Abstract

Previous research on the relationship between economic freedom and income inequality has produced mixed results. We provide a short survey of this literature, identifying potential causes for this empirical heterogeneity. Next, we replicate the results from two significant studies using six alternative measures of income inequality for an updated dataset of up to 112 countries over the period 1970–2010. Notably, we use the latest release of the Standardized World Income Inequality Dataset, which allows us to account for the uncertainty of the estimated Gini coefficients. We find that the results of previous studies are sensitive to the choice of country sample, time period and/or inequality measure used. We conclude with suggestions for future research in the area.

Similar content being viewed by others

Notes

The Deininger and Squire (1996) database contains inequality measures representing different income and household concepts. These conceptual differences are believed to produce systemic differences, and considerable effort has been exerted to construct more comparable inequality datasets in recent years (e.g., Atkinson and Brandolini 2001; Deininger and Squire 1996; Solt 2014).

This approach common in the literature, but has also been subject to criticism (Atkinson and Brandolini 2001; Pyatt 2003).

Growth is predicted by a regression of actual growth on initial GDP and a set of geographic and investment variables.

The EFW index used by Clark and Lawson (2008) excludes regulation due to scarcity of data.

Bennett and Vedder (2013) used US state-level data to estimate a quadratic inequality-economic freedom model and found the relationship to exhibit an inverted U-shape, opposite Carter’s findings; however, results from the two studies are not directly comparable due to differences in the samples and composition of the economic freedom indices. Differences between country and subnational economic freedom measures are discussed in more detail below. See footnote 12. In a forthcoming paper, Apergis and Cooray (2015) also find evidence of an inverted U-shaped economic freedom–inequality curve for a panel of 138 countries using cointegration techniques.

SWIID version not indicated in Bergh and Nilsson (2010), but confirmed in email correspondence with Therese Nilsson on June 23, 2015.

Bergh and Nilsson (2010) also find a positive and marginally significant relationship between EFW and gross income Gini coefficients. In addition, they obtain null results when employing a dynamic model to examine the effect of long-run changes in EFW on changes in inequality, as well as when utilizing GMM estimation.

The argument that government redistribution via the government sector and inflation does not impact market incomes assumes that redistribution is not distortionary and takes place without economic cost. Redistributionary policies often distort investment, labor-leisure and allocation decisions such that it is highly plausible that market incomes, and hence gross income inequality, would differ in the absence of such redistribution, although admittedly, it is not possible to measure incomes in such a counterfactual world. Regarding the use of his dataset, Solt (2014: 21) adds that “Market-income inequality, although accurately described as measuring the distribution of income before taxes and transfers are taken into account, cannot be considered ‘pre-government’: a wide range of non-redistributive government policies, from public education and job-training programs to capital-accounts regulations, also shape the income distribution. In addition to such market-conditioning policies, market-income inequality also includes the feedback effects of redistributive policies on household’s decisions regarding savings, employment, and retirement.”

Sturm and De Haan (2015) also found that the effect of economic freedom on income redistribution, as measured by the difference between net and gross income inequality, is conditional on fractionalization.

The EFNA index only accounts for heterogeneity among the US states in three areas: government expenditures, government revenues, and labor market policies (Stansel and McMahon 2013). National institutions measured by the EFW index such as the regulatory environment, monetary policy, international trade policy, and legal institutions are relatively homogenous across subnational regions. These macro-level institutions may nonetheless influence the distribution of income such that results pertaining to the relationship between subnational economic freedom and inequality are not directly comparable to those resulting from the study of county-level economic freedom and inequality because the margins by which institutions and policies are operating at the subnational and national level differ.

The Heritage Foundation provides an alternative economic freedom measure, the Index of Economic Freedom (IEF). The EFW measure is used in this study for several reasons. First, the EFW data are available for a large number of countries as far back as 1970, while the IEF data are only available since 1996. Second, one of the objectives of this study is to replicate the results of existing literature and all of the cross-country studies on economic freedom and inequality have utilized the EFW data. Third, the majority of the empirical economic freedom literature uses the EFW and not the IEF data. Hall and Lawson (2014), for instance, document that hundreds of scholarly articles have been published in academic journals that cite the EFW data. Analogous system GMM results using the Heritage data are presented, however, in Table 9 of Appendix.

