Abstract

With the increasing electric vehicle (EV) penetration, there arises an immediate need for charging infrastructure. In the future, the electrification of transportation will reduce the requirement of existing fuel stations, thereby rendering them obsolete. However, they are best suited to cater to the charging demand of EVs as the drivers are accustomed to the locations and the incremental cost of providing this service will be lower. In this paper, we propose a novel methodology to assess the techno-economic feasibility of retrofitting an existing fuel station with EV charging infrastructure also known as Electric Vehicle Supply Equipment (EVSE). To further enhance the value proposition, the potential of integrating Battery Energy Storage System (BESS) with EV charging infrastructure, which results in the reduction of grid connection costs, is studied. The sustainability of the proposed system is improved with additional onsite Photovoltaic (PV) generation. The proposed methodology is implemented for the UK as a case study. The configurations in this study are designed based on the technical considerations involved in retrofitting a typical fuel station as a fast charging facility for EVs. From the results, it is observed that the configurations with 4 EVSE, 1 BESS, and 8 h of operation and the configuration with 4 EVSE, 1 BESS, and 1 PV system for 8 h of operation are economically viable. The abovementioned configurations are the most economically feasible configurations in terms of the Net Present Value (NPV), Internal Rate of Return (IRR) and the Discounted Payback Period (DPP) amongst the other configurations considered in this study. The proposed methodology indicates that though the connection cost is the dominant factor affecting the feasibility, the use of BESS with or without PV can reduce the connection cost by almost 90% depending on the capacity of BESS. The methodology acts as a decision support tool to select a techno-economically feasible configuration of EVSE, BESS, and PV.

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

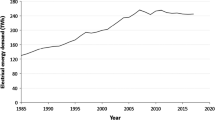

There is a global trend to promote sustainable modes of transport which have resulted in the increasing use of Ultra Low Emission Vehicles (ULEVs), as shown in Fig. 1. ULEVs are vehicles that emit less than 75 g of CO2/km and include Battery Electric Vehicles (BEV), electric range-extender vehicles, and plug-in hybrids (PHEVs) (Society of Motor Manufacturers and Traders 2020). Germany was the market leader in the EU with almost 60,000 new vehicles closely followed by France with 46,554 in 2018 (EEA 2018). Most of the EVs registered in the UK and Sweden are PHEVs whereas BEVs are preferred in France and China (International Energy Agency (IEA) 2017). However, the number of BEVs almost doubled in 2019 in the UK post the introduction of changes in grants available for the purchase of EVs (International Energy Agency (IEA) 2019).

ULEV deployment in different Regions (20132019) (International Energy Agency (IEA), 2020)

As the cost of EVs drop and the range of EVs increase, the unavailability of electric vehicle supply equipment (EVSE) is a major hindrance block for electric mobility (Gnann et al., 2018). This puts the development of the network of EVSE on the critical path to the decarbonisation of transport. The charging technology used for EVs can be categorized as: AC slow chargers (3–7 kW), AC fast chargers (22 kW) and DC fast chargers (50–150 kW) (Sbordone et al., 2015). To reduce the charging times, DC Fast Chargers (DCFCs) with a capacity in the range of 50–150 kW are used in public charging stations.

In the study performed by (Nie & Ghamami, 2013), the need for level 3 charging (50 kW-150 kW range) to provide a reasonable level of service and to reduce the social cost is emphasized. To assess the economic feasibility of using EV charging infrastructure, the business model has been developed and three different scenarios are considered in the study viz. 3.7 kW for home chargers, 22 kW for public hotspots and 50 kW DCFC along the highways in (Madina et al., 2016). The potential of using fast charging EV infrastructure in public hotspots is not considered in the study. Implications of installing a fast charging station in an existing fuel station have been explored. To reduce the reliance on the electricity grid, the potential of using solar PV using energy storage has also been explored. The authors highlight that fast charging EVSE can be a problem for weak distribution grids (Fernández et al., 2019). While the authors present a detailed technical analysis, the economic potential of installing fast charging infrastructure in existing gas stations is not explored.

The refuelling behaviour of people has highlighted the importance of familiarity and closeness to their residences as a key factor in choosing a fuel station for refuelling (Kitamura & Sperling, 1987) (M. A. Nicholas et al., 2012). A similar trend is observed among EV users as well, where the importance of DCFC in public charging infrastructure and the proximity to the residence for a shorter travel distance is highlighted (Majumdar et al., 2015) (Philipsen et al., 2019). From (Wang et al., 2020) and (Liu, 2012), it is observed that shorter charging time and familiarity with the charging stations are key indicators that determine the location of the charging station to promote the growth of EVs. The usage of public fast charging stations has also been studied and the location of fast chargers in fuel stations has been observed to have high usage among EV users (Morrissey et al., 2016).

To make the use of DCFC in public hotspots economically more profitable, the reliance on the electricity grid can be reduced by integrating a renewable energy source in the charging station. Solar energy-based Photovoltaic Systems (PV) are most suitable to be used in an EV charging station (Mohamed et al., 2020). To reduce the dependency on the electricity grid, renewable energy systems like solar PV can be integrated into the EV charging stations (Colak et al., 2016), (Ilango et al., 2022). Studies have also utilized modelling tools to conduct techno-economic assessments for integrating renewables with EV charging stations (Nishanthy et al., 2022). However, real-life scenario to assess the potential of implementing a fast charging station in an existing fuel station and the use of a renewable energy source (solar PV) to reduce the dependency on the electricity grid is missing in the existing literature.

