Abstract

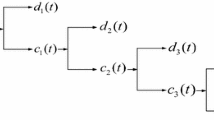

The recent price volatility in the energy market highlights the importance of financial hedging and the need of its incorporation into an investor’s set of portfolio strategies. Realizing the rapid advancement of artificial intelligence, our study empirically examines the use of machine learning models for hedging price risk associated with the holding of energy-based financial product. From a technical perspective, kernel regression and support vector machine are trained to estimate the time-varying optimal hedge ratio given the observed price movement and other factors. The estimated hedge ratio is then employed to guide the price hedging strategy of the crude oil contracts traded in the commodity exchanges. The two machine approaches’ hedging effectiveness against price risk is also compared with those of the un-hedged portfolio as well as a well-studied econometric time series approach. Our results indicate that the two forms of learning machines substantially outperform time series model and no-hedging over the out-of-sample period but neither machine dominates another across all testing scenarios. Given these mixed results between kernel regression and support vector machine, we propose and develop a kernel-supervised support vector machine to take advantage of the complementary nature of the two machine learning approaches and enhance the supervised learning process through hierarchical/sequential infusion of information. Cross-learning empirical testing shows that the proposed cross-learning machine is more effective in hedging than individual kernel regression and support vector machine. Furthermore, our study evaluates the impact of incorporating the coefficient of absolute risk aversion and the transaction costs to machine learning models. In general, cross-learning machine outperforms others in all tested scenarios.

Similar content being viewed by others

References

Johnson LL (1960) The theory of hedging and speculation in commodity futures. Rev Econ Stud 27:139–151

Peck AE (1975) Hedging and income stability: concepts, implications, and an example. Am J Agr Econ 57:410–419

Kahl KH (1983) Determination of the recommended hedging ratio. Am J Agr Econ 65:603–605

Engle RF (1982) Autoregressive conditional heteroskedasticity with estimates of the variance of U.K. inflation. Econometrica 50:987–1008

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31:307–327

Cecchetti SG, Crumby RE, Figlewski S (1988) Estimation of the optimal futures hedge. Rev Econ Stat 70:623–630

Ballie RT, Myers RJ (1991) Bivariate GARCH estimation of the optimal commodity futures hedge. J Appl Econom 6:109–124

Myers RJ (1991) Estimating time-varying optimal hedge ratios on commodity futures markets. J Futures Mark 11:39–53

Kroner KF, Sultan J (1991) Exchange rate volatility and time varying hedge ratios. In: Rhee SG, Chang RP (eds) Pacific-basin capital markets research. Elsevier Science Publishers, North-Holland, pp 397–412

Gagnon L, Lypny GJ, McCurdy TH (1998) Hedging foreign currency portfolios. J Empir Finance 5:197–220

Park TH, Switzer LN (1995) Bivariate GARCH estimation of the optimal hedge ratios for stock index future: a note. J Futures Mark 15:61–67

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation and testing. Econometrica 55:251–276

Ghosh A (1993) Cointegration and error correction models: intertemporal causality between index and futures prices. J Futures Mark 13(2):193–198

Kroner KF, Sultan J (1993) Time varying distributions and dynamic hedging with foreign currency futures. J Financ Quantit Anal 28:535–551

Chou WL, Denis KKF, Lee CF (1996) Hedging with the Nikkei index futures: the convential model versus the error correction model. Q Rev Econ Finance 36:495–505

Lahmiri S (2013) Hybrid systems for Brent volatility data forecasting: a comparative study. Uncertain Supply Chain Manag 1:145–152

Lahmiri S (2017) Modeling and predicting historical volatility in exchange rate markets. Physica A 471:387–395

Wang GJ, Xie C, He LY, Chen S (2014) Detrended minimum-variance hedge ratio: a new method for hedge ratio at different time scales. Physica A 405:70–79

Bryant HL, Haigh M (2005) Derivative pricing model and time-series approach to hedging: a comparison. J Futures Mark 25:613–641

Leung MT, Daouk H, Chen AS (2000) Forecasting stock indices: a comparison of classification and level estimation models. Int J Forecast 16:173–190

Lien D, Tse YK (2000) Hedging downside risk with futures contracts. Appl Finan Econ 10:163–170

Lien D, Tse YK (2001) Hedging downside risk: futures vs. options. Int Rev Econ Finance 10:159–169

Boudoukh J, Whitelaw RF, Richardson M, Stanton R (1995) Pricing mortgage-backed securities in a multifactor interest rate environment: a multivariate density estimation approach. Rev Finan Stud 10:405–446

Chen AS, Leung MT (2005) Modeling time series information into option prices: an empirical evaluation of statistical projection and GARCH option pricing model. J Bank Finance 29:2947–2969

