Abstract

This paper estimates the possible job-shortfall across Italian and EU regions using a time–space dynamic panel data model with a spatial moving average random effects structure of the disturbances. The paper is a companion paper to an earlier prediction exercise regarding Brexit. The model includes spatial and temporal dependencies involving the endogenous variable, leading to estimates based on a new dynamic spatial generalized moments estimator proposed by Baltagi et al. (Reg Sci Urban Econ, 2018. https://doi.org/10.1016/j.regsciurbeco.2018.04.013). The predictions use modified interregional trade estimates, assuming a reduction in trade flows between Italian and EU regions due to Italexit, to simulate the impact on employment across Italian regions and the wider EU. Comparisons are made between Italexit and Brexit.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Italexit is a term used to describe the possible exit of Italy, the EU’s third largest economy, from the EU. There is an obvious parallel between Italexit and the impending exit of the UK, the so-called Brexit, but of course Italy’s exit would be somewhat different from the UK’s, because Italy is also part of the Eurozone, whereas the UK retains sterling. The possibility of Italy’s exit is a real possibility given that powerful political parties involved in the coalition government (left-populist Five Star Movement and right populist League) are indeed advocating Italexit as a solution to Italy’s economic and social travails, particularly related to immigration. In this paper some ramifications for regional employment are explored, as measured by the percentage job-shortfall that would occur as a result of diminished trade between Italy and the EU regions. The manifestation of Italexit would be complex, for not only would trade barriers between the remaining EU regions and Italian regions increase, for example, involving tariff and non-tariff barriers that currently do not exist, but also there would be exchange rate differences between Italy and the EU if there was also withdrawal from the Eurozone. Indeed, devaluation of a reinstigated lira could possibly increase trade with the EU despite increased barriers, and also stimulate trade with other non-EU countries. However, the euro itself could be weakened or even destroyed by Italy’s exit, with heavy repercussions on the world financial system. A devalued currency could lead to a flight of assets from the country, inflationary pressures and high interest rates. An insightful account of the financial implications of Italexit is provided by Codogno and Galli (2017), who among other things argue that ‘redenomination, and a likely default on debt obligations, would not be a solution to the problem of a high public debt and would produce significant financial and economic instability’.

Given the complexity involved, it is of course very difficult to predict how Italexit might affect employment both within Italy and across the EU regions. Accordingly, I attempt to simulate the impact of reduced trade on employment as robustly as possible given the inherent uncertainties attached to Italexit. To do this, I consider a so-called job-shortfall, that is the gross number of jobs likely to be lost due to trade reduction alone. This is not a prediction of the actual, or net, change in employment, because of course the other factors such as increased trade due to the stimulus of a possible devaluation could more than offset the job-shortfall, or indeed there could be a catastrophic job loss due to ensuing global economic chaos. The job-shortfall considered in this paper is an estimate of the jobs that would need to be replaced given a negative Italexit trade shock. With a focus on the loss of trade between Italian and other EU regions, the question arises, by how much will trade flows diminish? In reality we would expect trade reductions to differ according to sector and according to regions. So a pair of regions, one Italian and one in the remaining EU, could have a diminution of trade that is different from a different regional pair. Of course, the percentage loss of trade that would occur is unknown. In an attempt to make the predictions robust, I assume that the percentage loss in trade is the same for every pair of regions. In that way, the geography of impact is constant across different assumptions about the trade loss. That is, the relative impact between regions remains constant regardless of what is assumed for the loss of trade and the ensuing job-shortfall.

There are similarities and contrasts with Brexit. In a companion paper to this one (Fingleton 2019) which uses precisely the same methodology, predictions of job-shortfall are also made as a consequence of the UK’s exit from the EU. As with my Brexit predictions, I emphasize that the Italexit predictions are treated with caution, to repeat my earlier warning, ‘the numbers SHOULD NOT be taken too seriously. They are naturally dependent on the assumptions underpinning the model. Different assumptions regarding model structure, relevant data and estimation techniques can all potentially affect the predictions’. In both cases we see that the impact of exit on the job-shortfall is bilateral, regions within the UK and Italy and the rest of the EU are expected to see a job-shortfall. The details of the geography differ somewhat however, as will be explored subsequently.

In order to estimate the Italexit effect, I estimate employment levels across \(N=255\) EU regionsFootnote 1 both with and without Italexit. The explicit drivers of employment are output and capital, which are approximated by gross value added (GVA) and a function of gross fixed capital formation (GFCF), respectively. Estimation of a model with employment related to output and capital is based on a viable data series over the period 2001 to 2010.Footnote 2 Different assumptions are made about post-2011 paths for GVA and GFCF, given that accessible data with the same geography are not available, although these different assumptions have relatively little effect on outcomes.

2 The model

The modelFootnote 3 providing Italexit simulations assumes that employment partly depends on level of output, as measured by GVA (gross value added), denoted by \({\mathbf {q}}_{t}\), and (a proxy for) the level of capital within the region, based on GFCF (gross fixed capital formation), which is denoted by \({\mathbf {k}}_{t}\). As shown below an approximation to the log level of capital is \(\ln \widetilde{{\mathbf {k}}}_{t}=-\ln \widetilde{a}+ \widetilde{b}\ln {\mathbf {k}}_{t}\). Collecting together constants as \(c\varvec{\iota }_{t}\) in which c is a scalar and \(\varvec{\iota }_{t}\) an N -by-1 vector of ones, and reorganizing gives

in which the error term \(\varvec{\varepsilon }_{t}\) captures the time-invariant regional heterogeneity plus idiosyncratic shocks.

In the dynamic context, and following Baltagi et al. (2018), our basic assumption is that interregional employment levels remain stable unless acted upon by fundamental causes. This means that (log) employment levels across N regions at time t, denoted by the N -by-1 vector \(\ln \mathbf { e}_{t},\) persist at dynamically stable levels so that \(\ln \mathbf {e} _{t}=\ln \mathbf {e}_{t-1}\) but do change with changes in the levels of \( {\mathbf {q}}_{t}\) or \({\mathbf {k}}_{t}\), changes in interregional trade, or changes in unobservable effects. Given a disturbance at time t which is ephemeral, then \(\ln \mathbf {e}_{t}\ne \ln \mathbf {e}_{t-1}\) but if there is a subsequent period of quiescence \(t\rightarrow T\), employment levels will again tend to equilibrium so that \(\ln \mathbf {e}_{T}=\ln \mathbf {e} _{T-1}.\) Typically data show a lack of equilibrium so that \(\ln \mathbf {e} _{t}\ne \ln \mathbf {e}_{t-1},\) but we might assume that there is an autoregressive process, hence

in which \(\varvec{\varsigma }\) is an N -by-1 vector and \(\gamma \) is a scalar parameter. In the long-run with \(abs(\gamma )<1,\) and with no subsequent disturbances, the process converges to \(\ln \mathbf {e}_{T}= \frac{\varvec{\varsigma }}{\left( 1-\gamma \right) }\).