(Egbue et al., 2017) have presented that lack of charging infrastructure and negative environmental impact owing to lack of renewables as key factors for not owning EVs among the respondents surveyed in the study. Thus, the integration of renewable energy systems along with the BESS units will have a twofold benefit of reducing the dependency on the electricity grid to fulfil the demand from the EV charging stations and also motivate vehicle owners to transition to EVs.

Existing research establishes the refuelling pattern of the vehicle owners and based on that suggests the potential of implementing charging stations for EVs at the existing fuel stations (Majumdar et al., 2015). Studies have also conducted a detailed analysis on siting based on different criteria namely technical, environmental, economic, and social factors. However, the real-life implementation has been highlighted as a key limitation in these studies (Pradhan et al., 2021), (Krol & Sierpinski, 2021) (Sierpiński et al., 2020). The potential of implementing a fast charging station in an existing fuel station and the use of a renewable energy source (solar PV) to reduce the dependency on the electricity grid has also been studied (Fernández et al., 2019) (Singh et al., 2021). However, an in-depth analysis on completely retrofitting existing fuel stations with EV fast charging infrastructure and the economic implications of the infrastructure from an investor’s perspective has not been studied yet.

The system architecture considered in this paper is described in Fig. 2. The existing fuel stations have been retrofitted with DCFC EVSE to charge the EVs. The power for the DCFCs is drawn from the electricity grid, however, to reduce the dependency on the electricity grid solar panels have been introduced. To effectively utilize the energy from solar panels, storage energy has also been introduced in the system architecture.

In this paper, the focus is to improve the resource efficiency, through retrofitting an existing fuel station thereby providing a new service at nominal incremental cost contributing to the circular energy economy. Also, the paper provides insights from an investor’s perspective by carrying out a detailed techno-economic analysis to implement EV charging into existing gas stations. The paper aims to analyse the dynamics of the relation between EVSE, BESS and PV for the EV charging infrastructure rather than focusing on absolute values.

The paper is organized as follows. Section Methodology discusses the methodology covering the key technical and economic parameters considered in the paper. Subsequently, Sect. Results and discussion highlights the results and discussion to highlight the results obtained from the analysis. Finally, the authors conclude the paper in Sect. Conclusion highlighting the key aspects of this study and the most feasible configuration obtained as 4 DCFCs, 1 BESS and 8 h of operation for operations without PV and 4 DCFCs, 1 BESS, 1 PV system and 8 h of operation is the most feasible configuration with PV integration.

Methodology

This section discusses the methodology to evaluate a techno-economically feasible design for refurbishing an existing fuel station. The results of the methodology as applied to the UK are discussed in detail in the results sections. The parameters used for the evaluation are discussed in Sect. Scenario 2: EVSE with BESS.

Design considerations

The design considers retrofitting an existing fuel station with DCFC.

The key assumptions in this analysis are:

Technical assumptions

-

1.

The EVSE used for this analysis is a 50 kW CCS-type fast charger.

-

2.

As the size of the fuel stations is variable, 1200 sq. m has been considered as an average.

-

3.

The number of DCFC EVSE that can be implemented in a typical fuel station has been calculated considering the size of a typical fuel station (1200 sq. m). The space for parking the vehicles, the size of EVSE equipment and BESS has been considered to arrive at the maximum number of DCFCs as four.

-

4.

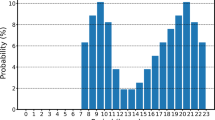

EV battery capacity is 50 kWh (Fig. 3 shows the growth of common battery capacities over the years in different regions. 50 kWh is an average value based on this growth).

-

5.

BESS efficiency is considered to be around 90%.

-

6.

The EV is assumed to arrive at a State of Charge (SoC) of 0.2 and would reach an SoC of 0.8 by the end of the charging session. The charging is considered in the SoC range of 0.2 to 0.8 where linear charging occurs.

-

7.

The following parameters were considered to size the solar panels. The local irradiance values were considered for the case study (considering the area of Oxford-shire)-

Average battery capacity in EVs (International Energy Agency (IEA), 2019b)

Area for Solar panels[A] | 160 | m2 |

|---|---|---|

Area of solar panel | 0.72 | m2 |

Total number of modules | 222 | – |

Max power | 110 | Wp |

Installed capacity | 24.44 | kWp |

Solar panel yield [r] | 0.152778 | – |

GTI at optimal angle [H] | 1251 | kWh/m2 |

Performance ratio [P] | 0.75 | – |

Non-technical assumptions

-

8.

Degradation losses of the battery are ignored.

-

9.

There is no queuing of vehicles in the fuel station at any given point in time as these are fast charging stations.

-

10.

It is assumed that there will be around fifteen minutes between the departure and arrival of cars at the charging station. This time interval will be used to charge the BESS at full capacity from grid electricity if required.

-

11.

The lifetime of the DCFCs is 10 years.

-

12.

The capacity of the PV system is considered equal to the capacity of the BESS used as no feed-in tariff is available in the UK.

-

13.

The hours of usage (husage) of newly installed DCFCs based on typical studies are about 4 h a day and reach up to a maximum of 8 h a day.

Proposed Methodology

The steps of the proposed methodology for the re-design of the fuel station (Fig. 4) are as follows:

-

1.

Calculation of number of DCFCs

-

a.

The number of DCFCs that can be installed on a fuel station is physically limited by the space available at the station. If there are 4 bays in the fuel station, it is possible to have 4 DCFCs. This gives the maximum number of DCFCs that can be installed (nDCFC, max).

