Abstract

Making decisions challenges foreign exchange (FX) market brokers due to the volatility of the foreign exchange market, as well as the unmanageable flood of possibly relevant information. Thus, decision making in this complex and dynamically changing environment is a difficult task requiring automated decision support systems. In this contribution, we describe an econometric decision support approach, which enables the extraction of essential information indispensable to set up accurate forecasting models. Our approach is based on a genetic algorithm (GA) and applies the resulting models to forecast daily EUR/USD-exchange rates. In doing so, the genetic algorithm optimizes single-equation regression forecast models. The approach discussed is new in literature and, moreover, allows flexibility in automated model selection within a reasonably short time.

Similar content being viewed by others

References

Allen F, Karjalainen R (1999) Using genetic algorithms to find technical trading rules. J Financ Econ 51:245–271

Chen S-H (2002) Genetic algorithms and genetic programming in computational finance. Kluwer, Boston

Cheung YW, Chinn MD (2001) Currency traders and exchange rate dynamics: a survey of the US market. J Int Money Fin 20:439–471

Cheung YW, Chinn MD, Pascual AG (2002) Empirical exchange rate models of the nineties: are any rit to survive? mimeo, Department of Economics, University of California B Santa Cruz

Diebold F, Nason J (1990) Nonparametric exchange rate prediction? J Int Econ 28:315–332

Engel C, Hamilton JD (1990) Long swings in the dollar: are they in the data and do markets know it? Am Econ Rev 80:689–713

Marks RE (2001). Playing games with genetic algorithms. In: Chen S-H (eds). Evolutionary computation in economics and finance. Springer, Berlin Heidelberg New York, pp. 31–44

Meese R (1990) Currency fluctuations in the post-Bretton Woods era. J Econ Perspect 4:117–134

Meese R, Rogoff K (1983a) Empirical exchange rate models of the seventies: do they fit out of sample? J Int Econ 14:3–24

Meese R, Rogoff K (1983b). The out of sample failure of empirical exchange models. In: Frenkel J (eds). Exchange rates and international macroeconomics. University of Chicago Press, Chicago

Neely C, Weller P, Dittmar R (1997) Is technical analysis in the foreign exchange market profitable? A genetic programming approach. J Financ Quant Anal 32:405–426

Nikolaev NY, Iba H (2002). Genetic programming of polynominal models for financial forecasting. In: Chen S-H (eds). Genetic algorithms and genetic programming in computational finance. Kluwer, Boston, pp. 103–124

Pagan A (1996) The econometrics of financial markets. J Empir Fin 3:13–102

Papadamou S, Stephanides G (2004) Improving technical trading systems by using a new MATLAB based genetic algorithm procedure. Lect Ser Comput Comput Sci 1:984–987

Pesaran H, Timmermann A (2005) Real-time econometrics. Econ Theory 21:212–231

Phillips PCB (2005) Automated discovery in econometrics. Econ Theory 21:3–20

Taylor MP, Allen H (1992) The use of technical analysis in the foreign exchange market. J Int Money Fin 11:304–314

Vilasuso J, Cunningham S (1996) Tests for nonlinearity in EMS exchange rates. Stud Nonlin Dynam Econ 1,3:155–168

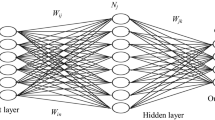

Zapranis A, Refenes AP (1999) Principles of neural model selection: identification and adequacy with applications to financial econometrics. Springer, London

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Brandl, B., Keber, C. & Schuster, M.G. An automated econometric decision support system: forecasts for foreign exchange trades. cent.eur.j.oper.res. 14, 401–415 (2006). https://doi.org/10.1007/s10100-006-0013-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-006-0013-8