Abstract

This paper examines the dynamics of innovation in low-carbon energy technologies distinguishing between research and development and technology diffusion as a response to alternative climate policies. We assess the implications of second-best policies that depart from the assumption of immediate and global participation and of full technology availability. The analysis highlights the heterogeneous effects of climate policy on different energy R&D programs and discusses the contribution of important determinants such as carbon price and policy stringency, policy credibility, policy and technological spillovers and absorptive capacity.

Similar content being viewed by others

Notes

The notion of induced innovation was introduced by Hicks (1932) who established the link between the change in relative prices and technical change. In the context of climate policy, this term refers to the ability of climate policy to induce innovation.

In this case of delayed action to 2020, regions can start to invest in mitigation options in 2020.

International trade of emissions credits is already possible through the CDM of the Kyoto Protocol, but the numerous inefficiencies of the current procedures make it hard to consider CDM as a good proxy for an efficient, global carbon market.

In the WITCH model, CCS can only be applied to power sector technologies and not to other sectors such as industry.

In the case of nuclear, which is already deployed in the baseline, this means that no further expansion compared to the baseline is allowed.

United States, Western Europe, Eastern Europe, South Korea, Australia, Canada, Japan, New Zealand.

References

Baker E, Shittu E (2006) Profit maximizing R&D investment in response to a random carbon tax. Resource Energ Econ 28:105–192

Barreto L, Kypreos S (2004) Endogenizing R&D and market experience in the bottom-up energy-systems ERIS model. Technovation 2:615–629

Bastianin A, Favero A, Massetti E (2010) Investments and financial flows induced by climate mitigation policies. FEEM Working Paper No. 13, Fondazione Eni Enrico Mattei, Milan.

Binswanger HP, Ruttan VW (1978) Induced innovation: technology institutions and development. John Hopkins University Press, Baltimore

Blanford GJ (2009) R&D Investment strategy for climate change. Energy Econ 31(S1):S27–S36

Bosetti V, Victor DG (2010) Politics and Economics of Second-Best Regulation of Greenhouse Gases: The Importance of Regulatory Credibility, FEEM Working Paper No. 29, Fondazione Eni Enrico Mattei, Milan.

Bosetti V, Carraro C, Galeotti M, Massetti E, Tavoni M (2006) WITCH: a world induced technical change hybrid model. The Energ J, Special Issue on Hybrid Modeling of Energy-Environment Policies: Reconciling Bottom-up and Top-down, 13–38

Bosetti V, Carraro C, Massetti E, Tavoni M (2008) International energy R&D spillovers and the economics of greenhouse gas atmospheric stabilization. Energ Econ 30:2912–2929

Bosetti V, Carraro C, Tavoni M (2009a) Climate change mitigation strategies in fast-growing countries: the benefits of early action, CESifo Working Paper No. 2742.

Bosetti V, Carraro C, Duval R, Sgobbi A, Tavoni M (2009b) The role of R&D and technology diffusion in climate change mitigation: new perspectives using the WITCH model. OECD Working Paper No. 664, February.

Bosetti V, Carraro C, Duval R, Tavoni M (2010) What should we expect from innovation? A model-based assessment of the environmental and mitigation cost implications of climate-related R&D, FEEM Working Paper No. 42, Fondazione Eni, Milan.

Bürer MJ, Wüsternhagen R (2009) Which renewable energy policy is a venture capitalist’s best friend? Empirical evidence from a survey of international cleantech investors. Energ Pol 37:4997–5006

Carraro C, De Cian E, Tavoni M (2009a) Human capital formation and global warming mitigation: evidence from an integrated assessment model, CESifo Working Paper No. 2874.

Carraro C, Massetti E, Nicita L (2009b) How does climate policy affect technical change? An analysis of the direction and pace of technical progress in a climate-economy model. The Energ J 30(2):7–38

Carraro C, De Cian E, Massetti E, Nicita L, Verdolini E (2010) Environmental policy and technical change: a survey. Int Rev Environ Resour Econ 4:163–219

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39(5):859–887

Criqui P, Klassen G, Schrattenholzer L (2000) The efficiency of energy R&D expenditures. Economic modeling of environmental policy and endogenous technical change, Amsterdam, November 16–17, 2000

De Cian E, Tavoni M (2010) The role of international carbon offsets in a second-best climate policy: a numerical evaluation. FEEM Working Paper, No. 33, Fondazione Eni Enrico Mattei, Milan.

Dechezleprêtre A, Glachant M, Ménière Y (2008) The clean development mechanism and the international diffusion of technologies: an empirical study. Energ Pol 36:1273–1283

Dechezleprêtre A, Glachant M, Johnstone N, Haščič I, Ménière Y (2009) Invention and transfer of climate change mitigation technologies on a global scale: a study drawing on patent data, FEEM Working Paper 082.2009.

Gerlagh R (2008) A climate–change policy induced shift from innovations in carbon-energy production to carbon-energy savings. Energ Econ 30(2):425–448

Gerschenkron A (1962) Economic backwardness in historical perspective. Harvard University Press.

Gillingham K, Newell RG, Pizer WA (2008) Modelling endogenous technological change for climate policy analysis. Energ Econ 30:2734–2753

Goulder L, Schneider S (1999) Induced technological change and the attractiveness of CO2 emissions abatement policies. Resource Energ Econ 21:211–253

Grossman G, Helpman E (1991) Innovation and growth in the global economy. The MIT Press, Cambridge

Hart R (2008) The timing of taxes on CO2 emissions when technological change is endogenous. J Environ Econ Manage 55(2):194–212

Hicks JR (1932) The theory of wages. McMillan, London

Jamasab T (2007) Technical change theory and learning curves: patterns of progress in electric generation technologies. The Energ J 28(3)

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782

Kennedy C (1964) Induced bias in innovation and the theory of distribution. Econ J 74(295):541–547

Klassen G, Miketa A, Larsen K, Sundqvist T (2005) The impact of R&D on innovation for wind energy in Denmark, Germany and the United Kingdom. Ecol Econ 54(2–3):227–240

Kouvaritakis N, Soria A, Isoard S (2000) Endogenous learning in world post-Kyoto scenarios: application of the POLES model under adaptive expectations. Int J Global Energ Issues 14(1–4):228–248

Kypreos S (2007) A MERGE model with endogenous technical change and the cost of carbon stabilisation. Energ Pol 35:5327–5336

Löschel A (2002) Technological change in economic models of environmental policy: a survey. Ecol Econ 43(2–3):105–126

Luderer G, Bosetti V, Jakob M, Leimbach M, Steckel JC, Waisman H, Edenhofer O (2011) The economics of decarbonizing the energy system—results and insights from the RECIPE model intercomparison. Climatic Change. doi:10.1007/s10584-011-0105-x.

Meyer A (2004) Briefing: contraction and convergence. Eng Sustain 157(4):189–192

Nemet GF (2010) Robust Incentives and the Design of a Climate Change Governance Regime, La Follette School Working Paper No. 2010–006.

Nordhaus WD (2009) The Perils of the learning model for modeling endogenous technological change, NBER Working Paper 14638.

Otto VM, Löschel A, Reilly J (2008) Directed technical change and differentiation of climate policy. Energ Econ 30(6):2855–2878

Peri G (2005) Determinants of knowledge flows and their effects on innovation. The Rev Econ Stat 87(2):308–322

Popp D (2002) Induced innovation and energy prices. Am Econ Rev 92(1):160–180

Popp D (2004) ENTICE: endogenous technological change in the DICE model of global warming. J Environ Econ Manage 48(1):742–768

Popp D (2006) International innovation and diffusion of air pollution control technologies: the effects of NOX and SO2 regulation in the U.S., Japan, and Germany. J Environ Econ Manage 51(1):46–71

Popp D, Hafner T, Johnstone N (2007) Policy vs. consumer pressure: innovation and diffusion of alternative bleaching technologies in the pulp industry. NBER Working Paper 13439

Popp D, Newell R, Jaffe A (2009) Energy, the Environment, and Technological Change NBER Working Paper Series, No 14832, April 2009.

Rosenberg N (1982) Inside the black box: technology and economics. Cambridge University Press, Cambridge

Rosenberg N (1994) Exploring the black box: technology, economics, and history. Cambridge University Press, Cambridge

Schmookler J (1966) Invention and economic growth. Harvard University Press, Cambridge

Seres S, Haites E, Murphy K (2009) Analysis of technology transfer in CDM projects: an update. Energ Pol 37:4919–4926

Söderholm P, Klassen G (2007) Wind power in Europe: a simultaneous innovation-diffusion model. Environ Res Econ 36(2):163–190

Sue Wing I (2003) Induced technical change and the cost of climate policy. MIT Joint Program on the Science and Policy of Global Change, Report No. 102, September 2003.

Tavoni M, De Cian E, Luderer G, Steckel J (2011) The value of technology and of its evolution towards a low carbon economy. Climatic Change, forthcoming

Verdolini E, Galeotti M (2009) At home and abroad: an empirical analysis of innovation and diffusion in energy-efficient technologies, FEEM Working Paper 123.2009.

Author information

Authors and Affiliations

Corresponding author

Additional information

Grateful acknowledgement is made for financial support provided by WWF and Allianz. The authors wish to thank the whole RECIPE project team.

Appendix I. WITCH: A model of endogenous technology and knowledge innovation and diffusion

Appendix I. WITCH: A model of endogenous technology and knowledge innovation and diffusion

The WITCH model describes technological advances that can occur in the energy sector of the economy, distinguishing between invention/innovation and diffusion/deployment. Innovation can either improve energy efficiency or increase competitiveness of advanced, not yet available, zero carbon technologies (breakthrough technologies). In both cases, the process of innovation follows similar dynamics. Knowledge creation is characterised by an innovation possibility frontier that exhibits both intertemporal and international spillovers of knowledge. The flow of new ideas (Z J ) adds to the exiting stock of knowledge (HE J ), depreciated by factor δ, and generates the new stock of knowledge available to each region, indexed by n, at each point in time, t:

Innovation can have three different applications, indexed by j, namely to improve energy efficiency (EE) and to reduce the cost of the two carbon-free technologies (breakthrough, power sector and breakthrough, final sector) and is meant to emphasise that each form of innovation requires specific, dedicated investments, I j .

At each point in time, new ideas (Z J ) are produced using a Cobb-Douglas combination between dedicated domestic investments (I j,R&D ), a domestic stock of knowledge (HE J ) and a foreign stock of knowledge (SPILL J ):

The contribution of foreign knowledge, SPILL j , is not immediate, but depends on the interaction between two components shown in Eq. A3. The first term describes the countries’ absorptive capacity whereas the second one captures the distance of each region from the technology frontier. The technology frontier is represented by the sum of the stock of knowledge across high-income countries HI Footnote 6:

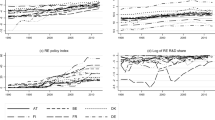

Figure 8 depicts the innovation possibility frontier for each country relative to the USA which has been normalised to one. Because rich countries are closer to the frontier, the potential inflow of knowledge is smaller compared to poor countries, despite the higher absorptive capacity (see also Table 1). Over time, developing countries progressively increase their knowledge stock and absorptive capacity but at the same time the potential inflow of knowledge is reduced as they converge to the frontier. Overall, spillovers are relatively higher in developing countries, as it can be seen from Fig. 9, which shows the ratio of international spillovers to the domestic R&D knowledge stock.

The empirical evidence that could guide the parameter value selection is almost nonexistent (see Bosetti et al. 2008 for a discussion on this issue). They have been chosen so as to assign the largest contribution to the knowledge stock (on average 0.4, close to what assumed in Popp 2004). Domestic R&D investments contribute to the creation of new ideas with a share of 0.18 whereas international spillovers have a slightly lower contribution of 0.15 (e.g. a 1% increase in international spillovers increases the output of domestic ideas by 0.15%).

R&D itself has an opportunity cost. Since we do not model non-energy R&D, exogenous crowding-out is assumed. Within each given region, domestic externalities are fully internalised and we consider the social return of investment four times larger than the private one. In addition, each dollar spent on energy R&D crowds out half as much investments in other R&D (Popp 2004). In Eq. A4 we set \( \psi = 0.{5} \):

Each stock of energy knowledge can have an alternative application.

The energy efficiency stock of knowledge augments the quantity of final energy services (ES) that can be provided per unit of physical energy (EN) according to a Constant Elasticity formulation:

This is a formulation that can be used to describe energy efficiency improvements (see also Popp 2004) because an increase in the stock of knowledge substitutes for the physical input of energy, reducing emissions per unit of energy services provided.

