Abstract

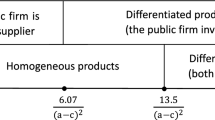

We study the effect of quadratic differentiation costs in the Hotelling model of endogenous product differentiation. The equilibrium location choices are found to depend on the magnitude of the differentiation costs (relatively to the transportation costs supported by consumers). When the differentiation costs are low, there is maximum differentiation. When they are high, there is partial differentiation, with a degree of differentiation that decreases with the differentiation costs. In any case, the socially optimal degree of differentiation is always lower than the equilibrium level. We also study the case of collusion between firms. If firms can combine locations but not prices, they locate asymmetrically when differentiation costs are high and choose maximum differentiation when they are low. When collusion extends to price setting, there is partial differentiation.

Similar content being viewed by others

Notes

We ignore the vertical differentiation aspect that may be associated with such modifications.

If the firms need to buy inputs from many suppliers, uniformly dispersed along the city, then the cost of transporting these inputs also increases with the distance between the firm and the center. This provides further justification for our assumption.

More precisely, we consider that the transportation costs supported by a consumer located at x who buys from a firm located at a are \(t \left( x-a \right)^2\) and that the differentiation cost supported by a firm located at a is \(\tau \left( \frac{1}{2}-a \right)^2\). We find that maximum differentiation is the unique equilibrium if \(\frac{\tau}{t} \leq \frac{1}{2}\), and that partial differentiation is the unique equilibrium if \(\frac{\tau}{t} > \frac{1}{2}\). We complement, thus, the results of Matsushima (2004), as he restricted his analysis to the case in which \(\frac{\tau}{t} \leq 1\) and did not establish uniqueness of equilibrium.

We remark that the model at hands considers that the demand is inelastic and that prices have a neutral effect on social welfare. This should be kept in mind for an adequate interpretation of the welfare implications of the model.

Häckner (1995) has studied full collusion in a repeated Hotelling game in which firms are allowed to costlessly change their locations and prices.

The difference with respect to the model of Aiura and Sato (2008) is that here marginal costs increase quadratically instead of linearly with the distance to the center.

It would also be of interest to study the case in which location choice implies an increase in fixed costs instead of marginal costs. This occurs in the model of Lambertini (1997a), where firms are taxed more heavily if they choose to locate far from the socially optimal locations. We leave the analysis of fixed differentiation costs for future work.

The concept of horizontal differentiation is commonly linked to the distance between the two firms. The farther are the firms from each other, the more differentiated are the products that they sell. Incurring in a small abuse of terminology, we will sometimes refer to the degree of differentiation as the distance between the firm and the center (standard product).

The model that we are considering corresponds to the model proposed by Matsushima (2004) with suppliers exogenously located at the center (we suppose that the firms in our market are not large enough to influence the location of suppliers). But we do not restrict the analysis to the case in which τ ≤ t.

This expression is valid for a + b < 1. It can be shown that if firms choose the same location (a + b = 1), then the equilibrium prices are equal to marginal cost, \(p_1 = \tau \left( \frac{1}{2} - a \right)^2\) and \(p_2 = \tau \left( \frac{1}{2} - b \right)^2\), and, therefore, the resulting profits are null.

All the proofs are collected in the Appendix.

Friedman and Thisse (1993) study an infinitely repeated game version of the Hotelling model, in which locations are chosen (once and for all) in period 0 and prices are chosen in each period. In such a model, collusion in the price setting stage can be sustainable. In our one-shot game, collusive price setting requires the ability to make a commitment.

When \(\frac{\tau}{t}=2+2\sqrt{2}\), decisions (i) and (ii) are equally optimal.

The corresponding assumption made by Häckner (1995), in his dynamic model without differentiation costs, was \(V \geq \frac{5t}{4}\).

When \(\frac{\tau}{t} = 1\), both (i) and (ii) are optimal.

This expression is valid for a + b < 1. It can be shown that if firms choose the same location (a + b = 1), then the equilibrium prices are equal to marginal cost, \(p_1 = \tau \left( \frac{1}{2} - a \right)^2\) and \(p_2 = \tau \left( \frac{1}{2} - b \right)^2\), and, therefore, the resulting profits are null.

