Abstract

The technological developments observed in the last two decades contributed to the digitalization of products and the introduction of various mobile devices designed for the consumption of this digital content. Many online retailers launched their own mobile devices, which had a direct effect on their multi-product pricing strategies, but also an effect on the other channel members’ pricing decisions (i.e., digital-content providers). In many industries, these developments resulted in switching from traditional wholesale pricing to Revenue-Sharing Contracts (RSC), involving a shift of control over retail prices in the channel, a situation that was not always easily accepted by channel members. We examine a manufacturer-retailer framework where the manufacturer sells a base product in two formats: a tangible product sold directly to consumers and a digital format sold via an online retailer. The latter also sells an optional contingent product, a device used to consume the digital product. We investigate two questions: The first one pertains to the contingent product’s impact on firms’ pricing strategies. The second question investigates whether the manufacturer is interested in the implementation of an RSC and then looks at whether this pricing model suits the retailer and consumers. Our main results are as follows: (1) The presence of the contingent product leads to a higher retail price for the digital base product and negatively affects the demand for the tangible product format. (2) The manufacturer is interested in an RSC only if it receives a sufficiently large part of the digital-product revenue, but the retailer is almost always interested by this pricing model. (3) The double marginalization effect could benefit the manufacturer.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The proliferation of transaction websites, the growth of product digitization and the expansion of mobile commerce (i.e., m-commerce) are some of the major retail developments driven by the digital revolution in the last two decades. The introduction of digital formats (i.e., e-products) such as music MP3s and e-books that can be instantly purchased and consumed on mobile devices illustrates this revolution in some industries (Grewal et al. 2010).Footnote 1 Meanwhile, the phenomena of m-commerce has created new business development opportunities for the launch of handheld devices that facilitate users’ experience when consuming digital products (Kalakota and Robinson 2000).Footnote 2 Some of these accessories are multifunctional (e.g., smartphones, smartwatches, or tablets), while others take the form of dedicated-for-use devices that allow consumers access only to a specific digital content (e.g., e-Reader and iPod). These devices are often made available for purchase on the same online channels providing the digital content. In particular, many online retailers have taken advantage of the interdependencies between digital-product and mobile-device demands by introducing their own mobile devices (Apple launched the iPod and Amazon launched its own reading device, Kindle).

During the early stages of the digital revolution, Kalakota and Robinson (2000) announced that firms should pay attention to these changes, and more particularly to their implications on the emergence of new business models. The authors urged managers to replace their traditional ways of doing business by adopting an e-business perspective where decisions are adapted to the digital world. Indeed, (1) changes in product formats, (2) omnichannel distribution, and (3) the emergence of new ways to consume digital products entail changes in the other marketing variables, and especially on product pricing strategies (Kannan et al. 2009; Grewal et al. 2010). These changes affect not only the digital format but also its tangible counterpart. Because variable production costs are negligible for digital products, and suppliers are often dependent on major online retailers for the distribution of their products, the new pricing strategies are no longer based on costs, while at the same time, the balance of power between suppliers and e-tailers over the control of retail price decisions is changing. The traditional wholesale pricing model, whereby retailers used to purchase products at a cost (i.e., the wholesale price) and then set their retail prices by adding their profit margins, is being replaced in the most strongly impacted industries by agency pricing contracts, in which the retail price control is given to suppliers, while retailers receive a commission on sales in the form of a Revenue-Sharing Contract (RSC).Footnote 3

The shift of control over retail prices in channels is not always easily accepted by vertical channel members. Many industries have experienced huge conflicts because of these changes. Suppliers have accused retailers of selling the digital content at very low prices in order to accelerate the adoption of their mobile devices (i.e., loss-leader pricing), and suppliers forced their retailers to move to an RSC. However, retailers wanted to keep control over retail prices.

For example, Amazon, who used to control e-book retail prices, disapproved of a change in business model that Macmillan, its content supplier, wanted to implement as an alternative to the traditional wholesale arrangement. Amazon reacted by ceasing all sales of Macmillan books on its e-Library.Footnote 4

The Macmillan-Amazon dispute over the choice of a pricing model was not unique. In another dispute, this time between Apple and NBC Universal, the latter clearly announced that Apple’s practice of loss-leader pricing was hurting the other channel members’ interests.

Broadly, the above stories take place in a context with the following features: (a) there are two firms (a manufacturer and an e-retailer) engaged in a vertical relationship; (b) the manufacturer is offering a frequently purchased product in two different formats (digital and tangible) through two marketing channels (e-retailer and direct distribution); (c) the two formats are partially substitutable, and hence the e-retailer is simultaneously a partner of the manufacturer in the e-channel and its competitor in the product market; (d) in addition, the e-retailer sells a durable product (a device). Demand for this durable product is positively affected by sales of the digital product. It is important to note that consumers can also use other devices for the consumption of the digital format. The device is called “an optional contingent product” since it is only an accessory and it is useless to consumers who do not buy the digital product’s format. Hence, the contingency between the digital product and the device is asymmetric.

In this study, we want to examine the issue of pricing in vertical channel structures when a base product is sold in the marketplace in two competing formats via a traditional and an online channel and when a contingent product is made available by the online retailer. Retaining a marketing channel having the features [(a)–(d)] described above, we wish to provide answers to the following questions:

- 1.

Assuming that the channel adopts a wholesale pricing model, then

- (a)

What are the equilibrium prices and outcomes?

- (b)

What is the impact of offering the two product formats on these strategies?

- (c)

How does the presence of a contingent product affect these pricing strategies?

- (d)

Under what circumstances is loss-leader pricing an optimal strategy for the retailer?

- (a)

- 2.

Assuming an RSC is envisioned, then

- (a)

Under what circumstances would the manufacturer be indeed interested in implementing it?

- (b)

Among those cases that suit the leader (manufacturer), are there instances that also suit the retailer and/or consumer?

- (a)

To answer these questions, we develop a parsimonious model retaining the features (a)–(d) mentioned above, and we characterize and compare the equilibrium strategies in the two business models, namely, the wholesale pricing arrangement and an RSC.

Furthermore, our context of pricing products in a marketing channel intrinsically differs from the existing literature dealing with cases of (1) pricing in an oligopoly (where the focus is on horizontal strategic interactions between a few firms competing with different brands in the same product category); (2) pricing of substitute products in marketing channels (where the focus is on vertical strategic interactions between manufacturers and retailers, with possible horizontal interactions at the manufacturing and/or retailing layer(s)); and (3) pricing of complementary products marketed by the same firm (i.e., product-line pricing). In the last case, it is clearly beneficial for the firm to control all the prices in the product line since decisions will be automatically coordinated by the same decision maker. When products are controlled by separate firms involved in a vertical structure, managers will not necessarily adopt the same strategies, because they will each have individual objectives.

