Abstract

Since the use of business analytics promises automation of business processes and time savings, the budgeting process seems predestined for the integration of analytical methods. Therefore, this study examines the determinants of the use of business analytics in the budgeting process and its effect on satisfaction with the budgeting process. Specifically, we focus on one technical determinant (data infrastructure sophistication) and the importance of the two major budgeting functions (the planning and the evaluation function), which could affect the degree of dissemination of using analytical methods. Based on a survey among German companies, we find, as predicted, that the sophistication of the data infrastructure is positively associated with the use of business analytics in the budgeting process. Further, the more a company emphasizes the planning function, the greater the extent to which business analytics is used in the budgeting process. In contrast, we find no association between the evaluation function and the use of business analytics in the budgeting process. Finally, we find that the use of business analytics is positively associated with satisfaction with the budgeting process. Thus, the use of business analytics can help to overcome dissatisfaction with traditional budgeting systems. Overall, our findings provide practitioners with valuable indications under which circumstances the use of analytical methods appears reasonable.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Budgets are widespread but are criticized just as strongly by practitioners and academics (Ekholm and Wallin 2000; Hope and Fraser 2003; Jensen 2003; Sivabalan et al. 2009). Frequently cited points of criticism are, for example, that budgets are time-consuming, add too little value given the time required to prepare them, or that they are too often based on unsupported assumptions and guesswork (Hansen et al. 2003; Neely et al. 2003). Although research has presented alternatives such as non-budgeting (Becker 2014), beyond budgeting (Bøgsnes 2009; Østergren and Stensaker 2011; Becker 2014) and better budgeting (Neely et al. 2003), traditional budgeting tends to keep its strong position in companies (Henttu-Aho and Järvinen 2013).

Yet, the current advances in information technology have the potential to make a lasting difference to the ways that accounting in general and budgeting in specific is carried out (e.g., Taipaleenmäki and Ikäheimo 2013). Business intelligence (BI) solutions offer new opportunities to automatically collect and leverage data that support data-driven decision making (Brynjolfsson and McElheran 2016). In fact, there seems to be an upward trend for using quantitative modeling such as business analytics (Fotr et al. 2015), which refers to the extensive use of data and corresponding sophisticated analyses. These new advances can surpass human performance levels and help companies to improve decision making. Further, prior research highlights that the successful implementation of information technology (IT) innovations, in general, allows companies to achieve significant improvements in the areas of time savings and convenience (Brynjolfsson and Hitt 1995, 2000; Davenport and Short 1990).

Time savings and increased convenience seem particularly promising for the budgeting process as both relate directly to frequently cited points of criticism. Therefore, we investigate whether the use of business analytics in the budgeting process increases satisfaction with the budgeting process. Further, we consider that the use of business analytics in the budgeting process likely differs between companies because the required costs are high while the organizational advantages are uncertain ex-ante (Brynjolfsson et al. 2019). Therefore, we also examine factors that potentially affect the cost–benefit-ratio and consequently the degree of dissemination of using analytical methods. Specifically, we focus on one technical determinant, which is the sophistication of data infrastructure, because a more sophisticated data infrastructure reduces the additional costs of implementing business analytics in the budgeting process. We also consider that the importance of the two major budgeting functions (the planning and the evaluation function) could have an impact on the urgency of investing in analytical solutions and, thus, could affect the degree of dissemination of using analytical methods. This can be attributed to the different purposes of the budgeting functions, which range from the best estimate of an expected outcome (planning function) to a motivational target (evaluation function) (Emmanuel et al. 1990). Business analytics likely supports the planning function because they can help companies to reduce the duration of budgeting and to improve the accuracy of planning. Therefore, we expect that a company’s importance of the planning function is positively associated with its use of business analytics. With regard to the evaluation function, the use of business analytics could allow companies to set more accurate targets by the use of technology. However, companies that emphasize the evaluation function could also consciously avoid the use of business analytics because employee participation in the budgeting process offers psychology-based reasons for higher employee performance. Therefore, we expect that there is no association between a firm’s importance of the evaluation function and the use of business analytics.

To investigate these potential determinants of the use of business analytics in the budgeting process and to examine the effect of business analytics on satisfaction with the budgeting process, we conducted a survey among German companies. Our data set contains 115 responses of company representatives. Using a partial least squares model (PLS), the empirical results provide statistical support for our predictions. We find that data infrastructure sophistication is significantly positively associated with the extent of using business analytics in the budgeting process. Further, we find that a firm’s importance of the planning function of budgeting is significantly positively associated with the use of business analytics in the budgeting process. However, we find no statistically significant association between a firm’s emphasis on the evaluation function and use of business analytics in the budgeting process. Finally, the empirical findings support our expectation of increased satisfaction with the budgeting process in association with a greater extent of using business analytics.

Our study contributes to research and practice in several ways. First, by investigating the use of business analytics in the budgeting process, we respond to several calls from prior literature to analyze how technology affects management accounting. As we examine the effect of business analytics on satisfaction with the budgeting process, we illuminate an important “technology-driven significant change […] in the field of accounting” (Taipaleenmäki and Ikäheimo 2013, 341). With the explicit focus on analytical methods as a subpart of BI solutions, we also add to Elbashir et al. (2011, 178), who posit that “future research should explore this [BI] diffusion phenomenon in order to better understand the impact on management accountants’ roles.” Second, we investigate the effects of business analytics on one of the most important management accounting tools, namely budgeting. Thereby, we add to the predominantly descriptive literature stream that assesses the status quo of digitization and the use of business analytics in accounting and “Controlling” (e.g., Keimer and Egle 2018; Schäffer and Weber 2018). More specifically, we identify factors that influence the extent of the use of business analytics in the budgeting process. Third, while prior research has mainly focused on the performance effects of digitization (e.g., Chae et al. 2014; Elbashir et al. 2008; Côrte-Real et al. 2017) and system success (e.g., Chapman and Kihn 2009; Elbashir et al. 2011), we contribute to this research stream by investigating the effect of digitization on the perceptual measure of satisfaction with the budgeting process. Finally, we expand prior research on budgeting by using self-created measures, which is in line with the call of Sivabalan et al. (2009, 868) to “broaden the way we measure existing budget variables.”

From a practical point of view, we inform practitioners that investments in the data infrastructure are necessary to improve processes. Further, we provide indications when these investments are particularly necessary, i.e., when the planning function of budgeting is pursued, but not when the evaluation function is preferred. We also show that efforts to support the budgeting process with analytical methods lead to overall higher satisfaction with the process. Hence, firms who are dissatisfied with the budgeting process could evaluate whether analytics could benefit them with overcoming their problems.

The remainder of this study proceeds as follows. Section 2 provides the background to budgeting in general and its interplay with business analytics. Section 3 presents the hypotheses development. Section 4 describes the methodology of our study. Section 5 presents the survey results. Section 6 concludes the paper.

2 Background and related literature

2.1 Budgeting

Budgets are an important tool for short-term planning and control in organizations (Anthony et al. 2007; Otley 1999). They assist companies in making decisions about alternative courses of action (Merchant and Van der Stede 2012) and allow them to reflect on their operating capacity utilization (Langfield-Smith et al. 2005). In this sense, we define budgeting as the entirety of the processes that describe the development and use of budgets.

Budgeting can be used for both operational and strategic functions. However, as the potential benefits of digitization for companies are much more apparent in operational budgeting functions than in strategic functions, we are focusing on the operational budgeting functions (Hansen et al. 2003; Hansen and Van der Stede 2004; Sivabalan et al. 2009). Thereby, budgeting can serve different operational functions, each with different implications. Extant research identifies three major functions of operational budgeting: evaluation, planning, and control (Henttu-Aho and Järvinen 2013; Sivabalan et al. 2009).

