Abstract

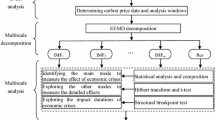

Unlike common financial markets, the European carbon market is a typically heterogeneous market, characterized by multiple timescales and affected by extreme events. The traditional Value-at-Risk (VaR) with single-timescale fails to deal with the multi-timescale characteristics and the effects of extreme events, which can result in the VaR overestimation for carbon market risk. To measure accurately the risk on the European carbon market, we propose an empirical mode decomposition (EMD) based multiscale VaR approach. Firstly, the EMD algorithm is utilized to decompose the carbon price return into several intrinsic mode functions (IMFs) with different timescales and a residue, which are modeled respectively using the ARMA–EGARCH model to obtain their conditional variances at different timescales. Furthermore, the Iterated Cumulative Sums of Squares algorithm is employed to determine the windows of an extreme event, so as to identify the IMFs influenced by an extreme event and conduct an exponentially weighted moving average on their conditional variations. Finally, the VaRs of various IMFs and the residue are estimated to reconstruct the overall VaR, the validity of which is verified later. Then, we illustrate the results by considering several European carbon futures contracts. Compared with the traditional VaR framework with single timescale, the proposed multiscale VaR–EMD model can effectively reduce the influences of the heterogeneous environments (such as the influences of extreme events), and obtain a more accurate overall risk measure on the European carbon market. By acquiring the distributions of carbon market risks at different timescales, the proposed multiscale VaR–EMD estimation is capable of understanding the fluctuation characteristics more comprehensively, which can provide new perspectives for exploring the evolution law of the risks on the European carbon market.

Similar content being viewed by others

References

Alberola, E., Chevallier, J., & Cheze, B. (2008). Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy, 36(2), 787–797.

Balcilar, M., Demirer, R., Hammoudeh, S., et al. (2016). Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energy Economics, 54, 159–172.

Boucher, C. M., Daníelssonc, J., Kouontchou, P. S., & Maillet, B. B. (2014). Risk models-at-risk. Journal of Banking & Finance, 44, 72–92.

Chevallier, J. (2013). Variance risk-premia in CO2 markets. Economic Modelling, 31, 598–605.

Dowd, K. (2005). Measuring market risk (2nd ed.). New York: Wiley.

Duffie, D., & Pan, J. (1997). An overview of value at risk. Journal of Derivatives, 4, 7–49.

Feng, Z. H., Wei, Y. M., & Wang, K. (2012). Estimating risk for the carbon market via extreme value theory: An empirical analysis of the EU ETS. Applied Energy, 99, 97–108.

Huang, N. E., Shen, Z., & Long, S. R. (1998). The empirical mode decomposition and the Hilbert spectrum for non-linear and non-stationary time series analysis. Proceedings of the Royal Society of London, 454, 903–995.

Iglesias, E. M. (2015). Value at Risk of the main stock market indexes in the European Union (2000–2012). Journal of Policy Modeling, 37, 1–13.

Inclan, C., & Tiao, G. C. (1994). Use of cumulative sums of squares for retrospective detection of changes of variance. Journal of the American Statistical Association, 89(427), 913–923.

Jiang, J. J., Ye, B., & Ma, X. M. (2015). Value-at-risk estimation of carbon spot markets based on an integrated GARCH–EVT–VaR model. Acta Scientiarum Naturalium Universitatis Pekinensis, 51(3), 511–517.

Jorion, P. (1997). Value at risk: The new benchmark for managing financial risk. New York: McGraw-Hill.

Karmakar, M., & Paul, S. (2016). Intraday Value-at-Risk and Expected Shortfall using high frequency data in International stock markets: A conditional EVT approach. International Review of Financial Analysis, 44(93), 34–55.

Kupiec, P. (1995). Techniques for verifying the accuracy of risk measurement models. Journal of Derivatives, 3, 73–84.

Lowry, C. A., Woodall, W. H., Champ, C. W., & Rigdon, S. E. (1992). A multivariate exponentially weighted moving average control chart. Technometrics, 34(1), 46–53.

Luo, C., & Wu, D. (2016). Environment and economic risk: An analysis of carbon emission market and portfolio management. Environmental Research, 149(5), 297–301.

Morgan, J. P. (1996). RiskMetrics technical document (4th ed). New York: Morgan Guaranty Trust Company.

Rilling, G., Flandrin, P., & Gonçalves, P. (2003). On empirical mode decomposition and its algorithms. In Proceedings of IEEE-EURASIP workshop on nonlinear signal and image processing NSIP-03, Grado.

Szegö, G. (2002). Measures of risk. Journal of Banking & Finance, 26, 1253–1272.

Tang, B. J., Gong, P. Q., & Shen, C. (2017). Factors of carbon price volatility in a comparative analysis of the EUA and sCER. Annals of Operations Research, 255(1–2), 157–168.

Wu, Z., & Huang, N. E. (2009). Ensemble empirical mode decomposition: A noise-assisted data analysis method. Advances in Adaptive Data Analysis, 1(1), 1–41.

Youssef, M., Belkacem, L., & Mokni, K. (2015). Value-at-risk estimation of energy commodities: A long-memory GARCH-EVT approach. Energy Economics, 51, 99–110.

Yu, L. A., Wang, Z. S., & Tang, L. (2015). A decomposition–ensemble model with data-characteristic-driven reconstruction for crude oil price forecasting. Applied Energy, 156, 251–267.

Zhang, Y. J., & Sun, Y. F. (2016). The dynamic volatility spillover between European carbon trading market and fossil energy market. Journal of Cleaner Production, 112, 2654–2663.

Zhang, Y. J., & Wei, Y. M. (2010). An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect. Applied Energy, 87(6), 1804–1814.

Zhu, B. Z., Ma, S. J., Chevallier, J., & Wei, Y. M. (2014a). Examining the structural changes of European carbon futures price 2005–2012. Applied Economics Letters, 21, 1381–1388.

Zhu, B. Z., Ma, S. J., Chevallier, J., & Wei, Y. M. (2014b). Modeling the dynamics of European carbon futures prices: A Zipf analysis. Economic Modelling, 38, 372–380.

Zhu, B., Shi, X., Chevallier, J., Wang, P., & Wei, Y. M. (2016). An adaptive multiscale ensemble learning paradigm for nonstationary and nonlinear energy price time series forecasting. Journal of Forecasting, 2, 633–651.

Zhu, B. Z., Wang, P., Chevallier, J., & Wei, Y. M. (2015). Carbon price analysis using empirical mode decomposition. Computational Economics, 45(2), 195–206.

Acknowledgements

Our heartfelt thanks should be given to the National Natural Science Foundation of China (NSFC) (71473180, 71671013, 71771105), Natural Science Foundation for Distinguished Young Talents of Guangdong (2014A030306031), and Humanities and Social Sciences Youth Foundation of Ministry of Education of China (No. 16YJC790026) for funding supports.

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Zhu, B., Ye, S., He, K. et al. Measuring the risk of European carbon market: an empirical mode decomposition-based value at risk approach. Ann Oper Res 281, 373–395 (2019). https://doi.org/10.1007/s10479-018-2982-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2982-0