Abstract

This paper examines the dynamics of self-employment rates overall and by gender across the UK during the period 2004–2016. Specifically, using the panel convergence methodology suggested by Phillips and Sul (Econometrica 75:1771–1855, 2007) we investigate whether self-employment rates can be characterised by a process where all regions tend to the same equilibrium (global or full convergence) or, if not, whether there are one or more clusters of regions with the same equilibrium (convergence clubs). We find that there is no global regional convergence in total and gender-specific self-employment rates. However, two convergence clubs of regions with lower self-employment rates are found along with a group of non-convergent regions which have higher self-employment rates and somewhat higher rates of growth in self-employment. We also show that gender differences in convergence patterns across UK exist.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Self-employment has become a prominent characteristic of industrialised economies. Whilst entrepreneurial activity has grown over time across many economies, regional differences in self-employment rates and business start-ups have been identified (e.g. Burke et al. 2009) and have proved surprisingly durable [see, for example, Andersson and Koster (2011) for evidence regarding Sweden; Robson (1998), Georgellis and Wall (2000) and Fotopoulos (2014) for UK evidence and Fritsch and Wyrwich (2014) for German evidence]. National differences have been found too. Burke et al. (2019) found that country-level investment in research and development influences not just self-employment, but the type of self-employment. Greater R&D spending was associated with greater levels of self-employed workers with their own employees and opportunity self-employment. Beugelsdijk and Noorderhaven (2004) find similar evidence for regional differences in entrepreneurial attitude, across 54 European regions, which they link to regional growth rates. Self-employment at European city level has been found to depend on city size, socio-economic conditions, the crime rate and location (Belitski and Korosteleva 2010).

Taken together, these results might imply that regional differences in self-employment rates will persist over time. Whilst the determinants of self-employment may be influenced by national or local policy initiatives, results of any such initiatives would take time to emerge. This might especially be the case, given the established economic and social divide between North and South in the UK. This was highlighted most recently by the UK 2070 Commission report, which drew a parallel between North and South of the UK and the East and West of Germany at reunification. However, as Fotopoulos and Storey (2017) suggest, whilst regional self-employment rates are path dependent (i.e. future rates are influenced by current rates, whilst current rates depend on past rates), there are also reasons to expect self-employment rates to change over time, through changes in industrial structure, regional age structure, human capital and (inter-regional) immigration. Building on the findings presented by Georgellis and Wall (2000) and Fotopoulos and Storey (2017), we explore the extent to which regional self-employment rates change over time and the extent to which those rates align with growth rates of other regions. Such alignment need not be positive; for example, where most regions align to a baseline rate whilst in a few “successful” regions self-employment grows more rapidly [as Fotopoulos and Storey (2017) results suggest for the UK].

Burke et al.’s (2009) results suggest that a North–South divide in the UK in terms of self-employment is caused more by structural differences between regions than by variation in individual characteristics across regions (although the latter do play a role). Dawson et al. (2014) also find a small but significant regional effect on motivation to become self-employed (more for men than for women), after both individual characteristics and industrial structure are controlled for. If these structural factors are less susceptible to policy interventions than individual characteristics such as education level and are more stable over time, it would offer an explanation for the persistence in regional differences in self-employment rates and rates of change. The persistence of differences between regions could also be attributed to the spatially bound nature of entrepreneurs’ social capital. Social ties with sector and financing contacts are, to an extent, spatially bound. Similarly, the ability to spot market opportunities could be enhanced by local market knowledge (and diminished by a move away from that market). Related to this is the concept of an entrepreneurial ecosystem (Stam 2015), which highlights the importance of the interaction of local conditions, policy and actors in creating sustainable self-employment. This may be amplified by path dependence or network effects (e.g. Arthur 1994), whereby as self-employment grows in a region it becomes more conducive to further self-employment through the development of support and ancillary networks and services. A higher self-employment rate may be taken as a signal to potential entrants that the risk of failure will be lower than in an area with lower self-employment. Entrepreneurial ability and reputation, however, need not be spatially bound. Such high self-employment regions could also attract more mobile/less spatially bound (and potentially more ambitious) entrepreneurs, further driving self-employment rates, whilst less mobile (potentially necessity) entrepreneurs stay where they are. As a consequence, the “strong” could regions grow faster by attracting talent from elsewhere whilst other regions see their self-employment rates converge towards a baseline level.

