Abstract

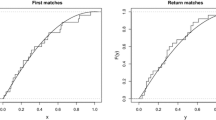

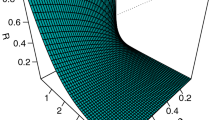

The paper is inspired by the stress–strength models in the reliability literature, in which given the strength (Y) and the stress (X) of a component, its reliability is measured by P(X < Y). In this literature, X and Y are typically modeled as independent. Since in many applications such an assumption might not be realistic, we propose a copula approach in order to take into account the dependence between X and Y. We then apply a copula-based approach to the measurement of household financial fragility. Specifically, we define as financially fragile those households whose yearly consumption (X) is higher than income (Y), so that P(X > Y) is the measure of interest and X and Y are clearly not independent. Modeling income and consumption as non-identically Dagum distributed variables and their dependence by a Frank copula, we show that the proposed method improves the estimation of household financial fragility. Using data from the 2008 wave of the Bank of Italy’s Survey on Household Income and Wealth we point out that neglecting the existing dependence in fact overestimates the actual household fragility.

Similar content being viewed by others

References

Adimari G, Chiogna M (2006) Partially parametric interval estimation of Pr(Y > X). Comput Stat Data Anal 51: 1875–1891

Azzalini A, Dal Cappello T, Kotz S (2003) Log-skew-normal and log-skew-t distributions as models for family income data. J Income Distrib 11: 13–21

Balakrishnan N, Lai CD (2009) Continuous bivariate distributions. 2nd. Springer, New York

Bandourian R, McDonald JB, Turley RS (2003) A comparison of parametric models of income distribution across countries and over time. Estadistica 55: 135–152

Brandolini A, Cannari L (1994) Methodological appendix: the bank of Italy’s survey of household income and wealth. In: Ando A, Guiso L, Visco I (eds) Saving and the accumulation of wealth: essays on Italian household and government saving behavior. Cambridge University Press, Cambridge, pp 369–386

Brown S, Taylor K (2008) Household debt and financial assets: evidence from Germany, Great Britain and the USA. J R Stat Soc Ser A 171(3): 615–643

Christelis D, Jappelli T, Paccagnella O, Weber G (2009) Income, wealth and financial fragility in Europe. J Eur Soc Policy 19: 359–377

Dagum C (1977) A new model of personal income distribution: specification and estimation. Econ Appl XXX: 413–437

Domma F, Giordano S (2009) Dependence in stress-strength models with FGM copula and Burr III margins. In: Ingrassia S, Rocci R (eds) Book of short papers of the meeting of the classification and data analysis. CLEUP, Padova, pp 477–480

Genest C, Remillard B, Beaudoin D (2009) Goodness-of-fit tests for copulas: a review and a power study. Insur: Math Econ 44: 199–213

Gupta RD, Gupta RC (1990) Estimation of P(a′x > b′y) in the multivariate normal case. Statistics 1: 91–97

Gupta RC, Ghitany ME, Al-Mutairi DK (2012) Estimation of reliability from a bivariate log-normal data. J Stat Comput Simul. doi:10.1080/00949655.2011.649284

Huang K, Mi J, Wang Z (2012) Inference about reliability parameter with gamma strength and stress. J Stat Plan Inference 142(4): 848–854

Jappelli T, Pagano M, Di Maggio M (2008) Households’ indebtedness and financial fragility. CSEF Working Papers, N. 208

Jappelli T, Pistaferri L (2010) The consumption response to income changes. Annu Rev Econ 2: 479–506

Joe H (1997) Multivariate models and dependence concepts, monographs in statistics and probability 73. Chapmann and Hall, New York

Joe H (2005) Asymptotic efficiency of the two-stage estimation method for copula-based models. J Multivar Anal 94: 401–419

Kleiber C (2008) A guide to the Dagum distribution. In: Duangkamon C (ed) Modeling income distributions LorenzCurvesSeries: EconomicStudies in inequality, social exclusion and well-being, 5. Springer, New York

Kotz S, Lumelskii Y, Pensky M (2003) The stress-strength models and its generalizations. World Scientific Publishing, Singapore

Krishnamoorthy K, Lin Y (2010) Confidence limits for stress-strength reliability involving Weibull models. J Stat Plann Inference 140: 1754–1764

Lusardi A, Schneider D, Tufano P (2011) Financially fragile households: evidence and implications. CeRP Working Papers, N. 116

Nadarajah S (2005) Reliability for some bivariate beta distributions. Math Prob Eng 2005(2): 101–111. doi:10.1155/MPE.2005.101

Nadarajah S, Kotz S (2005) Reliability for some exponential distributions. Math Probl Eng 2006: 1–14

Nelsen RB (2006) An introduction to copulas. Springer, New York

R Development Core Team (2011) R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. ISBN 3-900051-07-0. http://www.R-project.org

Rezaei S, Tahmasbi R, Mahmoodi M (2010) Estimation of P(Y < X) for generalized Pareto distribution. J Stat Plan Inference 140: 480–494

Sengupta S (2011) Unbiased estimation of P(X > Y) for two-parameter exponential populations using order statistics. Statistics 45(2): 179–188

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Domma, F., Giordano, S. A stress–strength model with dependent variables to measure household financial fragility. Stat Methods Appl 21, 375–389 (2012). https://doi.org/10.1007/s10260-012-0192-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10260-012-0192-5