The evaluation function of budgeting refers to the budget-based performance-evaluation. Since performance evaluation can apply to both individuals and organizational units, it can be divided into staff evaluation and business unit evaluation. Such a distinction can be particularly useful in highly volatile environments where companies may refuse to use budgets to evaluate their employees but still want to know how the business unit has been performing relative to a budget (Sivabalan et al. 2009). Yet, prior research focuses on the staff evaluation function of budgeting because of its great practical importance and its inherent conflicts between superiors and subordinates. We follow this line of research and focus on the staff evaluation function in the following.

The planning function of budgeting refers to the development of plans. It includes the coordination of resources across organizational units, formulation of action plans, determination of expected costs as a basis of price floors, and encouragement of innovative behavior (Sivabalan et al. 2009). Conceptually, the planning function is decoupled from budget-based performance-evaluation aspects so that the accuracy of planning should only reflect the ability to predict changing circumstances and should not include evaluative or motivating considerations (Arnold and Artz 2019; Henttu-Aho 2018). Vice versa, when providing estimates, managers who prioritize the evaluation function of budgeting could, therefore, distort information due to the (un)conscious evaluation focus.

The control function is regarded as another standalone function of budgeting. Specifically, the board of directors tends to use budgets as a monitoring device since budgets are one of the few formal financial controls that are provided to directors (Baysinger and Butler 1985). Further, budgets can also be used for the control of costs during the period. However, the control function is independent of predicting future developments and also less time-consuming. Since the advantages of business analytics are unlikely to materialize in the control function, our study focuses on the planning and staff evaluation functions of budgeting.

While budgets can be expressed in different ways, annual budgets are often set up as formal financial controls (Merchant and Van der Stede 2012; Sivabalan et al. 2009). The time horizon of annual budgets for budget planning is 1 year, and the results are accompanied by formal process guidelines and close integration with the annual performance assessment (Merchant and Van der Stede 2012). In addition to annual budgets, companies also use alternative budget forms that are updated more than once a year such as rolling forecasts (Haka and Krishnan 2005). Rolling forecasts refer to continuous and periodical (monthly or quarterly) forecast updates of the budget so that companies can adapt flexibly to new market conditions (Haka and Krishnan 2005; Hansen 2011; Hansen and Van der Stede 2004).

As annual budgets and rolling forecasts have different time horizons, the findings of recent research suggest that companies are using rolling forecasts as a complementary tool supporting the planning and control functions of annual budgeting (Ekholm and Wallin 2000; Henttu-Aho and Järvinen 2013; Sivabalan et al. 2009). It is thus likely and plausible that rolling forecasts are well interrelated with the annual budgeting process in practice. In fact, elements of rolling forecasts can also be found in annual budgeting in the sense that companies update their budgets after extraordinary events (Henttu-Aho 2018). However, these findings also imply that the dimensions of annual budgets and rolling forecasts overlap with the budgeting functions. With respect to Sivabalan et al. (2009), who find that the planning and control functions are regarded as more important than the evaluation function of budgeting, it appears that this relation is valid for both annual budgets and rolling forecasts. Besides, the focus of companies is often shifted to the corporate environment so that organizational considerations are pushed into the background. Especially when companies operate in a volatile environment, the importance of the planning function grows, such that forecasts have to be carried out much more frequently and with higher accuracy (Becker et al. 2016; Goretzki and Messner 2016; Palermo 2018). In other words, there is a clear tendency towards more predictive accounting practices (Henttu-Aho 2018), which can be supported by analytical software.

2.2 Business analytics

BI systems typically build on an existing enterprise resource planning (ERP) system to enhance data integration, preparation and analysis, and to support decision-making (Halladay 2013). In recent years, there has been substantial progress in data storage and processing technologies so that managers can now incorporate new opportunities in collecting and handling data into their decision-making (Brynjolfsson and McElheran 2016). In addition, BI systems are generally designed in such a way that they can also be used effectively in managerial control (Huikku et al. 2017). As such, BI comprises a number of different analysis techniques or simply put business analytics.

Previous research on business analytics has not yet been able to agree on a common definition. Instead, different perspectives have emerged in an attempt to define business analytics (e.g., Holsapple et al. 2014). From a frequently cited capability-set perspective, business analytics can be understood as “the extensive use of data, statistical and quantitative analysis, explanatory and predictive models, and fact-based management to drive decisions and actions” (Davenport and Harris 2007, 7). In this sense, business analytics can be classified as descriptive and diagnostic, predictive, and prescriptive analytics (Applebaum et al. 2017). Descriptive and diagnostic analytics refer to the basic question of what has happened. Typically, descriptive statistics, dashboards and other forms of visualizations are applied (Dilla et al. 2010). Predictive analytics is aimed at uncovering patterns and relationships in data, thereby answering the question of what could happen (Applebaum et al. 2017; Gandomi and Haider 2015). Methods of predictive analytics typically cover statistical techniques such as regression, factor analysis, and clustering or machine learning techniques such as neural networks (Chen et al. 2012; Gandomi and Haider 2015). What distinguishes predictive analytics is its proactive focus on forecasting, while descriptive and diagnostic analytics mainly concentrate on the analysis and reporting of past data (Halper 2013). In other words, predictive analytics uses an inductive logic instead of a deductive logic (Huikku et al. 2017). Finally, prescriptive analytics refers to the question of what should be done and follow an optimizing approach (Gandomi and Haider 2015).

Other definitional approaches understand business analytics as a collection of specific technologies or activities [e.g., online analytical processing (OLAP)] that contributes to improved guidance of human decisions but also provides automated decisions (Bose 2009; O’Dwyer and Renner 2011; Tyagi 2003).

With respect to the general trend of digitization and machine task automation, routine tasks (i.e., precise and carefully codified procedures) are potentially subject to computational automation (Autor et al. 2003; Autor 2013). Given the steadily increasing computational power, IT implementations such as business analytics can expand its scope beyond simple back-office support (Bresnahan et al. 2002). Since budgeting involves a number of recurring process steps, the effects of digitization could be integrated comparatively quickly into companies’ budgeting processes (Warren et al. 2015). Further, there is a general upward trend for using quantitative modeling (Fotr et al. 2015), which is expected to benefit budgeting as it may produce more accurate forecasts for annual budgeting and rolling forecasts (Huikku et al. 2017). Especially in a volatile business environment, more accurate forecasts could prove to be a tremendous competitive advantage (Hofer et al. 2015). Therefore, the use of business analytics in the budgeting process represents a promising improvement in budgeting. Although business analytics does not guarantee exact forecasts, the improved pace and, thus, convenience (Brynjolfsson and Hitt 1995, 2000; Davenport and Short 1990) of the budgeting process appear as enticing prospects, given that time consumption is a major point of criticism of budgeting (Hansen et al. 2003).

Hence, this study investigates the drivers of the use of business analytics in the budgeting process and its effect on satisfaction with the budgeting process. In light of various definitional approaches, we understand business analytics in a multifaceted way so that it consists of a collection of technologies or activities that can contribute to the automation of business processes, but its concrete use depends on the time horizon concerned (descriptive, diagnostic, predictive, and prescriptive analytics). Satisfaction with the budgeting process refers to the satisfaction of the employees who are responsible for the budgeting process with regard to the duration of the process, the use of resources, and costs. In the following, we derive our hypotheses regarding the drivers of the use of business analytics in the budgeting process and its effect on satisfaction with the budgeting process.

3 Hypotheses development

3.1 Data infrastructure sophistication

The data infrastructure sophistication is part of the IT infrastructure sophistication, which refers to “the extent to which an organization has diffused the key information technologies into its foundation for supporting business applications” (Armstrong and Sambamurthy 1999, 309). A more sophisticated data infrastructure relates to a more embedded data management with more standardized and higher quality data that enables companies to acquire and store data and to prepare and retrieve it for analysis (Chen et al. 2012; Gandomi and Haider 2015; Grover et al. 2018; Labrinidis and Jagadish 2012). Data quality is characterized by precision, completeness, timeliness, consistency, unambiguousness, or accessibility of data (Fox et al. 1994; Miller 1996).

