Abstract

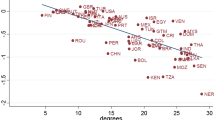

Following a recent line of research, this paper investigates the aggregated effects of temperature and rainfall on economic growth in Africa. Our econometric approach is based on a reduced-form model and takes account explicitly of parameter heterogeneity and cross section dependence, relying on ARDL modelling and panel estimators with multifactor structures. We find clear supportive evidence of short- and long-run relations between temperature and per-capita GDP growth, while the role played by rainfall appears to be less important and the evidence on its statistical significance is less clear-cut. Very similar results are reported when the analysis is carried out by focusing solely on Sub-Saharan African countries or considering GDP growth per worker. This evidence is in sharp contrast to the results obtained via standard MG estimation and this confirms that, by not controlling for cross section dependence, traditional panel estimators are likely to provide misleading inference. The empirical results suggest that, far from adapting quickly to weather shocks, African economies appear to be significantly damaged by them. In the absence of corrective measures, the current trends in climate change may impose a progressively heavier burden on African countries.

Similar content being viewed by others

Notes

For a more complete discussion of these points, see Barrios et al. (2010).

The simulations in Barrios et al. (2010) suggest that, depending on the level of rainfall assumed as a benchmark, the per-capita GDP differential between Sub-Saharan African and non-African developing countries could have been 15-40 % lower than it turned out to be.

Commenting the cross section estimation results in their Table 7, Dell et al. (2008) state that ‘The Africa sample shows similarly large effects in poor countries as other specifications, but the standard errors have increased with the substantially smaller sample size, so the result is not quite statistically significant’. (p. 23, footnote 27).

We are grateful to Ben Jones for kindly making the dataset available.

For a detailed description of the dataset, see Appendix I in Dell et al. (2008).

Between the two extremes, the pooled mean group (PMG) approach, developed by Pesaran et al. (1999), combines both pooling and averaging. PMG estimation allows the intercept and short-run coefficients to differ, but restricts the long-run slope coefficients to be the same across groups. When this hypothesis is correct, the PMG estimator is more efficient than the MG approach. However, if the hypothesis of long-run parameter homogeneity is invalid, the PMG estimates are inconsistent while the MG estimator remains consistent. As there is no a priori reason to expect the long-run influence of temperature and rainfall to be the same for all countries in the sample, we do not rely on PMG estimation in this paper.

See Appendix for a more detailed discussion of this point.

The ‘common dynamic process’ is extracted from the pooled regression in thefirst differences as unobservables (as well as the possible presence of nonstationary variables) would lead to biased estimates in pooled levels regressions.

Regarding the issues associated to second stage ‘regressions with generated regressors’ (Pagan 1984), Eberhardt and Teal (2010) point to the theoretical results in Bai and Ng (2008), who show that second stage standard errors need not be adjusted for first stage estimation uncertainty if \(\sqrt{T}/N\rightarrow 0\), as is arguably the case here. This is supported by simulation results in Bond and Eberhardt (2009), indicating that the average standard error of AMG estimates is of similar magnitude to the empirical standard deviation.

Indeed, this is the key feature of the AMG estimator, which Eberhardt and Teal (2010) develop as an alternative to the CCE approach for macro production function estimation.

We carried out lag selection tests for all the regressions reported in the paper, also using general-to-specific modelling methods. In all cases, the ARDL(1,0,0) turned out to be the most suitable model for the panel as a whole.

There is broad consensus that climate and weather shocks can have important effects on Northern African countries too. The World Bank, for instance, talks openly of a water crisis in Middle East and North African (MENA) countries, where in many cases more water is consumed on average than is received in rainfall (e.g. Bucknall 2007).

CCEMG and AMG estimations were carried out using the statistical software Stata 11 and the XTMG Stata module developed by Eberhardt (2012).

The country-specific trends represent deviations from \(\hat{{\mu }}_t^{\bullet } \), so they enter with positive and negative magnitudes for different countries which average out across the sample. This explains the statistically insignificant mean of the trends in the AMG regressions.

Note that the estimations in Dell et al. (2008) include a dummy variable for poor countries, which is also interacted with temperature and precipitation. The ‘poor dummy’ takes the value of 1 when the country has below-median PPP per-capita GDP in the first year of data—as most African countries fall in this category, the introduction of this dummy is unlikely to affect significantly the comparison with our own results.

Given the different approach used, the estimates in Barrios et al. (2010) are not directly comparable to those presented in this paper. The closest possible counterpart to our results are the long-run estimates from the growth regression in their Table 4, column 2, which, however, includes a number of control variables. In this specification, the coefficient on rainfall is significant but very small (i.e. 0.014), while that on temperature is even smaller and not significant.

