Abstract

In this paper we extend the test of periodic integration proposed by Boswijk and Franses (J Time Ser Anal 17:221–245, 1996) allowing for a change in the mean. We provide the asymptotic distribution and show that is the square of the distribution obtained by Perron and Vogelsang (J Bus Econ Stat 10:467–470, 1992a, J Bus Econ Stat 10:301–320, 1992b). In a Monte-Carlo experiment we show a good behaviour of the test in terms of size and power. Finally we have illustrated the use of the test in an empirical application to the case of external imbalances in the eurozone.

Similar content being viewed by others

Notes

Olekalns (1994) extends this result to cases in which dummies or band-pass filters are used to remove seasonality.

These countries are: Australia, Canada, Denmark, Sweden, the UK, Norway, Switzerland, Japan, France, Italy, the Netherlands, Finland and Spain.

For simplicity of exposition, we assume that data are available for precisely N years, so that the total sample size is \(T=4N\). Note that, throughout the paper, it is understood that \(y_{s - k,\tau }\) = \( y_{4-s+k,\tau -1}\) for \(s-k\le 0\).

Some of the other empirical studies that have investigated the existence of long-run co-movement of exports and imports for developed and developing countries include, Arize (2002), Irandoust and Sjoo (2000), Irandoust and Ericsson (2004), Narayan and Narayan (2005), Herzer and Nowak-Lehmann (2006), Hamori (2009), Greenidge et al. (2012) or Nag and Mukherjee (2012). For a large group of countries there is cointegration between exports and imports, as in Hamori (2009) and Narayan and Narayan (2005), Holmes et al. (2011), although the vector found is not frequently \((1,-1)\).

We follow a similar approach to del Barrio Castro et al. (2015) but allowing for a changing mean in the evolution of the exp/gdp and imp/gdp time series.

We leave for future research the extension of the Gregory and Hansen (1996) approach to the case of periodic cointegration.

References

Alterman, W. F., Diewert, W. E., & Feenstra, R. C. (1999). International trade price indexes and seasonal commodities. Washington: Bureau of Labor Statistics.

Arize, A. C. (2002). Imports and exports in 50 countries. Tests of cointegration and structural breaks. International Review of Economics and Finance, 11, 101–115.

Berenguer-Rico, V., & Carrion-i-Silvestre, J. Ll. (2011). Regime shifts in stock-flow I(2)–I(1) systems: The case of US fiscal sustainability. Journal of Applied Econometrics, 26, 298–321.

Boswijk, H. P., & Franses, P. H. (1995). Testing for periodic integration. Economics Letters, 48, 241–248.

Boswijk, H. P., & Franses, P. H. (1996). Unit roots in periodic autoregressions. Journal of Time Series Analysis, 17, 221–245.

Choi, I. (2015). Almost all about unit roots. Cambridge: Cambridge University Press.

del Barrio Castro, T., Camarero, M., & Tamarit, C. (2015). An analysis of the trade balance for OECD countries using periodic integration and cointegration. Empirical Economics, 49, 389–402.

del Barrio, Castro T., & Osborn, D. R. (2008). Cointegration for periodically integrated processes. Econometric Theory, 24, 109–142.

del Barrio, Castro T., & Osborn, D. R. (2011). Nonparametric tests for periodic integration. Journal of Time Series Econometrics, 3, 1–35.

Franses, P. H. (1994). A multivariate approach to modeling univariate seasonal time series. Journal of Econometrics, 63, 133–151.

Franses, P. H., & Paap, R. (2004). Periodic time series models. Oxford: Oxford University Press.

Franses, P. H., & Vogelsang, T. J. (1998). On seasonal cycles, unit roots, and mean shifts. The Review of Economics and Statistics, 80, 231–240.

Fountas, S., & Wu, J.-L. (1999). Are the U.S. current account deficits really sustainable? International Economic Journal, 13(3), 51–58.

Gersovitz, M., & McKinnon, J. G. (1978). Seasonality in regression: An application of smoothness priors. Journal of the American Statistical Association, 73, 264–273.