The compact domain is \(\mathcal{D} \times [0,1]\), where \(\mathcal{D} = \left\{ (a,b) \in [0,1]^2 : \ a+b \leq 1 \right\}\).

References

Aiura H, Sato Y (2008) Welfare properties of spatial competition with location-dependent costs. Reg Sci Urban Econ 38:32–48

Brekke KR, Straume OR (2004) Bilateral monopolies and location choice. Reg Sci Urban Econ 34:275–288

Chang M-H (1991) The effects of product differentiation on collusive pricing. Int J Ind Organ 9:453–469

Cramton PC, Palfrey TR (1990) Cartel enforcement with uncertainty about costs. Int Econ Rev 31:17–47

D’Aspremont C, Gabszewicz JJ, Thisse J-F (1979) On Hotelling’s ‘Stability in competition’. Econometrica 47:1145–1150

Eaton BC, Schmitt N (1994) Flexible manufacturing and market structure. Am Econ Rev 84:875–888

Friedman JW, Thisse J-F (1993) Partial collusion fosters minimum product differentiation. Rand J Econ 24:631–645

Gupta B, Kats A, Pal D (1994) Upstream monopoly, downstream competition and spatial price discrimination. Reg Sci Urban Econ 24:529–542

Häckner J (1995) Endogenous product design in an infinitely repeated game. Int J Ind Organ 13:277–299

Hotelling H (1929) Stability in competition. Econ J 39:41–57

Jehiel P (1992) Product differentiation and price collusion. Int J Ind Organ 10(4):633–641

Kihlstrom R, Vives X (1992) Collusion by asymmetrically informed firms. J Econ Manage Strategy 1(2):371–396

Kourandi F, Vettas N (2010) Endogenous spatial differentiation with vertical contracting. CEPR Discussion Papers, 7948

Lambertini L (1997a) Optimal fiscal regime in a spatial duopoly. J Urban Econ 41:407–420

Lambertini L (1997b) Unicity of the equilibrium on the unconstrained hotelling model. Reg Sci Urban Econ 27:785–798

Matsushima N (2004) Technology of upstream firms and equilibrium product differentiation. Int J Ind Organ 22:1091–1114

Meza S, Tombak M (2009) Endogenous location leadership. Int J Ind Organ 27(6):687–707

Miklós-Thal J (2008) Delivered pricing and the impact of spatial differentiation on cartel stability. Int J Ind Organ 26(6):1365–1380

Tabuchi T, Thisse J-F (1995) Asymmetric equilibria in spatial competition. Int J Ind Organ 13:213–227

Ziss S (1993) Entry deterrence, cost advantage and horizontal product differentiation. Reg Sci Urban Econ 23(5):523–543

Acknowledgements

We thank Frago Kourandi, Odd Rune Straume (Editor) and three anonymous referees for useful comments and suggestions which allowed us to improve this paper. João Correia-da-Silva (joao@fep.up.pt) acknowledges support from Fundação para a Ciência e Tecnologia and FEDER (research grant PTDC/EGE-ECO/108331/2008) and from CEF.UP. Joana Pinho (jpinho@fep.up.pt) acknowledges support from Fundação para a Ciência e Tecnologia (Ph.D. scholarship).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Equilibrium of the price-setting stage

The profit of firm 1, as a function of locations and prices, is:Footnote 21

The reader may verify that the profit function, Π1, is globally continuous and quasi-concave with respect to the price set by the firm, p 1. Therefore, a local maximum is also a global maximum.

Let’s start by searching an equilibrium of the second stage in which both firms have some demand. Profit maximization by the firms implies that:

From these best response functions, Eqs. 6 and 7, we obtain the prices that the firms choose, as a function of their locations:

Given these prices, the indifferent consumer is located at:

The profit obtained by firm 1 is:

This is valid for \(\tilde{x}(a,b) \in [0,1]\), which is equivalent to \(| a - b | \leq \frac{3}{1+\frac{\tau}{t}}\).

