Abstract

This paper compares the waves of globalization before the outbreak of the Great Recession in 2007 with its alleged historical antecedent before the outbreak of World War One. We describe trends in trade and openness, investigate the proximate causes of changes in openness and estimate the gains from trade from the early nineteenth century onwards. Our results suggest that the conventional wisdom has to be revised. The first wave of globalization started around 1820 and culminated around 1870. In the next century, trade continued to grow, with the exception of the Great Depression, but openness and gains fluctuated widely. They resumed a clear upward trend from the early 1970s. By 2007, the world was more open than a century earlier and its inhabitants gained from trade substantially more than their ancestors did.

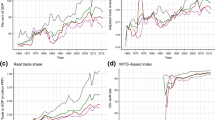

Sources: 1830–1938: Federico and Tena-Junguito (2016a) and 1950–2010 Appendix D (online)

Sources: 1830–1938: Federico and Tena-Junguito (2016a) and 1950–2010 Apendix D (online)

Sources: Exports of goods: Federico and Tena-Junguito (2016a) and Appendix D (online); GDP: Appendix C (online)

Sources: Export goods: Federico and Tena-Junguito (2016a) and Appendix D (online); GDP tradables: Appendix C (online)

Sources: See text Sect. 3

Sources: Exports of goods: Federico and Tena-Junguito (2016a) and Appendix D (online); GDP: Appendix C (online)

Similar content being viewed by others

Notes

It would be exactly a half if trade is balanced, lower (higher) if the country ran a deficit (surplus) in its trade balance. The bias from surpluses and deficits would disappear at world level, as they cancel each other out.

The baseline formula and the equivalent model with one sector producing several varieties of the same good yield an average of 4.4% of GDP. Gains are 15.3% of GDP for a model with multiple sectors, no trade in intermediate goods and no free entry, 14% for a model with multiple sectors, no trade in intermediate goods and free entry, 15% for a model with multiple sectors, no trade in intermediate goods and two factors of production, perfectly mobile across sectors, 27% for a model with multiple sectors and trade in intermediate goods, under perfect competition, 32% for the same model with monopolistic competition without firm heterogeneity (à la Krugman) and 40% for the same model with firm heterogeneity (à la Melitz).

They obtain ε = 5.24 for the baseline Armington (and the monopolistic competition à la Krugman), 4.17 for the extended baseline, 2.74 for the extended baseline with mark-up and 3.7 for monopolistic competition à la Melitz (Table 7). The corresponding gains in 2007 for our sample of 37 countries (see Sect. 6 for details) are 4.0, 5.1, 7.9 and 5.8%.

They estimate that gains for 11 countries in 2008 were about a quarter higher than with the Arkolakis et al. (2012) statistics.

Whenever available, we use modern estimates of trade or national accounts. Otherwise, we collect data on imports and exports at current prices from original sources, filling the gaps with interpolations or extrapolations based on trends in nearby polities or those with similar factor endowments. We then deflate these series with country-specific price indexes, mostly based on London prices, adjusted for freights. Finally, we convert all data to current or 1913 dollars (for details see Federico and Tena-Junguito 2016a).

Whenever possible (i.e. if the number of the observations exceeds 25–30), we compute the rate of change of the ith series as w = −β/ψ, where β and ψ are coefficients from a regression (Razzaque et al. 2007) Δ Ln Wt = α + β TIME + ψ lnWt−1 + φ ln Δ Ln Wt−1 + u. Otherwise we use a log-linear specification. In both cases, we test null hypotheses about rates (equal to zero or equal to rates in other periods) with a standard Wald restriction. We compute the cumulated change as Total = [exp(w)*n] − 1.

O’Rourke (2006) reckons that in 1815 exports were equal to the pre-war level in Sweden, one third lower in the United Kingdom and in the United States and half in France. If exports of all other polities declined as much as the French ones, world trade would have been 40% lower than in 1792.

The changes in boundaries before 1913 reduced trade, but the effect was minimal—at most 0.57% in 1860, on the eve of Italian unification. We treat the German Zollverein before 1870 as a single polity.

From 1924 to 1938 trade at constant prices increased by 9.7% if measured at current borders but by 11.1% if estimated at 1913 borders. European exports would have been 2.9% lower than actual ones without boundary changes.

