Summary.

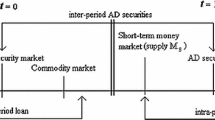

The monetary character of trade, use of a common medium of exchange, is shown to be an outcome of an economic general equilibrium. Monetary structure can be derived from price theory in a modified Arrow-Debreu model. Two constructs are added: transaction costs and market segmentation in trading posts (with a separate budget constraint at each transaction). Commodity money arises endogenously as the most liquid (lowest transaction cost) asset. Government-issued fiat money has a positive equilibrium value from its acceptability for tax payments. Scale economies in transaction cost account for uniqueness of the (fiat or commodity) money in equilibrium.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received: February 15, 2002; revised version: August 12, 2002

RID="*"

ID="*" This paper has benefited from seminars and colleagues' helpful remarks at the University of California - Santa Barbara, University of California - San Diego, NSF-NBER Conference on General Equilibrium Theory at Purdue University, Society for the Advancement of Behavioral Economics at San Diego State University, Econometric Society at the University of Wisconsin - Madison, SITE at Stanford University-2001, Federal Reserve Bank of Kansas City, Federal Reserve Bank of Minneapolis, Midwest Economic Theory Conference at the University of Illinois - Urbana Champaign, University of Iowa, Southern California Economic Theory Conference at UC - Santa Barbara, Midwest Macroeconomics Conference at University of Iowa, University of California - Berkeley, European Workshop on General Equilibrium Theory at University of Paris I, Society for Economic Dynamics at San Jose Costa Rica, World Congress of the Econometric Society at University of Washington, Cowles Foundation at Yale University. It is a pleasure to acknowledge comments of Henning Bohn, Harold Cole, James Hamilton, Mukul Majumdar, Harry Markowitz, Chris Phelan, Meenakshi Rajeev, Wendy Shaffer, Bruce Smith, and Max Stinchcombe.

Rights and permissions

About this article

Cite this article

Starr, R. Why is there money? Endogenous derivation of `money' as the most liquid asset: a class of examples. Econ Theory 21, 455–474 (2003). https://doi.org/10.1007/s00199-002-0326-3

Issue Date:

DOI: https://doi.org/10.1007/s00199-002-0326-3