Abstract

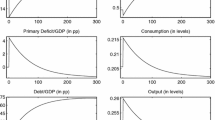

We extend the Cole and Kehoe model (J Int Econ 41:309–330, 1996) by adding a Rubinstein bargaining game between creditors and debtor country to determine the share of debt repayment in a sovereign debt crisis. Ex-post, the possibility of partial repayment avoids the costly case of total default, as seen recently in Greece. Ex-ante, the effects are to increase the sovereign debt cap and delay the fiscal adjustment. In other words, expectations of a haircut in times of crisis relax leverage restrictions implied by financial markets and make government more lenient, suggesting caution with haircut adoption, especially when risk-free interest rates are low.

Similar content being viewed by others

Notes

Sudden changes in outcomes, such as market prices of public bonds, without obvious comparable changes in the set of fundamentals, including public debt level, tax revenues and public expenditures.

For an applied example of multiplicity under non-common knowledge, see Araujo et al. (2016).

Here, the central planner is a player in a bargaining game, though in fact its importance to solve sovereign crises involves other aspects. Arellano and Bai (2014) discuss some of them.

Conesa and Kehoe (2014) also consider bailout of government debt by official lenders in a debt crisis and highlight that the bailout cost is smaller than the cost of a total default.

In each period, the crisis probability is defined exogenously, but the more periods the economy remains in the crisis zone, the higher is the cumulative chance of a crisis occurrence. One may argue that crisis probability per period itself should increase with partial default, a case to be considered in further extensions.

In order to avoid excessive wordiness, henceforth we omit the word partial.

\(f(0)=0;\ f^\prime (0)=\infty ;\) \(f^\prime (\infty )=0\).

See Kaminsky and Vega-Garcia (2014) for another discussion of investors asking higher discount rates to reflect a crisis rate.

Arellano (2008) describes an income shock and assumes it as i.i.d. In our paper, the income is also affected, but via productivity, \(a_{t}\).

The international credit restriction resulted from speculative attack on sovereign debt may be a response to a change in economic fundamentals not explicitly described in the model, such as a persistent change in prices of a key commodity exported by the country, fear of change in the government preferences after national elections, or a sudden reduction of international liquidity.

Sunspot \(\pi \) is considered independent from \(\phi \).

For new issuance during the crisis we consider \(E(z^{\prime })=0\), to reflect the debt market closure.

We could represent governments more concerned about private goods by replacing \(\ln (g)\) with \(\frac{\ln (g)}{2},\) for example.

See Greece government debt to GDP at http://www.tradingeconomics.com/greece/government-debt-to-gdp.

Under low probability of crisis, the first effect (lower interest rates due to the expected haircut instead of no payment) is more than sufficient to decelerate the fiscal adjustment to exit the crisis zone.

Presented at 13th SAET conference from July 22 through July 27 in Paris, France, at MINES ParisTech.

Redundant given condition (iii) - to be derived.

References

Angeletos, G.-M., Werning, I.: Crises and prices: information aggregation, multiplicity, and volatility. Am. Econ. Rev. 96(5), 1720–1736 (2006)

Araujo, A., Berriel, T., Santos, R.: Inflation targeting with imperfect information. Int. Econ. Rev. 57(1), 255–270 (2016)

Araujo, A., Leon, M., Santos, R.: Welfare analysis of currency regimes with defaultable debts. J. Int. Econ. 89, 143–153 (2013)

Arellano, C., Bai, Y.: Renegotiation policies in sovereign defaults. Am. Econ. Rev. 104(5), 94–100 (2014)

Arellano, C.: Default risk and income fluctuations in emerging economies. Am. Econ. Rev. 98(3), 690–712 (2008)

Cole, H., Kehoe, T.: A self-fulfilling model of Mexico’s 1994–1995 debt crisis. J. Int. Econ. 41, 309–330 (1996)

Cole, H., Kehoe, T.: Self-Fulfilling Debt Crises. Research Department Staff Report 211, Federal Reserve Bank of Minneapolis (1998)

Cole, H., Kehoe, T.: Self-fulfilling debt crises. Rev. Econ. Stud. 67(1), 91–116 (2000)

Conesa, J., Kehoe, T.: Is it too late to bail out the troubled countries in the eurozone? Am. Econ. Rev. 104(5), 88–93 (2014)

Eurostat.: Statistics Explained: Tax revenue statistics, Table 1 (2016). http://ec.europa.eu/eurostat/statistics-explained/index.php/File:Total_tax_revenue_by_country,_1995-2014_(%25_of_GDP).png. Acessed 2 July 2016

Kaminsky, G., Vega-Garcia, P.: Systemic and idiosyncratic sovereign debt crises. J. Eur. Econ. Assoc. 14(1), 80–114 (2016)

Kirsch, F., Rühmkorf, R.: Sovereign Borrowing, Financial Assistance and Debt Repudiation. Bonn Graduate School of Economics: Bonn Econ Discussion Papers, 01. ftp://ftp.repec.org/opt/ReDIF/RePEc/bon/bonedp/bgse01_2013.pdf (2013)