The group of ‘rich’ (or ‘advanced’) countries includes all countries whose GDP per capita exceeded half the British one in 1870—i.e. Australia, Belgium, Canada, Denmark, France, Germany, Netherlands, New Zealand, Switzerland, United Kingdom and the United States. The ‘other OECD’ countries are Austria, Greece, Finland, Ireland, Iceland, Italy, Japan, Norway, Portugal, Spain and Sweden. Some Asian and African polities are missing before 1850, and thus the shares of these two continents (and of poor countries) are correspondingly undervalued. However, the bias is very small (the coefficient of correlation between polity shares for the 1830 and the full sample in 1850 is 0.96) and it is a price worth paying to be able to extend the series back to 1830.

Data for 1939–1950 are not available and we prefer to omit from Fig. 3 the war years 1914–1920 because some GDP series at current prices are missing and the figures for belligerent countries are inflated by the inclusion of war-related expenditures.

The increase in export/GDP of the remaining polities would have matched the rise in openness of the sample if their rate of growth of GDP per capita had exceeded 0.9% yearly. This condition was met only by a quarter of the omitted polities from the Maddison (2010) database, and all of them except Germany were very small.

Openness can be computed from 1820 to 1830 for ten polities—the United States, five Latin American countries (Argentina, Brazil, Chile, Colombia and Cuba) and four European ones (France, Denmark, Netherlands and Sweden). The aggregate ratio remained constant around 6%, dragged down by the decline in the American ratio from 7% in 1818 to 5.3% in 1830, but the unweighted average increased from 9.4 to 12.7% and the median from 6.8 to 7.8%.

The long-run σ-convergence among the 29 polities of the sample appears modest (the coefficient of variation declining from over 0.50 in the 1890s to about 0.35–0.4) and it concentrates in the Golden Age when openness was not growing much.

The two series would diverge only if GDP-M and X/GDP have different trends, and this is possible only in the exceptional cases of very open countries with highly unbalanced trade.

We obtain these figures by aggregating all countries in one single ‘world’ rather than weighting country-specific estimates according to their GDP. The comparable estimates for the ‘1870 sample’ are 2.9 and 6.5%.

We use the data on tariff revenue in 1913 from the data-base underlying Federico and Vasta (2015), while for the 2000s we get data from Kee et al. (2009), referring to 2002 (figures in italic) and from the WDI (http://data.worldbank.org accessed Nov 2015), referring to 2007. We compute yearly series of nominal protection for 14 countries in 1870–1974, 11 in 1975–1987 and 8 in 1988–1993 with data on custom revenues from Mitchell (2010, Table G.6).

We compute exports at time t for the ith polity as \( {\text{X}}^{\text{GK}} {\text{t}} = {\text{X}}_{1990}^{\$ } *\left( {{\text{GDP}}_{1990}^{\text{GK}} /{\text{GDP}}_{1990}^{\$ } } \right)*\left( {{\text{X}}^{\text{R}} {\text{t}}/{\text{X}}_{1990}^{\text{R}} } \right) \), where the superscript R refers to local currency at constant prices, GK to Geary-Khamis dollars and $ to dollars at market exchange-rate. Cf. Appendix C for sources of GDP data.

Cf. Statistical Appendix Table S.2. Between 1870–1872 and 1911–1913, the Klasing and Millionis (2014) GDP series increase less than the polity-specific ones in 22 countries out of 25. The three exceptions are Argentina, Belgium, where the difference is minimal, and the Ottoman Empire, which during the period lost all of its Balkan provinces.

References

Anderson, J., & van Wincoop, E. (2004). Trade costs. Journal of Economic Literature, 42, 691–751.

Arkolakis, C., Costinot, A., & Rodriguez-Clare, A. (2012). New trade models, same old gains? American Economic Review, 102, 94–130x.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Baldwin, R. (2009). The great trade collapse: Causes, consequences and prospects. A VoxEU.org Publication. Geneve and London Graduate Institute and CEPR.

Baldwin, R., & Lopez-Gonzales, J. (2013). Supply-chain trade: A portrait of global patterns and several testable hypotheses. (NBER WP 18957).

Baldwin, R., & Martin, P. (1999). Two waves of globalization: Superficial similarities, fundamental differences. (NBER WP 6904).

Barbieri, K., & Keshk, O. (2012). Correlates of war project trade data set codebook, Version 3.0. Online: http://correlatesofwar.org. Accessed April 2012.

Barbieri, K., Keshk, O. M. G., & Pollins, B. (2009). TRADING DATA: Evaluating our assumptions and coding rules. Conflict Management and Peace Science, 26, 471–491.

