Abstract

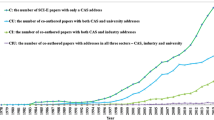

Technological complementarity is argued to be a crucial element for effective R&D collaboration. The real structure is, however, still largely unknown. Based on the argument that organizations’ knowledge resources must fit for enabling collective learning and innovation, we use the co-occurrence of firms in collaborative R&D projects in Germany to assess inter-sectoral technological complementarity between 129 sectors. The results are mapped as complementarity space for the Germany economy. The space and its dynamics from 1990 to 2011 are analyzed by means of social network analysis. The results illustrate sectors being complements both from a dyadic and portfolio/network perspective. This latter is important, as complementarities may only become fully effective when integrated in a complete set of different knowledge resources from multiple sectors. The dynamic perspective moreover reveals the shifting demand for knowledge resources among sectors at different time periods.

Similar content being viewed by others

Notes

Strategic alliances can take different forms such as joint ventures, franchising, licensing contracts, collaborative R&D efforts or trade agreements (Lavie, 2006). Central to our analysis are collaborative R&D efforts.

Resource complementarity matters at different stages of the value chain. While the present paper focuses on resource complementarity in R&D, for instance, Chung et al. (2000) measure complementarity by investment banks’ differences in locational (co-location) and sector strengths (shared clients). Wassmer and Dussauge (2012) define resource complementarity in terms of increases in served city pair markets when different airlines enter an alliance. Lin et al. (2009) use the standard industrial classification (SIC) system to define complementarity, which is given when alliance partners do not share the same four-digit SIC code. Wang and Zajac (2007) study complementary production processes by using co-occurrences of four digit NAICS codes at the firm level.

Another form of resource combinations can be seen in the pooling of unrelated resources. This bears potential for most radical innovations. However, because of lacking absorptive capacity between collaboration partners, innovations in this case are much more unlikely in comparison to combinations based upon complementary resources (Boschma and Iammarino, 2009; Makri et al., 2010).

This is not to say that knowledge flows are restricted to R&D. Technology diffusion comes along disembodied and product-embodied paths. Disembodied diffusion refers to the transmission of ideas and knowledge and can be studied by collaborative R&D or patent-citation matrices (Nomaler and Verspagen, 2008). Product-embodied diffusion highlights purchased goods as carriers of technology flows. Given this, Sakurai et al. (1997) found evidence that ICT plays a major role in the generation and acquisition of new technologies. Papaconstantinou et al. (1998) highlight the idea that innovations are developed mainly in clusters of R&D intensive manufacturing industries with service sectors being the main users of technologically sophisticated machinery and equipment. Both aspects will also receive further attention in this paper.

However, this method also has drawbacks, as the quantity J ij might not generally be valid to detect possible deterministic effects. It can attain abnormally high values when purely random processes are present as well as when occupancies are very heterogeneous. A second drawback concerns the random assignment of firms to activities. Assigning a random set of firms to each interaction, which in magnitude is equal to the actual number of associated firms in the data, does not correspond to a unique random association mechanism between firms and activity fields. See for a possible solution Bottazzi and Pirino (2010).

References

Ahuja G (2000) The duality of collaboration: inducements and opportunities in the formation of interfirm linkages. Strat Mgmt J 21:317–343

Ahuja G, Katila R (2001) Technological acquisitions and the innovation performance of acquiring firms: a longitudinal study. Strateg Manag J 22:197–220

Ahuja G, Lampert C (2001) Entrepreneurship in the large corporation: a longitudinal study of how established firms create breakthrough inventions. Strateg Manag J 22:521–543

Arora A, Gambardella A (1990) Complementarity and external linkages: The strategies of the large firms in Biotechnology. J Ind Econ 38:361–379

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17:99–120

Barrat A, Barthelemy M, Pastor-Satorras R, Vespignani A (2004) The architecture of complex weighted networks. Proc Natl Acad Sci 101:3747–3752

Baum J, Cowan R, Jonard N (2010) Network-independent partner selection and the evolution of innovation networks. Manag Sci 56:2094–2110

Baum J, Oliver C (1991) Institutional linkages and organizational mortality. Adm Sci Q 36:187–218

Boschma R, Iammarino S (2009) Related variety, trade links, and regional growth in Italy. Econ Geogr 85:289–311

Bottazzi G and Pirino D (2010) Measuring Industry Relatedness and Corporate Coherence. LEM Working Paper 10/2010, SantAnna School of Advanced Studies, Pisa

Breschi S, Lissoni F, Malerba F (2003) Knowledge relatedness in firm technological diversification. Res Policy 32:69–87

Broekel T, Graf H (2012) Public research intensity and the structure of German R&D networks: a comparison of 10 technologies. Econ Innov New Technol 21:345–372

Brusoni S, Marsili O, Salter A (2005) The role of codified sources of knowledge in innovation: empirical evidence from dutch manufacturing. J Evol Econ 15:211–231

