Abstract

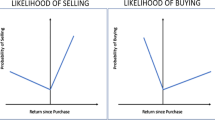

We study a general equilibrium model of asset trading with financial leverage, where the investors can engage in speculative trading with diverse beliefs about the asset’s fundamental value. We show that an increase in the leverage ratio causes the stock price to rise in the current period through a “leverage effect”, and will result in more borrowing and more stock purchase that pumps the stock price higher in the subsequent period, known as the “pyramiding effect”. There can also be a “depyramiding effect” when the price falls because lenders issue margin calls and force stock sales, contributing to further stock price plummeting. Price changes from depyramiding effect, however, may not take effect when margin calls are not triggered. We demonstrate that, under certain conditions, decreasing leverage ratios leads to lower stock price volatility, measured by the variation of prices caused by an exogenous shock, when the shock is unanticipated. The influences of dispersion of beliefs and available investment funds on the relation between financial leverage and market volatility are also examined. When the shock is anticipated, we demonstrate that reducing leverage ratios may not lower stock price volatility, which poses an important challenge to future studies on this issue.

Similar content being viewed by others

References

Anderson E.W., Ghsels E., Juergens J.L.: Does heterogeneous beliefs matter for asset pricing?. Rev Financial Stud 18, 875–924 (2003)

Aumann R.J.: Markets with a continuum of traders. Econometrica 32, 39–50 (1964)

Aumann R.J.: Existence of competitive equilibrium in markets with a continuum of traders. Econometrica 34, 1–17 (1966)

Biais B., Gollier C.: Trade credit and credit rationing. Rev Financial Stud 10, 903–937 (1997)

Brunnermeier M., Pedersen L.: Market liquidity and funding liquidity. Rev Financial Stud 22, 2201–2238 (2009)

Coen-Pirani D.: Margin requirements and equilibrium asset prices. J Monet Econ 52, 449–475 (2005)

Feiger G.: What is speculation?. Quart J Econ 90, 677–687 (1976)

Fostel, A., Geanakoplos, J.: Leverage cycles and the anxious economy. Am Econ Rev 1211–1244 (2008)

Geanakoplos, J.: The leverage cycle, working paper, Yale University (2009)

Hardouvelis G.A.: Margin requirements, volatility, and the transitory components of stock prices. Am Econ Rev 80, 736–762 (1990)

Hardouvelis G.A., Peristiani S.: Margin requirements, speculative trading, and stock price fluctuations: the case of Japan. Quart J Econ 107, 1130–1170 (1992)

Hardouvelis G.A., Theodossiu P.: The asymmetric relation between initial margin requirements and stock market volatility across bull and bear markets. Rev Financial Stud 15, 1525–1559 (2002)

Harris M., Raviv A.: Differences of opinion make a horse race. Rev Financial Stud 6, 473–506 (1993)

Harrison M., Kreps D.: Speculative investor behavior in a stock market with heterogeneous expectation. Quart J Econ 92, 323–336 (1978)

Hart O., Kreps D.: Price destabilizing speculation. J Political Econ 94, 927–952 (1986)

Hirshleifer J.: Speculation and equilibrium: information, risk, and markets. Quat J Econ 89, 519–542 (1975)

Hsieh D., Miller M.: Margin requirements and stock price volatility. J Finance 45, 3–29 (1990)

Kaldor N.: Speculation and economic stability. Rev Econ Stud 7, 1–27 (1939)

Keynes J.M.: The general theory of employment, interest and money. Macmillan, London (1936)

Kohn M.: Competitive speculation. Econometrica 46, 1061–1076 (1978)

Kupiec P.: Margin requirements, volatility, and market integrity: what have we learned since the crash?. J Financial Serv Res 13, 231–255 (1998)

Kupiec P., Sharpe S.: Animal spirits, margin requirements, and stock price volatility. J Finance 46, 717–731 (1991)

Kurz M.: On rational belief equilibria. Econ Theory 4, 877–900 (1994)

Kurz, M.: Rational diverse beliefs and economic volatility, Chap. 8. In: Hens, T., Schenk-Hoppe, K.R. (eds.) Handbook of Financial Markets: Dynamics and Evolution, pp. 439–506. North-Holland, Amsterdam (2009)

Kurz, M., Motolese, M.: Diverse beliefs and time variability of risk premia. Econ Theory (2010 this volume). doi:10.1007/s00199-010-0550-1

Kurz, M., Motolese, M.: The Role of Diverse Beliefs in Asset Pricing and Equity Premia, working paper, Stanford: Stanford University (2010)

Kurz M., Wu H.-M.: Endogenous uncertainty in a general equilibrium model with Price–Contingent contracts. Econ Theory 8, 461–488 (1996)

Leach J.: Rational speculation. J Political Econ 99, 131–144 (1991)

Luckett D.G.: On the effectiveness of the federal reserve’s margin requirement. J Finance 37, 783–795 (1982)

Miller E.: Risk, uncertainty, and divergence of opinion. J Finance 32, 1151–1168 (1977)

Moore T.: Stock market margin requirements. J Political Econ 74, 158–167 (1966)

Morris S.: Speculative investor behavior and learning. Quat J Econ 111, 1111–1133 (1996)

Seguin P.J.: Stock volatility and margin trading. J Monet Econ 26, 101–121 (1990)

Scheinkman J., Xiong W.: Overconfidence and speculative bubbles. J Political Econ 111, 1183–1219 (2003)

Varian H.R.: Divergence of opinion in complete markets: a note. J Finance 90, 309–317 (1985)

Varian H.R.: Differences of opinion in financial markets. In: Stone, C.C. (eds) Financial Risk: Theory, Evidence and Implications–Proceedings of the Eleventh Annual Economic Policy Conference of the Federal Reserve Bank of St. Louis., pp. 3–37. Kluwer, Dordrecht (1989)

Wu H.-M., Guo W.-C.: Speculative Trading with Rational Beliefs and Endogenous Uncertainty. Econ Theory 21, 263–292 (2003)

Wu H.-M., Guo W.-C.: Asset price volatility and trading volume with rational beliefs. Econ Theory 23, 795–829 (2004)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Mordecai Kurz, Kenneth Arrow, Peter Hammond, Maurizio Motolese, Carsten Nielsen, George Evans, Hiro Nakata and participants of Stanford Institute of Theoretical Economics (SITE) Conference in the summer of 2009 for many helpful suggestions.

Rights and permissions

About this article

Cite this article

Guo, WC., Wang, F.Y. & Wu, HM. Financial leverage and market volatility with diverse beliefs. Econ Theory 47, 337–364 (2011). https://doi.org/10.1007/s00199-010-0548-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-010-0548-8

Keywords

- Financial leverage

- Diverse beliefs

- Stock price volatility

- Leverage effect

- Pyramiding/depyramiding effect