Abstract

In this paper we consider the impact of transaction costs on the periodic portfolio revision. We offer a statistical model for simulation of daily returns which can explain the empirical behavior of equity returns. The model is based on ARMA–GARCH processes, principal component analysis, classical tempered stable distribution, and skewed \(t\) copula. The main contribution of this paper is the application of a new approach for modelling transaction costs using daily returns by estimating an optimal portfolio with an arbitrary length for the holding period. Moreover, we compare the portfolio selection problem solved with and without transaction costs by applying different risk and performance measures on simulated returns, taking into account their Sharpe ratio and stable tail-adjusted return ratio. The experimental analysis suggests that the incorporation of transaction costs into an optimal portfolio framework leads to remarkable reduction of the transaction costs and stabilization of the optimal portfolio strategy. However, ignoring transaction costs does not always result in a less efficient portfolio.

Similar content being viewed by others

References

Acerbi C, Tasche D (2001) Expected shortfall: a natural coherent alternative to value at risk. Technical report. http://ideas.repec.org/p/arx/papers/cond-mat-0105191.html

Allen DW (2000) Transaction costs. Encyclop Law Econ (Volume One: The History and Methodology of Law and Economics) 1:893–926

Atkinson C, Wilmott P (1995) Portfolio management with transaction costs: an asymptotic analysis of the morton and pliska model. Math Finance 5(4):357–367

Bachelier L (1900) Théorie de la spéculation. Ann Ec Norm Super 3:21–86

Bianchi ML, Rachev ST, Kim YS, Fabozzi FJ (2010) Tempered infinitely divisible distributions and processes. Theory Probab Appl 55(1):58–86

Biglova A, Ortobelli S, Rachev ST, Stoyanov S (2004) Different approaches to risk estimation in portfolio theory. J Portf Manag Fall 31(1):103–112

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Boyarchenko SI, Levendorskiĭ SZ (2000) Option pricing for truncated Lévy processes. Int J Theor Appl Finance 3:549–552

Carr P, Geman H, Madan D, Yor M (2002) The fine structure of asset returns: an empirical investigation. J Bus 75(2):305–332

Chalmers J, Edelen R, Kadlec G (2001) On the perils of financial intermediaries setting security prices: the mutual fund wild card option. J Finance 56:2209–2236

Chen AH, Fabozzi FJ, Huang D (2010) Models for portfolio revision with transaction costs in the mean–variance framework. In: Guerard JB Jr (ed) Handbook of portfolio construction. Springer, US, pp 131–151

Chen AHY, Jen FC, Zionts S (1971) The optimal portfolio revision policy. J Bus 44(1):51–61

Constantinides GM (1979) Multiperiod consumption and investment behavior with convex transactions costs. Manag Sci 25(11):1127–1137

Constantinides GM (1986) Capital market equilibrium with transaction costs. J Polit Econ 94(4):842–862

Davis MHA, Norman AR (1990) Portfolio selection with transaction costs. Math Oper Res 15(4):676–713

Dematra S, McNeil A (2005) The t copula and related copulas. Int Stat Rev 7(31):111–129

Demchuk A (2002) Portfolio optimization with concave transaction costs. FAME Research Paper Series rp103, International Center for Financial Asset Management and Engineering. http://ideas.repec.org/p/fam/rpseri/rp103.html

Duffie D, Pan J (1997) An overview of value-at-risk. J Deriv 4(3):7–49

Gennotte G, Jung A (1994) Investment strategies under transaction costs: the finite horizon case. Manag Sci 40(3):385–404

Gonzales-Rivera G, Lee T, Yoldas E (2007) Optimality of the riskmetrics var model. Finance Res Lett 4:137–145

Hicks JR (1935) A suggestion for simplifying the theory of money. Economica 2:1–19

Hotelling H (1933) Analysis of a complex of statistical variables into principal components. J Educ Psychol 24(7):498–520

Jolliffe IT (2002) Principal component analysis, 2nd edn. Springer, New York

Jorion P (2006) Value at risk, 3rd edn. McGraw-Hill, New York

Kim YS, Rachev ST, Bianchi ML, Fabozzi FJ (2008) A new tempered stable distribution and its application to finance. In: Bol G, Rachev ST, Wuerth R (eds) Risk assessment: decisions in banking and finance. Springer Physika Verlag, Heidelberg, pp 77–110

Kim YS, Rachev ST, Chung DM, Bianchi ML (2009) The modified tempered stable distribution, GARCH-models and option pricing. Probab Math Stat 29(1):91–117