Ghysels, E. (1990). Unit-root tests and the statistical pitfalls of seasonal adjustment: The case of U.S. postwar real gross national product. Journal of Business and Economic Statistics, 8, 145–152.

Ghysels, E., & Perron, P. (1993). The effect of seasonal adjustment filters on tests for unit roots. Journal of Econometrics, 55, 57–99.

Ghysels, E., & Osborn, D. R. (2001). The econometric analysis of seasonal time series. Cambridge: Cambridge University Press.

Gourinchas, P. O., & Rey, H. (2007). International financial adjustment. Journal of Political Economy, 115, 4.

Gregory, A. W., & Hansen, B. E. (1996). Residual-based tests for cointegration in models with regime shifts. Journal of Econometrics, 70, 99–125.

Greenidge, K., Drakes, L., Thomas, C., & Craigwell, R. (2012). Threshold effects of sovereign debt: Evidence from the Caribbean. IMF working papers 12/157, International Monetary Fund.

Gupta, J. B. (1965). Seasonality in world financial and trade data. IMF Staff Papers, 12, 353–364.

Hakkio, C. S., & Rush, M. (1991). Is the budget deficit too large? Economic Inquiry, 29, 429–445.

Hamori, S. (2009). The sustainability of trade accounts of the G-7 countries. Applied Economics Letters, 16, 1691–1694.

Hansen, L. P., & Sargent, T. J. (1993). Seasonality and approximation errors in rational expectation models. Journal of Econometrics, 55, 21–56.

Harvey, D. I., Leyboourne, S. J., & Newbold, P. (2002). Seasonal unit root tests with seasonal mean shifts. Economics Letters, 76, 295–302.

Hassler, U., & Rodrigues, P. M. M. (2004). Seasonal unit root tests under structural breaks. Journal of Time Series Analysis, 25, 33–53.

Herzer, D., & Nowak-Lehmann, F. (2006). Is there a long-run relationship between exports and imports in Chile? Applied Economics Letters, 13, 981–986.

Holmes, M., Panagiotidis, T., & Sharma, A. (2011). The sustainability of India’s current account. Applied Economics, 43, 219–229.

Husted, S. (1992). The emerging U.S. current account deficit in the 1980s: A cointegration analysis. The Review of Economics and Statistics, 74(1), 159–166.

Hylleberg, S. (1995). Tests for seasonal unit roots: General to specific or specific to general? Journal of Econometrics, 69, 5–25.

Hylleberg, S., Engle, R., Granger, C. W. J., & Yoo, B. S. (1990). Seasonal integration and co-integration. Journal of Econometrics, 44(1–2), 215–238.

IMF. (2004). Treatment of seasonal products, in producer price index manual, ch. 22. Washington: IMF.

Irandoust, M., & Sjoo, B. (2000). The behavior of the current account in response to unobservable and observable shocks. International Economic Journal, 14, 41–57.

Irandoust, M., & Ericsson, J. (2004). Are imports and exports cointegrated? An international comparison. Metroeconomica, 55(1), 49–64.

Johansen, S. (1995). Likelihood-based inference in cointegrated vector autoregressive models. Oxford: Oxford University Press.

Maekawa, K. (1997). Periodically integrated autoregression with a structural break. Mathematics and Computers in Simulations, 43, 467–472.

Maravall, A. (1993). Stochastic linear trends. Journal of Econometrics, 56, 5–37.

Mitchell, W. C. (1927). Business cycles. New York: National Bureau of Economic Research.

Narayan, P. K., & Narayan, S. (2005). Are exports and imports cointegrated? Evidence from 22 least developed countries. Applied Economics Letters, 12, 375–378.

Nag, B., & Mukherjee, J. (2012). The sustainability of trade deficits in the presence of endogenous structural breaks: Evidence from the Indian economy. Journal of Asian Economics, 23, 519–526.