References

Bai J, Ng S (2008) Large dimensional factor analysis. Found Trends Economet 3:89–163

Barrios S, Bertinelli L, Strobl E (2010) Trends in rainfall and economic growth in Africa: a neglected cause of the African growth tragedy. Rev Econ Stat 92:350–366

Bond SR, Eberhardt M (2009) Cross-section dependence in nonstationary panel models: a novel estimator. MPRA Paper No. 17870

Brückner M, Ciccone A (2010) International commodity prices, growth and the outbreak of civil War in sub-Saharan Africa. Econ J 120:519–534

Bucknall J (2007) Making the most of scarcity: accountability for better water management results in the middle East and North Africa. MENA development report series No. 5. The World Bank, Washington, DC

Dell M, Jones BF, Olken BA (2008) Climate shocks and economic growth: evidence from the last half century. NBER Working Paper No. 14132

Deschenes O, Greenstone M (2007) The economic impacts of climate change: evidence from agricultural output and random fluctuations in weather. Am Econ Rev 97:354–385

Deschenes O, Moretti E (2007) Extreme weather events, mortality, and migration. NBER working paper no. 13227

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Eberhardt M (2012) Estimating panel time series models with heterogeneous slopes. Stat J 12:61–71

Eberhardt M, Teal F (2010) Productivity analysis in global manufacturing production. Economics series working papers 515, Department of Economics, University of Oxford, Oxford

Hamilton LC (1991) How robust is robust regression? Stat Tech Bull 2:21–26

Heston A, Summers R, Aten B (2009) Penn world table version 6.3. Center for international comparisons of production, income and prices at the University of Pennsylvania

Huntington E (1915) Civilization and climate. Yale University Press, New Haven, CT

Jacob B, Lefgren L, Moretti E (2007) The dynamics of criminal behavior: evidence from weather shocks. J Human Res 42:489–527

Jones BF, Olken BA (2010) Climate shocks and exports. NBER working paper no. 15711

Loayza N, Ranciere R (2006) Financial development, financial fragility and growth. J Money, Credit and Banking 38:1051–1076

Marshall A (1890). Principles of economics. Macmillan and Co (1920), London

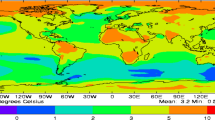

Matsuura K, Willmott C (2007) Terrestrial air temperature and precipitation: 1900–2006 gridded monthly time series, version 1.01. University of Delaware, http://climate.geog.udel.edu/~climate/

Mendelsohn R, Dinar A, Sanghi A (2001) The effect of development on the climate sensitivity of agriculture. Environ Develop Econ 6:85–101

Miguel E, Satyanath S, Sergenti E (2004) Economic shocks and civil conflict: an instrumental variables approach. J Polit Econ 112:725–753

Ng S, Perron P (1995) Unit root tests in ARMA models with data-dependent methods for the selection for the truncation lag. J Am Stat Assoc 90:268–281

Pagan A (1984) Econometric issues in the analysis of regressions with generated regressors. Int Econ Rev 25:221–247

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. IZA Discussion paper series, DP No 1240

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74:967–1012

Pesaran MH, Shin Y, Smith R (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Economet 68:79–113

Acknowledgments

The author would like to thank an anonymous Associate Editor of this journal and two anonymous referees for valuable comments and suggestions. The author is also grateful to Markus Eberhardt for many helpful observations. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Appendix B

Bond and Eberhardt (2009) and Eberhardt and Teal (2010) show that the inclusion of the ‘common dynamic process’ \(\hat{{\mu }}_t^{\bullet } \) in the country regressions allows the AMG procedure to account for cross section dependence. In order to see the intuition behind this, consider the following empirical model

where \(i=1,2,{\ldots },N\) and \(t=1,2,{\ldots },T\), while\(x_{it} \) is a \(k\times 1\) vector of explanatory variables, \(\beta _i \) are the \(k\times 1\) coefficient vectors,\(\alpha _i \) represents the (group-specific) fixed effect and \(f_t \) is a set of unobservable common factors with group-specific factor loading \(\lambda _i \). This is a simplified version of the model setup in Eberhardt and Teal (2010), which abstracts from the potential presence of multiple factors in the observable variables. Using (B2) into (B1) and first-differencing (to control for nonstationarity issues) we obtain

The AMG approach captures the common (or mean) evolution of unobservables across groups (e.g. countries) and over time via the inclusion of \(T-1\) year dummies \(\left( {\sum _{t=2}^T {\Delta D_t } } \right)\) in a pooled estimation of the model in (B3). Intuitively, if\(f_t \) is truly common across groups, in each year \(t\) the coefficient on the year dummy variable \(D_t \) will provide an average estimate of the common factors across groups in that particular year. Thus, the inclusion of \(T-1\) year dummies produces an estimate of how the common factors \(f_t \) evolve over time—this is the common dynamic process \(\hat{{\mu }}_t^{\bullet } \).

In other words, \(\hat{{\mu }}_t^{\bullet } \) is some function \(h\) of the common factors \(f_t \), i.e. \(\hat{{\mu }}_t^{\bullet } =h\left( {\bar{{\lambda }}f_t } \right)\). As such, \(\hat{{\mu }}_t^{\bullet } \) can be used as a proxy for \(f_t \) in the second stage of the AMG procedure as follows

Provided that in (B3) the error term \(\Delta \varepsilon _{it} \) is white noise, the estimated common dynamic process \(\hat{{\mu }}_t^{\bullet } \) can be included in the second-stage AMG regression (B4) to control for the presence of common factors \(f_t \) and their heterogeneous effects on \(y_{it} \). The Monte Carlo simulations in Bond and Eberhardt (2009) provide substantial evidence on the performance of the AMG estimator, indicating that the inclusion of \(\hat{{\mu }}_t^{\bullet } \) in the second-stage regression allows for the separate identification of \(\beta _i \) and \(f_t \), and that the small-sample performance of the AMG approach broadly matches that of the CCEMG and CCEP estimators.

Rights and permissions

About this article

Cite this article

Lanzafame, M. Temperature, rainfall and economic growth in Africa. Empir Econ 46, 1–18 (2014). https://doi.org/10.1007/s00181-012-0664-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-012-0664-3