Bryce D, Winter S (2009) A general inter-industry relatedness index. Manag Sci 55:1570–1585

Burt RS (1992) Structural holes: the social structure of competition. Harvard University Press, Cambridge

Cassiman B, Veugelers R (2002) Cooperation and spillovers: some empirical evidence from Belgium. Am Econ Rev 9:1169–1184

Castaldi C, Frenken K, Los B (2013) Related variety, unrelated variety and technological breakthroughs: an analysis of U.S. state-level patenting, papers in evolutionary economic geography 13.01, Utrecht University

Castellacci F (2008) Technological paradigms, regimes and trajectories: manufacturing and service industries in a new taxonomy of sectoral patterns of innovation. Res Policy 37:978–994

Chesbrough H (2003) The governance and performance of Xerox’s technology spin-off companies. Res Policy 32:403–421

Chung S, Singh H, Lee K (2000) Complementarity, status similarity and social capital as drivers of alliance formation. Strateg Manag J 21:1–22

Cohen W, Levinthal D (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35:128–152

D’Este P, Guy F, Iammarino S (2013) Shaping the formation of university-industry research collaborations: what type of proximity does really matter? J Econ Geogr 13:537–558

Das T, Teng B (2000) A resource based theory of strategic alliances. J Manag 26:31–61

Davis PS, Robinson RB Jr, Pearce JA III, Park SH (1992) Business unit relatedness and performance: a look at the pulp and paper industry. Strateg Manag J 13(5): 349–361

Dyer J, Singh H (1998) The relational view: cooperative strategy and sources of interorganizational competitive advantage. Acad Manag Rev 23:660–679

Dyer J, Singh H, Kale P (2008) Splitting the pie: rent distribution in alliances and networks. Manag Decis Econ 29:137–148

Eisenhardt K, Schoonhoven C (1996) Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organ Sci 7:136–150

Ennen E, Richter A (2010) The whole is more than the sum of its parts – or is it? A review of the empirical literature on complementarities in organizations. J Manag 36:207–233

Farjoun M (1998) The independent and joint effects of the skill and physical bases of relatedness in diversification. Strateg Manag J 19:611–630

Fier A (2002) Staatliche Förderung industrieller Forschung in Deutschland. Eine empirische Wirkungsanalyse der direkten Projektförderung des Bundes. Nomos Verlagsgesellschaft, Baden-Baden

Fleming L (2001) Recombinant uncertainty in technological search. Manag Sci 47:117–132

Freeman L (1977) A set of measures of centrality based upon betweenness. Sociometry 40:35–41

Gilkey R, Kilts C (2007) Cognitive fitness. Harv Bus Rev 85:53–66

Gulati R (1998) Alliances and networks. Strateg Manag J 19:293–318

Hagedoorn J (2002) Inter-firm R&D partnerships: an overview of major trends and patterns since 1960. Res Policy 31:477–492

Hagedoorn J, Schakenraad J (1994) The effect of strategic technology alliances on company performance. Strateg Manag J 15:291–310

Hagedoorn J, Wang N (2012) Is there complementarity or substitutability between internal and external R&D strategies? Res Policy 41:1072–1083

Harrison J, Hitt M, Hoskisson R, Ireland R (2001) Resource complementarity in business combinations: extending the logic to organizational alliances. J Manag 27:679–690

Hitt M, Dacin M, Levitas E, Arregle J, Borza A (2000) Partner selection in emerging and developed market contexts: Resource-based and organizational learning perspectives. Acad Manag J 43:449–467

Ireland R, Hitt M, Vaidyanath D (2002) Alliance management as a source of competitive advantage. J Manag 28:413–446

Khanna T, Gulati R, Nohria N (1998) The dynamics of learning alliances: competition, cooperation, and scope. Strateg Manag J 19:193–210

Lambe C, Spekman R (1997) Alliances, external technology acquisition, and discontinuous technological change. J Prod Innov Manag 14:102–116

Lane P, Lubatkin M (1998) Relative absorptive capacity and interorganizational learning. Strateg Manag J 19:461–478

Larsson R, Finkelstein S (1999) Integrating strategic, organizational, and human resource perspectives on mergers and acquisitions: a case survey of synergy realization. Organ Sci 10:1–25

Lavie D (2006) The competitive advantage of interconnected firms: an extension of the resource-based view of the firm. Acad Manag Rev 31:638–658

Lin Z, Yang H, Arya B (2009) Alliance partners and firm performance: resource complementarity and status association. Strateg Manag J 30:921–940

Madhok A, Tallman S (1998) Resources, transactions, and rents: managing value through interfirm collaborative relationships. Organ Sci 9:1–14

Makri M, Hitt M, Lane P (2010) Complementary technologies, knowledge relatedness, and innovation outcomes in high technology mergers and acquisitions. Strateg Manag J 31:602–628

Malerba F, Mancusi M, Montibbio F (2013) Innovation, international R&D spillovers and the sectoral heterogeneity of knowledge flows. Rev World Econ 149:697–722