-

a.

-

2.

Calculation of the BESS capacity

-

a.

As the idea is to repurpose the existing fuel station without additional infrastructure cost, it is proposed to use the fuel storage tanks as the battery storage area. Thus, the net storage that can be installed in a station is almost limited by the volume of storage pre-existing in the station. The maximum battery storage (\({E}_{S,max} \, in \, kWh)\) that can be installed is given by

$$ E_{S,\max } = {\text{energy density of Lithium ion battery}} \left( {{\text{kWh}}/{\text{m}}^{3} } \right) \times {\text{volume of storage}} \left( {{\text{m}}^{3} } \right) $$(1)

-

a.

The maximum number of battery units (\({n}_{bat,max})\) is given by

where \({E}_{bat}\) is the energy capacity of a single battery storage unit in kWh.

-

3.

Calculation of PV system capacity

-

a.

The annual energy generated by a 1 kWp PV system (\({PV}_{1} \, in \, kWh)\) is calculated using the PVWatts® Calculator [32] considering the average annual solar irradiance value in the region.

-

b.

The nominal capacity of the installed PV system is calculated (\({PV}_{size} \, in \, kWp)\) using the annual energy generated by the PV system \(({E}_{pv} \, in \, kWh)\) and the annual energy generated by a 1kWp PV system (\({PV}_{1} \, in \, kWh)\) as shown in Eq. (3)

$$ {\text{PV}}_{{{\text{size}}}} = \frac{{E_{{{\text{PV}}}} \times 1{\text{ kWp}}}}{{{\text{PV}}_{1} }} $$(3) -

c.

PV system can be integrated into the charging station to reduce the dependency on the grid electricity. The capacity of the PV system (\({PV}_{c} \, in \, kWh)\) installed is considered equal to the maximum battery storage (\({E}_{S,max} \, in \, kWh)\) and is limited by the maximum usable area in the fuel station (\({A}_{max}\)). The area of the PV system \(({A}_{PV} \, in \, {m}^{2})\) can be calculated using (4) where (\({A}_{1} \, in \, {m}^{2}\)) is the area of the PV system for 1 kWp capacity and (\({PV}_{size} \, in \, kWp\)) is the capacity of the PV system installed. The area of the PV system should be less than the maximum usable area of the fuel station. 25AC

$$ A_{{{\text{PV}}}} = \frac{{A_{1} \times {\text{PV}}_{{{\text{size}}}} }}{{1 {\text{kWp}}}} < A_{{{\text{max}}}} $$(4)

-

a.

PV system can be integrated into the charging station to reduce the dependency on the grid electricity. The energy capacity of the PV system (\({PV}_{c} \, in \, kWh)\) installed is considered equal to the maximum battery storage (\({E}_{S,max} \, in \, kWh)\) to avoid any loss of energy.

-

4.

Calculation of Upfront cost of the EV charging station

-

a.

If there are nDCFC DCFCs, nbat storage systems installed and npv PV modules installed, the total upfront cost of the fuel station repurposing will include the cost of the DCFC (CDCFC), cost of storage (Cbat) (if any), installation cost of DCFC (CI), installation cost of storage (Cins), electricity network connection cost (Cc), cost of solar PV (Cpv) as shown in Eq. (4)

$$ C_{{{\text{upfront}}}} = n_{{{\text{DCFC}}}} \times C_{{{\text{DCFC}}}} + n_{{{\text{bat}}}} \times C_{{{\text{bat}}}} + C_{I} + n_{{{\text{bat}}}} \times C_{{{\text{ins}}}} + C_{c} + n_{{{\text{pv}}}} \times C_{{{\text{pv}}}} $$(5)

where all the costs are in pounds. The connection cost is dependent on the net demand at the point of connection to the grid and it increases with an increase in net demand. However, this increase is nonlinear and may rise steeply after a knee point reflecting the need to upgrade the system and/or to have an additional local transformer. Typical values of this connection cost across the UK are given in (Aurora Energy Research Ltd, 2018).

-

a.

-

5.

Calculation of average revenue generation

-

a.

Calculation of annual revenue The annual revenue depends on the energy used per vehicle (Ev in kWh), the number of vehicles arriving per day (nv) and the billing rate of the customers. If customers are billed at ‘p’ pence/kWh, the annual revenue can be calculated using

$$ {\text{Revenue}}_{{{\text{Annual}}}} = n_{v} \times E_{v} \times p \times 365 $$(6) -

b.

Calculation of annual energy cost The annual energy cost will be dependent on the net energy consumed at the point of connection. If there is no storage, this energy will be the same as the energy supplied to the customers. If there is storage, a percentage of the energy supplied would come from the storage. It can be safely considered that the ratio of energy supplied from the battery will be equal to the ratio of the power capacity of storage units (Pbat in kW) to the net power of the DCFCs (PDCFC in kW). The percentage of energy utilized from the BESS is dependent on the availability of the BESS and the time needed to charge the BESS. It is calculated using Eq. (7) where the percentage of utilization is limited to 50% to prevent complete discharge of the BESS.

$$ {\text{Capacity}}_{{{\text{ratio}}}} = \frac{{n_{{{\text{bat}}}} \times P_{{{\text{bat}}}} }}{{n_{{{\text{DCFC}}}} \times P_{{{\text{DCFC}}}} }} $$(7)$$ {\text{perc}}_{{{\text{stor}}}} = \left\{ {\begin{array}{*{20}l} {{\text{Capacity}}_{{{\text{ratio}}}} , } \hfill & {{\text{if}}\, {\text{Capacity}}_{{{\text{ratio}}}} < 0.5} \hfill \\ {0.5, } \hfill & {{\text{if}}\, {\text{Capacity}}_{{{\text{ratio}}}} \ge 0.5} \hfill \\ \end{array} } \right. $$(8)

-

a.