Berthelon, M., & Freund, C. (2008). On the conservation of distance in international trade. Journal of International Economics, 75, 310–320.

Bordo, M., Taylor, A. M., & Williamson, J. G. (2003). Globalization in historical perspective. London: University of Chicago Press.

Boz, E., Bussière, M., & Marsilli, C. (2015). Recent slowdown in global trade: Cyclical or structural. In: Hoekman A VoxEU.org eBook, pp. 33–55.

Caliendo, L., & Parro, F. (2015). Estimates of the trade and welfare effects of the NAFTA. Review of Economic Studies, 82, 1–44.

Carrère, C., & Schiff, M. (2005/2006). On the geography of trade. Distance is alive and well. Revue Économique 56, 1249–1274.

Chilosi, D., & Federico, G. (2015). Asian globalisations: Market Integration, trade and economic growth, 1800–1938. Explorations in Economic History, 57, 1–18.

Collier, P., & Dollar, D. (2002). Globalization, growth and poverty. Washington: World Bank.

Constantinescu, C., Mattoo, A., & Ruta, M. (2015). The global trade slowdown cyclical or structural? (World Policy Research Working Paper 7158). World Bank.

Costinot, A., & Rodriguez-Clare, A. (2014). Trade theory with numbers: Quantifying the consequences of globalization. In G. Gopinath, E. Helpman, K. Rogoff (Eds.), Handbook of international economics, Vol. 4. (NBER WP 18896). Amsterdam: Elsevier-North Holland.

Disdier, A.-C., & Head, K. (2008). The puzzling persistence of the distance effect on bilateral trade. Review of Economics and Statistics, 90, 37–48.

Eaton, J., & Kortum, S. (2002). Technology, geography, and trade. Econometrica, 70, 1741–1780.

Eichengreen, B. (2015). Hall of mirrors. The Great Depression, the Great Recession and the uses—and misuses of history. New York: Oxford University Press.

Federico, G. (2004). The growth of world agricultural production, 1800–1938. Research in economic history, 22, 125–181.

Federico, G. (2011). When did the European market integrate? European Review of Economic History, 15, 93–126.

Federico, G. (2012). The Corn Laws in continental perspective. European Review of Economic History, 16, 166–187.

Federico, G., & Tena-Junguito, A. (1991). On the accuracy of foreign trade statistics (1909–35): Morgestern revised. Explorations in Economic History, 28, 259–273.

Federico, G., & Tena-Junguito, A. (2016a). World trade, 1800–1938: A new data-set (EHES Working paper n. 93). http://www.ehes.org/EHES_93.pdf.

Federico, G., & Tena-Junguito, A. (2016b). Population by country 1800–1938. Mimeo.

Federico, G., & Vasta, M. (2015). What do we really know about protection before the Great Depression: Evidence from Italy. Journal of Economic History, 75, 993–1029.

Feenstra, R. (1998). Integration of trade and disintegration of production in the global economy. Journal of economic perspectives, 12, 31–50.

Felbermayr, G., Jung, B., & Larch, M. (2015). The welfare consequences of import tariffs: A quantitative perspective. Journal International economics, 97(2), 295–309.

Findlay, Ronald, & O’Rourke, Kevin H. (2007). Power and plenty: Trade, war, and the world economy in the second millennium. Princeton, NJ: Princeton University Press.

Glick, R., & Taylor, A. M. (2010). Collateral damage: Trade disruption and the economic impact of war. Review of Economics and Statistics, 92, 102–127.

Grassman, S. (1980). Long term trends in openness of national economies. Oxford Economic Papers, 32, 123–130.

Head, K., & Mayer, T. (2014). Gravity equations: workhorse, toolkit and cookbook. In G. Gopinath, E. Helpman, & K. Rogoff (Eds.), Handbook of international economics (Vol. 4). Amsterdam: Elsevier-North Holland.

Head, K., & Ries, J. (2001). Increasing returns versus national product differentiation as an explanation for the pattern of U.S.-Canada Trade. American Economic Review, 91, 858–876.

Hilberry, R., & Hummels, D. (2014). Trade elasticity parameters for a computable general equilibrium model. In P. B. Dixon & D. W. Jorgenson (Eds.), Handbook of computable general equilibrium modelling (pp. 1213–1269). Amsterdam: Elsevier-North Holland.

Hoeckman, B. (2015). The great trade slowdown: A new normal? CEPR on-line book.

Hugot, J. (2014). Trade costs and the two globalizations: 1827–2012. Mimeo.