In our setting, the base product is the frequently purchased product being sold in digital format by the manufacturer through its retailer, which also offers the contingent durable product. Hence, there is no valid reason for the manufacturer to heavily discount the price of the digital product, especially because this will hurt sales of the other product’s format. However, there is a reason for the retailer to do so (i.e., to use a loss-leader pricing strategy), namely, to boost sales of the high-margin contingent product. Hence, the retailer needs the manufacturer to provide the base product at a sufficiently low wholesale price. This may be too much to ask the manufacturer, especially if it sells directly to consumers a substitute version of the product (i.e., the tangible format), which could be subject to a cannibalization effect by the digital format. This means that all the ingredients for a conflict in the channel are in place.

2 Literature review

Our work is related to two literature streams, namely, product-mix pricing and pricing in vertical marketing channels. We review the relevant papers in these two streams and point out our contribution.

2.1 Product-mix pricing

As the name suggests, product-mix pricing refers to strategies and tactics used to exploit mutual dependencies between brands, products, or items (Tellis 1986). Peterson and Mahajan (1978) propose a classification of products based on the interdependency of their demands. Two products are said to be

Independent when the sales of one product are not affected, in a transparent way, by the sales of the other.

Substitutes when an increase in the sales of one product leads to a decrease in the sales of the other. Competing brands in any product category are typically substitutes. Different formats of the same product can also be considered as substitutes since they belong to the same product line.Footnote 5

Complements when the sales of one product positively affect the sales of the other because there is an associative “natural, functional relationship” between them and this relationship is symmetric (or bilateral). A typical example is a hamburger and french fries.

Contingent when the sales of one product are conditional on the sales of another product. Mahajan and Muller (1991) distinguish between captive contingent products and optional contingent products . In the former case, we have bilateral or symmetric contingency, that is, neither product can be used without the other (e.g., a printer and its ink cartridges). In the case of optional contingent products, the contingency is unilateral or asymmetric (e.g., a cell phone and its accessories). Obviously, a consumer would only consider buying the contingent product (accessories) if she buys (or has bought) the base product (cell phone), and a consumer who has bought the base product could use it without necessarily possessing the contingent one.

In most popular examples of contingent products, e.g., printer/ink cartridges and razor/blades, the base product is the durable one, and the contingent product is the repeat-purchase product (Bayus 1987). In the example of the digital industries, it is the other way around. Indeed, no consumer would purchase an e-reader or an MP3 music player if e-books or MP3 music were not provided in the market.

Noble and Gruca (1999) surveyed 270 managers in order to identify the determinants of their pricing strategies. They found that complementary -product pricing is mainly used when the profitability of the contingent product is high. In such a context, the base product (printer, razor) is sold at cost or even given away for free, and money is made from the captive contingent product (ink cartridges, blades). This strategy, which is referred to as loss-leader pricing or the razor-and-blades business model,Footnote 6 is now practiced in many industries, but typically, for products belonging to the same product line and sold by the same firm (Kotler 1988).

Mahajan and Muller (1991) obtain that the prices of the base and contingent product are lower when the two products are managed by the same company, relative to the case where they are controlled by two separate firms.

2.2 Pricing in vertical marketing channels

This literature addresses multiple questions related to the pricing of products and services when this decision is controlled by agents interacting in a vertical distribution structure. Some of these studies are devoted to the design of coordination mechanisms and incentives that allow independent channel members to implement the prices resulting from cooperation (i.e., vertical integration). Revenue sharing is one of these mechanisms. Since the RSC links the channel members’ individual outcomes to the joint outcome of a centralized channel according to the sharing rule, it allows channel members to reach coordination while remaining independent firms (Cachon 2003; Cachon and Lariviere 2005).

There is a significant literature in marketing and operations management dealing with channel coordination and RSC, and reviewing it is beyond the objective of this paper.Footnote 7 To the best of our knowledge, only a few papers study the coordination of pricing decisions in vertical structures where products are complementary, namely, Coughlan (1987), Moorthy (1988), Wang (2006), Dong et al. (2009) and Cai et al. (2012). However, none of them address the particular case of contingency in products’ demands, and, more importantly, their focuses are very different from ours.

A second topic in this literature stream investigates the impact of using various pricing models on prices, sales, and on channel members profits. Abhishek et al. (2016) belongs to this stream. The authors study the case where a manufacturer sells its product either directly to consumers (via a traditional channel) or via an e-channel where two retailers can choose to adopt a wholesale pricing model or an RSC. The authors compute and compare profits and prices under three configurations: (1) when both retailers implement a wholesale arrangement, (2) when an RSC is adopted by both retailers, and (3) a hybrid case where one of the retailers implements an RSC and the other one a wholesale arrangement. One of their results states that retailers’ preferences between the two channel arrangements depends on the cross-effect between demands in both channels. When demand in the e-channel has a negative (positive) effect on the traditional channel’s demand, the retailers prefer the RSC (a wholesale pricing arrangement). A second result states that an RSC leads to lower retail prices and higher consumer welfare, but that, when the retailers benefit from a positive externality (e.g. by selling a product that is complementary to the existing one), the opposite result is observed, i.e., retailers will prefer the wholesale pricing arrangement and retail prices are higher under the RSC.

Dantas et al. (2014) investigate pricing strategies in a channel where a unique manufacturer sells two competing product formats (paper book and e-book) via a single retailer. They compare firms’ pricing strategies and profits under the wholesale and the agency-pricing (i.e., RSC) models and identify conditions under which the agency model can be implemented. The authors find that both products’ retail prices are lower under revenue-sharing, and this business model is Pareto-improving when the revenue-sharing parameter, which represents the part of the revenue that goes to the retailer, is selected in the interval \(\left[ 1/4,1/2\right] \).

Gaudin and White (2014) identify the conditions under which the move from wholesale pricing to an RSC in the e-book industry contributes to the increase of e-book retail prices. They use a general demand system where the base product is available in one format, and consider two polar cases concerning the contingent product: either that consuming e-books requires use of the contingent product, or that there is perfect competition on the market for the contingent product, leading to a price equal to zero (no marginal costs).

As mentioned above, our study belongs to this research stream. It contributes to the literature in several ways:

- 1.

