Abstract

Organizations adopt blockchain technologies to provide solutions that deliver transparency, traceability, trust, and security to their stakeholders. In a novel contribution to the literature, this study adopts the technology-organization-environment (TOE) framework to examine the technological, organizational, and environmental dimensions for adopting blockchain technology in supply chains. This represents a departure from prior studies which have adopted the technology acceptance model (TAM), technology readiness index (TRI), theory of planned behavior (TPB), united theory of acceptance and use of technology (UTAUT) models. Data was collected through a survey of 525 supply chain management professionals in India. The research model was tested using structural equation modeling. The results show that all the eleven TOE constructs, including relative advantage, trust, compatibility, security, firm’s IT resources, higher authority support, firm size, monetary resources, rivalry pressure, business partner pressure, and regulatory pressure, had a significant influence on the decision of blockchain technology adoption in Indian supply chains. The findings of this study reveal that the role of blockchain technology adoption in supply chains may significantly improve firm performance improving transparency, trust and security for stakeholders within the supply chain. Further, this research framework contributes to the theoretical advancement of the existing body of knowledge in blockchain technology adoption studies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Blockchain technology (BT), a distributed digital ledger technology that provides transparency, traceability, and security, has promised to ease global supply chain management problems. It also can improve supply chain transparency and traceability and reduce administrative costs (Kamble et al., 2019). Blockchain technology (BT) is a powerful tool to transform supply chain operations (Banerjee, 2018; Kshetri, 2018). The adoption of blockchain technology in supply chain operations may affect relative advantage, complexity, upper management support, cost, market dynamics, competitive pressure, and regulatory approval (Wong et al., 2020). The primary objective of any supply chain is to focus on cost, quality, speed, flexibility, and risk reduction (Kshetri, 2018). Several organizations are showing interest in adopting blockchain technology in their supply chain operations as it encourages collaboration and reduces trust issues in supply chain operations (Aslam et al., 2021; Lim et al., 2021; Longo et al., 2019).

SCM includes the flow from raw materials manufacturing to the distribution of goods to the consumers. The transactions in the flow need to be recorded and shared with all the players involved in the SC’s process to enable transparency in the system. Blockchain technology (BT) can help manage these transactions, enabling collaboration within the players, effective inventory management, and better utilization of available resources (Francisco & Swanson, 2018; Saberi et al., 2019; Tian, 2017; Gökalp et al., 2020a). Hence, adopting blockchain technology can help firms reduce overall logistics and operation costs (Francisco & Swanson, 2018). BT can also help disperse risk for firms. At present, SCM systems tend to be centralized. A centralized SCM system has several drawbacks (Monfared, 2016). For example, centralized systems may be more susceptible to being hacked, or damaged leaving firms vulnerable to having data stolen Hijazi et al., 2019; Mao et al., 2018; Dong et al., 2017). Blockchain technology reduces this risk.

According to PricewaterhouseCoopers (PwC) ‘Time for Trust’ report released in October 2020 suggests that BT provides solutions by furnishing information on provenance, traceability and tracking ($41 billion) in India in 2030. The draft paper on “Blockchain: The India strategy” released in January 2020 by NITI Aayog, India’s think tank on public policy making, stated that Blockchain technology (BT) reduces operational costs by delivering less government and more governance (NITI Aayog draft paper, January 2020). BT has therefore been identified as a disruptive technology.

Prior studies have discussed the challenges and benefits of BT within SCM (Queiroz & Fosso Wamba, 2019a); however, few studies exist which examine user acceptance of BT based SCM (Francisco & Swanson, 2018; Imeri & Khadraoui 2018; Sharma et al., 2020).(Gökalp et al., 2020a) utilized the technology-organization-environment perspective with a sample of 30 experts living in the UK and Turkey.(Kamble et al., 2019) also developed a model to understand the user perceptions of BT in supply chains based on three adoption theories TAM, TRI and TPB. However, research examining blockchain technology in supply chain management integration is still in an emerging phase (Babich & Hilary, 2020; Clohessy et al., 2019; Mathivathanan et al., 2021; Queiroz & Fosso Wamba, 2019a). Therefore, there is an opportunity to conduct further research that employs the TOE model and assesses the relative role of the TOE factors(Kouhizadeh et al., 2021). This study addresses the following research questions:

RQ1: What is the influence of technological, organizational, and environmental (TOE) factors on Blockchain technology adoption (BTA) within the supply chain management context?

RQ2: Which TOE factors are more strongly associated with blockchain technology adoption (BTA)?

This study employed structural equation modelling-SEM (Arbuckle and Wothke, 1999). SEM combines confirmatory factor analysis and path analysis (Anderson and Gerbing, 1998). CFA was used to assess the measurement of the latent psychological constructs (Garver and Mentzer, 1999). The structural (causal) relationships between the latent constructs were then examined (Anderson and Gerbing, 1998). The findings of this study will help industry decision-makers to understand various TOE factors that are influencing the adoption process. The results will also support the development of an effective implementation plan.

The remainder of this paper progresses as follows: the literature review is presented next, followed by the theoretical framework and hypothesis development. The following section is research methodology followed by data analysis, followed by discussion and the last section is the conclusion.

2 Theoretical framework and hypotheses development

2.1 Blockchain Technology Adoption (BTA) in Supply Chain Management (SCM)

Blockchain technology (BT) was introduced in a white paper on Bitcoin in the cryptocurrency market as a disrupting technology to process and verify data transactions based on a distributed peer to peer network (Nakamoto, 2008). BT can create value for businesses as the ‘internet of value’ replaces the ‘internet of information’ (Schlecht et al., 2021). BT has been identified as enhancing supply chain performance as it delivers real-time information sharing, transparency, reliability, cyber security, traceability, and visibility (Sunny et al., 2020; Aslam et al., 2021). BT helps integrate various SC functions such as recording, tracking, data sharing, and scalability (Helo & Hao, 2019; Perboli et al., 2018; Schmidt & Wagner, 2019). In addition, blockchain technology adoption (BTA) provides authentic information to all its stakeholders in the network resulting in immutability, security and subsequently increased client satisfaction (Risius & Spohrer, 2017; Wang et al., 2019). This is important since SCM firms expect reliable data (Korpela et al., 2017). BT, therefore, can enhance visibility and business process management in supply chains (Dutta et al., 2020; Dinh et al., 2018). Table 1 summarises the literature on adopting blockchain technology in supply chains.

2.2 Theoretical framework

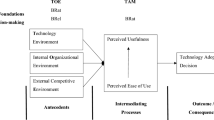

Several theoretical frameworks have been utilized to examine the adoption of new technologies, including the technology acceptance model (TAM) (Davis, 1989; Davis et al., 1989), the theory of planned behavior (TPB) (Ajzen, 1991), the unified theory of acceptance, the use of technology model (UTAUT)(Venkatesh et al., 2003) and the theory of reasoned action (TRA) (Ajzen & Fishbein, 1975). However, rational choice models are often criticized for being practical, technologically deterministic and techno-centric in their predictions resulting in the technology, as opposed to the users and firms determining adoption. This study adopts the technology, organisation and environment model (TOE) proposed by DePietro et al., (1990) as a way to explore firm choice in embracing innovations. The TOE framework has been identified as the model which delivers a more holistic assessment of the factors determining adoption. It has also been identified as an effective model to examine the value creation and innovation acceptance (Gangwar et al., 2015; Senyo et al., 2016). The TOE framework is also argued to provide higher quality insights based on firms’ outer and inner dynamics (Tornatzky et al., 1990). It has been widely applied to existing innovations such as the internet of things (Hsu & Yeh, 2017), cloud computing (CC) (Gangwar et al., 2015), and RFID (Wang et al., 2010). Therefore, there is an opportunity to expand the application of the TOE framework to BTA within SCM. Table 2 outlines the TOE dimensions employed in this study (Fig. 1).

