Abstract

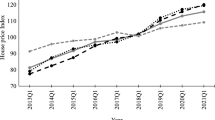

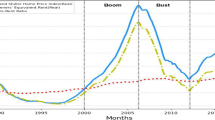

The existing researches show that the relationships across regional housing market in the USA are asymmetric, and the ripple effect may exist among regional housing markets. To study the ripple effect among regional housing market, this research uses vector autoregression model, Granger causality test and the forecast error variance decomposition to study the relationships within regional and cross-regional housing markets. Besides, this research also uses copula model to inspect the contagious effects between regional housing markets. The main empirical results show that, first, among the metropolitans under studied, Los Angeles in western region, New York in eastern region and Miami in southern region are the source of shock in their respective region. Second, apart from those in southern region, conditional contagious effects between regional housing markets are dynamic during the study period and there exist obvious contagious effect during the period of global financial crises started from 2008 to 2009. Third, contagious effects are more significant within the same region but less obvious in cross-regional housing markets. We also found that housing price comovement in down markets are rare to observe than housing price comovements in up markets.

Similar content being viewed by others

Notes

The Case & Shiller index is basically transaction-based indices which uses information on all residential property transactions. It is value-weighted index and is suggested to be properly gauged the US home price. For more detailed comparison of the CS index and home price index published by the Federal Housing Finance Agency, please refer to Miao et al. (2011).

\(\hbox {ER}_{{t,i}} =\hbox {logP}_{{t,i}} -\hbox {logP}_{{t-1,i}} -\hbox {Com10}_{t} \), \(\hbox {ER}_{{t,i}} = \) excess index return of housing, \({P}_{{t,i}} = \) regional housing index, \(\hbox {Com10}_{t} =\) composite index return of housing.

References

Bond SA, Patel K (2003) The conditional distribution of real estate returns: Are higher moments time varying? J Real Estate Finance Econ 26(2–3):319–339

Campbell JY (1991) A variance decomposition for stock returns. Econ J 101:157–179

Campbell JY, Ammer J (1993) What moves the stock and bond markets? A variance decomposition for long-term asset returns. J Finance 48(1):3–37

Campbell SD, Davis MA, Gallin J, Martin RF (2009) What moves housing markets: a variance decomposition of the rent-price ratio. J Urban Econ 66(2):90–102

Canarella G, Miller S, Pollard S (2012) Unit roots and structural change: an application to US house-price indices. Urban Stud 49:757–776

Chen PF, Chien MS, Lee CC (2011) Dynamic modeling of regional house price diffusion in Taiwan. J Hous Econ 20:315–332

Chinloy P, Cho M, Megbolugbe IF (1997) Appraisals, transaction incentives, and smoothing. J Real Estate Finance Econ 14(1–2):89–111

Clayton DG (1978) A model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incience. Biometrika 65:141–151

Cook S (2005) Regional house price behaviour in the UK: application of a joint testing procedure. Phys A 345:611–621

Crook J, Moreira F (2011) Checking for asymmetric default dependence in a credit card portfolio: a copula approach. J Empir Finance 18:728–742

Diersa D, Eling M, Marek SD (2012) Dependence modeling in non-life insurance using the Bernstein copula. Insur Math Econ 50:430–436

Dolde W, Tirtiroglu D (1997) Temporal and spatial information diffusion in real estate price changes and variances. Real Estate Econ 25(4):539–565

Enders W (2008) Applied econometric time series. Wiley, London

Forbes KJ, Rigobon R (2002) No contagion, measuring stock market comovements. J Finance 57:2223–2261

Fuss R, Zhu B, Zietz J (2011) US regional housing bubbles, their co-movements and spillovers. In: Working paper

Gao A, Lin Z, Na CF (2009) Housing market dynamics: evidence of mean reversion and downward rigidity. J Hous Econ 18:256–266

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econom J Econom Soc 37(3):424–438

Graff RA, Harrington A, Young MS (1997) The shape of Australian real estate return distributions and comparisons to the United States. J Real Estate Res 14(3):291–308

Guirguis HS, Giannikos CI, Garcia LG (2007) Price and volatility spillovers between large and small cities: a study of the Spanish market. J Real Estate Portfolio Manag 13(4):311–316