Spatial econometrics comes into the equation by virtue of a time-invariant N by N matrix \({\mathbf {W}}_{N}^{*}\), where N is the number of regions. This defines interregional connectivity. In subsequent model estimates, parameter interpretation is aided by normalizing by dividing \({\mathbf {W}} _{N}^{*}\) by its maximum eigenvalue, to giveFootnote 4\({\mathbf {W}}_{N}\). Accordingly, the maximum eigenvalue of \({\mathbf {W}}_{N}\) is one, and the continuous range for which \(\left( {\mathbf {I}}_{N}-\rho _{1}{\mathbf {W}}_{N}\right) \) is non-singular is \(\frac{1}{\min (eig)}<\rho _{1}<\frac{1}{\max (eig)}=1\), in which \(\rho _{1}\) is a scalar spatial autoregressive parameter.

Given Eq. (2), multiplying by \(\rho _{1}{\mathbf {W}}_{N}\) gives

Subtracting Eq. (3) from Eq. (2) leads to a logically consistent expression (4) in which the log level of employment \(\ln \mathbf {e} _{t}\) depends on \(\ln \mathbf {e}_{t-1}\)and on contemporaneous and lagged employment in other regions, as defined by \(\rho _{1}{\mathbf {W}}_{N},\) thus

Writing \(\theta =-\rho _{1}\gamma \) gives

in which \({\mathbf {B}}_{N}=\left( {\mathbf {I}}_{N}-\rho _{1}{\mathbf {W}} _{N}\right) ,{\mathbf {C}}_{N}=(\gamma {\mathbf {I}}_{N}+\theta {\mathbf {W}}_{N})\) and \({\mathbf {I}}_{N}\) is an identity matrix of order N. Given appropriate parameter restrictions, Eq. (4) implies dynamics which converge to equilibrium levels \(\ln \mathbf {e}_{T}=\left( {\mathbf {B}}_{N}-{\mathbf {C}} _{N}\right) ^{-1}{\mathbf {B}}_{N}\varvec{\varsigma }.\)

The two sources of variation in \(\ln \mathbf {e}_{t},\) either spatial and temporal spillovers as in Eq. (4), or variations in output \(\ln {\mathbf {q}}\) and capital \(\ln {\mathbf {k}},\) as in Eq. (1), together with other potential covariates, are combined by writing \({\mathbf {B}}_{N}\varsigma =\left( c\varvec{\iota }_{t}+{\mathbf {x}}{\varvec{\beta }}\right) ,\) in which \(c\varvec{\iota }_{t}\) is a constant N-by-1 vector, \({\mathbf {x}}\) is an N-by-k matrix, with k covariates such as \(\ln {\mathbf {q}}\) and \(\ln {\mathbf {k}},\) and \(\varvec{\beta }\) is a k-by-1 vector. Together this gives

Equation (5) converges to equilibrium levels

given appropriate restrictions on parameters. Following Elhorst (2001, 2014, p. 98), Parent and LeSage (2011, p. 478, 2012, p. 731) and Debarsy, Ertur and LeSage (2012, p. 162), this implies that the largest characteristic root \(\left( e_{\max }\right) \) of \({\mathbf {B}}_{N}^{-1}{\mathbf {C}}_{N}\) should be less than one.

Equation (5) is a fairly tightly restricted model specification, and with restriction it may not provide a good representation of actual data. To enable a good model fit, the model structure is loosened in three ways. First, taking account of temporal variation in covariates such as \(\ln {\mathbf {q}}_{t}\) and \(\ln {\mathbf {k}}_{t}\), the time-invariant matrix \(\mathbf { x}\) is replaced by time-varying matrixFootnote 5\({\mathbf {x}}_{t}.\)Although the system may still tend towards equilibrium, equilibrium will be continuously disturbed and new equilibrium levels established as t varies. Secondly, \(\ln \mathbf {e}_{t}\) may also depend on unobserved effects and these are represented by an error term \( \varepsilon _{t}.\)These unobserved effects are also treated as potentially spatially dependent, as explained below. Thirdly, the restriction that \( \theta =-\rho _{1}\gamma \) is removed so as to allow greater freedom in model prediction outcomes and also to facilitate an easier estimation process than would be the case if the restriction had to hold. Also for simplicity of estimation, interregional connectivity is assumed to remain constant over the estimation period. These considerations lead to the time–space dynamic panel data model given in Eqs. (7)–(10), thus

Given \({\mathbf {x}}_{1t}=\ln {\mathbf {q}}_{t}\), \({\mathbf {x}}_{2t}=\ln {\mathbf {k}} _{t},{\mathbf {x}}_{t}=\left[ {\mathbf {x}}_{1t}\;{\mathbf {x}}_{2t}\right] \) and \(\varvec{\beta }=\left[ \beta _{1}\;\beta _{2} \right] ^{^{\prime }}\), and \(\varvec{\iota }_{t}\) is an (N x 1) vector of ones, Eq. (7) can be stated more explicitly as

in which Eq. (9) defines the spatially dependent error process.

The disturbances \(\varvec{\varepsilon }_{t}\) have a compound structure (10) comprising time-invariant unobserved interregional heterogeneity represented by \(\mu _{i}\) with \(i=1,\ldots ,N\) and unobserved idiosyncratic shocks represented by \(\nu _{it};\,i=1,\ldots ,N,t=1,\ldots ,T\). These are assumed to be mutually independent and sum to \(u_{it}\). The frequent assumption is that spatial dependence is an autoregressive error (SAR-RE) process, so that \( \varvec{\varepsilon }_{t}=\rho _{2}\mathbf {M}_{N}\varvec{\varepsilon }_{t}+ {\mathbf {u}}_{t}\), the implication being that a shock to one region extends to all regions. Alternatively here we assume a spatial moving average error process (SMA-RE) as in Eq. (9); thus, \(\varvec{\varepsilon }_{t}= \mathbf {G}_{N}{\mathbf {u}}_{t}\), where \(\mathbf {G}_{N}=\left( {\mathbf {I}} _{N}-\rho _{2}\mathbf {M}_{N}\right) .\) With SMA-RE, a shock in a region only affects neighbours as defined by a row standardized interregional contiguity matrixFootnote 6\(\mathbf {M}_{N}\).

Figures 1, 2, 3 and 4 taken from Fingleton (2008) show, for the cross-sectional case, the essential difference between SMA-RE errors and SAR-RE errors. It is evident that SMA-RE errors might therefore proxy for omitted spillovers, which otherwise might be captured by the spatial lags \({\mathbf {W}}_{N}\mathbf { x}_{t}\mathbf {.}\) This is pertinent since the presence of \({\mathbf {W}}_{N} {\mathbf {x}}_{t}\) on the right hand side of (7) could adversely affect estimation. According to Baltagi et al. (2018) and Fingleton et al. (2017), using SMA-RE errors to account for local spillovers helps to avoid the problem for instrumental variable estimation identified by Pace et al. (2012). Ideally, as emphasized by Kelejian and Prucha (1998, 1999), two-stage least squares (2SLS) estimation should be based on the ‘exogenous’ variables (\({\mathbf {x}}_{t}\)) and their spatial lags (\({\mathbf {W}}_{N}\mathbf {x }_{t}\)), taking care to avoid linear dependence and retain full column rank for the matrix of instruments. As also explained by Pace et al. (2012), this ideal can be compromised by including \({\mathbf {W}}_{N}{\mathbf {x}}_{t}\) among the set of explanatory variables, since then spatial lags of the spatial lags (\({\mathbf {W}}_{N}^{2}{\mathbf {x}}_{t},{\mathbf {W}}_{N}^{3}{\mathbf {x}}_{t}, \ldots\)) would be among the set of instruments.