2.3 Hypotheses development

The current study develops a model which identifies the various components of technology, organizational, and environmental perspectives for BTA within SCM. Thus, the model enables an exploration of technology development, organizational conditions, configuration, and the industry environment when assessing the adoption and use of BTM in SCM.

2.3.1 Technological Perspective

The technological dimension of the TOE model refers to the pool of internal and external technologies to the firm and their perceived usefulness, compatibility, complexity, and usage. The TP dimension provides an opportunity to examine the extraneous and in-house technologies that influence BT’s adoption in SCM of a firm. It considers the selection and decision making concerning the adoption of software, networks, hardware and how they are adjusted in a compelling way to accomplish the accepted procedures of BTA (Aslam et al., 2021). To date, there has been limited research on the technological attribute for adopting BT in SCM. As such, we identify the TP dimension in BT as including Relative advantage (RA), Trust (T), Compatibility (COM) and Scalability (SC).

2.3.1.1 Relative advantage (RA)

RA refers to the enhancement of performance and productivity of SCM by BTA. As per (Tipmontian et al., 2020, BT improves SCM efficiency, product process, and quality. This technology offers better transparency with the process of SCM (Francisco & Swanson, 2018; Gokalp et al., 2019; Helo & Hao, 2019; Risius & Spohrer, 2017; Saberi et al., 2019; Wong et al., 2020; Yadav & Singh, 2020). RA can be defined as a determinant impacting a firms’ adoption of BT in SCM. Therefore, We propose that:

H1: Relative advantage has a significant positive effect on blockchain technology adoption (BTA) in SCM.

2.3.1.2 Trust (T)

Trust is defined as the cost-benefit trade-off concerning the risks related to technological adoption (Nam et al., 2020). Prior research suggests that components like security and privacy do not affect BT as they are its main features Alsetoohy et al., 2019a; Francisco & Swanson, 2018b; Isma’ili et al., 2016; Makena, 2013; Nuskiya, 2017; Shee et al., 2018). However, trust has been a significant contributor to TA (Kamble et al., 2019). Hence, it is considered an essential latent variable in the current study. We, therefore, posit that:

H2: Trust has a significant positive effect on blockchain technology adoption (BTA) in SCM.

2.3.1.3 Compatibility (COM)

Compatibility relates to the ability for the new technology to integrate with the adopter’s previous practices, existing qualities and present needs (Rogers, 1995). Compatibility is higher for new technologies where they are compatible with existing IT resources. As COM has been considered a significant determinant within SCM systems (Dutta et al., 2020; Koh et al., 2020; Sheel & Nath, 2019; Tan et al., 2018; Verhoeven et al., 2018; Yadav et al., 2020). We, therefore, identify it as a latent variable impacting firms’ adoption of BT in SCM as we propose that:

H3: Compatibility has a significant positive effect on blockchain technology adoption (BTA) in SCM.

2.3.1.4 Security (SC)

Security in the blockchain is a comprehensive plan for managing the risk in the blockchain networks to avoid the dangers of online attacks or fraud by ensuring trust in transactions. It works on the principles of cryptography, decentralization, and consensus. In supply chains, product information security can be improved using blockchain technology (Behnke & Janssen, 2020). BT extension and the cost involved in its extension is considered a complex and complicated task (Wang et al., 2016). Additional computational power for validating, processing and storing data is required. Increased BT size can slow transaction efficiency (Makhdoom et al., 2019). Hence, SC has been considered an indicator in the current study for BTA in SCM. We propose that:

H4: Security has a significant positive effect on blockchain technology adoption (BTA) in SCM.

2.3.2 Organizational perspective (OP)

The organisational perspective of the TOE framework refers to the resources and internal characteristics of the firm(Gide & Sandu, 2015), including intangible and tangible resources. Prior studies(Alsetoohy et al., 2019b; Damanpour, 2016; Gutierrez et al., 2015; Moch & Morse, 1977; Senyo et al., 2016b) have identified various components which are inclusive of OP. For this study, these are identified as the firms’ IT resources (FITR), higher authority support (HAS), firm size (FS), and monetary resources (MR).

2.3.2.1 Firm’s IT resources (FITR)

FITR refers to how the firms’ technical infrastructure displays readiness to adopt the new technology within the existing system. In BT, a duplicate copy of the transaction is stored in the IT storage system to efficiently support a database query and enable traceability of a product or service (Francisco & Swanson, 2018). Human resources play an essential role in BTA readiness given the requirement for advanced IT skills and technologically sound infrastructure (Grublješič & Jaklič, 2015). We, therefore, consider FITR as an important latent variable in the current study. Hence, the proposed hypothesis is:

H5: The firm’s IT resources positively affect blockchain technology adoption (BTA) in SCM.

2.3.2.2 Higher authority support (HAS)

Higher authority support (HAS) has a significant role in accepting and implementing new technologies in a firm. HAS individuals, if aware of the benefits of BTA in SCM, can support the transition to the latest technology by creating a positive climate within the firm (Alsetoohy et al., 2019; Dutta et al., 2020; Isma’ili et al., 2016; Makena, 2013; Nam et al., 2020). Given that BTA requires allocating human and financial resources, integrating BT with existing IT infrastructures, and BPR in client and supplier relationship management (Alshamaila, Papagiannidis, Li, et al., 2013), HAS is essential to adoption success. We posit that:

H6: Higher authority support significantly affects blockchain technology adoption (BTA) in SCM.

2.3.2.3 Firm size (FS)

As the firm’s size increases, the capability of risk handling and paybacks also develops. Prior studies (Alshamaila et al., 2013; Low et al., 2011; Makena & Kenyatta 2013; Oliveira & Martins, n.d.; Tornatzky & Klein 1982) have identified FS as an essential factor for the adoption of innovations. Hence, larger firms are more interested in adopting new and advanced technologies than smaller firms (Senyo et al., 2016). (Pan & Jang, 2008; Zhu et al., 2011) have stated that larger firms have better readiness in adopting innovations as they are better able to adjust to risk than smaller firms. Hence, FS is considered a latent variable in the current study. We propose that:

H7: Firm size has a significant positive effect on blockchain technology adoption (BTA) in SCM.

2.3.2.4 Monetary resources (MR)

When a higher monetary amount is allocated in a firm to initiate and maintain changes technologically, it helps build a competitive advantage in the market for a longer time (Clohessy et al., 2019; Kumar & Krishnamoorthy, 2020; Maroufkhani et al., 2020). MR are critical to successful adoption, especially in BT (Al-Hujran et al., 2018; Alshamaila, Papagiannidis, Li, et al., 2013; Amini & Bakri, 2015; Mrhaouarh et al., 2018). Hence, MR has been considered a latent variable in the current study. Therefore, the proposed hypothesis is:

H8: Monetary resources positively affect SCM’s blockchain technology adoption (BTA).

2.3.3 Environmental perspective (EP)

EP refers to impacts arising from external sources of the firm. Various indicators have been identified in the study which relates to the EP factor, including rivalry pressure (RP), business partners pressure (BPP) and regulatory support (RS).

2.3.3.1 Rivalry pressure (RP)

RP refers to the competition the firms face from other competitive firms within the same industry (Gokalp et al., 2019; Tashkandi & Al-Jabri, 2015). RP is an essential factor impacting new technology adoption as per prior studies (Francisco & Swanson, 2018; Saberi et al., 2019; Dutta et al., 2020; Kamble et al., 2019). BT offers more transparency and efficiency in SCM. Hence, RP has been considered a latent variable in the current study. We propose that:

H9: Rivalry Pressure positively affects SCM blockchain technology adoption (BTA).

