Abstract

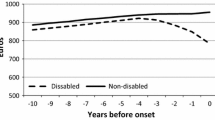

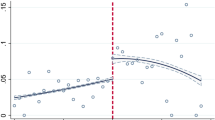

In this paper, we present a theoretical model along with an empirical model to identify the effects of disability on wages. From the theoretical model, we derive the hypothesis that only the temporary component of the wage gap, which is due to assimilation costs, will diminish over time, whereas the permanent element, which is due to the productivity loss after the disabling condition, will in fact persist. We test this theoretical hypothesis using an exogenous disability shock (accident) and combine propensity score matching with a difference-in-differences method to account for observed and unobserved time-constant differences. In all our specifications, we find that the reduction in wages for the disabled is between 274 and 308 euros per month, and this represents 19–22 % of the average wage of a disabled worker. This gap, however, is more than offset when we count disability benefits and wages collectively as income. As predicted in the theoretical model, we observe that around 40 % of the initial wage gap between disabled and non-disabled individuals is reversed once the transitory drop in productivity disappears. However, we also observe a constant wage gap that remains over time and that corresponds to the permanent fall in productivity predicted by the theoretical model (60 % of the initial wage gap).

Similar content being viewed by others

Notes

This refers to self-reported employment rates of disabled individuals. The general employment rate increased by 7 % between 2001 and 2007.

These employment rates are taken from the OECD and are, therefore, comparable for these countries. They refer to self-reported employment rates. The number of individuals receiving DI benefits has grown in Spain from 1995 to 2005 at an average annual rate of 1.4 %. In 2008, 3.7 % of the working-age population in Spain was receiving these benefits (as compared to an average of 5.7 % in other OECD countries), (OECD 2009).

Income is evaluated yearly. The income threshold in 2010 was set at 4755.80 euros/year for an individual living alone. This amount is adjusted if the individual lives with other household members.

197,126 individuals received non-contributory disability benefits in 2009, while 920,860 received contributory benefits that same year. The average non-contributory pension is 417.09 euros/month, compared to an average contributory disability pension of 831.49 euros/month.

Furthermore, there are disincentives to working because of the means-testing requirement for non-contributory DI benefits that cannot be disentangled from the effects of the health shock on income.

There was a fourth level of benefit (permanent limited disability) which now no longer exists.

\(\mathrm{Benefit}=\mathrm{regulatory\;base}*\mathrm{percentage}\).

There was a reform in the calculation of the level of disability benefits for ordinary illness introduced in 2008. After the reform, there was a percentage that depended on the number of years contributed to the system that was multiplied by the regulatory base. However, this change only affects individuals whose cause of disability is an ordinary illness and, in our sample, we only include individuals disabled due to accident. Therefore, this reform does not affect our sample.

This permanent component of the wage gap can also include discrimination related to disability status (see, for example, Malo and Pagán 2012). According to these authors, 80 % of the wage gap between non-disabled and disabled workers not hampered by their daily activities is explained by differences in workers’ characteristics (productivity gap), while 20 % can be explained by job discrimination.

This means that the only individuals missing from this database are those who were inactive in 2010 and did not receive any kind of contributory benefit (such as disability, orphan and widow). Furthermore, the sample is representative for 2010 but, as exit from the disability system is extremely low (1.1 %), we are confident that the sample is also representative for the other years included in the analysis.

Note that we identify if an individual has had an accident only if he/she receives disability benefits. Therefore, we have a number of milder accidents that we will not be able to capture in our database. Furthermore, individuals who have suffered an accident but that do not want to claim disability benefits, because this would entail changing jobs, are also not in our database.

We claim that an accident is an unexpected event that has to be externally assessed by a medical team in order to be eligible for disability benefits.

We take a 10 % random sample as we had too many individuals in the original sample.

Following García-Gómez et al. (2013), treated individuals are weighted as 1 and individuals in the control group receive a weight depending on the number of times the individual is used as a control and on the distance to the propensity score of their matched treated peer on the Epanechnikov kernel.

Only 1.1 % of individuals stop receiving partial disability benefits in our sample. Therefore, we consider partial disability as an absorbing state as exit from the partial disability system is very low.

An individual who is in the control group in one sequence can be a control unit for any given sequence and count as independent observation for each of the different sequences. However, individuals who appear as a treatment unit can only appear in one sequence as treated because, once he/she becomes disabled, he/she will remain disabled permanently. The sequence ND, D, D can only be experienced once. But a treated individual can appear in a previous sequence as a prior control if he becomes disabled in the final years of our sample.

In fact, we use a proxy for wages, the contributory base, which is equivalent to wages except for the fact that they are top and bottom-coded (censored). Although for the entire MCVL this is a significant problem as Bonhomme and Hospido (2009) mention, such an issue is not likely to be relevant in our case as wages are censored only for very few observations (\(<\)0.1 % of the sample).

We have also estimated our results with another measure of the wage variable. These results are presented in “Appendix 2”.

We do not use education because this variable is measured incorrectly in this database. Instead, we use professional category that captures very well the educational level and it is the variable that in general is used as a proxy of education in this database. Unfortunately and due to the nature of our data (administrative records), we do not have any other personal information that would have been interesting to include in the propensity score (such as spousal earnings).