3 Data

In this section we follow exactly the treatment given in Fingleton (2008), which is here replicated for convenience. Accordingly, Eq. (8) is estimated using dataFootnote 7 for employment (\(\mathbf {e}_{t}\)), output as measured by gross value added (GVA, \({\mathbf {q}}_{t})\) and capital as proxied by a function of gross fixed capital formation (GFCF, \({\mathbf {k}}_{t}\)), both denominated in €2005m, for the 10-year period 2001 to 2010. Data for 2011 are excluded from estimation to allow out-of-sample prediction tests of the model. \( {\mathbf {k}}_{t}\) is used as a proxy for capital stock \(\widetilde{{\mathbf {k}}} _{t}\), for which data are unavailable, on the basis of a simple relationship between the two variables. \({\mathbf {k}}_{t}\) measures gross net investment (acquisitions minus disposals of produced fixed assets) in fixed capital assets and so indicates changes to the stock of capital. Assume a standard model for the evolution of capital stock which is depreciating at a constant rate \(\widetilde{d}\) so that

in which T is a large number. One problem with Eq. (11) is that it requires the initial capital stock at time \(t=1,\) i.e. \(\widetilde{{\mathbf {k}}} _{1}.\) Instead assume that \({\mathbf {k}}_{t}\) is a nonlinear function of a constant fraction \(\widetilde{a}\) of \(\widetilde{{\mathbf {k}}}_{t}\) so that

hence

Data exist for both (albeit experimental estimates of) \(\widetilde{{\mathbf {k}} }_{t}\)Footnote 8 (Derbyshire et al. 2010) and \({\mathbf {k}}_{t}\) for the year, \(t=2008\), allowing estimation of the loglinear representation of Eq. (13). The loglinear regression of \(\ln \widetilde{{\mathbf {k}}}_{t}\) on \(\ln {\mathbf {k}} _{t}\) gives OLS estimates of the constant \(\ln \widetilde{a}^{-1}=2.4546\;(t\,\hbox {ratio}=13.5628\)) and slope \(\widetilde{b}=1.0195\;(t\,\hbox {ratio}=50.8118),\)with \(R^{2}=0.8888.\) The plot of \(\ln {\mathbf {k}}_{t}\) against \(\ln \widetilde{ {\mathbf {k}}}_{t}\) shows a significant linear relationship and no evidence of outliers or of heteroscedasticity. It thus appears that the model given as Eq. (12) provides a good approximation. The estimated \(\widetilde{a} =0.0859\) suggests the approximate proportion of the capital stock that is invested, and, by comparison, \(\sum {\mathbf {k}}_{t}\)/\(\sum \widetilde{\mathbf { k}}_{t}=0.0686.\)

The matrix \({\mathbf {W}}_{N}\) is based on estimated bilateral trade flows between EU NUTS2 regions. Two alternatives are available, but we focus on the first. This comes from the PBL (Planbureau voor de Leefomgeving, the Netherlands Environmental Assessment Agency)Footnote 9 who developed a new methodology which is close to that of Simini et al. (2012). Simini et al.’s (2012) approach requires no context-specific tunable parameters to estimate from data as in gravity, intervening opportunities or random utility models. There is no assumption of a deterrence function (exponential, power law etc.) and no need for interaction data to re-estimate gravity parameters when applying to different areas. Simini et al. (2012) argue that parameter-free methodologies can outperform sophisticated parameter estimations, stay closer to the actual data and are far less data demanding. Details of the PBL methodology are given in Thissen et al. (2013a, b, c), see also Gianelle et al. (2014).

The PBL method follows a top-down approach and therefore is consistent with the national accounts of the different countries. Given the total international exports and imports on the country level, interregional trade flows are derived using data on business travel (services) and on freight transport (goods). Additionally, exports that went to EU destination countries’ final demandFootnote 10 were also included.Footnote 11 For estimation, the start-of-period trade flows for the year 2000 is used. This year is chosen because it is the earliest available, so it is treated as exogenous to \(\mathbf {e}_{t}\),\({\mathbf {q}}_{t}\) and \({\mathbf {k}}_{t}\), for \(t=2000\) to 2010. Prediction is based on the 2010 trade flows.

The second optional trade flow matrix is based on the best linear disaggregation method of Chow and Lin (1971), which was initially used to break down annual time series into quarterly series (see Abeysinghe and Lee 1998; Doran and Fingleton 2014). The approach breaks down aggregate tradeFootnote 12 between 21 EU counties into trade flows between EU NUTS 2 regions. Polasek et al. (2010), Vidoli and Mazziotta (2010), and Fingleton et al. (2015), give details of the method.

4 Estimator for the time–space dynamic panel data model

Pesaran (2015, Chapters 29 and 30) and Baltagi (2013, Chapter 13) give comprehensive overviews of spatial panel econometrics, although they pre-date the estimator used in this paper, which was introduced by BaltagiFootnote 13 et al. (2018). The estimator is based on the earlier paper by Baltagi et al. (2014), which extends the approach of Arellano and Bond (1991) by the introduction of extra moments by virtue of the presence and availability of spatial lags (see also Bouayad-Agha and Védrine 2010). Baltagi et al. (2018) extend the available methodology by including the spatial lag of the temporal lag of the dependent variable \(W_{N}\ln \mathbf {e}_{t-1}\), which can reasonably be assumed to be part of the model specification following the arguments leading to Eq. (4). Otherwise, bias could be introduced due to constraints on \(\gamma \) and \(\rho _{1}\)necessary for dynamic stability and stationarity.

In such a dynamic spatial panel model the presence of a spatial lag, a time lag and a time–space lag dependent variable renders the usual panel data estimators that ignore this spatial correlation biased and inconsistent. Moreover, instrumental variables (IV) or GM estimators are preferred because consistent maximum likelihood (ML) depends on assumptions made about initial conditions. For example, Bond (2002) argues that the distribution of the dependent variable depends on what is assumed about the distribution of the initial conditions, and different assumptions about initial conditions will lead to different likelihood functions, and consequently, ML estimators can be inconsistent when the assumptions on the initial conditions are misspecified. For instance, initial observations may be fixed or random, or correlated with individual effects or not. According to Hsiao (2003, pp. 80–95) ‘a simple consistent estimator that is independent of the initial conditions is appealing’, hence the preference for IV or GM estimators. The second new feature is the combination of this specification with SMA-RE. One aspect of the estimation in this paper is the treatment of regressors as predetermined rather than exogenous.Footnote 14 Hence, in Eq. (8), \(\ln {\mathbf {q}}_{t}\) and \(\ln {\mathbf {k}}_{t}\) are considered to be predetermined.