Assuming that income is progressively redistributed and welfare programs are designed to not discourage work effort from transfer recipients. If the latter condition does not hold, then the net effect on an individual’s income could be neutral. Although the transfer would still reduce income inequality, it would do so by further increasing IO if the transfer recipient reduced his/her labor hours.

As discussed by Bennett and Vedder (2015), the relationship between educational attainment and income inequality is theoretically ambiguous and empirical evidence is mixed.

The theoretical result that redistribution reduces inequality is not completely generalizable either. Berggren’s framework hinges on income being redistributed from the rich to the poor at no economic cost, assumptions which may not hold in practice. “Director’s law,” for instance, suggests that the median voter will choose to redistribute resources to the middle class and not the poor (Stigler 1970). Additionally, the rent-seeking literature suggests that well-organized interest groups have an incentive to lobby for subsidies that result in regressive redistribution. Tax-and-transfer policies can also potentially distort labor market decisions on both the supply and demand sides, altering individual incomes.

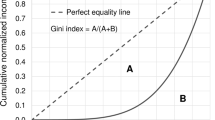

Gini coefficients take a value ranging from zero (resources equally distributed over population) to one (one person or household possess all resources). It is a relative inequality measure and there is no direct mapping between the underlying income distribution and the Gini coefficient.

SWIID author Frederick Solt confirmed in an email on June 4, 2015 that this was the appropriate way to compute longer term averages of the data series for multiply imputed estimation.

Sensitivity of the results from the cross-sectional models used by Berggren (1999) and Clark and Lawson (2008), as well as the results from the 2SLS model used by Scully, is not considered here, primarily because of methodological issues with the models they utilize, as described in Sect. 3, but also because of space limitations. In results not reported, we find that the Berggren cross-sectional and Scully 2SLS models are also quite sensitive to the time period, inequality measure, and sample of countries examined. Sturm and De Haan (2015) and Bennett and Cebula (2015) both found a null result, so the sensitivity of their models are not considered here either. The study by Apergis and Cooray (2015) was released after the current study was completed and it includes a number of sensitivity tests.

Covariates include the following and their square: real GDP per capita, political rights, civil liberties, share of population living in urban area, average years of schooling of adult population, shares of population under age 15 and above age 65, shares of labor force employed in the industrial and service sectors.

The other inequality datasets employed in this analysis do not have observations for some of the countries used by Carter (2006).

It is acknowledged that some p values from the Hansen specification test in the results reported below are close to 1.0, suggesting potential over-identification. See Roodman (2009) for a discussion of over-identification in the context of System GMM. It is also acknowledged that the p value of the ar(2) test in some estimates is less than 0.1, suggestive that instruments lagged t−2 are invalid and an additional lag should be introduced with t−3 lagged instruments used. Because the results are generally null, there are a limited number of time periods, and the objective of this analysis is to estimate comparable coefficients for each of the various coefficients, additional results addressing these issues are not reported.

The analysis for this paper executed in Stata. To the best of our knowledge, there is not a known method to apply system GMM analysis using MI data. For the regressions utilizing the SWIID version 5 inequality measures, we use the average of the 100 imputations for each observation.

The control variables include: log of real GDP per capita (LRGDPL), the shares of labor employed in the industrial (INDUSTRY) and service (SERVICE) sectors, the price of investment goods relative to the US (PDISTORT), the fertility rate (FERTILITY), the average years of secondary education of males (EDUCF) and females (EDUCF), the dependent to labor force ratio (DEP2LABOR), and the share of population residing in an urban area (URBAN). See Table 7 of appendix for more information.

ATG data available at http://data.worldbank.org/data-catalog/all-the-ginis.

References

Acemoglu D, Naidu S, Restrepo P, Robinson JA (2015) Democracy, redistribution and inequality. In: Akinson A, Bourguignon F (eds) Handbook of income distribution, vol 2B (Ch 21). Elsevier, North-Holland

Akerlof G, Dickens W, Perry G (1996) The macroeconomics of low inflation. Brook Pap Econ Act 27(1):1–76

Apergis N, Dincer O, Payne JE (2013) Economic freedom and income inequality revisited: evidence from a panel error correction model. Contemp Econ Policy 32:67–75

Apergis N, Cooray A (2015) Economic freedom and income inequality: evidence from a panel of global economics—a linear and a non-linear long-run analysis. The Manchester School. doi:10.1111/manc.12137 (forthcoming)

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68:29–51

Ashby NJ, Sobel RS (2008) Income inequality and economic freedom in the US states. Publ Choice 134:329–346