The annual energy cost (\({C}_{AE}\)) can thus be calculated using the following eqn.:

Annual energy cost

where (neff) is the efficiency of the BESS considering the standby losses.

Since there is no feed-in tariff available for solar PV, the cost of the electricity generated using the PV system is equivalent to the billing price ‘p’ pence/kWh.

-

c.

Calculation of annual operation and maintenance cost The annual maintenance cost (Cm) is roughly around 10% of the capital cost of the DCFC (Aurora Energy Research Ltd, 2018). This includes software maintenance and updates as well. The operation and maintenance cost for solar PV is considered 1.5% of the capital cost for the PV system. There are no operation and maintenance charges associated with the storage system.

-

6.

Calculation of economic feasibility via NPV, IRR and DPP

-

a.

Calculation of Net present value (NPV) NPV is used to calculate the discounted cash flows over 10 years to analyse the economic viability of the considered system. NPV can be calculated using (7) where Ct is the net cash flow during the period t and r is the discount rate. The cash flow Ct is calculated using (8), where Ct is the yearly discounted cash flow. All the cost parameters are in pounds.

$$ {\text{NPV}} = \mathop \sum \limits_{t = 1}^{10} \frac{{C_{t} }}{{\left( {1 + r} \right)^{t} }} - C_{{{\text{upfront}}}} $$(10)$$ C_{t} = {\text{Revenue}}_{{{\text{annual}}}} - \left( {C_{{{\text{AE}}}} + C_{m} } \right) $$(11) -

b.

Calculation of Internal rate of return (IRR) IRR is the interest rate r at which the NPV becomes zero. IRR can be calculated using (9)

$$ {\text{IRR is}} r {\text{at}} {\text{which }}\mathop \sum \limits_{t = 1}^{T} \frac{{C_{t} }}{{\left( {1 + r} \right)^{t} }} - C_{{{\text{upfront}}}} = 0 $$(12) -

c.

Calculation of Discounted Payback Period (DPP) DPP is the number of years taken to break even the initial investment by using future discounted cash flows. DPP can be calculated using (10)

$$ {\text{Number of years at which}}\mathop \sum \limits_{t = 1}^{T} \frac{{C_{t} }}{{\left( {1 + r} \right)^{t} }} = C_{{{\text{upfront}}}} $$(13) -

d.

Repeat steps 3–10 for all the potential combinations of hours of operation (e.g. for 4, 6 and 8 h of operation per day), number of DCFCs (1 to nDCFC,max), number of battery storage systems (1 to nbat,max) and number of solar PV systems (1 to npv,max).

-

e.

Selection of techno-economically feasible combination of the number of DCFCs and number of batteries: The most profitable scenario can be identified using NPV and IRR.

-

f.

Sensitivity analysis to assess the impact of fluctuating costs on NPV, IRR and DPP.

Case Study on the UK

A case study of a typical fuel station in the UK is considered and it will be able to accommodate 4 DCFCs. The underground storage capacity of the fuel station is 35,000 Gallons (~ 132 m3) (American Petroleum Institute, 2019). If we consider the typical energy density of a Lithium-ion battery (280 kWh/m3), this implies that we can have around 36.96 MWh (Meeus, 2019). The three scenarios considered for the analysis are:

-

1.

DCFC without storage (Considering 1–4 DCFCs)

-

2.

DCFCs with storage (Considering 1- 4 DCFCs and 1–3 Storage Units)

-

3.

DCFCs with storage and PV system (Considering 1–4 DCFCs, 1–3 Storage Units and 1–3 PV Units)

Considering the typical connection capacity of less than 69 kW in the UK (Scottish and Southern Electricity Networks, 2018), the size of a single battery unit is limited to 50 kWh with a maximum charging power of 50 kW. As this power is the same as the power rating of a DCFC, the maximum number of batteries (\({n}_{bat}\)) is considered as \({n}_{DCFC}\)-1 for the different scenarios listed above. The configurations with equal number of DCFC and storage units are not discussed as it did not provide any technical or economic advantages.

The technical and economical parameters considered for the analysis are given in Table 1.

The price to charge an EV is calculated using the average price from the companies in the UK as described in Table 2.

The next section discusses the results obtained by following the methodology using the UK as a case study.

Results and Discussions

The techno-economic analysis was conducted for the different scenarios described in Sect. Scenario 3: EVSE with BESS and PV. The scenarios with the same number of EVSE and the number of storage units were ignored as such scenarios do not provide any technical or economic advantages. The configurations considered for the analysis can be described as “n1Cn2Sn3h”, where n1 represents the number of DCFCs and ranges from 1 to 4, n2 represents the number of BESS and ranges from 0 to 3 and n3 represents the number of hours of operations per day which can be 4, 6 or 8.

Figure 5a, b, and c shows NPV, IRR and DPP, respectively, for all the scenarios considered for the analysis. The size of the circles represents the magnitude of the NPV for a given configuration. The positive value of NPV (Fig. 5a) indicates an economically viable configuration, but this should also be considered along with the values of IRR (Fig. 5b) and DPP (Fig. 5c).