Local, regional and national (in particular, Tax and National Insurance) policy might be expected to also have an influence on self-employment rates. Encouraging self-employment and entrepreneurship have often been used as a policy lever in attempts to drive regional economic development (e.g. Fischer and Nijkamp 1998). Promoting self-employment is also a feature of EU policy, in particular the Europe 2020 strategy (European Commission, no date) and of UK public policy at both national and regional level (OECD and European Commission 2016). Such activities, if successful, should reduce regional differences in self-employment rates by promoting entrepreneurship and hence growth in more depressed areas. There is increasing evidence, however, that this is not the case. Fotopoulos and Story (2017) found that whilst there is a path dependence effect (that current self-employment rates depend on past rates), there is also some evidence of higher growth rates in some areas (particularly in London) and declines in self-employment rates in other, particularly coastal, areas of the UK. However, the growth in self-employment in London cannot be attributed to entrepreneurship policy (nor can the decline in self-employment in coastal regions). Rather, they reflect the relative fortunes of the prominent industries in London (professional services) and coastal regions (tourism, catering and hospitality). Areas that have been the focus of policy attention have seen self-employment rates grow, but not by more than other areas. Areas that have not received policy attention, such as London, have shown greater rates of growth. More generally, Acs et al. (2016) argue that most entrepreneurship policies adopted in the western world merely benefit those already intending to become entrepreneurs, rather than solving or reducing the extent of market failure.

In this paper, we explore the extent to which self-employment rates in UK regions display club convergence and the nature of that convergence. We test for evidence of both global convergence (i.e. convergence to a national average) and club convergence (i.e. separate groups of regions converging) using Phillips and Sul’s (2007) panel convergence methodology. Given the evidence on regional differences in self-employment, global convergence would be unlikely; club convergence would seem to be the more likely outcome. However, it is the nature of such clubs which is of more interest. Regional differences could become more firmly entrenched as a result if some regions converge to a lower rate than that achieved by other faster-growing regions or clubs of regions. This would create a challenge both for and to entrepreneurship policy. We apply our analysis to total self-employment, but also to male and female self-employment rates in each region. As Saridakis et al. (2014) conclude, male and female self-employment rates are influenced in different ways by macroeconomic and social factors. For example, unemployment rates have an effect on self-employment rates for men and not women whilst divorce lowers self-employment rates for women. Burke et al (2009) also identified different influences on male and female self-employment and found that they differed across regions of the UK. Given these different responses to macroeconomic conditions and to social factors, and the regional differences in these relationships, it is possible that male and female self-employment rates will exhibit different dynamics.

2 Econometric methodology

The methodology proposed by Phillips and Sul (2007) is used to examine self-employment rate (SE) convergence dynamics in a panel of twelve UK regions and to identify any convergence clubs. The procedure used considers cross section elements (regions) to be heterogeneous, and the dynamics of each of them are identified on the basis of a single factor model, which has the following form:

In this specification, \(\delta_{i}\) measures the average distance of the self-employment rate of each region \(\left( {{\text{SE}}_{it} } \right)\) with respect to the common systematic part, \(\mu_{t}\), and \(\varepsilon_{it}\) is the error. The model may consider other panel data aspects, such as specifying that \(\left( {{\text{SE}}_{it} } \right)\) is decomposed by one part \(g_{it}\) with several systematic components and another \(a_{it}\) with the individual transitory components i for each t, as follows:

To separate common from idiosyncratic components in the panel, we divide and multiply Eq. (2) by the common component \(\left( {\mu_{t} } \right)\), that is:

where \(\mu_{t}\) is a single common component (such as the common trend) and \(\delta_{it}\) is a time-varying idiosyncratic element that contains the individual systematic and transitory components that change over time and explain the relative distance of each regional \(\left( {{\text{SE}}_{it} } \right)\) with respect to the common component \(\mu_{t}\). To extract information about \(\delta_{it}\), Phillips and Sul (2007) use their relative versions rather than their difference (i.e. relative transition parameters) and suggest that a “relative” long-term equilibrium or convergence between the \({\text{SE}}_{it}\) across different regions exist if the following condition is met:

Assuming that \(\delta_{it}\) has a behaviour that varies in time in a nonlinear semiparametric form, \(\delta_{it} = \delta_{i} + \sigma_{i} \xi_{it} L\left( t \right)^{ - t} t^{ - \alpha }\), where \(\delta_{i}\) is fixed, \(\xi_{it}\) is iid (0, 1) between i but weakly dependent on t, and \(L\left( t \right)\) is a slowly varying function so that \(L\left( t \right) \to \infty \;{\text{as}}\; t \to \infty\). In this context, the tests of convergence and non-convergence hypotheses are, respectively, defined as:

To test the hypotheses, the following regression model is estimated:

In this regression, \(L\left( t \right) = \log \left( {t + 1} \right)\) and \(\hat{b} = 2\hat{\alpha }\), where \(\hat{\alpha }\) is the least square estimate of \(\alpha\). Also, given the sample size we set r = 0.3, Phillips and Sul (2007) approach uses the one-sided t test and the null hypothesis is accepted when \(t_{{\hat{b}}} > - 1.65\) at the 5% level.

