Abstract

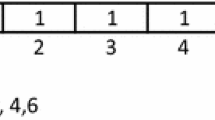

In credit card portfolio management, predicting the cardholder’s spending behavior is a key to reduce the risk of bankruptcy. Given a set of attributes for major aspects of credit cardholders and predefined classes for spending behaviors, this paper proposes a classification model by using multiple criteria linear programming to discover behavior patterns of credit cardholders. It shows a general classification model that can theoretically handle any class-size. Then, it focuses on a typical case where the cardholders’ behaviors are predefined as four classes. A dataset from a major US bank is used to demonstrate the applicability of the proposed method.

Similar content being viewed by others

References

Conover, W.J. (1999). Practical Nonparametric Statistics. Wiley.

“Debt Statistics,” http://www.nodebt.org/debt.htm.

“Enhancing human health through better decisions—from discovery through development to commercialization—and beyond”, SAS Institute Inc, http://www.sas.com/industry/pharma/.

Freed, N. and F. Glover. (1981). “Simple but Powerful Goal Programming Models for Discriminant Problems.” European Journal of Operational Research 7, 44–60.

Freed, N. and F. Glover. (1986), “Evaluating Alternative Linear Programming Models to Solve the Two-Group Discriminant Problem.” Decision Science 17, 151–162.

Han, J. and M. Kamber. (2001). Data Mining: Concepts and Techniques. Morgan Kaufmann Publishers.

Joachimsthaler, E.A. and A. Stam. (1988). “Four Approaches to the Classification Problems in Discriminant Analysis: An Experimental Study.” Decision Sciences 19, 322–333.

Koehler, G.J. and S.S. Erenguc. (1990). “Minimizing Misclassifications in Linear Discriminant Analysis.” Decision Science 21, 63–85.

Lin, Y. (2002). “Improvement on Behavior Scores by Dual-Model Scoring System.” International Journal of Information Technology and Decision Making 1, 153–164.

Miller, G.A. (1956). “The Magic Number seven, Plus or Minus Two.” The Psychological Review 63(2).

Peng, Y., Y. Shi, and W. Xu. (2002). “Classification for Three-group of Credit Cardholders’ Behavior Via A Multiple Criteria Approach.” Advanced Modeling and Optimization 4, 39–56.

Quinlan, J.R. (1986). “Induction of Decision Tree.” Machine Learning 1, 81–106.

Shi, Y. (2000). “Data Mining,” In M. Zeleny (ed), IEBM Handbook of Information Technology in Business. International Thomson Publishing, pp. 490–495.

Shi, Y. (2001b). Multiple Criteria Multiple Constraint-level Linear Programming: Concepts, Techniques and Applications. World Scientific Publishing.

Shi, Y., Y. Peng, W. Xu and X. Tang. (2002). “Data Mining via Multiple Criteria Linear Programming: Applications in Credit Card Portfolio Management.” International Journal of Information Technology and Decision Making 1, 131–151.

Shi, Y., M. Wise, M. Luo, and Y. Lin. (2001). “Data Mining in Credit card Portfolio Management: A Multiple Criteria Decision Making Approach.” In M. Koksalan and S. Zionts (eds.), Multiple Criteria Decision Making in the New Millennium. Berlin: Springer, pp. 427–436.

Shi, Y. and P.L. Yu (1989). “Goal Setting and Compromise Solutions,” In B. Karpak and S. Zionts (eds.), Multiple Criteria Decision Making and Risk Analysis Using Microcomputers. Berlin: Springer, pp. 165–203.

Stavins, J. (2000), “Credit Card Borrowing, Delinquency, and Personal Bankruptcy.” New England Economic Review, July/August 2000, http://www.bos.frb.org/economic/neer/neer2000/neer400b.pdf

“Survey on the Banking Sector’s Credit Card Receivables,” Hong Kong Monetary Authority, 2000, http://www.info.gov.hk/hkma/eng/press/2001/20010227e6.htm-annex.

“The First Credit Card was Issued in 1951.” http://www.didyouknow.cd/creditcards.htm.

www.fairi saac.com.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kou, G., Peng, Y., Shi, Y. et al. Discovering Credit Cardholders’ Behavior by Multiple Criteria Linear Programming. Ann Oper Res 135, 261–274 (2005). https://doi.org/10.1007/s10479-005-6245-5

Issue Date:

DOI: https://doi.org/10.1007/s10479-005-6245-5