Abstract

In this article we extend the model developed by Bogliacino and Pianta (Industrial and Corporate Change 22 649, 2013, b) on the link between R&D, innovation and economic performance, considering the impact of innovation on export success. We develop a simultaneous three equation model in order to investigate the existence of a ‘virtuous circle’ between industries’ R&D, share of product innovators and export market shares. We investigate empirically – at the industry level – three key relationships affecting the dynamics of innovation and export performance: first, the capacity of firms to translate their R&D efforts in new products; second, the role of innovation as a determinant of export market shares; third, the export success as a driver of new R&D efforts. The model is tested for 38 manufacturing and service sectors of six European countries over three time periods, from 1995 to 2010. The model effectively accounts for the dynamics of R&D efforts, innovation and international performance of European industries. Moreover, important differences across countries emerge when we split our sample into a Northern group – Germany, the Netherlands and the United Kingdom – and a Southern group – France, Italy and Spain. We find that the ‘virtuous circle’ between innovation and competitiveness holds for Northern economies only, while Southern industries fail to translate innovation efforts into export success.

Similar content being viewed by others

Notes

In our equations, technological and cost competitiveness are proxied by specific CIS variables accounting for R&D efforts, on the one hand, and new machinery, on the other.

In other contributions, Bogliacino and Pianta (2013a; 2013b) and Guarascio et al. (2015) found a differentiation in the impact that demand components have on product innovation. Exports resulted as the most dynamic component having always a positive and strongly significant impact on product innovation (similar arguments are put forth by Crespi et al. 2008). Conversely, the growth of domestic demand – without distinction between consumption and demand for capital goods - has been found to have a non-significant and, in some cases, negative impact. The role of demand in fostering innovation diffusion has been discussed theoretically by Pasinetti (1981).

In firm level literature, a recent contribution by Antonelli et al. (2012) highlights the persistence of product innovation through Transition Probability Matrices on annual data. Our data structure controls for that because it is based on long differences of four year windows (CIS waves).

An extensive description of the revised Pavitt taxonomy is provided by Bogliacino and Pianta (2010).

Pianta et al. 2011 provide a comprehensive description of the database. CIS innovation data are representative of the total population of firms and are calculated by national statistical institutes and Eurostat through an appropriate weighting procedure. A detailed description of the procedure is provided in Bogliacino and Pianta (2013a).

The simultaneous estimation performed in 3SLS further weakens the potential estimation biases associated with lagged dependent variables with respect to the 2SLS.

References

Adner R, Levinthal D (2001) Demand heterogeneity and technological evolution: implications for product and process Innovation. Manag Sci 47(5):611–628

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Howitt P (1998) Endogenous growth theory. The MIT Press, Cambridge

Amable B, Verspagen B (1995) The role of technology in market shares dynamics. Appl Econ 27:197–204

Amendola G, Dosi G, Papagni E (1993) The dynamics of international competitiveness. Weltwirtschaftliches Arch 129(3):451–471

Antonelli C, Crespi F, Scellato G (2012) Inside innovation persistence: New evidence from Italian micro-data. Struct Chang Econ Dyn 23(4):341–353

Archibugi D, Pianta M (1992) The technological specialization of advanced countries. a report to the ec on international science and technology activities. Kluwer, Dordrecht and Boston

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29:155–173

Arthur B. (2013) Complexity economics: a different framework for economic thought. Santa Fe Institute Working Papers Series 2013-4-012

Atkinson A, Stiglitz J (1969) A new view of technological change. Econ J 79(315):573–578

Backer K, Yamano D. (2012) International comparative evidence on global value chains, STI Working Paper 3, OECD

Bas M, Strauss-Kahn V (2010) Does importing more inputs raise exports? firm level evidence from France, MPRA Paper 27315. University Library of Munich, Germany

Bogliacino F, Gomez S (2014) Capabilities and investment in R&D: an analysis on European data. Struct Change Econ Dynam, Elsevier 31(C):101–111

Bogliacino F, Pianta M (2010) Innovation and employment. a reinvestigation using revised pavitt classes. Res Policy 39(6):799–809