The other possible type of equilibrium is one in which one of the firms captures the whole market. This is the case when: (i) firm 2 cannot lower its price; (ii) firm 1 is setting the lowest price for which \(\tilde{x}=1\); and (iii) it is not profitable for firm 1 to raise its price:

These conditions are compatible whenever \(a \geq b + \frac{3}{1+\frac{\tau}{t}}\). The resulting profit of firm 1 is \(\Pi_1 = \tau \left( a - a^2 - b + b^2 \right) - t (1-a+b)(1-a-b)\).

Hence, the profit of firm 1, as a function of locations, is given by:

□

Proof of Proposition 1

From the definition of equilibrium, it follows that maximal differentiation, \(\left( a^*, b^* \right) =(0,0) \), is an equilibrium if and only if:

-

(i)

\({\displaystyle 0\in \arg \max\limits_{a\in \left[ 0, 1 \right] }\left\{ \Pi_1(a,0)\right\} }\);

-

(ii)

\({\displaystyle 0\in \arg \max\limits_{b\in \left[ 0, 1 \right] }\left\{ \Pi_2(0,b)\right\} }\).

By symmetry, to prove that \(\left( a^*, b^* \right) =(0,0)\) is an equilibrium, it is enough to check that condition (i) holds.

When b = 0, we have:

For \(a<\frac{3}{1+\frac{\tau}{t}}\), the derivative of the profit function with respect to location is:

It is negative at a = 0 if and only if \(\frac{\tau}{t} \leq \frac{1}{2}\). For these values of \(\frac{\tau}{t}\), we always have \(a<\frac{3}{1+\frac{\tau}{t}}\), and it is easy to see that \(\frac{\partial \Pi _{1}(a,0)}{\partial a}\) is also negative for any \(a\in \lbrack 0,1)\). □

Proof of Proposition 2

No differentiation, \(\left( a^*, b^* \right) = \left( 1/2 , 1/2 \right)\), is an equilibrium if and only if:

-

(i)

\({\frac{1}{2} \in \arg {\displaystyle\max\limits_{a \in \left[ 0, 1 \right] }}\left\{ \Pi_1 \left( a, 1/2 \right)\right\} }\);

-

(ii)

\({\frac{1}{2} \in \arg {\displaystyle\max\limits_{b\in \left[ 0, 1 \right] }}\left\{ \Pi_2 \left( 1/2,b \right) \right\} }\).

By symmetry, to show that no differentiation is an equilibrium, it is only necessary to show that: \({\frac{1}{2} \in \arg {\displaystyle\max\limits_{a\in \left[ 0,\frac{1}{2}\right] }}\left\{ \Pi _{1}\left( a,1/2\right) \right\} }\).

When \(b=\frac{1}{2}\), the profit of firm 1 in the vicinity of \(a=\frac{1}{2}\) is:

Calculating the derivative with respect to location, we obtain:

A necessary condition for no differentiation to be an equilibrium is that this derivative is positive as \(a\rightarrow \frac{1}{2}^{-}\). But we find that it is always negative. □

Proof of Proposition 3

Partial differentiation, \(\left( a^*, b^* \right) =(d_c,d_c) \), with d c ∈ (0,1/2), is an equilibrium if and only if:

-

(i)

\({\displaystyle d_c \in \arg \max\limits_{a\in \left[ 0, 1 \right] }\left\{ \Pi_1(a,d_c)\right\} }\);

-

(ii)

\({\displaystyle d_c \in \arg \max\limits_{b\in \left[ 0, 1 \right] }\left\{ \Pi_2(d_c,b)\right\} }\).

With b = d c , the profit obtained by firm 1 is:

In the second branch, the partial derivative of the profit function is:

which is null at \(a = d_c - \frac{3}{1+\frac{\tau}{t}}\) and at \(a=\frac{1}{3} \left[ \frac{2 \frac{\tau}{t} - 1}{1+\frac{\tau}{t}}-d_c \right]\).