It extends the literature on the pricing of contingent products by looking at the case where three interdependent products are controlled by two different entities interacting in a vertical distribution structure, where double marginalization could play a key role.

- 2.

It extends the current modeling literature in marketing channels to digital-industry settings. We believe our model will shed light on equilibrium pricing in such industries, which will be of increasing importance in the economy. Our results give guidelines to each stakeholder in online distribution channels when it comes to elaborating its pricing strategy.

- 3.

It offers some insight into the problem of which business model, that is, wholesale pricing or RSC, is better from the point of view of the different stakeholders (firms and consumers) where members control three products, two of them being characterized by contingency in demand, a case that has not been considered in the existing literature.

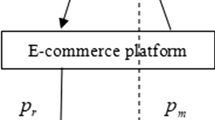

3 Models

This section introduces the wholesale pricing and RSC models. We consider a distribution channel composed of one manufacturer, player M, and one e-retailer (often called retailer), player R. The manufacturer sells a frequently purchased product, the base product b, in two different ways and formats: directly to the consumers (via the manufacturer’s website or its physical store) and indirectly (via the e-retailer). We distinguish between two product formats by letting bd refer to the version sold directly to the consumer, and bi to the version sold indirectly. For product bi to be used, the consumer has the option to employ a dedicated-for-this-use durable product o (the optional contingent product),Footnote 8 which is provided by the same retailer R. This setting captures the channel characteristics in some of the industries given as examples in the introduction. Manufacturer’s role is played by content suppliers (e.g., book editors, music producers, etc.) that provide tangible and digital versions of this content. The digital version being sold via platform retailers, such as Amazon or Apple, which sell also the contingent product (i.e., Kindle e-reader and iPod, respectively).

We denote by \(P_{x}\) the price of a product and \(Q_{x}\) the demand (quantity) with \(x=bd,bi,o\). The vectors of demands and prices are \( Q=\left( Q_{bd},Q_{o},Q_{bi}\right) \) and \(P=\left( P_{bd},P_{o},P_{bi}\right) ,\) respectively. The wholesale price of product bi is denoted \(w_{bi}\).

We denote by \(U\left( Q_{bd},Q_{o},Q_{bi}\right) \) the utility that the representative consumer derives from the three products. We impose that the utility function has the following characteristics:

- C1:

The maximum willingness to pay for product bd is higher than or equal to the maximum willingness to pay for product bi.

- C2:

The direct-price effect on demand is larger than the cross-price effect.

Characteristic C1 is a mild allusion to the empirical observation in many markets, including, e.g., the ebook market. Still, we do not require the equilibrium price \(P_{bd}\) to be necessarily higher than \(P_{bi}\), but only the maximum willingness to pay to be ranked as stated. Characteristic C2 is standard in economics.

3.1 Demand system

To derive the inverse demand system, we set up the problem of the representative consumerFootnote 9 who needs to solve

We retain the following functional form for \(U\left( Q_{bd},Q_{o},Q_{bi}\right) \):

where \(\lambda _{bd},\)\(\lambda _{o},\)\(\lambda _{bi},\)\(\theta _{bd},\)\( \theta _{o},\)\(\theta _{bi},\) and \(\mu \) are positive constants. The parameter \(\mu \)\(\in (0,1)\) measures the degree of substitution between the two base product formats, i.e., the term \(-\mu Q_{bd}Q_{bi}\) measures the loss in utility of the manufacturer’s (retailer’s) base product format due to the presence of the retailer’s (manufacturer’s) base product format. The reason is that the consumer can alternatively use the retailer’s (manufacturer’s) base product format.

The following proposition introduces some restrictions on the parameter values to get concavity of the utility function (2).

Proposition 1

The utility function is concave, provided the following conditions are satisfied:

Proof

See “Appendix”. \(\square \)

The second condition depends on the demands of the base product sold indirectly to consumers \((Q_{bi})\) and the demand of the contingent product \( \left( Q_{o}\right) \). This implies that the utility function is concave over some part of the domain only, i.e., there where (4) is satisfied. Hence, in principle we have to check whether the outcomes resulting from the first order conditions are indeed global maxima. This turns out to be the case in the scenarios we consider.

Solving problem (1), where the utility function is given by (2), results in the following first-order conditions, which are at the same time the inverse demand functions:

The parameter \(\theta _{x},x=bd,bi,o\) gives the marginal impact on price of varying the quantity of product x, that is, \(\theta _{x}=\frac{\partial P_{x}}{\partial Q_{x}}\). The parameters \(\lambda _{bd},\lambda _{bi}\) and \( \lambda _{o}\) measure partially the maximum willingness to pay for their corresponding products. Indeed, if we set in each of the above equation own quantity to zero, we see that in each case the maximum willingness to pay (MWP) depends on other product’s quantities. For instance, we obtain that the MWP for product bd depends on the degree of substitutability \(\mu \) between the two formats and on quantity \(Q_{bi}\). The MWP for product bi is even more complicated as it involves the other two products. The case of the contingent product o is special. We first note that if \( Q_{bi}=0\), then the price \(P_{o}=0\), which amounts at saying that there is no demand for the contingent product if there is no demand for product bi, which reflects our setting. Second, the higher the demand for product bi , the higher the MWP for product o. Characteristics C1 and C2 can be translated as follows in terms of parameter values:

Back to the first condition in the above proposition, it is now clear that it is economically reasonable, because it is fulfilled if the quantity of a base product has a greater impact on its own price than the quantity of the other base product has on this price, that is, \(\theta _{bd}>\mu \) and \( \theta _{bi}>\mu \). (Note that C2 implies (3).) Also note that \(\frac{\partial P_{bd}}{\partial Q_{o}}=\)\(\frac{\partial P_{o}}{ \partial Q_{bd}}=0\), which means that the relationship between products bd and o is not direct, but it is taken into account indirectly in the model via the interactions existing between products bd and bi in Eqs. (5) and (7), and the interactions between products bi and o captured by Eq. (6).

We assume that producing the base product in bd format has a marginal production cost denoted by C, with \(C<\lambda _{bd}\), whereas the production cost is zero for the bi format. The additional cost C reflects the fact that producing a tangible format for a product generates higher unit production costs than creating a digital product. Further we suppose that the e-retailer purchases product o from its supplier at zero cost. This is equivalent to saying that the supplier of the contingent product does not play any strategic role in our setting.Footnote 10

3.2 Pricing models

As stated in the introduction, we wish to characterize and compare the equilibrium solutions of two business pricing models, namely, wholesale pricing arrangements and RSC.

