Abstract

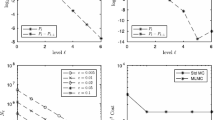

In this article we propose a novel approach to reduce the computational complexity of the dual method for pricing American options. We consider a sequence of martingales that converges to a given target martingale and decompose the original dual representation into a sum of representations that correspond to different levels of approximation to the target martingale. By next replacing in each representation true conditional expectations with their Monte Carlo estimates, we arrive at what one may call a multilevel dual Monte Carlo algorithm. The analysis of this algorithm reveals that the computational complexity of getting the corresponding target upper bound, due to the target martingale, can be significantly reduced. In particular, it turns out that using our new approach, we may construct a multilevel version of the well-known nested Monte Carlo algorithm of Andersen and Broadie (Manag. Sci. 50:1222–1234, 2004) that is, regarding complexity, virtually equivalent to a non-nested algorithm. The performance of this multilevel algorithm is illustrated by a numerical example.

Similar content being viewed by others

References

Andersen, L., Broadie, M.: A primal-dual simulation algorithm for pricing multidimensional American options. Manag. Sci. 50, 1222–1234 (2004)

Bally, V., Pagès, G.: A quantization algorithm for solving multidimensional discrete optimal stopping problem. Bernoulli 9, 1003–1049 (2003)

Belomestny, D.: Pricing Bermudan options using regression: optimal rates of convergence for lower estimates. Finance Stoch. 15, 655–683 (2011)

Belomestny, D.: Solving optimal stopping problems by empirical dual optimization and penalization. Annal. Appl. Probab. http://www.imstat.org/aap/future_papers.html (2012, to appear)

Belomestny, D., Bender, C., Schoenmakers, J.: True upper bounds for Bermudan products via non-nested Monte Carlo. Math. Finance 19, 53–71 (2009)

Bender, C., Kolodko, A., Schoenmakers, J.: Enhanced policy iteration for American options via scenario selection. Quant. Finance 8, 135–146 (2008)

Broadie, M., Glasserman, P.: A stochastic mesh method for pricing high-dimensional American options. J. Comput. Finance 7, 35–72 (2004)

Broadie, M., Cao, M.: Improved lower and upper bound algorithms for pricing American options by simulation. Quant. Finance 8, 845–861 (2008)

Carrière, J.: Valuation of early-exercise price of options using simulations and nonparametric regression. Insur. Math. Econ. 19, 19–30 (1996)

Davis, M.H.A., Karatzas, I.: A deterministic approach to optimal stopping. In: Kelly, F.P. (ed.) Probability, Statistics and Optimisation, pp. 455–466. Wiley, New York (1994)

Giles, M.B.: Multilevel Monte Carlo path simulation. Oper. Res. 56, 607–617 (2008)

Joshi, M.: A simple derivation of and improvements to Jamshidian’s and Rogers’ upper bound methods for Bermudan options. Appl. Math. Finance 14, 197–205 (2007)

Haugh, M., Kogan, L.: Pricing American options: a duality approach. Oper. Res. 52, 258–270 (2004)

Kolodko, A., Schoenmakers, J.: Upper bounds for Bermudan style derivatives. Monte Carlo Methods Appl. 10, 331–343 (2004)

Kolodko, A., Schoenmakers, J.: Iterative construction of the optimal Bermudan stopping time. Finance Stoch. 10, 27–49 (2006)

Longstaff, F.A., Schwartz, E.S.: Valuing American options by simulation: a simple least-squares approach. Rev. Financ. Stud. 14, 113–147 (2001)

Rogers, L.C.G.: Monte Carlo valuation of American options. Math. Finance 12, 271–286 (2002)

Schoenmakers, J.: Robust Libor Modelling and Pricing of Derivative Products. Boca Raton/London, Chapman & Hall/CRC Press (2005)

Schoenmakers, J., Zhang, J., Huang, J.: Optimal dual martingales, their analysis and application to new algorithms for Bermudan products. SIAM J. Financ. Math. 4, 86–116 (2013)

Tsitsiklis, J., Van Roy, B.: Regression methods for pricing complex American style options. IEEE Trans. Neural Netw. 12, 694–703 (1999)

Acknowledgements

This research was partially supported by the Deutsche Forschungsgemeinschaft through the SPP 1324 “Mathematical methods for extracting quantifiable information from complex systems” and through the Research Center Matheon “Mathematics for Key Technologies”, and by the Laboratory for Structural Methods of Data Analysis in Predictive Modeling, MIPT, RF government grant, ag. 11.G34.31.0073.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Belomestny, D., Schoenmakers, J. & Dickmann, F. Multilevel dual approach for pricing American style derivatives. Finance Stoch 17, 717–742 (2013). https://doi.org/10.1007/s00780-013-0208-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-013-0208-5