First differencing the data eliminates the time-invariant individual effects \(\varvec{\mu }\) which are correlated with the time- and space-lagged dependent variables. Accordingly the set of instruments are based on lagged levels of the endogenous regressors and predetermined regressors which are assumed to be independent of the differenced errors. This requires an assumption that \(\nu _{it}\) is serially uncorrelated so that \(E(\Delta \nu _{it},\Delta \nu _{it-2})=0.\) With endogenous variables, they can be used as instruments provided they are lagged by two periods, in which case the moments Eqs. (14) and (15) hold. Thus, following BaltagiFootnote 15 et al. (2014, 2018), we have

in which E denotes the expectation and the \(\left( 1\text { x }N\right) \) vector \(\mathbf {w}_{i}\) =\(\left( w_{i1,\ldots ,}w_{iN}\right) \) is the i-th row of matrix \({\mathbf {W}}_{N}\). Also, if we were to assume exogenous rather than predetermined regressors \(\left( {\mathbf {x}}_{1},{\mathbf {x}}_{2}\right), \) this leads to the set of instruments given by Eq. (16)

for \(t=3,\ldots ,T.\) In Eq. (16) the regressors \(\left( {\mathbf {x}}_{1}, {\mathbf {x}}_{2}\right) \) are assumed exogenous, so the moments equations are satisfied for the entire set regardless of t.

However, strict exogeneity eliminates feedback from past shocks to current values of the variable, which one would associate with variables \(\ln {\mathbf {q}}_{t}\), \(\ln {\mathbf {k}}_{t}\) which can reasonably be expected to depend on \(\ln \mathbf {e}_{t-1}\). The need to accommodate feedback, but avoid contemporaneous interdependence so as to allow time for feedback to occur, leads to the preferred estimator based on predetermined regressors (see Bond 2002; Pesaran 2015). Predetermined regressors are contemporaneously uncorrelated, so that \(corr({\mathbf {x}}_{t}\),\(\varvec{\nu }_{t})=0,\) but do depend on earlier shocks so that, for example, \(corr({\mathbf {x}}_{t}\),\( \varvec{\nu }_{t-1})\ne 0.\) This means that an adjustment to \(\ln \mathbf {e} , \) which embodies \(\varvec{\nu },\) at time t does not have an instantaneous effect on the explanatory variables at time t but takes effect at \(t+1\) and later. This allows an extension to the set of instruments (compared with assuming endogeneity, where all endogenous variables are lagged by two periods), by the inclusion of \({\mathbf {x}}_{1t-1}, {\mathbf {x}}_{2t-1},{\mathbf {W}}_{N}{\mathbf {x}}_{1t-1}\) and \({\mathbf {W}}_{N}\mathbf { x}_{2t-1}\) so that

The set of instruments in Eq. (17) are used to obtain initial estimates of \(\gamma ,\rho _{1},\theta \), \(\beta _{1},\)and \(\beta _{2},\) which are based on moments equations such as

As explained in detail in Baltagi et al. (2018), the resulting parameter estimates provide estimated errors which then yield estimates of the parameters of the SMA-RE error process. Referring to Eq. (10), these are \(\rho _{2},\sigma _{\mu }^{2}\) and \(\sigma _{\nu }^{2}\), which are obtained using moments equations given in Fingleton (2008). Given these, preliminary one-stage consistent spatial GM estimates are obtained, followed by the two-stage spatial GM estimates of \(\gamma ,\rho _{2},\theta \) and \( \varvec{\beta }\) based on a robust version of the variance–covariance matrix.

5 Estimates

In Table 1, because the parameter estimates are based on differences, no estimate of the constant c is provided. This estimate is subsequently constructed as the difference between observed time mean \(\ln \overline{e}\) and the expected time mean \(\ln \overline{\widehat{e}}\) given by Table 1 estimates applied to the time means of the regressors. This gives \(c =0.4462\). Observe that the \(\theta \) estimate for the spatial lag of the temporal lag \(({\mathbf {W}}_{N}\ln \mathbf {e}_{t-1})\) is not dissimilar to \(-\widehat{\gamma }\widehat{\rho }_{1}\), in line with expectation stemming from an equilibrium process.

Rather than the parameter estimates in Table 1, a full expression given in the literature (for example, Elhorst 2014) for the matrix of true partial derivatives of \(\ln e_{t}\) with respect to the k-th explanatory variable of \({\mathbf {x}}_{t}\) in unit 1 up to unit N at time t is given by

in which \(\beta _{k}\) is the coefficient on \({\mathbf {x}}_{k}\) and \(\widetilde{ \beta }_{k}\) denotes the coefficient on \({\mathbf {W}}_{N}{\mathbf {x}}_{k}.\) The mean (of the column totals of) expression (20) is typically taken as the total short-term effect, which is partitioned between direct and indirect effects. The direct effect is the mean of the diagonal of Eq. (20), and the indirect effect is the difference between the total and direct effect. We can think of the total short-term effect as the effect on \( \ln e_{t}\) at time t of a one unit change in \({\mathbf {x}}_{k}\) in each of N locations at time t only.

The presence of the spatial lags is typically motivated by a wish to pick up local spillovers. Given the SMA-RE error process which accounts for local spillovers among the errors, there are no spatial lags \({\mathbf {W}}_{N} {\mathbf {x}}_{k}(k=1,2)\) in Eq. (8) and their presence would lead to non-sensical predictions in the current study, as we show subsequently. Hence, \(\widetilde{\beta }_{k}=0\) in Eqs. (20) and (21).

The long-term effects are given by

which are likewise partitioned in direct, indirect and total effects. Here we can think of the total long-term effect as the effect on \(\ln e_{t}\) at time T (T very large) of a one unit change in \({\mathbf {x}}_{k}\) in each of N locations which remains through all times to T. Table 2 gives the short- and long-run effects, equal to (the means of) the true derivatives given by Eqs. (20) and (21), as also reported in Baltagi et al. (2018), who give the method used to obtain the standard errors. A characteristic feature of these estimates is that the omission of \({\mathbf {W}} _{N}{\mathbf {x}}_{1}\) and \({\mathbf {W}}_{N}{\mathbf {x}}_{2}\) causes the direct effect to the total effect ratios to be equal across explanatory variables, as evidentFootnote 16 from Table 2.

That the parameter estimates are stationary and dynamically stable is shown by the largest characteristic root of \({\mathbf {B}}_{N}^{-1}{\mathbf {C}}_{N},\) which is equal to 0.6757. Expressed in terms of individual parameters, the stationarity conditions require

in which \(\overline{\widetilde{e}}\) is the vector of eigenvalues of \(\mathbf { W}_{N}\) (Debarsy et al. 2012; Parent and LeSage 2011, 2012; Elhorst 2001). In the case of Table 2 estimates, \(\rho _{1}+\theta =0.13472,\gamma +\left( \rho _{1}+\theta \right) \overline{\widetilde{e}} _{\max }=0.78722,\rho _{1}-\theta =0.93587,\gamma -\left( \rho _{1}-\theta \right) \overline{\widetilde{e}}_{\max }=-0.28337.\) As an illustration of the importance of stationarity for prediction, the “Appendix” gives some simulated stationary and non-stationary paths and associated indicators. The stationary bounds for \(\rho _{2}\) are \(\widetilde{\widetilde{e}}_{\min }^{-1}=-1.1239<\ \rho _{2}<\widetilde{\widetilde{e}}_{\max }^{-1}=1.\) Observe that the negative values of \(\ \widehat{\rho }_{2}\) imply positive spatial dependence among the errors.