In the case of no global convergence between regions, Phillips and Sul (2007) propose a clustering algorithm to identify the existence of convergence groups. The clustering algorithm consists of the following four steps: the process starts with the ordering of the cross section elements (regions) with respect to the last period value of the time series; k-region size groups can then be formed based on panel member with the k highest final time period observations that are larger. To each group of regions, the convergence test is applied, where \(t_{k}\) is the test statistic for the data of \(G_{k}\), N > k ≥ 2, and finally, the size \(k^{*}\) of the core group is chosen according to the criterion:

The process considers one by one of the candidate k-regions using regression (5) to test whether there is a convergence between the k-regions based on \(t_{{\hat{b}}} > c ,\) where c is some critical value chosen for the test. With the core group of regions formed the regression is again estimated and tested again whether \(t_{{\hat{b}}} > - 1.65\) is fulfilled, otherwise the value of c is increased; the selection process is repeated for a new region that satisfies the condition \(t_{{\hat{b}}} > - 1.65\). Then another group is formed considering the conditions of the first group and the same process is repeated to test whether there is a convergence between them or there is a smaller subgroup. The process is applied sequentially until it is not possible to find k-regions that satisfy (6) and thus those that remain without classification are considered as regions that do not converge.

3 Data

We use annual data of the total, male and female self-employment rates (i.e. % aged 16–64 who are self-employed) from 12 UK regions over the period 2004–2016 provided by the Office of National Statistics (ONS). The focus on regions, rather than say cities, is determined in part by data availability; self-employment, house price data and economic growth data are all available at regional (i.e. NUTS 1) level. There are arguments that cities, rather than regions, would be a more appropriate level of analysis as the (economic) performance of regions will be driven largely by the major cities in them. Similarly, entrepreneurs (and other residents) may identify more with a city than a region. Should the data become available, exploring self-employment dynamics within regions and comparing cities to rural areas would be an interesting avenue for future research. The twelve regions to UK included in the analysis are North East, North West, Yorkshire and The Humber, East Midlands, West Midlands, East, London, South East, South West, Wales, Scotland and Northern Ireland. Although the majority of the self-employed people are men, female self-employment rate has grown more than the men over the study period (by 3.9% and 0.5%, respectively).

London has the highest total and male self-employment rates compared to other regions, reflecting the growth in the construction and the service sectors. The South West region has the second highest self-employment rates in the UK over the study period, but it has the highest female self-employment rate in the country leaving London in second position (although most are likely to be part-time or be self-employed in their second job rather business owners compared to London: see Causer and Park 2009). Although North East has the lowest female self-employment rate, it has experienced a strong upward growth. Whilst this might just reflect that the rate is growing from a low base, the North East also recorded the highest use of formal business advice of all UK regions (Centre for Enterprise and Economic Development and BMG Research 2011). Finally, male self-employment in Northern Ireland decreases whereas there is a substantial increase in female self-employment rate. Summary statistics of the data are given in Table 2 in “Appendix”.

4 Results

The Hodrick–Prescott (HP) filter is first used to obtain the trends of the series of the total and gender-specific self-employment rates. After extracting them, the algorithm of Phillips and Sul (2007) is applied (see Du 2018). Overall, the results for all regions show that \(t_{{\hat{b}}} < - 1.65\) suggesting that there is no global convergence in total self-employment as well as in male and female self-employment (Table 1). The algorithm of Phillips and Sul (2007) then is used to evaluate the possibility of individual convergences and formation of cluster or club of convergence between regions.

