Abstract

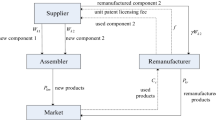

This paper studies remanufacturing cost disruption in a closed-loop supply chain consisting of a supplier, a manufacturer and a retailer. Specifically, the proposed work compares supplier–remanufacturing and manufacturer–remanufacturing modes with respect to equilibrium strategies and chain members’ profits, and analyzes the impacts of different disruption cases on each remanufacturing mode. Stackelberg game is applied to acquire equilibrium pricing decisions of each disruption case and it is found that the manufacturer–remanufacturing and supplier–remanufacturing modes have identical robustness. In manufacturer–remanufacturing mode, when the remanufacturing cost faces negative disruption, the manufacturer prefers to elevate the acquisition price and remanufacture more to improve profitability. In this case, the supplier will set a relatively lower wholesale price of components due to the marketing competition from the manufacturer, and the retailer can obtain more revenues. In supplier–remanufacturing mode, since the remanufactured components may cannibalize new component sales, the supplier will forgo some profits from new components in order to extract more profits from remanufacturing activities only if the negative disruption of remanufacturing cost is large enough. These results can provide a new insight into supplier–remanufacturing with cost disruption in a closed-loop supply chain.

Similar content being viewed by others

References

Ahmad, M. T., & Mondal, S. (2016). Dynamic supplier selection model under two-echelon supply network. Expert Systems with Applications, 65, 255–270. https://doi.org/10.1016/j.eswa.2016.08.043

Atasu, A., Guide, V. D. R., & Van Wassenhove, L. N. (2010). So what if remanufacturing cannibalizes my new product sales? California Management Review, 52(2), 56–76. https://doi.org/10.1525/cmr.2010.52.2.56

Atasu, A., Özdemir, Ö., & Van Wassenhove, L. N. (2013). Stakeholder perspectives on E-waste take-back legislation. Production and Operations Management, 22(2), 382–396. https://doi.org/10.1111/j.1937-5956.2012.01364.x

Bakal, I. S., & Akcali, E. (2006). Effects of random yield in remanufacturing with price-sensitive supply and demand. Production and Operations Management, 15(3), 407–420. https://doi.org/10.1111/j.1937-5956.2006.tb00254.x

Bhattacharya, S., Guide, V. D. R., & Wassenhove, L. N. (2006). Optimal order quantities with remanufacturing across new product generations. Production and Operations Management, 15(3), 421–431. https://doi.org/10.1111/j.1937-5956.2006.tb00255.x

Cai, K., He, S., & He, Z. (2018). Information sharing under different warranty policies with cost sharing in supply chains. International Transactions in Operational Research. https://doi.org/10.1111/itor.12597

Choi, T.-M., Li, Y., & Xu, L. (2013). Channel leadership, performance and coordination in closed loop supply chains. International Journal of Production Economics, 146(1), 371–380. https://doi.org/10.1016/j.ijpe.2013.08.002

De Giovanni, P., Reddy, P. V., & Zaccour, G. (2016). Incentive strategies for an optimal recovery program in a closed-loop supply chain. European Journal of Operational Research, 249(2), 605–617. https://doi.org/10.1016/j.ejor.2015.09.021

Demirel, S., Kapuscinski, R., & Yu, M. (2017). Strategic behavior of suppliers in the face of production disruptions. Management Science. https://doi.org/10.1287/mnsc.2016.2626

Elluru, S., Gupta, H., Kaur, H., & Singh, S. P. (2019). Proactive and reactive models for disaster resilient supply chain. Annals of Operations Research, 283, 199–224. https://doi.org/10.1007/s10479-017-2681-2

Esenduran, G., Kemahlıoğlu-Ziya, E., & Swaminathan, J. M. (2017). Impact of take-back regulation on the remanufacturing industry. Production and Operations Management. https://doi.org/10.1111/poms.12673

Gaur, J., Amini, M., & Rao, A. K. (2017). Closed-loop supply chain configuration for new and reconditioned products: An integrated optimization model. Omega, 66, 212–223. https://doi.org/10.1016/j.omega.2015.11.008

Gaur, J., Amini, M., & Rao, A. K. (2020). The impact of supply chain disruption on the closed-loop supply chain configuration profit: A study of sourcing policies. International Journal of Production Research, 58(17), 5380–5400. https://doi.org/10.1080/00207543.2019.1657244

Giri, B. C., & Sharma, S. (2016). Optimal production policy for a closed-loop hybrid system with uncertain demand and return under supply disruption. Journal of Cleaner Production, 112, 2015–2028. https://doi.org/10.1016/j.jclepro.2015.06.147

Golinska-Dawson, P. (2020). Logistics operations and management for recycling and reuse. Springer.