Bogliacino F, Pianta M (2013a) Profits, R&D and innovation: a model and a test. Ind Corp Chang 22(3):649–678

Bogliacino F, Pianta M (2013b) Innovation and demand in industry dynamics. R&D, new products and profits. In: Pyka A, Andersen ES (eds) Long term economic development. Springer, Berlin

Breschi S, Malerba F, Orsenigo L (2000) Technological regimes and Schumpeterian patterns of innovation. Econ J 110:388–410

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Financ 64:151–185

Carlin (2001) Export market performance of OECD countries: an empirical examination of the role of cost competitiveness. Econ J 111:128–162

Cimoli M, Dosi G, Stiglitz JE (eds) (2009) Industrial policy and development: the industrial policy of capability accumulation. Oxford University Press, New York

Cincera M, Ravet J (2010) Financing constraints and R&D investments of large corporations in Europe and the USA. Sci Public Policy 37(6):455–466

Cohen W (2010) Chapter 4: Fifty years of empirical studies of innovative activity and performance. In: Rosenberg N, Hall B (eds) Handbook of the economics of innovation. Elsevier, Amsterdam

Cohen WM, Levine RC (1989) Empirical studies of innovation and market structure. In: Schmalensee R, Willig RD (eds) Handbook of industrial organization, 2. Amsterdam, North-Holland, pp 1059–1107

Colantone I, Crinò R (2014) New imported inputs, new domestic products. J Int Econ 92(1):147–165

Crepon B, Duguet E, Mairesse J (1998) Research and development, innovation and productivity: an econometric analysis at the firm level’. Econ Innova New Technol 7(2):115–158

Crespi F, Pianta M (2007) Innovation and demand in European industries’. Econ Politica-J Instit Anal Econ 24(1):79–112

Crespi F, Pianta M (2008a) Demand and innovation in productivity growth’. Int Rev Appl Econ 22(6):655–672

Crespi F, Pianta M (2008b) Diversity in innovation and productivity in Europe’. J Evol Econ 18:529–545

Crespi G, Criscuolo C, Haskell J (2008) Productivity, exporting, and the learning-by-doing hypothesis: direct evidence from UK firms. Can J Econ 41(2):619–638

Daveri F, Jona-Lasinio C. (2007) Off-shoring and productivity growth in the Italian manufacturing industries, Economics Department Working Papers 2007-EP08, Parma University

Dosi G (1982) Technological paradigms and technological trajectories: a suggested interpretations of the determinants and directions of technical change. Res Policy 11:147–162

Dosi G (1988) ‘Sources, procedures and microeconomic effects of innovation’. J Econ Lit 26:1120–1171

Dosi G, Pavitt K, Soete L (1990) The economics of technical change and International Trade. Harvester Wheatsheaf, Brighton

Dosi G, Grazzi M, Tomasi C, Zeli A (2012) Turbulence underneath the big calm? the micro-evidence behind Italian productivity dynamics. Small Bus Econ 39(4):1043–1067

Dosi G, Grazzi M, Moschella D (2015) Technology and costs in international competitiveness. from countries and sectors to firms. Res Policy. doi:10.1016/j.respol.2015.05.012

Evangelista R, Lucchese M, Meliciani V (2013) Business services, innovation and sectoral growth. Struct Chang Econ Dyn 25:119–132

Evangelista R, Lucchese M, Meliciani V (2015) Business services and the export performances of manufacturing industries. J Evol Econ. doi:10.1007/s00191-015-0409-5

Fagerberg J (1988) International competitiveness. Econ J 98:355–374

Fagerberg J, Hansson P, Lundberg L, Melchior A (1997) Technology and international trade. Edward Elgar, Cheltenham

Feenstra R, Hanson GH (1996) Foreign investment, outsourcing and relative wages. In: Feenstra RC, Grossman GM, Irwin DA (eds) The political economy of trade policy: papers in honor of Jagdish Bhagwati. The MIT Press, Cambridge, pp 89–127

Greeve H. R. (2003) Organizational learning from performance feedback. Cambridge University Press

Griliches Z (1979) Issues in assessing the contribution of research and development to productivity growth. Bell J Econ 10:92–116

