Abstract:

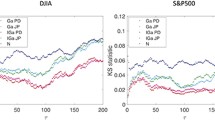

The probability distribution of stock price changes is studied by analyzing a database (the Trades and Quotes Database) documenting every trade for all stocks in three major US stock markets, for the two year period January 1994 - December 1995. A sample of 40 million data points is extracted, which is substantially larger than studied hitherto. We find an asymptotic power-law behavior for the cumulative distribution with an exponent \(a \approx 3\), well outside the Lévy regime \((0 < \alpha < 2)\).

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received: 23 April 1998 / Revised and Accepted: 24 April 1998

Rights and permissions

About this article

Cite this article

Gopikrishnan, P., Meyer, M., Amaral, L. et al. Inverse cubic law for the distribution of stock price variations. Eur. Phys. J. B 3, 139–140 (1998). https://doi.org/10.1007/s100510050292

Issue Date:

DOI: https://doi.org/10.1007/s100510050292