Abstract

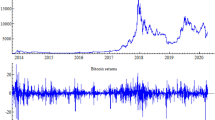

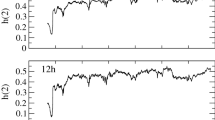

In this paper, we revisit the stylized facts of bitcoin markets and propose various approaches for modeling the dynamics governing the mean and variance processes. We first provide the statistical properties of our proposed models and study in detail their forecasting performance and adequacy by means of point and density forecasts. We adopt two loss functions and the model confidence set test to evaluate the predictive ability of the models and the likelihood ratio test to assess their adequacy. Our results confirm that bitcoin markets are characterized by regime shifting, long memory and multifractality. We find that the Markov switching multifractal and FIGARCH models outperform other GARCH-type models in forecasting bitcoin returns volatility. Furthermore, combined forecasts improve upon forecasts from individual models.

Similar content being viewed by others

Notes

Liu et al. (2007) find that assuming other base distributions, such as lognormal and gamma, makes little difference in empirical applications.

We note that the EGARCH process models the logarithm of the variance and enables positivity constraints on the model parameters to be relaxed. However, forecasts of conditional variances from the EGARCH model are the optimal least squares forecasts for logarithm volatility and biased, because by Jensen’s inequality \({{\,\mathrm{\mathbb {E}}\,}}(\sigma ^2_t)\ge \exp [{{\,\mathrm{\mathbb {E}}\,}}(\log \sigma ^2_t)]\).

The parameters \(\psi _i\) in the series expansion can be obtained via the following recursions \(\psi _1 = \phi - \beta + \tau d\) and \(\psi _i = \beta \psi _{i-1} + \left( \frac{i-1-d}{i}-\phi \right) \chi _{d,i-1}\) for \(i=2,\dots ,\infty \) where \(\chi _{d,i} = \chi _{d,i-1}\left( i-1-d\right) /i\) with \(\chi _{d,1}=\tau d\). We impose, however, a finite truncation at lag 1000 in the estimation procedures.

We refer the reader to Pesaran and Timmermann (2007) for more details on selection of an optimal window in the presence of breaks.

Financialisation implies that large changes of the prices and waves of high and low fluctuations might be caused by the trading process and might not necessarily reflect exogenous sources of uncertainty.

References

Aiolfi, M., Timmermann, A.: Persistence in forecasting performance and conditional combination strategies. J Econ 135, 31–53 (2006). https://doi.org/10.1016/j.jeconom.2005.07.015

Ardia, D., Bluteau, K., Rüede, M.: Regime changes in Bitcoin GARCH volatility dynamics. Finance Res Lett 29, 266–271 (2019)

Balcombe, K., Fraser, I.: Do bubbles have an explosive signature in markov switching models? Econ Model 66, 81–100 (2017)

Bariviera, A.F.: The inefficiency of Bitcoin revisited: a dynamic approach. Econ Lett 161, 1–4 (2017)

Bariviera, A.F., Basgall, M.J., Hasperué, W., Naiouf, M.: Some stylized facts of the Bitcoin market. Phys A Stat Mech Appl 484, 82–90 (2017)

Barndorff-Nielsen, O.E., Prause, K.: Apparent scaling. Finance Stoch 5, 103–113 (2001)

Bau, D.G., Dimpfl, T., Kuck, K.: Bitcoin, gold and the dollar–a replication and extension. Finance Res Lett 25, 103–110 (2018)

Begušić, S., Kostanjčar, Z., Stanley, H.E., Podobnik, B.: Scaling properties of extreme price fluctuations in Bitcoin markets. Phys A Stat Mech Appl 510, 400–406 (2018)

Beran J.: Statistics for Long-memory Processes: New York: Chapman and Hall (1994)

Berkowitz, J.: Testing density forecasts, with application to risk management. J Bus Econ Stat 12, 465–474 (2001)

Bollerslev, T.: Generalized autoregressive conditional heteroskedasticity. J Econ 31, 307–327 (1986)

Bollerslev, T., Engle, R.F., Nelson, D.: Handbook of Econometrics. In: ARCH models, vol. 4, pp. 2961–3038, Amsterdam: Elsevier Science BV (1994)

Bougerol, P., Picard, N.: Stationarity of GARCH processes and of some nonnegative time series. J Econ 52, 115–127 (1992)

Bouri, E., Azzi, G., Dyhrberg, A.H.: On the return-volatility relationship in the Bitcoin market around price crash of 2013. Economics 11, 1–17 (2017)

Calvet, L., Fisher, A.: Forecasting multifractal volatility. J Econ 105, 27–58 (2001)

Calvet, L., Fisher, A.: Regime-switching and the estimation of multifractal processes. J Financ Econ 2, 44–83 (2004)

Catania, L., Grassi, S.: Modelling crypto-currencies financial time-series. CEIS Research Paper 417, Tor Vergata University, CEIS (2017). https://ideas.repec.org/p/rtv/ceisrp/417.html

Chu, J., Chan, S., Nadarajah, S., Osterrieder, J.: GARCH modelling of cryptocurrencies. J Risk Financ Manage 10, 1–15 (2017)

Conrad, C.: Non-negativity conditions for the hyperbolic GARCH model. J Econ 157, 441–457 (2010)

Conrad, C., Haag, B.R.: Inequality constraints in the fractionally integrated GARCH model. J Financ Econ 4, 413–449 (2006)

Davidson, J.: Moment and memory properties of linear conditional heteroscedasticity models, and a new model. J Bus Econ Stat 22, 16–29 (2004)

Dickey, D.A., Fuller, W.A.: Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74, 427–431 (1979)

Diebold, F., Gunther, T., Tay, A.: Evaluating density forecasts with application to financial risk management. Int Econ Rev 39, 863–883 (1998)