While these descriptions may lead to the assumption that all companies use a highly sophisticated data infrastructure to remain competitive, Brynjolfsson et al. (2019) point to the time lag between the IT investment and its benefits. Specifically, they argue that the more far-reaching the investment charges because of a stronger IT implementation, the longer the average time lag between the initial invention of a technology and its full impact on companies. This is because the establishment of a highly sophisticated data infrastructure is frequently accompanied by losses in local autonomy, flexibility, and implementation costs (Goodhue et al. 1992). Further, the time lag between the IT investment and its positive impact on companies implies that companies have fewer problems estimating the contemporary IT investment than future advantages. For example, the use of a highly sophisticated data infrastructure requires skilled but also costly managers and employees that make use of the data availability (Bresnahan et al. 2002). In contrast, the positive effects on decision making are comparatively uncertain. Therefore, it is not only important but also challenging for companies to determine the specific level of the sophistication of the data infrastructure whose benefits exceed the costs of implementation (Goodhue et al. 1992).

With regard to business analytics, companies aim at evaluating complex and relevant data that is available in the company-wide database along with other information (Granlund and Malmi 2002). This implies that the use of such highly computerized organizational processes is accompanied by greater production of data (Bresnahan et al. 2002). The ability to process new information and make external data usable is, therefore, one of the most important factors in the integration of BI systems into corporate structures (Elbashir et al. 2011). Hence, business analytics creates more value for companies when they are integrated more within the data infrastructure (Elbashir et al. 2013). As a result, more sophisticated data infrastructure increases the benefits of business analytics (Elbashir et al. 2011). Specifically, companies have to undergo some kind of learning process in order to overcome obstacles and to make individual adaptations that meet their needs. Vice versa, a more sophisticated data infrastructure reduces the additional costs of implementing business analytics and thus makes it more likely that its benefits exceed the costs of implementation.

Since the positive effects of business analytics are higher and accessible at lower costs when companies have made higher investments in their data infrastructure, we expect that a more sophisticated data infrastructure facilitates the use of business analytics in the budgeting process. Thus, we propose the following hypothesis:

H1:

The sophistication of the data infrastructure is positively associated with a company’s use of business analytics in the budgeting process.

3.2 Planning and evaluation function of budgeting

Like almost all business processes, budgeting follows a clear economic logic: at the beginning, the budgeting process is assigned to employees because they are flexible and adaptive. With a steady increase in formalization and codification, forecast estimations become more accessible for business analytics since computers usually outperform humans in the execution of repetitive mathematical tasks (Autor 2013). In addition, analytical methods can better incorporate planning constraints such as limited resources and dependencies between subunits than humans (Grover et al. 2018). Further, business analytics promises a faster budgeting process and thus greater convenience (Brynjolfsson and Hitt 1995, 2000; Davenport and Short 1990), which is an important advantage in view of the otherwise time-consuming budgeting process.

With regard to the planning function of budgeting, business analytics enables companies to better predict future developments and simplify scenario analyses (Davenport and Harris 2007). Then, the predicted forecast reflects the actual outcome more precisely. This is important because it allows firms to set up more accurate plans and therefore to improve decision making. Prior research supports this argument because a high level of forecast accuracy can be a decisive advantage when companies operate in a highly competitive or uncertain environment, (Becker et al. 2016; Goretzki and Messner 2016; Palermo 2018). Research also provides evidence that the budgeting process duration is higher when forecast accuracy is lower (Schäffer and Weber 2016). This result suggests that business analytics can help to reduce the budgeting process’s duration and improve forecast accuracy simultaneously. Against this background, we argue that business analytics is particularly beneficial for enhancing the development of plans. Consequently, we expect that the more the company emphasizes the planning function of budgeting, the more likely it is that the use of business analytics in the budgeting process will be present. We formally state the following hypothesis.

H2a:

A company’s importance of the planning function of budgeting is positively associated with its use of business analytics in the budgeting process.

With regard to the evaluation function of budgeting, on the one hand, companies may also benefit from more accurate budgets and more efficient budgeting processes. As the use of business analytics helps companies to determine more realistic estimates, companies can also deduce budgets that are likely challenging targets (Becker 2014; Bourmistrov and Kaarbøe 2013; Henttu-Aho and Järvinen 2013). Then, companies can also be more confident that variances are due to agents’ insufficient effort. Further, the use of business analytics can help companies to circumvent issues related to agents’ strategic behavior when determining the budget if agents deploy their informational advantage opportunistically during the budgeting processes. Therefore, companies that emphasize the evaluation function of budgeting could be more inclined to use business analytics in the budgeting process.

On the other hand, companies may explicitly refrain from using business analytics when they emphasize the evaluation function of budgeting if companies prefer that their employees participate in the budgeting process. Prior research on participation in budgeting shows that participation can be valuable for the principle because it increases agents’ performance for psychology-based reasons (e.g., Wong-On-Wing et al. 2010). According to Locke and Schweiger (1979), agents’ performance can increase if agents participate in the budgeting process because they attain their own values, greater motivation, and improved flow of information. Further, in an environment of high uncertainty, companies are often inclined not to use budgets to evaluate employees because the unpredictable circumstances make it difficult to utilize the budget as an appropriate performance benchmark (Sivabalan et al. 2009), which in turn would suggest that business analytics are particularly useful. Finally, if budget accuracy is understood to mean how well the budget-related target has been met (Otley 1978; Van der Stede 2000), then no discernible value contribution can be seen from analytical methods, as it is purely intended to serve as an evaluative element. In this case, a company whose major priority is employee motivation will initially avoid the investment costs of a sophisticated data infrastructure and the use of analytical methods in the budgeting process.

To account for the theoretical uncertainty of whether a company’s importance of the evaluation function of budgeting has a positive or negative effect on the use of business analytics in the budgeting process, we formulate the following hypothesis in the null form.

H2b:

There is no association between a company’s importance of the evaluation function of budgeting and its use of business analytics in the budgeting process.

3.3 Effect of business analytics on satisfaction with the budgeting process

Finally, we consider the effect of the use of business analytics in the budgeting process on satisfaction with the budgeting process. Recall that budgets are among the most important and most frequently used instruments in management accounting because budgets offer advantages in terms of planning and coordination (Sivabalan et al. 2009). However, budgets are also often the subject of criticism by both practitioners and researchers (Hope and Fraser 2003; Jensen 2003; Libby and Lindsay 2010; Wallander 1999). The time consumption and the consequently low value relative to the invested time are the main sources of dissatisfaction with the budgeting process (Hansen et al. 2003).

While the use of business analytics in the budgeting process cannot eliminate all problems, it is likely to improve time consumption by potentially offering shorter turnaround times (Grover et al. 2018). Simultaneously, the use of business analytics in the budgeting process requires fewer resources because it increases the process’ automation. In addition, the potentially higher forecasting accuracy is ultimately attributed to the employee who has been responsible for budget estimation, which should also contribute positively to satisfaction. Therefore, we expect that the increased use of business analytics in the budgeting process will lead to higher satisfaction with the budgeting process. This is reflected in the following hypothesis.

H3:

A company’s use of business analytics during the budgeting process is positively associated with satisfaction with the budgeting process.

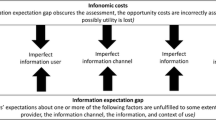

Figure 1 graphically summarizes our research model.

4 Method

4.1 Sample description

To test our hypotheses, we conducted a survey among German companies using the DAFNE database by Bureau van Dyk. To reach potential companies that currently deal with topics of digitization, we restricted our sample selection to companies that employ at least 100 employees and have annual revenue of at least 30 million euros. This results in approximately 17,000 potential addressees, of which we have randomly chosen 2000 companies. We sent a paper-based questionnaire with a signed cover letter to the management accounting (“Controlling”) departments of the companies. Additionally, we provided a short link within the cover letter for participants who wanted to answer the survey online.

