Abstract

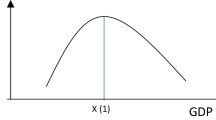

This paper provides empirical evidence regarding the effect of energy based taxes on economic growth. The analysis is based on a panel dataset of 31 OECD (Organisation for Economic Co-operation and Development) member countries from 1994 to 2013, using multiple imputation algorithm to address missingness pattern. Employing the instrumental variables with two-stage least squares instrumental variable estimator, we found that energy based taxes have a negative effect on economic growth rate. This effect may rely significantly on the level of the economy’s dependence on polluting energy use as a share of total energy used in the production process. In addition, our study shows that an increase in energy based taxes can enhance significantly the economic growth rate, as the initial level of country’s richness increases.

Similar content being viewed by others

Notes

See Ricci (2007) for a comprehensive survey on impacts of environmental policy on growth.

Polluting energy products include coal and coal products, oil products, natural gas and electricity. More details are provided in the Sect. 4.

Our sample includes 31 countries member in the OECD. Chile, Mexico, USA was excluded because they don’t have data for the productive expenditure variable. We explain this in Sect. 4.

Variables used in the Barro-type regression are called the conditioning variables (Kneller et al. 1999).

“General government consists of central government, state government, local government and social security funds” (OECD 2013: 62).

Barro (1990) suggests that the effects of taxes on economic growth depend on whether tax is distortionary or non-distortionary. Distortionary taxes in this context are those which affect the investment decisions of agents and hence distort the steady-state rate of growth. Conversely, non-distortionary taxation does not affect saving/investment decisions and hence has no effect on the rate of growth.

Since energy taxes are expected to affect the production of goods more than services and as we later aim to explore whether growth impacts of energy taxes depend on the level of trade openness of goods and services has been excluded from trade openness index.

Because of completely missingness patterns of data for the productive expenditure variable, Chile, Mexico, USA countries were excluded from our sample.

An econometric analysis of panel data was chosen to study the nature of relation between energy based taxes and growth for two reasons. First, the available data about environmental taxation ranges according to OECD statistics from 1994 to 2013. This series is not long enough for using time-series econometrics. Employing panel data will allow us to cover more observations and thus raise the statistical power and inference of the model. Second, Temple (1999) and Baltagi (2001) argue that panel estimators are the most appropriate choices for growth regression.

OCED statistics provide data of environmental tax revenues for the period 1994–2014. But as the available data on total final consumption of polluting energy products and on capital human are available only until 2013, we decided to restrict our study from 1994 to 2013.

In highly developed countries with a high income, the tertiary sector (services sector) dominates the total output of the economy.

References

Abdullah S, Morley B (2014) Environmental taxes and economic growth: evidence from panel causality tests. Energy Econ 42:27–33. https://doi.org/10.1016/j.eneco.2013.11.013

Adam CS, Bevan DL (2005) Fiscal deficits and growth in developing countries. J Public Econ 89(4):571–597. https://doi.org/10.1016/j.jpubeco.2004.02.006

Afonso A, Alegre JG (2010) Economic growth and budgetary components: a panel assessment for the EU. Empir Econ 41(3):703–723. https://doi.org/10.1007/s00181-010-0400-9

Alcántar-Toledo J, Venieris YP (2014) Fiscal policy, growth, income distribution and sociopolitical instability. Eur J Polit Econ 34(June):315–331. https://doi.org/10.1016/j.ejpoleco.2014.03.002

Alesina A, Ardagna S, Perotti R, Schiantarelli F (2002) Fiscal policy, profits, and investment. Am Econ Rev 92(3):571–589. https://doi.org/10.1257/00028280260136255

Aloi M, Tournemaine F (2011) Growth effects of environmental policy when pollution affects health. Econ Model 28(4):1683–1695. https://doi.org/10.1016/j.econmod.2011.02.035

Arin KP, Elias B, Doppelhofer G (2017) Revisiting the growth effects of fiscal policy: a Bayesian model averaging approach. In: 2017. CAMA working papers. Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University. https://ideas.repec.org/p/een/camaaa/2017-68.html. Accessed 13 June 2019

Baldacci E, Clements B, Gupta S, Cui Q (2008) Social spending, human capital, and growth in developing countries. World Dev 36(8):1317–1341. https://doi.org/10.1016/j.worlddev.2007.08.003

Baltagi B (2001) The econometrics of panel data, 2nd edn. Wiley, New York

Baltagi B (2008) Econometric analysis of panel data. Wiley, New York

Barro RJ (1990) Government spending in a simple model of endogeneous growth. J Polit Econ 98(5): S103–S125. http://www.jstor.org/stable/2937633

