Abstract

This article reevaluates the impulse response functions (IRFs) to a monetary policy shock of the structural vector autoregression (SVAR). Identifying restrictions are specified and justified based on empirical evidence,i.e., conditional independence relations of variables, which is an important dimension that a good model must be able to mimic. The empirical-based approach is able to significant narrow down the set of admissible causal orders to identify the IRFs to a monetary policy shock (from 2,482 to 8). I find that most of the qualitative “stylized” features reported in the literature remain intact. However, the quantitative predictions are much less certain than what is commonly perceived.

Similar content being viewed by others

Notes

Macroeconomists consider four types of restrictions to identify the IRFs of structural shocks: long-run identifying restrictions (e.g., Shapiro and Watson 1988; Blanchard and Quah 1989; Gali 1999), short-run identifying restrictions (e.g., Sims 1980; Bernanke 1986; Bernanke and Blinder 1992; Christiano et al. 1999, 5), sign restrictions (e.g., Uhlig 2005), and shape restrictions (e.g., Lippi and Reichlin 1994). These restrictions are commonly justified by theoretical arguments. Short-run identifying restrictions are the most susceptible to being viewed as “incredible.” Long-run identifying restrictions are the most well-grounded on widely acceptable economic theories—typically, in the form of neutrality of some variables. Sign restrictions and shape restrictions are somewhat ranged in the middle in terms of their credibility.

Long-run identifying restrictions have been criticized for the imprecision of the estimates of the IRFs in finite sample (Faust 1998; Erceg et al. 2005; Christiano et al. 2006). Christiano et al. (2006) argued in favor of using short-run identifying restrictions over long-run identifying restrictions as the former method leads to more precise estimates of the IRFs.

An exception to this is Moneta and Spirtes (2006) which presents a causal search method that allow for feedbacks. However, their analysis of macroeconomic variables is somewhat limited.

It is important to note that short-run identifying restrictions and long-run identifying restrictions should not be viewed as two mutually independent approaches. Combining well-accepted long-run identifying restrictions with the most plausible short-run identifying restrictions—possibly identified empirically by the method proposed in this article—could, conceptually, minimize the imprecision of the estimates of the IRFs problem and our concern on relying too much of weak economic theories. The IRFs to a structural shock may be identified by short-run restrictions and/or long-run restrictions as long as these restrictions are entailed in the data-generating process. Bjørnland and Leitemo (2009) imposed both long-run as well as short-run identifying restrictions simultaneously. Future studies should address this point.

Detail discussion of the CYCLIC-CPC algorithm and the proof of its validity are presented in the Electronic Supplementary Material (https://sites.google.com/a/sasin.edu/phiromswad/).

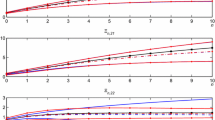

For the measure of monetary policy, they choose the federal funds rate (FED). Variables that are ordered before the monetary policy variable consist of the log of real gross domestic product (GDP), the log of real consumption excluded consumption of durable goods (CONS), the log of GDP deflator (INF), the log of real investment included consumption of durable goods (INV), the log of real wages (WAGE), the log of labor productivity (PROD). Variables that are ordered after the monetary policy variable consist of the log of real profits (PROFIT) and the growth rate of M2 (GM2). The Electronic Supplementary Material discusses sources and construction of these variables.

Tests of conditional independence are conducted using tests of conditional correlation. The p-values are computed using Fisher’s z-statistic. See Demiralp and Hoover (2003) footnote 8 for more discussion.

For comparison, I also consider the CPC algorithm and the PC algorithm (the causal search algorithm used in Demiralp and Hoover 2003). For the CPC algorithm, the result is almost identical except that there is one more orientation from GDP to PROFIT. However, this finding is—which is a marginal gain over the CYCLIC-CPC algorithm—valid only when feedbacks are not permitted which is restrictive. The result from the PC algorithm, on the other hand, clearly shows the problem of the PC algorithm. There are 5 out of 9 edges identified with double-headed arrow (i.e. orientation goes both ways).

Figure 1 panel (b) presents the associated \(A_{0}\) matrix in Eq. (1) with restrictions identified from the baseline causal search. “0” indicates structural parameters in the \(A_{0}\) matrix in which zero restrictions have been identified. All other structural parameters in the \(A_{0}\) matrix are still inconclusive whether they have zero or non-zero restrictions since we cannot rule out virtual edges when feedbacks are allowed. For more detail, I describe how to read zero and non-zero restrictions from an estimated causal graph in the Electronic Supplementary Material.