Wholesale pricing Following a long tradition in the marketing-channel and supply-chain literature (see, e.g., the books by Ingene and Parry (2004), Jørgensen and Zaccour (2004), and the survey by Ingene et al. (2012)), we suppose that the game is played à la Stackelberg, with the manufacturer acting as leader and the retailer as follower. Consequently, the manufacturer first decides the wholesale price of product bi and the quantity of product bd, that is, \(w_{bi}\) and \( Q_{bd}.\) Next the retailer sets the quantities \(Q_{bi}\) and \(Q_{o}\). The optimization problems of the manufacturer and the retailer are as follows:

Substituting for the prices, we obtain

Revenue-Sharing Contract One of the main differences between wholesale pricing and RSC stems from the fact that the control over \(Q_{bi}\) passes from the retailer to the manufacturer (Abhishek et al. (2016)). In this case of revenue sharing in product bi market, the game is also sequential. We consider the variant with the manufacturer as leader, who chooses the quantities of both base products’ formats, that is, \(Q_{bd}\) and \(Q_{bi}\). Next, the retailer selects the contingent product quantity \(Q_{o}.\) We denote by \(\alpha \in \left( 0,1\right) \) the revenue-share of the base product bi that accrues to the retailer and consider that this share is exogenously fixed. The optimization problems of the retailer and the manufacturer are as follows:

Substituting for the prices, we obtain the following expressions:

4 Wholesale pricing model

Since the game is played à la Stackelberg, with the manufacturer acting as leader, we start by considering the retailer’s problem. The retailer’s reaction functions are derived from the first-order conditions of Eq. (10). We obtain that product bi’s quantity \(Q_{bi}\) satisfies

and that the contingent product’s quantity \(Q_{o}\) equals

We see that there is strategic independence between \(Q_{o}\) and the manufacturer’s decisions (\(Q_{bd}\) and \(w_{bi}\)), and strategic substitutability between \(Q_{bi}\) and \(Q_{bd}\) and \(w_{bi}\). The fact that \( Q_{o}\) is independent of the manufacturer’s decision variables is intuitive, as \(Q_{o}\) is provided by another supplier and does not compete directly with the manufacturer’s products. The strategic substitutability between \( Q_{bi}\) and \(Q_{bd}\) is a by-product of the assumption that the two products are partially substitutable. The result that \(Q_{bi}\) is decreasing in \( w_{bi}\) is equivalent to stating that \(P_{bi}\) is increasing in \(w_{bi}\). The fact that the retail price increases with the wholesale price is reminiscent of the double marginalization feature of vertical interaction and of the strategic substitutability between channel members’ pricing decisions (Moorthy 1988).

The following proposition characterizes the Stackelberg equilibrium strategy in the wholesale pricing model.

Proposition 2

Assuming that the solution is interior and the utility function concave, the unique interior Stackelberg pricing equilibrium strategy is given by

The players’ profits are given by

Proof

See the “Appendix”. \(\square \)

From the above proposition, we first conclude that the price of product bd is exactly half of the maximum willingness to pay of the consumer plus the production cost, and thus independent of \(\mu \), the parameter capturing the substitutability between the two formats. This can be explained by noting that increasing the parameter \(\mu \) has contradictory effects on the bd product’s price that exactly offset each other in equilibrium. First, from the inverse demand function (5), we obtain that when \(\mu \) is larger a given quantity of product bi has a larger negative effect on \( P_{bd},\) resulting in a decrease of this price. Second, however, an increase of \(\mu \) reduces \(Q_{bi}\) and \(Q_{bd},\) since they negatively affect prices \(P_{bd}\) and \(P_{bi}\) via the cross price effect. The reduction of quantity \( Q_{bi}\) results in a positive effect on the price \(P_{bd}\) such that it exactly counterbalances the first effect.

Second, we see that the wholesale price increases with \(\lambda _{bi}\) and \( \lambda _{o},\) while it decreases with \(\theta _{o}.\) We explain this by noting that the manufacturer will ask a higher wholesale price in case of a more profitable market for the base product sold by the retailer. This is the case when \(\lambda _{bi}\) is large, because the price is linearly increasing with this parameter. Also the bi product’s demand is stimulated by sales of the contingent product, which, since \(Q_{o}=\frac{2\lambda _{o}}{ 3\theta _{o}}\) [cf. (14)], is large when \(\lambda _{o}\) is large while \(\theta _{o}\) is low.

To learn about the effects of the specific market characteristics that we consider here, we determine how the retailer’s prices change when a substitute to product bi is not available or when there is no contingent product. The following proposition considers the scenario where product bd is absent.

Proposition 3

The availability of an alternative product to bi leads to lower prices of products bi and o.

Proof

See “Appendix”. \(\square \)

The availability of an alternative product to bi involves the presence of competition on the base-product market because two formats are available for consumption. This reduces demand for the base product sold by the retailer, resulting in a decrease of the corresponding price \(P_{bi}\), compared to the case where no alternative exists. Since the contingent product is a strategic complement of product bi, demand for the contingent product also goes down, which implies that the contingent product’s price \(P_{o}\) decreases as well.

The following proposition establishes the effect of the availability of the contingent product.

Proposition 4

The availability of product o leads to higher wholesale and retail prices of product bi, and higher demand. It leaves the price of product bd unchanged, but leads to a lower demand of this product.

Proof

See “Appendix”. \(\square \)

The market for the base product sold by the retailer and the market for the contingent product each increase the other’s size, due to the contingent interdependencies in both products’ demands. Hence, it makes sense that the presence of the contingent product results in an increase of the retail and wholesale prices, and the quantity of product bi. Since product bi and product bd are strategic substitutes, product bd suffers from the increased size of the market of product bi, which results in decreasing product bd’s quantity while leaving its price unchanged.

4.1 Loss-leader pricing

Under the wholesale pricing arrangement, the retailer controls not only the contingent product’s retail price, but also the retail price of product bi . Then the retailer has the option to employ a loss-leader strategy where it sells the digital base product format at a loss to boost the sales of the optional contingent product. The next proposition presents the scenario under which the retailer finds it optimal to practice a loss-leader pricing strategy for product bi, that is, \(P_{bi}<w_{bi}\).

Proposition 5

If

then it is optimal for the retailer to adopt a loss-leader pricing strategy.