The survey period ran from mid-June to mid-July 2018. In total, we received 159 questionnaires, which equates to a response rate of approximately 8%. 107 out of 159 respondents answered the survey online. However, several questionnaires exhibit missing entries of certain items. While we cannot rule out that some data is missing systematically, we decided to exclude observations with missing data instead of extrapolating missing values (e.g., Byrne 2001). Therefore, the final number of observations for our hypothesis tests is reduced to 115. Table 1 provides an industry breakdown of our sample. While metal and mechanical engineering businesses have a slight edge in our sample, the breakdown presents a rather balanced and broad set of companies.

Table 2 presents sample characteristics. Specifically, our questionnaire targeted employees who were working for the finance or (management) accounting (“Controlling”) department of their company, favorably in an executive position. We achieved this goal because all respondents indicated that they work in finance or controlling. In addition, almost 75% of these respondents stated to have an executive function. The respondents’ average working experience within their current company is 12.7 years (median: 10.5 years). On average, survey participants self-assessed their proficiency in information technologies with 4.6 (median: 5), based on a 6-point Likert scale. Besides, only 6 respondents stated a 3, indicating more of a beginner level while about 95% would rate themselves between an advanced or expert level.Footnote 1 More than half of our respondents state that their companies’ total annual revenues lie between 50 and 1000 million euros and more than a fourth report revenues above 1000 million euros. Finally, most of our respondents state that their company belongs to a group that has several consolidated companies, which is an indicator of the importance of budgets within these organizations.

To test for a potential (non-)response bias (see, e.g., Armstrong and Overton 1977), we divide our sample into three parts, depending on when the survey has been answered. Performing a Kruskal–Wallis test, all survey constructs show no significant differences between early, middle and late respondents (p > 0.180, two-tailed). Hence, we infer that a potential non-response bias is unlikely to affect our inferences.

4.2 Variable measurement and control variables

Our questionnaire consists of three main areas. First, we gather information about the budgeting process and related aspects, such as satisfaction with the process. Second, we gather information about current software use, data governance, and deployed analytical techniques. Third, we pose questions about the respondents’ companies and personal attributes.

Based on a thorough literature review, we found that there are no existing instruments that will adequately capture the construct of using analytical methods in the budgeting process. We, therefore, use self-developed items because of at least two reasons. First, we intended to create items, which are particularly suited for German companies because of their specific style of budgeting (Kloock and Schiller 1997; Guenther 2013). Second, by using self-developed items we follow the call of Sivabalan et al. (2009) for alternative ways to measure budgeting variables. Although we are aware that the budgeting process can differ vastly (e.g., annual budgets vs. rolling forecasts), the general reasons for budgeting do not vary between its concrete types. Irrespective of the frequency of setting the budget, companies regularly pursue a specific purpose with budgets. In line with that reasoning, Sivabalan et al. (2009) find that there is no difference in the importance of the motives of planning/control and evaluation between rolling forecasts and annual budgets. In addition, they indicate that it is hard to separate annual budgets from rolling forecasts because companies often use rolling forecasts in parallel to annual budgets.

While developing new scales is always considered a sensitive process (Schmitt and Klimoski 1991), the frequently listed difficulties in the development process are mainly due to the aspiration to create behavioral measures (McCoach et al. 2013). In contrast, our scale captures methods or techniques that are deployed. Thus, the use of questions regarding a firm’s deployment of an analytical method is less prone to social desirability reporting (Edwards 1957) because it does not induce the respondent to self-report a favorable behavior. Besides, the wording of the items is likely to be less of an issue here since the items consist only of the analytical methods (e.g., “online analytical processing”). Nevertheless, we follow the typical steps to validate our measure. After an extensive item generation period that comprised extant literature, we pre-tested the content of our scale by using expert judges (DeVellis 2017). For this purpose, we have conducted several interviews with practitioners and adjusted our items accordingly. Lastly, we use a confirmatory factor analysis for data reduction and refining constructs (Ford et al. 1986) and goodness-of-fit indices to assess the model’s fit (MacKenzie et al. 1991). This will be further discussed in the measurement model section.

In accordance with Elbashir et al. (2011), our final measurement instrument consists of key components that capture the dimensions of business analytics, data infrastructure sophistication, as well as the importance of the planning and evaluation functions of budgeting. We use multiple items to measure each of our hypothesized variables since the use of multiple items for measuring theoretical constructs is considered robust (Gorsuch 1997). Unless stated otherwise, we deployed 6-point Likert-scales to prevent respondents from simply choosing the midpoint.

Use of business analytics in the budgeting process (ANALYT) Due to the multifaceted nature and the correspondingly various definitional approaches of business analytics, we created a large number of items that more or less accurately reflect our desired construct. In total, we ask survey participants about the extent to which their company (1) has or uses automated data integration and harmonization, (2) deploys technologies such as OLAP, big data analytics, text mining, natural language generation, regression analyses, time-series analyses, or classification, and we ask participants to rate the (3) overall extent to which methods from descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics are used. Lastly, we survey how they would assess the company’s level of automated processes during the budgeting process. However, the large number of items is also associated with a certain amount of dispersion, which means that not all items meet the validity criteria in order to be included in the final latent variable. As indicated, the measurement model section describes how we derive the final model.

Data infrastructure sophistication (DATA_INFRA) With this construct, we also aim to cover a broad field with our used items. We capture the extent to which the respondent’s company has standardized master data, data governance as well as the perceived data quality in terms of precision, completeness, timeliness, consistency, unambiguousness, and accessibility.

Importance of the planning function of budgeting (PLAN) To measure one of the two major functional areas, we ask respondents to indicate the importance of different functions of budgeting, anchored by 1 (extremely unimportant) and 6 (extremely important). More specifically, respondents assessed how important their companies consider coordination, codification, resource allocation, forecasts, alignment with the company’s objectives, and assignment of decision-making and spending authority as a function of budgeting.

Importance of the evaluation function of budgeting (EVAL) To measure the second functional area, we ask respondents to indicate how important their company considers motivating target attainment, performance evaluation, deviation analyses, and compensation as a function of budgeting.

Satisfaction with the budgeting process (BUDG_SAT) To assess employees’ satisfaction with the process of budget preparation, we break the satisfaction with the process down into single process components by examining respondents’ satisfaction with the fulfillment of budgeting functions as well as the process’ duration, use of resources, and costs.

Control variables In addition to our main variables, we include control variables that could have an impact on the budgeting process or satisfaction with it, distort the response to the survey, or have an impact on business analytics.

With regard to the budgeting process, size and complexity appear as important attributes (Brynjolfsson and McElheran 2016). Hence, we take the company’s annual revenue (REV) and the number of consolidated companies (CONSOL) into account. By using a dummy variable, we split the sample into almost equal parts and divide large companies from smaller ones. We code REV as 1 if the respondent marked an annual revenue of at least one billion euros, 0 otherwise. Regarding CONSOL, we also perform a sample split and code it as 1 when the respondents indicated at least 6–20 consolidated companies on the scale, resulting in a sample split of 51 companies with comparably low consolidation efforts and 64 highly consolidated companies.

Moreover, we add two aspects that are potentially associated with the satisfaction of the budgeting process. First, we include the approximate duration of the budget preparation process in weeks (BUDG_DURA), as time consumption is a major point of criticism (Hansen et al. 2003). Second, we add a factor measuring the perceived participation in the company’s budget preparation process (BUDG_PART) because a process design allowing for higher levels of participation is likely to increase employees’ satisfaction with the process (Derfuß 2016). The corresponding factor consists of three items, capturing the extent of employees’ input when setting the budgets.

Further, the respondent’s position (EXEC) within the company may alter his or her view on satisfaction with the budgeting process. We code EXEC as 1 if the respondent indicated that he or she has an executive position either in top management or in the finance or accounting department.

Finally, we include attributes that could influence (the evaluation of) the use of business analytics in the budgeting process. In accordance with Brynjolfsson and McElheran (2016), we control for the respondents’ knowledge and expertise regarding IT (IT_EXP), which may potentially lead to biased responses in terms of the state of the use of business analytics. Moreover, we distinguish between group subsidiaries (SUBSID) and group headquarters since this will likely affect the budgeting process and, hence, the degree of use of digitization. We code SUBSID as 1 if the respondent stated that he or she works for a subsidiary, 0 otherwise.