Kim YS, Rachev ST, Bianchi ML, Fabozzi FJ (2010a) Computing VaR and AVaR in infinitely divisible distributions. Probab Math Stat 30(2):223–245

Kim YS, Rachev ST, Bianchi ML, Fabozzi FJ (2010b) Tempered stable and tempered infinitely divisible GARCH models. J Bank Finance 34:2096–2109

Kim YS, Rachev ST, Bianchi ML, Mitov I, Fabozzi FJ (2011) Time series analysis for financial market meltdowns. J Bank Finance 35:1879–1891

Koponen I (1995) Analytic approach to the problem of convergence of truncated Lévy flights towards the gaussian stochastic process. Phys Rev E 52:1197–1199

Lobo M, Fazel M, Boyd S (2007) Portfolio optimization with linear and fixed transaction costs. Ann Oper Res 152(1):376–394

Mandelbrot BB (1967) The variation of some other speculative prices. J Bus 40:393–413

Markowitz HM (1952) Portfolio selection. J Finance 7(1):77–91

Merton RC (1973) The theory of rational option pricing. Bell J Econ Manag Sci 4(1):141–183

Morton AJ, Pliska SR (1995) Optimal portfolio management with fixed transaction costs. Math Finance 5(4):337–356

Mossin J (1968) Optimal multiperiod portfolio policies. J Bus 41(2):215–229

Nelsen R (2006) An introduction to copulas, 2nd edn. Springer, New York

Pearson K (1901) On lines and planes of closest fit to systems of points in space. Philos Mag 2(6):559–572

Rachev ST, Mittnik S (2000) Stable paretian models in finance. Wiley, New York

Rachev ST, Menn C, Fabozzi FJ (2005) Fat-tailed and skewed asset return distributions: implications for risk management, portfolio selection, and option pricing. Wiley, New York

Rachev ST, Stoyanov S, Fabozzi FJ (2007) Advanced stochastic models, risk assessment, and portfolio optimization: the ideal risk, uncertainty, and performance measures. Wiley, New Jersey

Rachev ST, Martin RD, Racheva B, Stoyanov S (2008) Stable etl optimal portfolios and extreme risk management. In: Mller WA, Bihn M, Bol G, Rachev ST, Wrth R (eds) Risk assessment. Physica-Verlag, Heidelberg, pp 235–262 (Contributions to Economics)

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Finance 26:1443–1471

Rosiński J (2007) Tempering stable processes. Stoch Process Their Appl 117(6):677–707

Sharpe W (1966) Mutual fund performance. J Bus 39(1):119–138

Sklar A (1959) Fonctions de repartition a n dimensions et leurs marges. Publ Inst Stat Univ Paris 8:229–231

Stoyanov SV, Rachev ST, Fabozzi FJ (2007) Optimal Financial Portfolios. Appl Math Financ 14(5):401–436

Yoshimoto A (1996) The mean–variance approach to portfolio optimization subject to transaction costs. J Oper Res Soc Jpn 39(1):99–117

Zugravu B, Oanea DC, Anghelache VG (2013) Analysis based on the risk metrics model. Rom Stat Rev Suppl 61(2):145–154

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 CTS distribution

The tempered stable random variables do not have a closed form of a probability density function, but they are defined by their characteristic function. For \(\alpha \in (0, 2), \, C, \, \lambda _+, \, \lambda _- > 0\), and \(m \in {\mathbb {R}}\). \(X\) is said to have classical tempered stable distribution, if the characteristic function of \(X\) is given by

where \(X \sim CTS(\alpha , C, \lambda _+, \lambda _-, m)\). A Lévy process induced from the CTS distribution is called a classical tempered stable process with parameters \((\alpha , C, \lambda _+, \lambda _-, m)\).

The parameters \(\lambda _+\) and \(\lambda _-\) give the rate of tail decay on the positive and negative part, respectively. If \(\lambda _+ > \lambda _-\), the distribution is skewed to the left and vice versa, and if \(\lambda _+=\lambda _-\), then it is symmetric. The parameter \(\alpha \) describes the tail weight and \(C\) determines the arrival rate of jumps of given size.

The following substitution supposed by Kim et al. (2010b)

leads to \(X \sim CTS(\alpha , C, \lambda _+, \lambda _-, 0)\), where the random variable \(X\) has a zero mean and unit variance, and is called the standard CTS distribution with parameters \((\alpha , \, \lambda _+, \, \lambda _-)\) and is denoted by \(X \sim \) stdCTS\((\alpha , \lambda _+, \lambda _-)\).