Govindan, K., Soleimani, H., & Kannan, D. (2015). Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. European Journal of Operational Research, 240(3), 603–626. https://doi.org/10.1016/j.ejor.2014.07.012

Guo, J., He, L., & Gen, M. (2019). Optimal strategies for the closed-loop supply chain with the consideration of supply disruption and subsidy policy. Computers and Industrial Engineering, 128, 886–893. https://doi.org/10.1016/j.cie.2018.10.029

Han, X., Wu, H., Yang, Q., & Shang, J. (2016). Collection channel and production decisions in a closed-loop supply chain with remanufacturing cost disruption. International Journal of Production Research, 55(4), 1147–1167. https://doi.org/10.1080/00207543.2016.1230684

Hosseini, S., Morshedlou, N., Ivanov, D., Sarder, M. D., Barker, K., & Khaled, A. A. (2019). Resilient supplier selection and optimal order allocation under disruption risks. International Journal of Production Economics, 213, 124–137. https://doi.org/10.1016/j.ijpe.2019.03.018

Huang, S., Yang, C., & Zhang, X. (2012). Pricing and production decisions in dual-channel supply chains with demand disruptions. Computers and Industrial Engineering, 62(1), 70–83. https://doi.org/10.1016/j.cie.2011.08.017

Huang, M., Song, M., Lee, L. H., & Ching, W. K. (2013). Analysis for strategy of closed-loop supply chain with dual recycling channel. International Journal of Production Economics, 144(2), 510–520. https://doi.org/10.1016/j.ijpe.2013.04.002

Kleber, R., Reimann, M., Souza, G. C., & Zhang, W. (2020). Two-sided competition with vertical differentiation in both acquisition and sales in remanufacturing. European Journal of Operational Research., 284, 572–587. https://doi.org/10.1016/j.ejor.2020.01.012

Li, X., & Li, Y. (2016). On the loss-averse dual-sourcing problem under supply disruption. Computers and Operations Research. https://doi.org/10.1016/j.cor.2016.12.011

Mardani, A., Kannan, D., Hooker, R. E., Ozkul, S., Alrasheedi, M., & Tirkolaee, E. B. (2020). Evaluation of green and sustainable supply chain management using structural equation modelling: A systematic review of the state of the art literature and recommendations for future research. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2019.119383

Minner, S., & Kiesmüller, G. P. (2012). Dynamic product acquisition in closed loop supply chains. International Journal of Production Research, 50(11), 2836–2851. https://doi.org/10.1080/00207543.2010.539280

Mishra, S., & Singh, S. P. (2020). Designing dynamic reverse logistics network for post-sale service. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03710-9

Mitra, S. (2016). Models to explore remanufacturing as a competitive strategy under duopoly. Omega, 59, 215–227. https://doi.org/10.1016/j.omega.2015.06.009

Mutha, A., Bansal, S., & Guide, V. D. R. (2016). Managing demand uncertainty through core acquisition in remanufacturing. Production and Operations Management, 25(8), 1449–1464. https://doi.org/10.1111/poms.12554

Örsdemir, A., Kemahlıoğlu-Ziya, E., & Parlaktürk, A. K. (2014). Competitive quality choice and remanufacturing. Production and Operations Management, 23(1), 48–64. https://doi.org/10.1111/poms.12040

Park, Y., Hong, P., & Roh, J. J. (2013). Supply chain lessons from the catastrophic natural disaster in Japan. Business Horizons, 56(1), 75–85. https://doi.org/10.1016/j.bushor.2012.09.008

Paul, S. K., Sarker, R., & Essam, D. (2017). A quantitative model for disruption mitigation in a supply chain. European Journal of Operational Research, 257(3), 881–895. https://doi.org/10.1016/j.ejor.2016.08.035

Pavlov, A., Ivanov, D., Werner, F., Dolgui, A., & Sokolov, B. (2019). Integrated detection of disruption scenarios, the ripple effect dispersal and recovery paths in supply chains. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03454-1

Reimann, M., Xiong, Y., & Zhou, Y. (2019). Managing a closed-loop supply chain with process innovation for remanufacturing. European Journal of Operational Research, 276(2), 510–518. https://doi.org/10.1016/j.ejor.2019.01.028

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252. https://doi.org/10.1287/mnsc.1030.0186

Sawik, T. (2014). Joint supplier selection and scheduling of customer orders under disruption risks: Single vs. dual sourcing. Omega, 43, 83–95. https://doi.org/10.1016/j.omega.2013.06.007

