Abstract.

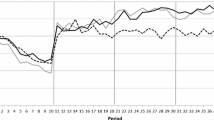

In an internal capital market, individual departments may compete for a share of the firm’s budget by engaging in wasteful influence activities. We show that firms with more levels of hierarchy may experience lower influence costs than less hierarchical firms, even though the former provide more opportunities for exerting influence. The unique influence-cost minimizing hierarchy is strongly asymmetric. With a linear production technology this is also the optimal hierarchy. If individual departments have different productivities, however, and the production technology exhibits decreasing returns to scale, a symmetric hierarchy that does not minimize influence costs may be optimal.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Received: July 2004, Accepted: October 2004,

JEL Classification:

D74, G31, G34

We thank Martin Hellwig, seminar participants at the University of Mannheim, and an anonymous referee for helpful comments, and Kai Konrad for handling the editorial tasks on this paper. Financial support from Deutsche Forschungsgemeinschaft, Sonderforschungsbereich 504 (Inderst and Müller) and the Bank of Sweden Tercentenary Foundation (Wärneryd) is gratefully acknowledged.

Rights and permissions

About this article

Cite this article

Inderst, R., Müller, H.M. & Wärneryd, K. Influence costs and hierarchy. Economics of Governance 6, 177–197 (2005). https://doi.org/10.1007/s10101-004-0084-8

Issue Date:

DOI: https://doi.org/10.1007/s10101-004-0084-8