2.3.3.2 Business partners’ pressure (BPP)

BPP refers to the pressure faced by firms from its business partners (Alharbi et al., 2016) and has a critical impact on advanced technology adoption (Alsetoohy et al., 2019a; Shee et al., 2018). Business partner collaboration is essential for maintaining trade relations, primarily where a dominant partner exists in the SC. BPP has been a critical factor in BTA in SCM in prior studies (Braunscheidel & Suresh, 2009; Francisco & Swanson, 2018; Saberi et al., 2019). Hence, we posit that:

H10: Business Partners’ Pressure positively affects the blockchain technology adoption (BTA) in SCM.

2.3.3.3 Regulatory Support (RS)

RS refers to the regulations and policies set by Government for monitoring and regulating industries for new technology usage. This is a fundamental factor impacting innovation diffusion. As BT is an emerging technology, regulations such as authority for digitalized records and access rights have not yet been established (Korpela et al., 2017.; Sharma et al., 2020). As a result, RS has been defined as a determinant impacting firms’ BTA in SCM. We propose that:

H11: Regulatory Support has a significant effect on blockchain technology adoption (BTA) in SCM.

3 Research Methodology

3.1 Data and sample

An online survey was used to collect the data (Lefever et al., 2007). The respondent’s indystry details were found on the company websites. This study selected only the supply chain professionals or the employees working in the supply chain department. The criteria for determining the respondents were based on educational qualification and experience in the field of supply chain and IT. The email id was obtained from the company websites or after contacting the HR department. An email regarding the consent for the study was emailed to the 1075 targeted respondents. A total of 525 supply chain professionals agreed to participate in the survey. Before sending the questionnaire to all the respondents, a pilot survey was carried out by sending 55 questionnaires to the supply chain professionals. The questionnaire was then sent to 525 supply chain professionals working in different industries such as healthcare, manufacturing, retail, textile, and food. Three hundred and fifteen responses from the supply chain professionals were received, indicating an acceptable response rate of 60% (Moss & Hendry, 2002). After the data cleaning process a total of two hundred eighty-seven responses were available for use in the final analysis. The companies selected for this study were listed on the national stock exchange and were limited to India. To preserve the anonymity of the participants, we have used a random sampling method.

3.2 Research instrument development

Scales were adapted from prior studies (Churchill et al., 1974; Nunnally, 1978). A 7-point Likert scale on an interval range from ‘strongly disagree’ to ‘strongly agree’ was developed for this study for measuring the items, as shown in Table 3. Six experienced academicians who were subject experts verified the questionnaire.

3.3 Common Method Bias (CMB)

CMB was assessed via Harman’s single factor test. Exploratory factor analysis was performed, and the results show that the first factor explained a maximum covariance of (15.209%), which is below the recommended value of 50% (Podsakoff et al., 2003).

4 Data Analysis

A four-step method was adopted to test the hypothesis and model. Firstly, reliability and validity were measured, followed by exploratory factor analysis (EFA) using SPSS 20.0. The measurement model was developed, and convergent validity, composite reliability, and discriminant validity were examined before the structural model was tested using AMOS 22.0.

4.1 Reliability and validity (Cronbach’s alpha)

Assessment of reliability helps examine the degree of internal consistency between variable measurement items and its freedom of error at any point in time (Kline, 2015). Cronbach’s alpha is used to measure the reliability of the data (Hair et al., 2014). The values should be greater than 0.70, i.e., the recommended level (Nunnally, 1994). Table 4 shows Cronbach’s alpha values for all the items.

4.2 Exploratory factor analysis

The Kaiser-Meyer-Olkin (KMO) was calculated at 0.802, greater than the 0.60 minimum level (Hair et al., 2012). All the factor loading values were greater than 0.5, the acceptance level (Hair et al., 2010). Table 5 shows the factor loading for the rotated component matrix.

4.3 Measurement model

The values of composite reliability and AVE are presented in Table 6. From Table 6, we can infer that all the composite reliability values are above the recommended value of 0.70, indicating good indicator reliability of the constructs. Further, we can also observe that all the AVE values are above the recommended value of 0.50 and satisfy the convergent validity (Fornell & Larcker, 1981).

Construct pairs were assessed and found to achieve discriminant validity(Fornell & Larcker, 1981) stringent tests. The results are presented in Table 7. The table shows that the square root of AVE shown bold is higher than the correlation between the constructs, indicating that all the constructs in Table 7 satisfied the discriminant validity and can be used to test the structural model.

Confirmatory factor analysis was performed. As indicated in Table 8, the model fit the data well. The χ2/df ratio value was 1.889, which is lower than the threshold value of 3 as suggested by (Byrne, 2010). The goodness of fit statistics indicated a good model fit.

4.4 Structural model

The blockchain technology adoption (BTA) model is shown in Fig. 2. The structural model has 11 unobserved latent factors and forty-seven observed variables. These 47 indicators act as the indicators of their respective underlying latent constructs. SEM was conducted using AMOS 22.0.

The researchers tested the hypotheses by conducting structural equation modelling (SEM) using AMOS 22.0, as shown in Fig. 2. It can be observed from Table 9 that all the constructs are found to be significant and support the hypotheses. The goodness of fit indices as reported in Table 10 was χ2 = 2658.439 with df = 1314, RMSEA = 0.054, IFI = 0.903, CFI = 0.911, TLI = 0.904, and GFI = 0.953, which were within the threshold values suggested by (Hu et al., 2009). For all the constructs in our model, the fit indices are acceptable. The results of the hypotheses are shown in Table 9. The acceptable model with standardised coefficients for the paths is shown in Fig. 2. We can infer from Table 9 that all the eleven study variables tested relationships in the final SEM model were statistically significant. The findings further report that the independent constructs explained 42% of the variance in blockchain technology adoption.

5 Discussion

The current study empirically examined the adoption of blockchain technology in the supply chain management of various firms. Prior studies were reviewed and proposed a model based on the TOE frameworkwas presented. Eleven hypotheses were submitted for testing the model, and all were significant.

The technological perspective comprises four factors: relative advantage, trust, compatibility, and security. The first hypothesis examined the impact of relative advantage on blockchain technology adoption in supply chain management. The importance of relative advantage on blockchain technology adoption in supply chain management was supported (β = 0.181, p = .000). Relative advantage is a critical component in prior IT-related studies (Alharbi et al., 2016; Alkhater et al., 2018; Amini & Bakri, 2015; Gangwar et al., 2014; Ghode et al., 2020; Gokalp et al., 2019), the adoption of cloud computing for healthcare organisations (Alharbi et al., 2016) and supply chain management among Malaysian SMEs (Wong et al., 2020).

The second hypothesis examined the impact of trust on blockchain technology adoption in supply chain management. Trust had a positive relationship with blockchain technology (β = 0.245, p = .000). Trust is a significant contributor in prior studies Alazab et al., 2021; Alkhater et al., 2018; Francisco & Swanson, 2018; Priyadarshinee et al., 2017).

The third hypothesis examined the impact of compatibility on blockchain technology adoption in supply chain management. Compatibility was found to have a moderate effect on blockchain technology adoption in supply chain management (β = 0.211, p = .000). Compatibility is a critical component in prior studies Alharbi et al., 2016; Alkhater et al., 2018; Amini & Bakri, 2015; Kumar & Krishnamoorthy, 2020; Makena, 2013) and particularly the adoption of cloud computing. However, it is non-significant in the manufacturing sector (Oliveira et al., 2014).

The fourth hypothesis examined the impact of security on blockchain technology adoption in supply chain management. The relationship between security and blockchain technology adoption in supply chain management was supported (β = 0.263, p = .000). This is in line with previous studies, which have found that security is a critical component in prior studies (Alkhater et al., 2018; Mrhaouarh et al., 2018; Priyadarshinee et al., 2017).