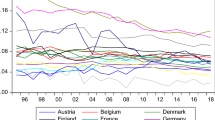

For the case of total self-employment, two convergence clubs \(t_{{\hat{b}}} > - 1.65\) and a group of non-convergent or divergent regions (\(t_{{\hat{b}}} < - 1.65)\) are found (Table 1 Panel A). The first convergence club includes the following six regions: North West, Yorkshire and The Humber, East Midlands, West Midlands, Wales and Northern Ireland. As shown in Fig. 1, this club is characterised by regions around the national average (i.e. average of total self-employment of all regions); it is important to note, however, that Northern Ireland’s self-employment rate was initially above the national average (until its peak value was reached in 2010) but it became closer to the average over the years. The second convergence club has only two regions, North East and Scotland, with the lowest total self-employment rate nationwide (Fig. 1). Finally, the diverging group of regions in total self-employment rate contains the four regions: East, London, South East and South West, which are characterised by the largest total self-employment rate. As shown in Fig. 1, these regions had similar self-employment rates in 2004 but they have diverged over time.

These convergence clubs in self-employment could reflect regional variations in economic conditions. Looking across the clubs identified, they seem to mirror regional variation in house prices. A house can be used as collateral against which funds can be raised and house ownership has been used as a proxy for access to capital (e.g. Mason 1991). The higher the house price, the greater the capital which could be raised against it (e.g. through re-mortgaging). The regions in the diverging group are those with the highest house prices in the UK, whilst those in the second club (North East and Scotland) are those with the lowest house prices as reported by the Office for National Statistics (2017). Hence, we have evidence for an “average” self-employment club and a “low” self-employment club along with four regions whose self-employment rates are higher, but follow their own paths. Looking at regional unemployment figures (collated by Powell 2019) and regional economic growth figures (Harari 2018) provides further insight. The regions in the biggest club have unemployment rates and economic growth rates per head close to the UK average. Whilst Scotland and the North East have similar self-employment rates, unemployment in Scotland largely mirrors the UK rate but for the North East it is above the UK average. The same is true for economic growth. This might suggest that although the two regions follow a similar trajectory, self-employment in the North East is more likely to be necessity self-employment than opportunity self-employment. The non-converging regions (East, London, South East and South West) all have lower than average unemployment figures (except for London) and higher than average economic growth (except for East of England).

This implies that a North/Middle/South divide in terms of self-employment in the UK is likely not just to remain, but to widen. Whilst both convergence clubs show growth in self-employment, they are outpaced by the rates seen in the diverging regions. Should this growth be fuelled by migration into those diverging regions, the divide would widen still further. The convergence groups we find tend to contain regions with average or lower self-employment rates along with lower economic growth rates and lower house prices whilst higher growth regions tend to be wealthier. This suggests that the success of programmes promoting self-employment as a way of driving economic growth will be limited. It also parallels other regional disparities, with the UK exhibiting regional inequalities worse than any comparable developed country (Raikes et al. 2019). This in turn suggests that substantial changes in regional policy, in terms of both scale and scope, would be required to arrest and subsequently reverse these regional differences. Such a policy shift could create additional regional tensions though, if it was perceived as involving direct cross-subsidisation. An alternative would be to refocus central government investment (e.g. in infrastructure) away from London and the South East.

There is reason to expect different dynamics in male and female self-employment, which could in turn be reflected in the composition of the convergence clubs. Burke et al (2009) identified different drivers of self-employment for males and females and that the effect of those drivers differed across regions (for example, inherited wealth was a significant predictor of female self-employment only in the south of England compared to the north). The analysis reveals some additional interesting findings. For example, in the case of male self-employment rate a single convergence club is formed with eight regions: North West, Yorkshire and The Humber, East Midlands, West Midlands, East, South East, Wales and Northern Ireland (Table 1 Panel B). In this convergence club, the male self-employment rates are below 14% (Fig. 2) and again form an “average” self-employment group. Similar to the analysis of the total self-employment rate sample, London and South West continue to be diverging regions joined this time by Scotland and the North East. Again though, London and the South West display higher SE rates, whilst in Scotland and the North East the rates are the lowest in the UK.

The overall picture is of convergence between most regions of the UK. Four regions though follow their own paths with London accelerating away, but growth in the other high self-employment region, South West, seems to tail off. The North East and Scotland, though showing lower self-employment rates than elsewhere in the UK, achieve higher growth rates than other regions (excluding London). However, they are starting from a lower base.

The analysis of the female self-employment paints a different picture. Again, two convergence clubs are identified; however, this time the female self-employment clubs are found in regions with the highest and the lowest regional female self-employment rates (Table 1 Panel C). The convergence club with high female self-employment rate females includes London, South East and South West, the regions of the UK with the highest economic growth (except for South West where growth is more moderate) and the lowest unemployment rates (except for London). The convergence club regions with lower female self-employment rates are North East, North West, Yorkshire and The Humber, East Midlands, Wales and Scotland, which could again be characterised as an “average” growth club. The diverging regions of West Midlands, East and Northern Ireland are characterised by unstable behaviour without a consistent trend between the two converging clubs (Fig. 3). Again, this implies a widening North/South divide in self-employment.

5 Conclusions

In this paper, we use the convergence analysis proposed by Phillips and Sul (2007) to explore self-employment rates in 12 UK regions. Unsurprisingly, we find no evidence of global convergence during 2004–2016 suggesting that UK regions do not converge to the same steady-state equilibrium in terms of overall and gender-specific self-employment rates. However, we identify two convergence clubs and one group of non-converging regions total self-employment rates. The first convergence club comprises North West, Yorkshire and The Humber, East Midlands, West Midlands, Wales and Northern Ireland with self-employment rates close to the national average. The second club includes North East and Scotland, which are characterised by the lowest self-employment rates within the UK. Finally, East, London, South East and South West are found to be non-converging regions. In terms of convergence at least, rather than identify a North-South divide, we see evidence of a North–Middle–South divide, where Southern regions of England show higher, but distinct, levels of self-employment whilst the “middle” and northern regions tend to show convergence towards group growth rates. This may in part reflect differences in industrial structure, with service industries (and hence self-employment opportunities) more predominant in London and the South than elsewhere. It also, however, reflects the more general divide between the North and the South of the UK.

For the male self-employment sample, only a single convergence club is formed which excludes the North East, London, South West and Scotland. London records the highest rate of self-employment and the highest growth rate, whilst the South West shows a similar rate lower growth. The North East and Scotland show lower rates of self-employment than other regions. Again, we have a club of regions with “average” self-employment rates, along this time with regions with higher and lower rates following their own trajectories. Turning to the analysis of the female self-employment sample, we find two convergence clubs: one with the high regional female self-employment rates consisting of southern regions and one with lower regional female self-employment rates, consisting of Northern English regions (although the North East shows a higher growth rate than other regions).

These findings suggest that self-employment rates are not as static as might be expected based on the notions of spatially bound entrepreneurial capital and structural differences across regions. The general pattern (across male self-employment and total self-employment) is one of a small group of regions with higher self-employment rates growing at least as fast if not faster than others with a convergence club of regions with lower rates of self-employment and lower rates of growth. Female self-employment shows a somewhat different pattern with a club of neighbouring regions with high self-employment rates and average growth rates and a second club of regions with lower self-employment rates. That we see different patterns for male and female self-employment might suggest that effects of particular regions such as differences in entrepreneurial culture and history are outweighed by other factors.

Overall, our results have a rather troubling implication: regions with high self-employment rates follow their own paths, whilst regions with lower rates and lower levels of self-employment tend to converge. To a degree, self-employment dynamics appear to be influenced by local economic conditions (as reflected in house prices). The types of self-employment driving the growth patterns merit further investigation. As Burke et al. (2019) argue, self-employed with employees and opportunity self-employed make a greater economic contribution than own-account workers or necessity entrepreneurs. If a greater proportion of the self-employed in high growth regions are opportunity self-employed, or self-employed with employees, economic growth will be stronger. This in turn could create more opportunities for self-employment. If those opportunity self-employed migrate into high growth regions, then regional differences will be exacerbated still further. The existence of convergence clubs could be a positive or a negative sign. A convergence club of regions where self-employment is predominantly opportunity self-employment, or self-employed with employees would suggest a strong club of regional economies. Conversely, a convergence club of predominantly necessity self-employed would be a more worrying sign. There is some evidence to suggest that this is happening in the UK. For example, self-employment in London and the South East grew faster than elsewhere in the UK between 2010 and 2014, but it was also being more likely to be in professional/high-skilled sectors, compared to elsewhere in the country where low-skilled self-employment is more likely (Elliott 2015).

Fotopoulos and Storey (2017) argue that whilst self-employment rates have risen over time in areas which were the focus of policy intervention and support, they have not risen faster than elsewhere. Our results echo this conclusion and suggest that differences between regions risk becoming even more firmly entrenched, posing a greater challenge not just for enterprise policy but also for regional policy in the UK.

References

Acs Z, Astebro T, Audretsch D, Robinson DT (2016) Public policy to promote entrepreneurship: a call to arms. Small Bus Econ 47:35–51

Andersson M, Koster S (2011) Sources of persistence in regional start-up rates—evidence from Sweden. J Econ Geogr 16:39–66

Arthur WB (1994) Increasing returns and path dependence in the economy. University of Michigan Press, Ann Arbor

Belitski M, Korosteleva J (2010) Entrepreneurial activity across European cities. In: 50th Congress of the European Regional Science Association, 19–23 August, Jonköping, Sweden. http://hdl.handle.net/10419/119293. Accessed 8 Oct 2019

Beugelsdijk S, Noorderhaven N (2004) Entrepreneurial attitude and economic growth: a cross-section of 54 regions. Ann Reg Sci 38:199–218

Burke AE, Fitzroy FR, Nolan MA (2009) Is there a North-South divide in self-employment in England? Reg Stud 43(4):529–544

Burke A, Lyalkov S, Millán A, Millán JM, van Stel A (2019) How does country R&D change the allocation of self-employment across different types? Small Bus Econ. https://doi.org/10.1007/s11187-019-00196-z

Causer P, Park N (2009) Women in business. Off Natl Stat Reg Trends 41:31–51

Centre for Enterprise and Economic Development and BMG Research (2011) Research to understand the barriers to take up and use of business support. Final report for the Department of Business Innovation and Skills, online, available from: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/32250/11-1288-research-barriers-to-use-of-business-support.pdf. Accessed 22 Nov 2017

Dawson C, Henley A, Latreille P (2014) Individual motives for choosing self-employment in the UK: Does region matter? Reg Stud 48(5):804–822

Du K (2018) Econometric convergence test and club clustering using Stata. Stata J 17(4):882–900

Elliott L (2015) Why George Osborne is wrong about the north-south divide. The Guardian, 22nd March https://www.theguardian.com/business/2015/mar/22/why-george-osborne-wrong-north-south-divide. Accessed 20 Jan 2020

European Commission (no date) Supporting entrepreneurs and the self-employed. https://ec.europa.eu/social/main.jsp?catId=952&langId=en. Accessed 16 May 2018

Fischer MM, Nijkamp P (1998) The role of small firms for regional revitalization. Ann Reg Sci 22(10):28–42

Fotopoulos G (2014) On the spatial stickiness of UK new firm formation rates. J Econ Geogr 14:651–679

Fotopoulos G, Storey D (2017) Persistence and change in interregional differences in entrepreneurship: England and Wales, 1921–2011. Environ Plan A 49(3):670–702

Fritsch M, Wyrwich M (2014) The long persistence of regional levels of entrepreneurship: Germany, 1925–2005. Reg Stud 48(6):955–973

Georgellis Y, Wall HJ (2000) What makes a region entrepreneurial? Evidence from Britain. Ann Reg Sci 34:385–403

Harari D (2018) Regional and local economic growth statistics. House of Commons Library Briefing Paper 05795. https://researchbriefings.parliament.uk/ResearchBriefing/Summary/SN05795. Accessed 8 Oct 2019

Mason C (1991) Spatial variations in enterprise. In: Burrows R (ed) Deciphering the enterprise culture. Routledge, London, pp 77–104

OECD and European Commission (2016) Inclusive entrepreneurship policies, country assessment notes, United Kingdom. http://www.oecd.org/cfe/smes/UK-country-note.pdf. Accessed 16 May 2018

Office for National Statistics (2017) House Price Index. https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/jan2017. Accessed 23 Nov 2017

Phillips PCB, Sul D (2007) Transition modeling and econometric convergence tests. Econometrica 75:1771–1855

Powell A (2019) Labour market statistics: UK regions and countries. House of Commons Library Briefing paper number 7950. https://researchbriefings.parliament.uk/ResearchBriefing/Summary/CBP-7950. Accessed 8 Oct 2019

Raikes L, Giovannini A, Getzel B (2019) Divided and connected: State of the North 2019, Institute for Public Policy Research. https://www.ippr.org/files/2019-11/sotn-2019.pdf. Accessed 20 Jan 2020

Robson M (1998) Self-employment in the UK regions. Applied Economics 30(3):313–322

Saridakis G, Marlow S, Storey D (2014) Do different factors explain male and female self-employment rates? J Bus Ventur 29:345–362

Stam E (2015) Entrepreneurial ecosystems and regional policy: a sympathetic critique. Eur Plan Stud 23(9):1759–1769

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Saridakis, G., Mendoza González, M.A., Hand, C. et al. Do regional self-employment rates converge in the UK? Empirical evidence using club-clustering algorithm. Ann Reg Sci 65, 179–192 (2020). https://doi.org/10.1007/s00168-020-00979-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-020-00979-3