Guo F, Chen CR, Huang YS (2011) Markets contagion during financial crisis: a regime-switching approach. Int Rev Econ Finance 20(1):95–109

Gupta R, Miller SM (2010) The time-series properties on housing prices: a case study of the Southern California market. J Real Estate Finance Econ 44:339–361

Gupta R, Miller SM (2009) “Ripple effects” and forecasting home prices in Los Angeles, Las Vegas and Phoenix. Ann Reg Sci 48:763–782

Gusdorf F, Hallegatte S (2007) Behaviors and housing inertia are key factors in determining the consequences of a shock in transportation costs. Energy Policy 35:3483–3495

Hoesli M, Reka K (2011) Volatility spillovers, comovements and contagion in securitized real estate markets. J Real Estate Finance Econ 47:1–35

Holly S, Pesaran MH, Yamagata T (2011) The spatial and temporal diffusion of house prices in the UK. J Urban Econ 69:2–23

Holmes MJ (2007) How convergent are regional house prices in the United Kingdom some new evidence from panel data unit root testing. J Econ Soc Res 9:1–17

Hui ECM, Zheng X, Hu J (2012) Housing price, elderly dependency and fertility behaviour. Habitat Int 36:304–311

Joe H (1997) Multivariate models and multivariate dependence concepts. CRC Press

Juselius K (2006) The cointegrated VAR model: methodology and applications. Oxford University Press, Oxford

Kuethe TH, Pede VO (2009) Regional housing price cycles: a spatio-temporal analysis using US State level data. Reg Stud 45:563–574

Kwiatkowski D, Phillips PC, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J Econom 54(1):159–178

Liow KH, Lee Z (2011) Extreme dependence between public real estate and stock markets. In: IRES working paper series

Meen G (1999) Regional house prices and the ripple effect : a new interpretation. Hous Stud 14(6):733–753

Miao H, Ramchander S, Simpson MW (2011) Return and volatility transmission in US housing markets. Real Estate Econ 39:701–741

Miller N, Peng L (2006) Exploring metropolitan housing price volatility. J Real Estate Finance Econ 33(1):5–18

Myer FCN, Webb JR (1994) Statistical properties of returns: financial assets versus commercial real estate. J Real Estate Finance Econ 8(3):267–282

Nelsen RB (2013) An introduction to copulas, vol 139. Springer Science & Business Media

Nikoloulopoulos AK, Joe H, Li H (2012) Vine copulas with asymmetric tail dependence and applications to financial return data. Comput Stat Data Anal 56:3659–3673

Patton AJ (2006) Modelling asymmetric exchange rate dependence. Int Econ Rev 47(2): 527–556

Pollakowski HO, Ray TS (1997) Housing price diffusion patterns at different aggregation levels: an examination of housing market efficiency. J Hous Res 8:107–124

Sims CA (1980) Macroeconomics and reality. Econom J Econom Soc 48:1–48

Steven C (2003) The convergence of regional house prices in the UK. Urban Stud 40:2285–2294

Tsai IC, Lee CF, Chiang MC (2012) The asymmetric wealth effect in the US housing and stock markets: evidence from the threshold cointegration model. J Real Estate Finance Econ 45(4):1005–1020

Tsai IC (2013) The asymmetric impacts of monetary policy on housing prices: a viewpoint of housing price rigidity. Econ Model 31:405–413

Vaz de Melo Mendes B, Martins de Souza R (2004) Measuring financial risks with copulas. Int Rev Financial Anal 13:27–45

Young MS, Graff RA (1995) Real estate is not normal: a fresh look at real estate return distributions. J Real Estate Finance Econ 10(3):225–259

Young MS, Lee SL, Devaney SP (2006) Non-normal real estate return distributions by property type in the UK. J Prop Res 23(2):109–133

Zhou J, Gao Y (2010) Tail dependence in international real estate securities markets. J Real Estate Finance Econ 45:128–151

Zhu B, Füss R, Rottke NB (2012) Spatial linkages in returns and volatilities among US regional housing markets. Real Estate Econ 41:29–64

Acknowledgments

We would like to thank Yong-Ren Lai for research assistance. The comments and suggestions by the referee and the editor are also appreciated. Errors, if any, remain the responsibility of the authors. Funding from the National Science Council of Taiwan under Project No. NSC 101-2410-H-224-037 has enabled the continuation of this research and the dissemination of these results.