Griliches Z (1995) R&D and productivity: econometric results and measurement issues. In: Stoneman P (ed) Handbook of the economics of innovation and technological change. Blackwell Publishers, Oxford, p 5289

Grossman M, Helpman E (1991) Trade, innovation and growth. Am Econ Rev 80(2):86–91

Guarascio D, Pianta M, Lucchese M et al. (2015) Business cycles, technology and exports. Economia Politica – J Anal Institut Econ, Springer

Hall BH (2002) The financing of research and development’. Oxf Rev Econ Policy 18(1):35–51

Harris R, Moffat J (2011) “R&D, Innovation and exporting” SERC Discussion paper, Spatial Economic Research Center, LSE

Hummels D, Ishii J, Yi KM (2001) The nature and growth of vertical specialization in world trade. J Int Econ 54(1):959–972

Kaldor N (1981) The role of increasing returns, technical progress and cumulative causation in the theory of international trade and economic growth. Econ Appl 34(4):593–617

Kleinbaum DG, Kupper LL, Muller KE (1988) Applied regression analysis and other multivariate methods, 2nd edn. PWS Publishing, Boston

Kleinknecht A, Verspagen B (1990) Demand and innovation: Schmookler re-examined. Res Policy 19:387–394

Krugman P (1990) Increasing returns and economic geography, NBER Working Papers 3275, National Bureau of Economic Research

Landesmann M, Pfaffermeyr M (1997) Technological competition and trade performances. Appl Econ 29(2):179–196

Loof H, Heshmati A (2006) On the relationship between innovation and performance: a sensitivity analysis. Econ Innov New Technol 15(4-5):317–344

Laursen K, Meliciani V (2010) The role of ICT knowledge flows for international market share dynamics” Res Policy, Elsevier 39(5):687–697

Lorentz A, Ciarli T, Savona M, Valente M (2015) The effect of demand-driven structural transformations on growth and technological change. J Evolution Econ June 2015 Springer Berlin. doi:10.1007/s00191-015-0409-5

Lucchese M. (2011) Demand, innovation and openness as determinants of structural change. University of Urbino DEMQ WP

Lucchese M, Pianta M (2012) Innovation and employment in economic cycles. Comp Econ Stud 54:341–359

Mairesse J., Mohnen P. (2010) Using innovations surveys for econometric analysis. NBER working paper, w15857

Malerba F (2002) Sectoral systems of innovation and production. Res Policy 31:247–264

Malerba F (ed) (2004) Sectoral systems of innovation. Cambridge University Press, Cambridge

Malerba F, Orsenigo L, Peretto P (1997) Persistence of innovative activities sectoral patterns of innovation and international technological specialization. Int J Ind Organ 15:801–826

Metcalfe J (2010) Technology and economic theory. Camb J Econ 34(1):153–171

Montobbio F (2003) Sectoral patterns of technological activity and export market share dynamics. Camb J Econ 27:523–545

Mowery D, Rosenberg N (1979) The influence of market demand upon innovation: a critical review ofsome recent empirical studies. Res Policy 8:102–153

Nelson RR (1959) The simple economics of basic scientific research. J Polit Econ 67:297–306

Nelson R, Winter S (1982) An evolutionary theory of economic change. The Belknap Press of Harvard University Press, Cambridge

Nemet GF (2009) Demand-pull, technology-push, and government-led incentives for non-incremental technical change. Res Policy 38:700–709

OECD (2009) Innovation in firms. a microeconomic perspective. OECD, Paris

Parisi ML, Schiantarelli F, Sembenelli A (2006) Productivity, innovation and R&D: micro evidence for Italy’. Eur Econ Rev 50:2037–2061

Pasinetti L (1981) Structural change and economic growth. Cambridge University Press, Cambridge

Pavitt K (1984) Sectoral patterns of technical change: towards a taxonomy and a theory. Res Policy 13(6):343–373

Peters B (2009) Persistence of innovation: Stylized facts and panel data evidence. J Technol Transfer 34:226–243

Pianta M (2001) Innovation, demand and employment. In: Petit P, Soete L (eds) Technology and the future of European employment. Elgar, Cheltenham, pp 142–165