Nunes, L. C., & Rodrigues, P. M. M. (2011). On LM-type tests for seasonal unit roots in the presence of a break in trend. Journal of Time Series Analysis, 32, 08–134.

Olekalns, N. (1994). Testing for unit roots in seasonally adjusted data. Economic Letters, 45, 273–279.

Osborn, D. (1991). The implications of periodically varying coefficients for seasonal time-series processes. Journal of Econometrics, 48, 373–384.

Osborn, D. R. (1988). Seasonality and habit persistence in a life-cycle model of consumption. Journal of Applied Econometrics, 3, 255–266.

Perron, P. (1988). Trends and random walks in macroeconomic time series: Further evidence from a new approach. Journal of Economic Dynamics and Control, 12(1988), 297–332.

Perron, P. (1989). The great crash, the oil price shock and the unit root hypothesis. Econometrica, 57, 1361–1401.

Perron, P. (1990). Testing for a unit root in time series with changing mean. Journal of Business and Economic Statistics, 8, 153–162.

Perron, P. (1997). Further evidence from breaking trend functions in macroeconomic variables. Journal of Econometrics, 80(1997), 355–385.

Perron, P. (2006). Dealing with structural breaks. In K. Patterson & T. C. Mills (Eds.), Palgrave handbook of econometrics, vol. 1: Econometric theory (pp. 278–352). Palgrave Macmillan.

Perron, P., & Vogelsang, T. J. (1992a). Testing for a unit root in time series with changing mean: Corrections and extensions. Journal of Business and Economic Statistics, 10, 467–470.

Perron, P., & Vogelsang, T. J. (1992b). Nonstationarity and level shifts with an application to purchase power parity. Journal of Business and Economic Statistics, 10, 301–320.

Rodrigues, P. M. M., & Taylor, A. M. R. (2007). Efficient tests of the seasonal unit root hypothesis. Journal of Econometrics, 141, 548–573.

Zivot, E., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 10, 251–270.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Denise R. Osborn, A. M. Robert Taylor, A. Banerjee and two anonymous referees for helpful and constructive comments on a previous version of this paper. The authors gratefully acknowledge the financial support from MINECO (Projects ECO2014-51759-REDT and ECO2014-58991-C3-3-R), the Generalitat Valenciana (PROMETEOII/2014/053 project) and the European Commission Lifelong Learning Program (Project 542434-LLP-1-2013-1-ES-AJM-CL). The usual disclaimer applies.

Appendices

Appendix 1: Proof

Proof

First note that from (5) it is possible to write:

with \(\mathbf {u}_{\tau }=\mathbf {\Psi }(L)^{-1}\mathbf {e}_{\tau }\), them we have that:

Replace \(\mathbf {u}_{\tau }\) by \(\left( \mathbf {\gamma }D\left( {\textit{NB}}\right) _{\tau }+\mathbf {u}_{\tau }\right) \), hence we have:

As in Perron and Vogelsang (1992a) it is possible to write for \(\tilde{y} _{s\tau }=y_{s\tau }-\hat{\mu }_{s}-\hat{\gamma }_{s}^{*}{\textit{DU}}_{s\tau }\), where \(\bar{y}_{s}^{a}=N_{b}^{-1}\sum _{\tau =1}^{N_{b}}y_{s\tau }=\lambda ^{-1}N^{-1}\sum _{\tau =1}^{N_{b}}y_{s\tau }\) and \(\bar{y}_{s}^{b}=\left( N-N_{b}\right) ^{-1}\sum _{\tau =N_{b}+1}^{N}y_{s\tau }=\left( 1-\lambda \right) ^{-1}N^{-1}\sum _{\tau =N_{b}+1}^{N}y_{s\tau }\):