4.3 Measurement model

We evaluate our theoretical model with confirmatory factor analysis (Gerbing and Anderson 1988). We assess the model fit by using a two-step modeling approach that first evaluates the measurement model to assure its fit and then examines the full structural model (Schumacker and Lomax 2016). Since the majority of the constructs in this study were new constructs, factor analysis has been performed initially to clarify the elements of the constructs. In this way, we also check the reliability, convergent validity, and discriminant validity (Chin 1998; Fornell and Bookstein 1982; Tenenhaus et al. 2005) of our measures. The scales resulting from the analysis were then used in the final confirmatory factor analysis. This approach is similar to that in Fullerton and Wempe (2009).

We use average variance extracted (AVE) and composite reliability (CR) to assess the general reliability (Chin 1998; Fornell and Larcker 1981). With respect to AVE, only BUDG_SAT (0.64) and EVAL (0.55) exceed the general threshold of 0.5. However, Fornell and Larcker (1981) point out that if AVE is less than 0.5, but CR is higher than 0.6, the convergent validity of the construct is still adequate. All latent variables exceed the threshold of 0.6 (Bagozzi and Yi 1988), with PLAN having the worst CR with 0.73.Footnote 2 These results indicate good consistency of all constructs, even when using another suggested threshold of 0.70 (Nunnally 1978).

Regarding convergent validity, we check the factor loadings of the measures on their respective constructs (Chin 1998; Tenenhaus et al. 2005). We use the common threshold of 0.5 as a cut-off value (Hair et al. 1995, 2010; Hulland 1999) and retain all items whose reliability exceeds this value. In contrast, this means that we delete 9 out of 38 items due to insufficient factor loadings. Table 3 provides an overview of the final items, their corresponding factor loadings, means, and standard deviations.

With regard to the means, Table 3 also shows that respondents indicate a predominantly average level of satisfaction with the duration (3.347) and commitment of resources (3.339) of the budgeting process. Satisfaction with the costs of the process is significantly higher than the scale’s midpoint of 3.50 (t = 3.77, p < 0.001; one-tailed). Regarding the use of business analytics (ANALYT), the items of OLAP, descriptive analytics, and diagnostic analytics have the highest standard deviations of the sample, indicating considerable differences between companies. Moreover, all items of ANALYT have mean values that are significantly lower than the scales midpoint (all p ≤ 0.016, one-tailed). In addition, the frequency of use decreases when we cross the line from reporting and analyzing historical data to proactively forecasting the future (Halper 2013; Huikku et al. 2017). Specifically, sample firms use descriptive analytics significantly more frequently than predictive analytics (t = 4.09, p < 0.001, one-tailed). This marks an interesting IT-related productivity paradox while digitization is a trending topic with great opportunities, but companies currently struggle to implement corresponding solutions (Brynjolfsson et al. 2019).

To ensure discriminant validity, we compare the square root of the AVE of each latent variable with the correlation of the latent constructs in the model. Hence, Table 4 presents the correlations between the different constructs in the lower left, off-diagonal elements of the matrix, and the square root of the AVE for each of the constructs along the diagonal (marked in bold). As can be seen from Table 4, every square root of each construct’s AVE has a higher value than the correlations with other latent constructs. Therefore, the Fornell–Larcker criterion is met so that we can assume adequate discriminant validity (Fornell and Larcker 1981; Hulland 1999).

5 Results

5.1 Hypothesis tests

To account for the sample size, we employ the partial least squares path modeling method (PLS). Since PLS is a distribution-free method, it is generally not possible to obtain p values and confidence intervals for the parameters of the model. For this reason, the model is usually computed using bootstrapping (Davison and Hinkley 1997). Thereby, the standard errors of the individual parameters are estimated using bootstrapping procedures (e.g., Hair et al. 2017). To test the effects and statistical significance of our constructs in the structural model, we use a bootstrapping procedure with 500 resamples (Chin 1998, 2001). Table 5 shows results (Panel A without controls, Panel B with controls). Figure 2 illustrates them in a graphical model.

H1 predicts that data infrastructure sophistication (DATA_INFRA) is positively associated with the use of business analytics in the budgeting process. In line with our prediction, the standardized coefficient of DATA_INFRA is positive and significant (β = 0.33, p < 0.001), which supports our argument that companies with a higher sophistication level of their data infrastructure are better enabled to integrate analytics solutions. Panel B of Table 5 shows that the result is robust (β = 0.28, p < 0.001) when controls are added.

H2a predicts a positive association between the importance of the planning function (PLAN) and the degree of the use of business analytics in the budgeting process (ANALYT). The empirical results support this prediction with a positive and significant coefficient (Panel A: β = 0.23, p = 0.007; Panel B: β = 0.23, p = 0.004). Thus, companies use business analytics more when they put more emphasis on the planning function of budgeting. Concerning the evaluation function (EVAL), H2b makes no prediction regarding the link to ANALYT. In fact, we do find a slightly positive but insignificant coefficient, both for the base model (β = 0.08, p = 0.379) and the model with control variables (β = 0.07, p = 0.414). While this result agrees with the theoretical considerations, the insignificant correlation may also be related to the small sample size. We discuss this result in more detail in the conclusion.

Concerning H3, we predict that increased use of business analytics in the budgeting process (ANALYT) will ultimately increase the perceived level of satisfaction with the budgeting process (BUDG_SAT). As predicted, we find statistical support for a positive association between ANALYT and BUDG_SAT for both the base model (β = 0.25, p = 0.001) and the model with control paths (β = 0.16, p = 0.079).

To see how much predictive value the latent variables add to the model, we determine their additive explanatory power by calculating Cohen’s f2 effect size measure (Chin et al. 2003; Cohen 1988). The results show that all significant predictor variables also have Cohen’s f2 measures greater than 0.02, indicating that the inclusion of the latent variables DATA_INFRA, PLAN, and ANALYT increases the explanatory power of the model. In addition, when control variables are added, the effect strength classification does not change. Overall, the effect sizes of DATA_INFRA (f2 = 0.107), PLAN (f2 = 0.028), and ANALYT (f2 = 0.055) are small. However, this may also be related to the small sample size.

Some of the control variables may also contribute to the explanation of the model. For instance, we find significant indications that the respondents’ IT expertise (IT_EXP) explains some of the variance of ANALYT (β = 0.17, p = 0.023). The corresponding effect size is small, though (f2 = 0.025). Further, SUBSID is negatively associated with ANALYT (β = -0.17, p = 0.067, f2 = 0.019), which suggests that analytical methods are used more at the group level than in subsidiaries, which appears plausible. With regard to possible other variables that could explain satisfaction with the budgeting process, the PLS reveals a negative and highly significant influence (β = − 0.34, p < 0.001, f2 = 0.131) of the duration of the budgeting process (BUDG_DURA). This effect is in line with prior literature, which highlights the time-consuming duration of the budgeting process (Hansen et al. 2003; Neely et al. 2003). Conversely, the shorter the process, the more satisfied the employees are with the budgeting process. Finally, CONSOL has a negative and significant effect on BUDG_SAT (β = − 0.34, p = 0.039, f2 = 0.016). This result is intuitive since the coordination within the budgeting process is more complex, the larger the group of consolidated companies. In sum, we find a qualitatively identical level of statistical support for our hypotheses by adding control variables.

5.2 Robustness check

To test the robustness of our findings, we additionally examine our theoretical model using a covariance-based structural equation model (SEM). We use maximum likelihood estimation for both the measurement model and the full structural model. Where suggested by the statistical computations and justified theoretically, we include covariances between error terms of the same construct (Baines and Langfield-Smith 2003; Shields et al. 2000). Given the small sample size, we take a careful approach and use robust standard errors.