The organizational perspective consists of four factors: firm’s IT resources, higher authority support, firm size, and monetary resources. The fifth hypothesis examined the impact of a firm’s IT resources on blockchain technology adoption in supply chain management. A firm’s IT resources are an essential determinant of adoption (Gokalp et al., 2019). In the current study, the firm’s IT resources were positively related to blockchain technology adoption (β = 0.277, p = .000).

The sixth hypothesis examined the impact of higher authority support on blockchain technology adoption in supply chain management, and the relationship was supported (β = 0.412, p = .000) in the current study. Upper management support has been essential blockchain adoption in Malaysian SMEs’ operations and supply chain management(Wong et al., 2020).

The seventh hypothesis examined the impact of firm size on blockchain technology adoption in supply chain management. Firm size was supported as a moderate driver of adoption intis the study (β = 0.394, p = .000), supporting prior research which has found that size is a critical factor in the adoption of technology Clohessy et al., 2019; Gide & Sandu, 2015; Lin, 2014; Makena, 2013; Nuskiya, 2017; Skafi et al., 2020).

The eighth hypothesis examined the impact of monetary resources on blockchain technology adoption in supply chain management. Economic resources have been a critical component(Nam et al., 2020). Also, in the final structural model, the current study supported the financial resources and blockchain technology adoption in supply chain management (β = 0.321, p = .000). The environmental perspective consisted of three factors: rivalry pressure, business partners’ pressure, and regulatory support; all the three factors displayed positive relationships with adoption. Rivalry pressure has been a critical component in prior studies (Amini & Bakri, 2015; Gangwar et al., 2014; Kumar & Krishnamoorthy, 2020; Lin, 2014; Maroufkhani et al., 2020; Mrhaouarh et al., 2018). Competitive pressure has been found to influence blockchain adoption in operations and supply chain management among Malaysian SMEs (Wong et al., 2020a). The ninth hypothesis, which examined the impact of rivalry pressure on blockchain technology adoption in supply chain management, was supported (β = 0.371, p = .000) in the current study.

The tenth hypothesis examined the impact of business partners’ pressure on blockchain technology adoption in supply chain management. Business partners’ pressure has been a critical component in prior studies Alharbi et al., 2016; Cruz-Jesus et al., 2019; Gokalp et al., 2019; Haryanto et al., 2020; Kouhizadeh et al., 2021; Lin 2014; Senyo et al., 2016; Sharma et al., 2020; L.-W. Wong et al., 2020; Wong et al., 2020a). Trading partners pressure has been linked to blockchain adoption in both the USA and India (Wamba & Queiroz, 2020). This study supports prior research findings as BPP had a moderate impact upon adoption (β = 0.293, p = .000).

The final hypothesis examined the impact of regulatory support on blockchain technology adoption in supply chain management. In line with prior research, regulatory support was also identified as an essential driver of adoption (β = 0.343, p = .000) Amini & Bakri, 2015; Gide & Sandu, 2015; Gokalp et al., 2019; Maroufkhani et al., 2020; Oliveira et al., 2014; Senyo et al., 2016). This represents a departure from the findings of(Wong et al., 2020a), who found that regulatory support was not significant in blockchain adoption in operations and supply chain management among Malaysian SMEs.

6 Implications

6.1 Theoretical implications

The TOE framework has been used to examine many technological or innovation adoption models in the past Alazab et al., 2021; Clohessy et al., 2019; Dutta et al., 2020b; Ghode et al., 2020; Gokalp et al., 2019; Gökalp et al., 2020b; Kamble et al., 2019a; Koh et al., 2020; Kouhizadeh et al., 2021a; Makhdoom et al., 2019; Queiroz & Fosso Wamba, 2019a; Saberi et al., 2019b; Sheel & Nath, 2019; Supranee & Rotchanakitumnuai, 2017; Tan et al., 2018; Taufiq et al., 2018; Verhoeven et al., 2018; Wamba & Queiroz, 2020; L.-W. Wong et al., 2020; Yadav et al., 2020). Most of the literature on blockchain thus far is mainly in the form of a literature review(Hughes et al., 2019; Lu, 2019; Min, 2019; Queiroz & Fosso Wamba, 2019b). Some studies were found with some empirical evidence. However, these studies have been either rather narrow. They have either focused on a sole entity (Ying et al., 2018), they have been qualitative in natire (Wang et al., 2020), and based upon the TAM (Kamble et al., 2019) or they have utilised UTAUT theoretical frameworks (Fosso Wamba et al., 2020; Francisco & Swanson, 2018). In addition many of the studies have explored blockchain adoption in operations and supply chain management within specific contexts such as Malaysian SMEs (Wong et al., 2020). To date, research has not examined TOE as applied to blockchain adoption. Hence this study provides a valuable contribution to the existing literature.

6.2 Managerial implications

This study will assist management in understanding, managing, and coordinating blockchain technology adoption in supply chains. The sample was drawn from a diverse range of industries, including healthcare, manufacturing, retail, textile, and food. This study found that higher authority support is critical for adopting emerging technologies such as blockchain technology in the supply chains. Top management should be aware of the benefits of implementing the latest technologies to support organisational transformation by eliminating resistance to change from the existing systems and assisting operations to function efficiently and effectively. Therefore, it is recommended that top management support and encourage staff to adopt the new technologies that allow flexibility and innovation. This can be achieved by creating a positive and supportive organisational culture, including fostering trust in the latest technology, which will support adoption.

Firm size, the second significant factor in this study, implies that as the company’s size increases, the ability to handle risks also increases. According to (MendlingJan et al., 2018), firm size is essential for adopting blockchain technologies. Hence, it is advised that larger organizations should consider the adoption of innovative technologies to gain a competitive advantage in the market. Rivalry pressure has been found to significantly impact the technology adoption process in the prior literature (Francisco & Swanson, 2018c; Gokalp et al., 2019).

In addition, this study also found that the firm’s IT resources have a direct influence on blockchain technology adoption. The extent to which firms are ready to adopt new innovative technologies within the existing infrastructure is necessary to support firm success. BT needs to be seamlessly integrated with existing resources. If the organisation and its staff perceive BT as compatible, they will be more likely to approach adoption. A positive organisational perspective on BT may also be created to develop a comprehensive plan for managing risk. This will assist the organisation in avoiding the dangers of online attacks or fraud by ensuring trust in transactions as it works on the principles of cryptography, decentralization, and consensus. Business partners should also have an integrated approach to adopting new technologies to increase operational efficiency within the supply chains among all the stakeholders. Relative advantage, was found to play an essential role in enhancing productivity and performance with the adoption of BT. Organisations will therefore benefit from the adoption of BT through improved operational efficiency in the overall supply chain.

7 Conclusion and Limitations

7.1 Conclusions

This study provides fruitful insights and empirical evidence for various firms to remove barriers and challenges for adopting blockchain technologyPrior research on BT has been criticized, including a small sample-sized limited industry analysis (Gökalp et al., 2020). This study provides robust insights into the adoption of BT by utilising a large sample size of respondents’ across multiple industry sectors. The responses for the current study are collected from various Indian industries like healthcare, manufacturing, retail, textile, and food increasing the generalisability of the identified factors within both diverse and developing countries. In addition, this research has established the validity of the relationships between constructs by employing a structural modeling approach. This empirical approach supports management decision making concerning the adoption of blockchain within organizations whilst also providing evidence-based approaches to enhance the efficiency of the firm.

7.2 Limitations and future research

There are certain limitations for the study, leading to future research in this area. In this study, we have compared responses given by various industries. Future studies may focus on a single sector to ascertain context specificity. Also, further research should examine the model within developing countries to understand the implications of this research.

Data availability statements

The data that support the findings of this study are available from the corresponding author upon request.