with \(S_{\tau }=\mathbf {b}^{\prime }\mathop {\displaystyle \sum }\nolimits _{j=1}^{\tau }\mathbf {u} _{j}\), \(\bar{S}_{a}=N_{b}^{-1}\sum _{\tau =1}^{N_{b}}S_{\tau }=\lambda ^{-1}N^{-1}\sum _{\tau =1}^{N_{b}}S_{\tau }\) and \(\bar{S}_{b}=\left( N-N_{b}\right) ^{-1}\sum _{\tau =N_{b}+1}^{N}S_{\tau }=\left( 1-\lambda \right) ^{-1}N^{-1}\sum _{\tau =N_{b}+1}^{N}S_{\tau }\). Additionally we define \(\tilde{y}_{s\tau }^{*}\) ,without serial correlation, as the residuals from a projection of \(\tilde{y}_{s\tau }\) on \(D\left( {\textit{NB}}\right) _{s,\tau }\) and ,in the presence of serial correlation, as the the residuals from a projection of \(\tilde{y}_{s\tau }\) on \(D\left( {\textit{NB}}\right) _{s,\tau }\) and its \(p-1\) lags. Assume for simplicity the absence of serial correlation, hence:

Following the lines of the proof of Theorem 1 in Boswijk and Franses (1996) it is convenient to write (10)/(11) using conventional time subscripts and seasonal dummy variable notation (\(D_{st}\) taking the value unity when observation t falls in season s and zero otherwise). Employing this notation yields the representation (see Boswijk and Franses 1996, p. 238):

where the restrictions \(\varphi _{1}\varphi _{2}\varphi _{3}\varphi _{4}=1\) is imposed. Note that since the deterministic terms enter unrestrictedly then \(\tilde{y}_{t}^{*}\) are the residuals as defined in (24)/(25). Let \(\theta =\left[ \theta _{1},\theta _{2}^{\prime },\theta _{3}^{\prime }\right] ^{\prime }\) denote the full parameter vector with \( \theta _{1}=\pi _{1}\), \(\theta _{2}^{\prime }=\left[ \varphi _{2},\varphi _{3},\varphi _{4}\right] \) and \(\theta _{3}^{\prime }=\left[ \psi _{11},\ldots ,\psi _{1,p-1},\ldots ,\psi _{41},\ldots ,\psi _{4,p-1}\right] \). Under the null hypothesis \(\pi _{1}=0\), hence this parameter is associated with the unit root while, \(\varphi _{2}\), \(\varphi _{3}\) and \(\varphi _{4}\) are cointegration parameters (with \(\varphi _{1}\) defined from the periodic unit root restriction as \(\varphi _{1}=\left( \varphi _{2}\varphi _{3}\varphi _{4}\right) ^{-1}\)), and \(\theta _{3}\) collects the parameters associated with the stationary regressors in (26). Let \(z_{t}=\left[ z_{t}^{1},z_{t}^{2\prime },z_{t}^{3\prime }\right] ^{\prime }\) be defined conformably with \(\theta \) as \(z_{t}=\partial \tilde{y}_{t}/\partial \theta \) , and hence

Note that for \(z_{t}^{1}\) we have that

and

From lemma 1 in Boswijk and Franses (1996) it is possible to establish:

Hence we have that:

and:

Note also that form (27) and following the lines of (28)–(33) it is possible to establish:

and \(\left[ {\textit{DE}}\left( \lambda \right) \right] \) defined in (33). Under the periodic unit root null hypothesis the \({\textit{PAR}}(p-1)\) regressors \( D_{st}y_{t-j}-\varphi _{s-j}D_{st}y_{t-j-1}\) collected in the vector \( z_{t}^{3}\) are stationary with

As a consequence of the different rates of convergence for the parameter estimates corresponding to the nonstationary PI regressors and those for the stationary \({\textit{PAR}}(p-1)\) component in the augmented regression (10) or (11), we have that:

