Abstract

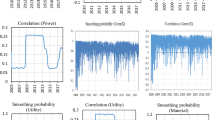

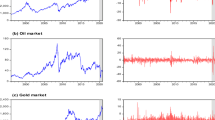

We study the tail dependence between crude oil and BRIC stock markets using a time-varying optimal copula (TVOC) approach. We show evidence of multiple tail dependence regimes, suggesting that simple static or dynamic copula specifications do not fully characterize the extreme dependence between oil and BRIC stock markets. The identified combinations of asymmetric and extreme positive lower tail dependence justify the application of the TVOC. Interestingly, the positive lower tail dependence between oil and stock markets and risk spillover from oil is higher for Brazil and Russia (oil exporters) than India and China (oil importers). Finally, we assess the effectiveness of hedging and measure the conditional diversification benefits of investing in oil for BRIC stock indices. Notably, the Chinese and Indian equity markets offer higher conditional diversification benefits when combined with oil in an equally weighted portfolio.

Similar content being viewed by others

Notes

Crude oil prices can also move international bond markets (e.g., Nazlioglu et al., 2020).

Brazil is considered a rising power in terms of economic growth and political influence beyond South America.

For example, Fang and Egan (2018) indicate that “investors holding a portfolio of oil and Chinese stocks should pay special attention to the extreme changes in crude oil prices and adopt hedging measures to protect their portfolio from extreme shocks to oil markets”.

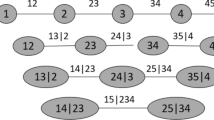

Some recent studies apply not only the common copulas but also half-rotated copulas in order to capture negative market dependence in extreme cases (e.g., Patton, 2012; Reboredo and Ugolini, 2015). However, the TVOC is more advantageous, as it combines all these copulas together to capture potential changes in the type of tail dependence between markets over time.

According to Liu et al. (2017), the Normal and Student-t copulas can capture both positive and negative dependence between markets.

The details of the distribution-free test can be seen in Liu et al. (2016).

References

Adrian, T., & Brunnermeier, M. K. (2016). CoVaR. The American Economic Review, 106(7), 1705–1741

Baillie, R. T., & Myers, R. J. (1991). Bivariate GARCH estimation of the optimal commodity futures hedge. Journal of Applied Econometrics, 6(2), 109–124

Basher, S. A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics, 54, 235–247

Batten, J. A., Kinateder, H., Szilagyi, P. G., Wagner, N. F. (2019). Hedging stocks with oil. Energy Economics, 104422.

Bildirici, M. E., & Badur, M. M. (2018). The effects of oil prices on confidence and stock return in China, India and Russia. Quantitative Finance and Economics, 2, 884–903

Boubaker, H., & Raza, S. A. (2017). A wavelet analysis of mean and volatility spillovers between oil and BRICS stock markets. Energy Economics, 64, 105–117

Bouri, E., & Demirer, R. (2016). On the volatility transmission between global oil and stock markets: A comparison of emerging importers and exporters. Economia Politica, 33(1), 63–82

Bouri, E., Chen, Q., Lien, D., & Lv, X. (2017). Causality between oil prices and the stock market in China: The relevance of the reformed oil product pricing mechanism. International Review of Economics & Finance, 48, 34–48

Bouri, E., Lien, D., Roubaud, D., & Shahzad, S. J. H. (2018). Directional predictability of implied volatility: From crude oil to developed and emerging stock markets. Finance Research Letters, 27, 65–79

Broadstock, D. C., Fan, Y., Ji, Q., & Zhang, D. (2016). Shocks and stocks: A bottom-up assessment of the relationship between oil prices, gasoline prices and the returns of Chinese firms. The Energy Journal, 37(1), 55–86

Broadstock, D. C., & Filis, G. (2014). Oil price shocks and stock market returns: New evidence from the United States and China. Journal of International Financial Markets, Institutions and Money, 33, 417–433

Cheema, M. A., & Scrimgeour, F. (2019). Oil prices and stock market anomalies. Energy Economics, 83, 578–587

Chen, Q., & Lv, X. (2015). The extreme-value dependence between the crude oil price and Chinese stock markets. International Review of Economics and Finance, 39, 121–132

Christoffersen, P., Jacobs, K., Jin, X., & Langlois, H. (2018). Dynamic dependence and diversification in corporate credit. Review of Finance, 22(2), 521–560

Creal, D., Koopman, S. J., Lucas, A. (2008). A general framework for observation driven time-varying parameter models. Tinbergen Institute Discussion Paper 08–108/4.