Table 3 gives estimates for rival models. Column A1 replaces the assumption of predetermined regressors with an assumption that they are exogenous. Column A2 retains the predeterminedness assumption, but replaces the SMA-RE error dependence assumption with SAR-RE errors. Column A3 retains both the predetermined regressor assumption and SMA-RE errors, but \(\mathbf {W }_{N}\) is derived using the Chow–Lin approach. Columns A4 and A5 show the outcomes retaining SMA-RE errors but include additional variables \({\mathbf {W}} _{N}{\mathbf {x}}_{1},\) the spatial lag of \(\ln {\mathbf {q}}\), with parameter \( \widetilde{\beta }_{1}\), and \({\mathbf {W}}_{N}{\mathbf {x}}_{2},\)the spatial lag of \(\ln k\), with parameter \(\widetilde{\beta }_{2}\), with \({\mathbf {W}}_{N}\) given by the PBL trade data. A4 relates to an assumption of predetermined regressors, and A5 assumes they are exogenous. The introduction of spatial lags is commonly recommended as a way to allow for local spillovers and to avoid the ratio of direct to indirect effects remaining constant. But as noted in Section 6, the predictive ability of none of these rivals is not as good as obtained via the preferred estimates summarized in Table 2, although the A1, A2 and A3 estimators do retain dynamic stability as indicated by the maximum characteristic root of \( {\mathbf {B}}_{N}^{-1}{\mathbf {C}}_{N}\) which is less than one. In contrast, with the spatial Durbin specifications of estimators A4 and A5, with regressors \({\mathbf {x}}_{t}=\left( {\mathbf {x}}_{1t},{\mathbf {x}}_{2t},{\mathbf {W}} _{N}{\mathbf {x}}_{1t},{\mathbf {W}}_{N}{\mathbf {x}}_{2t}\right) \), the additional covariates evidently cause a problem of weak instruments, giving dynamically unstable non-stationary estimates, as reflected by the largest characteristic root of \({\mathbf {B}}_{N}^{-1}{\mathbf {C}}_{N}\) equal to 1.0663 (1.9041). Although the details are not reported in Table 3, the spatial Durbin specification assuming predetermined regressors but with \(\rho _{2}\) restricted to zero gives a largest characteristic root equal to 1.1127 and assuming exogenous regressors and but with a spatial autoregressive (SAR) error process gives a largest characteristic root equal to 2.489. These results point to the viability of Table 1 estimates for prediction purposes.

6 Prediction

In order to support the preferred estimator, a cross-validation strategy is employed to assess the performance of competing estimators ‘by comparing their predictive ability on data which have not been used in model estimation’ (Anselin 1988). Out-of-sample predictions of the level of employment across regions are obtained for the years 2011 and 2012 using 2011 and 2012 data combined with the parameter estimates obtained for data over the estimation period 2001 to 2010.

Baltagi et al. (2014), who assume a SAR-RE error structure, propose a predictor that depends on the process that generates the initial values. This is difficult to operationalize in practice, so in this paper, following Baltagi et al. (2018), a tractable approach is adopted which does not depend explicitly on the initial values, and which allows an SMA-RE process for the errors.

A key element of the approach adopted is the estimation of the time-invariant individual error component \(\varvec{\mu .}\) Assuming a SMA-RE error process gives Eq. (7) rewritten thus

Using the data for the period \(t=2,\ldots ,T\) (assuming \(\ln \mathbf {e}_{0}\) is unavailable) \(\widehat{\varvec{\mu }}\) is obtained from Eq. (27) by introducing the estimated parameters from Table 1 to give \(\widehat{ \mathbf {G}}_{N}^{{}}=\left( {\mathbf {I}}_{N}-\widehat{\rho }_{2}\mathbf {M} _{N}\right) ,\widehat{{\mathbf {B}}}_{N}=\left( {\mathbf {I}}_{N}-\widehat{\rho } _{1}{\mathbf {W}}_{N}\right) ,\widehat{{\mathbf {C}}}_{N}=\left( \widehat{\gamma }+ \widehat{\theta }{\mathbf {W}}_{N}\right) ,\widehat{c}\) and \(\widehat{\varvec{\beta }}\) together with observed data \(\ln \mathbf {e}_{t}\) and \({\mathbf {x}} _{t}\) and drawing an N-by-1 vector \(\varvec{\nu }_{t}\) at random from \(N( \mathbf {0},\sigma _{\nu }^{2}{\mathbf {I}}_{N}).\) This gives \(T-1\) estimates of \( \widehat{\varvec{\mu }},\) and the time mean \(\overline{\varvec{\mu }}\) provides an estimate of the time-invariant \(\varvec{\mu .}\)This is scaled so that var(\(\overline{\varvec{\mu }})=\widehat{\sigma }_{\mu }^{2}\) with \( \widehat{\sigma }_{\mu }^{2}\) obtained using the moment conditions in levels described by Fingleton (2008a).

Given \(\overline{\varvec{\mu }}\), it is possible to calculate the prediction equation, Eq. (29), for \(T+1=2011,\) in which \(\mathbf {x }_{1T+1}=\ln {\mathbf {q}}_{T+1}\) and \({\mathbf {x}}_{2T+1}=\ln {\mathbf {k}}_{T+1}.\) For two-step ahead prediction,Footnote 17\({\mathbf {x}}_{1T+2}=\ln {\mathbf {q}}_{T+2}\) and \(\mathbf { x}_{2T+2}=\ln {\mathbf {k}}_{T+2}.\)

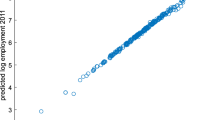

Figure 5 shows a close correlation between predicted log employment \(\ln \widehat{\mathbf {e}}_{T+1}\)and observed log employment, suggesting that the preferred estimator giving Table 2 estimates would be a good basis for simulating the impact on employment following Italexit.

The preference for Table 1 estimates is based on the mean of the \( RMSE=\left( \sum \nolimits _{i=1}^{N}\left( \ln e_{i,T+s}-\ln \widehat{e} _{i,T+s}\right) ^{2}/N\right) ^{\frac{1}{2}}\) for \(s=1,2,\) denoted by \( \overline{RMSE}\). In the case of Table 2, \(\overline{RMSE}=0.0721.\) As shown in Table 3, rival estimators give less accurate one- and two-step ahead predictions. In the case of assuming SMA-RE errors but with exogenous regressors, \(\overline{RMSE}=0.1791\). Assuming SAR-RE errors with predetermined regressors gives \(\overline{RMSE}=0.2890\). Note that in this case, \(\widehat{\mathbf {G}}_{N}=\left( {\mathbf {I}}_{N}-\widehat{\rho } _{2}\mathbf {M}_{N}\right) ^{-1}\) in equations ( 27,29). In Table 3, column A3 indicates that basing \({\mathbf {W}}_{N}\) on the Chow–Lin approach gives \(\overline{RMSE}=0.2529,\) which is larger than \( \overline{RMSE}=0.0721\) based on the PBL trade data. The spatial Durbin specifications in columns A4 and A5 were seen to be dynamically unstable and as a consequence with \({\mathbf {x}}\) and \({\mathbf {W}}_{N}{\mathbf {x}} \) in Eqs. (27) and (29) \(\overline{RMSE}=7.4403\) (3.0918). Likewise assuming a spatial Durbin with predetermined regressors but with \(\rho _{2}\) restricted to zero gives \(\overline{RMSE}=3.3017\), and assuming exogenous regressors and with a spatial autoregressive (SAR) error process gives \(\overline{RMSE}=20.9333\).