Atkinson AB, Brandolini A (2001) Promise and pitfalls in the use of ’secondary’ data-sets: income inequality in OECD countries as a case study. J Econ Lit 19:771–799

Bagus P (2014) How monetary inflation increases inequality. Institute for Economic Affairs, London (June 6)

Barro R, Lee J-W (2013) A new data set of educational attainment in the world, 1950–2010. J Dev Econ 104:184–198

Bennett DL (2016) Subnational economic freedom and performance in the United States and Canada. Cato J 36(1):165–185

Bennett DL, Cebula RJ (2015) Misperceptions about capitalism, government and inequality. In: Cebula RJ, Hall JC, Mixon FG, Payne JE (eds) Economic behavior, economic freedom, and entrepreneurship. Edward Elgar, Northampton

Bennett DL, Nikolaev B (2016) Factor endowments, the rule of law and structural inequality. J Inst Econ. doi:10.1017/S1744137416000084 (forthcoming)

Bennett DL, Vedder RK (2013) A dynamic analysis of economic freedom and income inequality in the 50 US states: evidence of a parabolic relationship. J Reg Anal Pol 43:42–55

Bennett DL, Vedder RK (2015) Public policy, higher education, and income inequality in the United States: have we reached diminishing returns? Soc Philos Pol 31:252–280

Berggren N (1999) Economic freedom and equality: friends or foes? Publ Choice 100:203–223

Bergh A, Nilsson T (2010) Do liberalization and globalization increase income inequality? Eur J Polit Econ 26:24–505

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel date models. J Econ 87:115–143

Carter JA (2006) An empirical note on economic freedom and income inequality. Publ Choice 130:163–177

Clark JR, Lawson RA (2008) The impact of economic growth, tax policy and economic freedom on income inequality. J Priv Enterp 24:23–31

Compton RA, Giedeman DC, Hover GA (2014) A distributional analysis of the benefits of economic freedom. Eur J Polit Econ 33:121–133

Dawson JW (1998) Institutions, investment, and growth: new cross-country and panel data evidence. Econ Inq 36:603–619

Dawson JW (2003) Causality in the freedom-growth relationship. J Eur Polit Econ 19:479–495

De Haan J, Lundström S, Sturm J-E (2006) Market-oriented institutions and policies and economic growth: a critical survey. J Econ Surv 20:157–191

Deininger K, Squire L (1996) A new data set measuring income inequality. World Bank Econ Rev 10:565–591

Engerman SL, Sokoloff KL (2002) Factor endowment, inequality, and paths of development among new world economies. Economia 3:41–109

Faria HJ, Montesinos HM (2009) Does economic freedom cause prosperity? An IV approach. Publ Choice 141:103–127

Galbraith JK, Kum H (2005) Estimating the inequality of household incomes: a statistical approach to the creation of a dense and consistent data set. Rev Wealth Income 51(1):115–143

Gwartney JD, Holcombe RG, Lawson RA (2006) Institutions and the impact of investment on growth. Kyklos 59:255–273

Gwartney JD, Lawson RA, Hall JC (2013) Economic freedom of the world annual report 2013. Fraser Institute, Vancouver

Hall JC, Lawson RA (2014) Economic freedom of the world: an accounting of the literature. Contemp Econ Pol 32:1–19

Heston I, Summers R, Aten B (2012) Penn World Table Version 7.1. Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania. http://pwt.econ.upenn.edu/

Holcombe RG (2013) Crony capitalism: by-product of big government. Indep Rev 17:541–559

Hopkin J, Blyth M (2012) What can Okun teach Polanyi? Efficiency, regulation and equality in the OECD. Rev Int Polit Econ 19:1–33

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 44(1):1–28

Marrero GA, Rodriguez JG (2013) Inequality of opportunity and growth. J Dev Econ 104:107–122

Murphy RH (2015) The impact of economic inequality on economic freedom. Cato J 1:117–131

Okun AM (1975) Equality and efficiency: the big tradeoff. Brookings Institution Press, Washington, DC

Pyatt G (1993) Development and the distribution of living standards: a critique of the evolving data base. Rev Income Wealth 49:333–358

Roodman D (2009) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158

Rubin DB (1987) Multiple imputation for nonresponse in surveys. Wiley, New York

Scully GW (2002) Economic freedom, government policy and the trade-off between equity and economic growth. Publ Choice 113:77–96

