (2009). Chaos in economics and finance. Annual Reviews in Control, 33(1), 89–93.

Haas, L. (1998). Stabilizing chaos in a dynamic macroeconomic model. Journal of Economic Behavior and Organization, 33(3–4), 313–332.

Ikeda, Y., Aoyama, H., Fujiwara, F., Iyetomi, H., Ogimoto, K., Souma, W., et al. (2012). Coupled oscillator model of the business cycle with fluctuating goods markets. Progress of Theoretical Physics Supplement, 194, 111–121.

Januario, C., Garcia, C., & Duarte, J. (2009). Measuring complexity in a business cycle model of the Kaldor type. Chaos, Solitons and Fractals, 42, 2890–2907.

Kruwiec, A., & Szydlowski, M. (1999). The Kaldor–Kalecki business cycle model. Annals of Operational Research, 89, 89–100.

Liu, X., Cai, W., Lu, J., & Wang, Y. (2015). Stability and Hopf bifurcations for a business model with with expectation and delay. Communications in Nonlinear Science and Numerical Simulation, 25, 144–161.

Lorenz, H. W. (1993). Nonlinear dynamical economics and chaotic motion. Berlin: Spring-Verlag.

Lublin, L., & Athans, M. (1995). An experimental comparison of and designs for interferometer testbed. In B. Francis & A. Tannenbaum (Eds.), Lectures notes in control and information sciences: Feedback control, nonlinear systems and complexity (pp. 150–172). New York: Springer.

Ma, J., & Gao, G. (2009). Stability and Hopf bifurcations in a business cycle model with delay. Applied Mathematica and Computation, 215, 829–834.

Rigatos, G. G. (2011). Modelling and control for intelligent industrial systems: Adaptive algorithms in robotcs and industrial engineering. New York: Springer.

Rigatos, G. (2015). Nonlinear control and filtering using differential flatness approaches: Applications to electromechanicsl systems. New York: Springer.

Rigatos, G. (2017a). Intelligent renewable energy systems: Modelling and control. New York: Springer.

Rigatos, G. (2017b). State-space approaches for modelling and control in financial engineering, systems theory and machine learning methods. New York: Springer.

Rigatos, G., & Siano, P. (2015). A new nonlinear H-infinity feedback control approach to the problem of autonomous robot navigation. Journal of Intelligent Industrial Systems, 1(3), 179–186.

Rigatos, G., Siano, P., Wira, P., & Profumo, F. (2015). Nonlinear H-infinity feedback control for asynchronous motors of electric trains. Journal of Intelligent Industrial Systems, 1(3), 85–98.

Rigatos, G. G., & Tzafestas, S. G. (2007). Extended Kalman filtering for fuzzy modelling and multi-sensor fusion. Mathematical and Computer Modelling of Dynamical Systems, 13, 251–266.

Rigatos, G., & Zhang, Q. (2009). Fuzzy model validation using the local statistical approach. Fuzzy Sets and Systems, 60(7), 882–904.

Selover, D., & Jensen, V. (1990). Mode-locking and international business cycle transmission. Journal of Economic Dynamics and Control, Elsevier, 23, 591–619.

Selover, D., Jensen, R., & Kroll, J. (2005). Mode-locking and regional business cycle synchronization. Journal of Regional Science, 45(4), 703–745.

Simon, D. (2006). A game theory approach to constrained minimax state estimation. IEEE Transactions on Signal Processing, 54(2), 405–412.

Szydlowski, M., Krawiec, A., & Tabola, J. (2001). Nonlinear oscillators in business cycle model with time lag. Chaos, Solitons and Fractals, 12, 505–517.

Szydlowski, M., Kruwiec, A., & Tobola, J. (2001). Nonlinear oscillations in business cycle model with time lags. Chaos, Solitons and Fractals, 12, 505–517.

Toussaint, G. J., Basar, T., & Bullo, F. (2000). \(H_{\infty }\) optimal tracking control techniques for nonlinear underactuated systems. In Proceedings of IEEE CDC 2000, 39th IEEE Conference on Decision and Control, Sydney, Australia.

Yuichi, I., Hidecki, A., & Hiroshi, Y. (2013). Synchronization of the coupled oscillator model in international business cycles, The Research Institute of Economy, Trade and Industry, RIETI discussion paper series 13-E-089.

Zamballi, S. (2011). Flexible accelerator economic systems as coupled oscillators. Journal of Economic Surveys, 25(3), 608–633.

Zhao, M., & Wang, J. (2014). H-infinity control of a chaotic finance system in the presence of external disturbance and input time-delay. Applied Mathematics and Computation, 233, 320–327.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rigatos, G., Siano, P. & Ghosh, T. A Nonlinear Optimal Control Approach to Stabilization of Business Cycles of Finance Agents. Comput Econ 53, 1111–1131 (2019). https://doi.org/10.1007/s10614-017-9785-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9785-2