7 Simulating the Italexit effect

The approach adopted is to use the parameter estimates in Table 2 to predict the impact on employment, measured by the percentage job-shortfall in each region, of presumably reduced trade between Italy and the remaining EU regions in the year 2020 and beyond. The assumption is that the parameter estimates remain at their estimated levels into the future, and that the Italexit impact on employment is captured by changes to the trade flows between Italian regions and the regions in the rest of the EU. Attention is focussed on 2020 and later, so as to allow comparison with the Brexit effect estimated in the companion paper (Fingleton 2019), given that the UK’s formal exit from the EU is scheduled for the first half of 2019, so 2020 will the first full year outside the EU.

Given assumptions regarding future levels of \({\mathbf {q}}\) and \({\mathbf {k}}\), for \(\tau =2020\) onwards there are two scenarios: one based on the trade flows assuming no-Italexit effect and the other assuming an Italexit effect on trade flows, and the difference between them is taken as the Italexit effect. Regarding the no-Italexit effect scenario, this applies matrix \( {\mathbf {W}}_{N}\),which is based on the latest available trade flows pertaining to the year 2010. The prediction is then given by the solution to Eq. (30) with \(\widehat{{\mathbf {B}}}_{N}=\left( {\mathbf {I}}_{N}- \widehat{\rho }_{1}{\mathbf {W}}_{N}\right) ,\widehat{{\mathbf {C}}}_{N}=\left( \widehat{\gamma }+\widehat{\theta }{\mathbf {W}}_{N}\right) \) and \(\widehat{ \mathbf {G}}_{N}=\left( {\mathbf {I}}_{N}-\widehat{\rho }_{2}\mathbf {M} _{N}\right) .\) Also \({\mathbf {x}}_{\tau }\) is an \(\left( N\text {-by-}2\right) \) matrix containing forward projections \(\ln {\mathbf {q}}_{\tau }\) and \(\ln {\mathbf {k}}_{\tau },\) thus

Observe that as \(\tau \) becomes large, so that \(\tau =T,\) given stationarity (30) converges to

which is equivalent to Eq. (6) but with the additional term \( \widehat{\mathbf {G}}_{N}\overline{\varvec{\mu }}\) representing the effect of the SMA-RE error process. Also from Eq. (21) the total long-run effect of a persistent unit change in \({\mathbf {x}}_{k\tau }\) (\(\tau =2000,\ldots ,T)\) is

This emphasizes that the log-run effect of \({\mathbf {x}}_{k}\) is simply the difference between the equilibrium levels given by two different levels of \( {\mathbf {x}}_{k}.\) In contrast, the Italexit (and Brexit) effect depends on differences between two different versions of \({\mathbf {W}}_{N},\) denoted by \( {\mathbf {W}}_{N}\) and \(\widetilde{{\mathbf {W}}}_{N}.\)

Accordingly, the second (Italexit) scenario is to assume that bilateral trade between the Italian regions and the (remaining) EU regions is lower than it would otherwise be. Thus of the \(N=255\) Italian plus EU regions, there are \(N^{2}-N=64{,}770\) bilateral interregional trade flows in any 1 year. With 20 Italian regions and 235 other EU regions, 9400 interregional trade flows involving Italian and other EU regions are assumed to be smaller than under an assumption of no-Italexit effect. This Italexit-affected trade flow matrix is denoted by \(\widetilde{{\mathbf {W}}} _{N}^{{}}\) which leads to \(\widetilde{{\mathbf {B}}}_{N}=\left( {\mathbf {I}}_{N}- \widehat{\rho }_{1}\widetilde{{\mathbf {W}}}_{N}\right) ,\widetilde{{\mathbf {C}}} _{N}=\left( \widehat{\gamma }+\widehat{\theta }\widetilde{{\mathbf {W}}} _{N}\right) \) and the prediction equation

with convergence to

Thus, the percentage job-shortfall at time \(\tau \) is \(\ln \widehat{\mathbf {e}}_{\tau }-\ln \widetilde{\mathbf {e}}_{\tau }\), with long-run convergence to

8 Results

Figure 6 traces the paths of the percentage job-shortfall across all 255 regions as a result of a 10% reduction in trade between Italian regions and other EU regions. This is based on an assumption that \(\ln {\mathbf {q}}_{\tau }\) and \(\ln {\mathbf {k}}_{\tau }\) for \(\tau =2020\) to 2050 are at the same level as observed in each region in 2011.

Figure 7 shows the simulated outcomes assuming that from 2011 onwards \( {\mathbf {q}}_{i}\) and \({\mathbf {k}}_{i}\) grow at their historical rates, taken over the period 1991 to 2011 in each region. It is evident that the outcomes are reasonably robust to the assumption made regarding the paths of the regressors.

It is apparent that both Figs. 6 and 7 show that the Italexit impact stabilizes from about 2025 onwards across all regions, so what is presented is close to the stable, long-term outcome of the Italexit effect, without being so far into the future that the prediction equation becomes untenable because the variables controlling the equilibrium levels have greater scope to change and cause movement to new equilibria. Figures 8 and 9 show the distribution of the effect for \(\tau =2025\) assuming a 10% reduction in trade with \(\ln {\mathbf {q}}_{\tau }\) and \(\ln {\mathbf {k}}_{\tau }\) remaining stable over time.

Frequency distribution from Fig. 8

Frequency distribution from Fig. 10

Figures 10 and 11 show close-up views of the impact of an assumed reduction of 10% in trade across all sectors between the Italian regions and other regions of the EU. Of course, the 10% reduction is completely arbitrary, but exactly the same geography occurs under alternative trade reduction assumptions, so while we cannot predict the impact on jobs with certitude, we can see that the relative impacts are robust to the assumptions made about the reduction in interregional trade, provided the trade reduction, such as 10%, is the same for different regional pairs. Accordingly the largest percentage job-shortfall occurs in the largest regions with the strongest trade links with the rest of the EU. These are Lazio (− 10.6%) and Lombardia (− 11.7%) though the largest impact is in the small Alpine region of Valle d’Aosta (− 15.5%). Significant impacts are also predicted further south in Campania (− 6.3%) and Sicilia(− 5.2%). However, significant effects are also predicted beyond the boundaries of Italy, notably in Austria (Wien, − 3.9%) extending Eastwards into Hungary and in a more detached fashion to parts of Spain (Madrid, − 3.2%, Catalunia, − 3.0%), Germany and France. The conclusion that can be made is that the negative employment effect of Italexit is likely to be bilateral, but asymmetrical.