Pianta M, Lucchese M. (2011) The sectoral innovation database 2011. Methodological Notes, University of Urbino, DEMQ working paper

Pianta M, Tancioni M (2008) Innovations, profits and wages’. J Post Keynesian Econ 31(1):103–125

Piva M, Vivarelli M (2007) Is demand-pulled innovation equally important in different groups of firms? Camb J Econ 31:691–710

Saviotti P, Pyka A (2013) The co-evolution of innovation, demand and growth. Econ Innov New Technol, Taylor & Francis J 22(5):461–482

Scherer F (1982) Demand-pull and technological invention: Schmookler revisited. J Ind Econ 30(3):225–237

Schmookler J. (1966) Invention and economic growth. Harvard University Press

Schumpeter JA (1975) Capitalism, socialism and democracy, 1st edn. Harper, New York

Soete LLG (1981) A general test of the technological gap trade theory. Weltwirtschaftliches Arch 117:638–666

Soete L (1987) The impact of technological innovation on international trade patterns: the evidence reconsidered. Res Policy 16(2-4):101–130

Stapel S, Pasanen J, Reinecke S et al. (2004) Purchasing power parities and related economic indicators for EU, Candidate Countries and EFTA, Eurostat - Statistics in Focus

Stiglitz JE (1987) Learning to learn localized learning and technological progress. In: Stoneman P, Dasgupta P (eds) Economic policy and technological performance. Cambridge University Press, Cambridge

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Thirlwall A (1979) The balance of payment constraint as an explanation of growth rate differences. BNL Quarter Rev, Banca Nazionale del Lavoro 32(128):45–53

Tiffin A. (2014) European productivity, innovation and competitiveness: the case of Italy. IMF Working Paper Strategy, Policy and Review department

Timmer M. (2013) The World Input Output Database (WIOD): contents, sources and methods. WIOD WP 10

Timmer M, Los B, Stehrer R, de Vries G (2013) Fragmentation, incomes and jobs: an analysis of European competitiveness. Econ Policy 28(76):613–661

Triguero-Cano A, Corcoles-Gonzales D (2013) Understanding the innovation: an analysis of persistence for Spanish manufacturing firms. Res Policy 42:340–352

Verspagen B (1993) Technological and social factors in long term fluctuations. Struct Change Econ Dynam, Elsevier 4(1):210–213

Wooldridge JM (2002) Econometric analysis of cross section and panel data. The MIT Press, Cambridge

Yamano N., Ahmad N.,(2006) The OECD input-output database: 2006 Edition, OECD Science, Technology and Industry Working Papers 2006/8, OECD Publishing

Zellner A, Theil H (1962) Three-stage least squares: simultaneous estimation of simultaneous equations. Econometrica 30(1):54–78

Kleinert and Zorell (2012) The export magnification effects of offshoring. European Central Bank - Working Papers Series, 1430

Acknowledgments

The authors wish to thank the editor Uwe Cantner, an anonymous referee and, for their comments, Jan Fagerberg and all the participants at the 15th ISS Conference held in Jena – Schiller University. We are particularly grateful to Luca Zamparelli for a previous discussion of this paper. Dario Guarascio is strongly indebted with Michael Landesmann, Robert Steherer, Mario Holzner, Sebastian Leitner, Roman Stöllinger and Julia Grübler for their comments and suggestions during his visiting period at the Vienna Institute for International Economic Studies. All the usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Descriptive statistics

1.1.1 Export market shares

The six countries contained in our sample account for 95 % of the EU-15 and for the 70 % of the EU-28 exports. The percentages are obtained dividing the sum of the exports of the considered countries by the total EU exports. Data are synthetized in Table 10. Moreover, the export performance of the countries in our sample (measured by the export market shares) remain stable when different data sources are considered (calculations based on our SID database are compared with Eurostat data) and when exports are distinguished by destination. These elements bring us to consider the export market share variable used in the third equation of the system as a reliable proxy for industries performances in terms of international competitiveness.