References

Abed, S. S. (2020). Social commerce adoption using TOE framework: An empirical investigation of Saudi Arabian SMEs. International Journal of Information Management, 53(March), 102118. https://doi.org/10.1016/j.ijinfomgt.2020.102118

Ahani, A., Rahim, N. Z. A., & Nilashi, M. (2017). Forecasting social CRM adoption in SMEs: A combined SEM-neural network method. Computers in Human Behavior, 75, 560–578. https://doi.org/10.1016/j.chb.2017.05.032

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-5978(91)90020-T

Ajzen, I., & Fishbein, M. (1975). A Bayesian analysis of attribution processes. Psychological Bulletin, 82(2), 261–277. https://doi.org/10.1037/H0076477

Alain, C. Y. L., & Ooi, K. B. (2008). Adoption of interorganizational system standards in supply chains: An empirical analysis of RosettaNet standards. Industrial Management & Data Systems, 108(4), 529–547. https://doi.org/10.1108/02635570810868371

Alazab, M., Alhyari, S., Awajan, A., & Abdallah, A. B. (2021). Blockchain technology in supply chain management: an empirical study of the factors affecting user adoption/acceptance. Cluster Computing, 24(1), 83–101. https://doi.org/10.1007/s10586-020-03200-4

Alharbi, F., Atkins, A., & Stanier, C. (2016). Understanding the determinants of Cloud Computing adoption in Saudi healthcare organisations. Complex & Intelligent Systems, 2(3), 155–171. https://doi.org/10.1007/s40747-016-0021-9

Al-Hujran, O., Al-Lozi, E. … A.-D.-I. J. of, M. (2018). & undefined. (2018). Challenges of cloud computing adoption from the TOE framework perspective. Igi-Global.Com, 14. https://doi.org/10.4018/IJEBR.2018070105

Alkhater, N., Walters, R., & Wills, G. (2018). An empirical study of factors influencing cloud adoption among private sector organisations. Telematics and Informatics, 35(1), 38–54. https://doi.org/10.1016/j.tele.2017.09.017

Alsetoohy, O., Ayoun, B., Arous, S., Megahed, F., & Nabil, G. (2019a). Intelligent agent technology: what affects its adoption in hotel food supply chain management? Journal of Hospitality and Tourism Technology, 10(3), 317–341. https://doi.org/10.1108/JHTT-01-2018-0005

Alsetoohy, O., Ayoun, B., Arous, S., Megahed, F., & Nabil, G. (2019b). Intelligent agent technology: what affects its adoption in hotel food supply chain management? Journal of Hospitality and Tourism Technology, 10(3), 317–341. https://doi.org/10.1108/JHTT-01-2018-0005

Alshamaila, Y., Papagiannidis, S., & Li, F. (2013). Cloud computing adoption by SMEs in the north east of England: A multi-perspective framework. Journal of Enterprise Information Management, 26(3), 250–275. https://doi.org/10.1108/17410391311325225

Alshamaila, Y., Papagiannidis, S., Li, F., Agostino, A., Søilen, K. S., Gerritsen, B. … Raj, J. R. (2013). The usage and adoption of cloud computing by small and medium businesses. International Journal of Computer Applications Technology and Research, 33(5), 861–874. https://doi.org/10.7753/ijcatr0205.1003

Amini, M., & Bakri, A. (2015). Cloud computing adoption by SMEs in the Malaysia: A multi-perspective framework based on DOI theory and TOE framework. Journal of Information Technology & Information Systems Research (JITISR), 9(2), 121–135

Aslam, J., Saleem, A., Khan, N. T., & Kim, Y. B. (2021). Factors influencing blockchain adoption in supply chain management practices: A study based on the oil industry. Journal of Innovation & Knowledge. https://doi.org/10.1016/j.jik.2021.01.002

Babich, V., & Hilary, G. (2020). Distributed ledgers and operations: What operations management researchers should know about blockchain technology. Manufacturing and Service Operations Management, 22(2), 223–240. https://doi.org/10.1287/MSOM.2018.0752

Banerjee, A. (2018). Blockchain Technology: Supply Chain Insights from ERP. In Advances in Computers (Vol. 111, pp. 69–98). Academic Press Inc. https://doi.org/10.1016/bs.adcom.2018.03.007

Behnke, K., & Janssen, M. F. W. H. A. (2020). Boundary conditions for traceability in food supply chains using blockchain technology. International Journal of Information Management, 52, 101969. https://doi.org/10.1016/J.IJINFOMGT.2019.05.025

Braunscheidel, M. J., & Suresh, N. C. (2009). The organizational antecedents of a firm’s supply chain agility for risk mitigation and response. Journal of Operations Management, 27(2), 119–140. https://doi.org/10.1016/J.JOM.2008.09.006

Byrne, B. M. (2010). Structural equation modeling with AMOS: basic concepts, applications, and programming (multivariate applications series) (396 vol., p. 7384). Taylor & Francis Group

Churchill, G. A., Ford, N. M., & Walker, O. C. (1974). Measuring the Job Satisfaction of Industrial Salesmen. Journal of Marketing Research, 11(3), 254–260. https://doi.org/10.1177/002224377401100303

Clohessy, T., Acton, T., & Rogers, N. (2019). Blockchain Adoption: Technological, Organisational and Environmental Considerations. Business Transformation through Blockchain, 47–76. https://doi.org/10.1007/978-3-319-98911-2_2

Cruz-Jesus, F., Pinheiro, A., & Oliveira, T. (2019). Understanding CRM adoption stages: empirical analysis building on the TOE framework. Computers in Industry, 109, 1–13. https://doi.org/10.1016/j.compind.2019.03.007

Damanpour, F. (2016). The Adoption of Technological, Administrative, and Ancillary Innovations: Impact of Organizational Factors: Https://Doi.Org/10.1177/014920638701300408, 13(4), 675?688. https://doi.org/10.1177/014920638701300408

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly: Management Information Systems, 13(3), 319–339. https://doi.org/10.2307/249008

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Management Science, 35(8), 982–1003. https://doi.org/10.1287/MNSC.35.8.982

DePietro, R., Wiarda, E., & Fleischer, M. (1990). “The context for change: organization, technology and environment”. In L. G. Tornatzky, & M. Fleischer (Eds.), The Process of Technological Innovation (pp. 151–175). Lexington, MA: Lexington Books

Dutta, P., Choi, T. M., Somani, S., & Butala, R. (2020). Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transportation Research Part E: Logistics and Transportation Review, 142, 102067. https://doi.org/10.1016/j.tre.2020.102067

Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104

Fosso Wamba, S., Queiroz, M. M., & Trinchera, L. (2020). Dynamics between blockchain adoption determinants and supply chain performance: An empirical investigation. International Journal of Production Economics, 229(September 2019), 107791. https://doi.org/10.1016/j.ijpe.2020.107791

Francisco, K., & Swanson, D. (2018a). The Supply Chain Has No Clothes: Technology Adoption of Blockchain for Supply Chain Transparency. Logistics, 2(1), 2. https://doi.org/10.3390/logistics2010002

Francisco, K., & Swanson, D. (2018b). The Supply Chain Has No Clothes: Technology Adoption of Blockchain for Supply Chain Transparency. Logistics, 2(1), 2. https://doi.org/10.3390/logistics2010002

Francisco, K., & Swanson, D. (2018c). The Supply Chain Has No Clothes: Technology Adoption of Blockchain for Supply Chain Transparency. Logistics, 2(1), 2. https://doi.org/10.3390/logistics2010002

Gangwar, H., Date, H., & Ramaswamy, R. (2015). Understanding determinants of cloud computing adoption using an integrated TAM-TOE model. Journal of Enterprise Information Management, 28(1), 107–130. https://doi.org/10.1108/JEIM-08-2013-0065

Gangwar, H., Date, H., & Raoot, A. D. (2014). Review on IT adoption: insights from recent technologies. Journal of Enterprise Information Management, 27(4), 488–502. https://doi.org/10.1108/JEIM-08-2012-0047

Ghobakhloo, M., Arias-Aranda, D., & Benitez-Amado, J. (2011). Adoption of e-commerce applications in SMEs. Industrial Management & Data Systems, 111(8), 1238–1269. https://doi.org/10.1108/02635571111170785

Ghode, D., Yadav, V., Jain, R., & Soni, G. (2020). Adoption of blockchain in supply chain: an analysis of influencing factors. Journal of Enterprise Information Management, 33(3), 437–456. https://doi.org/10.1108/JEIM-07-2019-0186

Gide, E., & Sandu, R. (2015). A Study to Explore the Key Factors Impacting on Cloud Based Service Adoption in Indian SMEs. Proceedings – 12th IEEE International Conference on E-Business Engineering, ICEBE 2015, 387–392. https://doi.org/10.1109/ICEBE.2015.72

Gokalp, E., Coban, S., & Gokalp, M. O. (2019). Acceptance of Blockchain Based Supply Chain Management System: Research Model Proposal [Blokzincir Tabanli Tedarik Zinciri Yönetimi Sistemi Kabulü: Arastirma Modeli Önerisi]. 1st International Informatics and Software Engineering Conference: Innovative Technologies for Digital Transformation, IISEC 2019 - Proceedings

Gökalp, E., Gökalp, M. O., & Çoban, S. (2020). Blockchain-Based Supply Chain Management: Understanding the Determinants of Adoption in the Context of Organizations. Information Systems Management, 1–22. https://doi.org/10.1080/10580530.2020.1812014

Grublješič, T., & Jaklič, J. (2015). Business Intelligence Acceptance: The Prominence of Organizational Factors. Http://Dx.Doi.Org/10.1080/10580530.2015.1080000, 32(4), 299–315. https://doi.org/10.1080/10580530.2015.1080000

Gutierrez, A., Boukrami, E., & Lumsden, R. (2015). Technological, organisational and environmental factors influencing managers’ decision to adopt cloud computing in the UK. Journal of Enterprise Information Management, 28(6), 788–807. https://doi.org/10.1108/JEIM-01-2015-0001

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2010). Multivariate Data Analysis (7th ed.). Upper Saddle River, NJ: Prentice Hall

Hair, J. F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. In European Business Review (Vol. 26, Issue 2, pp. 106–121). Emerald Group Publishing Ltd. https://doi.org/10.1108/EBR-10-2013-0128

Hair, J. F., Sarstedt, M., Ringle, C. M., & Mena, J. A. (2012). An assessment of the use of partial least squares structural equation modeling in marketing research. Journal of the Academy of Marketing Science, 40(3), 414–433. https://doi.org/10.1007/s11747-011-0261-6

Haryanto, B., Gandhi, A., & Giri Sucahyo, Y. (2020, November 3). The Determinant Factors in Utilizing Electronic Signature Using the TAM and TOE Framework. 2020 5th International Conference on Informatics and Computing, ICIC 2020. https://doi.org/10.1109/ICIC50835.2020.9288623

Helo, P., & Hao, Y. (2019). Blockchains in operations and supply chains: A model and reference implementation. Computers and Industrial Engineering, 136, 242–251. https://doi.org/10.1016/j.cie.2019.07.023

Hijazi, A. A., Perera, S., Alashwal, A. M., Alashwal, A. M., & Calheiros, R. N. (2019). Blockchain Adoption in Construction Supply Chain: A Review of Studies Across Multiple Sectors.CIB World Building Congress, June,17–21

Hooper, A. (2008). A multi-temporal InSAR method incorporating both persistent scatterer and small baseline approaches. Geophysical Research Letters, 35(16), https://doi.org/10.1029/2008GL034654

Hsu, C. W., & Yeh, C. C. (2017). Understanding the factors affecting the adoption of the Internet of Things. Technology Analysis and Strategic Management, 29(9), 1089–1102. https://doi.org/10.1080/09537325.2016.1269160

Hu, L., a, P. B.-S. equation modeling:, & 1999, undefined. (2009). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Taylor & Francis, 6(1), 1–55. https://doi.org/10.1080/10705519909540118

Hughes, L., Dwivedi, Y. K., Misra, S. K., Rana, N. P., Raghavan, V., & Akella, V. (2019). Blockchain research, practice and policy: Applications, benefits, limitations, emerging research themes and research agenda. International Journal of Information Management, 49, 114–129. https://doi.org/10.1016/j.ijinfomgt.2019.02.005

Imeri, A., & Khadraoui, D. (2018). The Security and Traceability of Shared Information in the Process of Transportation of Dangerous Goods. 2018 9th IFIP International Conference on New Technologies, Mobility and Security, NTMS 2018 - Proceedings, 2018-Janua, 1–5. https://doi.org/10.1109/NTMS.2018.8328751

Isma’ili, A., Li, M., Shen, J., & He, Q. (2016). Cloud computing adoption determinants: an analysis of Australian SMEs

Kamble, S., Gunasekaran, A., & Arha, H. (2019). Understanding the Blockchain technology adoption in supply chains-Indian context. International Journal of Production Research, 57(7), 2009–2033. https://doi.org/10.1080/00207543.2018.1518610

Kline, R. B. (2015). Principles and practice of structural equation modeling. Guilford publications

Koh, L., Dolgui, A., & Sarkis, J. (2020). Blockchain in transport and logistics ? paradigms and transitions. Https://Doi.Org/10.1080/00207543.2020.1736428, 58(7), 2054–2062. https://doi.org/10.1080/00207543.2020.1736428

Korpela, K., Hallikas, J., & Dahlberg, T. (2017). Digital Supply Chain Transformation toward Blockchain Integration. Proceedings of the 50th Hawaii International Conference on System Sciences (2017). https://doi.org/10.24251/HICSS.2017.506

Kouhizadeh, M., Saberi, S., & Sarkis, J. (2021). Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. International Journal of Production Economics, 231, 107831. https://doi.org/10.1016/j.ijpe.2020.107831

Kshetri, N. (2018). 1 Blockchain’s roles in meeting key supply chain management objectives. International Journal of Information Management, 39, 80–89. https://doi.org/10.1016/J.IJINFOMGT.2017.12.005

Kumar, A., & Krishnamoorthy, B. (2020). Business Analytics Adoption in Firms: A Qualitative Study Elaborating TOE Framework in India. International Journal of Global Business and Competitiveness, 15(2), 80–93. https://doi.org/10.1007/s42943-020-00013-5

Lefever, S., Dal, M., & Matthíasdóttir, Á. (2007). Online data collection in academic research: Advantages and limitations. British Journal of Educational Technology, 38(4), 574–582. https://doi.org/10.1111/J.1467-8535.2006.00638.X

Lim, M., Li, Y., Wang, C., & Engineering, M. T. C. (2021). & I., & U. (2021). A literature review of blockchain technology applications in supply chains: A comprehensive analysis of themes, methodologies and industries. Elsevier

Lin, H. F. (2014). Understanding the determinants of electronic supply chain management system adoption: Using the technology-organization-environment framework. Technological Forecasting and Social Change, 86, 80–92. https://doi.org/10.1016/j.techfore.2013.09.001

Lin, H. F., & Lin, S. M. (2008). Determinants of e-business diffusion: A test of the technology diffusion perspective. Technovation, 28(3), 135–145. https://doi.org/10.1016/J.TECHNOVATION.2007.10.003

Longo, F., Nicoletti, L., Padovano, A. … d’Atri, G. (2019). -C. & I., & U. (2019). Blockchain-enabled supply chain: An experimental study. Elsevier

Low, C., Chen, Y., & Wu, M. (2011). Understanding the determinants of cloud computing adoption. Industrial Management & Data Systems, 111(7), 1006–1023. https://doi.org/10.1108/02635571111161262

Lu, Y. (2019). The blockchain: State-of-the-art and research challenges. Journal of Industrial Information Integration, 15, 80–90. https://doi.org/10.1016/J.JII.2019.04.002

Luo, X., Li, H., Zhang, J., & Shim, J. P. (2010). Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decision Support Systems, 49(2), 222–234. https://doi.org/10.1016/J.DSS.2010.02.008

Makena, J. N. (2013). Factors That Affect Cloud Computing Adoption By Small And Medium Enterprises In Kenya. International Journal of Computer Applications Technology and Research, 2(5), 517–521. www.ijcat.com

Makhdoom, I., Abolhasan, M., Abbas, H., & Ni, W. (2019). Blockchain’s adoption in IoT: The challenges, and a way forward. Journal of Network and Computer Applications, 125(March 2018), 251–279. https://doi.org/10.1016/j.jnca.2018.10.019

Mao, D., Wang, F., Hao, Z., & Li, H. (2018). Credit evaluation system based on blockchain for multiple stakeholders in the food supply chain. International Journal of Environmental Research and Public Health, 15(8), https://doi.org/10.3390/ijerph15081627

Maroufkhani, P., Wan Ismail, W. K., & Ghobakhloo, M. (2020). Big data analytics adoption model for small and medium enterprises. Journal of Science and Technology Policy Management, 11(2), 171–201. https://doi.org/10.1108/JSTPM-02-2020-0018

Mathivathanan, D., Mathiyazhagan, K., Rana, N. P., Khorana, S., & Dwivedi, Y. K. (2021). Barriers to the adoption of blockchain technology in business supply chains: a total interpretive structural modelling (TISM) approach. International Journal of Production Research, 59(11), 3338–3359. https://doi.org/10.1080/00207543.2020.1868597

MendlingJan, W. I., van Der, A., Vom, B., CabanillasCristina, DanielFlorian, DeboisSøren, Di, C. … DumasMarlon, R. (2018). LeopoldHenrik, LeymannFrank, ReckerJan, ReichertManfred, … ZhuLiming. Blockchains for Business Process Management - Challenges and Opportunities. ACM Transactions on Management Information Systems (TMIS), 9(1). https://doi.org/10.1145/3183367

Min, H. (2019). Blockchain technology for enhancing supply chain resilience. Business Horizons, 62(1), 35–45. https://doi.org/10.1016/J.BUSHOR.2018.08.012

Moch, M. K., & Morse, E. (1977). Size, Centralization and Organizational Adoption of Innovations. American Sociological Review, 42(5), 716. https://doi.org/10.2307/2094861

Monfared, R. (2016). Blockchain ready manufacturing supply chain using distributed ledger. In Accepted to the International Journal of Research in Engineering and Technology-IJRET (Issue 09)

Moore, G. C., & Benbasat, I. (1991). Development of an instrument to measure the perceptions of adopting an information technology innovation. Information Systems Research, 2(3), 192–222. https://doi.org/10.1287/ISRE.2.3.192

Moss, J., & Hendry, G. (2002). Use of electronic surveys in course evaluation. British Journal of Educational Technology, 33(5), 583–592. https://doi.org/10.1111/1467-8535.00293

Mrhaouarh, I., Okar, C., Namir, A., & Chafiq, N. (2018). Cloud Computing adoption in developing countries: A systematic literature review. 2018 IEEE International Conference on Technology Management, Operations and Decisions, ICTMOD 2018, 73–79. https://doi.org/10.1109/ITMC.2018.8691295

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system.Decentralized Business Review,21260

Nam, K., Dutt, C. S., Chathoth, P., Daghfous, A., & Khan, M. S. (2020). The adoption of artificial intelligence and robotics in the hotel industry: prospects and challenges. Electronic Markets. https://doi.org/10.1007/s12525-020-00442-3

Nunnally, J. C. (1994). Psychometric theory 3E. Tata McGraw-hill education

Nunnally, J. C. (1978). and I. H. B. Psychometric Theory

Nuskiya, F. A. (2017). Factors Influencing Cloud Computing Adoption by SMEs in Eastern Region of Sri Lanka. Journal of Information Systems & Information Technology (JISIT), 2(1), 2478–0677

Oliveira, T., & Martins, M. F. (n.d.). Information Technology Adoption Models at Firm Level: Review of Literature

Oliveira, T., Thomas, M., & Espadanal, M. (2014). Assessing the determinants of cloud computing adoption: An analysis of the manufacturing and services sectors. Information and Management, 51(5), 497–510. https://doi.org/10.1016/j.im.2014.03.006

Pan, M. J., & Jang, W. Y. (2008). Determinants of the adoption of enterprise resource planning within the technology-organization-environment framework: Taiwan’s communications industry. Journal of Computer Information Systems, 48(3), 94–102. https://doi.org/10.1080/08874417.2008.11646025

Perboli, G., Musso, S., & Rosano, M. (2018). Blockchain in Logistics and Supply Chain: A Lean Approach for Designing Real-World Use Cases. Ieee Access : Practical Innovations, Open Solutions, 6, 62018–62028. https://doi.org/10.1109/ACCESS.2018.2875782

Premkumar, G., & Roberts, M. (1999). Adoption of new information technologies in rural small businesses. Omega, 27(4), 467–484. https://doi.org/10.1016/S0305-0483(98)00071-1

Priyadarshinee, P., Raut, R. D., Jha, M. K., & Gardas, B. B. (2017). Understanding and predicting the determinants of cloud computing adoption: A two staged hybrid SEM - Neural networks approach. Computers in Human Behavior, 76, 341–362. https://doi.org/10.1016/j.chb.2017.07.027

Priyadarshinee, P., Raut, R. D., Jha, M. K., & Kamble, S. S. (2017). A cloud computing adoption in Indian SMEs: Scale development and validation approach. Journal of High Technology Management Research, 28(2), 221–245. https://doi.org/10.1016/j.hitech.2017.10.010

Queiroz, M. M., & Fosso Wamba, S. (2019a). Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA. International Journal of Information Management, 46, 70–82. https://doi.org/10.1016/j.ijinfomgt.2018.11.021

Queiroz, M. M., & Fosso Wamba, S. (2019b). Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA. International Journal of Information Management, 46, 70–82. https://doi.org/10.1016/j.ijinfomgt.2018.11.021

Risius, M., & Spohrer, K. (2017). A Blockchain Research Framework: What We (don’t) Know, Where We Go from Here, and How We Will Get There. Business and Information Systems Engineering, 59(6), 385–409. https://doi.org/10.1007/s12599-017-0506-0

Rogers, E. M. (1995). Diffusion of Innovations: Modifications of a Model for Telecommunications. Die Diffusion von Innovationen in der Telekommunikation (pp. 25–38). Berlin Heidelberg: Springer. https://doi.org/10.1007/978-3-642-79868-9_2

Saberi, S., Kouhizadeh, M., Sarkis, J., & Shen, L. (2019). Blockchain technology and its relationships to sustainable supply chain management. International Journal of Production Research, 57(7), 2117–2135. https://doi.org/10.1080/00207543.2018.1533261

Schlecht, L., Schneider, S., & Buchwald, A. (2021). The prospective value creation potential of Blockchain in business models: A delphi study. Technological Forecasting and Social Change, 166, 120601. https://doi.org/10.1016/J.TECHFORE.2021.120601

Schmidt, C. G., & Wagner, S. M. (2019). Blockchain and supply chain relations: A transaction cost theory perspective. Journal of Purchasing and Supply Management, 25(4), 100552. https://doi.org/10.1016/j.pursup.2019.100552