First, the elimination step of the CYCLIC-CPC algorithm, the CPC algorithm, and the PC algorithm are identical. Thus, the suggestion of Spirtes et al. (2000) for the PC algorithm applies for the elimination step of the CYCLIC-CPC algorithm naturally. Second, Ramsey et al. (2006) provided Monte Carlo simulation experiments comparing the effectiveness in orientation of the CPC algorithm and the PC algorithm (when both were using the same significance level of the conditional correlation tests). They found that the CPC algorithm is better in terms of avoiding false orientation without reducing correct orientation rates. Since the CYCLIC-CPC algorithm is just the CPC algorithm that stops at the conservative orientation toward unshielded colliders step, the CYCLIC-CPC algorithm must be as good as the CPC algorithm in terms of avoiding false orientations. These support my choice of the significance level of the conditional correlation tests.

I performed the ADF tests on the log of real GDP, the log of real consumption, the log of GDP deflator, the log of real investment, the log of real wage, the log of labor productivity, the fed funds rate, and the growth rate of M2 and the log of real profit. This was accomplished in EViews 5.1. The lag lengths in the Augmented Dickey-Fuller tests were selected based on the SIC criterion. The p-values of the tests were computed based on the method of MacKinnon (1996).

The results of the ADF tests are presented in the Electronic Supplementary Material.

As a preliminary check, I investigated the lag length selection by using the AIC and SIC criteria. For the level specification, the SIC criterion selected the lag length of one while the AIC criterion selected the lag length of two when the maximum number of eight lags are allowed. For the first-difference specification, the SIC criterion and the AIC criterion selected the lag length of one when the maximum number of eight lags were allowed. Given these, alternative lag length assumptions, beyond what used in Christiano et al. (2005), should be considered.

Smets and Wouters (2003) also use similar strategy. They estimated their models between (i) 1966:1 and 1979:2; and (ii) between 1984:1 and 2004:4 (see p. 592) when checking sub-sample stability. I choose to follow Demiralp et al. (2009) in allowing five more years until the monetary policy regime was more stabilized.

More discussion on the sensitivity of some edges to the possibility of structural breaks is presented in the Electronic Supplementary Material. However, this sensitivity does not affect the IRFs to a monetary policy shock estimated in this article in a significant way.

The area within the dashed line in Fig. 1 panel (b) indicates structural parameters that are relevant for the validity of the recursive identification scheme of Christiano et al. (2005). In particular, all structural parameters within the dashed line in Fig. 1 panel (b) must satisfy zero restrictions. Even though, we cannot confirm the presence of non-zero restrictions (and, thus, cannot reject the recursive identification scheme of Christiano et al. 2005) in this case (as we allow for virtual edges and not all edges are oriented), there are five structural parameters within the dashed line in Fig. 1 panel (b) which could still invalidate the recursive identification scheme of Christiano et al. (2005). Also, the identified restrictions on the contemporaneous causal relationships of variables can be used to test restrictions adopted by other articles. More discussion about this is presented in the Electronic Supplementary Material. It turns out that, for several articles (e.g., Sims 1986; Bernanke 1986; Blanchard and Watson 1986; Sims and Zha 2006) that completely specify the structural equations for the contemporaneous causal relationships and estimate the structural parameters using GMM or maximum likelihood estimations, some of the restrictions they adopted are clearly rejected. Even though this approach leads to better efficiency in estimation, however, risk of misspecification is clearly large.

Demiralp and Hoover (2003) and Demiralp et al. (2008) found that real GNP (real GDP in this article), real consumption, and real investment are all contemporaneously connected directly which is similar to this article. However, unlike this article, (i) they found that the growth rate of money (real balances in their case) and real consumption are connected directly; and (ii) real consumption and real investment are caused by real GDP. Nevertheless, these differences could arise since (i) they use different causal search algorithm, (ii) they did not perform robustness checks of the kind considered in this article, and (iii) I consider a larger set of variables. Moneta (2008) discovered the structure of the contemporaneous causal relationships which is somewhat consistent with the findings in this article. However, he did not discover that the federal funds rate is adjacent to the aggregate measure of money. Furthermore, based on testing the over-identifying restrictions, he argued against the recursive restrictions. He discovered that the federal funds rate cause investment.

The Electronic Supplementary Material discusses sources and construction of these variables.

Results are presented in the Electronic Supplementary Material.

IRFs to a monetary policy shock identified by the recursive identification scheme were used: (i) qualitatively as stylized-facts for building DSGE models, and (ii) quantitatively as inputs for structural parameters estimation (e.g., Christiano et al. 2005). However, the validity of this approach depends on the validity of the imposed restrictions which is still “debatable” (Christiano et al. 2005 p. 5). Therefore, it is important to re-evaluate the IRFs to a monetary policy shock when restrictions are specified and justified empirically instead.