1.1.2 Innovation vs performance variables

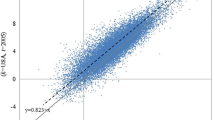

The following scatter plots relate product innovation with export and value added as proxies for economic performance; they identify countries’ heterogeneity and sectoral regularities, using Pavitt classes. Figure 2 shows a clear correlation between R&D efforts and innovation performance; Science Based and Supplier Specialized industries - those sectors for which innovation is most important – are located at the top right of the graph, as expected. Within technological intensive sectors, the best performers are from Northern countries and France. Figure 3 relates product innovation and exports and also, in this case, the correlation between the two variables is detected. As in Fig. 2, sectors with a higher technological intensity (SB and SS) are positioned in the top right of the graph and the North–south divide is again clear in the distribution.

Figure 4 provides a cross country comparison plotting product innovation versus the rate of change of value added over the sampled period. In this graph, the North–south divide is again clear, as well as the role of Germany as an outlier. The descriptive evidence provided is the background to the results of the econometric model developed in section 5.

1.1.3 Intermediate inputs

The final step of this data inspection regards the role played by intermediate inputs, distinguishing them in terms of technological content and source. Table 11 reports the share of each intermediate input over total industry production of countries. The numbers in Table 11 depict a situation where there is little variability across countries; even the high tech imported inputs have a highly stable relevance across countries. Conversely, domestic low tech intermediate inputs play a major role in Southern countries, and Italy in particular, where their share over total production is 32 %, ten point higher than the Northern average.

The final Table 12 reports the intensity in the use of domestic and imported inputs by Pavitt Categories for the period 1995-2010. As expected, the variability across Pavitt Categories is higher than the one observed among countries. Sectors belonging to Science Based and Supplier Specialized categories rely mostly on high tech intermediate inputs, and their openness to the foreign market is also remarkable. Conversely, Scale Intensive and Supplier Dominated sectors are characterized by an intensive use of low tech inputs originating principally from the domestic market. A substantial divergence in terms of economic and innovative performances across our sample’s countries emerges from this first data inspection. Moreover, technological factors turn out as a crucial element in the explanation of competitiveness for the EU countries we have considered.

1.2 Model diagnostics

1.2.1 Dummy variables estimations

In this subsection, we report the estimations, equation by equation including the dummy variable coefficients. The dummy variable coefficients have been discussed in Section 5.1.

The standard diagnostic tests are examined here, equation by equation. We try to detect the presence of heteroscedasticity and/or multicollinearity. To check we respectively use a Breusch-Pagan test and a Variance Inflation Factor (VIF, calculated on the baseline WLS regression). In order to address the endogeneity issue, we regress the explanatory variables over a set of instruments, compute the residuals and re-run a robust standard errors-WLS of the equation, with the residuals included as an explanatory variable. The T-test for the coefficient of the residuals included becomes a test of endogeneity; see Wooldridge (2002, p. 118).

The results are the following: we have to estimate robust standard errors since the Breusch-Pagan test rejected the null hypothesis of homoscedasticity, explanatory variables are orthogonal to the error term, and multicollinearity is not an issue; usually VIF is considered worrisome if it is higher than four (or higher than ten, according to different sources), and these thresholds are four to ten times higher than the value of our sample statistics. We cannot reject our formulation of WLS with robust standard errors. Regarding endogeneity (we developed standard endogenity tests on SIZE, EXPGR, MACH and INT_IMP_HT), our diagnostic rejects the hypothesis of endogeneity for the tested variables.

To go a step further in the endogeneity test, we report the results of the 2SLS estimation of each of our baseline equations (as already illustrated above, we instrumented our regressors suspected of being endogenous with their lag, the rate of change of value added, country dummies, time dummies and Pavitt dummies).

The basic formulation of the R&D (1) and New products (2) equations is not rejected by the results and the overidentification test supports the validity of the selected instruments. As a final step, we report the results of the 2SLS estimation for the third equation of the system.

Also in this case, our formulation is consistent with the data and the instruments are properly selected.

Rights and permissions

About this article

Cite this article

Guarascio, D., Pianta, M. & Bogliacino, F. Export, R&D and new products. a model and a test on European industries. J Evol Econ 26, 869–905 (2016). https://doi.org/10.1007/s00191-016-0445-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-016-0445-9