Abstract

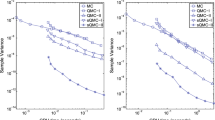

Quasi-Monte Carlo method (QMC) is an efficient technique for numerical integration. QMC provides a lower convergence rate, O(lnd n/n), than the standard Monte Carlo (MC), \({O( 1/\sqrt{n})}\) , where n is the number of simulations and d the nominal problem dimension. However, some studies in the literature have claimed that the QMC performs better than the MC method for d < 20/30 because of its dependence on d. Caflisch et al. (J Comput Finance 1(1):27–46, 1997) have proposed to extend the QMC superiority by ANOVA considerations. To this aim, we consider the Asian basket option pricing problem, where d is much higher than 30, by QMC simulation. We investigate the applicability of several path-generation constructions that have been proposed to overtake the dimensional drawback. We employ the principal component analysis, the linear transformation, the Kronecker product approximation and test their performance both in terms of computational cost and accuracy. Finally, we compare the results with those obtained by the standard MC.

Similar content being viewed by others

References

Acworth, P., Broadie, M., Glasserman, P.: A comparison of some Monte Carlo and Quasi-Monte Carlo methods for option pricing. In: Proceedings of the 1996 Conference on Monte Carlo and Quasi-Monte Carlo Methods. Springer, New York (1998)

Bratley P., Fox B., Niederreiter H.: Implementation and tests of low-discrepancy sequences. ACM Trans. Model. Comput. Simul. 2(3), 195–213 (1992)

Brigo, D. Mercurio, F., Rapisarda, F.: Connecting univariate smiles and basket dynamics: a new multidimensional dynamics for basket options. http://www.ima.umn.edu/talks/workshops/4-12-16.2004/rapisarda/MultivariateSmile.pdf (2004)

Caflisch R., Morokoff W., Owen A.: Valuation of mortgage-backed securities using Brownian bridges to reduce effective dimension. J. Comput. Finance 1(1), 27–46 (1997)

Imai, J., Tan, K.S.: Enhanced quasi-Monte Carlo method with dimension reduction. In: Proceedings of the 2002 Winter Simulation Conference, pp. 1502–1510 (2002)

Imai, J., Tan, K.S.: Minimizing effective dimension using linear transformation. In: Proceedings of the 2002 Monte Carlo and Quasi-Monte Carlo Methods. Springer, Berlin (2004)

Imai J., Tan K.S.: A general dimension reduction techique for derivative pricing. J. Comput. Finance 10(2), 129–155 (2006)

Matouŝek J.: On the L 2-discrepancy for anchored boxes. J. Complex. 14, 527–556 (1998)

Niederreiter H.: Random Number Generation and Quasi-Monte Carlo Methods. SIAM, Philadelphia (1992)

Owen A.: Latin supercube sampling for very high-dimensional simulations. ACM Trans. Model. Comput. Simul. 8, 71–102 (1998)

Pellizzari, P.: Efficient Monte Carlo pricing of basket options. 9801001, Economics Working Paper Archive at WUSTL. http://ideas.repec.org/p/wpa/wuwpfi/9801001.html (1998)

Pitsianis, N., Van Loan, C.F.: Approximation with Kronecker Products. Linear Algebra for Large Scale and Real Time application, pp. 293–314. Kluwer Academic Publishers, Dordrecht (1993)

Sabino, P.: Monte Carlo methods and path-generation techniques for pricing multi-asset path-dependent options. Rapporto 36/07, Dipartimento di Matematica, Universitá degli studi di Bari. http://www.arxiv.org. Code arXiv:0710.0850v1 (2007)

Sabino, P.: Implementing quasi-Monte Carlo simulations with linear transformations. Comput. Manage. Sci. (2009, in press)

Sobol’ I.M.: Uniformly distributed sequences with an additional uniform property. USSR J. Comput. Math. Math. Phys. (English Translation) 16, 1332–1337 (1976)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sabino, P. Efficient quasi-Monte simulations for pricing high-dimensional path-dependent options. Decisions Econ Finan 32, 49–65 (2009). https://doi.org/10.1007/s10203-009-0084-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-009-0084-9