We evaluate the structural fit of the measurement model by using various indicators. Although the model’s χ2 is highly significant, the χ2/df ratio is less than two, indicating an acceptable fit (Kline 2015). In addition, further goodness-of-fit statistics confirm the acceptable fit. Both the Comparative Fit Index (CFI) and the Root Mean Square Error of Approximation (RMSEA) are above/below their acceptable fit level of 0.90 or 0.08, respectively (Bentler 1990; Browne and Cudeck 1993).

Table 6 reveals the standardized coefficients for both models. In essence, the covariance-based SEM largely supports the previously presented results of the PLS model. Concerning our base model, significance levels and effect sizes remain qualitatively unchanged. The associations between DATA_INFRA and ANALYT (β = 0.37, p < 0.001, f2 = 0.121), PLAN and ANALYT (β = 0.26, p = 0.022, f2 = 0.034), and ANALYT and BUDG_SAT (β = 0.26, p = 0.023, f2 = 0.071) all remain significant in the base model. When computing the covariance-based SEM with control variables, DATA_INFRA (β = 0.33, p = 0.002, f2 = 0.064) and PLAN (β = 0.27, p = 0.020, f2 = 0.036) maintain their significant signs and effect sizes. With respect to the effect of ANALYT on BUDG_SAT, the associations also remain statistically significant (β = 0.22, p = 0.048, f2 = 0.047). In addition, the control variables BUDG_DURA, CONSOL, and SUBSID retain their previously shown indications.

6 Conclusion

This study examines potential drivers of the use of business analytics in the budgeting process and the relation between business analytics and satisfaction with the budgeting process. Budgeting is usually very data-driven, which makes it suitable for the application of analytical methods. While traditional budgeting systems are often criticized for being too time-consuming, costly, and inflexible (Hansen et al. 2003; Neely et al. 2003), business analytics may overcome these problems, leading to increased satisfaction with the budgeting process.

We conduct a survey using a data set of 115 German companies to investigate factors determining the use of business analytics in the budgeting process and its effect on satisfaction with the budgeting process. Regarding potential drivers of the use of business analytics in the budgeting process, we predict and find that a sophisticated data infrastructure is positively associated with the use of analytical methods. Moreover, we investigate two major functions of budgeting as possible determinants. On the one hand, our results show that the importance of the planning function is positively associated with the use of business analytics in the budgeting process. Thus, the use of business analytics in the budgeting process seems to be particularly appropriate when a company puts a high emphasis on aspects such as planning, forecasting, coordination, and resource allocation. On the other hand, we find no statistically significant association between a company’s emphasis on the evaluation function of budgeting and the use of business analytics in the budgeting process. While this result could be due to the small sample size, our theoretical arguments are also mixed. Specifically, we argue that companies with a strong focus on the evaluation function prefer that their agents participate in the budgeting process because participation has positive psychology-based effects on performance. In fact, companies with a strong emphasis on the evaluation function might use other tools (e.g., Groves schemes or Weitzman schemes) to elicit “true” budget estimates from agents instead of business analytics. Finally, we find that a greater extent of the use of business analytics in the budgeting process leads to increased satisfaction with the budgeting process.

Our study contributes to both theory and practice. From a theory perspective, we respond to earlier calls of previous research to investigate the influence of digitization, especially of business intelligence elements such as analytical methods, on instruments of management accounting and control Elbashir et al. 2011; Taipaleenmäki and Ikäheimo 2013). Specifically, we contribute to empirical evidence on digitization in budgeting and identify factors that influence the extent of business analytics in the budgeting process. While Chae et al. (2014) examine how the use of business analytics contributes to manufacturing planning quality and operational performance, we provide further insights into what are the determinants for the use of business analytics in the budgeting process and how it affects satisfaction with the budgeting process. We also contribute to the research stream of digitization in (management) accounting by investigating the effect of digitization on the perceptual measure of satisfaction with the budgeting process instead of performance or system success. Studies such as Keimer and Egle (2018) or Schäffer and Weber (2018) highlight the importance of sophisticated data governance or data management as a prerequisite for successful digitization in management accounting. In this context, our study can supplement this perspective with a positive association between the data infrastructure sophistication and the use of business analytics in the budgeting process. From a practical point of view, our results inform practitioners about important factors for and the benefits of increased investment in analytical methods. In this sense, our results indicate that there is at least a perceived positive association between the increased use of business analytics in the budgeting process and satisfaction with the budgeting process so that the investment can pay off.

Since our study is based on a survey among 115 accounting representatives of German companies, it is subject to a number of limitations. First, there is a threat for potential self-selection bias in our study because it is plausible that particularly companies, which have made substantial progress in analytics, tend to participate in a survey as ours. Therefore, our study could overestimate the current state of the use of business analytics in German companies. Second, our study covers only a short time frame that does not enable the examination of intertemporal effects of increased use of business analytics in the budgeting process. Future studies could, therefore, conduct consecutive surveys to gain new insights. Third, German companies inherited a specific way of cost accounting and budgeting (Kloock and Schiller 1997; Guenther 2013). Therefore, our findings may not be transferable to other European countries or Anglo-Saxon companies. Fourth, while our results study the perceived satisfaction with the budgeting process, we cannot draw inferences about forecast accuracy. However, accuracy is only one possible outcome of business analytics in the budgeting process because business analytics could also provide more insights, allow better coordination, or increase convenience. The various potential outcomes of business analytics might also explain why business analytics are not clearly useful for evaluation purposes. We leave it to future research to investigate the various potential outcomes of business analytics in budgeting. Finally, while we surveyed managers or (management) accountants in an executive function, our results are likely to present biased results in terms of employee satisfaction. Regarding the budgeting process, one could argue about diverging interests between (1) subunits and management accountants, and (2) superiors and subordinates, especially in the accounting department. Thus, future studies could investigate the effects of the use of business analytics on satisfaction with the budgeting process from a subunit point of view. Similarly, the threats of budgeting automation to the job security of lower-level management accountants could be examined (Huerta and Jensen 2017).

Notes

While this result gives an indication that the respondents are familiar with IT in their company, the mean value should not be over-interpreted against the background of a potential self-serving bias.

We use composite reliability (McDonald 1970; Raykov 1997a) instead of Cronbach’s alpha because the latter measure wrongly assumes equal factor loadings of all items in a factorial model (tau-equivalence) (Bollen 1989; Raykov 1997b). In contrast, composite reliability constitutes a superior choice and considers standardized loadings and measurement error for each item (Shook et al. 2004).

References

Anthony, R. N., Govindarajan, V., & Dearden, J. (2007). Management control systems (Vol. 12). New York, NY: McGraw-Hill.

Applebaum, D., Kogan, A., Vasarhelyi, M., & Zhaokai, Z. (2017). Impact of business analytics and enterprise systems on managerial accounting. International Journal of Accounting Information Systems,25, 29–44.

Armstrong, J. S., & Overton, T. S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research,14(3), 396–402.

Armstrong, C. P., & Sambamurthy, V. (1999). Information technology assimilation in firms: The influence of senior leadership and IT infrastructures. Information Systems Research,10(4), 304–327.

Arnold, M., & Artz, M. (2019). The use of a single budget or separate budgets for planning and performance evaluation. Accounting, Organizations and Society, 73, 50–67.

Autor, D. H. (2013). The” task approach” to labor markets: An overview. Journal of Labour Market Research,46, 185–199.

Autor, D. H., Levy, F., & Murnane, R. J. (2003). The skill content of recent technological change: An empirical exploration. The Quarterly Journal of Economics,118(4), 1279–1333.

Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the academy of marketing science, 16(1), 74–94.

Baines, A., & Langfield-Smith, K. (2003). Antecedents to management accounting change: A structural equation approach. Accounting, Organizations and Society,28(7–8), 675–698.

Baysinger, B. D., & Butler, H. N. (1985). Corporate governance and the board of directors: Performance effects of changes in board composition. Journal of Law Economics and Organization,1(1), 101–124.

Becker, S. D. (2014). When organisations deinstitutionalise control practices: A multiple-case study of budget abandonment. European Accounting Review,23(4), 593–623.