Scenario 1: EVSE without BESS

The configuration 1C0S4h has a negative NPV indicating that if an investor invests in only one DCFC, the system is infeasible for lower hours of operation. The return-on-investment increases with an increasing number of hours of operation leading to a positive NPV of £60 k and a DPP of less than 6 years for 8 h of operation (1C0S8h). The configuration 2C0S4h has a negative NPV as well indicating that this is economically infeasible. For the configuration 2C0S8h, with the increase in the hours of operation, the NPV increases to a value of £122 k and the IRR becomes 22% with a payback period of 5.4 years. The configuration 3C0S4h has a negative NPV indicating that this is economically infeasible. With the increasing number of hours of operation, the configuration becomes economically more feasible with a higher NPV and IRR and a lower DPP. For 8 h of operation, the NPV value is £187 k with an IRR of 23% and a payback period of 5.5 years. For the configuration 4C0S4h when the daily hours of operation are low, the NPV is negative indicating that this configuration is not economically viable. This is due to the high connection cost involved in connecting 4 DCFCs to the electricity grid. However, as the hours of operation increase, the configuration 4C0S8h has an NPV value of £143 k and an IRR of 12% with a discounted payback period of 7 years.

Scenario 2: EVSE with BESS

The configuration 2C1S4h was found to be economically infeasible with a negative NPV for four hours of operation. However, with an increase in the hours of operation, the NPV value becomes more positive as observed from the configuration 2C1S8h which has an NPV value of £93 k, IRR of 16% and a DPP of 6.3 years. The configurations for three DCFCs with storage for 4 h of operation are not viable economically and the rest have positive NPV with the most economical configuration being 3C1S8h (NPV £15 k and IRR of 18%). Even the configurations 4C1S4h and 4C2S4h are not economically feasible as operational hours are less, and the annual revenue generated cannot compensate for the upfront costs involved for the installation of DCFC and the BESS. But as the daily hours of operation increase, the system becomes economically viable. 4C1S8h and 4C2S8h have highly positive NPV of £219 k and £185 k and the IRR is 20 and 16%, respectively. The DPP for the configurations is also 5 years and 6.3 years, respectively. For the configuration with 3 battery storage units, scenario 4C3S4h is economically infeasible with a negative cash flow value. The price of the BESS increases the upfront costs and the annual revenue generated is not sufficient to compensate for the increased upfront costs. However, with the increase in daily hours of operation the configurations 4C3S6h and 4C3S8h become economically viable with a highly positive NPV of £33 k and £165 k and IRR of 6% and 14%, respectively. The DPP is 9.1 years and 7.7 years, respectively.

Scenario 3: EVSE with BESS and PV

The techno-economic analysis was also conducted for the different scenarios after integrating solar PV along with the EVSE. The configurations with PV are defined as “n1Cn2Sn2Pn3h”. The total capacity of the PV units installed in the charging station is considered equal to the capacity of BESS installed. This assumption is to ensure the PV generation capacity suffices for the EV consumption, any dispensable capacity generation may not be economically viable. The positive values of the NPV (Fig. 6a) highlight the economic feasibility of the scenario but should be considered with IRR (Fig. 6b) and the DPP (Fig. 6c).

For all the configurations with PV at 4 h of operation, the NPV is observed to be negative. When two DCFCs with one storage and one PV system is considered, it is observed that the configuration 2C1S1P6h has a positive NPV of £18 k with an IRR of 5%; however, the payback period is more than 10 years. For 8 h of operation, the configuration 2C1S1P8h has a positive NPV of £84 k with an IRR of 10% and a DPP of 8.6 years when 8 h of operation is considered.

It is observed that the configuration 3C1S1P4h is economically infeasible as it has a negative NPV value. However, when the hours of operation are increased, the configuration 3C1S1P6h has a positive NPV value of £44 k with an IRR of 6% and a DPP of 9.3 years, indicating that it is economically feasible. With an increasing number of PV systems installed along with the BESS units for the configuration 3C2S2P6h, the NPV reduces to £11 k and the IRR reduces to 4% with a payback period of more than 10 years. The configuration 3C1S1P8h has a highly positive NPV of £145 k with an IRR of 12% and a DPP of 7.4 years when 8 h of operation are considered. As the number of PV units increases, i.e. 3C2S2P8h, the IRR reduces to 8% and the DPP increases to 8.1 years. The configuration 3C2S2P has a lower NPV and IRR value than the configuration 3C1S1P for 6 and 8 h of operations, respectively.

The configurations of 4 DCFCs with storage and PV for four hours of operation are economically infeasible with a negative NPV value. However, when the hours of operation are increased, the configurations 4C1S1P6h are only economically feasible with a positive NPV of £76 k IRR of 8% and DPP of 9.7 years. 4C1S1P8h has a highly positive NPV value of £252 k with an IRR of 13% and a discounted payback period of 7.5 years. As the hours of operation are increased to 8, it can be observed that the configurations 4C1S1P8h, 4C2S2P8h and 4C3S3P8h have positive NPV of £210 k, £168 k and £139 k, IRR values of 14%, 10% and 8% and the DPP value of 6, 8.6 years and 8 years, respectively.