We also estimate the effects using difference in differences without propensity score matching (comparing the distance between the treated group and the control group before and after the shock), and we obtain a reduction in the wage of 273 EUR per month. Furthermore, we estimate the effect using event study. With this methodology, we assume that the treatment is totally random and we predict the wages for treated individuals as if they had been in the control group. We then calculate the difference between that prediction and their actual wage and we obtain what is labelled in event study literature as the “abnormal return”. In particular, we obtain a reduction in wages of 296 EUR per month.

We observe the same pattern when we apply a different estimation method. This can be observed in Table 7 in the Appendix (sensitivity check).

References

Abadie A, Imbens G (2002) Simple and bias-corrected matching estimators for average treatment effects in STATA. Stata J 1(1):1–18

Abadie A, Drukker D, Herr H, Imbens G (2004) Implementing matching estimators for average treatment effects in Stata. Stata J 4:290–311

Brakmann N (2012) The consequences of own and spousal disability on labor market outcomes and subjective well-being: evidence from Germany. Rev Econ Househ 12(4):717–736

Bayer C, Juessen F (2012) Happiness and the persistence of income shock. IZA discussion paper no. 6771

Becker S, Ichino A (2002) Estimation of average treatment effects based on propensity scores. Stata J 2(4):358–377

Blundell R, Costa Dias M (2002) Alternative approaches to evaluation in empirical microeconometrics. Port Econ J 1:91–115

Bonhomme S, Hospido L (2009) Using social security data to estimate earnings inequality. Mimeo

Charles KK (2003) The longitudinal structure of earnings losses among work-limited disabled workers. J Hum Resour 38(3):618–646

Contoyannis P, Rice N (2001) The impact of health on wages: evidence from the British Household Panel Study. Empir Econ 26(4):599–622

García Gómez P, López Nicolás A (2006) Health shocks, employment and income in the Spanish labour market. Health Econ 15:997–1009

García-Gómez P, van Kippersluis Hans, O’Donnell Owen, van Doorslaer Eddy (2013) Long-term and spillover effects of health shocks on employment and income. J Hum Resour 48(4):873–909

Halla M, Zweimüller M (2011) The effects of health on income: quasi-experimental evidence from commuting accidents. IZA discussion paper 5833

Heckman J, Hotz J (1989) Choosing among alternative methods for estimating the impact of social programs: the case of manpower training. J Am Stat Assoc 84:862–874

Heckman J, Ichimura H, Todd P (1997) Matching as an econometric evaluation estimator: evidence from evaluating a job training program. Rev Econ Stud 64:605–654

Kidd M, Sloane P, Ferko I (2000) Disability and labour market: an analysis of British males. J Health Econ 19:961–981

Lechner M, Vazquez-Alvarez R (2011) The effect of disability on labour market outcomes in Germany. Appl Econ 43:389–412

Lundborg P, Nilsson M, Vikström J (2011) Socioeconomic heterogeneity in the effect of health shocks on earnings: evidence from population-wide data on Swedish workers. IZA working papers no. 6121

Malo MA, Pagán R (2012) Wage differentials and disability across Europe: discrimination and/or lower productivity. Int Labour Rev 151(1–2):43–60

Meyer BD and Mok WKC (2008) Disability, earnings, income and consumption. Mimeo, University of Chicago

Moller Dano A (2005) Road injuries and long-run effects on income and employment. Health Econ 14:955–970

Mok WKC, Meyer BD, Charles KK, Achen AC (2008) A note on the longitudinal structure of earnings losses among work-limited disabled workers. J Hum Resour 43(3):721–728

OECD (2009) Sickness, disability and work: keeping on track in the economic downturn: background paper

Oswald AJ, Powdthavee N (2008) Does happiness adapt? A longitudinal study of disability with implications for economists and judges. J Public Econ 92(5–6):1061–1077

Rubin DB (1973) Matching to remove bias in observational studies. Biometrics 29:159–183

Rubin DB (1974) Estimating casual effects of treatments in randomised and non-randomised studies. J Educ Psychol 66:688–701

Rosenbaum P, Rubin DB (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70:41–55

Rosenbaum P, Rubin DB (1984) Reducing bias in observational studies using subclassification on the propensity score. J Am Stat Assoc 79:516–524

Walker I, Thompson A (1996) Disability, wages and labour force participation: evidence from UK panel data. Keele Department of Economics, working paper no. 96/14

Wu S (2001) Adapting to heart conditions: a test of the hedonic treadmill. J Health Econ 20(4):495–507

Author information

Authors and Affiliations

Corresponding author

Additional information

Constructive advice from two anonymous referees and the Editor Bernd Fitzenberger has contributed to improve this paper. José I. Silva and Judit Vall acknowledged financial support from the Spanish Ministry of Economy and Competitiveness thought grant ECO2012-31081.

Appendices

Appendix 1: The Spanish disability system

See Table 3.

Appendix 2: Estimations with a different wage measure

Alternatively, we consider a second measure of wages. Wage 2 is the monthly average of the wages for the whole year. In this case, we add together the wages received in all months worked and then we divide it by the total number of months worked in order to obtain a monthly measure. Tables 4, 5 and 6 present the same descriptive statistics and estimates as our baseline results but using this new definition of wages (Wage 2). Although the figures are slightly higher, all results are akin to those we obtain with our baseline wage measure.

Appendix 3: Sensitivity check; Wage gap over time with alternative estimation methods

See Table 7.

Rights and permissions

About this article

Cite this article

Cervini-Plá, M., Silva, J.I. & Castelló, J.V. Estimating the income loss of disabled individuals: the case of Spain. Empir Econ 51, 809–829 (2016). https://doi.org/10.1007/s00181-015-1019-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-1019-7