Abstract

Can consolidation policy be made consistent with macro-prudential supervision? In this study, we seek to provide new insights on this key-question using a network approach. We study how the resilience of a banking network evolves as we shock an initially homogenous competitive market with a sequence of M&A activities that significantly alter the topology of the network. We study how different M&A treatments impact the structural vulnerabilities that can propagate through the system and we show that the severity of contagion and default dynamics depends on the chosen treatment. The desirability of alternative competitive settings (such as a hub-centered market or a more concentrated and yet symmetric market) are assessed against a homogenous benchmark case. We show that the choice depends crucially on the size of the interbank market and the level of bank capitalization. The existence of a large highly connected hub is beneficial in a capitalized network with a well-developed interbank market, but it can significantly weaken the system’s resilience in a poorly capitalized market. Antitrust and competition authorities should adopt a state-contingent approach to M&A activities according to the market conditions in which banks operate.

Similar content being viewed by others

Notes

Press reports on the emerging consensus abound. See, for instance, the ones published on the Bloomberg (Small banks feel the urge to merge, Oct. 3, 2013) and the Reuters (Top bankers expect EU stress tests to reignite banking M&A, Jan. 26, 2014) websites.

A similar approach was adopted by local regulators during the 1997-98 Asian financial crisis (Shih 2003).

Alternative contagion dynamics and channels can, of course, be envisaged. In their seminal work, Nier et al. (2007) rely on a liquidation mechanism in which failed nodes are simply removed from the network. On top of this, several amplification mechanisms have been discussed in the literature, such as fire-sales (Anand et al. 2013), funding shocks triggered by recalling interbank assets (Krause and Giansante 2012), financial accelerator (Battiston et al. 2012), haircuts (Gai et al. 2011). Distress can also be managed via a public bail-out, and this has occurred several times during the last crisis. Both these solutions require some sort of outside money to be poured into the system. A substantial amount of state funds (or tax-payer money) is required to finance bail-out, and liquidation implicitly assumes that someone from outside is willing to purchase the liquidated assets. Our mechanism does not rely on such infusion of external funds (that may not necessarily be there when needed). Gaffeo and Molinari (2015) provide a comparative analysis of the system’s resilience under the resolution scheme described above and the more standard liquidation rule. They show that the former scheme is more effective in shielding the network from default cascades and is, hence, more coherent with the macro-prudential vision that is at the core of this paper.

Let us assume that the exogenous shock is given to bank i at time t = 1. This means that \(NDC_{ji}(1)=X^{l}_{ij}\) ∀ i,j. The rule of motion as in Eq. 4 allows us to fill in the matrix of non-distressed loans (N D C j i (t)) for t>1) at each time-round during the contagion process.

The residual loss for any bank j γ j (t+k) for any k is defined a \(\gamma _{j}(t+k)={\sum }_{i\neq j} NDC_{ji}(t+k-1)-{\sum }_{i\neq j} NDC_{ji}(t+k)\).

We call this a symmetric system because banks belong to the same size-class and share the same probability of being connected to one another.

Let us define the probability of lending for a small bank \({P^{L}_{s}}\) and \({P^{L}_{l}}\) the probability of lending for a large bank, respectively. These probabilities are computed as: \({P^{L}_{s}}=[P_{l}N_{l}+P_{s}(N_{s}-1)](N_{s}+N_{l}-1)^{-1}\) and \({P^{L}_{l}}=[P_{l}(N_{l}-1)+P_{s}N_{s}](N_{s}+N_{l}-1)^{-1}\).

The ECB report on banking structures (ECB 2010) reports information on the Herfindahl index for most EU countries from 2005 to 2009. The average is around 11 percent but there is a great deal of cross-country heterogeneity. Italy (along with Germany and Luxembourg) stands out as a low-concentrated market with values increasing from 2.3 percent in 2005 to 3.53 in 2009. The Netherlands (or even more, Finland) appear at the other end of the spectrum with a market concentration starting at 17 percent in 2005, up to 20 percent in 2009.

The interested reader may refer to the working-paper version (Gaffeo and Molinari 2014), which features a detailed discussion of all possible cases.

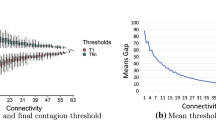

These plots are obtained by pooling 100 Monte Carlo experiments in order to maximize the number of observations. In these simulations, we set α = 5 and β = 0.04.

An alternative modeling strategy would be to create a scale-free network with a power-law parameter in line with that estimated using real data. This would yield a scale-free network even with a small sample size but the total number of links would be much smaller than that required to have a meaningful comparison with the benchmark case presented in the previous section.

Let us note that N l is both treatment and merge-round specific, as it should be clear from Table 2.