For the first-order condition, \(\left.\frac{\partial \Pi_{1}(a,d_c)}{\partial a}\right|_{a=d_c}=0\), to hold, we must have:

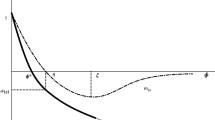

Notice that d c ∈ (0, 1/2) if and only if \(\frac{\tau}{t}>\frac{1}{2}\). Therefore, partial differentiation can only be an equilibrium for \(\frac{\tau}{t}>\frac{1}{2}\).

Observe that the first branch is relevant when \(0 < d_c - \frac{3}{1+\frac{\tau}{t}}\), which holds for \(\frac{\tau}{t} > \frac{13}{2}\). The third branch of the profit function becomes relevant when there is some a ≤ 1 − d c for which \(a \geq d_c + \frac{3}{1+\frac{\tau}{t}}\), that is, when:

which is impossible.

To check the second-order condition, write the second derivative of the profit function with respect to location (in the second branch):

With \(d_c=\frac{2\frac{\tau}{t}-1}{4\frac{\tau}{t}+4}\), we find that there is a threshold, a 0 < d c , such that \(\frac{\partial^{2}\Pi_{1}(a,d_c)}{\partial a^{2}}\) is negative (positive) for a > a 0 (a < a 0):

Since a 0 < d c , the local second order condition always holds. Furthermore, we can conclude that the profit function is quasi-concave for a ∈ (0, 1 − d c ). This is because the second branch of the profit function is cubic in a with null derivative at \(a=d_c - \frac{3}{1+\frac{\tau}{t}}\) and at a = d c . Therefore, the profit is zero for a lower than \(d_c - \frac{3}{1+\frac{\tau}{t}}\) (the first branch is active) and concave for higher a. □

Proof of Proposition 4

Asymmetric differentiation, \(\left( a^*, b^* \right)=(d_a, d_b)\), with d a ≠ d b , is an equilibrium if and only if:

-

(i)

\({\displaystyle d_a \in \arg \max\limits_{a\in \left[ 0, 1 \right] }\left\{ \Pi_1(a,d_b)\right\} }\);

-

(ii)

\({\displaystyle d_b \in \arg \max\limits_{b\in \left[ 0, 1 \right] }\left\{ \Pi_2(d_a,b)\right\} }\).

We have seen in the proof of Proposition 3, that the profit function is zero in the first branch, then quasi-concave in the second branch, with a maximum at \(a=\frac{1}{3} \left[ \frac{2 \frac{\tau}{t} - 1}{1+\frac{\tau}{t}}-d_b \right]\).

In the third branch, the profit function is concave in a for \(\frac{\tau}{t} > 1\). Otherwise, the third branch is irrelevant because \(d_b + \frac{3}{1+\frac{\tau}{t}} > 1\).

In equilibrium, both firms must be in the second branch. Otherwise one of the firms has zero profit, and therefore is not maximizing.

Then, by symmetry, we must have:

There is no asymmetric differentiation equilibrium. □

Proof of Proposition 5

The derivative of W with respect to \(\tilde{x}\) is:

The corresponding first-order condition, \(\frac{\partial W }{\partial \tilde{x}}=0\), can be written as:

Welfare is concave in \(\tilde{x}\), as the second derivative is:

The first-order condition with respect to a, \(\frac{ \partial W}{\partial a}=0\), is equivalent to:

Similarly, the first-order condition with respect to b is:

With \(\tilde{x} = 0\) (the same would result for \(\tilde{x} =1\)), social welfare is:

which is maximal at \(b = \frac{1}{2}\), attaining the value:

For \(\tilde{x}\neq 0\), from the first-order conditions, Eqs. 8, 9 and 10, we obtain:

To make sure that this pair of locations is optimal, we now construct the Hessian matrix:

At \(\left( a,b,\tilde{x}\right) =\left( \frac{2\frac{\tau }{t}+1}{4\left( 1+\frac{\tau }{t}\right) },\frac{2\frac{\tau }{t}+1}{4\left( 1+\frac{\tau }{t}\right) },\frac{1}{2}\right) \equiv \left( d_{g},d_{g}, \frac{1}{2}\right) \), we obtain:

