Abstract

To the extent that oil imports may be relevant to the international dimension of policy, we study the transmission of shocks to open economies dependent on oil within a NOEM framework through a DSGE model of a small open economy with flexible prices, staggered price setting and local currency pricing. For this purpose we introduce imports of oil as a new intermediate good needed to produce the final good and, apart from the usual exogenous shocks when a small open economy is being modeled, we consider an uncovered interest-rate parity shock, a technology shock and an oil price shock. A second-order accurate solution method is used to solve numerically a calibrated model for Portugal and Spain and the simulation results are compared with historical data, showing similar volatilities and expected dynamic responses to exogenous shocks. The model is computed with an optimized Taylor-style interest rate rule that includes real exchange targeting, thus arguing in favour of an international dimension of monetary policy.

Similar content being viewed by others

Notes

Dynamic Stochastic General Equilibrium models (DSGE).

However, when local currency pricing is assumed there is less exchange rate volatility arising from monetary policy than under producer currency pricing.

See also: Kim M, Prakash L (1992) The role of energy in real business cycle models. J Monet Econ; Rotemberg J, Woodford M (1996) Imperfect competition and the effects of energy price increases on economic activity. J Money Credit Bank; Finn M (2000) Perfect competition and the effects of energy price increases on economic activity. J Money Credit Bank.

See also: Miguel C, Manzano B (2006) Optimal oil taxation in a small open economy. Rev Econ Dyn; Aguiar-Conraria L, Wen Y (2008) A note on oil dependence and economic instability. Macroecon Dyn; Chen Y, Zhang Y (2009) A note on tariff policy, increasing returns, and endogenous fluctuations. Macroecon Dyn.

When varieties are imperfect substitutes of each other, 1 < ν < ∞. The closer to one ν, the less substitutes are varieties and the higher the market power of each firm. This elasticity is also the elasticity of demand for the variety: from expression 5, see that \(\left\vert \frac{\partial q_{t}^{i}(s)}{\partial p_{t}^{i}(s)}\frac{p_{t}^{i}(s)}{ q_{t}^{i}(s)}\right\vert =\nu \frac{q_{t}^{i}(s)}{q_{t}^{i}(s)}\).

\(P_{t}^{i}\) is the price of one unit of \(Q_{t}^{i}\) that minimizes expenditure \(\int_{0}^{1}p_{t}^{i}(s)q_{t}^{i}(s)ds\), given prices \(p_{t}^{i}(s)\).

Home is Portugal or Spain and thus an increase in the exchange rate corresponds to a depreciation of the euro.

The first t denotes the time the price is re-optimized while the second time subscript denotes the moment of time considered when summing profits.

Therefore profits are not included in the budget constraint.

As LCP is assumed the price set by Foreign firms is a domestic currency price.

The correspondent composites are \(Q_{t}^{x}=\big( \textstyle\int_{0}^{1}q_{t}^{x}(s)^{\frac{\nu -1}{\nu }}ds\big) ^{\frac{\nu }{\nu -1 }}\) and \(P_{t}^{x}=\big( \int_{0}^{1}p_{t}^{x}(s)^{1-\nu }ds\big) ^{\frac{ 1}{1-\nu }}\).

At + 1 starts to yield services at t + 1 (use of funds in t). A t is the net stock of Home bonds that mature in period t (source of fund in t). A t and B t are denominated in the currency of the issuing country.

Considering Φ d = Φ f = 0 as they are small by assumption, substituting condition 27 into Eq. 28 we obtain the usual UIP condition \((1+i_{t})=(1+i_{t}^{\ast })E_{t}\left\{ e_{t+1}/e_{t}\right\} \) or, up to a log-linear approximation, \(i_{t}-i_{t}^{\ast }=\log E_{t}\left\{ e_{t+1}/e_{t}\right\} .\)

The Taylor Principle states that the response of nominal interest rates to excess inflation should be more than one for one, such that real rates rise whenever inflation lies above its target, ceteris paribus. A monetary policy rule that obeys the Taylor principle is usually defined as active monetary policy, and passive is one that does not.

See http://www.econ.duke.edu/~uribe/2nd_order.htm; the Matlab codes adapted to this model are available upon request: tsousa@fe.unl.pt.

An intercept was included in all OLS regressions and a linear time trend was also included in the regression for productivity.

A positive world interest rate shock shall induce the appreciation of the Foreign currency, which increases the nominal exchange rate.

