Abstract

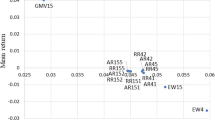

We study portfolio selections under mean-variance preference with multiple priors for means and variances. We introduce two types of multiple priors, the priors for means and the priors for variances of risky asset returns. As our framework, in the absence of a risk-free asset, the global minimum-variance portfolio is optimal when the investor is extremely ambiguity averse with respect to means, and the equally weighted portfolio is optimal when the investor is extremely ambiguity averse with respect to variances.

Similar content being viewed by others

Notes

We can exclude the case that the RHS of (25) converges to zero since \(C_M\), \(\eta ^\theta \), \(\eta ^V\), and \(\psi ^*\) are positive.

The author computes the performances with the other values of \(\alpha \), \(\alpha =0,\;0.01,\;0.5,\) and 1.0. However, the ad hoc portfolio with \(\alpha = 0.1\) has the best performance among all examined ad hoc portfolios, so we do not report the cases with \(\alpha \ne 0.1\).

References

Biagini, S., Pınar, M.Ç.: The robust Merton problem of an ambiguity averse investor. Math Financ Econ (2016). doi:10.1007/s11579-016-0168-6

Cass, D., Stiglitz, J.E.: The structure of investor preferences and asset returns, and separability in portfolio allocation: A contribution to the pure theory of mutual funds. J Econ Theory 2, 122–160 (1970)

Chen, Z., Epstein, L.G.: Ambiguity, risk, and asset returns in continuous time. Econometrica 70, 1403–1443 (2002)

Cochrane, J.H.: Macro-finance. https://faculty.chicagobooth.edu/john.cochrane/research/papers/habit_habit_clean.pdf (2016). Accessed 12 Sept 2016

DeMiguel, V., Garlappi, L., Uppal, R.: Optimal versus naive diversification: how inefficient is the \(1/N\) portfolio strategy? Rev Financ Stud 22, 1915–1953 (2009)

Ellsberg, D.: Risk, ambiguity, and the Savage axioms. Q J Econ 75, 643–669 (1961)

Epstein, L.G., Ji, S.: Ambiguous volatility and asset pricing in continuous time. Rev Financ Stud 26, 1740–1786 (2013)

Epstein, L.G., Schneider, M.: Ambiguity, information quality, and asset pricing. J Finance 63, 197–228 (2008)

Garlappi, L., Uppal, R., Wang, T.: Portfolio selection with parameter and model uncertainty: a multi-prior approach. Rev Financ Stud 20, 41–81 (2007)

Gilboa, I., Schmeidler, D.: Maxmin expected utility with non-unique prior. J Math Econ 18, 141–153 (1989)

Ju, N., Miao, J.: Ambiguity, learning, and asset returns. Econometrica 80, 559–591 (2012)

Kan, R., Wang, X., Zhou, G.: On the value of portfolio optimization in the presence of estimation risk: the case with and without risk-free asset. Rotman School of Management Working Paper No. 2819254 (2016)

Kan, R., Zhou, G.: Optimal portfolio choice with parameter uncertainty. J Financ Quant Anal 42, 621–656 (2007)

Kirby, C., Ostdiek, B.: It’s all in the timing: simple active portfolio strategies that outperform naïve diversification. J Financ Quant Anal 47, 437–467 (2012)

Klibanoff, P., Marinacci, M., Mukerji, S.: A smooth model of decision making under ambiguity. Econometrica 73, 1849–1892 (2005)

Ledoit, O., Wolf, M.: Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J Empir Financ 10, 603–621 (2003)

Liu, H.: Dynamic portfolio choice under ambiguity and regime switching mean returns. J Econ Dyn Control 35, 623–640 (2011)

Maccheroni, F., Marinacci, M., Ruffino, D.: Alpha as ambiguity: Robust mean-variance portfolio analysis. Econometrica 81, 1075–1113 (2013)

Merton, R.C.: An analytic derivation of the efficient portfolio frontier. J Financ Quant Anal 7, 1851–1872 (1972)

Merton, R.C.: An intertemporal capital asset pricing model. Econometrica 41, 867–887 (1973)