Schmitt, T. G., Kumar, S., Stecke, K. E., Glover, F. W., & Ehlen, M. A. (2017). Mitigating disruptions in a multi-echelon supply chain using adaptive ordering. Omega, 68, 185–198. https://doi.org/10.1016/j.omega.2016.07.004

Tirkolaee, E. B., Mahmoodkhani, J., Bourani, M. R., & Tavakkoli-Moghaddam, R. (2019). A self-learning particle swarm optimization for robust multi-echelon capacitated location–allocation–inventory problem. Journal of Advanced Manufacturing Systems, 18(4), 677–694. https://doi.org/10.1142/s0219686719500355

Wang, Y., & Yu, Y. (2020). Flexible strategies under supply disruption: The interplay between contingent sourcing and responsive pricing. International Journal of Production Research, 58(16), 4829–4850. https://doi.org/10.1080/00207543.2020.1722326

Wang, L., Cai, G. G., Tsay, A. A., & Vakharia, A. J. (2017). Design of the reverse channel for remanufacturing: Must profit-maximization harm the environment? Production and Operations Management. https://doi.org/10.1111/poms.12709

Wei, J., Govindan, K., Li, Y., & Zhao, J. (2015). Pricing and collecting decisions in a closed-loop supply chain with symmetric and asymmetric information. Computers & Operations Research, 54, 257–265. https://doi.org/10.1016/j.cor.2013.11.021

Wu, C.-H. (2012). Price and service competition between new and remanufactured products in a two-echelon supply chain. International Journal of Production Economics, 140(1), 496–507. https://doi.org/10.1016/j.ijpe.2012.06.034

Wu, C.-H., & Wu, H.-H. (2016). Competitive remanufacturing strategy and take-back decision with OEM remanufacturing. Computers and Industrial Engineering, 98, 149–163. https://doi.org/10.1016/j.cie.2016.05.033

Xiao, T., & Qi, X. (2008). Price competition, cost and demand disruptions and coordination of a supply chain with one manufacturer and two competing retailers. Omega, 36(5), 741–753. https://doi.org/10.1016/j.omega.2006.02.008

Xiong, Y., Zhou, Y., Li, G., Chan, H.-K., & Xiong, Z. (2013). Don’t forget your supplier when remanufacturing. European Journal of Operational Research, 230(1), 15–25. https://doi.org/10.1016/j.ejor.2013.03.034

Xiong, Y., Zhao, Q., & Zhou, Y. (2016). Manufacturer–remanufacturing vs supplier–remanufacturing in a closed-loop supply chain. International Journal of Production Economics, 176, 21–28. https://doi.org/10.1016/j.ijpe.2016.03.001

Zhang, W.-G., Fu, J., Li, H., & Xu, W. (2012). Coordination of supply chain with a revenue-sharing contract under demand disruptions when retailers compete. International Journal of Production Economics, 138(1), 68–75. https://doi.org/10.1016/j.ijpe.2012.03.001

Zhao, T. Z., & Peng, B. (2019). Research on complexity of Chinau 2019s manufacturing networks. Intelligent Automation and Soft Computing, 25(4), 725–733. https://doi.org/10.31209/2019.100000076

Zhou, L., Naim, M. M., & Disney, S. M. (2017). The impact of product returns and remanufacturing uncertainties on the dynamic performance of a multi-echelon closed-loop supply chain. International Journal of Production Economics, 183, 487–502. https://doi.org/10.1016/j.ijpe.2016.07.021

Acknowledgements

This research is supported by National Natural Science Foundation of China under Grant 72001147, Guangdong Planning Project of Philosophy and Social Science of China under Grant GD19YGL18 and the Startup Fund from Shenzhen University under Grants 2019023 and 860-000002110361.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Proposition 1

The second-order derivative of \(\Pi_{R}^{M}\) with respect to \(p\) is \(\partial^{2} \Pi_{R}^{M} /\partial p^{2} = - 2b < 0\), and thus \(\Pi_{R}^{M}\) is concave in \(p\). And the first-order derivative of the optimal price strategy can be solved as follows:

Taking the second-order partial derivatives of \(\Pi_{M}^{M}\) with respect to \(w_{n}\) and \(r\), the Hessian matrix is

It can be found that, \(\Pi_{M}^{M}\) is jointly concave in \(w_{n}\) and \(r\). And the first-order partial derivatives of \(\Pi_{M}^{M}\) with respect to \(w_{n}\) and \(r\) are in the following:

Afterward, taking the second-order derivative of \(\Pi_{S}^{M}\) with respect to \(w_{c}\), the equation \(\partial^{2} \Pi_{S}^{M} /\partial w_{c}^{2} = - 2b - 4v < 0\) can be obtained, thus \(\Pi_{S}^{M}\) is concave in \(w_{c}\). The optimal price strategy can be solved as:

1.2 Proof of Proposition 2

Taking the second-order derivative of \(\tilde{\Pi }_{R}^{MD}\) with respect to \(p\), it can be obtained by \(\partial^{2} \Pi_{R}^{MD} /\partial p^{2} = - 2b < 0\), thus \(\tilde{\Pi }_{R}^{MD}\) is concave in \(p\).