In the empirical part of this study we apply the following interesting results, for the CTS distribution derived by Kim et al. (2010a). They give a closed-form solution for the cumulative distribution function \(F_{{X}}\) of \(X\) and for the survival function \(\overline{F}_{{X}}\) of \(X\)

where \(\rho >0\), such that \(|\phi _X (z)|<0\), \( \forall \, z \in {\mathbb {C}}\), with \(\mathfrak {I}(z)=\rho ,\)

where \(\rho <0\), such that \(|\phi _X (z)|<0\), \( \forall \, z \in {\mathbb {C}}\), with \(\mathfrak {I}(z)=\rho \).

The probability density function is given through the inverse Fourier transform

1.2 Principal component analysis

Principal component analysis (PCA) is a technique which simplifies a data set. It was first introduced by Pearson (1901) and Hotelling (1933), while the best modern reference is Jolliffe (2002). The application of the method reduces the dimensionality of multivariate data whilst preserving as much of the relevant information as possible. PCA is a model that reveals the internal structure of the data in a way that best explains its variance. Mathematically, it is defined as an orthogonal linear transformation that transforms the data to a new coordinate system such that the new set of variables, the principal components (PCs), are linear functions of the original variables and are uncorrelated, and the greatest variance by any projection of the data comes to lie on the first coordinate, the second greatest variance on the second coordinate, and so on.

Hence, \(n\) original correlated time series \(y_i\) can be replaced with \(n\) uncorrelated time series \(F_j\) assuming that each \(y_i\) is a linear combination of \(F_j\). Then, the dimensionality reduction is done by choosing only the first \(m\) factors, whose variance is significantly different from zero. Thus, each series \(y_i\) can be approximated as a linear combination of the factors plus small uncorrelated noise

where \(i=1 \ldots n\), and \(n\) is the number of stocks. Generally, the principal component analysis can be applied either to the variance–covariance matrix or to the correlation matrix.

1.3 Skewed \(t\) copula

A multivariate function \(C\) on \([0, 1]^m\) is called an \(m\)-dimensional copula function, if it is a distribution function with standard uniform marginal distributions on [0,1]. According to Sklar’s Theorem (1959) and Nelsen (2006) every cumulative density function \(F\) with marginal distributions \(F_1,\ldots , F_m\) can be written as

where \(C\) is a copula function, which is uniquely determined on \([0, 1]^m\) for distributions \(F\) with absolutely continuous margins. Any copula \(C\) can be employed to join a collection of univariate cumulative density functions \(F_1,\ldots , F_m\), so we can achieve a multivariate cumulative density function \(F\) with margins \(F_1,\ldots , F_m\). For strictly increasing continuous marginals the copula \(C\) of their joint distribution function can be extracted from (14) by evaluating

where the \(F^{-1}_i\) are the quantile functions of the marginals. The form of the multivariate skewed Student’s \(t\) distribution, which we apply is defined through the following stochastic representation supposed by Dematra and McNeil (2005),

where \(W \in \) IG\((\nu /2, \nu /2)\) and \(Z \in N(0,\varSigma )\) and \(Z\) is independent of \(W\), \(\gamma =(\gamma _1,\ldots , \gamma _m)\) is an \(m\)-dimensional vector accounting for the skewness, \(\mu =(\mu _1,\ldots , \mu _m)\) is an \(m\)-dimensional location parameter vector, and \(\nu \) is the degrees of freedom. We denote this distribution by \(X \sim t_m(\nu ,\mu ,\varSigma ,\gamma )\), where its marginal distribution is given through \(X_i \sim t_1(\nu , \mu _i,\varSigma _{ii}, \gamma _{i})\). The notation \(IG(\nu /2, \nu /2)\) stands for the inverse gamma distribution with parameters \(\nu /2\). Thus, \(W\) is a one-dimensional random variable and \(Z\) is a random vector having a zero-mean multivariate normal distribution with covariance matrix

The multivariate skewed Student’s \(t\) distribution has a closed density, which is given through

where \(x \in {\mathbb {R}}^n\), \(K\) is the modified Bessel function of the third kind, and \(c\) is the normalizing constant

The copula remains invariant under a standardization of the marginal distributions and any series of strictly increasing transformations. Thus, it follows that the copula of a \(t_m( \nu , \mu ,\varSigma , \gamma ) \) is identical to that of \(t_m(\nu , 0, P, \gamma )\) distribution, where \(P\) is the correlation matrix implied by the covariance matrix \(\varSigma \) and we denote it by \(C^{t}_{\nu , P, \gamma }\),

where \(t_{\nu ,\gamma }^{-1}\) denotes the quantile function of a skewed univariate \(t\) distribution. By calibration of the skewed \(t\) copula we use its density function, which can be derived from (15) and it has the form

where \(f_{\nu , P, \gamma }\) is the joint density of a \(t_m(\nu ,0,1, \gamma )\) and \(f_{\nu ,\gamma }\) is the density of the univariate skewed standard \(t\)-distribution with \(\nu \) degrees of freedom and parameter of skewness \(\gamma \).

