Abstract

This article develops an evolutionary model of industry dynamics in order to carry out a richer theoretical analysis of the consequences of a stronger patent system. The first results obtained in our article are rather consistent with the anti-patent arguments and do not favor the case for a stronger patent system: higher social welfare and technical progress are observed in our model in industries with milder patent systems (lower patent height and patent life).

Similar content being viewed by others

Notes

See Hall and Ziedonis (2001) for electronics firms.

Running 1,000 simulations is sufficiently robust and secure in our case since \(\sigma ^{2} /\overline{x} \) becomes stable after 500 runs for any variable x in our model.

Social suplus=consumers' surplus+total profits of the firms.

These boxplots show four quartiles of the distributions of our indicators: the statistically significant minimum and the maximum correspond to the extreme end of the whiskers, while Q 1 and Q 3 correspond to the edges of the central box and the median corresponds to the horizontal line inside the box.

The statistical appendix may be obtained from the following address: http://beagle.u-bordeaux4.fr/yildi/files/tvmy1appendix.pdf.

See Yildizoglu (2001) for a possible modelling strategy.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Cohen WM, Nelson R, Walsh J (2000) Protecting their intellectual assets: appropriability conditions and why U.S. manufacturing firms patent (or not). Working paper series 7552, NBER, Cambridge, MA

Gallini N, Scotchmer S (2002) Intellectual property: when is it the best incentive system? In: Jaffé A, Lerner J, Stern S (eds) Innovation policy and the economy, Vol. 2. MIT, Cambridge, MA, pp 51–78

Hall B (2002) Current issues and trends in the economics of patents. Lecture to the ESSID Summer School in Industrial Dynamics, http://emlab.berkeley.edu/users/bhhall/papers/BHH

Hall BH, Ziedonis RH (2001) The patent paradox revisited: an empirical study of patenting in the U.S. semiconductor industry, 1979–1995. Rand J Econ 32(1):101–128

Machlup F (1958) An economic review of the patent system. Study No. 15 of Commission on Judiciary, Sub comm. on Patents, Trademarks, and Copyrights, 85th Congress, 2nd Session

Mansfield E (1986) Patents and innovation: an empirical study. Manage Sci 32:173–181

Mazzoleni R, Nelson RR (1998) The benefits and costs of strong patent protection: a contribution to the current debate. Res Policy 27:273–284

Merges R, Nelson RR (1990) On the complex economics of patent scope. Columbia Law Rev 90:839–916

R Development Core Team (2003) R: A language and environment for statistical computing. Vol. http://www.r-project.org/, R Foundation for Statistical Computing, Vienna

Silverberg G, Verspagen B (1994) Learning, innovation and economic growth: a long run model of industrial dynamics. Industrial and Corporate Change 3

Silverberg G, Yildizoglu M (2002) An evolutionary interpretation of the Aghion & Howitt (1992) model. Working Paper 2202-3, IFReDE-E3i, Univ. Montesquieu Bordeaux IV

van Dijk TWP (1994) The limits of patent protection. Essays on the Economics of Intellectual Property Rights, Universitaire Pers Maastricht

Yildizoglu M (2001) Connecting adaptive behaviour and expectations in models of innovation: the potential role of artificial neural networks. Eur J Econ Soc Syst 15(3):203–220

Author information

Authors and Affiliations

Corresponding author

Additional information

Murat Yıldızoğlu gratefully acknowledges the support of the CCRRDT Program of the Aquitaine region.

Appendix

Appendix

Initialisation of the main parameters of the model

Exogenous variables

N=50: Number of firms

T=500: Number of periods

PROBIMITATE∈[10, 0.005]: Probability of imitation

PROBMUTATE∈[0, 0.005]: Probability of mutation

SIGMA_IN∈[0.1, 5]: Standard deviation of the innovative draws

DIVIDENDRATE∈[0, 1]: Initial average share of the distributed dividends in the gross profits

PATENTRATE∈[0, 1]: Initial average share of the patent budget in the gross profits

EQUITY RATE∈[0, 1]: Initial average share of the savings in the gross profits

IKRATE∈[0, 1]: Initial average share of the investment in physical capital in the gross profits

IRDRATE∈[0, 1]: Initial average share of the R&D budget in the gross profits

ENTRY PROB∈[0, 0.01]: Probability of new entry

ALPHA∈[0, 1]: Depreciation rate of the technological knowledge of the firm

GAMMA∈[0, 0.02]: Transformation rate of dividends into supplementary demand

NEWPATENTCOST∈[0, 5]: Cost of filing a new patent

RENEWPATENTCOST∈[0, 1]: Cost of renewing an existing patent

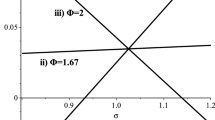

PATENTHEIGHT∈[0, 5]: The height of the granted patents. If the patent correspond to the productivity A 0, all productivities in [A 0−PATENTHEIGHT, A 0+PATENTHEIGHT] are protected from the competitors.

PATENTLIFE∈[0, 30]: Legal maximal life of patents

EQUITY∈[10, 50]: Initial equity of the firms

CF∈[0, 2]: Fixed costs of the firms

K∈[10, 50]: Initial average capital stock of the firms

PROD∈[0.2, 1.2]: Initial average productivity of the firms

COST∈[0, 1]: Initial average unit using cost of the capital

DEM∈[300, 1000]: Initial demand coefficient

ETA∈0.9: Elasticity of demand

Endogenous variables

price: Market price

max prod: Maximal productivity of the period

averprod: Average productivity of the period

activeN: Number of active firms in the industry

invCI: Inverse Herfindal index of the period

averprofit: Average profits

nbinnov: Number of innovations in the period

nbpat: Total number of active patents in the period

cumbpat: Cumulated number of the patents in the industry history

max patage: Age of the oldest active patent

nbpatfirms: Number of patenting firms in the period

avpatrate: Average percentage of the patent budget in the gross profits

avirdrate: Average percentage of the R&D budget in the gross profits

avikrate: Average percentage of the capital investment budget in the gross profits

avequitrate: Average percentage of the savings in the gross profits

avdivrate: Average percentage of the distributed dividends in the gross profits

Rights and permissions

About this article

Cite this article

Vallée, T., YıLdızoğlu, M. Social and technological efficiency of patent systems. J Evol Econ 16, 189–206 (2006). https://doi.org/10.1007/s00191-005-0004-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-005-0004-2