Degiannakis, S., Filis, G., Arora, V. (2018). Oil prices and stock markets: A review of the theory and empirical evidence. Energy Journal, 39(5).

Dogah, K. E., & Premaratne, G. (2018). Sectoral exposure of financial markets to oil risk factors in BRICS countries. Energy Economics, 76, 228–256

Fang, C. R., & You, S. Y. (2014). The impact of oil price shocks on the large emerging countries’ stock prices: Evidence from China, India and Russia. International Review of Economics and Finance, 29, 330–338

Fang, S., & Egan, P. (2018). Measuring contagion effects between crude oil and Chinese stock market sectors. The Quarterly Review of Economics and Finance, 68, 31–38

Global Economic Prospects: Weak investment in uncertain times. World Bank, January 2017.

Hamilton, J. D. (1983). Oil and the macroeconomy since World War II. Journal of Political Economy, 91(2), 228–248

Hansen, B. E. (1994). Autoregressive conditional density estimation. International Economic Review, 35, 705–730

Jammazi, R., Ferrer, R., Jareño, F., & Shahzad, S. J. H. (2017). Time-varying causality between crude oil and stock markets: What can we learn from a multiscale perspective? International Review of Economics & Finance, 49, 453–483

Ji, Q., Liu, B. Y., Zhao, W. L., Fan, Y. (2018). Modelling dynamic dependence and risk spillover between all oil price shocks and stock market returns in the BRICS. International Review of Financial Analysis, 101238.

Ji, Q., Bouri, E., & Roubaud, D. (2018). Dynamic network of implied volatility transmission among US equities, strategic commodities, and BRICS equities. International Review of Financial Analysis, 57, 1–12

Ji, Q., Zhang, D., & Zhao, Y. (2020). Searching for safe-haven assets during the COVID-19 pandemic. International Review of Financial Analysis, 71, 101526

Joe, H., & Xu, J. J. (1996). The estimation method of inference functions for the margins for multivariate models. Technical Report 166. Department of Statistics ,University of British Columbia.

Kroner, K. F., & Sultan, J. (1993). Time-varying distributions and dynamic hedging with foreign currency futures. Journal of Financial and Quantitative Analysis, 28(4), 535–551

Li, X., & Wei, Y. (2018). The dependence and risk spillover between crude oil market and China stock market: New evidence from a variational mode decomposition-based copula method. Energy Economics, 74, 565–581

Liu, B., Ji, Q., & Fan, Y. (2017). A new time-varying optimal copula model identifying the dependence across markets. Quantitative Finance, 17(3), 437–453

Liu, K., Luo, C., & Li, Z. (2019). Investigating the risk spillover from crude oil market to BRICS stock markets based on Copula-POT-CoVaR models. Quantitative Finance and Economics, 3(4), 754

Liu, C., Naeem, M. A., Rehman, M. U., Farid, S., & Shahzad, S. J. H. (2020). Oil as hedge, safe-haven, and diversifier for conventional currencies. Energies, 13(17), 4354

Luo, J., Ji, Q., Klein, T., Todorova, N., Zhang, D. (2020). On realized volatility of crude oil futures markets: Forecasting with exogenous predictors under structural breaks. Energy Economics, 104781.