Here, I focus only on the IRFs to a monetary policy shock identified by the recursive identification scheme. I assume that the data-generating process can be represented by a system of linear structural equations that satisfies the recursive identification scheme. However, what needs to be determined is the appropriate causal order.

See Electronic Supplementary Material for more discussion on how to read the estimated causal graph.

To determine this, suppose that at least one of the three edges that are adjacent to FED in the estimated causal graph in Fig. 1 panel (a) is a virtual edge (i.e., represent only an indirect contemporaneous causal relationship). Note that, according to the estimated causal graph, the following pairs of variables GM2 and FED, INV and FED, and PROD and FED must be correlated conditionally on all sets of conditioning variables. This is the case since edges between GM2 and FED, INV and FED, and PROD and FED are not eliminated by the CYCLIC-CPC algorithm. For GM2 and FED, it is obvious that they will be uncorrelated unconditionally (based on applying the d-separation theorem to the estimated causal graph) if an edge between GM2 and FED is virtual. For INV and FED, it is also obvious that they will be uncorrelated unconditionally (based on applying the d-separation theorem to the estimated causal graph) if an edge between INV and FED is virtual. For PROD and FED, PROD and FED are uncorrelated conditionally on INV regardless of if there is a simultaneous causal relationship between INV and FED when an edge between PROD and FED is a virtual edge (based on applying the d-separation theorem to the estimated causal graph). Thus, they contradict by having at least one virtual edge among the three edges that are adjacent to FED in the estimated causal graph in Fig. 1 panel (a).

See the Electronic Supplementary Material on how the causal order to identify the IRFs to a monetary policy shock for each of the eight cases is determined.

It is possible to consider alternative lag length assumptions. However, the focus of this article is about estimating the contemporaneous causal relationships of variables empirically. The contemporaneous causal relationships of variables seem to play a very important role for dynamic effects of a monetary policy shock in short term. However, lag length assumption is likely to play a very important role for dynamic effects of a monetary policy shock in medium to long term. Future studies need to focus more on appropriate lag length selection (see Jorda 2005 for a promising solution). However, I have shown that the estimated contemporaneous causal relationships of variables are robust to alternative lag length assumptions.

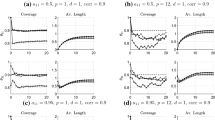

These 95 % confidence intervals are computed in EViews 5.1 (with the option ‘analytic (asymptotic)’ for response standard errors).

Results are presented in the Electronic Supplementary Material.

Results are presented in the Electronic Supplementary Material. A notable finding is that, as expected, the inclusion of the commodity price index helps in dampening the price puzzle.

References

Bernanke B (1986) Alternative explanations of the money-income correlation. In: Karl B, Allan M (eds) Real business cycles, real exchange rates, and actual policies, Carnegie Rochester conference series on public policy 25. North-Holland, Amsterdam

Bernanke B, Blinder A (1992) The federal funds rate and the channels of monetary transmission. Am Econ Rev 82:901–921

Bernanke B, Mihov I (1998) Measuring monetary policy. Q J Econ 113:869–902

Bernanke B, Parkinson M (1991) Procyclical labor productivity and competing theories of the business cycle: some evidence from interwar U.S. manufacturing industries. J Polit Econ 99:439–459

Bjørnland C, Leitemo K (2009) Identifying the interdependence between US monetary policy and the stock market. J Monetary Econ 56:275–282

Blanchard O, Quah D (1989) The dynamic effects of aggregate demand and supply disturbances. Am Econ Rev 79:655–673

Blanchard O, Watson M (1986) Are business cycles all alike? In: Robert G (ed) The American business cycle, continuity and change. NBER, University of Chicago Press, Chicago, pp 123–156

Boivin J, Watson M (1999) Time-varying parameter estimation in the linear IV framework. Princeton University, Mimeo

Christiano L, Eichenbaum M (1992) Liquidity effects and the monetary transmission mechanism. Am Econ Rev Paper Proc 82:346–353

Christiano L, Eichenbaum M, Evans C (1999) Monetary policy shocks: what have we learned and to what end? In: John BT, Woodford M (eds) Handbook of macroeconomics 1, vol 1A. Elsevier Science, Amsterdam, pp 65–148

Christiano L, Eichenbaum M, Evans C (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 113:1–45

Christiano L, Eichenbaum M, Vigfusson R (2006) Assessing structural VARs. International Finance Discussion Papers 866

Clarida R, Gali J, Gertler M (1999) The science of monetary policy: a new Keynesian perspective. J Econ Lit 37:1661–1707

Cooley T, Dwyer M (1998) Business cycle analysis without much theory: a look at structural VARs. J Econom 83:57–88