Proof

It suffices to compute \(P_{bi}-w_{bi}\) from Proposition 2 to get the result. \(\square \)

Loss-leader pricing can be expected to occur when the profitability of the contingent product market is large. This is indeed reflected by expression (21): from this condition we first conclude that, given a sufficiently low value of \(\mu ,\) a loss-leader pricing strategy is optimal when the contingent product market is sufficiently profitable, thus, when \( \lambda _{o}\) is large and \(\theta _{o}\) is low.

The profitability of the base product bi supplied by the retailer has two contradictory effects. First a low profitability for this market implies that the retailer concentrates on making profits from the contingent product market and thus pursues a loss-leader pricing strategy. Second a less profitable bi market results from low demand. This implies that the quantity of the bi product, \(Q_{bi},\) is low, which means fewer potential buyers for the contingent product, and thus, in turn, a lower profitability for the contingent-product market. Thus a loss-leader strategy is less likely to be optimal. This explains the less straightforward effect of the base products’ substitution parameter \(\mu \) and of the price sensitivity parameter of base product bi, \(\theta _{bi},\) on the satisfaction of condition (21).

These two contradictory effects also play a role when we analyze the effect of the base product bd directly supplied on the market by the manufacturer. An increase of the price sensitivity parameter \(\theta _{bd}\) reduces the profitability of the bd market, which makes this market less competitive than the bi market, thereby enhancing its profitability. This gives the two contradictory effects described in the previous paragraph. This explains why, when studying condition (21), we cannot conclude whether an increase of \(\theta _{bd}\) supports the optimality of a loss-leader strategy. On the other hand, clearly, a loss-leader strategy is more likely to occur if the bd market is more profitable, in the sense of having a large maximum-willingness-to-pay parameter \(\lambda _{bd}\) and low unit costs C. This increases the quantity of base product bd. The resulting increased competition for the bi market reduces the bi product’s price \(P_{bi}\), making loss leader more likely, and its quantity \(Q_{bi},\) making loss leader less likely since it reduces the number of potential consumers on the contingent product market. Apparently, the price effect is the largest here.

One clear conclusion that we can draw from the loss-leader condition is that loss-leader pricing is more likely to occur if \(\lambda _{bi}\) is low. This is because the price of the bi product positively depends on this parameter.

5 Revenue-sharing contract and comparison

Recall that, in this model, the retailer’s share in the revenue of product bi is given by a parameter \(\alpha \in \left( 0,1\right) \). One of our objectives is to find the range of values for \(\alpha \) under which an RSC leads to higher profits for the manufacturer, who acts as leader in this channel, compared to the wholesale business model, which is taken as the benchmark. Once this range of values is determined, we next check if it is also in the retailer’s best interest to sign an RSC. Finally, we verify under what conditions the consumers would also prefer an RSC to a wholesale pricing arrangement.

In this RSC, the optimization problems are defined as follows:

As in the wholesale pricing arrangement, the manufacturer acts as leader in the RSC and chooses the quantities \(Q_{bd}\) and \(Q_{bi}\) of the b product. The retailer next chooses the quantity of \(Q_{o}\). As usual in a leader-follower game, we begin by solving the follower problem. Considering retailer R’s optimization problem in (23), and assuming an interior solution,we obtain the following reaction function:

We observe that the contingent-product quantity is independent from the leader’s decision variables, but does depend on the sharing parameter \( \alpha \), with

that is, the higher the retailer’s share of the revenue of product bi, the higher the quantity of the contingent product. Indeed, with a higher \( \alpha \), the retailer receives more of the revenue resulting from product bi sales. In such a case the retailer is more inclined to increase the price for this product, which can be done by raising the quantity of the contingent product (see (7), from which we obtain that \(P_{bi}\) goes up with \(Q_{o}).\)

Substituting for \(Q_{o}\) from (24) in the manufacturer’s optimization problem, we get

Assuming an interior solution, from the first-order optimality conditions we obtain the following quantities:Footnote 11

Inserting the equilibrium quantities in the inverse demand and profit functions, we get very long expressions, which are by no means amenable to a qualitative analysis. Consequently, we resort to a numerical analysis to answer our research questions 2a and 2b posed in the Introduction. The first task is then to define a benchmark case. The following parameter value constellation is such that we have solutions for both business models satisfying all assumptions, characteristics of the utility function, and nonnegativity of prices, quantities, and profits:

Table 1 reports the results for the benchmark case under the two pricing models for different values of the revenue-sharing parameter \(\alpha \).Footnote 12

In the discussion below, we use the superscript WP to refer to the wholesale pricing model and superscript RSC for the revenue-sharing contract. We first of all observe that the bi product price is higher under the wholesale pricing model. This comes from the double marginalization effect, resulting from the vertical distribution structure of the bi product.

Under wholesale pricing, the manufacturer is also hurt by the inefficiently low quantity \(Q_{bi}^{WP},\) leading to too-low profits resulting from selling product bi to consumers via the retailer. On the other hand, the manufacturer also collects profits from selling product bd, and these profits are higher,Footnote 13 because the too-low quantity \(Q_{bi}^{WP}\) positively affects demand for product bd. Therefore, the manufacturer will always set a higher price under wholesale pricing, i.e., \(P_{bd}^{WP}>P_{bd}^{RSC},\) as our numerical results confirm.

As a result, due to these contrary effects one cannot establish beforehand whether manufacturer profits under wholesale pricing are lower or higher than the profits under the RSC model. In particular, there exists an upper bound value on the sharing parameter, call it \(\alpha _{u},\) such that, for any \(\alpha \ge \alpha _{u}\), profits under wholesale pricing are higher for the manufacturer compared to under RSC. In this benchmark case, we observe that \(\alpha _{u}\) is in the interval \(\left( 0.3,0.4\right) \). Consequently, the manufacturer will implement an RSC for \(\alpha \) relatively low, that is, larger than 0.1 and lower than \(\alpha _{u}\). It follows that an RSC is profit Pareto improving in this case.

Concerning the contingent-product market, we can prove analytically that it is less developed under the RSC, regardless of the revenue-sharing parameter value. Indeed,

This is because the retailer, who determines the contingent product quantity, has a higher incentive to increase this quantity under wholesale pricing. The reason is that \(Q_{o}\) adds to the demand of product bi, and under wholesale pricing, the retailer receives all the profits from selling product bi, while they need to be shared under RSC. Still we have to keep in mind that, as stated above, contingent product profits are higher under RSC, because demand undergoes more stimulation there from the higher quantity of product bi. Hence, it has to hold that \(P_{o}^{RSC}>P_{o}^{WP},\) which is confirmed by our numerical results.