Merler, S., Pisani-Ferry, J.: Hazardous tango: sovereign-bank interdependence and financial stability in the euro area. Banque de France, Financial Stability Review, 16 (2012). http://bruegel.org/wp-content/uploads/imported/publications/201204_Hazardous_Tango_RSF.pdf

Mora, N.: What determines creditor recovery rate? Federal Reserve Bank of Kansas City, Economic Review, Second Quarter 2012 (2012). https://www.kansascityfed.org/Publicat/EconRev/PDF/12q2Mora.pdf

Morris, S., Shin, H.: Rethinking multiple equilibria in macroeconomic modeling. In: Bernanke, B.S., Rogoff, K. (eds) NBER Macroeconomics Annual 2000, vol. 15. MIT Press, pp. 139–182 (2001). http://www.nber.org/chapters/c11056.pdf

OECD: Revenue Statistics. OECD Publishing, Paris (2014). doi:10.1787/rev_stats-2014-en-fr

Pisani-Ferry, J.: Euro crisis and the new impossible trinity. Paper prepared for the AEEF Conference “Impact of Eurozone Debt Crisis and East Asian Countries”, Seoul (2012). http://bruegel.org/wp-content/uploads/imported/publications/pc_2012_01_.pdf

Rubinstein, A.: Perfect equilibrium in a bargaining model. Econometrica 50, 97–109 (1982)

Trabandt, M., Uhlig, H.: How far are we from the slippery slope? The lafer curve revisited. Working Paper Series, 1174. European Central Bank (2010). https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1174.pdf

Yue, V.: Sovereign default and debt renegotiation. J. Int. Econ. 80, 176–187 (2010)

Zettelmeyer, J., Trebesch, C., Gulati, M.: The greek debt restructuring: an autopsy. Econ Policy 28(75), 513–563 (2013). doi:10.1111/1468-0327.12014

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank the participants at the 13th SAET meeting, the editor, and two anonymous reviewers for their valuable comments.

Appendix

Appendix

First, we highlight that, as already extensively discussed in the original Cole and Kehoe model (1996), a government that cares sufficiently more about private than public consumption or is sufficiently farsighted is guaranteed to have a non-empty crisis zone (i.e., \(\overline{B}>\underline{B}\)). Second, we assume the existence of a non-empty crisis zone for \(\phi =0\), and we show, in the end of this appendix, that the condition \(\overline{B}>\underline{B}\) remains as long as \(\phi \) has an upper limit.Next, we are going to detail the three conditions—(i), (ii) and (iii)—that ensure the result of our proposition, taking as given the existence of the crisis zone for \(\phi =0\). To derive such conditions, note that the floor of the crisis zone, \(\underline{B},\) is defined as the highest stationary debt level under which not defaulting \((z=1)\) is better than defaulting \((z=\phi <1),\) even when there is a speculative attack, i.e., \(q=0\) and new debt is not available. Then, to compute the floor of the crisis zone, we need to compare \(V(s,B^\prime ,0,1)\) with \(V(s,B^\prime ,0,\phi )\). Formally, \(V(s,B^\prime ,0,1)\) is given by :

where the payment of \(\frac{B\left( 1-\beta \right) }{1-\beta ^{T}}\) must be made at maturities \(1,2,\ldots ,T\), and the value function is decreasing in the current debt level as expected. \(V(s,B^\prime ,0,\phi )\) is given by:

and again, the debt payment of \(\frac{\phi B\left( 1-\beta \right) }{1-\beta ^{T}}\) must be made during T periods, and the value function is decreasing in the current debt level as expected. For B sufficiently close to zero, it is trivial to conclude that \(V(s\left( B\rightarrow 0\right) , B^\prime ,0,\phi )<V(s\left( B\rightarrow 0\right) , B^\prime ,0,1),\) since after the default, the productivity becomes lower without significantly improving the public expenditure. Moreover, if B is high enough, higher than \(g_{n}\frac{1-\beta ^{T}}{\left( 1-\beta \right) },\) then \(z_{t}=1\) is not an option as g cannot be negative. To ensure \(z_{t}=\phi \) as the unique feasible option for this high debt level, \(\phi \) must be lower than \(\frac{g_{d}}{g_{n}}\).Footnote 18 Then, to assure the existence of the floor of the crisis zone, \(\underline{B},\) it is sufficient to have \(\phi <\frac{g_{d}}{g_{n}}\) and \(\frac{\partial V(s,B^\prime ,0,1)}{\partial B}<\frac{\partial V(s,B^\prime ,0,\phi )}{\partial B},\) or, more than sufficient to have :

assured by

i.e., funds raised by the government due to the partial default must be higher than the reduction of the government revenue from tax collection.