Following Boswijk and Franses (1996), we establish the distribution of \( {\textit{LR}}_{io}\left( \lambda \right) \) using

where \(Y_{N}=diag\left[ N\times I_{4},N^{1/2}\times I_{4\left( p-1\right) } \right] \), \(\left( Y_{N}^{-1}Q_{\theta }Y_{N}^{-1}\right) ^{11}\) is the first element of the principal diagonal of the inverse matrix \(\left( Y_{N}^{-1}Q_{\theta }Y_{N}^{-1}\right) ^{-1}\), \(N\hat{\theta }_{1}\) is the first element of \(\left( Y_{N}^{-1}Q_{\theta }Y_{N}^{-1}\right) ^{-1}Y_{N}^{-1}q_{\theta }\), and \(q_{\theta }\) and \(Q_{\theta }\) are the score and negative of the Hessian matrix, respectively, formulated in terms of \(\theta \). Note that, as in Boswijk and Franses (1996),

From (31), (33)–(34) it is easy to see that

Therefore,

Note that \(\left[ {\textit{DE}}\left( \lambda \right) \right] \) is a scalar and also that for \(\sigma ^{-1}\left( K^{\prime }K\right) ^{-1}K^{\prime }\left[ NU\left( E\right) ,\left( \lambda \right) \right] \) it is possible to write:

Now, partitioning \(K=\left[ K_{1}\vdots K_{2}\right] \) to focus on the first element of \(\left( Y_{N}^{-1}Q_{\theta }Y_{N}^{-1}\right) ^{-1}Y_{N}^{-1}q_{\theta }\), namely \(N\hat{\theta }_{1}\), (37) and (38) implies

In Boswijk and Franses (1996) it is shown that \(S_{1}\left( r\right) =\left( K_{1}^{\prime }M_{2}K_{1}\right) ^{-1/2}w\left( r\right) \) hence we have:

note also that:

Then finally substituting (39) and (40) into (3) the required result is easily obtained. \(\square \)

Appendix 2: Tables

See Tables 1, 2, 3, 4, 5, 6, 7 and 8.

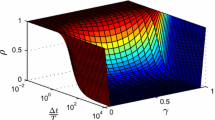

Appendix 3: Figures

Appendix 4: Empirical Literature

Authors | Countries analyzed | Period | Variables | Techniques |

|---|---|---|---|---|

Arize (2002) | 50, all continents | Quart., 73-98 | Nom. X/GDP, M/GDP dom. curr. | Johansen, SW, Hansen |

Fountas and Wu (1999) | US | Quart., 67-94 | X, M, real, nominal, relative | EG, structural breaks |

Greenidge et al. (2012) | Barbados | Annu. 60-2006 | Real X/GDP, M/GDP | ERS, NP, KPSS, Johansen, DOLS |

Hamori (2009) | G-7 countries | Annu, 60-2005 | X and M, mill. US $, trade bal | panel u. roots, coint., IPS, Pedroni |

Herzer and Nowak-Lehmann (2006) | Chile | Annu, 75-2004 | Real X and M domest. currency | Gregory-Hansen, DOLS, ECM |

Holmes et al. (2011) | India | Annu. 50-2003 | X/GDP, M/GDP | Johansen, Saikkonen and Lütkepohl, |

Breitung, Breitung and Taylor | ||||

Husted (1992) | US | Quart. 67-89 | Nom., real, differenced ratios | EG, ADF, Perron-breaks |

Irandoust and Sjoo (2000) | Sweden | Quart. 80-95 | Nom., real, X, M/GDP dom. curr. | VECM, Johansen, stability tests |

Irandoust and Ericsson (2004) | Fr, G, I, Sw, UK, US | Quart. 71-97 | Real, log, seasonally adj. | VECM, Johansen, stability tests |

Nag and Mukherjee (2012) | India | Annu. 50-2008 | Real X and M (inclusive interest) | Lee and Strazicich, Gregory-Hansen |

Narayan and Narayan (2005) | 22 least developed | Annu. 60-2000 | Nominal X and M | bounds ARDL, ECM, Hansen, DOLS |

Rights and permissions

About this article

Cite this article

del Barrio, T., Camarero, M. & Tamarit, C. Testing for Periodic Integration with a Changing Mean. Comput Econ 54, 45–75 (2019). https://doi.org/10.1007/s10614-017-9680-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9680-x