Finally, we observe in the last row of Table 1 that, under an RSC scenario, consumer utility is increasing in \(\alpha .\) This is first of all due to \(Q_{bd}^{RSC}\) being strictly increasing in \(\alpha \). For low values of \(\alpha ,\) the manufacturer receives a great deal of revenue from the bi market. Therefore, it keeps \(Q_{bd}^{RSC}\) low in order to stimulate demand of product bi. Furthermore, for higher values of \(\alpha \) the retailer collects more of the bi-market profits. Therefore, for higher \(\alpha ,\) it is more inclined to stimulate demand for the bi product by raising the contingent product quantity \(Q_{o}.\) Both of these developments apparently more than compensate for the drop in \(Q_{bi}\) for rising \(\alpha , \) which is because the manufacturer, who decides on \(Q_{bi},\) receives a smaller portion of the corresponding revenue. In our benchmark case, a switch from wholesale pricing to a revenue-sharing contract with \(\alpha =0.3 \) would benefit all market participants, i.e., consumers, manufacturer, and retailer.

The next step is to check the robustness of these results by varying the parameter values. To keep the number of simulations reasonable, we fix once and for all the values of some of the parameters, namely, \(\theta _{bi}=\theta _{bd}=\theta _{o}=1\), and \(C=15\) (as in the benchmark case). This is not a severe assumption, as we vary the other demand parameters, that is, \(\mu ,\lambda _{bi},\lambda _{bd}\) and \(\lambda _{o}\), whereas the cost parameter only has a quantitative impact.Footnote 14 More specifically, we consider the following values for these parameters:

This means that the Stackelberg equilibrium in the RSC was computed for 27,000 cases \((3\times 10\times 10\times 10\times 9=27{,}000)\). For the wholesale model, the number is 3000, as the sharing parameter \(\alpha \) does not appear there. Note that the benchmark case belongs to the set of retained experiments.

To answer our research question 2a, namely, when is the manufacturer interested in implementing an RSC, Tables 2 and 3 report the percentages of cases where the manufacturer and consumers respectively are better off with an RSC than with wholesale pricing arrangements. In both tables, these percentages are computed after excluding the cases where the results violate one of the admissibility criteria, i.e., concavity of the utility function and nonnegativity of prices, demands and profits. These results can be summarized as follows:

- 1.

The existence of an upper bound for \(\alpha \) above which the manufacturer will not implement the RSC is confirmed, which of course makes sense because the share of the bi revenue the manufacturer receives decreases with \(\alpha .\) In any event, the upper bound value is close to 0.3.Footnote 15

- 2.

Even for a value of \(\alpha \) as low as 0.1, it is far from being granted that the manufacturer will find it optimal to push for RSC. This is because the retailer does not receive much of the bi revenue and therefore does not have much incentive to stimulate demand for product bi by raising the quantity of the contingent product. This also reduces the revenue of product bi for the manufacturer.

- 3.

For all cases where an RSC leads to higher profits for the manufacturer, we make the following observations:

- (a)

For all parameter values, the channel’s total profit under an RSC is also higher. Therefore, where the manufacturer receives higher profits under RSC, an RSC is more efficient than wholesale pricing. This is because, with very few exceptions, our simulations show that the retailer is always better off with an RSC than with wholesale pricing.Footnote 16 As explained above, the reason for this is that, especially under wholesale pricing, the retailer is hurt by the inefficiency in the bi market due to the double marginalization effect, which leads to insufficient quantity of product bi.

- (b)

All the statements regarding the prices of bi, bd and o in the benchmark case, remain valid for all parameter values. The conclusion is that an RSC leads to lower retail prices of products bi and bd and a higher price of the contingent product o.

- (c)

The consumer surplus highly depends on the value of \(\mu \), the parameter of substitutability between the two formats of the b product. For the highest retained value, that is, \(\mu =0.75\), the message is clear-cut: an RSC always hurts the consumer. In this case, the formats are highly substitutable, and, because under wholesale pricing, different firms decide about the retail prices of the different formats of product b, the resulting competition leads to relatively low prices benefitting the consumers. For \(\mu \in \left\{ 0.25,0.5\right\} \), the percentage is increasing in \(\alpha \) and reaches its maximum at \(\alpha =0.4\). This arises because the manufacturer reduces \(Q_{bi}\) when \(\alpha \) goes up, because it gets a lower share of the profits in the bi-product market.

- (a)

To investigate the impact of \(\lambda _{x}\), \(x\in \{bd,bi,o\}\) on the percentage of cases where the RSC can be implemented, we set the value of \(\alpha \) at 0.3, which corresponds in the benchmark to the case where the RSC is preferred by all parties, i.e., the retailer, the manufacturer, and the consumers. We found that the percentage of cases where an RSC is preferred by both the manufacturer and the retailer increases

when \(\lambda _{bi}\) increases. This increases the willingness to pay for product bi. Then the double marginalization effect that makes the bi market more inefficient under wholesale pricing becomes bigger, so it is understandable that the RSC pricing model will be more preferable.

when \(\lambda _{o}\) decreases. Under wholesale pricing, the quantity in the contingent product market is higher because the retailer is more inclined to stimulate demand on the bi market. This is because it can keep all profits on this market for itself, while, under an RSC, it has to share these profits with the manufacturer. When \(\lambda _{o}\) decreases the role of the contingent-product market is more minor, so that this effect in favor of wholesale pricing diminishes.

does not have a clear-cut impact when \(\lambda _{bd}\) increases. If \( \lambda _{bd}\) goes up the willingness to pay for product bd increases. Under wholesale pricing, this market is more profitable because the quantity of the substitute product bi is lower due to the double marginalization effect. This implies that the manufacturer will increasingly appreciate wholesale pricing when \(\lambda _{bd}\) increases. However, this is the other way round for the retailer because a higher value of \(\lambda _{bd}\) increases the quantity of the product bd, which reduces profitability of the bi market. This explains why the effect of \(\lambda _{bd}\) on the relative appreciation of RSC by both market parties is less clear-cut.

6 Conclusions

In this study, we examined a vertical distribution structure where a monopolist manufacturer supplies a base product in two formats sold via two channels: a tangible product sold directly to consumers and a digital format sold via a single online retailer. The latter also offers an optional contingent product that consumers may employ to consume the digital version of the base product. Such a setting frequently occurs in digital industries. Obvious examples are the e-book and MP3 music markets (base products) with the e-reader and the iPod as optional contingent products.

In such a context channel members can choose between adopting a wholesale price arrangement, where the retailer controls the digital product’s price, or implementing an RSC, which involves passing the control over the digital product’s price from the retailer to the manufacturer.