Peng, S.: G-expectation, G-Brownian motion and related stochastic calculus of itô type. In: Benth, F.E., DiNunno, G., Lindstrøm, T., Øksendal, B., Zhang, T. (eds.) Stochastic Analysis and Applications: The Abel Symposium 2005, pp. 541–567. Springer, Berlin (2007)

Pflug, G.C., Pichler, A., Wozabal, D.: The \(1/N\) investment strategy is optimal under high model ambiguity. J Bank Finance 36, 410–417 (2012)

Savage, L.J.: The Foundations of Statistics. Wiley, New York (1954)

Schmeidler, D.: Subjective probability and expected utility without additivity. Econometrica 57, 571–587 (1989)

Tobin, J.: Liquidity preference as behavior towards risk. Rev Econ Stud 25, 65–86 (1958)

Wozabal, D.: Robustifying convex risk measures for linear portfolios: a nonparametric approach. Oper Res 62, 1302–1315 (2014)

Acknowledgements

The author would like to express his gratitude to Masahiko Egami, Katsutoshi Wakai, and Chiaki Hara for their helpful suggestions in regard to this paper. The author is also grateful to Yuji Yamada and to the participants of the 24th annual meeting of the Nihon Financial Association for their helpful advice. Finally, the author is also grateful to the anonymous referee for his or her insightful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

The former version of this paper is entitled by “Optimality of Naive Investment Strategies in Dynamic Mean-Variance Optimization Problems with Multiple Priors,” and it is a part of the author’s Ph.D thesis.

Appendix: Derivation of (12)

Appendix: Derivation of (12)

Let us denote by \(v^{i,j}\) the \(i\times j\) th element of V. The first derivative of the Lagrange function \(L^{\theta ,V}\) with respect to \(v^{i,j}\) is

Recall that V is a symmetric matrix. We have

We need to compute \(\partial \theta ^\prime (\varSigma + V)^{-1} \theta / \partial v^{i,j}\). To do this, we need the following lemma.

Lemma 3

Let us denote \(F:{\mathbb {R}}\rightarrow {\mathbb {R}}^{N\times N}\) by a matrix-valued function.

-

1.

Suppose that F(x) is invertible for all x. Then, the following equality holds.

$$\begin{aligned} \frac{\partial (F(x))^{-1}}{\partial x} = - (F(x))^{-1}\frac{\partial F(x)}{\partial x}(F(x))^{-1}. \end{aligned}$$(35) -

2.

Let us denote \(g:{\mathbb {R}}^{N\times N}\rightarrow {\mathbb {R}}\) by a real-valued function. Then, the following equality holds.

$$\begin{aligned} \frac{\partial g(F(x))}{\partial x} = \mathrm {tr}\left\{ \left( \frac{\partial g(F(x))}{\partial F(x)}\right) ^\prime \frac{\partial F(x)}{\partial x}\right\} . \end{aligned}$$(36)

Proof

We first prove (35). For all x, F(x) satisfies the following identity.

Differentiating the above identity with respect to x, we have

where \({\mathbf {O}}_N\) is an N-dimensional zero matrix, and we have used the chain rule of derivatives. Hence, we obtain (35).

Next, we prove (36). By the chain rule, we have

where \(F^{i,j}(x)\) is the \(i\times j\) th element of F(x).\(\square \)

Let \(g(F) := \theta ^\prime F^{-1}\theta \) and \(F := \varSigma + V\). Then, by (36), we have

By the symmetry of V,

where \(M^{i,j}\) has been defined in the proof of Lemma 1. Since g(F) is linear in all elements of \(F^{-1}\), we have

where we have used (35). It can be easily seen that \(\theta ^\prime F^{-1} (\partial F/\partial F^{i,j})F^{-1}\theta \) is equal to the \(i\times j\) th element of \(F^{-1}\theta \theta ^\prime F^{-1}\). Hence,

Thus,

Substituting (34) and (37) into \(\partial L^{\theta , V}/\partial v^{i,j} = 0\), we can derive the first order condition (12).

Rights and permissions

About this article

Cite this article

Shigeta, Y. Portfolio selections under mean-variance preference with multiple priors for means and variances. Ann Finance 13, 97–124 (2017). https://doi.org/10.1007/s10436-016-0291-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-016-0291-7

Keywords

- Ambiguity aversion

- Multiple priors

- Maxmin expected utility model

- Mean-variance preference

- The global minimum-variance portfolio

- The equally weighted portfolio