Abstract

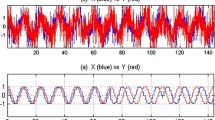

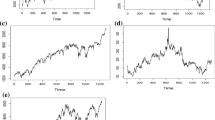

This paper examines the dynamic relationship between power spot prices and related trading volumes in one of the most emergent energy markets. Traditionally, investigating the bivariate stochastic processes has been dominated by linear econometrical methods that proved helpful especially in finance. However, when dealing with intradaily power data, we cannot rely on models developed for financial or other commodity markets. Therefore, wavelet transforms are applied for power markets data to search for and decode nonlinear regularities and hidden patterns existing between the variables. Given its ability to decompose the time series into their time scale components and thus to reveal structure at different time horizons, wavelets are useful in analyzing situations in which the degree of association between processes is likely to change with the time-horizon. Therefore, a wavelet-based cross-analysis is performed between prices and trading volume time series. On the same basis, causality tests and out-of-sample forecasting tasks are carried out to empirically the strong relationship between the two investigated time series.

Similar content being viewed by others

References

Baek, E., & Brock, W. (1992). A general test for nonlinear Granger causality: Bivariate model. Working Paper, Iowa State University and University of Wisconsin, Madison.

Bollerslev T., Chou R., Kroner K. (1992) ARCH modeling in finance. Journal of Econometrics 52: 5–59

Brock, W. A., Deschest, W. D., & Scheinkman, J. A. (1987). A test for independence based on the correlation dimension. Economics Working Paper SSRI-8702, University of Wisconsin, Madison.

Chatfield C. (1995) The analysis of time series: An introduction. Chapman & Hall, New York

Cifter, A., & Ozun, A. (2008). Estimating the effects of interest rates on share prices in Turkey using a multi-scale causality test. Review of Middle East Economics and Finance, 4, 68–79.

Clark P. (1973) A subordinated stochastic process model with finite variance for speculative process. Econometrica 41: 135–155

Copeland T. (1976) A model of asset trading under the assumption of sequential information arrival. Journal of Finance 31: 1149–1168

Cornell B. (1981) The relationship between volume and price variability in futures markets. Journal of Futures Markets 1: 303–316

Dalkir M. (2004) A new approach to causality in the frequency domain. Economics Bulletin 3: 1–14

Daubechies I. (1992) Ten lectures on wavelets. SIAM, Philadelphia

Daubechies S., Maes I. (1996) A nonlinear squeezing of the continuous wavelet transform based on auditory nerve models. In: Aldroubi A., Unser M. (Eds.), Wavelets in medicine and biology. CRC Press, Boca Raton, FL, pp 527–546

Diks V., Panchenko C. (2006) A new statistic and practical guidelines for nonparametric Granger causality testing. Journal of Economic Dynamics and Control 30: 1647–1669

Diongue A. K., Guégan B., Vignal D. (2009) Forecasting electricity spot market prices with a k-factor GIGARCH process. Applied Energy 86: 505–510

Epps T., Epps M. (1976) The stochastic dependence of security price changes and transaction volumes: Implications for the mixture of distributions hypothesis. Econometrica 44: 305–321

Gallegati M. (2008) Wavelet analysis of stock returns and aggregate economic activity. Computational Statistics and Data Analysis 52: 3061–3074

Gençay R., Selcuk F., Whitcher B. (2002) An introduction to wavelets and other filtering methods in finance and economics. Academic Press, San Diego, CA

Granger C. W. J. (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37: 424–438

Hiemstra C., Jones J. D. (1994) Testing for linear and nonlinear Granger causality in the stock price–volume relation. The Journal of Finance 49: 1639–1664

Lamoureux C. G., Lastrapes W. D. (1990) Heteroscedasticity in stock returns data: Vomume versus GARCH effects. Journal of Finance 45: 221–229

Llorente G., Michaely R., Saar G., Wang J. (2002) Dynamic volume–return relation of individual stocks. Review of Financial Studies 15: 1005–1047

Mallat S. (1999) A wavelet tour of signal processing. Academic Press, New York

Misiorek, A., Trueck, S., & Weron, R. (2006). Point and interval forecasting of spot electricity prices: Linear vs non linear time series models. Studies in Nonlinear Dynamics and Econometrics, 10, Article 2.

Nicolosi M. (2010) Wind power integration and power system flexibility—An empirical analysis of extreme events in Germany under the new negative price regime 38: 7257–7268

Osborne M. F. M. (1959) Brownian motion in the stock market. Operations Research 7: 145–173

Percival D. B., Walden A. T. (2000) Wavelet methods for time series analysis. Cambridge University Press, Cambridge

Tauchen G. E., Pitts M. (1983) The price variability volume relationship on speculative markets. Econometrica 51: 485–505

Whitcher, B., Guttorp, P., & Percival, D. B. (1999). Mathematical background for wavelet estimators for cross covariance and cross correlation. Technical Report 38, National Research Centre for Statistics and the Environment, Seattle.

Whitcher B., Guttorp P., Percival D. B. (2010) Wavelet analysis of covariance with application to atmospheric time series 105: 14941–14962

Zivot E., Wang J. (2003) Modeling financial time series with S-PLUS. Springer, New York

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Saâdaoui, F. The Price and Trading Volume Dynamics Relationship in the EEX Power Market: A Wavelet Modeling. Comput Econ 42, 47–69 (2013). https://doi.org/10.1007/s10614-012-9346-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-012-9346-7