Our objective is to provide answers on two main questions: The first one investigates the contingent product’s impact on firms’ pricing strategies when a wholesale pricing arrangement is adopted and explores the conditions under which the retailer, who controls the digital product’s price, uses the digital product as a loss-leader. The second question investigates whether the different stakeholders in the channel (i.e., the manufacturer, the retailer, and consumers) are benefitted by the implementation of an RSC.

Our first result states that the presence of the contingent product leads to a higher retail price for the digital base product and negatively affects the demand for the tangible product format. Furthermore, using a loss-leader pricing strategy where the digital product is sold at a loss in order to boost sales of the contingent product, does not always benefit the retailer. This result is explained by the fact that a less profitable digital-base-product market could also have harming effects on the contingent-product market.

On the implementation of an RSC, we identify an upper bound for the revenue-sharing parameter beyond which the manufacturer does not want an RSC because it earns too less on the digital product. The retailer, one the other hand, almost always has a preference for applying a RSC business model over the more traditional wholesale pricing arrangement. The reason is that, under wholesale pricing, the price of the digital product is too high due to a double marginalization effect: in selling to the retailer, the manufacturer likes to fix a positive profit margin, and the retailer wants the same when selling the digital product to consumers. This inefficiency not only leads to low profits for the digital products, but it also holds for the optional contingent product market. The latter effect can be explained as follows. The high digital product price implies that not too many of these products are sold to consumers. This in turn implies that demand for the optional contingent product will be low, because these products can only be used to consume the digital product.

This paper is an attempt to understand the relative value of business models like wholesale pricing and revenue-sharing contracts in the presence of base and optional contingent products, in a one-manufacturer, one-retailer supply chain. One meaningful extension is to consider competition in the contingent product market. Here, the conjecture is that competition would incite firms to reduce the contingent products’ retail prices, which would contribute to an increase in demand for both the digital base and the contingent product. Then one could investigate if the channel efficiency can be improved by this competitive effect and how this affects the appreciation for the different business models.

In the digital-books industry for example, we observe that competition is now present in the e-reader market, following the arrival of Nook (by Barns & Noble), Kobo (by Indigo), etc. Also, tablets are competitors to the e-readers that have multi-functional properties. Hence, their demand interdependencies with digital books are complementary rather than optional contingent, as it is the case for e-readers.Footnote 17 As usually expected in such a context, the retail price of e-readers went down. More than that, Amazon started to sell the Kindle as a loss-leader. The second reaction of firms controlling such devices was to add some features to e-readers that allow consumers to use them for different purposes. These developments bring up interesting research questions: (1) Does competition necessarily lead to the classical situation, where loss-leader pricing is reserved for the durable product (e.g., e-reader)? (2) How long can an optional contingent product survive in the market, given that multi-functional products are around the corner?

Many experts in the industry consider that the fall of the “tangible” formats in the entertainment industry is mainly due to pirating. According to these experts, things could be different for the book industry if editors “provide a legitimate alternative to pirated materials” and if they adopt a well-thought-out pricing strategy. By doing so, they would allow e-books to play a complementary role rather than a substitute for print, since digital books could create a new market by attracting customers “who would not have purchased a traditional book but may be inclined to buy an e-book that costs less, offers additional features, and works on a digital device they already own.”Footnote 18 A recent survey of US customers published by The Pew Research Center’s Internet Project confirmed this analysis.Footnote 19

Taking stock of the above and the rapid technological developments in the digital book and other similar industries, we believe that the following research questions need additional attention: (1) Is there a future for tangible products when a digital alternative exists? (2) What are the best pricing strategies for different formats of a product (book, music, etc.), where the digital product fulfills a complementary role instead of providing competition to the tangible product format, as analyzed in this paper? (3) How does real or potential piracy affect pricing strategies?

Notes

Cultural and informational products (e.g., books, newspapers, music, films), software and services (e.g., travel and hospitality) are among the industries that most strongly experienced the e-commerce revolution. In many industries, the online marketplace replaced traditional channels (e.g., nowadays, airplane tickets are mainly sold in digital format either by airline companies or by online travel agencies such as Expedia).

eMarketer reports that retail e-commerce sales worldwide reached $1.61 trillion in 2015, which corresponds to 7.4% of total retail market. In the US market, retail e-commerce sales are expected to represent more than 10% of total retail sales in 2019. According to the same report, almost 40% of ecommerce sales are expected to be done on a mobile device. Source: Liu, C. (December, 2015) “Worldwide Retail Ecommerce Sales: eMarketer’s Updated Estimates and Forecast Through 2019.”

Cultural and informative industries are among those most affected by the digital wave and that have observed similar changes in their pricing models (i.e., a move from a wholesale business model to a revenue-sharing contract).

Source: “Amazon’s E-Book Price Reversal: A Mixed Blessing.” Business Week website (last visited Jan. 19, 2016). Published February 2, 2010. MacMillan, D.

Some studies consider that the various formats of the same product could also be perceived as complements, depending on the utility that consumers derive from the product form (Kannan et al. 2009).

In reference to Gillette, a company that has often used this price strategy.

Since this study considers only one type of contingency in products’ demand interdependencies, the optional contingent product is often called “contingent product”.

We follow Singh and Vives (1984) by considering “a continuum of consumers of the same type” that have the same utility function U, but extend their model by taking into account that utility is derived from the consumption of three products instead of two.

Note that the contingent product does not face any competition in the contingent product market. Hence, assuming that it has a zero cost does not affect the qualitative insights from the model.

If we assume that

$$\begin{aligned} 4\theta _{bd}\theta _{bi}\left( 1-\alpha \right) -\mu ^{2}\left( 2-\alpha \right) ^{2}>0, \end{aligned}$$(26)then the conditions for an interior solution are

$$\begin{aligned} \frac{\mu \left( 2-\alpha \right) }{2\theta _{bi}}\left( \lambda _{bi}+\frac{ \lambda _{c}^{2}}{2\theta _{c}}\frac{\left( \alpha +1\right) \left( \alpha +3\right) }{\left( \alpha +2\right) ^{2}}\right)<\lambda _{bd}-C<\frac{ 2\theta _{bd}\left( 1-\alpha \right) }{\mu \left( 2-\alpha \right) }\left( \lambda _{bi}+\frac{\lambda _{c}^{2}}{2\theta _{c}}\frac{\left( \alpha +1\right) \left( \alpha +3\right) }{\left( \alpha +2\right) ^{2}}\right) . \end{aligned}$$(27)The condition in (26) is slightly more restrictive than the condition for concavity of the utility function, which is

$$\begin{aligned} 4\theta _{bd}\theta _{bi}-\mu ^{2}>0. \end{aligned}$$Further, condition (27) is always satisfied for \(\mu =0\) and thus for \(\mu \) sufficiently small.