Hummels, D. (2007). Transportation costs and international trade in the second era of globalization. Journal of Economic Perspectives, 21, 131–154.

Jacks, D. (2005). Intra- and international commodity market integration in the Atlantic economy. Explorations in Economic History, 42, 381–413.

Jacks, D., Meissner, C., & Novy, D. (2006). Trade costs in the first wave of globalization. (NBER WP 12602).

Jacks, D., Meissner, C., & Novy, D. (2011). Trade booms, trade busts and trade costs. Journal of International Economics, 83, 185–201.

Kander, A., Malanima, P., & Warde, P. (2013). Power to the people Energy in Europe over the last five centuries. Princeton: Princeton University Press.

Kee, H. L., Nicita, A., & Olarreaga, M. (2009). Estimate trade restrictiveness indices. Economic Journal, 119, 172–199.

Klasing, M., & Millionis, P. (2014). Quantifying the evolution of world trade, 1870–1949. Journal of International Economics, 92, 185–197.

Lavallée, E., & Vicard, V. (2013). National borders matter…where one draws the lines too. Canadian Journal of Economics, 46, 135–163.

Maddison, A. (1995). Monitoring the world economy 1820–1992. Paris: OECD Paris.

Maddison, A. (2001). The world economy. A millennial perspective. Paris: OECD Paris.

Maddison Project Data Base (2010). The Maddison-Project, http://www.ggdc.net/maddison/maddison-project/home.htm, 2013 version. http://www.ggdc.net/maddison/maddison-project/data.htm. Accessed November 2014.

Meissner, C. (2014). Growth from globalization? A view from the very long run. In P. Aghion & S. Durlauf (Eds.), Handbook of economic growth (Vol. 2B, pp. 1033–1069). Amsterdam: Elsevier.

Mitchell, B. R. (1988). British historical statistics. Cambridge: Cambridge University Press.

Mitchell, B. R. (2010). International Historical Statistics 1750 to 2010. The online database. http://www.palgraveconnect.com/pc/archives/ihs.html. Accessed September 2013.

O’Rourke, K. (2006). The worldwide economic impact of the French revolutionary and Napoleonic wars, 1792–1815. Journal of Global History, 1, 123–149.

O’Rourke, K., & Williamson, J. G. (1999). Globalization and history. The evolution of the nineteenth Atlantic economy. Cambridge, MA: MIT Press.

Ossa, R. (2015). Why trade matters. Journal of International Economics, 97(2), 266–277.

Razzaque, M., Osafa-Kwaako, P., & Grynberg, R. (2007). Long-run trend in the relative price: empirical estimation for individual commodities. In R. Grynberg & S. Newton (Eds.), Commodity prices and development (pp. 35–67). Oxford: Oxford University Press.

Rodrik, D. (1998). Symposium on globalization in perspective: An introduction. Journal of Economic Perspectives, 12(4), 3–8.

Sharp, P., & Weisdorf, J. (2013). Globalization revisited: Market integration and the wheat trade between North America and Britain from the eighteenth century. Explorations in Economic History, 50, 88–98.

Simonovska, I., & Waugh, M. (2014a). The elasticity of trade: Estimates and evidence. Journal of International Economics, 92, 34–50.

Simonovska, I., & Waugh, M. (2014b). Trade model, trade elasticities and gains from trade. (NBER WP 20495).

Tena-Junguito, A., Lampe, M., & Tamega-Fernandes, F. (2012). How much trade liberalization was there in the world before and after Cobden-Chevalier? Journal of Economic History, 72, 708–740.

Timmer, M. P., Los, B., Stehrer, R., & de Vries, G. J. (2016). An anatomy of the global trade slowdown based on the WIOD 2016 Release. GGDC RESEARCH MEMORANDUM 162. Groningen Growth and Development Centre.

UN Yearbook (ad annum) Yearbook of international trade statistics. New York: United Nations.

World Bank. World development indicators. http://data.worldbank.org/data-catalog/world-development-indicators. Accessed February 2014.

Acknowledgements

Funding was provided by European Research Council Advanced Research Grant (Grant No. 230484) and Spanish Minister of Science and Innovation (Grant Nos. ECO2011-25713, ECO2015/00209/001).

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

Federico, G., Tena-Junguito, A. A tale of two globalizations: gains from trade and openness 1800–2010. Rev World Econ 153, 601–626 (2017). https://doi.org/10.1007/s10290-017-0279-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-017-0279-z