Abstract

Over the past two decades, assessing future price of stock market has been a very active area of research in financial world. Stock price always fluctuates due to many variables. Thus, an accurate prediction of stock price can be considered as a tough task. This study intends to design an efficient model for predicting future price of stock market using technical indicators derived from historical data and natural inspired algorithm. The model adopts Elman neural network (ENN) because of its ability to memorize the past information, which is suitable for solving stock problems. Trial and error-based method is widely used to determine the parameters of ENN. It is a time-consuming task. To address such an issue, this study employs Grey Wolf optimization (GWO) algorithm to optimize the parameters of ENN. Optimized ENN is utilized to predict the future price of stock data in 1 day advance. To evaluate the prediction efficiency, proposed model is tested on NYSE and NASDAQ stock data. The efficacy of the proposed model is compared with other benchmark models such as FPA-ELM, PSO-MLP, PSOElman, CSO-ARMA and GA-LSTM to prove its superiority. Results demonstrated that the GWO-ENN model provides accurate prediction for 1 day ahead prediction and outperforms the benchmark models taken for comparison.

Similar content being viewed by others

Abbreviations

- ACO:

-

Ant colony optimization

- ANN:

-

Artificial neural network

- ARV:

-

Average relative variance

- BPNN:

-

Back propagation neural network

- ELM:

-

Extreme learning machine

- EMA:

-

Exponential moving average

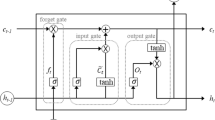

- ENN:

-

Elman neural network

- ERNN:

-

Elman recurrent neural network

- FLANN:

-

Functional link artificial neural network

- FPA:

-

Flower pollination algorithm

- GA:

-

Genetic algorithm

- GWO:

-

Grey Wolf optimization

- LSTM:

-

Long short-term memory

- MA:

-

Moving average

- MACD:

-

Moving average convergence/divergence

- MAE:

-

Mean absolute error

- MAPE:

-

Mean absolute percentage error

- MFI:

-

Money flow index

- MLP:

-

Multi-layer perceptron

- MSE:

-

Mean square error

- OBV:

-

On balance volume

- PCA:

-

Principal component analysis

- PMO:

-

Price momentum oscillator

- PMRE:

-

Percentage mean relative error

- RBFN:

-

Radial basis function network

- RMSE:

-

Root mean square error

- RNN:

-

Recurrent neural network

- ROC:

-

Rate of change

- RSI:

-

Relative strength index

- SI:

-

Swarm intelligence

- SMAPE:

-

Symmetric mean absolute percentage error

- SVM:

-

Support vector machine

- WNN:

-

Wavelet neural network

References

Atsalakis GS, Valavanis KP (2009) Surveying stock market forecasting techniques—part II soft computing methods. Expert Syst Appl 36:5932–5941

Cacciola M, Megali G, Pellicano D, Morabito FC (2012) Elman neural network for characterizing voids in welded strips: a study. Neural Comput Appl 21(5):869–875

Chandra R, Zhang M (2012) Cooperative coevolution of Elman recurrent neural networks for chaotic time series prediction. Neurocomputing 86:116–123

Chen W, Zhang Y, Yeo CK, Lau CT, Lee BS (2017) Stock market prediction using neural network through news on online social networks. In: International conference on smart cities

Chen L, Qiao Z, Wang M, Wang C, Du R, Stanley HE (2018) Which artificial intelligence algorithm better predicts the Chinese Market? Special section on big data learning and discovery. IEEE Access 6:48625–48633

Chung H, Shin KS (2018) Genetic algorithm-optimized long short-term memory network for stock market prediction. Sustainability 10:1–18

Das SR, Mishra D, Rout M (2017) A hybridized ELM-Jaya forecasting model for currency exchange prediction. J King Saud Univ Comput Inf Sci. https://doi.org/10.1016/j.jksuci.2017.09.006

Devadoss AV, Legori TAA (2013) Forecasting of stock prices using multilayer perceptron. Int J Comput Algorithm 2:440–449