Cooley T, LeRoy S (1985) Atheoretical macroeconometrics: a critique. J Monetary Econ 16:283–308

Demiralp S, Hoover K (2003) Searching for the casual structure of a vector autoregression. Oxford Bull Econ Stat 65:745–767

Demiralp S, Hoover K, Perez S (2008) A bootstrap method for identifying and evaluating a structural vector autoregression. Oxford Bull Econ Stat 70:509–533

Demiralp S, Hoover K, Perez S (2009) Still puzzling: evaluating the price puzzle in an empirically identified structural Vector Autoregression. Working paper. Economics Department, Duke University, Durham

Eichenbaum M (1992) Comments on interpreting the macroeconomic time series fact: the effects of monetary policy. Eur Econ Rev 36:1001–1011

Erceg C, Guerrieri L, Gust C (2005) Can long-run restrictions identify technology shocks? J Eur Econ Assoc 3:1237–1278

Estrella A, Fuhrer J (2003) Monetary policy shifts and the stability of monetary policy models. Rev Econ Stat 85:94–104

Faust J (1998) The robustness of identified VAR conclusions about money. Carnegie Rochester Conf Ser Public Policy 49:207–244

Gali J (1999) Technology, employment, and the business cycle: do technology shocks explain aggregate fluctuations? Am Econ Rev 89:249–271

Hoover K (2005) Automatic inference of the contemporaneous causal order of a system of equations. Econom Theory 21:69–77

Hoover K, Demiralp S, Perez J (2009) Empirical identification the vector autoregression: the causes and effects of US M2. In: Jennifer LC, Neil S (eds) The methodology and practice of econometrics: a Festschrift in Honour of David F. Hendry. Oxford University Press, Oxford, pp 37–58

Hoover K, Jorda O (2001) Measuring systematic monetary policy. Fed Reserv Bank St. Louis Rev 83: 113–137

Jorda O (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95: 161–182

Lippi M, Reichlin L (1994) Diffusion of technical change and the decomposition of output into trend and cycle. Rev Econ Stud 61:19–30

Lucas RE (1980) Methods and problems in business cycle theory. J Money Credit Bank 12:696–715

MacKinnon J (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econom 11:601–618

Moneta A (2008) Graphical causal models and VARs: an empirical assessment of the real business cycles hypothesis. Empir Econ 35:275–300

Moneta A, Spirtes P (2006) Graphical models for the identification of causal structures in multivariate time series model. In: Proceeding at the, (2006) joint conference on information sciences. Kaohsiung, Taiwan

Ramsey J, Spirtes P, Zhang J (2006) Adjacency-faithfulness and conservative causal inference. In: Proceedings of 22nd conference on uncertainty in artificial intelligence, AUAI Press, Oregon, pp 401–408

Richardson T (1996) A polynomial-time algorithm for deciding markov equivalence of directed cyclic graphical models. In: Horvitz E, Jensen F (eds) Proceedings of the twelfth conference on uncertainty in artificial intelligence. Morgan Kaufmann, San Francisco, pp 462–469

Shapiro M, Watson M (1988) Sources of business cycle fluctuations. In: Stanley F (ed) NBER macroeconomics annual. MIT Press, Cambridge, pp 111–148

Sims C (1980) Macroeconomics and reality. Econometrica 48:1–48

Sims C (1986) Are forecasting models useful for policy analysis. Fed Reserve Bank of Minneap Q Rev 10:2–16

Sims C (1992) Interpreting the macroeconomic time series facts: the effects of monetary policy. Eur Econ Rev 36:975–1011

Sims C, Zha T (2006) Does monetary policy generate recessions? Macroecon Dyn 10:231–272

Smets F, Wouters R (2003) An estimated dynamic stochastic general equilibrium model of the euro area. J Eur Econ Assoc 1:1123–1175

Spirtes P, Glymour C, Scheines R (2000) Causation, prediction, and search, 2nd edn. MIT Press, Cambridge

Strongin S (1995) The identification of monetary policy disturbances explaining the liquidity puzzle. J Monetary Econ 35:463–497

Swanson N, Granger C (1997) IRFs based on a causal approach to residual orthogonalization in vector autoregressions. J Am Stat Assoc 92:357–367

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monetary Econ 52:381–419

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Phiromswad, P. Measuring monetary policy with empirically grounded identifying restrictions. Empir Econ 46, 681–699 (2014). https://doi.org/10.1007/s00181-013-0692-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-013-0692-7

Keywords

- Monetary policy

- Monetary policy shock

- Graph theory

- Causality

- Causal search

- PC algorithm

- CPC algorithm

- SVAR

- Recursiveness assumption