1.4 Risk measures

1.4.1 VaR

VaR, or a value-at-risk, is a risk measure (see for details Duffie and Pan 1997; Jorion 2006) that was accepted in nineties in the financial industry. VaR is defined as the minimum level of loss at a given, significantly high confidence for a predefined time horizon. For the sake of simplicity, we take 1 day as the time horizon in the following example.

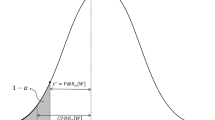

VaR at confidence level \((1-\epsilon )100\,\%\) of a random variable \(X\), which describes random returns, is defined as the negative of the lower \(\epsilon \)-quantile of the return distribution

where \(\epsilon \in (0,1)\) and \(F^{-1}_X(\epsilon )\) is the inverse of the cumulative distribution function.

The following two important properties are important when dealing with VaR

For the non-parametric estimate of VaR no assumptions for the distributional returns are needed and VaR at confidence level \((1-\epsilon )100\,\%\) is given by

where \(\lceil y \rceil \) is the smallest integer larger than \(y\) and \(x\) is the sorted vector of observations and \(n\) is the size of the sample. The sorted sample is presented as follows \(x_{(1)} \le x_{(2)} \le , \ldots , \le x_{(n)}\), thus \(x_{(1)}\) is the smallest observation in the sample and \(x_{(n)}\) is the largest.

1.4.2 AVaR

The average value-at-risk (AVaR) is the average of VaRs larger than the VaR for a given tail probability. It is a risk measure that is a superior alternative to VaR, because it satisfies all axioms of coherent risk measures (Acerbi and Tasche 2001).

The AVaR at tail probability \(\epsilon \) of a random variable \(X\), which describes random returns, is computed through

where VaR\(_p\) is defined in Eq. (18).

For the non-parametric estimation of AVaR at tail probability \(\epsilon \), no distributional assumptions are needed for the sample. Rockafellar and Uryasev (2002) suppose the following formula

where \(\lceil y \rceil \) is the smallest integer larger than \(y\) and \(x\) is the sorted vector of observations and \(n\) is the size of the sample. The sorted sample is presented as follows \(x_{(1)} \le x_{(2)} \le , \ldots , \le x_{(n)}\), thus \(x_{(1)}\) is the smallest observation in the sample and \(x_{(n)}\) is the largest.

1.5 Performance measures

1.5.1 Sharpe ratio

Sharpe (1966) ratio calculates the adjusted return of the portfolio relative to a target return. It is the ratio between the average active portfolio return and its standard deviation. In this case, it can be thought of as a reward to a variability ratio. Commonly, it is defined as

when the benchmark return is a random variable. If it is a constant, then the Sharpe ratio is equal to

1.5.2 STARR

STARR (stable tail-adjusted return ratio) is an alternative performance measure that overcomes the disadvantages of the Sharpe ratio, selecting AVaR as a risk measure Rachev et al. (2008). It is defined as

If \(r_b\) is a constant benchmark return, then STARR is equal to

In this research, we use the tail probability \(\epsilon =1\,\%\) for computing the STARR.

1.5.3 Rachev ratio

The Rachev ratio Biglova et al. (2004) is a performance measure that is constructed on the basis of AVaR. The reward measure is defined as the average of the quantiles of the portfolio return distribution which are above a certain quantile level or expected tail gain, and the risk measure is the AVaR, expected tail loss, at a given tail probability. The Rachev ratio is defined in the following way

where the tail probability \(\epsilon _1\) denotes the quantile level of the reward measure and \(\epsilon _2\) is the tail probability of the AVaR. For the computation of the Rachev ratio we utilize \(\epsilon _1=1\,\%\) and \(\epsilon _2=1\,\%\).

Rights and permissions

About this article

Cite this article

Georgiev, K., Kim, Y.S. & Stoyanov, S. Periodic portfolio revision with transaction costs. Math Meth Oper Res 81, 337–359 (2015). https://doi.org/10.1007/s00186-015-0500-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-015-0500-6