Consider by way of comparison the predicted effect of Brexit (as detailed in the companion paper). Figure 12 gives the impacts of a 10% reduction in trade between EU and UK regions as predicted for 2025. There are some similarities in the geography, with Southern Britain expected to see the largest job-shortfall in a similar way to the impact of Italexit on Northern Italy, and the effect spills over to proximate regions and especially large trade partners. But the effect of Brexit appears to be more geographically widespread. As shown in Fig. 13, there are fewer EU regions overall with negligible impacts. Within the UK, Figs. 14 and 15 show that the regions with the greatest impact are in the South and East and form a more contiguous group than the more fractionated distribution found for Italy. Also the largest impact is − 8.6% for Inner London, which is somewhat less than the impact predicted for northern Italy.

Frequency distribution from Fig. 12

Frequency distribution from Fig. 14

9 Conclusion

In this paper Italy’s possible exit from the EU, or Italexit, and its implication for trade flows between Italian regions, is assessed in terms of its impact on employment. The predictions are in terms of a job-shortfall; in other words, the percentage difference between the estimated level of employment where trade is reduced between Italian regions and other regions of the EU, and the level of employment that would occur where there is no effect on trade. Therefore, the impacts as reflected in the maps of job-shortfall indicate those regions which will be in the greatest need of alternative employment sources to compensate for the job-shortfall likely as a result of Italexit. Thus, the paper is not predicting a job loss per se, simply a potential job loss without successful alternative trade arrangements post-Italexit.

The paper shows negative potential impacts on employment in the Italian regions and also on employment levels in EU regions, particularly those which are close trading partners. Across-Europe interregional interdependency depends on the strength of interdependence measured by well-founded data on trade flows within a state-of-the-art dynamic spatial panel model characterized by spatial and temporal interactions.

The model assumes that employment within a region depends on its capital and output levels, and on unobservable effects which are embodied within the prediction equation. In addition, employment within a region depends on demand coming from other regions which are trading partners. The assumption is that a reduction in trade between EU and Italian regions amounts to a reduction in demand. The approach adopted is robust to the assumptions made about the reduction in trade, with relative impacts across regions remaining the same regardless of the assumed percentage reduction in trade. The predictions show that there are different impacts in different regions. The Italian regions have the largest percentage shortfall, especially in the larger regions with the biggest trade flows. Regions outside Italy are also affected negatively, depending on their trade connections with Italy, but the impact is generally lower.

With regard to the question, Italexit, is it another Brexit?, there are both similarities and differences between the two. Of course, the EU-wide geographical spread of the respective impacts is very different, but internally they both have in common a large impact on the largest regions with close trade links to the rest of the EU, and generally more remote and smaller regions are less affected. However, the similarity ends there, because Italexit could have a much more serious impact than the already serious impact of Brexit, since it would quite naturally entail exit from the Eurozone also. The predictions have abstracted from this possibility, which could have very significant effects on employment, but it is so uncertain what they would be that no attempt is made to simulate these.

To reiterate the caution exercise in Fingleton (2019), these are not predictions of what will happen. What we have are simulations based on models with strong assumptions. Again, it is worth emphasizing the words of Box and Draper (1986), ‘Essentially, all models are wrong but some are useful’. The alternative to simulating outcomes is to simply say it is not possible to predict the future and to bury our heads in the sand waiting for events to happen. At least with scenarios of possibilities, contingencies can be developed to defend again potential adverse outcomes. As Pesaran (1990) points out, ‘econometric models are important tools for forecasting and policy analysis, and it is unlikely that they will be discarded in future. The challenge is to recognize their limitations and to work towards turning them into more reliable and effective tools. There seem to be no viable alternatives’.

Notes

Although Switzerland and Norway are formally outside the EU, they are an integral part of the analysis. Their regions are referred to as EU regions for convenience.

Data for 2011 are not used in estimation but held for one-step ahead prediction.

The companion (Brexit) paper, Fingleton (2019) gives details of theory leading to this specification.

The matrix \({\mathbf {W}}_{N}\) retains (scaled) absolute levels rather than shares as the basis of interregional connectivity, and we make the standard assumptions for a weights matrix, that it comprises fixed (non-stochastic) non-negative values with zeros on the leading diagonal and its row and column sums are uniformly bounded in absolute value, and maintain the same assumption for \({\mathbf {B}}_{N}^{-1}=\left( {\mathbf {I}}_{N}-\rho _{1}{\mathbf {W}} _{N}\right) ^{-1}\) (Elhorst 2014, p. 99).

We assume that the elements of \(\mathbf {X}_{t}\) are uniformly bounded in absolute value.

The matrix \(\mathbf {M}_{N}\) has \(\widetilde{\widetilde{e}}_{\max }^{-1}=1,\) where \(\widetilde{\widetilde{e}}\) is the vector of purely real characteristic roots of \(\mathbf {M}_{N}.\) We assume that \(\mathbf {M}_{N}\) has the same properties as \({\mathbf {W}}_{N},\) and with the restriction that \( \widetilde{\widetilde{e}}_{\min }^{-1}<\rho _{2}<\widetilde{\widetilde{e}} _{\max }^{-1}=1\) one guarantees the invertibility of \(\mathbf {G}_{N}\) as in Eq. (27).

Taken from the Cambridge Econometrics European Regional Economic database.

I am grateful to Cambridge Econometrics for providing these data.

We are grateful to Mark Thiessen, who kindly provided the data. The data can be visualized at http://themasites.pbl.nl/eu-trade/index2.html?vis=net-scores.

Final consumption expenditure by households and non-profit organizations, final consumption expenditure by government, net capital formation and inventory adjustment.

OLS regression of the log PBL trade flows on log Chow–Lin trade flows produced parameters used to predict missing PBL regional trade flows for Switzerland and Norway using the values for these regions obtained via the Chow–Lin approach.

They are downloadable from http://cid.econ.ucdavis.edu/data/undata/undata.html, see also Feenstra et al. (2005).

Since the estimator is fully described in Baltagi et al. (2018), only a simple outline sketch is provided here.

We show below that the assumption of predetermined regressors produces superior one-step ahead predictions compared with assuming exogenous regressors.

They also include additional moments based on the matrix \({\mathbf {W}}_{N}^{2}\) which for simplicity are not included here.

Rounding eliminates exact equality.

Data limitations mean that for 2012, \({\mathbf {k}}\) in each region is estimated using each region’s previous growth rate.