Sensitivity analysis

With the increase in demand for EVs and the advancement of technology in the EV charging infrastructure, a decline in the price of components can be observed in the upcoming years. A sensitivity analysis is thus conducted to assess the impact of change in EVSE and BESS on the NPV, IRR and DPP. A reduction of 25% in the price of a typical 50 kW EVSE unit is observed from the time period of 2015(Smith & Castellano, 2015) to 2019 (M. Nicholas, 2019). However, the typical installation cost of an EVSE has increased by 20% from 2015 (Smith & Castellano, 2015) to 2019 (M. Nicholas, 2019). For the sensitivity analysis, the price of both the EVSE and BESS is reduced by 25% and the installation cost is increased by 20% to analyse the impact on NPV, IRR and DPP.

From the sensitivity analysis, it is observed that the trend followed by the NPV, IRR and DPP is similar to the cost fluctuation as shown in Figs. 7, 8 and 9. Despite the change in costs, the scenarios which were earlier economically feasible tend to maintain parity.

Discussions

It is observed that operational hours play a critical role in the success of the proposed configurations, as it leads to increased revenue. However, as the number of DCFCs increase, the connection costs increase and adversely impacts the economic feasibility. An analysis of different configurations of DCFC with BESS and PV as discussed in this paper will enable the stakeholder to make an informed decision. This paper considers the technical parameters of all components of the system while calculating the techno-economic feasibility. The present analysis aims to assess the dynamics between economic indicators given the combination of DCFC and storage for observing the feasibility trend for the proposed design of retrofitting the fuel station. With an increase in the number of DCFCs, there is an increase in the connection cost owing to the increased power demand from the grid. This increase can be mitigated by integrating BESS with EVSE, which in turn reduces the connection costs making the scenarios economically more viable. For example, in the UK, 4DCFC without storage would incur a connection cost of £120 k, whereas 4DCFC with storage will incur a connection cost of £10 k only, leading to a reduction of connection by 91%. The sustainability and resource efficiency of the proposed retrofit of the fuel station is further improved by the integration of PV. Due to the additional cost of PV, we can observe an increase in the DPP and a decrease in the IRR when solar PV is installed in the charging station for all the configurations. But the additional PV system reduces the reliance on the electricity grid and as PV is considered along with storage, it would also avoid the high connection cost.

With a suitable feed-in tariff, the additional electricity generated by the PV system can be sold to the electricity grid increasing the profitability of the installed PV system. Also, the integration of storage can become more profitable if the storage is used to provide other services in the electricity market. In the future, as dynamic pricing becomes more common, the integration of storage with EVSE will enable the use of cheaper electricity without affecting the services provided by the station. Also, apart from this, the availability of grid capacity will play a huge role in the transition of a fuel station to an EV charging station. The proposed design gives an idea about the feasibility of retrofitting the existing fuel station to an EV station given the present technical constraints and economic parameters. This would pave the way for sustainable expansion of EV transportation with efficient asset utilization, thereby contributing to circular energy systems.

Conclusion

Techno-economic feasibility of retrofitting existing fuel stations with EVSE equipped with/without storage and with/without PV is analysed in this paper. The method is applied to the UK as a case study, the results of which are discussed. The results indicate that with an increase in hours of operation per day, the NPV becomes more positive and the discounted payback period reduces as well. The most economic configuration is 4C1S8h with an IRR of 20% and DPP of 5 years for the case study of the UK. With the integration of solar PV into the system, the configuration 4C1S1P8h is the most suitable configuration with an IRR of 14% and a DPP of 6 years.

The repurposing of fuel stations is more sustainable as the existing infrastructure is used and there is no additional construction needed for the charging stations which aims to utilize the existing infrastructure in an efficient manner. The existing gas stations are ideally located to implement EV fast charging stations and the methodology proposed in this study presents a techno-economic feasibility method to repurpose the existing gas stations to install EV fast chargers. The electricity network connection cost negatively affects the economic feasibility of the system as the number of DCFCs increases beyond three. This is due to the need for the upgrade of the electricity network beyond the current capacity, the costs of which are partially passed on to the installer of the DCFC. The usage of storage along with the DCFC will help reduce the connection cost, earn more revenue in the future by participating in local energy markets, and enable utilization of cheaper time of use of flexible tariffs while also limiting the impact on the electricity network. The installation of PV will reduce the dependency on the electricity grid and reduce the yearly fuel cost generated by using the electricity grid making the system more sustainable. The economic feasibility of PV-integrated fast charging stations will motivate investors to explore the potential of retrofitting existing fuel stations. This will further accelerate the transition to EVs by addressing the issues of range anxiety among the EV users. There is potential for the work to be further expanded to include the revenue generated by batteries from participation in multiple electricity markets, which is likely to further improve the economic feasibility of battery integrated fast charging stations.

Data availability

Data will be available on request.

Abbreviations

- BEV:

-

Battery electric vehicle

- BESS:

-

Battery energy storage system

- CAGR:

-

Compound annual growth rate

- DC:

-

Direct current

- DCFC:

-

Direct current fast charging

- EU:

-

European union

- EV:

-

Electric vehicles

- EVSE:

-

Electric vehicle supply equipment

- FAME:

-

Faster adoption and manufacturing of hybrid and EV

- ICE:

-

Internal combustion engines

- IRR:

-

Internal rate of return

- LCOS:

-

Levelised cost of storage

- PV:

-

Photovoltaic

- A 1 :

-

Area of 1 kWp PV system

- A PV :

-

Area of the PV system installed in the fuel station

- A max :

-

Maximum usable area of the fuel station

- C bat :

-

Cost of storage

- C I :

-

Installation cost of DCFC

- C ins :

-

Installation cost of storage

- C c :

-

Electricity network connection cost

- C m :

-

Operation and maintenance cost

- \({C}_{\mathrm{upfront}}\) :