References

Bergin P (2004) How well can the new open macroeconomics explain the exchange rate and current account. Working paper, University of California, Davis

Blanchard OJ, Galí J (2008) The macroeconomic effects of oil price shocks: why are the 2000s so different from the 1970s? Mimeo

Calvo CA (1983) Staggered prices in a utility-maximizing framework. J Monet Econ 12:383–398

Chen S-S (2009) Oil price pass-through into inflation. Energy Econ 31:126–133

Corsetti G (2006) Openness and the case for flexible exchange rates. Res Econ 60:1–21

Corsetti G, Pesenti P (2005) International dimensions of optimal monetary policy. J Monet Econ 52(2):281–305

Garcia-Cebro JA, Varela-Santamaria R (2007) Raw materials world price changes and exchange rates in a small open economy. Econ Lett 95:132–139

Díaz A, Puch LA, Guilló MD (2004) Costly capital reallocation and energy use. Rev Econ Dyn 7:494–518

Kollmann R (2002) Monetary policy rules in the open economy: effects on welfare and business cycles. J Monet Econ 49:989–1015

Leith C, Wren-Lewis S (2009) Taylor rules in the open economy. Eur Econ Rev. doi:10.1016/j.euroecorev.2009.04.009

Martins J, Scarpetta S, Pilat D (1996) Mark-up pricing, market structure and the business cycle. OECD Econ Stud 27:71–105

Schmitt-Grohé S, Uribe M (2004) Solving dynamic general equilibrium models using a second-order approximation to the policy function. J Econ Dyn Control 28:755–775

Wang J (2007) Home bias, exchange rate disconnect, and optimal exchange rate policy. Working paper no. 0701, Federal Reserve Bank of Dallas

Wohltmann H-W, Winkler R (2006) Anticipated raw materials price shocks and monetary policy response–a new keynesian approach. Economics working paper no. 2006-19, Christian-Albrechts-Universitat Kiel

Acknowledgements

I am grateful to Manuel Santos and Robert Kollmann for encouragement and advice, as well as to Stephanie Schmitt-Grohé and José-Miguel Cardoso-Costa for discussions on computational issues. I thank the participants of the ASSET 2009, the Portuguese Ministry of Economy Research Seminar and of the Informal Research Workshop at Nova for comments. Financial support from FCT (BD/11184/2002) is kindly acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Parameters

1.2 Exogenous shocks

1.3 Data and model predictions

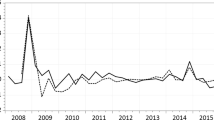

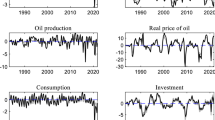

Variables are quarterly and data series are from the OECD Main Economic Indicators (General Economic Problems), for the period 1973:Q1–2008:Q4. The sample period starts in 1973 since the Bretton Woods system, after lasting two decades during the 50s and 60s, ended officially in that year. GDP is real gross domestic product, consumption is total private final consumption expenditure in constant prices, investment is gross fixed capital formation plus inventory change in constant prices (nominal series deflated using CPI), net exports are nx = exports/imports, exports of goods and services in volume and imports of goods and services in volume, inflation is measured with the gross domestic product deflator for Home economies (Portugal and Spain) and with CPI price level for the world economy (USA), nominal interest rates are short-term quarterly rates expressed in fractional units, nominal exchange rates are bilateral rates of Portugal and Spain vis-à-vis the U.S. (national currency per USD) expressed in a quarterly basis, real exchange rates are indexes based on relative CPI prices, the price of oil is the price of crude, fob, spot Brent, in USD.

With exception of interest rates, all series—historical and predicted by the model–are first logged and then HP filtered to obtain detrended series (e.g. detrended logθ t = logθ t − HPfilter(logθ t )). The HP smoothing parameter was set at 1,600 for all quarterly series. Standard deviations have been multiplied by 100 to express results in percentage terms.

1.4 Impulse responses

Responses of endogenous variables to one-time 1 standard deviation of exogenous variables (responses are relative deviations of endogenous variables from baseline path, except in the case of variables without logs whose responses are differences from baseline path). Variables are defined in Section 3; t are the periods after the shock.

1.5 Model simulation with five exogenous shocks

About this article

Cite this article

Sousa, T. International macroeconomic interdependence and imports of oil in a small open economy. Port Econ J 10, 35–60 (2011). https://doi.org/10.1007/s10258-010-0068-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-010-0068-2