References

Abeysinghe T, Lee C (1998) Best linear unbiased disaggregation of annual GDP to quarterly figures: the case of Malaysia. J Forecast 17:527–537

Anselin L (1988) Spatial econometrics: methods and models. Kluwer Academic Publishers, Dordrecht

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment. Rev Econ Stud 58(2):277–297

Baltagi BH (2013) Econometric analysis of panel data, 5th edn. Wiley

Baltagi BH, Fingleton B, Pirotte A (2014) Estimating and forecasting with a dynamic spatial panel model. Oxf Bull Econ Stat 76(1):112–138

Baltagi B, Fingleton B, Pirotte A (2018) A time-space dynamic panel data model with spatial moving average errors. Reg Sci Urban Econ. https://doi.org/10.1016/j.regsciurbeco.2018.04.013

Bond S (2002) Dynamic panel data models: a guide to micro data methods and practice. Port Econ J 1(1):141–162

Bouayad-Agha S, Védrine L (2010) Estimation strategies for a spatial dynamic panel using GMM. A new approach to the convergence issue of European regions. Spat Econ Anal 5(2):205–227

Box GEP, Draper NR (1986) Empirical model-building and response surfaces. Wiley, Chichester

Chow G, Lin A-I (1971) Best linear unbiased interpolation, distribution and extrapolation of time series by related series. Rev Econ Stat 53(4):372–375

Codogno L, Galli G (2017) ’Italexit is not a solution for Italy’s problems’. LSE EUROPP Blog. http://blogs.lse.ac.uk/europpblog/2017/02/24/italexit-is-not-a-solution-for-italys-problems/

Debarsy N, Ertur C, LeSage JP (2012) Interpreting dynamic space-time panel data models. Stat Methodol 9(1–2):158–171

Derbyshire J, Gardiner B, Waights S (2010) Estimating the capital stock for the NUTS 2 regions of the EU-27. European Union Working Papers no. 01/2011

Doran J, Fingleton B (2014) Economic shocks and growth: spatio-temporal perspectives on Europe’s economies in a time of crisis. Pap Reg Sci 93(S1):S137–S165

Elhorst JP (2001) Dynamic models in space and time. Geogr Anal 33(2):119–140

Elhorst JP (2014) Spatial econometrics: from cross-sectional data to spatial panels. Springer, Heidelberg

Feenstra RC, Lipsey RE, Deng H, Ma AC, Mo H (2005) World trade flows: 1962–2000. NBER working paper series, Working Paper 11040. Available at: http://www.nber.org/papers/w11040

Fingleton B (2008) A generalized method of moments estimator for a spatial panel model with an endogenous spatial lag and spatial moving average errors. Spat Econ Anal 3(1):27–44

Fingleton B (2019) Exploring Brexit with dynamic spatial panel models: some possible outcomes for employment across the EU regions. Ann Reg Sci. https://doi.org/10.1007/s00168-019-00913-2

Fingleton B, Garretsen H, Martin RL (2015) Shocking aspects of monetary union: the vulnerability of regions in Euroland. J Econ Geogr 15:907–934

Fingleton B, Le Gallo J, Pirotte A (2017) A multi-dimensional spatial lag panel data model with spatial moving average nested random effects errors. Empir Econ. https://doi.org/10.1007/s00181-017-1410-7

Gianelle C, Goenaga X, González I, Thissen M (2014) Smart specialisation in the tangled web of European inter-regional trade. S3 Working Paper Series No. 05/2014, JRC-IPTS, Sevilla

Hsiao C (2003) Analysis of panel data, 2nd edn. Cambridge University Press, Cambridge

Kelejian HH, Prucha IR (1999) A generalized moments estimator for the autoregressive parameter in a spatial model. Int Econ Rev 40(2):509–533

Pace RK, LeSage JP, Zhu S (2012) Spatial dependence in regressors. In: Terrell D, Millimet D (eds) Advances in econometrics volume 30, Thomas B. Fomby, R. Carter Hill, Ivan Jeliazkov, Juan Carlos Escanciano and Eric Hillebrand. Emerald Group Publishing Limited, Bingley, pp 257–295

Parent O, LeSage JP (2011) A space-time filter for panel data models containing random effects. Comput Stat Data Anal 55(1):475–490

Parent O, LeSage JP (2012) Spatial dynamic panel data models with random effects. Reg Sci Urban Econ 42(4):727–738

Pesaran MH (1990) Econometrics. In: Eatwell J, Milgate M, Newman P (eds) The New Palgrave: econometrics. W.W. Norton and Company, New York, pp 25–6

Pesaran MH (2015) Time series and panel data econometrics. Oxford University Press, Oxford

Polasek W, Verduras C, Sellner R (2010) Bayesian methods for completing data in spatial models. Rev Econ Anal 2(2):194–214

Simini F, González MC, Maritan A, Barabási A (2012) A universal model for mobility and migration patterns. Nature 484(7392):96–100

Thissen M, van Oort F, Diodato D, Ruijs A (2013a) Regional competitiveness and smart specialization in Europe: place-based development in international economic networks. Edward Elgar Publishing, Cheltenham

Thissen M, Diodato D, van Oort F (2013b) Integration and convergence in regional Europe: European regional trade flows from 2000 to 2010. PBL publication number: 1036. PBL Netherlands Environmental Assessment Agency, The Hague/Bilthoven

Thissen M, Diodato D, van Oort F (2013c) Integrated regional Europe: European regional trade flows in 2000. PBL publication number: 1035. PBL Netherlands Environmental Assessment Agency, The Hague/Bilthoven

Vidoli F, Mazziotta C (2010) Spatial composite and disaggregate indicators: Chow–Lin methods and applications. In: Proceedings of the 45th Scientific Meeting of the Italian Statistical Society, Padua

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Simulation of dynamics

Appendix: Simulation of dynamics

Consider a data-generating process

This is based on a Toeplitz matrix \(d_{ij},\forall i,j,\) of dimension \(N=20,\) where \(d_{ij}\) denotes the distance between regions i and j , and \( w_{N,ij}=d_{ij}^{-2}\) with zeros on the main diagonal and subsequently row normalized, giving \({\mathbf {W}}_{N}\). Hence, \({\mathbf {A}}_{N}=\left( {\mathbf {I}} _{N}-\rho _{1}{\mathbf {W}}_{N}\right) ^{-1}\left( \gamma {\mathbf {I}}_{N}+\theta {\mathbf {W}}_{N}\right) \). \({\mathbf {x}}\) is an N-by-1 vector drawn at random from a U(0,1) distribution and \(\beta =0.75\).

The parameter values used in the recursive generation of the region paths are \(\rho _{1}=-\,0.4,\gamma =0.9\) and \(\theta =-\,0.5.\)

The explosive outcome is reflected by the maximum absolute eigenvalue of the matrix \({\mathbf {A}}_{N}\), which is equal to 1.3007. As time proceeds the levels of \(y_{it}\) across the different locations deviate from their earlier values and from the levels in other locations. Evidently with a dynamically explosive process, predicted outcomes are going to be unlike past experience (Fig. 16).

Figure 17 is based on the same data-generating process but with \(\rho _{1}=0.1,\gamma =0.4\) and \(\theta =-\,0.25.\) In this case the dynamics are stable, as reflected by the maximum absolute eigenvalue of the matrix \( {\mathbf {A}}_{N}\), which is equal to 0.4794.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Fingleton, B. Italexit, is it another Brexit?. J Geogr Syst 22, 77–104 (2020). https://doi.org/10.1007/s10109-019-00307-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10109-019-00307-0

Keywords

- Italexit

- Brexit

- Interregional trade

- Panel data

- Spatial lag

- Spatio-temporal lag

- Dynamic

- Spatial moving average

- Prediction

- Simulation