Becker, S. D., Mahlendorf, M. D., Schäffer, U., & Thaten, M. (2016). Budgeting in times of economic crisis. Contemporary Accounting Research,33(4), 1489–1517.

Bentler, P. M. (1990). Comparative fit indexes in structural models. Psychological Bulletin,107, 238–246.

Bøgsnes, B. (2009). Implementing beyond budgeting: Unlocking the performance potential. New York, NY: Wiley.

Bollen, K. A. (1989). A new incremental fit index for general structural equation models. Sociological Methods & Research,17(3), 303–316.

Bose, R. (2009). Advanced analytics: Opportunities and challenges. Industrial Management & Data Systems,109(2), 155–172.

Bourmistrov, A., & Kaarbøe, K. (2013). From comfort to stretch zones: A field study of two multinational companies applying ‘beyond budgeting’ ideas. Management Accounting Research,24(3), 196–211.

Bresnahan, T. F., Brynjolfsson, E., & Hitt, L. M. (2002). Information technology, workplace organization, and the demand for skilled labor: Firm-level evidence. The Quarterly Journal of Economics,117(1), 339–376.

Browne, M. W., & Cudeck, R. (1993). Alternative ways of assessing model fit. Sage Focus Editions,154, 136.

Brynjolfsson, E., & Hitt, L. (1995). Information technology as a factor of production: The role of differences among firms. Economics of Innovation and New Technology,3(3–4), 183–200.

Brynjolfsson, E., & Hitt, L. M. (2000). Beyond computation: Information technology, organizational transformation and business performance. Journal of Economic Perspectives,14(4), 23–48.

Brynjolfsson, E., & McElheran, K. (2016). The rapid adoption of data-driven decision-making. American Economic Review,106(5), 133–139.

Brynjolfsson, E., Rock, D., & Syverson, C. (2019). Artificial intelligence and the modern productivity paradox: A clash of expectations and statistics. In A. Agrawal, J. Gans, & A. Goldfarb (Eds.), The economics of artificial intelligence: An Agenda (pp. 23–57). Chicago, IL: University of Chicago Press.

Byrne, B. M. (2001). Structural equation modeling with AMOS, EQS, and LISREL: Comparative approaches to testing for the factorial validity of a measuring instrument. International Journal of Testing,1(1), 55–86.

Chae, B., Yang, C., Olson, D., & Sheu, C. (2014). The impact of advanced analytics and data accuracy on operational performance: A contingent resource based theory (RBT) perspective. Decision Support Systems,59, 119–126.

Chapman, C. S., & Kihn, L. A. (2009). Information system integration, enabling control and performance. Accounting, Organizations and Society,34(2), 151–169.

Chen, H., Chiang, R. H., & Storey, V. C. (2012). Business intelligence and analytics: From big data to big impact. MIS Quarterly,36(4), 1165–1188.

Chin, W. W. (1998). The partial least square approach for structural equation modeling. In G. A. Marcoulides (Ed.), Modern methods for business research (pp. 295–336). Mahwah, NJ: Lawrence Erlbaum Associates.

Chin, W. (2001). PLS-graph user’s guide version 3.0. Houston, TX: C.T. Bauer College of Business, University of Houston.

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research,14(2), 189–217.

Cohen, J. (1988). Statistical power analysis for the behavioral sciences. Hillsdale, NJ: Lawrence Erlbaum Associates.

Côrte-Real, N., Oliveira, T., & Ruivo, P. (2017). Assessing business value of big data analytics in European firms. Journal of Business Research,70, 379–390.

Davenport, T. H., & Harris, J. G. (2007). Competing on analytics: The new science of winning. Boston: Harvard Business Press.

Davenport, T. H., & Short, J. E. (1990). The new industrial engineering: Information technology and business process redesign. Sloan Management Review,31, 11–27.

Davison, A. C., & Hinkley, D. V. (1997). Bootstrap methods and their application (Vol. 1). New York, NY: Cambridge University Press.

Derfuß, K. (2016). Reconsidering the participative budgeting–performance relation: A meta-analysis regarding the impact of level of analysis, sample selection, measurement, and industry influences. The British Accounting Review,48(1), 17–37.

DeVellis, R. F. (2017). Scale development: Theory and applications (4th ed.). Thousand Oaks, CA: Sage.

Dilla, W., Janvrin, D. J., & Raschke, R. (2010). Interactive data visualization: New directions for accounting information systems research. Journal of Information Systems,24(2), 1–37.

Edwards, A. (1957). The social desirability variable in personality assessment and research. New York: The Dryden Press.

Ekholm, B., & Wallin, J. (2000). Is the annual budget really dead? European Accounting Review,9(4), 19–539.

Elbashir, M. Z., Collier, P. A., & Davern, M. J. (2008). Measuring the effects of business intelligence systems: The relationship between business process and organizational performance. International Journal of Accounting Information Systems,9(3), 135–153.

Elbashir, M. Z., Collier, P. A., & Sutton, S. G. (2011). The role of organizational absorptive capacity in strategic use of business intelligence to support integrated management control systems. The Accounting Review,86(1), 155–184.

Elbashir, M. Z., Collier, P. A., Sutton, S. G., Davern, M. J., & Leech, S. A. (2013). Enhancing the business value of business intelligence: The role of shared knowledge and assimilation. Journal of Information Systems,27(2), 87–105.

Emmanuel, C., Otley, D., & Merchant, K. (1990). Accounting for management control (2nd ed.). London, UK: Chapman & Hall.

Ford, J. K., MacCallum, R. C., & Tait, M. (1986). The application of exploratory factor analysis in applied psychology: A critical review and analysis. Personnel Psychology,39(2), 291–314.

Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing Research,19(4), 440–452.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research,18(1), 39–50.

Fotr, J., Špaček, M., Souček, I., & Vacík, E. (2015). Scenarios, their concept, elaboration and application. Baltic Journal of Management,10(1), 73–97.

Fox, C., Levitin, A., & Redman, T. (1994). The notion of data and its quality dimensions. Information Processing and Management,30(1), 9–19.

Fullerton, R. R., & Wempe, W. F. (2009). Lean manufacturing, non-financial performance measures, and financial performance. International Journal of Operations & Production Management, 29(3), 214–240.

Gandomi, A., & Haider, M. (2015). Beyond the hype: Big data concepts, methods, and analytics. International Journal of Information Management,35(2), 137–144.

Gerbing, D. W., & Anderson, J. C. (1988). An updated paradigm for scale development incorporating unidimensionality and its assessment. Journal of Marketing Research,25(2), 186–192.

Goodhue, D. L., Wybo, M. D., & Kirsch, L. J. (1992). The impact of data integration on the costs and benefits of information systems. MIS Quarterly,16(3), 293–311.

Goretzki, L., & Messner, M. (2016). Coordination under uncertainty: A sensemaking perspective on crossfunctional planning meetings. Qualitative Research in Accounting & Management,13(1), 92–126.

Gorsuch, R. L. (1997). Exploratory factor analysis: Its role in item analysis. Journal of Personality Assessment,68(3), 532–560.

Granlund, M., & Malmi, T. (2002). Moderate impact of ERPS on management accounting: A lag or permanent outcome? Management Accounting Research,13(3), 299–321.

Grover, V., Chiang, R. H., Liang, T. P., & Zhang, D. (2018). Creating strategic business value from big data analytics: A research framework. Journal of Management Information Systems,35(2), 388–423.

Guenther, T. W. (2013). Conceptualisations of ‘controlling’ in German-speaking countries: Analysis and comparison with Anglo-American management control frameworks. Journal of Management Control,23(4), 269–290.

Hair, J. F., Anderson, R. E., Tatham, R. L., & William, C. (2010). Multivariate data analysis. New Jersey: Pearson.

Hair, J. F., Hult, G. T. M., Ringle, C., & Sarstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM) (4th ed.). Thousand Oaks, CA et al.: Sage publications.

Hair, J. F., Tatham, R. L., & Black, W. C. (1995). Multivariate data analysis: With readings. Upper Saddle River: Pearson.