-

Total upfront cost of the fuel station

- C t :

-

Annual discounted cash flow

- E pv :

-

Annual energy generated by the PV system

- \({E}_{\mathrm{S},\mathrm{max}}\) :

-

Maximum battery storage capacity

- E v :

-

Energy used per vehicle

- h usage :

-

Hours of usage of the DCFCs

- H :

-

Global tilt irradiance at an optimal tilt angle

- n DCFC :

-

Number of DCFCs that can be installed

- n bat :

-

Number of storage units installed

- n DCFC,max :

-

Maximum number of DCFCs that can be installed

- \({n}_{\mathrm{bat},\mathrm{max}}\) :

-

Maximum number of battery units

- n v :

-

Number of vehicles arriving per day at the charging station

- n eff :

-

Efficiency of the BESS considering the standby losses

- n pv :

-

Number of PV system installed

- n pv,max :

-

Maximum number of PV system installed

- P bat :

-

Power capacity of storage units

- P DCFC :

-

Net power of the DCFCs

- \({\mathrm{perc}}_{\mathrm{stor}}\) :

-

Ratio of power capacity of storage units to the net power of the DCFCs

- p :

-

Billing price for the customers

- \({P}_{\mathrm{r}}\) :

-

Performance ratio of the solar panel

- \({\mathrm{PV}}_{1}\) :

-

Annual energy generated by 1 kWp PV system

- \({\mathrm{PV}}_{\mathrm{c}}\) :

-

Maximum energy capacity of the PV system

- \({\mathrm{PV}}_{\mathrm{size}}\) :

-

Capacity of the PV system that is installed

- r :

-

Solar panel yield

- \({\mathrm{Revenue}}_{\mathrm{annual}}\) :

-

Annual revenue

- t :

-

Number of years

References

American Petroleum Institute. (2019) Energy-Understanding our oil supply chain. Energy API. https://www.api.org/~/media/Files/Policy/Safety/API-Oil-Supply-Chain.pdf

Aurora Energy Research Ltd. (2018) Opportunities in electric vehicle charging at commercial and industrial sites. https://www.auroraer.com/wp-content/uploads/2018/10/Aurora-Report-Full-Opportunities-in-EV-charging-at-CI-sites-October-2018.pdf

Barnes J, Bhagavathy SM (2020) The economics of heat pumps and the (un)intended consequences of government policy. Energy Policy 138:111198. https://doi.org/10.1016/j.enpol.2019.111198

Battery University. (2021) Elevating Self-discharge. Retrieved May 30, 2020, from https://batteryuniversity.com/learn/article/elevating_self_discharge

BP Chargemaster. (2022) 150kW EV chargers. Retrieved July 9, 2020, from https://bpchargemaster.com/ultracharge-150/

Colak I, Bayindir R, Aksoz A, Hossain E, Sayilgan S (2016) Designing a competitive electric vehicle charging station with solar PV and storage. In: INTELEC, International telecommunications energy conference (Proceedings), 2016-September. https://doi.org/10.1109/INTLEC.2015.7572480

Cole W, Frazier AW (2020) Cost Projections for Utility-Scale Battery Storage: 2020 Update. https://www.nrel.gov/docs/fy20osti/75385.pdf

EEA. (2018) Electric vehicles as a proportion of the total fleet — European Environment Agency. https://www.eea.europa.eu/data-and-maps/indicators/proportion-of-vehicle-fleet-meeting-4/assessment-4

Egbue O, Long S, Samaranayake VA (2017) Mass deployment of sustainable transportation: evaluation of factors that influence electric vehicle adoption. Clean Technol Environ Policy 19(7):1927–1939. https://doi.org/10.1007/S10098-017-1375-4/TABLES/5

Fernández G, Torres J, Cervero D, García E, Alonso MÁ, Almajano J, Machín S, Bludszuweit H, Sanz JF (2019) EV charging infrastructure in a petrol station, lessons learned. In: 2018 International Symposium on Industrial Electronics, INDEL 2018 - Proceedings, 1–6. https://doi.org/10.1109/INDEL.2018.8637635

Fu R, Feldman D, Margolis R. (2009) U.S. Solar Photovoltaic System Cost Benchmark: Q1 2018. www.nrel.gov/publications

Gnann T, Stephens TS, Lin Z, Plötz P, Liu C, Brokate J (2018) What drives the market for plug-in electric vehicles? - A review of international PEV market diffusion models. Renew Sustain Energy Rev 93:158–164. https://doi.org/10.1016/j.rser.2018.03.055

Ilango R, Vengadachalam N, Seethalakshmi VS (2022) Charging demand based on the interaction among electric vehicles and renewable energy sources using hybrid technique. Clean Technol Environ Policy 2022:1–20. https://doi.org/10.1007/S10098-022-02334-W

International Energy Agency (IEA). (2017) Global EV Outlook 2017. In IEA. IEA. https://doi.org/10.1787/9789264278882-en

International Energy Agency (IEA). (2019a) Global EV Outlook 2019. https://www.iea.org/reports/global-ev-outlook-2019

International Energy Agency (IEA). (2019b) Global EV Outlook 2019. In IEA. https://www.iea.org/reports/global-ev-outlook-2019

International Energy Agency (IEA) (2020) Global EV Outlook 2020 Global EV Outlook 2020 https://doi.org/10.1787/d394399e-en

Kitamura R, Sperling D (1987) Refueling behavior of automobile drivers. Transp Res Part A General 21(3):235–245. https://doi.org/10.1016/0191-2607(87)90017-3