Elman JL (1990) Finding structure in time. Cognit Sci 14(2):179–211

Guo ZQ, Wang HQ, Liu Q (2013) Financial time series forecasting using LPP and SVM optimized by PSO. Soft Comput 7(5):805–818

Hegazy O, Soliman OS, Salam MN (2015) FPA-ELM model for stock market prediction. Int J Adv Res Comput Sci Softw Eng 5(2):1050–1063

Kalaiselvi K, Velusamy K, Gomathi C (2018) Financial prediction using back propagation neural networks with opposition based learning. In: 2nd international conference on computational intelligence

Kara Y, Boyacioglu MA, Baykan OK (2011) Predicting direction of stock price index movement using artificial neural networks and support vector machines: the sample of the Istanbul stock exchange. Expert Syst Appl 38:5311–5319

Lei L (2018) Wavelet neural network prediction method of stock price trend based on rough set attribute reduction. Appl Soft Comput 62:923–932

Liao Z, Wang J (2010) Forecasting model of global stock index by stochastic time effective neural networks. Expert Syst Appl 37(1):834–841

Majhi B, Rout M, Baghel V (2014) On the development and performance evaluation of a multi objective GA based RBF adaptive model for the prediction of stock indices. J King Saud Univ Comput Inf Sci 26:319–331

Mirjalili S, Mirjalili SM, Lewis A (2014) Grey wolf optimizer. Adv Eng Softw 69:46–61

Qasem SN, Shamsuddin SM, Zain AM (2012) Multi objective hybrid evolutionary algorithms for radial basis functional neural network design. Knowl Based Syst 27:475–497

Rahimunnisa K (2019) Hybrdized genetic-simulated annealing algorithm for performance optimization in wireless adhoc network. J Soft Comput Paradigm (JSCP) 1(01):1–13

Raj JS (2019) QoS optimization of energy efficient routing in IoT wireless sensor networks. J ISMAC 1(01):12–23

Rather AM, Agarwal A, Sastry VN (2015) Recurrent neural network and a hybrid model for prediction of stock returns. Expert Syst Appl 42:3234–3241

Ray P, Mahapatra GS, Rani P, Pandy SK, Dey KN (2014) Robust feed forward and recurrent neural network based dynamic weighted combination models for software reliability prediction. Appl Soft Comput 22:629–637

Rout M, Majhi B, Majhi R, Panda G (2014) Forecasting of currency exchange rate using an adaptive ARMA model with differential evolution based training. J King Saud Univ Comput Inf Sci 26:7–18

Shakya S (2020) Performance analysis of wind turbine monitoring mechanism using integrated classification and optimization techniques. J Artif Intell 2(01):31–41

Shi H, Liu X (2014) Application on stock price prediction on Elman neural networks based on principal component method. In: 2014 International computer conference on wavelet active technology and information processing

Vanstone B, Finnie G (2009) An empirical methodology for developing stock-market trading systems using artificial neural networks. Expert Syst Appl 36:6668–6680

Wang JJ, Zhang WY, Li YN, Wanganf JZ, Dang ZL (2014) Forecasting wind speed using empirical mode decomposition and Elman neural network. Appl Soft Comput 23:452–459

Wang J, Fang W, Nice H (2016) Financial time series prediction using Elman recurrent neural network. Comput Intell Neurosci 2016:1–14

Yoshihara A, Fujikawa K, Seki K, Uehara K (2014) Predicting stock market trends by recurrent deep neural networks. In: Pacific rim international conference on artificial intelligence, gold coast, Australia, 1–5 December 2014, Springer, Berlin/Heidelberg, Germany, pp 759–769

Zhang Z, Shen Y, Zhang G, Song Y, Zhu Y (2017) Short-term prediction for opening price of stock market based on self-adapting variant PSO-Elman neural network. In: IEEE international conference on soft computing and service sciences

Zheng J (2015) Forecast of opening stock price based on Elman neural network. Chem Eng Trans 46:565–570

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that they have no conflict of interest regarding the publication of this paper.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kumar Chandar, S. Grey Wolf optimization-Elman neural network model for stock price prediction. Soft Comput 25, 649–658 (2021). https://doi.org/10.1007/s00500-020-05174-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-05174-2