Haka, S., & Krishnan, R. (2005). Budget type and performance—The moderating effect of uncertainty. Australian Accounting Review,15(1), 3–13.

Halladay, S. D. (2013). Using predictive analytics to improve decisionmaking. The Journal of Equipment Lease Financing,31(2), B1–B6.

Halper, F. (2013). Predictive analytics for business advantage. Best practice report: TDWI Research.

Hansen, S. C. (2011). A theoretical analysis of the impact of adopting rolling budgets, activity-based budgeting and beyond budgeting. European Accounting Review,20(2), 289–319.

Hansen, S. C., Otley, D. T., & Van der Stede, W. A. (2003). Practice developments in budgeting: An overview and research perspective. Journal of Management Accounting Research,15(1), 95–116.

Hansen, S. C., & Van der Stede, W. A. (2004). Multiple facets of budgeting: An exploratory analysis. Management Accounting Research,15(4), 415–439.

Henttu-Aho, T. (2018). The role of rolling forecasting in budgetary control systems: Reactive and proactive types of planning. Journal of Management Control,29(3–4), 327–360.

Henttu-Aho, T., & Järvinen, J. (2013). A field study of the emerging practice of Beyond Budgeting in industrial companies: An institutional perspective. European Accounting Review,22(4), 765–785.

Hofer, P., Eisl, C., & Mayr, A. (2015). Forecasting in Austrian companies: Do small and large Austrian companies differ in their forecasting processes? Journal of Applied Accounting Research,16(3), 359–382.

Holsapple, C., Lee-Post, A., & Pakath, R. (2014). A unified foundation for business analytics. Decision Support Systems, 46,130–141.

Hope, J., & Fraser, R. (2003). New ways of setting rewards: The beyond budgeting model. California Management Review,45(4), 104–119.

Huerta, E., & Jensen, S. (2017). An accounting information systems perspective on data analytics and Big Data. Journal of Information Systems,31(3), 101–114.

Huikku, J., Hyvönen, T., & Järvinen, J. (2017). The role of a predictive analytics project initiator in the integration of financial and operational forecasts. Baltic Journal of Management,12(4), 427–446.

Hulland, J. (1999). Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strategic Management Journal,20(2), 195–204.

Jensen, M. C. (2003). Paying people to lie: The truth about the budgeting process. European Financial Management,9(3), 379–406.

Keimer, I., & Egle, U. (2018). Die Treiber der Digitalisierung im Controlling. Controlling & Management Review,62(4), 62–67.

Kline, R. B. (2015). Principles and practice of structural equation modeling (4th ed.). New York, NY: Guilford publications.

Kloock, J., & Schiller, U. (1997). Marginal costing: Cost budgeting and cost variance analysis. Management Accounting Research,8(3), 299–323.

Labrinidis, A., & Jagadish, H. V. (2012). Challenges and opportunities with big data. Proceedings of the VLDB Endowment,5(12), 2032–2033.

Langfield-Smith, K., Thorne, H., & Hilton, R. W. (2005). Management accounting: Information for managing and creating value (4th ed.). Sydney, NSW: McGraw-Hill-Irwin.

Libby, T., & Lindsay, R. M. (2010). Beyond budgeting or budgeting reconsidered? A survey of North-American budgeting practice. Management Accounting Research,21(1), 56–75.

Locke, E., & Schweiger, D. M. (1979). Participation in decision-making: One more look. In B. Staw (Ed.), Research in organizational behavior (Vol. 1, pp. 265–339). Greenwich, CT: JAI Press.

MacKenzie, S. B., Podsakoff, P. M., & Fetter, R. (1991). Organizational citizenship behavior and objective productivity as determinants of managerial evaluations of salespersons’ performance. Organizational Behavior and Human Decision Processes,50(1), 123–150.

McDonald, R. P. (1970). The theoretical foundations of principal factor analysis, canonical factor analysis, and alpha factor analysis. British Journal of Mathematical and Statistical Psychology,23(1), 1–21.

McCoach, D. B., Gable, R. K., & Madura, J. P. (2013). Instrument development in the affective domain. New York, NY: Springer.

Merchant, K. A., & Van der Stede, W. A. (2012). Management control systems: Performance measurement, evaluation and incentives (Vol. 3). Harlow: Pearson.

Miller, H. (1996). The multiple dimensions of information quality. Information Systems Management,13(2), 79–82.

Neely, A., Bourne, M., & Adams, C. (2003). Better budgeting or beyond budgeting? Measuring Business Excellence,7(3), 22–28.

Nunnally, J. (1978). Psychometric theory. New York: McGraw-Hill.

O’Dwyer, J., & Renner, R. (2011). The promise of advanced supply chain analytics. Supply Chain Management Review,15(1), 32–37.

Østergren, K., & Stensaker, I. (2011). Management control without budgets: A field study of ‘Beyond Budgeting’ in practice. European Accounting Review,20(1), 149–181.

Otley, D. T. (1978). Budget use and managerial performance. Journal of Accounting Research,16(1), 122–149.

Otley, D. (1999). Performance management: A framework for management control systems research. Management Accounting Research,10(4), 363–382.

Palermo, T. (2018). Accounts of the future: A multiple-case study of scenarios in planning and management control processes. Qualitative Research in Accounting & Management,15(1), 2–23.

Raykov, T. (1997a). Estimation of composite reliability for congeneric measures. Applied Psychological Measurement,21(2), 173–184.

Raykov, T. (1997b). Scale reliability, Cronbach’s coefficient alpha, and violations of essential tau-equivalence with fixed congeneric components. Multivariate Behavioral Research,32(4), 329–353.

Schäffer, U., & Weber, J. (2016). Erfolgsfaktor Planung – Budgetierung und Strategiebeteiligung, Vallendar 2016.

Schäffer, U., & Weber, J. (2018). Digitalisierung ante portas. Controlling,30(1), 42–48.

Schmitt, N. W., & Klimoski, R. J. (1991). Research methods in human resource management. Cincinnati, OH: South-Western Publishing Co.

Schumacker, R. E., & Lomax, R. G. (2016). A beginner’s guide to structural equation modeling (4th ed.). New York, NY: Routledge.

Shields, M. D., Deng, F. J., & Kato, Y. (2000). The design and effects of control systems: Tests of direct-and indirect-effects models. Accounting, Organizations and Society,25(2), 185–202.

Shook, C. L., Ketchen, D. J., Jr., Hult, G. T. M., & Kacmar, K. M. (2004). An assessment of the use of structural equation modeling in strategic management research. Strategic Management Journal,25(4), 397–404.

Sivabalan, P., Booth, P., Malmi, T., & Brown, D. A. (2009). An exploratory study of operational reasons to budget. Accounting and Finance,49(4), 849–871.

Taipaleenmäki, J., & Ikäheimo, S. (2013). On the convergence of management accounting and financial accounting—The role of information technology in accounting change. International Journal of Accounting Information Systems,14(4), 321–348.

Tenenhaus, M., Vinzi, V. E., Chatelin, Y. M., & Lauro, C. (2005). PLS path modeling. Computational Statistics & Data Analysis,48(1), 159–205.

Tyagi, S. (2003). Using data analytics for greater profits. Journal of Business Strategy,24(3), 12–14.

Van der Stede, W. A. (2000). The relationship between two consequences of budgetary controls: budgetary slack creation and managerial short-term orientation. Accounting, Organizations and Society, 25(6), 609–622.

Wallander, J. (1999). Budgeting—An unnecessary evil. Scandinavian Journal of Management,15(4), 405–421.

Warren, J. D., Jr., Moffitt, K. C., & Byrnes, P. (2015). How big data will change accounting. Accounting Horizons,29(2), 397–407.

Wong-On-Wing, B., Guo, L., & Lui, G. (2010). Intrinsic and extrinsic motivation and participation in budgeting: Antecedents and consequences. Behavioral Research in Accounting,22(2), 133–153.

Acknowledgements

Open Access funding provided by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions