Abstract

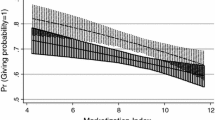

Recent downward trends in corporate giving have renewed interest in the factors that shape corporate philanthropy. This paper examines the relationships between charitable contributions, firm size and industry. Improvements over previous studies include an IRS data base that covers a much broader range of firm sizes and industries as compared to previous studies and estimation using an instrumental variable technique that explicitly addresses potential simultaneity between charitable contributions and profitability. Important findings provide evidence of a cubic relationship between charitable giving and firm size and evidence of strong industry effects. The plus-minus-plus regression coefficient sign pattern for the cubic firm size model suggests that small and large firms give more relative to total receipts with lower giving ratios among medium size firms. One interpretation for this finding is that small firms are close to the communities they serve while high visibility creates a need for large firm philanthropy. Strong industry effects provide evidence of inter-industry differences in giving culture and/or different public relations requirements across industries.

Similar content being viewed by others

References

Atkinson L. and Glaskiewicz J. (1988). Stock Ownership and Company Contributions to Charity. Administrative Sciences Quarterly 33(1):82–100

Boatsman J. R. and Gupta S. (1996). Taxes and Corporate Charity: Empirical Evidence from Micro-Level Panel Data. National Tax Journal 49(2):193–213

Brammer S. and Millington A. (2005). Corporate Reputation and Philanthropy: An Empirical Analysis. Journal of Business Ethics 61(1):29–44

Buckholtz A. K., Amason A. C. and Rutherford M. A. (1999). Beyond Resources: The Mediating Effects of Top Management Discretion and Values on Corporate Philanthropy. Business & Society 38(2):167–187

Burlingame D. F. and Frishkoff P. A. (1996). How Does Firm Size Affect Corporate Philanthropy? In: Burlingame D. F., Young D. R. (eds) Corporate Philanthropy at the Crossroads. Indiana University Press, Bloomington, pp. 86–104

Bain J. S. (1956). Barriers to New Competition. Harvard University Press, Cambridge

Benston G. J. (1985). The Validity of Profits-Structure with Particular Reference to the FTC’s Line of Business. American Economic Review 75(1):67

Caves R. E. and Pugel T. A. (1980). Intra Industry Differences in Conduct and Performance: Viable Strategies in U.S. Manufacturing. New York University Monograph Series in Finance and Economics Monograph, 1980–1982, New York

Demsetz H. (1973). Industry Structure, Market Rivalry, and Public Policy. Journal of Law and Economics 16(1):1–9

Fisher F. M. and McGowan J. J. (1983). On the Misuse of Accounting Rates of Return to Infer Monopoly Profits. American Economic Review 73(1):82–97

Fry L. F., Keim G. D., Meiners R. E. (1982). Corporate Contributions: Altruistic or For-Profit? Academy of Management Journal 25(1):94–106

Greene W. H. (2000). Econometric Analysis, 4th edn. Prentice Hall, Upper Saddle River, New Jersey

Griffin J. J. and Mahon J. F. (1997). The Corporate Social Performance and Corporate Financial Performance Debate. Business & Society 36(1):5–31

Hall M. and Weiss L. W. (1967). Average Concentration Ratios and Industrial Performance. Review of Economics and Statistics 49(3):319–331

Hess D., Rogovsky N., and Dunfee T. W. (2002). The Next Wave of Corporate Community Involvement: Corporate Social Initiatives. California Management Review 44(2):110–125

Johnson O. (1966). Corporate Philanthropy: An Analysis of Corporate Contributions. Journal of Business 39(4):489–504

Kedia B. L. and Kuntz E. C. (1981). The Context of Social Performance: An Empirical Study of Texas Banks. In: L. E. Preston (ed.), Research in Corporate Social Performance and Policy, 3rd edn. JAI Press, Greenwich, Conn., pp. 133–154

Maignan I., Ferrell O. C., Hunt G. T. M. (1999). Corporate Citizenship: Cultural Antecedents and Business Benefits. Journal of the Academy of Marketing Science 27(4):455–469

Maignan I. (2001). Consumers’ Perceptions of Corporate Social Responsibilities: A Cross-Cultural Comparison. Journal of Business Ethics 30(1):57–72

Martin S. (1993). Advanced Industrial Economics. Blackwell, Oxford

Martin S. A. (1985). An Essential Grace. McClelland and Stewart, Toronto

McElroy K. M. and Siegfried J. J. (1985). The Effect of Firm Size on Corporate Philanthropy. Quarterly Review of Economics and Business 25(2):18–26