Kung JJ (2016) A nonparametric kernel regression approach for pricing options on Stock market index. Appl Econ 48:902–913

Pan Z, Sun X (2014) Hedging strategy using copula and nonparametric methods: evidence from China securities index futures. Int J Econ Finan Issues 4:107–121

Sewell M, Shawe-Taylor J (2012) Forecasting foreign exchange rates using kernel methods. Expert Syst Appl 39:7652–7662

Cortes C, Vapnik V (1995) Support-vector networks. Mach Learn 20:273–297

Drucker H, Burges CJC, Kaufman L, Smola AJ, Vapnik VN (1997) Support vector regression machines. In: Advances in Neural Information Processing Systems 9, NIPS 1996, pp 155–161, MIT Press

Vapnik VN (1998) Statistical learning theory. Wiley, New York

Vapnik VN (2000) The nature of statistical learning theory. Springer, New York

Lu CJ, Lee TS, Chiu CC (2009) Financial time series forecasting usinig independent component analysis and support vector regression. Decis Support Syst 47:115–125

Tay FEH, Cao LJ (2001) Application of support vector machines in financial time series forecasting. Omega 29:309–317

Tay FEH, Cao LJ (2003) Support bector machine with adaptive parameters in financial time series forecasting. IEEE Trans Neural Netw 14:1506–1518

Xie C, Mao Z, Wang G (2015) Forecasting RMB exchange rate based on a nonlinear combination model of ARFIMA, SVM, and BPNN. Math Probl Eng 2015:1–10

Dutta I, Dutta S, Raahemi B (2017) Detecting financial restatements using data mining techniques. Expert Syst Appl 90:374–393

Barboza F, Kimura H, Altman E (2017) Machine learning models and bankruptcy prediction. Expert Syst Appl 83:405–417

Weng B, Ahmed M, Megahed F (2017) Stock market one-day ahead movement prediction using disparate data sources. Expert Syst Appl 79:153–163

Ahmadi E, Jasemi M, Monplaisir L, Navavi M, Magnoodi A, Jam P (2018) New efficient hybrid candlestick technical analysis model for stock market timing on the basis of the Support Vector Machine and Heuristic Algorithms of Imperialist Competition and Genetic. Expert Syst Appl 94:21–31

Peng Y, Albuquerque P, Sá J, Padula A, Montenegro M (2018) The best of two worlds: forecasting high frequency volatility for cryptocurrencies and traditional currencies with Support Vector Regression. Expert Syst Appl 97:177–192

Lahmiri S (2014) Entropy-based technical analysis indicators selection for international stock markets fluctuations prediction using support vector machines. Fluct Noise Lett 13:1450013.1–1450013.16

Casdagli M (1992) A dynamical systems approach to modeling input-output systems. In: Casdagli M, Eubank S (eds) Nonlinear modeling and forecasting vol XII of SFI Studies in the sciences of complexity. Addison-Wesley, Reading, p 265

Epanechnikov V (1969) Nonparametric estimates of multivariate probability density. Theory Probab Appl 14:153–158

Scott DW (1992) Multivariate density estimation: theory, practice, and visualization. Wiley, New York

Hardle W (1990) Applied nonparametric regression. Cambridge University Press, New York

Hardle W (1991) Smoothing techniques with implementation in S. Springer, New York

Hardle W, Scott DW (1992) Smoothing by weighted averaging of rounded points. Comput Stat 7(97):128–133

Cherkassky V, Ma Y (2004) Practical selection of SVM parameters and noise estimation for SVM regression. Neural Netw 2004(17):113–126

Yu L, Wang S, Lai KK (2005) A novel nonlinear ensemble forecasting model incorporating GLAR and ANN for foreign exchange rates. Comput Oper Res 2005(32):2523–2541

Lahmiri S, Boukadoum M (2015) An ensemble system based on hybrid EGARCH-ANN with different distributional assumptions to predict S&P 500 intraday volatility. Fluct Noise Lett 14:1550001.1–1550001.10

Ljung GM, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65:297–303

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6:255–259

Schwarz G (1978) Estimating the dimensions of a model. Ann Stat 6:461–464

Dickey D, Fuller W (1976) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 1976(74):427–431

Lee S, Hansen BE (1994) Asymptotic theory for the GARCH (1, 1) quasi-maximum likelihood estimator. Econom Theory 10:29–52

Haigh M, Holt M (2000) Hedging multiple price uncertainty in international grain trade. Am J Agr Econ 2000(82):881–896

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chen, AS., Leung, M.T., Pan, S. et al. Financial hedging in energy market by cross-learning machines. Neural Comput & Applic 32, 10321–10335 (2020). https://doi.org/10.1007/s00521-019-04572-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-019-04572-4