Senyo, P. K., Effah, J., & Addae, E. (2016). Preliminary insight into cloud computing adoption in a developing country. Journal of Enterprise Information Management, 29(4), 505–524. https://doi.org/10.1108/JEIM-09-2014-0094

Sharma, M., Gupta, R., & Acharya, P. (2020). Prioritizing the Critical Factors of Cloud Computing Adoption Using Multi-criteria Decision-making Techniques. Article Global Business Review, 21(1), 142–161. https://doi.org/10.1177/0972150917741187

Shee, H., Miah, S. J., Fairfield, L., & Pujawan, N. (2018). The impact of cloud-enabled process integration on supply chain performance and firm sustainability: the moderating role of top management. Supply Chain Management, 23(6), 500–517. https://doi.org/10.1108/SCM-09-2017-0309/FULL/HTML

Sheel, A., & Nath, V. (2019). Effect of blockchain technology adoption on supply chain adaptability, agility, alignment and performance. Management Research Review, 42(12), 1353–1374. https://doi.org/10.1108/MRR-12-2018-0490

Skafi, M., Yunis, M. M., & Zekri, A. (2020). Factors influencing SMEs’ adoption of cloud computing services in Lebanon: An empirical analysis using TOE and contextual theory. Ieee Access : Practical Innovations, Open Solutions, 8, 79169–79181. https://doi.org/10.1109/ACCESS.2020.2987331

Supranee, S., & Rotchanakitumnuai, S. (2017). The acceptance of the application of blockchain technology in the supply chain process of the Thai automotive industry. Proceedings of the International Conference on Electronic Business (ICEB), 2017-Decem, 252–257

Tan, B., Yan, J., Chen, S., & Liu, X. (2018). The Impact of Blockchain on Food Supply Chain: The Case of Walmart. Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics), 11373 LNCS, 167–177. https://doi.org/10.1007/978-3-030-05764-0_18

Tashkandi, A. N., & Al-Jabri, I. M. (2015). Cloud computing adoption by higher education institutions in Saudi Arabia: an exploratory study. Cluster Computing 2015 18:4, 18(4), 1527–1537. https://doi.org/10.1007/S10586-015-0490-4

Taufiq, R., Meyliana, Hidayanto, A. N., & Prabowo, H. (2018). The Affecting Factors of Blockchain Technology Adoption of Payments Systems in Indonesia Banking Industry. Proceedings of 2018 International Conference on Information Management and Technology, ICIMTech 2018, September, 506–510. https://doi.org/10.1109/ICIMTech.2018.8528104

Tian, F. (2017, July 28). A supply chain traceability system for food safety based on HACCP, blockchain & internet of things. 14th International Conference on Services Systems and Services Management, ICSSSM 2017 - Proceedings. https://doi.org/10.1109/ICSSSM.2017.7996119

Tipmontian, A., & Rajmohan (2020). Impact of Blockchain Adoption for Safe Food Supply Chain Management through System Dynamics Approach from Management Perspectives in Thailand. Proceedings, 39(1), 14. https://doi.org/10.3390/proceedings2019039014

To, M. L., & Ngai, E. W. T. (2006). Predicting the organisational adoption of B2C e-commerce: an empirical study. Industrial Management & Data Systems, 106(8), 1133–1147. https://doi.org/10.1108/02635570610710791

Tornatzky, L. G., Fleischer, M., & Chakrabarti, A. K. (1990). processes of technological innovation. Lexington Books

Tornatzky, L. G., & Klein, K. J. (1982). INNOVATION CHARACTERISTICS AND INNOVATION ADOPTION-IMPLEMENTATION: A META-ANALYSIS OF FINDINGS. IEEE Transactions on Engineering Management, EM-29(1), 28–45. https://doi.org/10.1109/TEM.1982.6447463

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly: Management Information Systems, 27(3), 425–478. https://doi.org/10.2307/30036540

Verhoeven, P., Sinn, F., & Herden, T. T. (2018). Examples from Blockchain Implementations in Logistics and Supply Chain Management: Exploring the Mindful Use of a New Technology. Logistics 2018, 2(3), 20. https://doi.org/10.3390/LOGISTICS2030020. 2

Wamba, S. F., & Queiroz, M. M. (2020). Blockchain in the operations and supply chain management: Benefits, challenges and future research opportunities. In International Journal of Information Management (Vol. 52, p. 102064). Elsevier Ltd. https://doi.org/10.1016/j.ijinfomgt.2019.102064

Wang, H., Chen, K., & Xu, D. (2016). A maturity model for blockchain adoption. Financial Innovation 2016, 2:1(1), 1–5. https://doi.org/10.1186/S40854-016-0031-Z. 2

Wang, Y. M., Wang, Y. S., & Yang, Y. F. (2010). Understanding the determinants of RFID adoption in the manufacturing industry. Technological Forecasting and Social Change, 77(5), 803–815. https://doi.org/10.1016/j.techfore.2010.03.006

Wang, Z., Wang, T., Hu, H., Gong, J., Ren, X., & Xiao, Q. (2020). Blockchain-based framework for improving supply chain traceability and information sharing in precast construction. Automation in Construction, 111, 103063. https://doi.org/10.1016/j.autcon.2019.103063

Wong, L. W., Leong, L. Y., Hew, J. J., Tan, G. W. H., & Ooi, K. B. (2020). Time to seize the digital evolution: Adoption of blockchain in operations and supply chain management among Malaysian SMEs. International Journal of Information Management, 52, 101997. https://doi.org/10.1016/j.ijinfomgt.2019.08.005

Wong, L. W., Tan, G. W. H., Lee, V. H., Ooi, K. B., & Sohal, A. (2020). Unearthing the determinants of Blockchain adoption in supply chain management. International Journal of Production Research, 58(7), 2100–2123. https://doi.org/10.1080/00207543.2020.1730463

Wu, K., Zhao, Y., Zhu, Q., Tan, X., & Zheng, H. (2011). A meta-analysis of the impact of trust on technology acceptance model: Investigation of moderating influence of subject and context type. International Journal of Information Management, 31(6), 572–581. https://doi.org/10.1016/J.IJINFOMGT.2011.03.004

Yadav, S., & Singh, S. P. (2020). Blockchain critical success factors for sustainable supply chain. Resources Conservation and Recycling, 152, 104505. https://doi.org/10.1016/j.resconrec.2019.104505

Yadav, V. S., Singh, A. R., Raut, R. D., & Govindarajan, U. H. (2020). Blockchain technology adoption barriers in the Indian agricultural supply chain: an integrated approach. Resources Conservation and Recycling, 161, 104877. https://doi.org/10.1016/J.RESCONREC.2020.104877

Yap, C. S., Thong, J. Y. L., & Raman, K. S. (2017). Effect of government incentives on computerisation in small business. Https://Doi.Org/10.1057/Ejis.1994.20, 3(3), 191–206. https://doi.org/10.1057/EJIS.1994.20

Ying, W., Jia, S., & Du, W. (2018). Digital enablement of blockchain: Evidence from HNA group. International Journal of Information Management, 39, 1–4. https://doi.org/10.1016/J.IJINFOMGT.2017.10.004

Zhu, B., Jajodia, S., & Kankanhalli, M. S. (2006). Building trust in peer-to-peer systems: a review. International Journal of Security and Networks, 1(1–2), 103–112. https://doi.org/10.1504/IJSN.2006.010827

Zhu, W., Luo, C., Wang, J., & Li, S. (2011). Multimedia cloud computing. IEEE Signal Processing Magazine, 28(3), 59–69. https://doi.org/10.1109/MSP.2011.940269

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chittipaka, V., Kumar, S., Sivarajah, U. et al. Blockchain Technology for Supply Chains operating in emerging markets: an empirical examination of technology-organization-environment (TOE) framework. Ann Oper Res 327, 465–492 (2023). https://doi.org/10.1007/s10479-022-04801-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04801-5