McGuire J. B., Sundgren A. and Schneeweis T. (1988). Corporate Social Responsibility and Firm Financial Performance. Academy of Management Journal 31(4):854–872

Mueller D. C. (1990). The Dynamics of Company Profits: An International Comparison. Cambridge University Press, Cambridge

Porter M. E. (1979). The Structure within Industries and Company Performance. Review of Economics and Statistics 61(2):214–227

Porter M. E. and Kramer M. R. (2002). The Competitive Advantage of Corporate Philanthropy. Harvard Business Review 80(12):57–68

Powell T. C. (1996). How Much Does Industry Matter? An Alternative Empirical Test. Strategic Management Journal 17(4):323–334

Roberts R. W. (1992). Determinants of Corporate Social Responsibility Disclosure: An Application of Stakeholder Theory. Accounting, Organizations and Society 17(6):595–612

Rumelt R. P. (1991). How Much Does Industry Matter. Strategic Management Journal 12(3):167–185

Saiia D. H., Carroll A. B. and Buchholtz A. K. (2003). Philanthropy as Strategy: When Corporate Charity “Begins at Home”. Business & Society 42(2):162–201

Scherer F. M. and Ross D. (1990). Industrial Market Structure and Economic Performance. Houghton Mifflin Company, Boston

Schmalensee R. (1985). Do Markets Differ Much? American Economic Review 75(3):341–351

Seifert B., Morris S. A. and Bartkus B. R. (2003). Comparing Big Givers and Small Givers: Financial Correlates of Corporate Philanthropy. Journal of Business Ethics 45(3):195–211

Shepherd W. G. (1972). The Elements of Market Structure. Review of Economics and Statistics 54(1):25–37

Stigler G. J. (1963). Capital and Rates of Return in Manufacturing. Princeton University Press, Princeton

Thompson J. K., Smith H. L., Hood J. N. (1993). Charitable Contributions by Small Businesses. Journal of Small Business Management 31(3):35–51

Ullmann A. A. (1985). Data in Search of a Theory: A Critical Examination of the Relationships Among Social Performance, Social Disclosure, and Economic Performance of U.S. Firms. Academy of Management Review 10(3):540–557

Useem M. (1988). Market and Institutional Factors in Corporate Contributions. California Management Review 30(2):77–88

Vidaver-Cohen D. and Altman B. W. (2000). Corporate Citizenship in the New Millennium: Foundation for an Architecture of Excellence. Business & Society Review 105(1):145–168

Waddock S. A. and Graves S. B. (1997). The Corporate Social Performance-Financial Performance Link. Strategic Management Journal 18(4):303–319

Wernerfelt B. and Montgomery C. (1988). Tobin’s Q and the Importance of Focus in Firm Performance. American Economic Review 78(1):246–250

Williams R. J. and Barrett J. D. (2000). Corporate Philanthropy, Criminal Activity, and Firm Reputation: Is There A Link? Journal of Business Ethics 26(4):341–350

Wood D. J. and Jones R. E. (1995). Stakeholder Mismatching: A Theoretical Problem in Empirical Research on Corporate Social Performance. International Journal of Organizational Analysis 3(3):229–267

Author information

Authors and Affiliations

Corresponding author

Additional information

Christie H. Amato (Ph.D., University of Alabama) is professor of marketing at the Belk College of Business Administration, University of North Carolina, Charlotte. Dr. Amato's research interests lie in the area of strategic marketing, productivity, quality of life and ethics. She has published articles in top marketing journals including: Journal of Marketing Research, Journal of the Academy of Marketing Science, Journal of Retailing, Journal of Advertising and Journal of Business Research.

Louis H. Amato (Ph.D., University of South Carolina) is professor of economics at the Belk College of Business Administration, University of North Carolina-Charlotte. Dr.␣Amato's research interests lie in the areas of market structure and profitability, productivity, quality of life and ethics. He has published articles in top journals including Southern Economic Journal, Review of Industrial Organization, and Quarterly Journal of Business and Economics.

Rights and permissions

About this article

Cite this article

Amato, L.H., Amato, C.H. The Effects of Firm Size and Industry on Corporate Giving. J Bus Ethics 72, 229–241 (2007). https://doi.org/10.1007/s10551-006-9167-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-006-9167-5