Ma, Y., Zhang, Y., & Ji, Q. (2021). Do oil shocks affect Chinese bank risk? Energy Economics, 96, 105166

Nazlioglu, S., Gupta, R., & Bouri, E. (2020). Movements in international bond markets: The role of oil prices. International Review of Economics and Finance, 68, 47–58

Mensi, W., Hammoudeh, S., Shahzad, S. J. H., & Shahbaz, M. (2017). Modeling systemic risk and dependence structure between oil and stock markets using a variational mode decomposition-based copula method. Journal of Banking & Finance, 75, 258–279

Naeem, M. A., Balli, F., Shahzad, S. J. H., & de Bruin, A. (2020). Energy commodity uncertainties and the systematic risk of US industries. Energy Economics, 85, 104589

Naeem, M. A., Hasan, M., Arif, M., Balli, F., & Shahzad, S. J. H. (2020). Time and frequency domain quantile coherence of emerging stock markets with gold and oil prices. (p. 124235). Statistical Mechanics and Its Applications.

Patton, A. J. (2006). Modelling asymmetric exchange rate dependence. International Economic Review, 47, 527–556

Patton, A. J. (2012). A review of copula models for economic time series. Journal of Multivariate Analysis, 110, 4–18

Poon, S.-H., Rockinger, M., & Tawn, J. (2004). Extreme value dependence in financial markets: Diagnostics, models, and financial implications. Review of Financial Studies, 17(2), 581–610

Raza, N., Shahzad, S. J. H., Tiwari, A. K., & Shahbaz, M. (2016). Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Resources Policy, 49, 290–301

Reboredo, J. C., & Ugolini, A. (2015). Systemic risk in European sovereign debt markets: A CoVaR-copula approach. Journal of International Money and Finance, 29, 743–759

Shahzad, S. J. H., Mensi, W., Hammoudeh, S., Rehman, M. U., & Al-Yahyaee, K. H. (2018). Extreme dependence and risk spillovers between oil and Islamic stock markets. Emerging Markets Review, 34, 42–63

Sheng, X., Gupta, R., & Ji, Q. (2020). The impacts of structural oil shocks on macroeconomic uncertainty: Evidence from a large panel of 45 countries. Energy Economics, 91, 104940

Tiwari, A. K., Jena, S. K., Mitra, A., & Yoon, S. M. (2018). Impact of oil price risk on sectoral equity markets: Implications on portfolio management. Energy Economics, 72, 120–134

Tiwari, A. K., Trabelsi, N., Alqahtani, F., & Hammoudeh, S. (2019). Analysing systemic risk and time-frequency quantile dependence between crude oil prices and BRICS equity markets indices: A new look. Energy Economics, 83, 445–466

Wang, L., Ma, F., Niu, T., & He, C. (2020). Crude oil and BRICS stock markets under extreme shocks: New evidence. Economic Modelling, 86, 54–68

Wen, X., Wei, Y., & Huang, D. (2012). Measuring contagion between energy market and stock market during financial crisis: A copula approach. Energy Economics, 34, 1435–1446

Wen, X., Bouri, E., & Cheng, H. (2019). The Crude oil–stock market dependence and its determinants: Evidence from emerging economies. Emerging Markets Finance and Trade, 55(10), 2254–2274

You, W., Guo, Y., Zhu, H., & Tang, Y. (2017). Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Economics, 68, 1–18

Zhu, H. M., Li, R., & Li, S. (2014). Modelling dynamic dependence between crude oil prices and Asia-Pacific stock market returns. International Review of Economics & Finance, 29, 208–223

Zhu, H., Guo, Y., You, W., & Xu, Y. (2016). The heterogeneity dependence between crude oil price changes and industry stock market returns in China: Evidence from a quantile regression approach. Energy Economics, 55, 30–41

Zhu, Z., Ji, Q., Sun, L., Zhai, P. (2020). Oil price shocks, investor sentiment, and asset pricing anomalies in the oil and gas industry. International Review of Financial Analysis, 101516.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Shahzad, S.J.H., Bouri, E., Rehman, M.U. et al. Oil price risk exposure of BRIC stock markets and hedging effectiveness. Ann Oper Res 313, 145–170 (2022). https://doi.org/10.1007/s10479-021-04078-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04078-0