The local second-order condition for \(\left( d_{g},d_{g},\frac{1}{2}\right) \) to be a maximum is: \(\left\vert A_{1}\right\vert <0\), \(\left\vert A_2\right\vert >0\) and \(\left\vert A_3\right\vert <0\). We have:

-

(i)

\(\left\vert A_{1} \right\vert = -\left( \tau+t\right) <0\);

-

(ii)

\(\left\vert A_{2}\right\vert ={\rm{det}} \left[ \begin{array}{cc} -\left( \tau +t\right) & 0 \\ 0 & -\left( \tau +t\right) \end{array} \right] =\left( \tau +t\right)^{2}>0\);

-

(iii)

\(\left\vert A_{3} \right\vert = {\rm{det}} \left[ \begin{array}{ccc} - \left( \tau+t\right) & 0 & \displaystyle\frac{1}{2} \\[6pt] 0 & - \left( \tau+t\right) & \displaystyle-\frac{1}{2} \\[6pt] \displaystyle\frac{1}{2} & \displaystyle-\frac{1}{2} & \displaystyle-\frac{t^2}{\tau+t} \end{array} \right] = - \displaystyle\frac{t^2 \left( \tau+t\right)}{2} < 0\).

Thus, \(\left( d_g, d_g,\frac{1}{2}\right)\) is a local maximum of W. Since the domain of W, \(\mathcal{D} \times \left[ 0, 1 \right]\), is a compact and W is C ∞ , to show that it is a global maximum, we only need to prove that \(W\left( d_g, d_g,\frac{1}{2}\right)\) is higher than W at the frontier.Footnote 22 Calculating welfare at \(\left( d_g,d_g,\frac{1}{2}\right)\), we obtain:

which is higher than welfare for \(\tilde{x}=0\).

By symmetry, the only remaining candidate is of the form \(\left( 0,b,\tilde{x}\right)\).

But, at a = 0, \(\frac{\partial W}{\partial a} > 0\), therefore, \(\left( 0,b,\tilde{x}\right)\) cannot be a maximizer. □

Proof of Proposition 6

Let’s start by maximizing over \(| a-b | \leq \frac{3}{1+\frac{\tau}{t}}\). The first-order conditions for an interior maximum are:

Subtracting the second from the first, we obtain a = b (which does not satisfy any of the conditions) or a + b = 1 (which is surely not optimal, as it implies that Π pj = 0). Therefore, there are no interior maxima.

The only possible maximizers are the frontier points. Assuming, w.l.o.g., that a ≥ b, we must have b = 0 or \(a= \min \left\{ b+\frac{3}{1+\frac{\tau}{t}} , 1-b \right\}\).

Suppose that b = 0. The joint profit becomes cubic in a:

The first-order condition of the maximization with respect to a is:

which is inside the domain for \(\frac{\tau}{t} \in [\sqrt{27}-1,5]\).

For \(\frac{\tau}{t} < \sqrt{27}-1\), the profit is maximized at a = 0. For \(\frac{\tau}{t} \in [\sqrt{27}-1,5]\), there are two possible maximizers: a = d pj or the frontier point a = 0. The reader may check that, for \(\frac{\tau}{t} < 5\), we have \(\Pi_{pj}\left( 0,0 \right) > \Pi_{pj}\left( d_{pj},0\right)\).

For \(\frac{\tau}{t} \geq 5\), we must compare the frontier points: \(\Pi_{pj}\left( 0,0 \right)\) with \(\Pi_{pj}\left( \frac{3}{1+\frac{\tau}{t}},0\right)\). It is easy to show that \(\Pi_{pj}\left( \frac{3}{1+\frac{\tau}{t}},0\right)\) is higher.

If b ≠ 0, we have \(a= b+\frac{3}{1+\frac{\tau}{t}}\), because in the other frontier point, a = 1 − b, the joint profit is null. Then:

which is decreasing in b, therefore, b = 0 is better.