And the optimal price strategy can be solved as follows:

Assuming that \(q_{n} > q_{n}^{M*}\) and \(q_{r} > q_{r}^{M*}\), and taking the second-order partial derivatives of \(\tilde{\Pi }_{M}^{MD}\) with respect to \(w_{n}\) and \(r\), the Hessian matrix is given by

Since \(\partial^{2} \tilde{\Pi }_{M}^{MD} /\partial w_{n}^{2} = - 2b < 0\) and \(\left| {H_{M}^{MD} } \right| = 4bv > 0\), \(\tilde{\Pi }_{M}^{MD}\) is jointly concave in \(w_{n}\) and \(r\). Taking the first-order partial derivatives of \(\tilde{\Pi }_{M}^{MD}\) with respect to \(w_{n}\) and \(r\), and letting the derivative be zero, we have

Subsequently, taking the second-order derivative of \(\tilde{\Pi }_{S}^{MD}\) with respect to \(w_{c}\), it can be expressed that \(\partial^{2} \tilde{\Pi }_{S}^{MD} /\partial w_{c}^{2} = - 2b - 4v < 0\). Thus, \(\tilde{\Pi }_{S}^{MD}\) is concave in \(w_{c}\). Then the equilibrium results can be obtained by taking the first-order derivative of \(\tilde{\Pi }_{S}^{MD}\) with respect to \(w_{c}\).

And the proofs of other cases of \(q_{n}\) and \(q_{r}\) in Model MD are similar.

1.3 Proof of Proposition 3

The second-order derivative of \(\Pi_{R}^{S}\) with respect to \(p\) is \(\partial^{2} \Pi_{R}^{S} /\partial p^{2} = - 2b < 0\), and thus \(\Pi_{R}^{S}\) is concave in \(p\). And the first-order derivative of \(\Pi_{R}^{S}\) can be obtained as follows:

Then taking the second-order derivative of \(E(\Pi_{M}^{S} )\) with respect to \(w_{n}\), it can be obtained that \(\partial^{2} E(\Pi_{M}^{S} )/\partial w_{n}^{2} = - 2b < 0\). Therefore, \(E(\Pi_{M}^{S} )\) is concave in \(w_{n}\). And the optimal price strategy can be solved as:

Afterward, taking the second-order partial derivatives of \(\Pi_{S}^{S}\), the Hessian matrix of \(\Pi_{S}^{S}\) with respect to \(w_{c}\) and \(r\) is

Since \(\partial^{2} \Pi_{S}^{S} /\partial w_{c}^{2} = - 2b < 0\) and \(\left| {H_{S}^{S} } \right| = 4bv > 0\), \(\Pi_{S}^{S}\) is strictly concave in \(w_{c}\) and \(r\). Then, the first-order partial derivatives of \(\Pi_{S}^{S}\) with respect to \(w_{c}\) and \(r\) can be expressed as follows:

1.4 Proof of Proposition 4

The second-order derivative of \(\tilde{\Pi }_{R}^{SD}\) with respect to \(p\) is \(\partial^{2} \tilde{\Pi }_{R}^{SD} /\partial p^{2} = - 2b < 0\), thus \(\tilde{\Pi }_{R}^{SD}\) is concave in \(p\). And the optimal price strategy can be solved as follows:

Taking the second-order derivative of \(\tilde{\Pi }_{M}^{SD}\) with respect to \(w_{n}\), we can acquire \(\partial^{2} \tilde{\Pi }_{M}^{SD} /\partial w_{n}^{2} = - 2b < 0\). Therefore, \(\tilde{\Pi }_{M}^{SD}\) is concave in \(w_{c}\). And the optimal price strategy can be solved as:

Subsequently, assume that \(q_{n} > q_{n}^{S*}\) and \(q_{r} > q_{r}^{S*}\), and taking the second-order partial derivatives of \(\tilde{\Pi }_{S}^{SD}\) with respect to \(w_{c}\) and \(r\), the Hessian matrix is given by

Since \(\partial^{2} \tilde{\Pi }_{S}^{SD} /\partial w_{n}^{2} = - 2b < 0\) and \(\left| {H_{S}^{SD} } \right| = 4bv > 0\), \(\tilde{\Pi }_{S}^{SD}\) is jointly concave in \(w_{c}\) and \(r\).

