Abstract

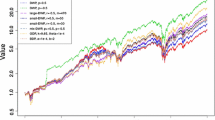

We apply the recently introduced generalized tree-structured (GTS) model to the analysis and forecast of stock market diversity. Diversity is a measure of capital concentration across a market that plays a central role in the search for arbitrage. The GTS model allows for different conditional mean and volatility regimes that are directly related to the behavior of macroeconomic fundamentals through a binary threshold construction. Testing on US market data, we collect empirical evidence of the model’s strong potential in estimating and forecasting diversity accurately in comparison with other standard approaches. In addition, the GTS model allows for the construction of very simple portfolio strategies that systematically beat the standard cap-weighted S&P500 index.

Similar content being viewed by others

References

Audrino F., Bühlmann P. (2001) Tree-structured GARCH models. J R Stat Soc, Ser B 63(4): 727–744

Audrino F., Bühlmann P. (2004) Synchronizing multivariate financial time series. J Risk 6(2): 81–106

Audrino, F., Trojani, F. Estimating and predicting multivariate volatility regimes in global stock markets. J Appl Econom (2003) (forthcoming)

Conrad J., Kaul G. (1988) Time-variation in expected returns. J Bus 61, 409–425

De Bondt W.F.M., Thaler R.H. (1987) Further evidence of overreaction and stock market seasonality. J Financ 42, 557–581

Diebold F.X., Mariano R.S. (1995) Comparing predictive accuracy. J Bus Econom Stat 13, 253–263

Efron B., Tibshirani R.J. (1993) An Introduction to the Bootstrap. Chapman & Hall, London

Fama E.F., French K.R. (1993) Common risk factors in the returns on stocks and bonds. J Financ Econom 33, 3–56

Fama E.F., French K.R. (1996) Multifactor explanations of asset-pricing anomalies. J Financ 47, 426–465

Fernholz R. (1999) On the diversity of equity markets. J Math Econom 31, 393–417

Fernholz R. (2001) Equity portfolios generated by functions of ranked market weights. Financ Stoch 5, 469–486

Fernholz R. (2002) Stochastic Portfolio Theory. Springer, Berlin Heidelberg New York

Fernholz R., Garvy R. (1999) Diversity changes affect relative performance. Pension Invest 112

Fernholz R., Garvy R., Hannon J. (1998) Diversity-weighted indexing. J Portf Manag 24, 74–82

Gray S.F. (1996) Modeling the conditional distribution of interest rates as a regime-switching process. J Financ Econom 42, 27–62

Hansen P.R., Lunde A., Nason J.M. (2003) Choosing the best volatility models: the model confidence set approach. Oxf Bull Econom Stat 65, 839–861

Lo A.W., MacKinlay A.C. (1988) Stock market prices do not follow random walks: evidence from a simple specification test. Rev Financ Stud 1, 41–66

Renyi, A. On measures of entropy and information. In: Proceedings 4th Berkeley Symposium on Mathematical Statistics and Probability, vol. 1, pp 547–561. UC Berkeley, 1961

Author information

Authors and Affiliations

Corresponding author

Additional information

Financial support by the Foundation for Research and Development of the University of Lugano and by the National Centre of Competence in Research “Financial Valuation and Risk Management” (NCCR FINRISK) is gratefully acknowledged. The authors thank four anonymous referees for helpful comments.

Rights and permissions

About this article

Cite this article

Audrino, F., Fernholz, R. & Ferretti, R.G. A Forecasting Model for Stock Market Diversity. Annals of Finance 3, 213–240 (2007). https://doi.org/10.1007/s10436-006-0046-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-006-0046-y

Keywords

- Diversity

- Generalized tree-structured threshold models

- Maximum-likelihood estimation

- Diversity-based portfolio strategies