We conclude that the maximum joint profit over \(| a-b | \leq \frac{3}{1+\frac{\tau}{t}}\) is obtained at:

Now, let’s maximize over \(a > b + \frac{3}{1+\frac{\tau}{t}}\), which is not empty for \(\frac{\tau}{t} \geq 2\). The first-order conditions for an interior maximum are:

But, since the determinant of the Hessian matrix is negative, there is no interior maximum. The maximum is at the frontier.

We either have b at the frontier or a at the frontier. Assuming, w.l.o.g., that a ≥ b, we can ignore the case in which a is at the frontier because a = 1 − b yields a null profit.

With b = 0 and an interior a, we obtain \(a =\frac{1+\frac{1}{2}\frac{\tau}{t}}{1 + \frac{\tau}{t}}\), which is inside the domain for \(\frac{\tau}{t} \geq 4\), and satisfies the second-order condition. For \(\frac{\tau}{t} \leq 4\), the maximum is attained at \((a,b) = \left( \frac{3}{1+\frac{\tau}{t}} , 0 \right)\).

After some calculations, we conclude that the maximum joint profit is obtained at:

□

Proof of Lemma 1

Recall that \(u_{1}\left(x \right)\) and \(u_{2}\left(x \right)\) is the utility of the consumer located at x when she buys the good from firm 1 and from firm 2, respectively.

We start by showing that the firms are always interested in selling to the consumers who are located between them (\(x\in \left[ a,1-b\right]\)). Suppose, without loss of generality, that \(a<\frac{1}{2}\), and, by way of contradiction, that there exists \(y\in \left[ a,1-b\right] \) such that \(u_1\left( y\right) <0\) and \(u_2\left( y\right) <0\). There exists \(y_1 \in \left( a,y\right)\) such that u 1(y 1) = 0. It is straightforward to see that the consumers in \(\left( y_1,y\right)\) do not buy from any firm. Then, by locating at a + ϵ, with \(\epsilon \in \left( 0,y-y_1\right)\), and keeping p 1 fixed, firm 1 increases its profit, by lowering the differentiation costs while maintaining (at least) its demand. The profit of firm 2 is not affected, thus we have a contradiction.

We now proceed to show that the extremes of the market are also covered. By way of contradiction, let us now suppose that there exists \(\tilde{x}_1 \in \left( 0,a\right)\) such that \(u_1\left(\tilde{x}_1\right) = 0\) and \(u_2\left(\tilde{x}_1\right) \leq 0\). The consumers located at \(\left[ 0,\tilde{x}_1 \right)\) do not buy from any firm. If \(a>\frac{1}{2}\), by moving firm 1 to a − ϵ, the joint profit would increase. With \(a\leq \frac{1}{2}\), moving to a − ϵ increases demand (prices are kept fixed) but also increases the differentiation costs. With \(\tilde{x}_2\) denoting the greatest x such that u 2(x) ≥ 0, the joint profit is:

Since \(u_1\left( \tilde{x}_{1}\right)=0\), we must have \( p_{1}=V-t\left( a-\tilde{x}_{1}\right)^2\). And, as before, the indifferent consumer is given by \(\tilde{x}=\frac{1+a-b}{2}+\frac{p_{2}-p_{1}}{2t\left( 1-a-b\right) }\).

The derivative of Π j with respect to \(\tilde{x}_1\) is:

where:

Thus:

Therefore, \(V\geq \frac{5t}{4}+\frac{\tau }{4}\) implies that \(\frac{\partial \Pi _{J}}{\partial \tilde{x}_{1}}<0\). Under this assumption, joint profit maximization implies full market coverage. □

Proof of Proposition 7

Observe that if the consumers at the extremes, x = 0 and x = 1, and the indifferent consumer, \(x=\tilde{x}\), buy the good, then all the other consumers also buy the good.

With a single firm producing, say firm 1, the maximum profit would be obtained by locating the firm in the center and setting \(p = V - \frac{t}{4}\) (which implies u 1(0) = u 1(1) = 0). The resulting profit would also be equal to \(V - \frac{t}{4}\). The same outcome results if both firms locate at the center and charge this same price.