Barro RJ, Sala-i-Martin X (2004) Economic growth. MIT Press, Cambridge

Bosquet B (2000) Environmental tax reform: does it work? A survey of the empirical evidence. Ecol Econ 34:19–32

Bovenberg AL, De Mooij RA (1994) Environmental levies and distortionary taxation. Am Econ Rev 84(4):1085–1089. http://www.jstor.org/stable/2118046

Bovenberg AL, De Mooij RA (1997) Environmental tax reform and endogenous growth. J Public Econ 63(2):207–237

Bovenberg AL, Heijdra BJ (1998) Environmental tax policy and intergenerational distribution. J Public Econ 67(1):1–24. https://doi.org/10.1016/S0047-2727(97)00064-9

Bovenberg A, Smulders S (1995) Environmental quality and pollution-augmenting technological change in a two-sector endogenous growth model. J Public Econ 57(3):369–391. https://doi.org/10.1016/0047-2727(95)80002-Q

Checherita-Westphal C, Rother P (2012) The impact of high government debt on economic growth and its channels: an empirical investigation for the euro area. Eur Econ Rev 56(7):1392–1405. https://doi.org/10.1016/j.euroecorev.2012.06.007

Chen JH, Shieh JY, Chang JJ, Lai CC (2009) Growth, welfare and transitional dynamics in an endogenously growing economy with abatement labor. J Macroecon 31(3):423–437. https://doi.org/10.1016/j.jmacro.2008.10.004

Dökmen G (2012) Environmental tax and economic growth: a panel VAR analysis. http://dergipark.ulakbim.gov.tr/erciyesiibd/article/view/5000119372. Accessed 13 June 2019

Durusu-Ciftci D, Gokmenoglu KK, Yetkiner H (2018) The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach. Econ Syst 42(3):503–513

Freire-González J, Puig-Ventosa I (2019) Reformulating taxes for an energy transition. Energy Econ 78:312–323

Fullerton D, Heutel G (2007) The general equilibrium incidence of environmental taxes. J Public Econ 91(3–4):571–591. https://doi.org/10.1016/j.jpubeco.2006.07.004

Fullerton D, Metcalf GE (1997) Environmental taxes and the double-dividend hypothesis: did you really expect something for nothing? In: Working paper no. 6199. National Bureau of Economic Research. http://www.nber.org/papers/w6199. Accessed 13 June 2019

Goulder LH (1995) Environmental taxation and the double dividend: a reader’s guide. Int Tax Public Financ 2(2):157–183. https://doi.org/10.1007/BF00877495

Gradus R, Smulders S (1993) The trade-off between environmental care and long-term growth—pollution in three prototype growth models. J Econ 58(1):25–51. https://doi.org/10.1007/BF01234800

Grimaud A (1999) Pollution permits and sustainable growth in a Schumpeterian model. J Environ Econ Manag 38(3):249–266. https://doi.org/10.1006/jeem.1999.1088

Hart R (2004) Growth, environment and innovation—a model with production vintages and environmentally oriented research. J Environ Econ Manag 48(3):1078–1098. https://doi.org/10.1016/j.jeem.2004.02.001

Heckman JJ (2008) Econometric causality. Int Stat Rev 76(1):1–27. https://doi.org/10.1111/j.1751-5823.2007.00024.x

Honaker J, King G, Blackwell M (2011) Amelia II: a program for missing data. J Stat Softw 45(7):1–47

Kneller R, Bleaney MF, Gemmell N (1999) Fiscal policy and growth: evidence from OECD countries. J Public Econ 74(2):171–190. https://doi.org/10.1016/S0047-2727(99)00022-5

Lewbel A (2012) Using heteroscedasticity to identify and estimate mismeasured and endogenous regressor models. J Bus Econ Stat 30(1):67–80. https://doi.org/10.1080/07350015.2012.643126

Ligthart JE, van der Ploeg F (1994) Pollution, the cost of public funds and endogenous growth. Econ Lett 46(4):339–349. https://doi.org/10.1016/0165-1765(94)90155-4

Lin B, Jia Z (2018) The energy, environmental and economic impacts of carbon tax rate and taxation industry: a CGE based study in China. Energy 159:558–568

Lucas RE Jr (1988) On the mechanics of economic development. J Monetary Econ 22(1):3–42. https://doi.org/10.1016/0304-3932(88)90168-7

Lucas RE Jr (1993) Making a miracle. Econom J Econom Soc 251–272. http://www.jstor.org/stable/2951551

Lundberg M, Squire L (2003) The simultaneous evolution of growth and inequality. Econ J 113(487):326–44. http://www.jstor.org/stable/3590323

Markandya A (2005) Chapter 26 Environmental implications of non-environmental policies. In: Maler KG, Vincent JR (eds) Handbook of environmental economics, vol 3. Elsevier, pp 1353–1401. https://doi.org/10.1016/S1574-0099(05)03026-3

Martinez-Vázquez JM, Vulovic V, Moreno-Dodson B (2012) The impact of tax and expenditure policies on income distribution: evidence from a large panel of countries. Hacienda Pública Española 200:95–130. http://dialnet.unirioja.es/servlet/articulo?codigo=3961194. Accessed 13 June 2019

Metcalf GE (2003) Environmental levies and distortionary taxation: Pigou, taxation, and pollution. J Public Econ 87(2):313–322. https://doi.org/10.1016/S0047-2727(01)00116-5

Morley B (2010) Environmental policy and economic growth: empirical evidence from Europe. Unpublished results. http://opus.bath.ac.uk/21167/. Accessed 13 June 2019

Nakada M (2004) Does environmental policy necessarily discourage growth? J Econ 81(3):249–275. https://doi.org/10.1007/s00712-002-0609-y

Nong D (2018) General equilibrium economy-wide impacts of the increased energy taxes in Vietnam. Energy Policy 123:471–481

OECD (2006) The political economy of environmentally related taxes. OECD Publishing, Paris

OECD (2010) Linkages between environmental policy and competitiveness. OECD Environment Working Papers 13. http://www.oecd-ilibrary.org/environment/linkages-between-environmental-policy-and-competitiveness_218446820583. Accessed 13 June 2019

OECD (2013) Government at a glance 2013. Government at a Glance. OECD Publishing. http://www.oecd-ilibrary.org/governance/government-at-a-glance-2013_gov_glance-2013-en. Accessed 13 June 2019

Olinsky A, Shaw C, Lisa H (2003) The comparative efficacy of imputation methods for missing data in structural equation modeling. Eur J Oper Res 151(1):53–79. https://doi.org/10.1016/S0377-2217(02)00578-7

Oueslati W (2002) Environmental policy in an endogenous growth model with human capital and endogenous labor supply. Econ Model 19(3):487–507. https://doi.org/10.1016/S0264-9993(01)00074-8

Pautrel X (2008) Reconsidering the impact of the environment on long-run growth when pollution influences health and agents have a finite-lifetime. Environ Resour Econ 40:37–52

Ramey VA (2011) Identifying government spending shocks: it’s all in the timing. Q J Econ 126(1):1–50. https://doi.org/10.1093/qje/qjq008

Ricci F (2007) Channels of transmission of environmental policy to economic growth: a survey of the theory. Ecol Econ 60(4):688–699. https://doi.org/10.1016/j.ecolecon.2006.11.014

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037. http://www.jstor.org/stable/1833190

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5):S71–S102. http://www.jstor.org/stable/2937632

Roodman D, Morduch J (2014) The impact of microcredit on the poor in Bangladesh: revisiting the evidence. J Dev Stud 50(4):583–604. https://doi.org/10.1080/00220388.2013.858122

Smulders S, Gradus R (1996) Pollution abatement and long-term growth. Eur J Polit Econ 12(3):505–532. https://doi.org/10.1016/S0176-2680(96)00013-4

StataCorp (2013) Stata: Release 13. Statistical software. College Station, StataCorp LP

Teles VK, Mussolini CC (2014) Public debt and the limits of fiscal policy to increase economic growth. Eur Econ Rev 66:1–15. https://doi.org/10.1016/j.euroecorev.2013.11.003

Temple J (1999) The new growth evidence. J Econ Lit 37(1):112–156. https://doi.org/10.1257/jel.37.1.112

Ulph A (2007) Climate change—environmental and technology policies in a strategic context. Environ Resour Econ 37:159–180

Van Ewijk C, Van Wijnbergen S (1994) Can abatement overcome the conflict between environment and economic growth? De Econ 143(2):197–216. https://doi.org/10.1007/BF01384535

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflict of interest.

Ethical statements

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

Hassan, M., Oueslati, W. & Rousselière, D. Exploring the link between energy based taxes and economic growth. Environ Econ Policy Stud 22, 67–87 (2020). https://doi.org/10.1007/s10018-019-00247-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-019-00247-5

Keywords

- Environmental tax

- Economic growth

- Instrumental variables with two-stage least squares IV (2SLS) approach

- Multiple imputation