Miotti L, Sachwald F (2003) Co-operative R&D: Why and with whom? An integrated framework of analysis. Res Policy 32:1481–1499

Miozzo M, Soete L (2001) Internationalization of services: a technological perspective. Technol Forecast Soc Chang 67:159–185

Mowery D, Oxley J, Silverman B (1998) Technological overlap and interfirm cooperation: implications of the resource-based view of the firm. Res Policy 27:507–523

Neffke F, Henning M (2013) Skill relatedness and firm diversification. Strateg Manag J 34:297–316

Newman M, Girvan M (2004) Finding and evaluating community structure in networks. Phys Rev E 69(2):026113–1, 026113–15

Nonaka I, Takeuchi H, Umemoto K (1996) A theory of organizational knowledge creation. Int J Technol Manag 11:833–846

Nooteboom B (1999) Innovation, learning and industrial organization. Camb J Econ 23:127–150

Nooteboom B (2000) Learning and Innovation in Organizations and Economies. Oxford University Press, Oxford

Nooteboom B, Van Haverbeke W, Duysters G, Gilsing V, Van Den Ooord A (2007) Optimal cognitive distance and absorptive capacity. Res Policy 36:1016–1034

Nomaler Ö, Verspagen B (2008) Knowledge flows, patent citations and the impact of science on technology. Econ Syst Res 20:339–366

Opsahl T, Colizza V, Panzarasa P, Ramasco J (2008) Prominence and control: the weighted rich-club effect. Phys Rev Lett 101(168702)

Papaconstantinou G, Sakurai N, Wyckoff A (1998) Embodied technology diffusion: an empirical analysis for OECD countries. OECD Working Papers, Vol. IV, No. 8

Parise S, Casher A (2003) Alliance portfolios: designing and managing your network of business-partner relationships. Acad Manag Exec 1:25–39

Pavitt K (1984) Patterns of technical change: towards a taxonomy and a theory. Res Policy 13:343–73

Powell W, Koput K, Smith-Doerr L (1996) Interorganizational collaboration and the locus of innovation: networks of learning in biotechnology. Adm Sci Q 41:116–45

Rothaermel F, Hitt M, Jobe L (2006) Balancing vertical integration and strategic outsourcing: effects on product portfolio, product success, and firm performance. Strateg Manag J 27:1033–1056

Sakurai N, Papaconstantinou G, Ioannidis E (1997) Impact of R&D and technology diffusion on productivity growth: empirical evidence for 10 OECD countries. Econ Syst Res 9:81–109

Schmiedeberg C (2008) Complementarities of innovation activities: an empirical analysis of the German manufacturing sector. Res Policy 37:1492–1503

Shah R, Swaminathan V (2008) Factors influencing partner selection in strategic alliances: the moderating role of alliance context. Strateg Manag J 29:471–494

Stigler G (1958) The economies of scale. J Law Econ 1:54–71

Stuart T (1998) Network positions and propensities to collaborate: An investigation of strategic alliance formation in a high-technology industry. Adm Sci Q 43:668–698

Stuart T (2000) Interorganizational alliances and the performance of firms: a study of growth and innovation rates in a high-technology industry. Strateg Manag J 21:791–911

Tanriverdi H, Venkatraman N (2005) Knowledge relatedness and the performance of multibusiness firms. Strateg Manag J 26:97–119

Teece D (1986) Profiting from technological innovation: Implications for integration, collaboration, licensing, and public policy. Res Policy 15:285–305

Teece D, Rumelt R, Dosi G, Winter S (1994) Understanding corporate coherence - theory and evidence. J Econ Behav Organ 23:1–30

Van Eck N, Waltman L (2009) How to normalize cooccurrence data? An analysis of some well-known similarity measures. J Am Soc Inf Sci Technol 60:1635–1651

Wang L, Zajac E (2007) Alliance or acquisition? A dyadic perspective on interfirm resource combinations. Strateg Manag J 28:1291–1317

Wasserman S, Faust K (1994) Social network analysis: methods and applications. Cambridge University Press, Cambridge

Wassmer U, Dussauge P (2012) Network resource stocks and flows: how do alliance portfolios affect the value of new alliance formations? Strateg Manag J 33:871–883

Wassmer U, Dussauge P (2011) Value creation in alliance portfolios: the benefits and costs of network resource interdependencies. Eur Manag Rev 8:47–64

Wernerfelt B (1984) A resource based view of the firm. Strateg Manag J 5:171–180

Zajac E, Olsen C (1993) From transaction cost to transactional value analysis: Implications for the study of interorganizational strategies. J Manag Stud 30:131–145

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Broekel, T., Brachert, M. The structure and evolution of inter-sectoral technological complementarity in R&D in Germany from 1990 to 2011. J Evol Econ 25, 755–785 (2015). https://doi.org/10.1007/s00191-015-0415-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-015-0415-7