Krol A, Sierpinski G (2021) Application of a genetic algorithm with a fuzzy objective function for optimized siting of electric vehicle charging devices in urban road networks. IEEE Trans Intell Transp Syst. https://doi.org/10.1109/TITS.2021.3085103

Liu J (2012) Electric vehicle charging infrastructure assignment and power grid impacts assessment in Beijing. Energy Policy 51:544–557. https://doi.org/10.1016/j.enpol.2012.08.074

Madina C, Zamora I, Zabala E (2016) Methodology for assessing electric vehicle charging infrastructure business models. Energy Policy 89:284–293. https://doi.org/10.1016/j.enpol.2015.12.007

Majumdar D, Majhi BK, Dutta A, Mandal R, Jash T (2015) Study on possible economic and environmental impacts of electric vehicle infrastructure in public road transport in Kolkata. Clean Technol Environ Policy 17(4):1093–1101. https://doi.org/10.1007/s10098-014-0868-7

Meeus M (2019) Overview of battery cell technologies overview of battery technologies bridging the innovation gap. Tech rep, 2019

Mohamed AAS, El-Sayed A, Metwally H, Selem SI (2020) Grid integration of a PV system supporting an EV charging station using Salp swarm optimization. Sol Energy 205:170–182. https://doi.org/10.1016/j.solener.2020.05.013

Morrissey P, Weldon P, O’Mahony M (2016) Future standard and fast charging infrastructure planning: An analysis of electric vehicle charging behaviour. Energy Policy 89:257–270. https://doi.org/10.1016/J.ENPOL.2015.12.001

Nicholas M A, Tal G, Davies J, Woodjack J (2012) DC Fast as the only public charging option? scenario testing from GPS-tracked vehicles. Transportation Research Board 91st Annual Meeting

Nicholas, M. (2019) Estimating electric vehicle charging infrastructure costs across major U.S. metropolitan areas. In: International Council on Clean Transportation, 14, 11.

Nie Y, Ghamami M (2013) A corridor-centric approach to planning electric vehicle charging infrastructure. Transp Res Part B Methodol 57:172–190. https://doi.org/10.1016/j.trb.2013.08.010

Nishanthy J, Charles Raja S, Praveen T, Nesamalar JD, Venkatesh P (2022) Techno-economic analysis of a hybrid solar wind electric vehicle charging station in highway roads. Int J Energy Res 46(6):7883–7903. https://doi.org/10.1002/er.7688

Philipsen R, Brell T, Biermann H, Ziefle M (2019) Under pressure-users’ perception of range stress in the context of charging and traditional refueling. World Electr Veh J. https://doi.org/10.3390/wevj10030050

Pradhan S, Ghose Shabbiruddin D (2021) Planning and design of suitable sites for electric vehicle charging station– a case study. Int J Sustain Eng 14(3):404–418. https://doi.org/10.1080/19397038.2020.1862347

Public charging networks - national and regional EV charging networks. (2022) Retrieved October 23, 2020, from https://www.zap-map.com/charge-points/public-charging-point-networks/

Sbordone D, Bertini I, Di Pietra B, Falvo MC, Genovese A, Martirano L (2015) EV fast charging stations and energy storage technologies: a real implementation in the smart micro grid paradigm. Electric Power Syst Res 120:96–108. https://doi.org/10.1016/j.epsr.2014.07.033

Scottish and Southern Electricity Networks. (2018) Your guide to applying for a new connection.

Sierpiński G, Staniek M, Kłos MJ (2020) decision making support for local authorities choosing the method for siting of in-city EV charging stations. Energie 13(18):4682. https://doi.org/10.3390/EN13184682

Singh A, Shaha SS, Nikhil PG, Sekhar YR, Saboor S, Ghosh A (2021) Design and analysis of a solar-powered electric vehicle charging station for indian cities. World Electr Veh J 12(3):132. https://doi.org/10.3390/WEVJ120301326

Smith M, Castellano J (2015) Costs Associated With Non-Residential Electric Vehicle Supply Equipment. U.S. Department of Energy, November, 1–43

Society of Motor Manufacturers and Traders. (2020) Ultra Low Emission Vehicles (ULEVs). Retrieved May 30, 2020, from https://www.smmt.co.uk/industry-topics/technology-innovation/ultra-low-emission-vehicles-ulevs/

Solar photovoltaic (PV) cost data - GOV.UK. (2021) Retrieved June 29, 2020, from https://www.gov.uk/government/statistics/solar-pv-cost-data

Vartiainen E, Masson G, Breyer C (2015) PV LCOE in Europe 2014–30 - Final Report, 23 June 2015. European PV Technolgoy Platform Steering Committee PV LCOE Working Group. http://www.etip-pv.eu/fileadmin/Documents/FactSheets/English2015/PV_LCOE_Report_July_2015.pdf

Wang Y, Yao E, Pan L (2020) Electric vehicle drivers’ charging behavior analysis considering heterogeneity and satisfaction. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.124982

Funding

Open access funding provided by Royal Institute of Technology. The authors have not disclosed any funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have not disclosed any competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ghosh, N., Mothilal Bhagavathy, S. & Thakur, J. Accelerating electric vehicle adoption: techno-economic assessment to modify existing fuel stations with fast charging infrastructure. Clean Techn Environ Policy 24, 3033–3046 (2022). https://doi.org/10.1007/s10098-022-02406-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-022-02406-x