References

Anand K, Gai P, Kapadia S, Brennan S, Willison M (2013) A network model of financial system resilience. J Econ Behav Organ 85(0):219–235

Barabasi AL, Albert R (1999) Emergence of scaling in random networks. Science 286(5439):509–512

Battiston S, Delli Gatti D, Gallegati M, Greenwald B, Stiglitz JE (2012) Default cascades: When does risk diversification increase stability J Fin Stab 8(3):138–149

Beck T (2008) Bank competition and financial stability : friends or foes ? Policy Research Working Paper Series 4656, The World Bank

Berger A, Klapper L, Turk-Ariss R (2009) Bank competition and financial stability. J Finan Serv Res 35(2):99–118

Boot A (2003) Consolidation and strategic positioning in banking with implications for europe. Brookings-Wharton Papers Finan Serv 1:37–83

Boss M, Elsinger H, Summer M, Thurner S (2004) Network topology of the interbank market. Quant Finance 4(6):677–684

ECB (2010) Eu banking structures. Technical Report 711, European Central Bank

Elliehausen G (1998) The cost of banking regulation: A review of the evidence. Working paper series 171, Board of Governors of the Federal Reserve System, U.S.

Gaffeo E, Molinari M (2015) Interbank contagion and resolution procedures: inspecting the mechanism. Quant Finance 15(4):637–652

Gaffeo E, Molinari M (2015) Interbank contagion and resolution procedures: inspecting the mechanism. Quant Finance 15(4):637–652

Gai P, Kapadia S (2010) Contagion in financial networks. Proc Royal Soc Lond, A 466(2120):2401–2423

Gai P, Haldane A, Kapadia S (2011) Complexity, concentration and contagion. J Monet Econ 58(5):453–470

Hahm JH, Shin HS, Shin K (2013) Noncore bank liabilities and financial vulnerability. J Money Credit Bank 45(1):3–36

Haldane A (2013) On being the right size. Speech delivered at the Economics Festival in Trento, Bank of England

IMF (2012) Global financial stability report. IMF

Kliesen KL (2013) Uncertainty and the economy. Reg Econ 21(4):1–3

Krause A, Giansante S (2012) Interbank lending and the spread of bank failures: A network model of systemic risk. J Econ Behav Organ 83(3):583–608

Leitner Y (2005) Financial networks: Contagion, commitment, and private sector bailouts. J Finance 60(6):2925–2953

Manna M, Iazzetta C (2009) The topology of the interbank market: developments in italy since 1990. Working Paper 711, Bank of Italy, Economic Research and International Relations Area

May R, Arinaminpathy N (2010) Systemic risk: the dynamics of model banking systems. J Royal Soc Interface 7(46):823–38

Nier E, Yang J, Yorulmazer T, Alentorn A (2007) Network models and financial stability. J Econ Dyn Control 31(6):2033–2060

Pilloff SJ (2002) What’s happened at divested bank offices? an empirical analysis of antitrust divestitures in bank mergers. Finance and Economics Discussion Series, Working Paper 2002-60, Board of Governors of the Federal Reserve System (U.S.)

Ratnovski L (2013) Competition policy for modern banks. Working paper no.13/126, IMF

Rogers LCG, Veraart LAM (2013) Failure and rescue in an interbank network. Manag Sci 59(4):882–898

Shih MSH (2003) An investigation into the use of mergers as a solution for the Asian banking sector crisis. Q Rev Econ Finance 43(1):31–49

Soramäki K, Bech ML, Arnold J, Glass RJ, Beyeler WE (2007) The topology of interbank payment flows. Phys A: Stat Mech Appl 379(1):317–333

Vives X (2011) Competition and stability in banking. Oxf Rev Econ Policy 27 (3):479–497

Acknowledgments

The authors wish to thank to Flavio Bazzana, Simone Giansante, Kevin J. Lansing, Stefania Ottone, Roberto Tamborini and two anonymous referees for their valuable comments. We are also very grateful to the audiences at the SIE (Italian Economic Association) 55th annual conference (University of Trento), the 2013 EBES Conference in Rome, the 2012 Latsis Symposium, Economics On The Move at the ETH Zurich, the 2012 IFABS Conference, Rethinking Banking and Finance: Money, Markets and Models in Valencia, and seminar participants at the University of Trento (Department of Economics and Management) the University of Bath (School of Management) and the Institute of Economics (Sant’Anna School of Advanced Studies) for their feedback on previous versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Edoardo Gaffeo and Massimo Molinari gratefully acknowledge the financial support from the Institute for New Economic Thinking (INET) grant on “Financial fragility and systemic risk”. The usual disclaimers apply.

Rights and permissions

About this article

Cite this article

Gaffeo, E., Molinari, M. Macroprudential consolidation policy in interbank networks. J Evol Econ 26, 77–99 (2016). https://doi.org/10.1007/s00191-015-0419-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-015-0419-3