The stock of energy knowledge can also reduce the unit cost of breakthrough technologies. The cost of each technology is described by a two-factor learning curve which also considers the role of diffusion (Kouvaritakis et al. 2000). The unit cost of technology, \( {P_{{tec}}}\left( {n,t} \right) \), at time t is a function of global deployment, \( \sum\limits_n {{K_{{tec}}}} \left( {n,t} \right) \), which accrues with technology investments or deployment in the case of the final sector breakthrough and a dedicated energy knowledge stock, \( H{E_{{tec}}}\left( {n,t} \right) \). To roughly capture the lag exiting between research and commercialisation, innovation has an impact on costs with a delay of two periods which in the model correspond to 10 years:

The R&D stock accumulates with the perpetual rule and with the contribution of international knowledge spillovers, as in Eq. A1. The R&D expenditure devoted to breakthrough technologies prior 2005 has been very small. As a consequence, we omit the contribution of the knowledge stock which however is negligible. To give a term of comparison, the total stock of energy knowledge computed using International Energy Agency statistics amounts at 120 2005US$ billion in 2005. Only 4 billion can be attributed to a technology that could represent a breakthrough, namely concentrated solar power.

The two exponents are the Learning-by-Doing index (−b) and the Learning-by-Researching index (−c). They define the speed of learning due to diffusion and deployment (Learning-by-Doing) and to innovation (Learning-by-Researching). They are derived from a learning ratio which is the rate at which the generating cost declines each time the cumulative capacity or the knowledge stock doubles.

This formulation has received significant attention from the empirical and modelling literature in the most recent past (Criqui et al. 2000; Barreto and Kypreos 2004; Klassen et al. 2005; Kypreos 2007; Jamasab 2007; Söderholm and Klassens 2007). Table 2 summarises some estimates of parameters controlling the learning processes mostly for technologies used in the power sector and it shows a large variability. Based on those estimates, we assumed values in the lower range which are reported in the last row of the table. Note that the value chosen for the Learning-by-Doing parameter is lower than those normally estimated in single factor experience curves since part of the technology advancement is now led by specific investments.

Finally, it must be highlighted that modelling of long-term and uncertain phenomena such as technological evolution calls for caution in the interpretation of exact quantitative figures and for accurate sensitivity analysis. The model parsimony allows for tractable sensitivity studies as stressed above. One should nonetheless keep in mind that the economic implications of climate policies as well as carbon price signals are influenced by innovative technologies availability only after 2030.

Once competitive, the uptake of the two breakthrough technologies is not immediate and complete but there is a transition/adjustment period. These penetration limits reflect the inertia of current energy and transport systems. The upper limit on penetration is set equal to 5% of electricity generation from other technologies in the case of the electric backstop and to 5% of consumption of other energy carriers in the case of non-electric backstop.

Initial prices are about ten times the 2005 price of commercial equivalents (16,000 US$/kW for electric, and 550 US$/bbl for non-electric). The cumulative deployment is initiated at 1,000 TWH and 1,000 EJ, for the electric and non-electric backstop, respectively, an arbitrarily low value (Kypreos 2007). The backstop technologies are assumed to be renewable in the sense that the fuel cost component is negligible; for power generation, it is assumed to operate at load factors comparable with those of base load power generation.

Once competitive, deployment and technology diffusion contribute to further reduce the costs of backstop technologies. This is the second component of Eq. A5. International spillovers characterise also the diffusion phase and thus technology costs depend on the capacity installed globally. Differently from knowledge spillovers occurring during the innovation phase, experience spillovers that are embodied in the use of the technology are free and immediate within the period time step of the model which is 5 years.

Learning-by-doing also affects the cost of wind and solar photovoltaic power. In this case, most cost reduction comes from increased deployment and the cost, \( SC\left( {n,t + 1} \right) \), follows a one-factor learning curve and declines with the world installed capacity, \( \sum\nolimits_n {K\left( {n,t} \right)} \):

The progress ratio, PR, defines the speed of learning. Although the econometric approach used to estimate learning curves and ratios has recently been criticised by Nordhaus (2009), there is evidence for a negative relationship between capacity and costs. For example, the annual world market for wind turbines has increased to tens of billions of dollars over the last two decades and the price of turbines has been reduced by a factor of four (Nemet 2010).

Without any policy, investment costs decline from the initial level 1,906US$/kW in 2005 to 1,010 in 2050 and 649 in 2100 with an overall reduction of about 66%. With a stabilisation policy (550 ppm CO2-eq), investment costs can be lowered to reach the floor price of US$ 500.

Rights and permissions

About this article

Cite this article

De Cian, E., Bosetti, V. & Tavoni, M. Technology innovation and diffusion in “less than ideal” climate policies: An assessment with the WITCH model. Climatic Change 114, 121–143 (2012). https://doi.org/10.1007/s10584-011-0320-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-011-0320-5