Ding, Z., Granger, C., Engle, R.: A long memory property of stock market returns and a new model. J Empir Finance 1, 83–106 (1993)

Dowd, K.: A modified Berkowitz backtest. Risk 17, 86–87 (2004)

Glosten, L., Jagannathan, R., Runkle, D.E.: On the relation between the expected value and volatility of the nominal excess return on stocks. J Finance 46, 1779–1801 (1993)

Granger, C.W., Teräsvirta, T.: A simple nonlinear time series model with missleading linear properties. Econ Lett 62, 161–165 (1999)

Granger, C.W.J., Joyeux, R.: An introduction to long-memory time series models and fractional differencing. J Time Series Anal 1, 15–29 (1980)

Haas, M., Mittnik, S., Paolella, M.S.: A new approach to Markov-switching GARCH models. J Financ Econ 2, 493–530 (2004)

Hansen, P.R., Lunde, A., Nason, J.M.: The model confidence set. Econometrica 79, 453–497 (2011)

Harvey, D.I., Leybourne, S.J., Newbold, P.: Tests for forecast encompassing. J Bus Econ Stat 16, 254–259 (1998)

Hentschel, L.: All in the family nesting symmetric and asymmetric GARCH models. J Financ Econ 39, 71–104 (1995)

Hosking, J.R.: Fractional differencing. Biometrika 68, 165–176 (1981)

Kantelhardt, J.W., Zschiegner, S.A., Koscielny-Bunde, E., Havlin, S., Bunde, A., Stanley, H.E.: Multifractal detrented fluctuation analysis of nonstationary time series. Phys A 316, 87–114 (2002)

Katsiampa, P.: Volatility estimation for Bitcoin: a comparison of GARCH models. Econ Lett 158, 3–6 (2017)

Lahmiri, S., Bekiros, S.: Chaos, randomness and multi-fractality in Bitcoin market. Chaos Solitions Fractals 106, 28–34 (2018)

Lahmiri, S., Bekiros, S., Salvi, A.: Long-range memory, distribution variation and randomness of bitcoin voaltility. Chaos, Solitions Fractals 107, 43–48 (2018)

Ling, S.: On the probabilistic properties of a double threshold ARMA conditional heteroskedasticity model. J Appl Prob 36, 1–18 (1999)

Ling, S., Li, W.: On fractionally integrated autoregressive moving-average time series models with conditional heteroscedasticity. J Am Stat Assoc 92, 1184–1194 (1997)

Ling, S., McAleer, M.: Necessary and sufficient moment conditions for the GARCH(r, s) and asymmetric power GARCH(r, s) models. Econ Theory 18, 722–729 (2002)

Ling, S., McAleer, M.: Stationary and the existence of moments of a GARCH processes. J Econ 106, 109–117 (2002)

Liu, J.C.: Stationarity of a markov-switching GARCH model. J Financ Econ 4, 573–593 (2006)

Liu, R., di Matteo, T., Lux, T.: True and apparent scaling:the proximity of the Markov-switching multifractal model to long-range dependence. Phys A 383, 35–42 (2007)

Lux, T.: Detecting multi-fractal properties in asset returns. Int J Mod Phys 15, 481–491 (2004)

Lux, T.: The Markov-switching multifractal model of asset returns: GMM estimation and linear forecasting of volatility. J Bus Econ Stat 26, 194–210 (2008)

Lux, T., Morales-Arias, L.: Forecasting volatility under fractality, regime-switching, long memory and Student-\(t\) innovations. Comput Stat Data Anal 54, 2676–2692 (2010)

Lux, T., Segnon, M., Gupta, R.: Forecasting crude oil price volatility and value-at-risk: evidence from historical and recent data. Energy Econ 56, 117–133 (2016)

Nakamoto, S.: Bitcoin: A peer-to-peer electronic cash system. Prequel Books (2011). https://bitcoin.org/bitcoin.pdf

Nelson, D.B.: Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59, 347–370 (1991)

Osterrieder, J., Lorenz, J.: A statistical risk assessment of Bitcoin and its extreme tail behaviour. Ann Financ Econ 12, 175000 (2017)

Peng, C., Buldyrev, S., Havlin, S., Simons, M., Stanley, H., Goldberger, A.: Mosaic organization of DNA nucleotides. Phys. Rev. E 49, 1685–1689 (1994)

Pesaran, M.H., Timmermann, A.: Selection of estimation window in the presence of breaks. J Econ 137, 134–161 (2007)

Phillip, A., Chan, J.S.K., Shelton, P.: A new look at cryptocurrencies. Econ Lett 163, 6–9 (2018)

Pichl, L., Kaizoji, T.: Volatility analysis of bitcoin time series. Quant Finance Econ 1, 474–485 (2017)

Rosenblatt, R.F.: Remarks on a multivariate transformation. Ann Math Stat 23, 470–472 (1952)

Sansó, A., Arragó, V., Carrion, J.L.: Testing for change in the unconditional variance of financial time series. Rev de Econ Financ 4, 32–53 (2004)

Shiryaev, A.: Probability (Graduate Texts in Mathematics), 2nd edn. Springer, Verlag (1995)

Stavroyiannis, S.: Value-at-risk and related measures for the Bitcoin. J Risk Finance 19, 127–136 (2018)

Thies, S., Molnár, P.: Bayesian change point analysis of Bitcoin returns. Finance Res Lett 27, 223–227 (2018)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank an anonymous referee for many helpful comments. However, any remaining errors are solely ours.

Rights and permissions

About this article

Cite this article

Segnon, M., Bekiros, S. Forecasting volatility in bitcoin market. Ann Finance 16, 435–462 (2020). https://doi.org/10.1007/s10436-020-00368-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-020-00368-y