If the two firms produce, there is full market coverage if and only if u 1(0) ≥ 0, u 2(1) ≥ 0 and \(u_1(\tilde{x})\geq 0\).

We start by maximizing the joint profit subject to u 1(0) ≥ 0 and u 2(1) ≥ 0, ignoring the restriction \(u(\tilde{x}) \geq 0\). Then, we check whether the solution obtained satisfies this restriction. If it does, then it is the solution to our problem.

For the consumer located at x = 0 to buy the good from firm 1, the price charged, p 1, cannot be higher than V − t a 2. The corresponding margin of firm 1 is: \(p_1 - V - t a^2 - \tau \left( \frac{1}{2}-a \right)^2\). The highest possible margin is obtained when (the derivative with respect to a is null):

To maximize its margin subject to covering x = 1, firm 2 should locate symmetrically and set the same price. Firms are, with these decisions, maximizing their margins. If the market is fully covered (that is, the ignored restriction is satisfied), then the joint profit is being maximized. This occurs if the firm is closer to the center than to the extreme:

For \(\frac{\tau}{t}\geq 1\), we have obtained the solution. Firms locate at \(\left( a^*, b^* \right) = \left( d_j,d_j \right)\), with \(d_j = \frac{\frac{\tau}{t}}{2\left( 1+\frac{\tau}{t}\right)}\), set prices \(p_1^*=p_2^* = V - t \frac{\left(\frac{\tau}{t}\right)^2}{4 \left(1+\frac{\tau}{t}\right)^2}\), and obtain a joint profit \(\Pi_j = V - \frac{t}{4} \ \frac{\left( \frac{\tau}{t} \right)^2 - \frac{\tau}{t} }{\left(1+\frac{\tau}{t}\right)^2}\) (higher than \(V - \frac{t}{4}\)).

For \(\frac{\tau}{t}<1\), the solution of the relaxed problem, obtained above, does not satisfy the ignored restriction, \(u_1(\tilde{x})\geq 0\), where \(\tilde{x}\in (0,1)\) as both firms are supposedly producing. Suppose, by way of contradiction, that the solution for this case is such that \(u_1(\tilde{x})=0\), u 1(0) > 0 and u 2(1) ≥ 0. These conditions imply that the indifferent consumer is between both firms, \(a<\tilde{x}<1-b\). Observe also that \(u_1(0) \geq u_1(\tilde{x})\) implies \(a < \frac{\tilde{x}}{2}\), and that \(u_2(1) \geq u_2(\tilde{x})\) implies \(b \leq \frac{1-\tilde{x}}{2}\). Therefore, \(a+b\leq \frac{1}{2}\).

But, then, the joint profit is not being maximized. It can be higher if firm 1 moves to a + ϵ (towards the center) and increases p 1 for the indifferent consumer to be kept constant (revenues increase, and the differentiation costs decrease). This contradiction implies that the solution must be such that \(u(\tilde{x})=0\), u(0) = 0 and u(1) = 0, implying that \(a+b = \frac{1}{2}\).

Since \(u\left( 0\right) = u\left( 1\right) = 0\), the charged prices must be \(p_1=V-ta^2\) and \(p_2=V-tb^2\), and the demands of firm 1 and 2 are 2a and 2b, respectively. The resulting joint profit is:

The corresponding first-order condition is:

because we are assuming that \(\frac{\tau}{t} < 1\).

Consequently, if \(\frac{\tau }{t} < 1\), firms choose to locate at \((a^*,b^*)=\left(\frac{1}{4},\frac{1}{4} \right)\). The joint-profit, in this case, is \(V - \frac{t+\tau}{16}\) (higher than \(V - \frac{t}{4}\)). □

About this article

Cite this article

Correia-da-Silva, J., Pinho, J. Costly horizontal differentiation. Port Econ J 10, 165–188 (2011). https://doi.org/10.1007/s10258-010-0066-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-010-0066-4