Solt F (2009) Standardizing the world income inequality dataset. Soc Sci Q 90(2):231–242

Solt F (2014) The standardized world income inequality database. Working paper

Stigler GJ (1970) Director’s law of public income redistribution. J Law Econ 13:1–10

Stiglitz JE (2012) The price of inequality: how today’s divided society engagers our future. W.W.Norton, New York

Sturm J-E, De Haan J (2015) Income inequality, capitalism, and ethno-linguistic fractionalization. Am Econ Rev Pap Proc 105:593–597

Székely M, Hilgert M (1999) What’s behind inequality we measure: an investigation using Latin American data for the 1990s. In: Bank, I-AD (ed) OCE working paper series

Webster AL (2013) The relationship between economic freedom and income inequality in the United States. Int Bus Econ Res J 12:469–476

Wiseman T (2016) Economic freedom and growth in US state level market incomes at the top and bottom. Contemp Econ Pol. doi:10.1111/coep.12173

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Additional tables

Appendix 2: Custom inequality dataset

As indicated in Table 1, three of the measures of inequality used in the current analysis are drawn from a custom inequality database developed using Gini measures over the period 1967–2012 from Milanovic’s All the Ginis (ATG) databaseFootnote 27 and the UNU-WIDER World Income Inequality Database version 2.0c (WIID2C). The construction of the custom database that contains the NETGINI, GROSSGINI and CONGINI measures is described in this appendix.

The ATG database consists of 3401 country-year Gini coefficients that were retrieved from eight sources: Luxembourg Income Study (LIS); Socio-Economic Database for Latin America and the Caribbean (SEDLAC); Survey of Income and Living Conditions (SILC); World Bank’s Easter Europe and Central Asia (ECA); World Income Distribution (WYD); World Bank’s POVCAL; World Institute for Development Economics Research’s World Income Inequality Database version 1 (WIID1) and individual data sets (INDIE). Most of the Gini coefficients contained in the ATG database were derived from nationally representative household survey micro-datasets, a characteristic desirable by many inequality scholars. ATG also provides information on the welfare concept and recipient unit for each Gini measure. It indicates whether a Gini is based on income or consumption, whether the concept is gross or net, and whether the measure represents total household welfare or is adjusted to per capita household welfare. This is valuable information because it allows for the creation of a custom dataset containing Gini coefficients that are highly comparable across countries and time, reducing the likelihood of erroneous empirical results attributable to incomparable data, as described in Sect. 3.1.

With the exception of the WIID1 measures, all of the Gini measures included in the ATG database were screened to develop a database consisting of measures of per capita net income inequality (NETGINI), per capita gross income inequality (GROSSGINI), and per capita consumption inequality (CONGINI). The WIID1 dataset only includes observations prior to 1999. A more recent version, WIID2C, includes observations through 2006. Because the WIID2C database contains a greater number of Gini observations than the WIID1 database, the WIID1 measures from ATG are not included in the construction of the custom database, while the WIID2C measures are included. The 5313 WIID2C observations were also carefully screened. Only measures with a quality rating of 1 or 2 that cover the entire population and are based on a household per capita welfare measure were included. Observations whose source is indicated as LIS, SEDLAC, or Milanovic were excluded to avoid possible duplication. Gini observations were classified as consumption if the income definition is given as consumption, consumption/expenditure or expenditure. Gini measures were classified as net and gross income if the income definition is given as disposable and gross income, respectively.

An initial screening of the ATG and WIID2C data yielded 2413 Gini observations, some of which are available from multiple sources for the same country-year. For each of the three Gini concepts (NETGINI, GROSSGINI, CONGINI), the following procedures were followed in assembling the custom measures observed at 5-year intervals. First, if a Gini observation was only available from a single source for a given country-year observation, that source is used. Table 10 indicates the number of observations for each Gini concept by the original source, as well as the total. Second, if Gini observations are available for more than one source for a given country-year observation, then the source providing the greatest number of observations for a given country is selected. Next, each country-year observation is assigned to the nearest quinquennial year ending in five or zero. Lastly, the average of all of a country’s Gini observations assigned to a given quinquennial period (if more than one) spanning 1970–2010 is used as the measure for that period.

Rights and permissions

About this article

Cite this article

Bennett, D.L., Nikolaev, B. On the ambiguous economic freedom–inequality relationship. Empir Econ 53, 717–754 (2017). https://doi.org/10.1007/s00181-016-1131-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1131-3