And the proofs of other cases of \(q_{n}\) and \(q_{r}\) in Model SD are analogous.

1.5 Proof of Corollary 1

In Model MD, since \(\tilde{w}_{c}^{MD*(3)} = \frac{{a - bc_{n} + (b + 2v)c_{c} - 2vs_{1} - 2u}}{2b + 4v}\) and \(w_{c}^{M*} = \frac{{a - bc_{n} + (b + 2v)c_{c} - 2vs_{1} - 2u}}{2b + 4v}\), it can be obtained that \(\tilde{w}_{c}^{MD*(3)} = w_{c}^{M*}\).

Moreover, to prove \(\tilde{\Pi }_{M}^{MD*(3)} > \Pi_{M}^{M*}\), it has to show that

After simplification, this reduces to showing that \(\Delta c_{r} < 0\).

Therefore, it can be obtained that, if \(\Delta c_{r} < 0\), then \(\tilde{\Pi }_{M}^{MD*(3)} > \Pi_{M}^{M*}\).

And the proofs of the relationships of other prices, quantities and profits are analogous.

1.6 Proof of Corollary 2

Since \(\Delta c_{r} < - (1 + \frac{b}{2v})\lambda_{n2} - \lambda_{r1}\) holds in case 1, it can be obtained that

Meanwhile, as \(\Delta c_{r} > (1 + \frac{b}{2v})\lambda_{n1} + \lambda_{r2}\) is satisfied in case 5, it can be given by

Moreover, since \(\tilde{w}_{c}^{*(2)} = \tilde{w}_{c}^{*(3)} = \tilde{w}_{c}^{*(4)} = \frac{{a - bc_{n} - 2(u + vs_{1} ) + (b + 2v)c_{c} }}{2(b + 2v)}\),

Then we can get that \(\tilde{w}_{c}^{*(1)} < \tilde{w}_{c}^{*(2)} = \tilde{w}_{c}^{*(3)} = \tilde{w}_{c}^{*(4)} < \tilde{w}_{c}^{*(5)}\).

The proofs of the relationships of others prices, quantities and profits are analogous.

1.7 Proof of Corollary 3

As \(\Delta c_{r} > (1 + \frac{b}{2v})\lambda_{n1} + \lambda_{r2}\) holds in case 5, to prove \(\tilde{w}_{c}^{MD*} < \tilde{w}_{c}^{SD*}\), it has to examine that

After simplification, this reduces to showing that

Therefore, it can be obtained that if \(\Delta c_{r} < \frac{{v(a - bc_{n} ) + b(u + vs_{1} ) + (b + 2v)b\lambda_{n1} }}{bv} + \lambda_{r2}\) holds, then \(\tilde{w}_{c}^{MD*} < \tilde{w}_{c}^{SD*}\). And the proofs of the relationships of the prices, quantities and profits are analogous.

1.8 Proof of Corollary 4

If \(\Delta c_{r} > (1 + \frac{b}{2v})\lambda_{n1} + \lambda_{r2}\) is satisfied in case 5, it can be obtained that

Therefore, to prove \(\tilde{\Pi }_{R}^{MR*} > \tilde{\Pi }_{R}^{SR*}\), it has to show that

After simplification, this reduces to showing that

Moreover, as \(\Delta c_{r} > (1 + \frac{b}{2v})\lambda_{n1} + \lambda_{r2}\) is satisfies in case 5, we can get \(\tilde{\Pi }_{R}^{MR*} > \tilde{\Pi }_{R}^{SR*}\), when \((1 + \frac{b}{2v})\lambda_{n1} + \lambda_{r2} < \Delta c_{r} < \frac{{v(a - bc_{n} ) + b(u + vs_{1} )}}{bv} + \lambda_{r2}\) holds.

Similarly, the relationships of others prices, quantities and profits in Model MD and Model SD can be proved.

1.9 The equilibrium results in Model MD and Model SD

1. The equilibrium results in Model MD (Tables 8, 9).

2. The equilibrium results in Model SD (Tables 10, 11).

Rights and permissions

About this article

Cite this article

Huang, Y., Zheng, B. & Wang, Z. Supplier–remanufacturing and manufacturer–remanufacturing in a closed-loop supply chain with remanufacturing cost disruption. Ann Oper Res 324, 61–92 (2023). https://doi.org/10.1007/s10479-021-04230-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04230-w