We do not investigate the extreme cases where \(\alpha \in \{0,1\}\) since these situations cannot be implemented. They imply that only one channel member takes up the total channel revenue.

With the exception of \(\alpha =0.8,\) where the manufacturer’s share of product bi revenue is so low that it mainly concentrates on the bd market.

Actually, we examined the effects of these parameters on the results and found that they do not affect the results qualitatively.

Interestingly, this is in line with the revenue-sharing contract between Apple and MacMillan, which gives 30% to Apple.

For \(\alpha =0.1\), and when \(\mu \in \left\{ 0.25,0.5\right\} \), we found a percentage of simulations (around 10%) where retailer’s profit is negatively impacted by the implementation of the RSC. These cases correspond to situations where the RSC is channel efficient but hurts the retailer. One can imagine the manufacturer offering the retailer a side payment to encourage its participation and avoid channel conflict.

Kindle sales moved from 11.6 to 12.5 million units between 2011 and 2012: an 8% increase. If we compare this to the 325% increase observed between 2009 and 2010 (the year when Nook, Kobo and iPad were launched), we can see the negative impact of competition on Amazon’s dominant position in the e-reader market. Source: eMarketer Report, September 11, 2012.

Source: “Turning the Page: The Future of eBooks”. A pwc report (2010, p3).

Source: “Ebook Readers Use Devices to Supplement, Not Replace, Printed Media.” eMarketer. January 30, 2014

References

Abhishek V, Jerath K, Zhang ZJ (2016) Agency selling or reselling? Channel structures in electronic retailing. Manag Sci 62(8):2259–2280

Bayus BL (1987) Forecasting sales of new contingent products: an application to the compact disc market. J Prod Innov Manag 4(4):243–255

Cachon G (2003) Supply chain coordination with contracts. In: Graves S, de Kok T (eds) Handbooks in operations research and management science: supply chain management. Elsevier, North-Holland, pp 227–339

Cachon GP, Lariviere MA (2005) Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Manag Sci 51:30–44

Cai G, Dai Y, Zhou SX (2012) Exclusive channels and revenue sharing in a complementary goods market. Mark Sci 31(1):172–190

Coughlan A (1987) Distribution channel choice in a market with complementary goods. Int J Res Mark 4:85–97

Dantas CD, Taboubi S, Zaccour G (2014) Which business model for e-book pricing? Econ Lett 125:126–129

Dong L, Narasimhan C, Zhu K (2009) Product line pricing in a supply chain. Manag Sci 55(October):1704–1717

Gaudin G, White A (2014) On the antitrust economics of the electronic books industry. Working paper

Grewal D, Janakiraman R, Kalyanam K, Kannan PK, Ratchford B, Song R, Tolerico S (2010) Strategic online and offline retail pricing: a review and research agenda. J Interact Mark 24:138–154

Ingene CA, Parry ME (2004) Mathematical models of distribution channels. International series in quantitative marketing. Kluwer Academic Publishers, Boston

Ingene CA, Taboubi S, Zaccour G (2012) Game-theoretic coordination mechanisms in distribution channels: integration and extensions for models without competition. J Retail 88(4):476–496

Jørgensen S, Zaccour G (2004) Differential games in marketing. International series in quantitative marketing. Kluwer Academic Publishers, Boston

Kalakota R, Robinson M (2000) E-business 2.0: looking over the new horizon. eAI Journal 18(4):22–30

Kannan PK, Pope BK, Jain S (2009) Pricing digital content product lines: a model and application for the National Academies Press. Mark Sci 28:620–636

Kotler P (1988) Marketing management, 6th edn. Prentice Hall, Englewood Cliffs, pp 516–517

Mahajan V, Muller E (1991) Pricing and diffusion of primary and contingent products. Technol Forecast Soc Change 39:291–307

Moorthy S (1988) Strategic decentralization in channels. Mark Sci 7(4):335–355

Noble PM, Gruca TS (1999) Industrial pricing: theory and managerial practice. Mark Sci 18:435–454

Peterson RA, Mahajan V (1978) Multi-product growth models. In: Jagdish S (ed) Research in marketing. JAI Press, Greenwich, pp 201–231

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. Rand J Econ 15:546–554

Tellis GJ (1986) Beyong the many faces of pricing. J Mark 50(October):146–160

Wang Y (2006) Joint pricing-production decisions in supply chains of complementary products with uncertain demand. Oper Res 54(6):1110–1127

Author information

Authors and Affiliations

Corresponding author

Additional information

Research supported by NSERC, Canada, Grant RGPIN-2016-04975.

Appendix: Proof of propositions

Appendix: Proof of propositions

1.1 Proposition 1

Concavity of the utility function requires that the determinant of the Hessian matrix be negative, i.e.,

Concavity also requires that the diagonal elements of the Hessian matrix be negative, which is the case, and that

So concavity of the utility function requires

and

1.2 Proof of Proposition 2

Substitution of (14) into (13) gives

We then move to the problem of the manufacturer who solves

The equilibrium wholesale price, \(w_{bi},\) equals

whereas the quantity for the base product bd is

Next, we determine \(Q_{bi}\) by substitution of (33) and (34) into (32):

It suffices to insert the values of \(Q_{o},Q_{bd}\) and \(Q_{bi}\) in (5)–(7) to get the following prices:

Concavity requires the satisfaction of conditions (3)–(4). Substitute for (14) and (35) in (4) to obtain the condition in terms of only the parameters, that is,

To have an interior solution, the following conditions must be satisfied:

The above two conditions are equivalent to

1.3 Proof of Proposition 3

Compute the differences

Negativity in both cases follows from the positivity of the numerator, which is due to the assumption of an interior solution [see (42) in the Appendix], and the negativity of the denominator, which follows from (3).

1.4 Proof of Proposition 4

From the proof of Proposition 2, it is easy to see that in the absence of product o, we would have the following results:

It is straightforward to verify that

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Kort, P.M., Taboubi, S. & Zaccour, G. Pricing decisions in marketing channels in the presence of optional contingent products. Cent Eur J Oper Res 28, 167–192 (2020). https://doi.org/10.1007/s10100-018-0527-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-018-0527-x