The cap of the crisis zone, \(\overline{B},\) is defined as the highest stationary debt level under which not defaulting \((z=1)\) is better than defaulting \((z=\phi <1)\) when there is no speculative attack, i.e., \(q=\beta \) and new lending is available. Then, to compute the cap of the crisis zone, we need to compare \(V(s,B^\prime ,\beta ,1)\) with \(V(s,B^\prime , \beta ,\phi ).\) Formally, \(V(s,B^\prime ,\beta ,1)\) is given by :

where \(B\left( 1-\beta \right) \) is the interest payment on total debt. The value function is decreasing in the current debt level as expected. \(V(s,B^\prime ,\beta ,\phi )\) is given by :

For B sufficiently close to zero, it is trivial to conclude that \(V(s\left( B\rightarrow 0\right) , B^\prime ,\beta ,\phi )<V(s\left( B\rightarrow 0\right) , B^\prime ,\beta ,1),\) since after the default, the productivity becomes lower without significantly improving the public expenditure. Moreover, if B is high enough, higher than \(\frac{g_{n} }{\left( 1-\beta \right) },\) then \(z_{t}=1\) is not an option as g cannot be negative. To ensure \(z_{t}=\phi \) as the unique feasible option for this high debt level, \(\phi \) must be lower than \(\left( 1-\beta ^{T}\right) \frac{g_{d}}{g_{n}}\). Given this condition, to ensure the existence of the cap of the crisis zone, \(\overline{B},\) it is sufficient to have \(\frac{dV(s,B^\prime ,\beta ,1)}{dB}<\frac{dV(s,B^\prime ,\beta ,\phi )}{dB},\) or, by considering \(\left( \phi \le \beta ^{T}\right) \), it is sufficient to have:

Then, we have two conditions for the existence of \(\overline{B}\). First, partial default must occur on the principal amount of the debt, i.e., partial default must imply negative return on bonds \(\left( \phi <\beta ^{T}\right) \). Note that, after the payment of \(\phi \), the rate of return is equal to \(\left( \frac{\phi }{\beta ^{T}}-1\right) \). Second, the flow reduction of the government revenue from both tax collection \(\left( g_{n}-g_{d}\right) \) and partial repayment of maturing debt \(\left( \phi B_{T}\right) \) must be lower than the total interest payment on the total debt \(B\left( 1-\beta \right) \). Therefore, the conditions for \(\underline{B} \) and \(\overline{B}\) to be well defined are the following:

and noting that the first condition is redundant, we can focus only in the following three conditions:

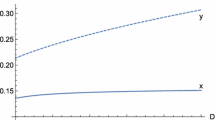

Again, as already discussed in the original CK96 paper, a government that cares sufficiently more about private than government consumption or is sufficiently farsighted is guaranteed to have a crisis zone \((\overline{B}>\underline{B})\). For a non-empty crisis zone, conditions (i), (ii) and (iii) are sufficient to ensure the result of proposition, i.e., the higher the \(\phi ,\) the higher are the limits \(\overline{B}\) and \(\underline{B}\). Note that since \(\underline{B}\) is increasing in \(\phi \) and \(V(s,B^\prime ,0,1)\) does not depend on \(\phi \), it is sufficient to show that \(\frac{\partial V(s,B^\prime ,0,\phi )}{\partial \phi }<0,\) which is true, since :

and to have \(\overline{B}\) increasing in \(\phi ,\) it is sufficient to show that \(\frac{\partial V(s,B^\prime ,\beta ,\phi )}{\partial \phi }<0,\) which is true:

Finally, in order to assure that the crisis zone characterized under total default; \(\left[ \underline{B}_{\phi =0},\overline{B}_{\phi =0}\right] \) remains non-empty under partial default (\(\phi >0\)), i.e., to assure that \(\underline{B}_{\phi >0}\) remains smaller than \(\overline{B}_{\phi >0}\) when partial repayment is allowed, it is sufficient to show that the resulted reduction in the crisis zone is limited:

or it is sufficient to have

where,

where

and to have non-empty crisis zone at least for \(T=1\) and a positive \(\phi \), after replacing the debt level where derivative is evaluated, it is sufficient to have:

And it is sufficient

As in the original Cole and Kehoe model, depending on the set of parameters, the crisis zone is non-empty. For a particular example, and remembering that a government that cares sufficiently more about private than public consumption or that is sufficiently farsighted assures a non-empty crisis zone (i.e., \(\Delta >0\)), suppose \(v^\prime (.)\) tends to a constant \(\kappa \). Then, the previous condition becomes

and \(\beta <\Delta \) makes the incentive to smooth the private consumption important enough to assure a non-empty crisis zone for, at least, \(T=1\), and small positive \(\phi \).

Rights and permissions

About this article

Cite this article

Araujo, A., Leon, M. & Santos, R. Bargained haircuts and debt policy implications. Econ Theory 64, 635–656 (2017). https://doi.org/10.1007/s00199-016-0981-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-0981-4